Customer onboarding in the digital age is finally picking up the pace of modernization, as everyone has started doing everything online. With approximately 216.8 million people (only in the US!) using digital banking services, financial institutions must pick up the pace.

Before, if a customer wanted to open a bank account, they’d simply go to a bank, show their ID, and have the clerk manually copy the information to confirm their identity. Now, even though onboarding has moved online, it often still requires manual data entry, which is such a laborious and time-consuming task.

That’s where smart tech steps in.

Technologies like Optical Character Recognition (OCR) and AI, especially when they are combined into a platform like Klippa’s DocHorizon, can save companies tons of time and resources.

So, how does this work, and which KYC checks can be done automatically? Let’s zoom in and find out!

Key Takeaways

- Know Your Customer (KYC) is a legal requirement that ensures that customers are who they claim to be, and it typically requires verifying a customer’s identity and proof of residency.

- Traditional KYC processes involve employees manually handling documents, which is slow, delays access to services, and decreases user satisfaction.

- Whatever document is checked, Klippa performs real-time validation to meet KYC and AML compliance. You can check photos, names, personal details, and residency proofs in a matter of seconds.

- Klippa’s AI and OCR have been trained and perfected to recognize and extract relevant information with a 95–100% accuracy rate, even from complex or non-standard documents.

What Are KYC Checks and Why Automate Them?

Know Your Customer (KYC) is a mandatory process for verifying clients’ identities during onboarding. Usually, it involves collecting and validating identity documents such as passports, ID cards, driver’s licenses, utility bills, and bank statements.

Traditionally, this process was done manually, with employees reviewing documents, extracting information, and inputting it into internal systems. It didn’t take long to see that this approach is time-consuming, error-prone, and costly.

Luckily, automating document-based KYC transforms this workflow. OCR technology extracts text from submitted documents, while AI interprets the data. The structured output is then seamlessly integrated into your systems, speeding up verification, reducing human error, and improving compliance.

But how? Let’s see how OCR and AI come together in the automated KYC process.

How Do OCR and AI Work for Automated KYC Checks?

With Optical Character Recognition (OCR), all sorts of documents containing text can be read, and data can be extracted from them automatically. This automated recognition is backed by AI, which is trained extensively and specifically on thousands of examples of IDs, tax statements, salary slips, and so on.

The automated KYC process usually involves two proofs: a proof of identity and a proof of residency. In essence, this means that the AI needs to be able to detect certain data categories to distill the right information. At present, Klippa’s OCR API can do this with at least 95% accuracy, bordering on 100%.

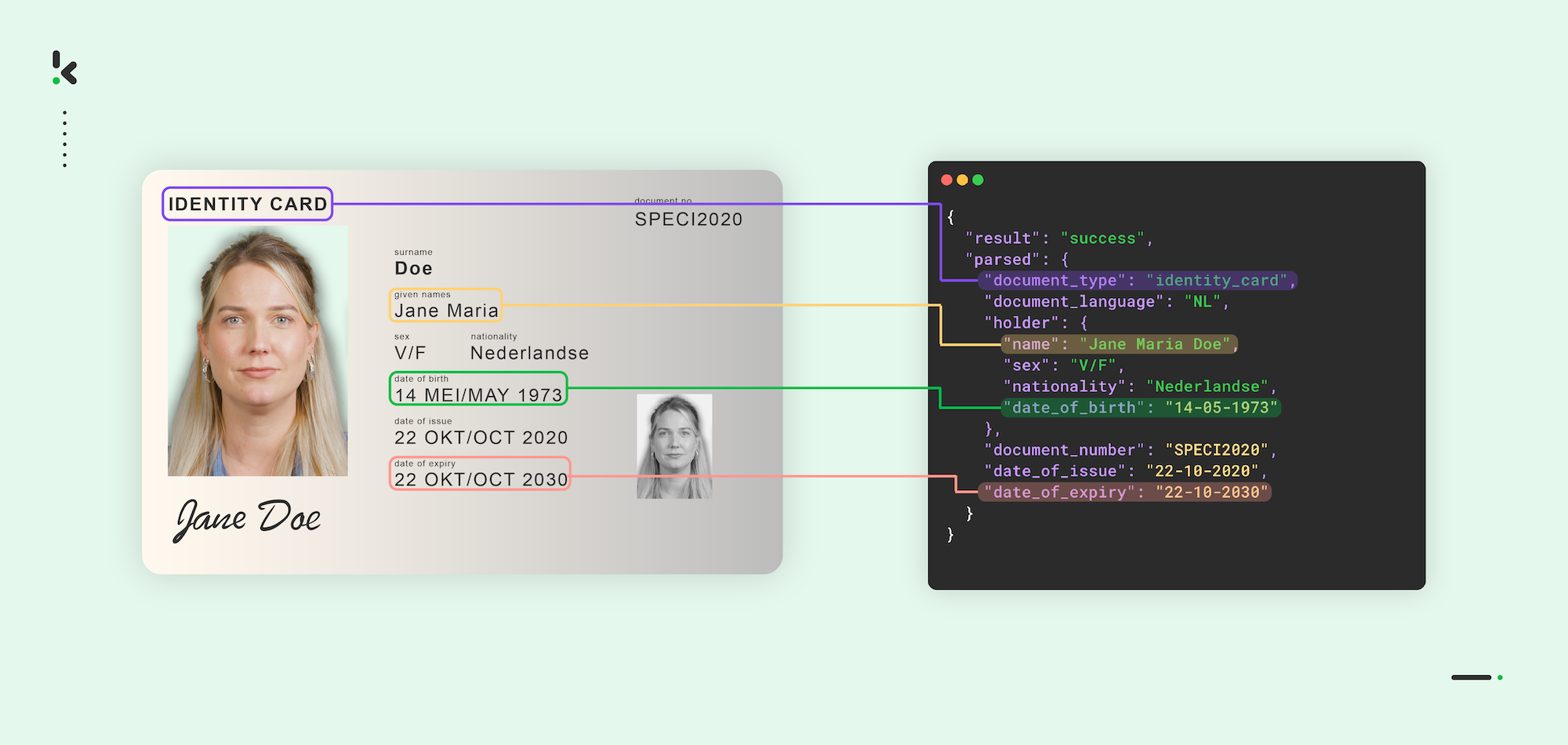

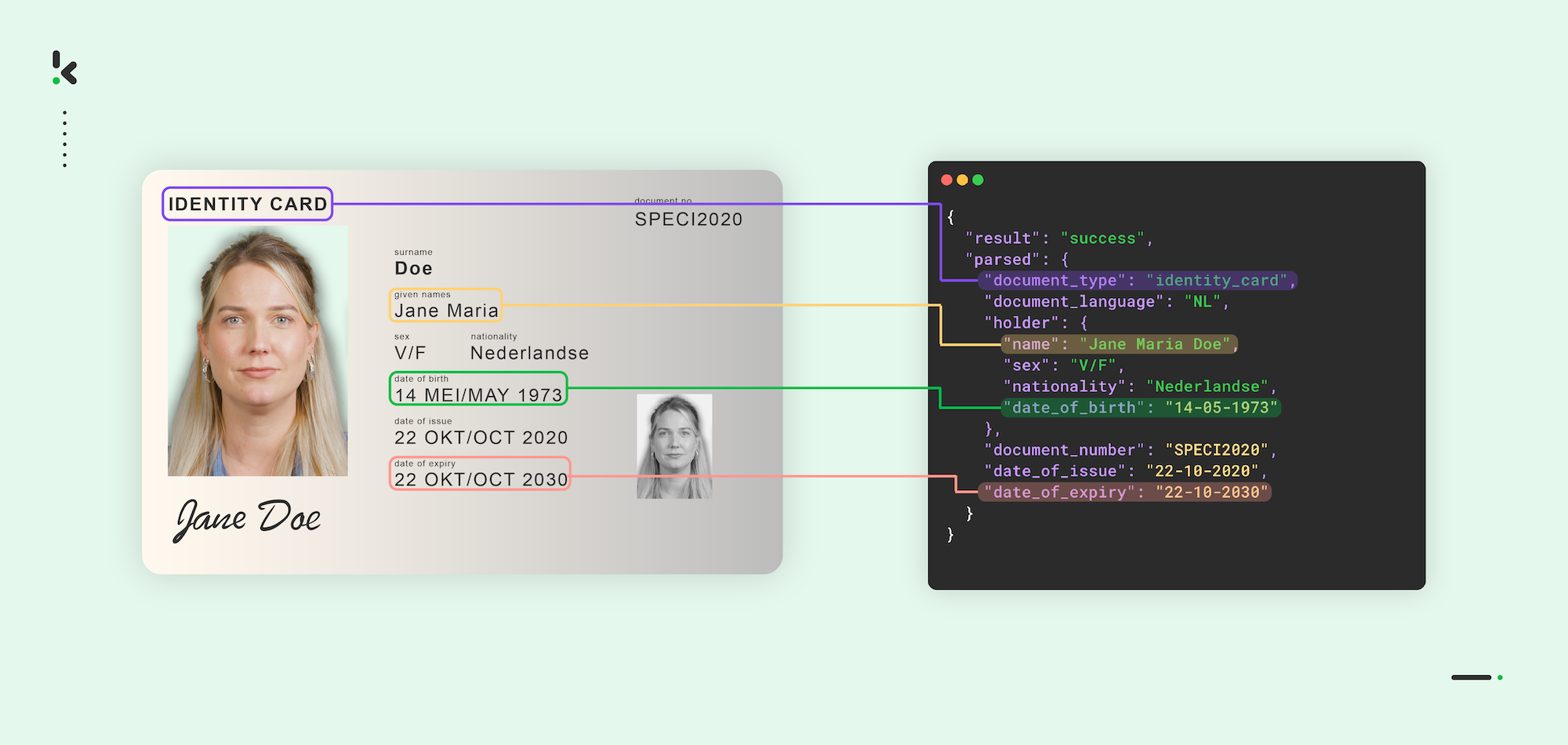

So, OCR reads the text, and the AI recognizes the context and extracts the required data. This is done in three steps: a scan of the ID is sent to the OCR API, the photo is converted into a raw text file, and AI interprets the information and returns the data in a structured format.

This completely automates the KYC process (also called eKYC) within seconds and provides a failsafe way of checking one’s identity, as human error is removed from the process.

Step-by-Step Guide to Automate KYC Checks

Here at Klippa, we think that the process, actually, any process of automating your KYC checks, should not be a hassle. This guide walks you through each step of automating your document-based KYC process from start to finish:

Step 1: Collect Customer Documents

The first step involves collecting the required identity documents from your customer. This usually includes items like a passport, national ID card, driver’s license, or a recent utility bill (more about them in the next section). Customers can upload scanned documents or photos via a secure portal, app, or email.

Step 2: Upload Documents to Your Processing System

You can do this by using either a web interface, a mobile SDK, or an API. Their integrated document capture module allows for seamless uploading of the documents to your backend or cloud-based system. Solutions like Klippa make it easier for you to connect the chosen upload method – let’s say Google Drive – to the platform and automatically access the files without any human intervention.

Step 3: Apply OCR for Text Extraction

Use OCR software to scan the uploaded documents and extract a variety of textual data, including names, addresses, ID numbers, dates of birth, and expiry dates. OCR transforms unstructured images into machine-readable text.

Step 4: Use AI for Data Interpretation and Validation

It’s the turn of the AI models to analyze the extracted data so they can classify the document type (e.g., passport vs. driver’s license), match fields against expected formats or known templates, detect anomalies or signs of tampering, and compare document data with submitted forms or user input.

Step 5: Structure the Extracted Data

Once validated, the AI now structures the data into standardized formats (e.g., JSON or XML). This step is essential so the extracted data can be easily integrated into your CRM, onboarding system, or compliance software.

Step 6: Deliver Results and Store Records Securely

Once the KYC check is complete, results are delivered instantly or within seconds to your internal system or dashboard. In the long run, it’s important that all processed data and documents are securely stored, encrypted, and audit-ready for regulatory purposes.

Step 7: Maintain Logs and Audit Trails

The final step is to ensure your automated system keeps logs of each step in the process, including timestamps, system actions, and verification outcomes. This supports compliance with regulations like GDPR, AMLD, and other KYC requirements.

Easier than expected, right?

As we promised, let’s take a closer look at four documents you can deploy OCR and AI for to determine proof of identity or proof of residency.

Supported Document Types for KYC Checks

Various documents can be used in KYC processes to verify identity and residency. Let’s explore some of them:

Identity documents (ID/Passport/Driver’s License)

The first and primary type of document that comes to mind when talking about KYC checks is the identity document, in this case, ID cards, passports, and driver’s licenses. It is the most obvious first way of checking one’s identity for onboarding purposes, but it also involves the most security requirements.

Both regular text and non-textual data that are on an ID card or passport can be extracted. This information provides the most complete picture of the potential customer, and thus, their identity can be confirmed. A photo can, for instance, be checked with a recent selfie in combination with a signature to further increase security checks.

Tax statements

A tax statement is an excellent way to check proof of residency or sometimes even proof of identity in a KYC process. A person’s name, address, county, or region, depending on how tax is governed in a particular country, can all be identified and extracted from a tax statement.

Purely in terms of KYC standards, this information, combined with another form of identification, can safely confirm the residency or identity of a potential customer.

Tax statements can also indicate other information, such as a confirmation of payment of said taxes to the relevant tax authorities, a check for potential tax fraud in line with AML regulations, and much more data.

Salary slips

A salary slip, or payslip, is another easy way to perform your KYC processing. Although it is generally used to confirm a person’s name, address, and even confirm that the person works at a specific company, it can also serve as a confirmation of someone’s monthly income.

So, by extracting data from a salary slip, you can confirm a person’s name, address, gross and net salary, hours worked, tax rate, and more. The AI is trained to identify where this information is on the payslip and turn it into usable data for KYC purposes.

Utility Bills

Any form of a utility bill can be deployed as proof of residency. Payment of such utility services proves the address of a specific person as it is directly related to their property.

Proof of residency in the form of a utility bill indicates that the potential customer is financially solvent, has been so for a period of time, and, of course, has been living in a specific region for a certain time.

Also, with OCR, any document tampering can be determined, and data can be confirmed with an existing database.

Benefits of Automated KYC Processes

Releasing the power of automation on your KYC processing comes with numerous benefits. These benefits are present for any type of industry, be it in banking or in the public sector. Let’s look at the primary benefits that make automation highly recommended to comply with current and future KYC, AML, and GDPR requirements:

- Process documents within seconds. Automation via OCR and AI allows for processing to take a couple of seconds and can process an endless number of documents simultaneously. That is not something a human employee can easily do.

- Achieve a ~100% accuracy rate. Data extraction at Klippa is nearly 100% accurate, meaning that you can rest assured that the required data on a provided document is the exact data you need. This is especially the case when there is a short human check afterwards.

- Be fully GDPR compliant. Our OCR and AI service for KYC is fully GDPR compliant. Within the European Union, we only use ISO certified servers, and outside of the EU, we can open a local server that aligns with local legislation and compliance regulations. We never store data, we only process it for you.

- Applicable to almost every document type. We mentioned four types of documents above, but this service extends to any document that may provide proof of identity or proof of residency. You can think of bank cards or statements, permits, contracts, P&L statements, you name it.

- Easily adaptable. Changing your way of working or the data you aim to identify can impact your employees. When changing the focus of an AI and OCR, this adaptation is executed way more smoothly. An AI can be subjected to way more adaptations in a shorter period than a human could effectively be.

How Trading 212 Optimized Onboarding with Automated KYC Checks

Do you know which is the best part of implementing automated KYC checks? You’ll have fewer things to worry about and more things to enjoy. Just like Trading 212 does.

Trading 212, a leading UK-based trading platform, improved its customer onboarding processes by integrating Klippa DocHorizon for automated document verification. Previously relying on manual checks for payment cards and proof of residence, the company faced delays, errors, and a high support workload.

With Klippa’s OCR-powered solution, data is now extracted and validated in real time, reducing document rejections and speeding up the onboarding process. The result is a faster, more accurate, and user-friendly experience, while easing the burden on compliance and support teams.

How to Get Started with KYC Automation

If you want to automate and secure your KYC processing, you’re at the right address.

Klippa’s KYC software offers a range of digital identity verification methods to simplify and secure KYC checks. These include document verification, biometric verification, liveness detection, and NFC checks, which can be combined based on your needs.

But, with Klippa DocHorizon, you can do so much more! You’ll be able to:

- Mobile scan documents – Scan documents from mobile devices at any place, any time.

- Use AI-powered OCR – Turn scanned documents and images into text and structured data formats.

- Extraction data – Real-time extraction of important data points with endless customizations.

- Classify files instantly – Classify and sort documents according to your needs.

- Parse data – Turn JPG, PNG, and PDF files into searchable text and export them to formats like PDF or structured CSV, XLSX, XML, and JSON.

- Anonymize data – Mask sensitive data in just a few seconds, from anonymization to removal.

- Detect fraud – Avoid incidents with robust fraud detection features.

- Verify data – Verify the authenticity and validity of documents and data.

Ready to try our solution? Schedule a demo with our product experts below. We can help you find the right solution for you. And if we don’t have it, we create it for you!

FAQ

KYC checks are mandatory for regulated industries such as banking, fintech, insurance, and investment platforms. However, any business dealing with sensitive transactions can benefit from KYC.

Yes, advanced AI-powered systems are trained to detect forged IDs, tampering, or anomalies in document layout, fonts, photos, and metadata—often more accurately than human reviewers.

Yes, Klippa’s KYC solutions are highly customizable. Businesses can tailor the identity verification flow, including document types, verification steps, and user interface elements, to fit their specific needs.

Klippa ensures data privacy and security by implementing end-to-end encryption, complying with GDPR, and offering options for data processing within specific jurisdictions to meet local data protection requirements.