You probably know the feeling…

Spending hours managing your company’s expenses and trying to keep track of piles of receipts and invoices. Well, you’re not the only one. Recent research shows that roughly one-third of the companies rely on manual processes and reconciliation using spreadsheets and paper, resulting in inefficient management of expenses.

The good news is that there are now several spend management software solutions on the market that can help streamline your financial processes and improve your bottom line. To save you time and effort in your search for the best option, we’ve compiled a list of the top eight spend management software solutions for 2025.

Check out our analysis of each software option to find the one that best fits your organization’s needs.

But before we dive into the best spend management software solutions, it’s good to take a step back and look at what spend management software actually is and why you would need it.

Let’s get started!

Key Takeaways

The 8 Best Spend Management Software in 2025 are:

- Klippa SpendControl – Best all-in-one financial management platform that simplifies expense reporting, invoice management, and credit card processing with automation, fraud detection, and seamless ERP integrations.

- Airbase – Great spend management solution featuring a unified dashboard, corporate card program, and approval workflows.

- Emburse Chrome River – A great choice for small to medium organizations, offering robust expense processing, accounts payable automation, and purchase order matching with real-time reporting and integration with accounting systems.

- Tipalti – A comprehensive solution for expense and invoice processing, currency management, and seamless ERP integrations with OCR technology for data extraction; best suited for medium-sized businesses and enterprises.

- Rydoo – Perfect for small to medium companies looking to streamline expense reporting with compliance controls, mileage tracking, and transaction reconciliation, Rydoo ensures a smooth expense management experience.

- FreshBooks – Intuitive spend management tool for freelancers and small businesses, offering an intuitive interface for automated bank reconciliation, expense tracking, and customizable accounts.

- Wave – A free tool for bookkeeping, offering invoice processing and expense tracking with added coaching for users needing support.

- Expensify – Great for simplifying expense report management with credit card imports, tax rate synchronization, and integration with various financial tools.

Comparison of the Best Spend Management Software in 2025:

What is Spend Management Software?

Spend management software is a type of software that helps businesses manage and optimize their spending by providing features to streamline the procurement process, automate expense report processing, create expense policies, and track spending across departments and teams.

It can be used to automate data entry, gain visibility into spending patterns, identify areas where money can be saved, and ensure compliance with financial regulations and internal policies.

Spend management software typically consists of several modules that work together to provide a comprehensive solution for managing expenses. Some of the common modules that may be included in spend management software are:

- Expense Management: This module allows employees to submit expense reports for approval, and it automates expense report processing, reimbursement, and tracking. It can also enforce spending policies and identify document fraud or non-compliant spending.

- Invoice Management: This module allows businesses to manage and track their invoices, automate the invoice approval process, and reconcile invoices with purchase orders and contracts. It can also provide visibility into payment status and help prevent duplicate payments.

- Credit Card Management: Besides expenses and invoices, credit card management is often overlooked. With this module, businesses can manage their credit card transactions and automate the payment reconciliation process. They can also monitor credit card usage, enforce spending policies, and identify potential financial fraud.

Overall, spend management software can help businesses control costs, improve financial visibility, and optimize spending to drive greater profitability. In the next section, we’ll take a deep dive into the best 8 spend management software in 2025.

The 8 Best Spend Management Solutions Explained

To help you, we’ve selected some of the most popular tools, looked into their features, and explored real user feedback from trusted review platforms. The result is a clear overview of what each app does well and where it might fall short based on what actual users are saying.

1. Klippa SpendControl – Best all-in-one financial management platform that simplifies expense reporting

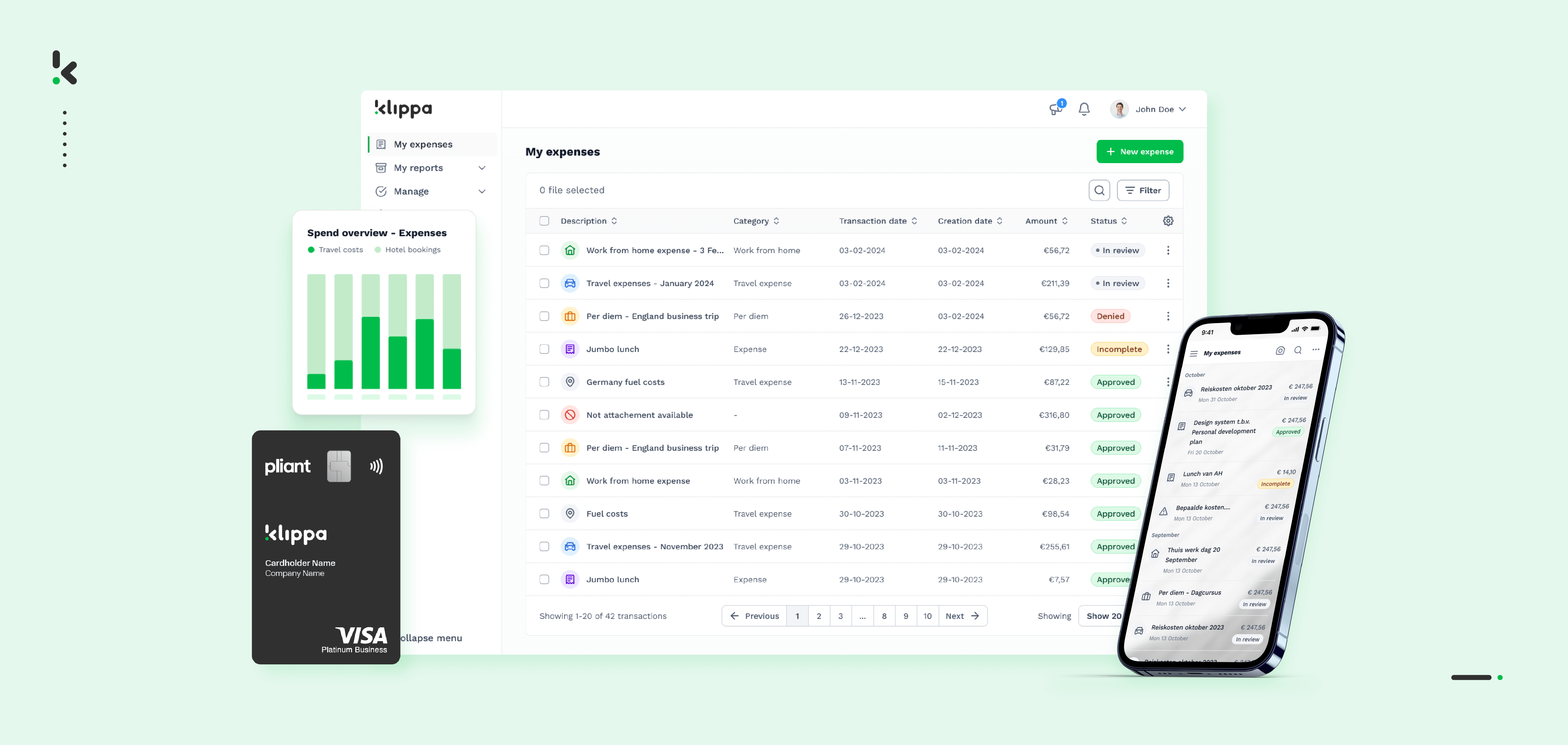

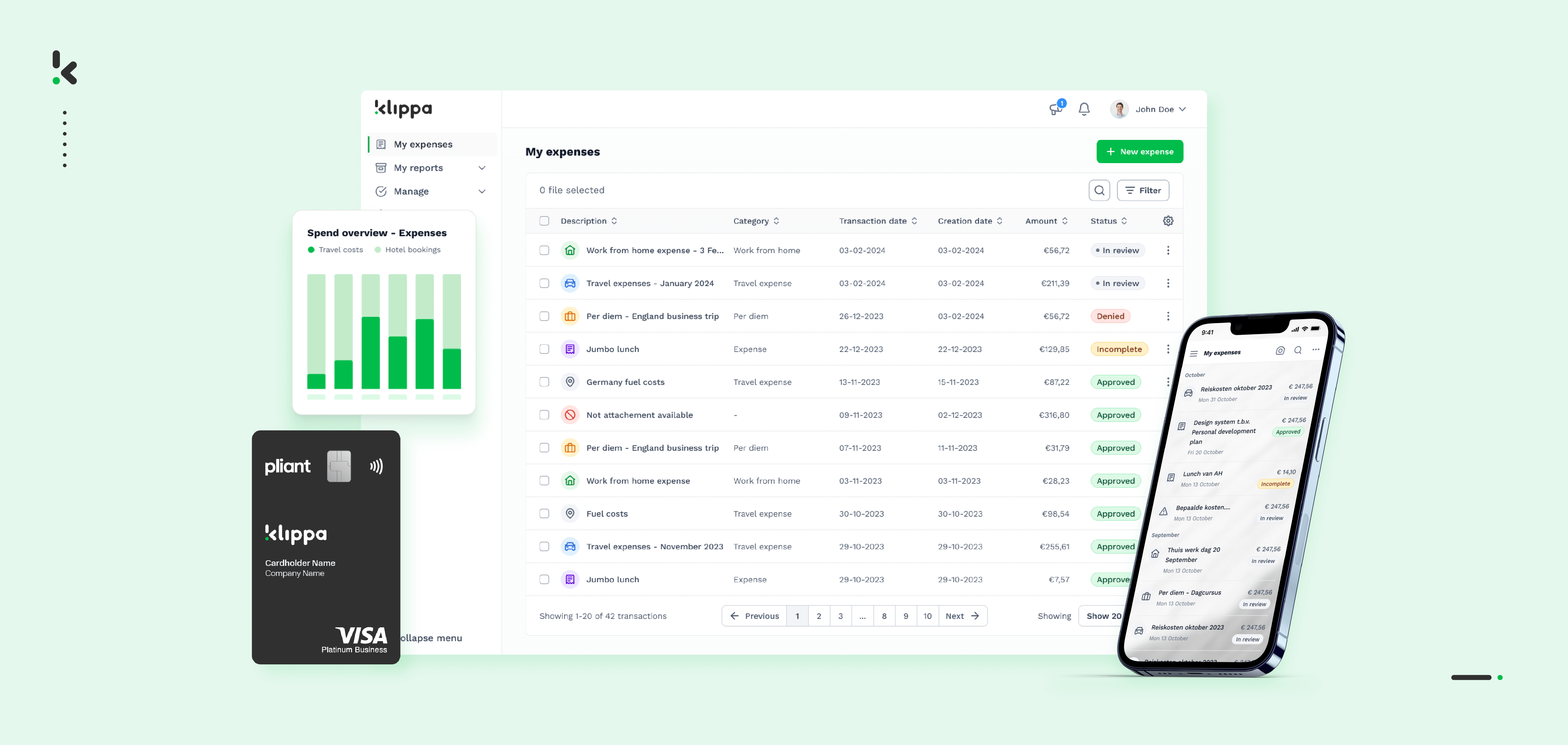

Klippa SpendControl is a state-of-the-art solution for financial teams seeking an efficient and streamlined way to take full control over their entire spend management.

It’s an all-in-one platform that features two separate yet fully integrated modules for invoice processing and expense management software, which can be used together or separately to best fit your needs. In addition, you can also get a clear overview of all your credit card expenses through credit card statement scanning. This gives you full control over all your spending from a central platform.

With Klippa SpendControl, you can easily and quickly process your expenses in just a few clicks. Klippa’s own advanced OCR technology automatically extracts data from your receipts, invoices, and other documents within seconds, while the solution’s sophisticated workflow automates your approval management for an even more seamless experience.

Pros

- User-friendly web dashboard and app design

- Proprietary OCR technology with up to 99% data extraction accuracy

- Fully customizable approval workflows with smart business rules

- 2-way purchase order matching (3-way matching available soon)

- Dedicated cloud storage to access files for up to 10 years for possible audits

- Reliable customer service with quick reaction time

- Over 20 integration options with accounting and ERP software, such as Xero, NetSuite, SAP, and many other integrations

- White Label option for a premium solution in your corporate identity

Cons

- No integration options for other areas, such as mobility or productivity

- For now, no 3-way matching (coming soon)

Starting price: From $5 per user/month.

Klippa SpendControl is best for: All-sized companies and organizations seeking growth through enhanced efficiency of spend management.

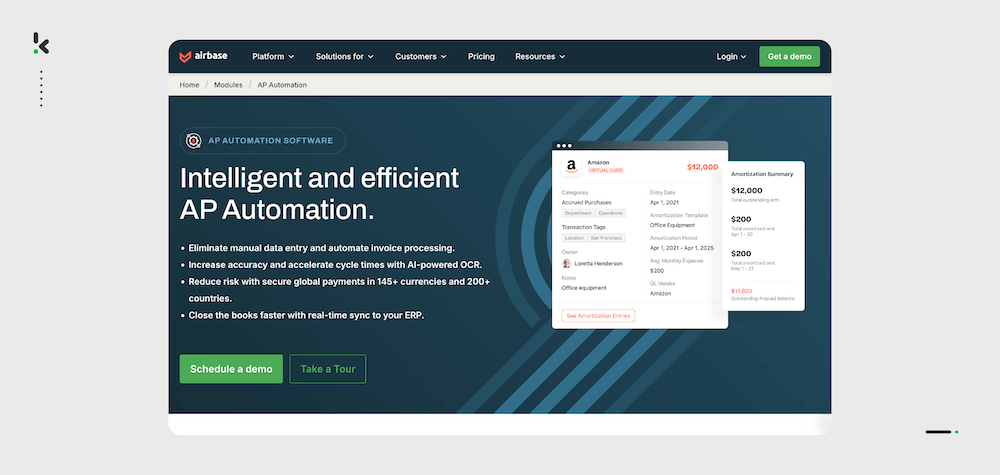

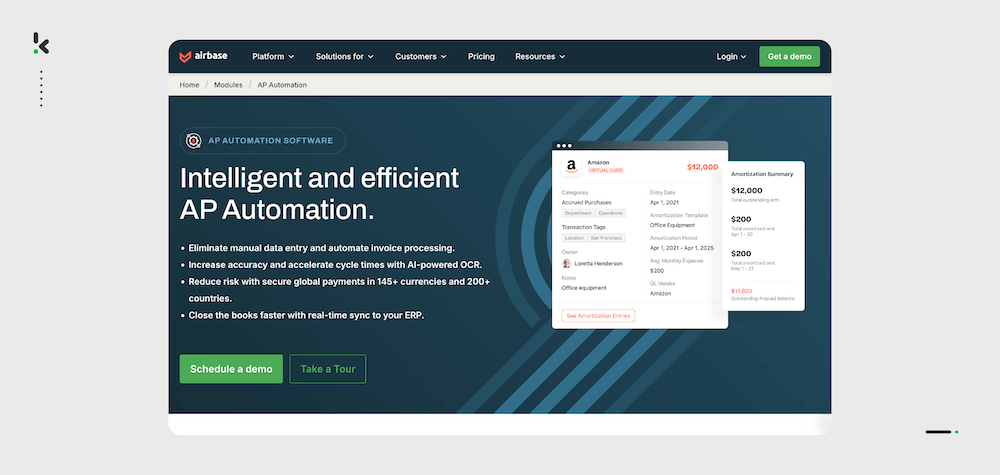

2. Airbase – Great spend management solution featuring a unified dashboard

Airbase is a spend management software that simplifies the tedious tasks of finance teams by automating the spend management process. The software allows you to handle finances from a unified dashboard. Besides that, it offers a corporate card program and streamlined employee reimbursement functionalities to make your spend management more efficient.

Pros

- Comprehensive platform with a clear user interface

- Real-time visibility into financial data

- Flexible solution for managing finances

- Approval workflows

- Corporate card program

- A diverse set of integration possibilities

Cons

- No international payments supported

- User reviews highlight integration difficulties with certain financial tools

- Users mention limited reporting and customization features

Starting price: Custom pricing.

Airbase is best for: Small organizations, freelancers, and self-employed professionals.

3. Emburse Chrome River – Great for SMEs, offering robust features

Chrome River is a solution that helps finance teams with day-to-day tasks like expense processing and accounts payable automation. Chrome River can ease your accounts payable process with integration options, decent accuracy rates for data extraction, and a unified user interface.

For a direct comparison between Klippa & Chrome River, check out this Chrome River comparison page.

Pros

- Unified user interface

- Purchase order matching

- Accounting and ERP system integrations

- Real-time reporting and analytics

- Expense policy checks with receipt matching

- Integrations for multiple accounting systems

Cons

Pricing: Custom pricing.

Chrome River is best for: Small to medium organizations, freelancers, or self-employed professionals.

4. Tipalti – Expense solution best suited for medium-sized businesses

Tipalti provides a solution to manage employee spending with a finance automation solution. It simplifies financial processes and streamlines spend management with a mobile app to submit and track expenses. Managers can review and approve expenses on the go.

The solution includes OCR technology for automatic data extraction to extract various data from receipts and other documents.

Pros

- User-friendly interface

- Both expense and invoice processing options

- Financial controls

- Purchase order matching

- Currency management

- Integrations with multiple accounting and ERP systems

Cons

- Some users find the system challenging to set up and navigate initially

- Might be expensive for smaller organizations with lower transaction volumes

- Users have reported slower response times from customer support

Starting price: From $129/month.

Tipalti is best for: Small to medium companies, and larger enterprises focusing on spend management optimization.

5. Rydoo – Ensures a smooth expense management experience for SMBs

Rydoo offers a spend management solution designed to process expenses from the submission of claims to their reimbursement. It provides multiple controls for compliance to get a good grasp of the financial status of your company. For a direct comparison between Klippa & Rydoo, check out this Rydoo comparison page.

Pros

- Clearly designed dashboard and application

- An affordable option for start-ups

- Expense controls for per diems, mileage, and tax rates

- Transaction reconciliation

- Integrations specifically for mobility and productivity

Cons

- No invoice processing module is available

- Provides data extraction with average extraction accuracy

- Lacking functionalities

Starting price: Pricing starts at €8 per user per month when billed annually for the Essentials plan, and €10 per user per month when billed monthly

Rydoo is best for: Small to medium companies that are looking for a spend management solution without invoicing capabilities.

6. FreshBooks – Intuitive spend management tool for freelancers and small businesses

FreshBooks provides an automated spend management tool that enables users to easily record and manage expenses. It is considered a convenient feature for growing businesses that rely on FreshBooks for their accounting needs.

While it may not offer as many features as other tools, FreshBooks’ automated expense processing tool is a good place to start for businesses looking to streamline their spend management processes.

Pros

- Consolidated and user-friendly dashboard

- Customizable chart of accounts and expense categories

- Clear and comprehensive expense tracking

- Automated bank reconciliation with the general ledger

- A good option for small and growing companies

Cons

- Considered to be difficult to set up and configure (based on user reviews on Trustpilot)

- Limited integration possibilities

- Limited functionality besides expense tracking

Starting price: Starting at $15/month for essential invoicing and accounting, with additional packages tailored to individual business needs. For more details, visit FreshBooks pricing.

FreshBooks is best for: Small organizations, freelancers, self-employed professionals, or individual accountants.

7. Wave – A free tool for bookkeeping

Wave is a bookkeeping tool ideal for freelancers and novice entrepreneurs. As most people in this category may not possess financial expertise, the platform does most of the work for them.

Solo business owners can leverage the tool to accept credit card payments, process invoices, and organize their books. They also offer 1-on-1 coaching for bookkeeping and accounting to people who need assistance in this area.

Pros

- Intuitive and user-friendly dashboard

- A good option for freelancers with a variety of functionalities

- Offers both modules for expense and invoice processing

- Supports in organizing expenses in a clear way

- 1-on-1 coaching sessions available for bookkeeping, accounting, or payroll processes

Cons

- Too complex and bloated with functionalities users don’t need

- Not the best option for small or even larger companies

Starting price: The Starter plan is available for free, covering basic accounting and invoicing features. However, additional services, such as payment processing and payroll, are available for $16 per month.

Wave is best for: Freelancers, self-employed entrepreneurs, or consultants.

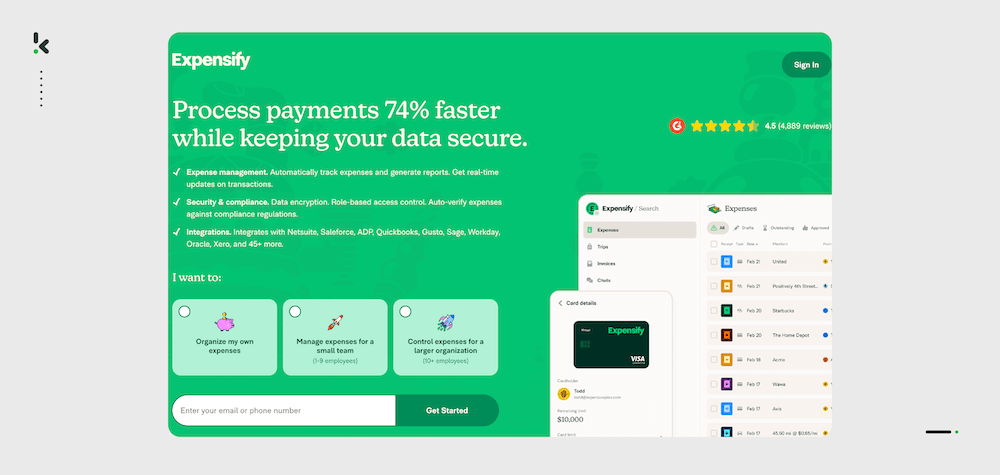

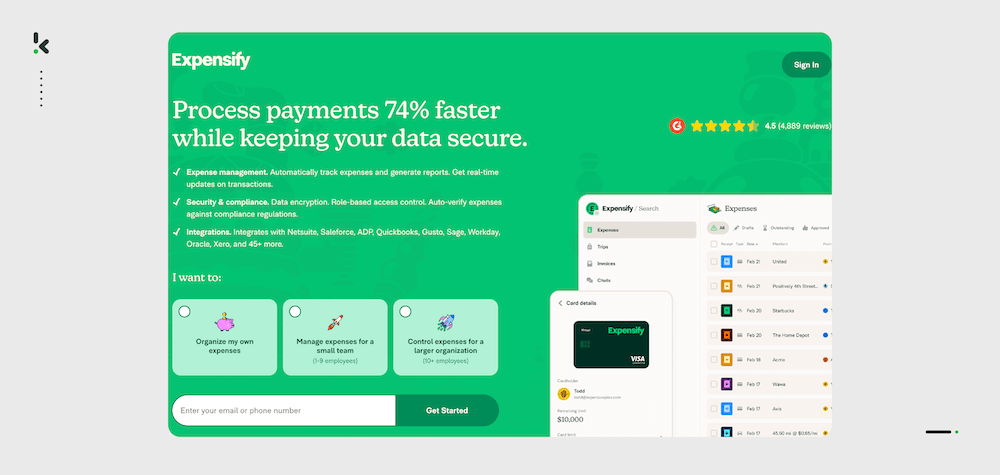

8. Expensify – Great for simplifying expense report management with various tools

Expensify is a spend management tool that streamlines expense reporting for small businesses. With features such as importing expenses from credit cards and automating recurring payments, it simplifies the process of recording and processing expenses. Its simple user interface also allows for easy tracking of expenses on a single screen. For a direct comparison between Klippa & Expensify, check out this Expensify comparison page.

Pros

- Easy-to-use solution

- Ideal option for small and emerging companies

- Credit card imports

- Various integration options

- Tax rate synchronization

Cons

- Users reported issues with customer support responsiveness and difficulties during the onboarding process (Trustpilot)

- Users find the system difficult to navigate and understand

- There are reports of problems when trying to upload files or receipts

Starting price: Expensify is free for individual use. For businesses, pricing starts at $5 per user per month.

Expensify is best for: Small emerging companies or freelancers.

We understand that choosing the right spend management solution can be daunting. That’s why we’ve done the research and identified the top-performing options on the market. And, to make it even easier, we listed below the top benefits your business can have by using this kind of software.

Why Do You Need a Spend Management Tool to Scale Your Business?

As your business grows, managing expenses becomes increasingly complex and time-consuming. That’s why it’s crucial to have a spend management tool to help you stay on top of things. Here are some benefits of using a spend management tool to scale your business:

Increased efficiency

Manual processes for managing expenses, often involving paper-based receipts and spreadsheets, can be time-consuming and error-prone. A spend management tool can automate these processes, reducing the amount of time and effort required to manage expenses and enabling employees to focus on other tasks.

Reduced costs

Automating tedious and repetitive tasks of manual expense processing results in improved efficiency, which ultimately minimizes costs. The time saved by using spend management tools reduces the need for manual labor and lowers operational costs. This allows companies to increase profitability.

Improved financial insights

A spend management tool provides real-time insight into spending, enabling businesses to make informed decisions about budget allocation and investment opportunities. It also helps to identify potential financial risks and areas for improvement.

Ensured compliance

With the increasing complexity of financial regulations and internal policies, businesses need to ensure compliance with these regulations to avoid penalties or even reputational damage. A spend management tool can help to enforce spending policies and ensure compliance with financial regulations as well as internal policies.

Overall, a spend management tool is essential for businesses that are looking to scale and grow. It helps you to improve your business by increasing efficiency and reducing expenses, which enables you to scale with confidence and achieve sustainable growth.

In the next section, we’ll tell you more about the number one spend management solution. We’ll explain why it’s the best choice and how it can help your business achieve greater efficiency and profitability. Keep reading to find out more about this solution!

What Makes Klippa a Top Choice for Accounting Automation?

Klippa SpendControl isn’t just another tool – it’s a fully AI-powered receipt scanning and processing platform. Klippa combines AI-powered pre-processing, smart automation, and fraud detection to deliver the fastest, most accurate, and secure accounting automation workflows in 2025.

What makes Klippa stand out from the rest?

Klippa SpendControl leads the way with its all-in-one platform that integrates invoice processing, expense management, and corporate credit card modules. It uses AI-powered OCR to ensure fast, accurate, and automated data extraction. For businesses needing a comprehensive solution, it offers the perfect combination of invoice approval workflows, fraud prevention, and seamless integration with popular accounting software like QuickBooks and NetSuite.

Now part of the SER Group, a recognized Leader in the Gartner® Magic Quadrant™ for Document Management, Klippa brings enterprise-grade workflow automation capabilities to teams across industries. Whether you’re in finance, logistics, or healthcare, SpendControl is the most powerful and flexible software available in 2025.

Get started with Klippa SpendControl

Spend management solutions can effectively streamline your financial processes, saving a significant amount of time and effort on manual tasks. Klippa SpendControl is an all-in-one financial management software that simplifies spend management processes, making this an effortless experience.

With Klippa SpendControl, you can automate tasks such as expense reporting, invoice management, and credit card processing, eliminating the need for manual data entry and analysis. This ultimately saves you costs and increases your efficiency, allowing you to focus on other critical aspects of growth. Besides this, Klippa SpendControl has multiple other benefits, such as:

- A dedicated customer support team to assist you with any questions you have. This will make your transition feel like a breeze to kickstart your journey efficiently.

- Simplify your expense approval procedure with fixed or variable approval processes customized to your specific business needs.

- Prevent fraud with the help of a built-in analysis that detects duplicates and recognizes potential fraudulent documents to avoid losing money to fraud.

- Maximize control and protection with intelligent controls and digital audit trails to ensure compliance as well as enhance your internal management.

- Integrate smoothly with your preferred accounting or ERP system, such as NetSuite, Twinfield, Xero, and many more.

We are confident that Klippa SpendControl provides a wide range of features and valuable automation to streamline your spend management process. Do you want to get full control of your spend management and optimize your bottom line with automation?

Don’t hesitate to contact one of our experts or book a free demo. Our team is excited to showcase how Klippa SpendControl can benefit your business and streamline your expense operations.

FAQ

Spend management software is a digital solution designed to help businesses streamline their procurement process, automate expense reporting, track spending, and ensure compliance with financial policies. It optimizes financial workflows by automating data entry, providing real-time visibility into spending, and identifying areas for savings.

The answer depends on your business needs and size. Here’s a quick breakdown:

– If you need an all-in-one solution for automating expense reporting, invoice management, and credit card processing, Klippa SpendControl is the perfect choice, offering seamless ERP integration and fraud detection.

– For small organizations and freelancers seeking a simple yet powerful platform with corporate card management, Airbase provides a unified dashboard and flexible approval workflows.

– If you’re managing accounts payable and expense automation, Emburse Chrome River is a great option, offering real-time reporting, purchase order matching, and integration with accounting systems.

– For medium-sized businesses and enterprises, Tipalti is the ideal choice, offering expense and invoice processing, OCR technology, currency management, and ERP integrations.

– If you require compliance controls, mileage tracking, and transaction reconciliation, Rydoo is the solution, designed for small to medium companies.

– For small businesses or freelancers looking for a user-friendly solution for expense tracking and bank reconciliation, FreshBooks is a great fit.

– If you’re a freelancer or solo entrepreneur needing a simple, free tool for bookkeeping and invoicing, Wave is perfect, offering coaching support as well.

– For managing expenses with ease, Expensify is a great solution, with credit card imports, tax rate synchronization, and multiple integration options.

That said, Klippa SpendControl stands out as the most complete and ideal spend management software in 2025, offering comprehensive automation and integration for businesses of all sizes.

Klippa SpendControl uses AI-powered OCR to extract data from receipts, invoices, and documents. It automatically processes and categorizes the information, streamlining the approval process and reducing manual effort.

Klippa SpendControl has built-in fraud detection features that automatically analyze documents for duplicates and potential fraudulent patterns, reducing the risk of financial loss.