Klippa SpendControl | Approval Management

Digital and Automated Approval Workflow

Simplify your approval process with automated and rule-based expense and invoice workflows for fast approvals in the accounting or ERP system.

Trusted by 1000+ innovators and finance leaders worldwide

<img decoding=”async” src=”https://www.klippa.com/wp-content/uploads/2024/02/Banijay-grey-logo.png” alt=””/>

<img decoding=”async” src=”https://www.klippa.com/wp-content/uploads/2024/02/Online-Payment-Platform-grey-logo.png” alt=””/>

<img decoding=”async” src=”https://www.klippa.com/wp-content/uploads/2024/02/DZBank-grey-logo.png” alt=””/>

<img decoding=”async” src=”https://www.klippa.com/wp-content/uploads/2024/02/Nivea-grey-logo.png” alt=””/>

<img decoding=”async” src=”https://www.klippa.com/wp-content/uploads/2024/02/Krombacher-grey-logo.png” alt=””/>

<img decoding=”async” src=”https://www.klippa.com/wp-content/uploads/2024/02/Car-Offer-grey-logo.png” alt=””/>

<img decoding=”async” src=”https://www.klippa.com/wp-content/uploads/2024/02/Car-Offer-grey-logo.png” alt=””/>

No More Paper-Based Approval Processes,Full Budget Control in One Central Place

Fast approval process

Avoid invoice stacking and delays through automated workflows.

Compliance with guidelines

Standardized processes ensure compliant and efficient workflows.

Prompt decisions

Clear processes ensure transparent approvals and punctual payments.

Error prevention

Avoid input errors and fraud with OCR, receive reminders and notifications.

Why Modern Finance Teams Choose SpendControl

99%

correct data extraction by Klippa’s leading OCR70%

of time saving on processing100%

insights into your operational expenses20+

integration possibilitiesto connect with

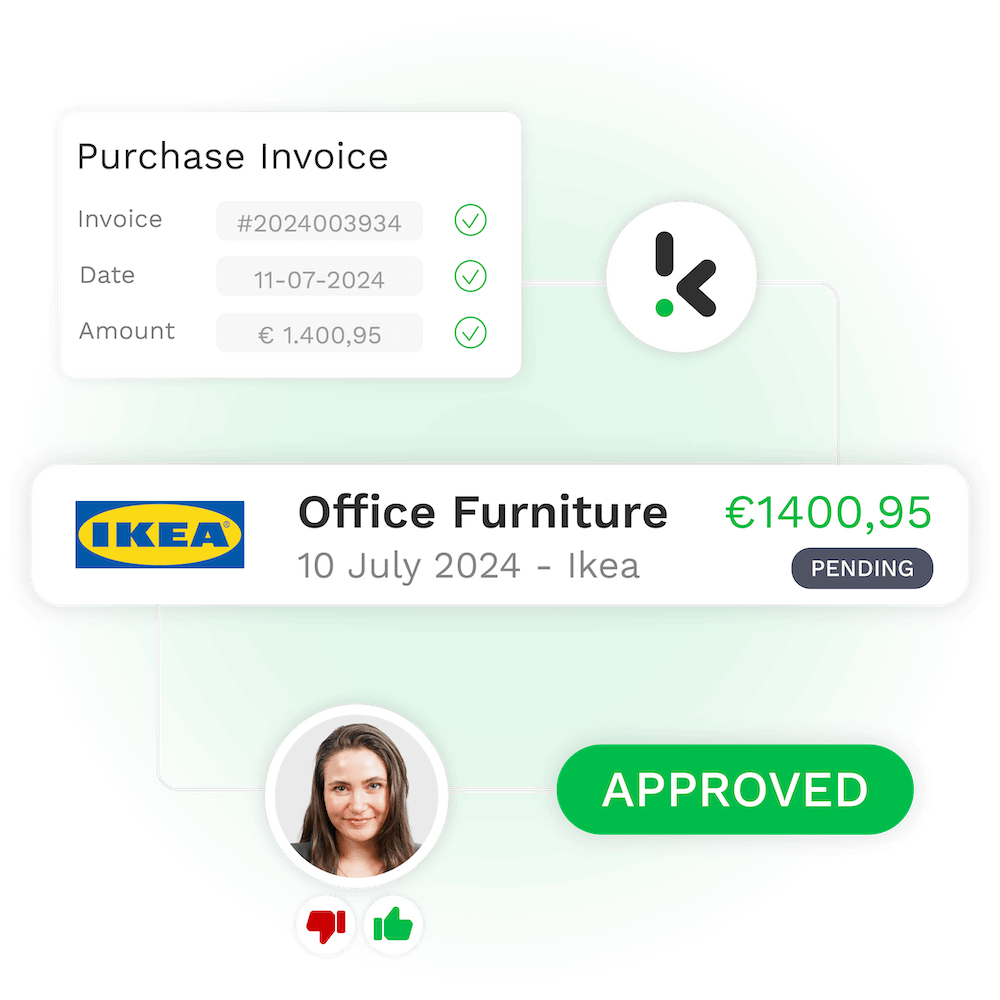

Automated Approval Software

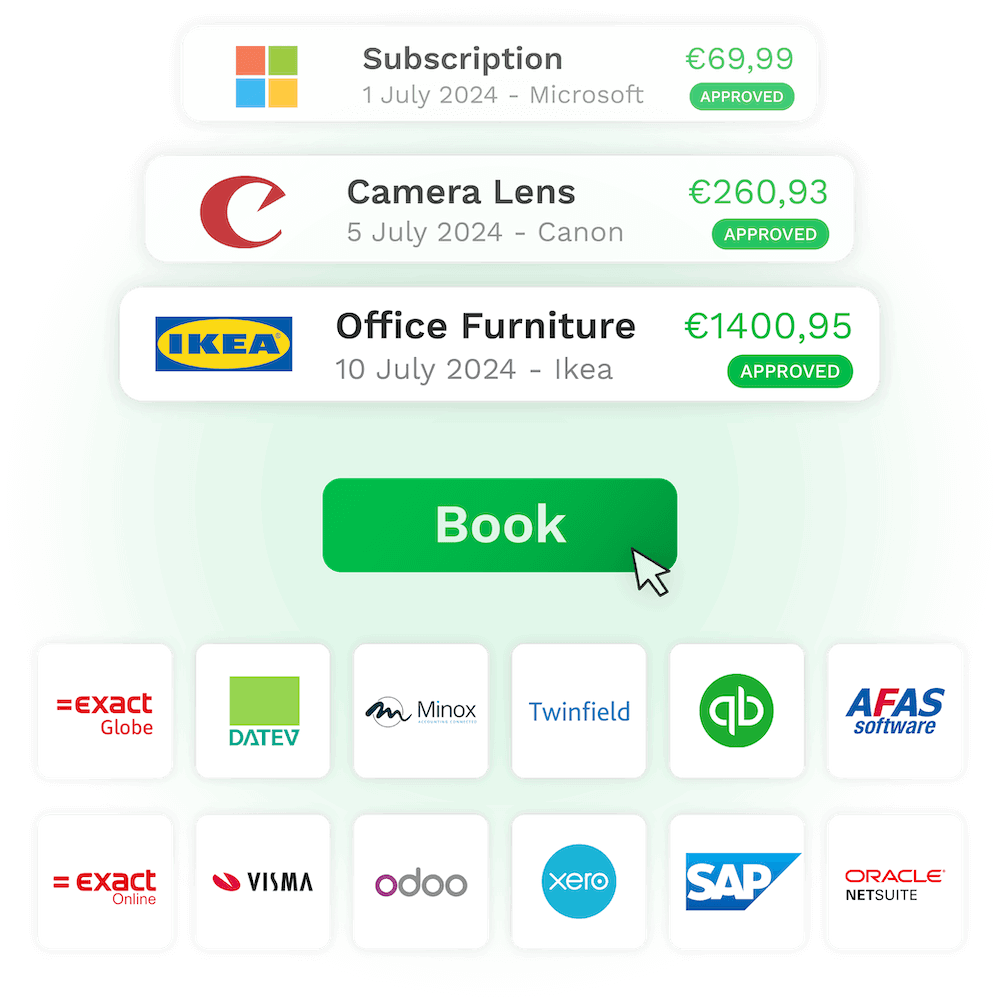

Speed up invoice processing with standardized workflows, automatic approver assignment, and AI-powered data capture along with cloud-based invoice approval.

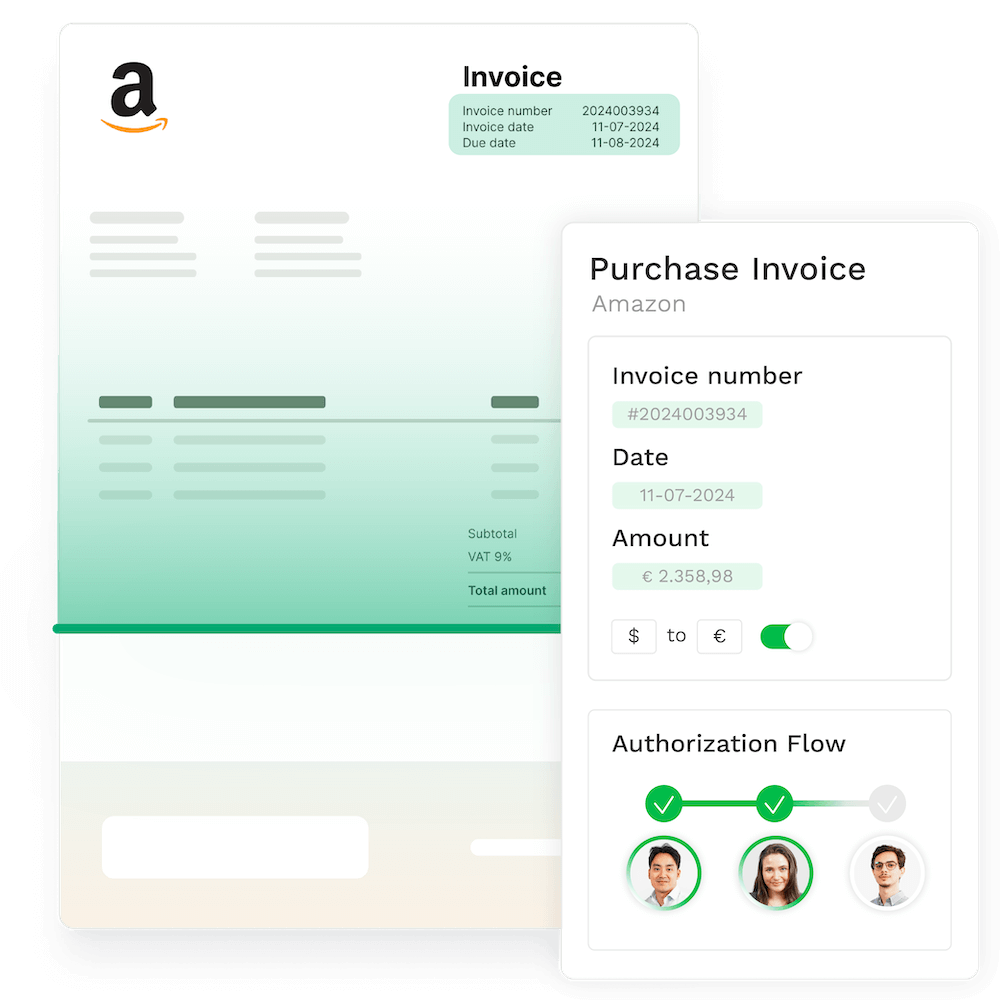

Flexible and Individual Workflows

Create flexible workflows that integrate seamlessly into existing processes. Ensure that invoice fraud is prevented and expenses are processed in line with regulations.

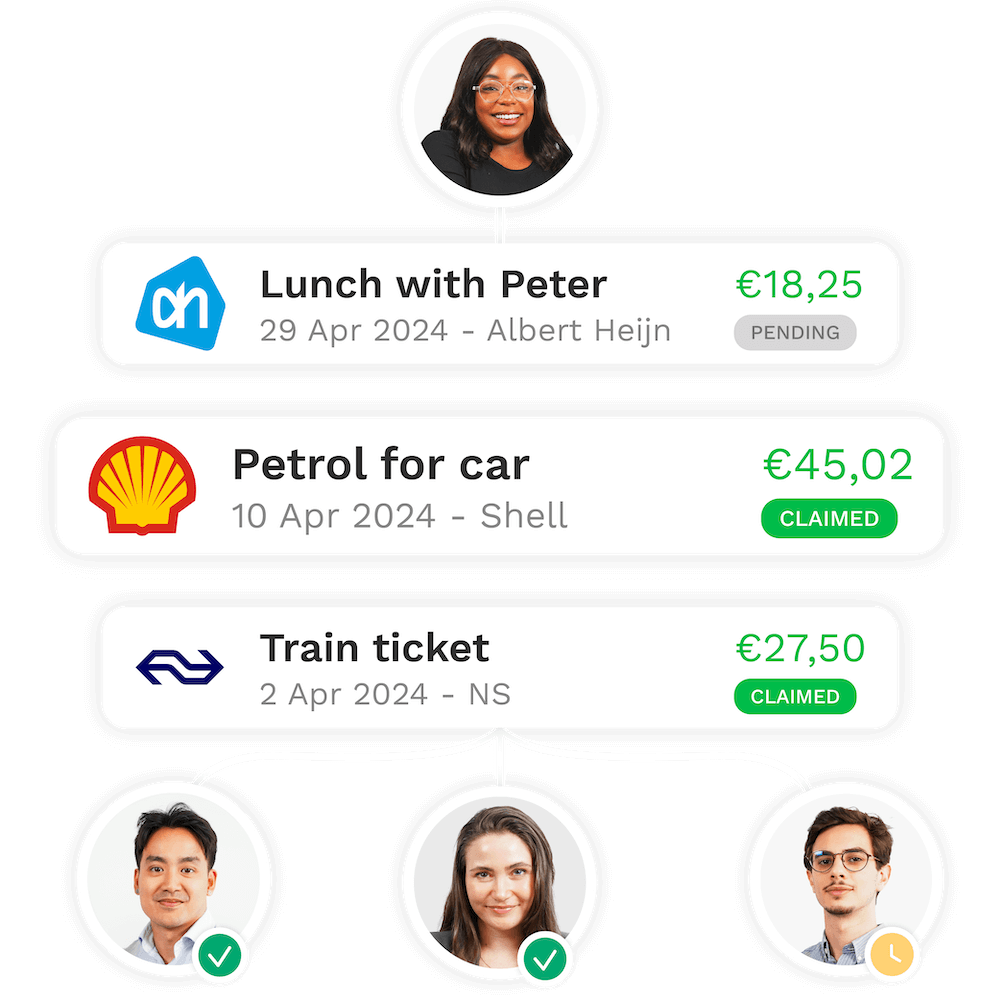

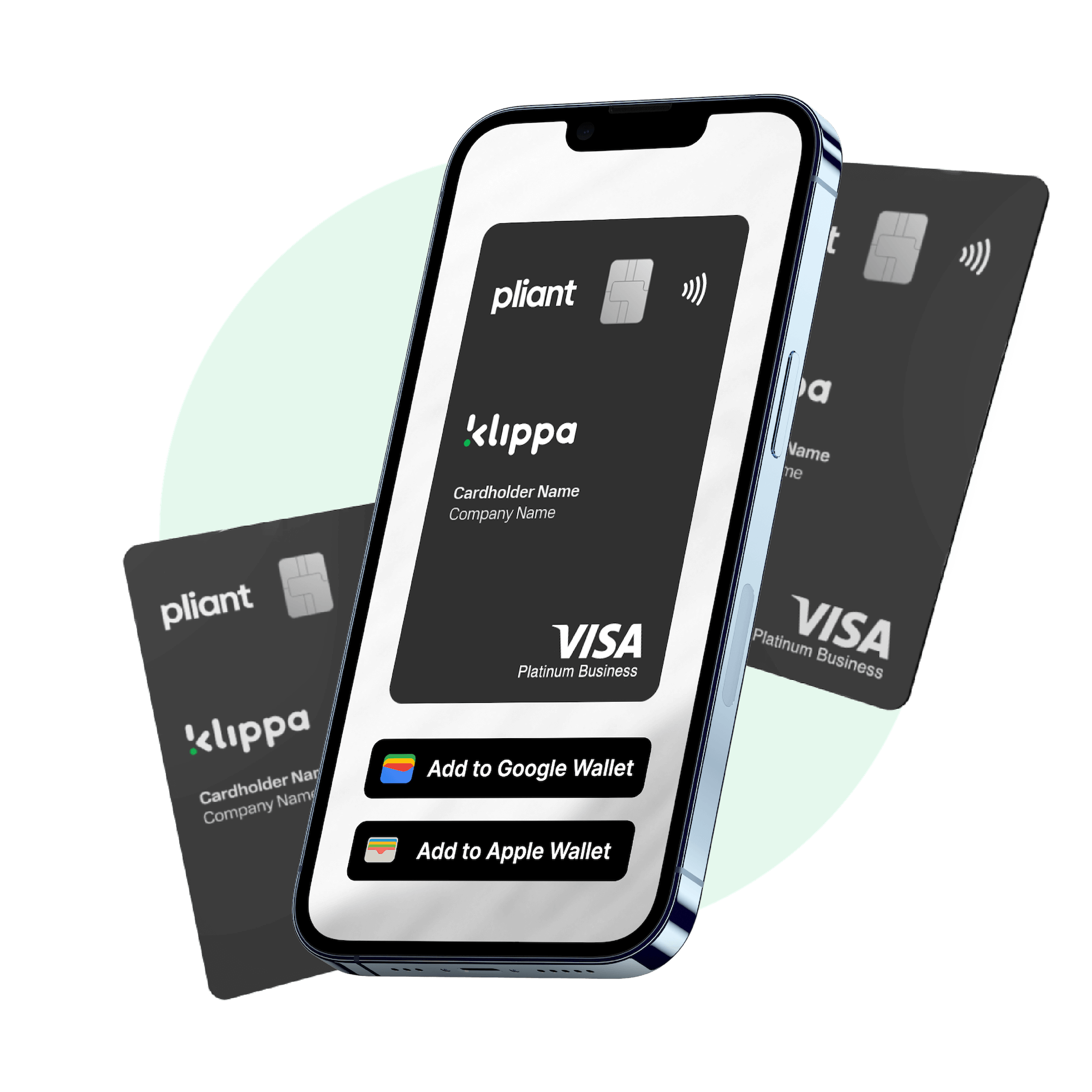

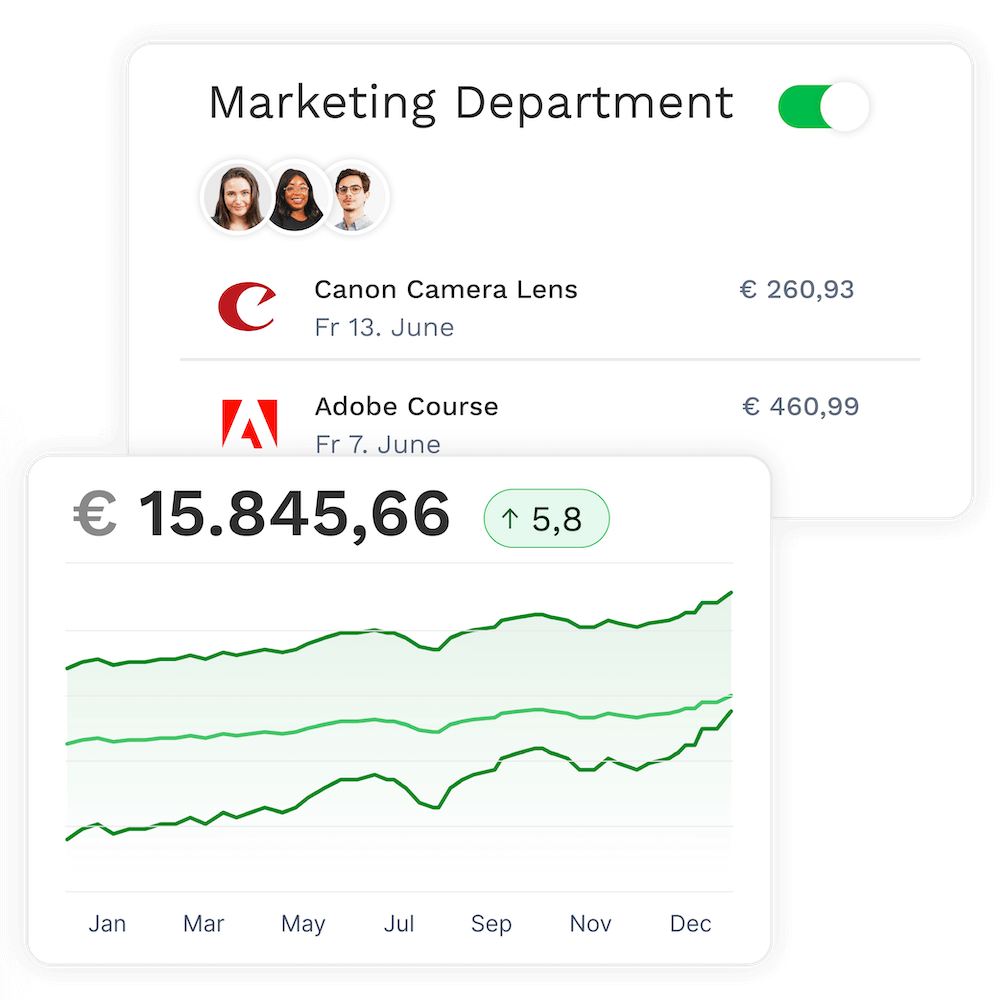

No More Out-of-Pocket

Get a grip on employee expenses with company cards. Track spending, set limits, and eliminate out-of-pocket costs with a complete expense card system. Enjoy easy tracking, management, and real-time processing of card transactions for effective budget control.

Spending Control Made Easy

Ensure that only authorized employees approve expenses and maintain control through precise audit trails. Link people to your business rules for efficient budget control.

Fast Approvals and Payments

Strengthen your vendor relationships with fast payments. Ensure invoices are processed and compensated on time with seamless invoice approval software.

Made To Integrate With

<img decoding=”async” src=”https://www.klippa.com/wp-content/uploads/2023/07/googlemail.png” alt=””/>

<img decoding=”async” src=”https://www.klippa.com/wp-content/uploads/2023/07/googledrive.png” alt=””/>

<img decoding=”async” src=”https://www.klippa.com/wp-content/uploads/2023/07/onedrive.png” alt=””/>

<img decoding=”async” src=”https://www.klippa.com/wp-content/uploads/2024/05/Microsoft_Entra_ID_light.png” alt=””/>

<img decoding=”async” src=”https://www.klippa.com/wp-content/uploads/2023/07/sharepoint.png” alt=””/>

<img decoding=”async” src=”https://www.klippa.com/wp-content/uploads/2021/11/Oracle-NetSuite-partner-01-e1637526692391.png” alt=””/>

<img decoding=”async” src=”https://www.klippa.com/wp-content/uploads/2019/08/xero-klippa.png” alt=””/>

<img decoding=”async” src=”https://www.klippa.com/wp-content/uploads/2023/07/dropbox.png” alt=””/>

<img decoding=”async” src=”https://www.klippa.com/wp-content/uploads/2023/07/quickbooks-Round.png” alt=””/>

<img decoding=”async” src=”https://www.klippa.com/wp-content/uploads/2023/07/zohobooks_short.png” alt=””/>

See all of our integrations.

Set Up User-Defined Authorization Processes

Checking The Submitted Issues With OCR Technology

Klippa’s OCR technology recognizes fields such as company name, purchase date, amounts, currency, and description. Based on defined business rules, expenses, and invoices can be approved automatically, or an approval process can be started.

Use Multi-Level Transaction Approval

Issues with active authorization processes are forwarded to one or more authorized persons. If the order is fixed, the release takes place hierarchically within the group; without a fixed order, the transactions are sent to all approvers in parallel.

Simplify Your Approval Process

Managers can manually review and rate submitted documents. Managers approve expenses and invoices conveniently via the app or web application. Mandatory fields ensure that only complete submissions are approved.

Join 1000+ Finance Teams in Carefree Spend Management

Klippa allows us to digitally register, approve, and process expenses and invoices in one user-friendly cloud environment.

With Klippa, colleagues can focus on key tasks as workload and manual processes are greatly reduced, achieving an ROI of 60–80%.

Employees can now submit their claims directly via the app. Managers approve them, and finance ensures proper receipt allocation.

We Take Your Data Privacy & Security Seriously

FAQ – Frequently Asked Questions

Can I automate my approval flows?

Can I maintain my approval process during the absence of an authorized employee?

Is it possible to modify the active authorization flow if a mistake is found?

Is it possible to claim expenses obtained in foreign currency?

How can I transfer approved expenses to my bookkeeping or ERP software?

Can I maintain my approval process during the absence of an authorized employee?

Is it possible to modify the active authorization flow if a mistake is found?

Is it possible to claim expenses obtained in foreign currency?

How can I transfer approved expenses to my bookkeeping or ERP software?

Is it possible to claim expenses obtained in foreign currency?

No problem!

When your employees submit transactions in foreign currency, SpendControl applies auto-conversions through its exchange currency feature.

Our system identifies the date of purchase and uses the exchange rate from that day, calculating the equivalent value in your local currency. This streamlined process allows you to reimburse business trip expenses effortlessly.

Can I automate my approval flows?

Absolutely!

With SpendControl features like business rules and authorization flows, you can speed up your approval management by assigning the employees in charge or even setting automatic approvals through determined conditions.

Our Helpdesk articles explain the technicality of authorization flows and business rules for an effortless set-up.

Can I maintain my approval process during the absence of an authorized employee?

Sure!

Klippa SpendControl is fully customizable. With admin rights, you can always edit the authorization flow that is linked to any business rule in case of a holiday, sick leave, personnel change, etc.

Our Helpdesk articles illustrate the authorization flow set-up process step by step.

How can I transfer approved expenses to my bookkeeping or ERP software?

Easily!

SpendControl offers ready to go integrations with most big accounting and ERP systems. Companies that use other accounting and ERP platforms can integrate with SpendControl using an API connection. Besides this we offer intelligent export-import files to create journal entries even without direct API integration.

Check out our direct API integration possibilities here.

Is it possible to modify the active authorization flow if a mistake is found?

Definitely!

We know that no one is immune to a misstep. If an invoice or expense was assigned to the wrong person for approval, a user with a finance or admin role can always manually select a different authorization flow.

Our Helpdesk articles provide in-depth information on all authorization flow features.

Discover Our Insightful Blogs

Stay informed with our insightful blogs on expense management, intelligent document processing and more.