Virtual Expense Cards for Flexible Spending

Effortlessly manage and control your business expenses with customizable & convenient virtual credit cards.

Trusted by 1000+ innovators and finance leaders worldwide

<img decoding=”async” src=”https://www.klippa.com/wp-content/uploads/2024/02/Banijay-grey-logo.png” alt=””/>

<img decoding=”async” src=”https://www.klippa.com/wp-content/uploads/2024/02/Online-Payment-Platform-grey-logo.png” alt=””/>

<img decoding=”async” src=”https://www.klippa.com/wp-content/uploads/2024/02/DZBank-grey-logo.png” alt=””/>

<img decoding=”async” src=”https://www.klippa.com/wp-content/uploads/2024/02/Nivea-grey-logo.png” alt=””/>

<img decoding=”async” src=”https://www.klippa.com/wp-content/uploads/2024/02/Krombacher-grey-logo.png” alt=””/>

<img decoding=”async” src=”https://www.klippa.com/wp-content/uploads/2024/02/Car-Offer-grey-logo.png” alt=””/>

<img decoding=”async” src=”https://www.klippa.com/wp-content/uploads/2024/02/Car-Offer-grey-logo.png” alt=””/>

Why Modern Finance Teams Choose SpendControl

99%

correct data extraction by Klippa’s leading OCR70%

of time saving on processing100%

insights into your operational expenses20+

integration possibilitiesto connect with

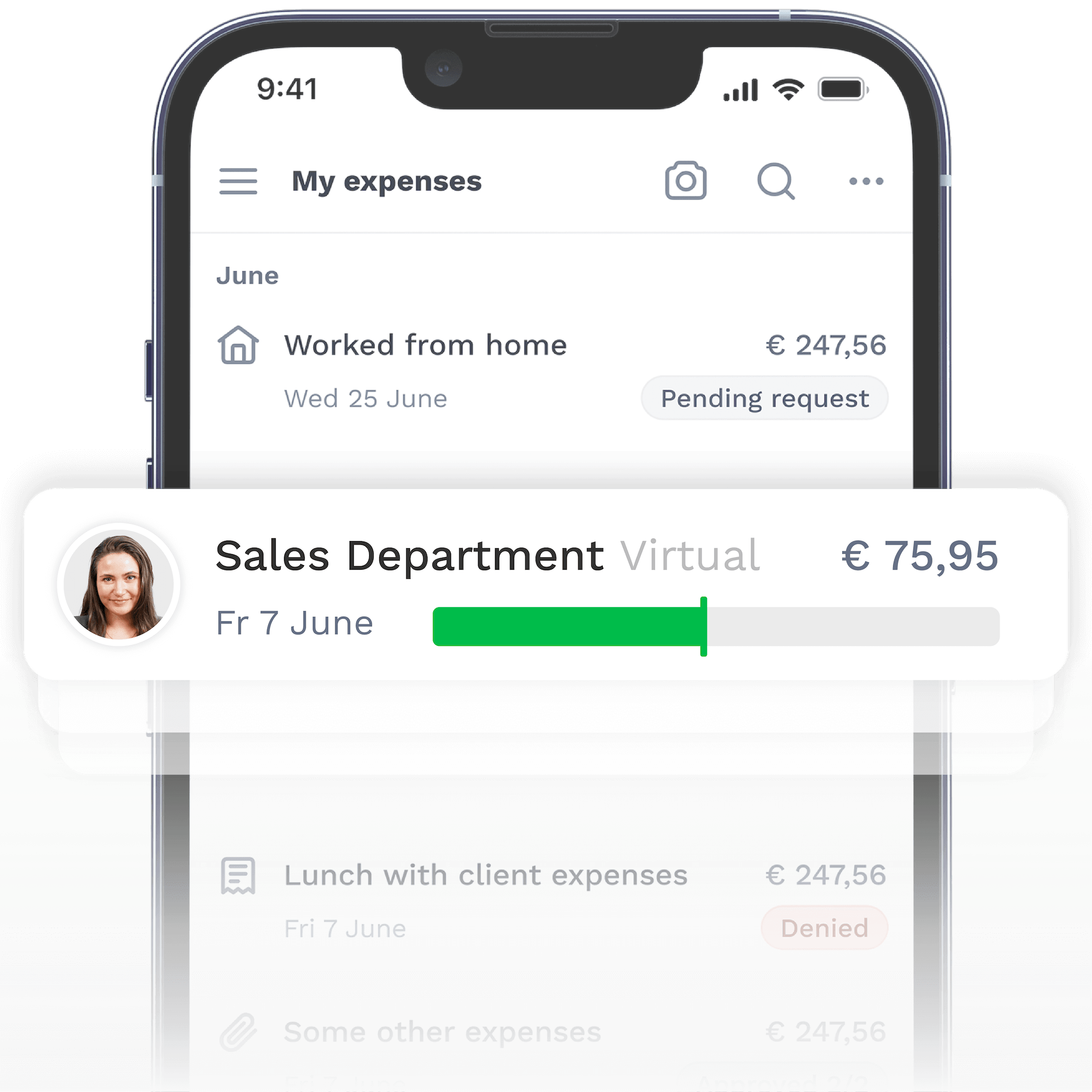

No More Out-of-Pocket Costs

Provide a secure and convenient way to make expenses without the use of personal funds. Set spending limits and monitor real-time transactions, ensuring all employee payments are legitimate and authorized.

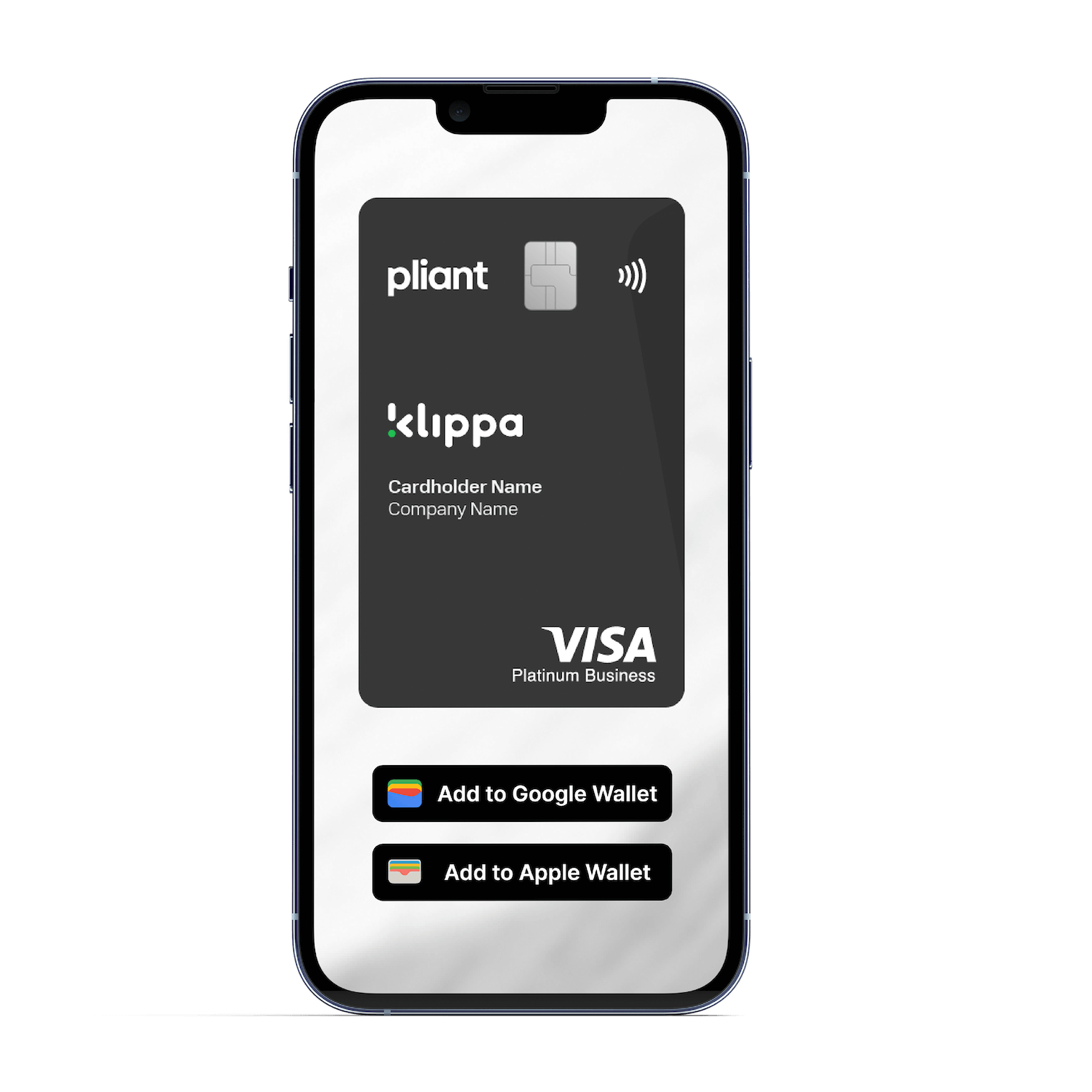

Discover Fast & Secure Purchases

Avoid the risk of lost or stolen information by storing cards in your Apple or Google wallet and rely on the 3-DS protection layer for secure online transactions.

The Power of Klippa Business Expense Cards

No more OOP costs

No more out-of-pocket costs, but an expense card system.

Widely Accepted

With Klippa Cards you can pay anywhere with Visa card support

Physical & Virtual

Whether it’s in-store or online, Klippa suits your needs.

Fully Secured

Rest easy knowing that your financial data is fully secured.

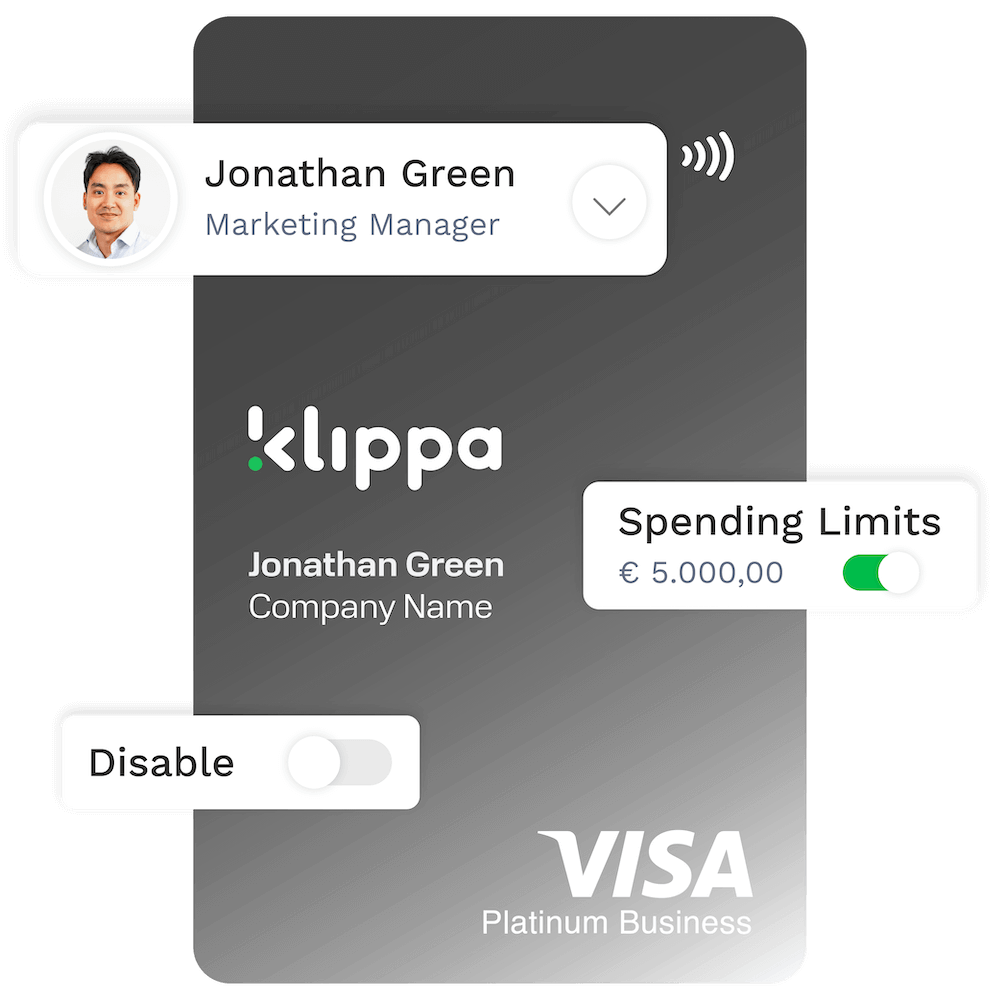

Spending Limits

Take charge of expenses and ensure responsible spending.

Easy To Manage

Effortlessly manage your cards in your own dashboard.

Issue Custom Cards in Seconds

Instantly issue unlimited virtual cards for immediate use. Tailor them to specific merchants or purchases, with the option for single-use cards for one-time transactions.

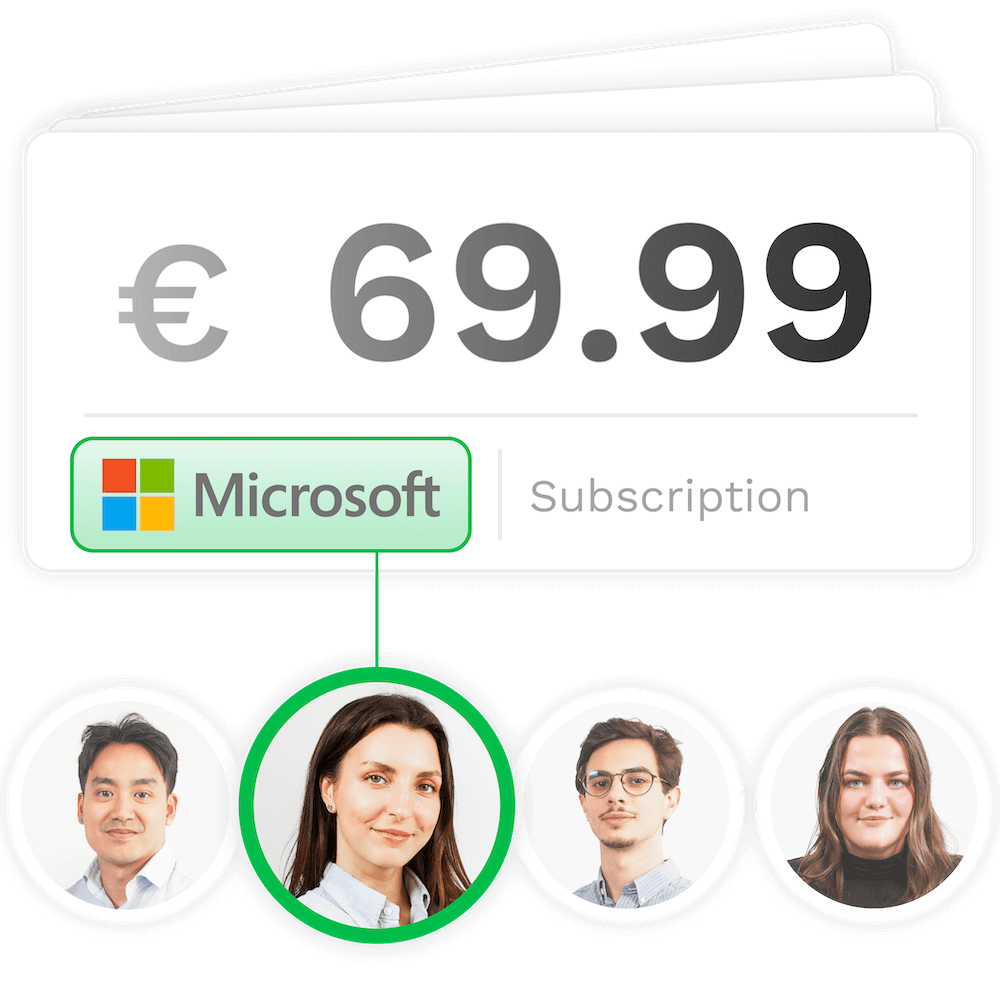

Smart Limits, Easy Management

Easily update card settings with a single click. Set up approval management with custom rules, assign flexible spending limits, and gain full control over recurring charges like SaaS subscriptions.

Made To Integrate With

<img decoding=”async” src=”https://www.klippa.com/wp-content/uploads/2023/07/googlemail.png” alt=””/>

<img decoding=”async” src=”https://www.klippa.com/wp-content/uploads/2023/07/googledrive.png” alt=””/>

<img decoding=”async” src=”https://www.klippa.com/wp-content/uploads/2023/07/onedrive.png” alt=””/>

<img decoding=”async” src=”https://www.klippa.com/wp-content/uploads/2024/05/Microsoft_Entra_ID_light.png” alt=””/>

<img decoding=”async” src=”https://www.klippa.com/wp-content/uploads/2023/07/sharepoint.png” alt=””/>

<img decoding=”async” src=”https://www.klippa.com/wp-content/uploads/2021/11/Oracle-NetSuite-partner-01-e1637526692391.png” alt=””/>

<img decoding=”async” src=”https://www.klippa.com/wp-content/uploads/2019/08/xero-klippa.png” alt=””/>

<img decoding=”async” src=”https://www.klippa.com/wp-content/uploads/2023/07/dropbox.png” alt=””/>

<img decoding=”async” src=”https://www.klippa.com/wp-content/uploads/2023/07/quickbooks-Round.png” alt=””/>

<img decoding=”async” src=”https://www.klippa.com/wp-content/uploads/2023/07/zohobooks_short.png” alt=””/>

See all of our integrations.

Join 1000+ Finance Teams in Carefree Spend Management

Klippa allows us to digitally register, approve, and process expenses and invoices in one user-friendly cloud environment.

With Klippa, colleagues can focus on key tasks as workload and manual processes are greatly reduced, achieving an ROI of 60–80%.

Employees can now submit their claims directly via the app. Managers approve them, and finance ensures proper receipt allocation.

We Take Your Data Privacy & Security Seriously

Frequently Asked Questions

What are Klippa’s Virtual Cards?

What can Klippa Virtual Cards be used for?

What is the cost of Klippa’s Virtual Cards?

Can Klippa’s Virtual Cards be used for online payments?

Can Klippa’s Virtual Cards be used for personal expenses?

Cards are issued by Pliant OY, identified by business ID 3266913-9, in accordance with a license from VISA Europe Limited. Pliant OY is recognized as an Authorized E-money payment institution and duly authorized and regulated by the Financial Supervisory Authority of Finland.