On average, accounting teams dedicate around 25 days to complete the annual close, a critical period that coincides with month-end closing and quarter-end reporting. This period adds more pressure to an already heavy workload for accountants to deliver accurate and timely financial information.

However, amidst the chaos, there is a way to alleviate stress and enhance productivity during this crucial time. By establishing and adhering to a well-defined workflow, finance professionals can structure and simplify their year-end closing cycle.

In this article, we will discuss the ultimate year-end accounting checklist for 2024. This includes: what is year-end accounting, year-end accounting challenges, and steps needed for a successful year-end close. Let’s begin!

What is a Year-End Close in Accounting?

Year-end accounting, also known as year-end closing, refers to the period at the end of a company’s fiscal year when all financial transactions are completed, financial statements are prepared, and financial accounts are reconciled before the end of the fiscal year.

The year-end close process can be a complex and demanding task for businesses due to the sheer volume of financial records that need to be reviewed and analyzed. It requires a significant amount of work and attention to ensure that all transactions are accurately recorded and comply with regulatory requirements.

Businesses must identify any adjustments that need to be made, review financial statements, and prepare for audits, which can be a time-consuming and challenging process. Overall, the year-end close process requires careful planning, organization, and dedication to ensure that everything is completed accurately and on time.

Unlike the calendar year, which starts on January 1st and ends on December 31st, the fiscal year is a 12-month period that can begin on any day a business is registered. Business owners can leverage this flexibility to choose a year-end closing date that is tailored to their industry standards and business goals.

What Are the Challenges of the Year-End Closing?

The fiscal year-end preparation is a demanding process for accounting teams, who must navigate various challenges. Some of the most common end-of-year accounting challenges include:

Human error

Managing year-end accounts is a tedious process as all financial accounts must be checked carefully for discrepancies and omissions. Every amount must be accounted for and all supporting documentation available for a possible tax audit. Even a simple human error in the accrued expenses, for example, can be costly and damage relationships with suppliers and employees.

Inefficient communication

Accountants often need to communicate with multiple departments to obtain necessary documentation and information. Inefficient communication results in time-consuming and unproductive information chains, making end-of-year accounting take longer.

Manual data entry

Manual data entry is a time-consuming process, especially challenging during the end-of-year accounting when dealing with large volumes of data. An increase in manual invoice processing volume can demand more employees and resources.

This is why you should consider more effective methods like automated data entry, to improve your end-of-year accounting process.

Missing receipts and invoices

During the fiscal year, keeping track of paper receipts and supplier invoices can be a headache. However, as the year-end approaches, the pressure to conduct payment reconciliation grows stronger. Missing receipts and invoices can cause significant delays in the fiscal year-end close process and can lead to inaccurate financial statements that may bring about legal concerns.

To overcome the common struggles that arise during year-end closing, it’s essential to have a clear plan in place. Fortunately, we have created a checklist for you to make the process easier.

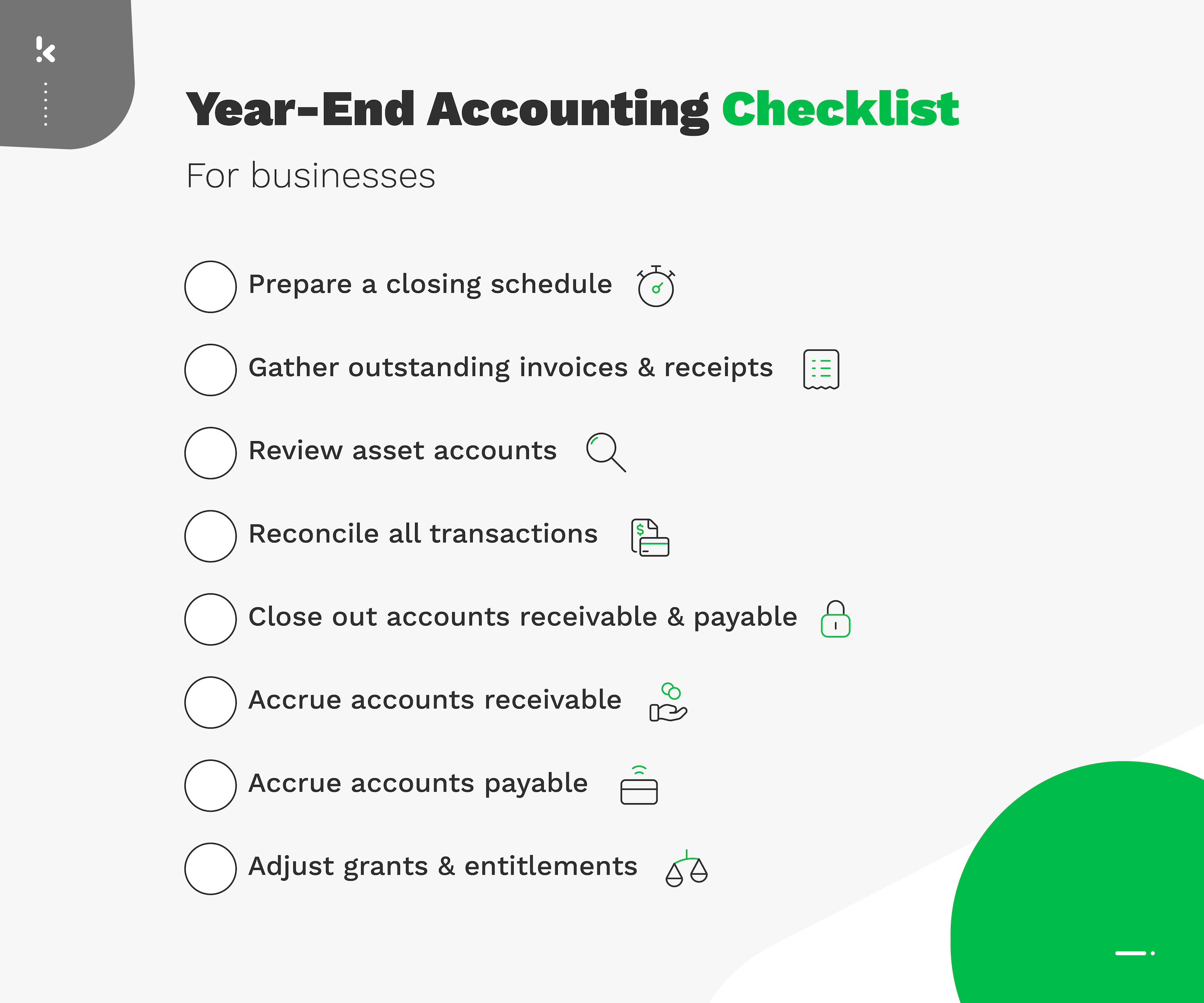

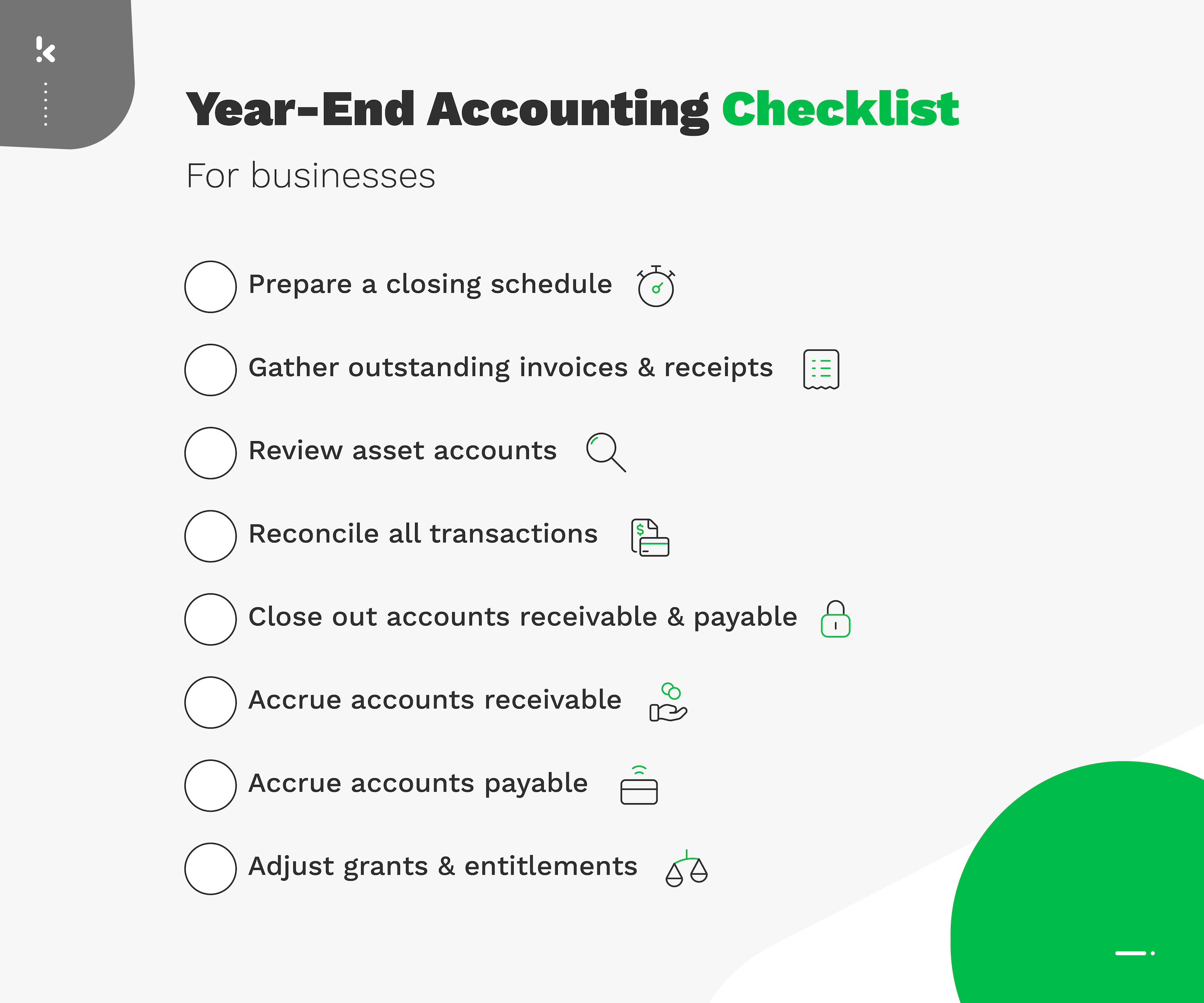

The Ultimate End-of-Year Accounting Checklist

To help simplify the year-end close, our end-of-year accounting checklist provides a comprehensive list of steps businesses should follow to minimize the stress and uncertainty around this process.

By following these steps, businesses can ensure that they are fully prepared for the year-end close and that their financial records are accurate and up-to-date.

1. Prepare a closing schedule

- Establish a specific timeline of important dates and activities that need to be performed, including data processing, reporting, and the fiscal close date.

- Plan ahead and set reminders for upcoming tasks to stay on track.

2. Gather outstanding invoices & receipts

- Collect all invoices and receipts needed to close the books.

- Communicate the requirements to employees and give them sufficient time to submit documents.

- Expect delays and provide reminders to ensure that nothing falls through the cracks.

Consider using automation software with features like digital receipt capture and digital document submission to speed up the process (especially for the employees on the road) and reduce manual data entry.

3. Review asset accounts

- Review asset expenses and keep track of fixed assets and any impairment losses that need to be accounted for.

- Reconcile all cash accounts and account for relevant transactions.

- Determine the value of all assets your company currently owns and ensure the accuracy of your financial statements.

4. Reconcile all transactions

- Resolve any discrepancies or errors, and ensure that all items are appropriately classified in your accounting system.

- Guarantee that all recorded transactions match credit card statements, bank statements, invoices, and receipts.

- Pay attention to the smallest details to be audit-ready for the fiscal year-end.

5. Close out accounts receivable and payable

- Differentiate the amounts received or paid against what has been accrued.

- Ensure that you have accurate records of all outstanding invoices and bills, and create adjusting entries for any uncollected or unpaid balances (also known as accounts payable).

6. Accrue accounts receivable

- Include any outstanding receivables as credits on the income statement and debits on the balance sheet.

- Monitor your accounts receivable report and identify any overdue or collectible balances, this is critical for starting the new fiscal year with accurate financials.

7. Accrue accounts payable

- Keep track of all your company debts to manage your finances effectively with AP automation or by simply following the steps of the accounts payable process.

- List any unpaid debts as liabilities or accrued payables on the balance sheet.

- Ensure that all expenses have been recorded in the correct period.

8. Adjust grants and entitlements

- Don’t forget to record any grants or entitlements that your business received during the fiscal year.

This includes government contributions, special tax exemptions, and private grants, which must be properly accounted for in your financial statements.

It’s clear that with year-end accounting, there are numerous tasks to complete and challenges to overcome. The good news is, there are solutions available that can simplify the end-of-year accounting process and make it less daunting.

One solution is Klippa SpendControl. In the next section, we will explain more in-depth how this easily adaptable expense management software and invoice processing automation software can help simplify the year-end close process for businesses.

Simplify Your Next Year-End Close

As the fiscal year-end approaches, businesses must prepare to properly close their accounting books. Klippa SpendControl provides a comprehensive solution to streamline all year-end closing processes.

Our all-in-one digital pre-accounting software combines invoice processing, expense management, and corporate credit card modules, assisting companies in optimizing accounting and financial processes throughout the year and simplifying the year-end close.

With SpendControl, you can effortlessly capture, process, and approve receipts, invoices, and credit card transactions, all within a single platform. It automatically books validated, authorized, and structured data to your ERP or bookkeeping system, transforming hours-long processes into just a few clicks.

Additionally, SpendControl simplifies the approval process for expenses and invoices by automatically routing data to authorized employees based on custom business rules. By keeping all data up-to-date, Klippa SpendControl provides real-time overviews and insights, ensuring a smooth and efficient year-end closing.

With SpendControl you can:

- Manage your vendor invoices, employee expenses, and corporate credit cards in one platform

- Scan, submit, process, and approve invoices via web or mobile app

- Achieve 99% invoice data extraction accuracy with Klippa’s OCR

- Regain control over your accounts payable with intuitive dashboards

- Customize your approval management with multi-level authorization flows

- Never fail to comply with tax and data privacy regulations with our ISO27001-certified and GDPR-compliant solution

- Rely on automatic multi-currency support for international payments

- Prevent invoice fraud with built-in duplicate and fraud detection

- Integrate SpendControl with your accounting and ERP software, like Quickbooks, NetSuite, or SAP

FAQ

The end-of-year accounting checklist is an action plan that helps organize the financial closing of the fiscal year. It involves preparing a schedule, gathering receipts, reconciling transactions, reviewing accounts, closing receivables and payables, and ensuring accurate financial reporting.

To prepare for year-end accounting, create a detailed schedule with key dates and deadlines. Gather all necessary financial documents like receipts and invoices. Review asset accounts, ensure all transactions are reconciled, and close out accounts receivable and payable.

Year-end closing involves reconciling all transactions, reviewing asset accounts, closing accounts receivable and payable, and ensuring that all financial documents are accurate. The final step is preparing financial reports and statements for audits, ensuring everything aligns for regulatory compliance.

Year-end accounts include all financial records, such as the income statement, balance sheet, cash flow statement, and statements of retained earnings. These documents provide a complete financial overview of the company’s performance, including revenue, expenses, assets, liabilities, and equity.