You know how frustrating receipt processing can be if you handle business expenses, accounting, or finance operations. Paper receipts fade, digital ones get buried in inboxes, and no two formats ever look the same. Manually entering this data is tedious, prone to errors, and takes time away from more important work.

But there’s a better way. Automation eliminates the hassle of extracting key details instantly and ensuring accuracy without manual effort. In this guide, we’ll walk through how receipt data extraction works, the common challenges businesses face, and how AI-powered solutions can transform the process.

Let’s dive in!

Key Takeaways

Receipt data extraction automates the conversion of unstructured receipt text into structured, machine‑readable data for accounting, compliance, and analytics. A typical workflow follows five key steps:

- Capture: Scan or photograph a paper receipt, or upload a digital PDF or image.

- Convert: Use Optical Character Recognition (OCR) to read and digitize the text.

- Extract: Identify and capture fields such as merchant name, date, totals, taxes, discounts, and itemized purchases.

- Structure: Organize the data into formats like JSON, CSV, XML, or XLSX for integration.

- Verify: Apply validation rules or Human‑in‑the‑Loop checks to ensure compliance and detect fraud.

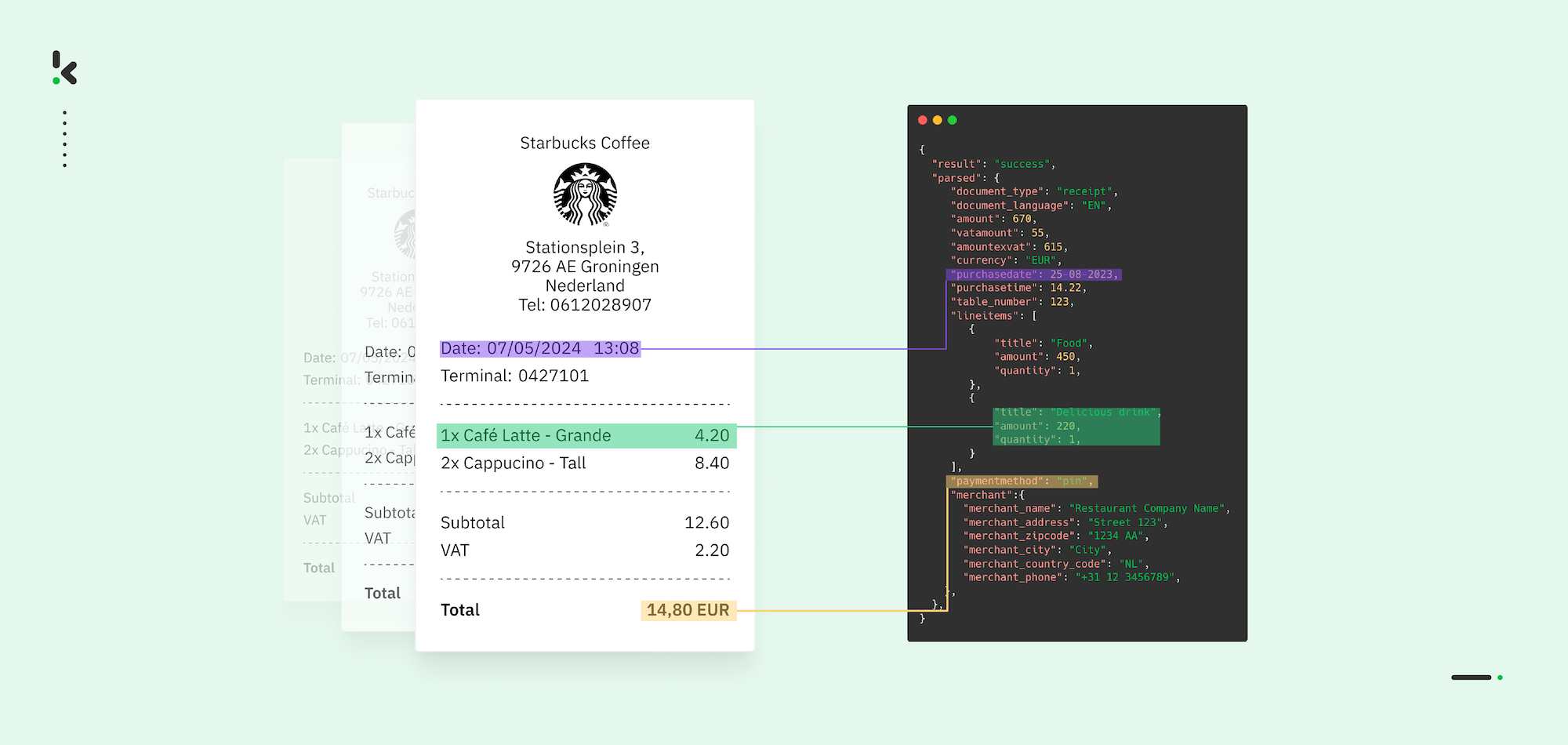

Automated solutions, like Klippa DocHorizon, combine OCR, Artificial Intelligence, and Machine Learning to handle varied formats, improve accuracy, and integrate seamlessly with ERP or accounting systems.

What is Receipt Data Extraction?

Receipt data extraction is the process of identifying and converting key receipt details into structured, machine-readable data that can be used for accounting, tax filing, and expense management. The scanned information typically includes details such as merchant name, date, amount, etc.

Traditionally, businesses relied on employees to manually input this data into spreadsheets or accounting software. Today, automated solutions use AI and Optical Character Recognition (OCR) to scan receipts, correct errors, and extract relevant values. Once extracted, this data is automatically formatted and integrated into expense management systems, accounting software, or tax reporting tools.

Methods of Extracting Data from Receipts

Businesses can extract data from receipts using manual, semi‑automated, or fully automated methods. The right choice depends on factors such as receipt volume, format variability, accuracy requirements, and available resources.

Manual Data Entry

Manual data entry involves typing receipt details, such as merchant name, date, total amount, and tax, into spreadsheets or accounting systems by hand.

Pros:

- No technical setup required

- Low cost for very small receipt volumes

Cons:

- Extremely time‑consuming for high volumes

- Prone to human error, leading to potential compliance and reporting issues

- Difficult to scale for growing businesses

Best Practice Tip: Use manual entry only for occasional receipts or as a fallback when automated systems cannot process a document.

Template‑Based OCR

Template‑based OCR (Optical Character Recognition) uses predefined layouts to read receipts. The system scans the image, matches it to a set template, and pulls data from specific locations.

Pros:

- High accuracy for receipts with standardized layouts

- Faster than manual entry for consistent formats

Cons:

- Fails with varied or unfamiliar layouts

- Cannot adapt easily to new receipt designs without re‑templating

- Struggles with handwritten text or degraded images

Best Practice Tip: Template‑based OCR is suited for organizations with one or two fixed receipt formats, such as internal POS systems.

AI‑Powered OCR with ML/NLP

AI‑powered OCR combines Optical Character Recognition with Machine Learning (ML) and Natural Language Processing (NLP) to recognize, classify, and interpret data across varied formats, languages, and currencies.

Pros:

- Highly adaptable to different layouts, fonts, and languages

- Can process low‑quality images with preprocessing (cropping, de‑skewing, contrast adjustment)

- Automates classification of fields without predefined templates

Cons:

- Requires training data for best accuracy

- May have higher initial cost compared to basic OCR tools

Best Practice Tip: Choose AI‑enabled OCR tools when processing receipts from multiple sources with inconsistent designs, especially in global operations.

3. Human‑in‑the‑Loop (HITL) Validation

Human‑in‑the‑Loop combines automated extraction with manual review to verify accuracy, correct misclassifications, and handle complex edge cases.

Pros:

- Achieves near‑perfect accuracy

- Detects fraud or subtle errors that automation may miss

- Adds flexibility for irregular or unconventional receipts

Cons:

- Increases processing time compared to fully automated extraction

- Requires trained personnel for review

Best Practice Tip: Use HITL for critical workflows where mistakes could have compliance or financial consequences, such as tax audits or reimbursement approvals.

Inconsistent formats, poor image quality, and varying tax rules make receipt extraction challenging for most businesses. For long‑term efficiency, many organizations adopt hybrid approaches: AI‑powered OCR as the primary method, supported by Human‑in‑the‑Loop validation for accuracy-critical tasks.

What Data to Extract from Receipts?

Receipts contain critical financial and transactional details that businesses need for expense tracking, tax compliance, and accounting automation. Below are the key data points extracted from receipts:

1. Transaction Details

Details that verify when and where a purchase occurred.

- Date & Time – The exact timestamp of the transaction.

- Transaction ID – A unique reference number for tracking.

- Store/Business Name – The name of the merchant issuing the receipt.

- Business Location – The address of the store or branch.

2. Purchase Information

Line items within the receipt that describe the purchase.

- Item Descriptions – A breakdown of purchased goods or services.

- Quantity – Number of units per item.

- Unit Price – Cost per unit before tax.

- Total per Item – The final price per line item (quantity × unit price).

3. Financial Breakdown

Summarizes the cost structure of the transaction.

- Subtotal – The total cost before taxes, discounts, and fees.

- Taxes – Applied VAT, sales tax, or other charges.

- Discounts/Promotions – Price reductions from sales, loyalty rewards, or coupons.

- Total Amount Paid – The final amount after all calculations.

- Currency – The currency of the amounts charged,

4. Payment Information

Identifies how the transaction was completed.

- Payment Method – Cash, credit card, mobile wallet, or other payment types.

- Card Details – Last four digits of the card used, if applicable.

- Change Given – For cash payments, the amount returned to the customer.

5. Merchant-Specific Data

Includes branding elements and internal tracking details.

- Receipt Number – An internal reference number assigned by the merchant.

- Cashier ID – Identifies the employee who processed the sale.

- Store Logo & Branding – Used for branding and customer recognition.

- Receipt Messages – Custom notes such as return policies, promotions, or thank-you messages.

6. Digital & Machine-Readable Data

Additional data encoded in digital or printed receipts.

- QR Codes & Barcodes – Links to digital receipts or product information.

- Item Categories – Categorization for analytics (e.g., groceries, electronics).

- Loyalty Program Details – Points earned or used in the transaction.

7. Additional Transaction-Specific Data

Varies depending on the type of purchase.

- Order Number – Reference number for order tracking (e.g., in restaurants or e-commerce).

- Delivery Details – Shipping or pickup instructions if applicable.

- Service Fees & Tips – Additional charges in industries like hospitality and food service.

Main Challenges of Extracting Data from Receipts

Extracting data from receipts might appear simple, but businesses frequently encounter technical limitations that affect accuracy and efficiency when utilizing semi-automated or template-based data extraction solutions. Here are the key challenges:

- Inconsistent Formats: Layouts, fonts, and structures vary widely between merchants and locations, requiring flexible AI parsing.

- Mixed File Types: Receipts may be printed, PDF, emailed, or photographed, each requiring different extraction methods.

- Handwritten & Hard-to-Read Text: Small vendors still use handwritten receipts, which are more difficult for OCR to interpret.

- Fading or Damage: Thermal paper fades over time and poor-quality prints need image enhancement before extraction.

- Tax & Discount Variability: Differences in how taxes and discounts are displayed complicate consistent financial data capture.

- Currency & Language Differences: Format changes across countries demand localization to avoid misinterpretation.

- Mobile Capture Distortion: Shadows, angles, and glare from camera shots require automated correction to improve readability.

- Validation Errors: Even accurate OCR can misclassify fields without automated checks or Human-in-the-Loop review.

Addressing these challenges requires a combination of AI-driven OCR, intelligent data classification, and validation algorithms to ensure high accuracy across different receipt types. All of these components can be found in IDP platforms like Klippa Dochorizon.

Benefits of Automated Receipt Data Extraction

Automating receipt data extraction replaces slow, error-prone manual entry with fast, accurate workflows. The main benefits include:

- Time Savings: Process large volumes of receipts in seconds instead of hours, freeing staff for higher-value tasks.

- Higher Accuracy: AI-powered OCR reduces human error, ensuring reliable financial records and cleaner audit trails.

- Scalability: Easily handle thousands of receipts per month without adding headcount or overstretching resources.

- Improved Compliance: Automatically capture complete tax and payment details for regulatory reporting across multiple jurisdictions.

- Cost Reduction: Lower operational expenses by eliminating the need for manual data entry and validation teams.

- Integration Ready: Structured data outputs (JSON, CSV, XML, XLSX) connect seamlessly to ERP, accounting, and analytics platforms.

- Fraud Prevention: Built-in verification and duplicate detection protect against false claims and forged receipts.

Automated extraction improves speed, accuracy, and security while reducing costs, whether you use a small-scale OCR app or a full Intelligent Document Processing (IDP) platform like Klippa DocHorizon.

How to Automatically Extract Data from Receipts with Klippa

AI-powered solutions like Klippa DocHorizon can fully automate the entire process of extracting receipt data, from submission to the booking of structured information in your preferred system.

Let’s walk you through a step-by-step process of extracting data from a receipt using Klippa DocHorizon. For our example, we will process PDF receipts from Google Drive as our input source and choose JSON as our output format.

And the best part? You can try it yourself for free!

Step 1: Sign up on the platform

The first thing you have to do is sign up for free on the DocHorizon Platform. Enter your email address and password, then provide details such as your full name, company name, use case, and document volume. Once you’ve done that, you’ll receive a free credit of €25 to explore all the platform’s features and capabilities.

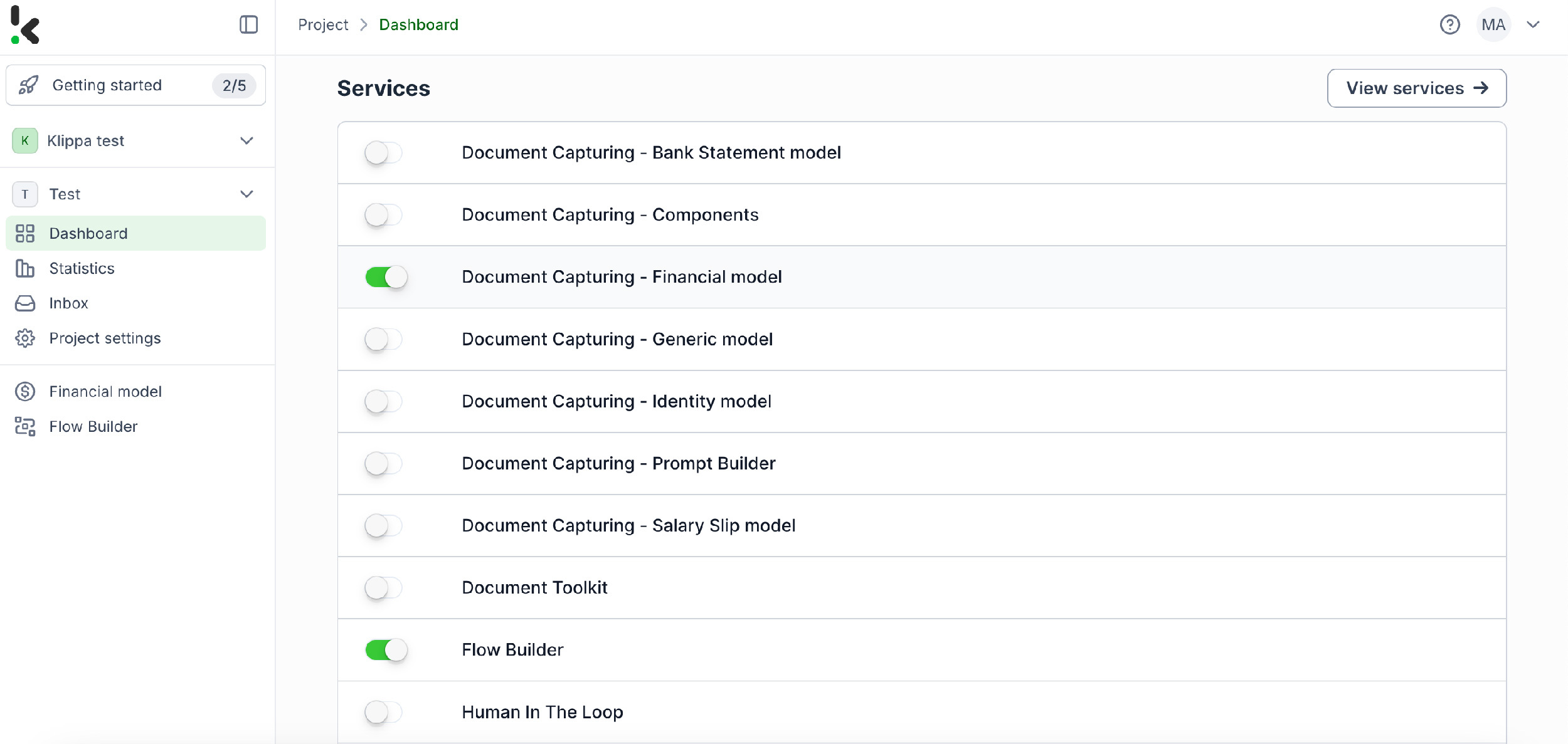

After logging in, create an organization and set up a project to access our services. For our goal – extracting data from receipts – simply enable the Financial Model and Flow Builder to get started. This setup ensures you have everything you need right from the start!

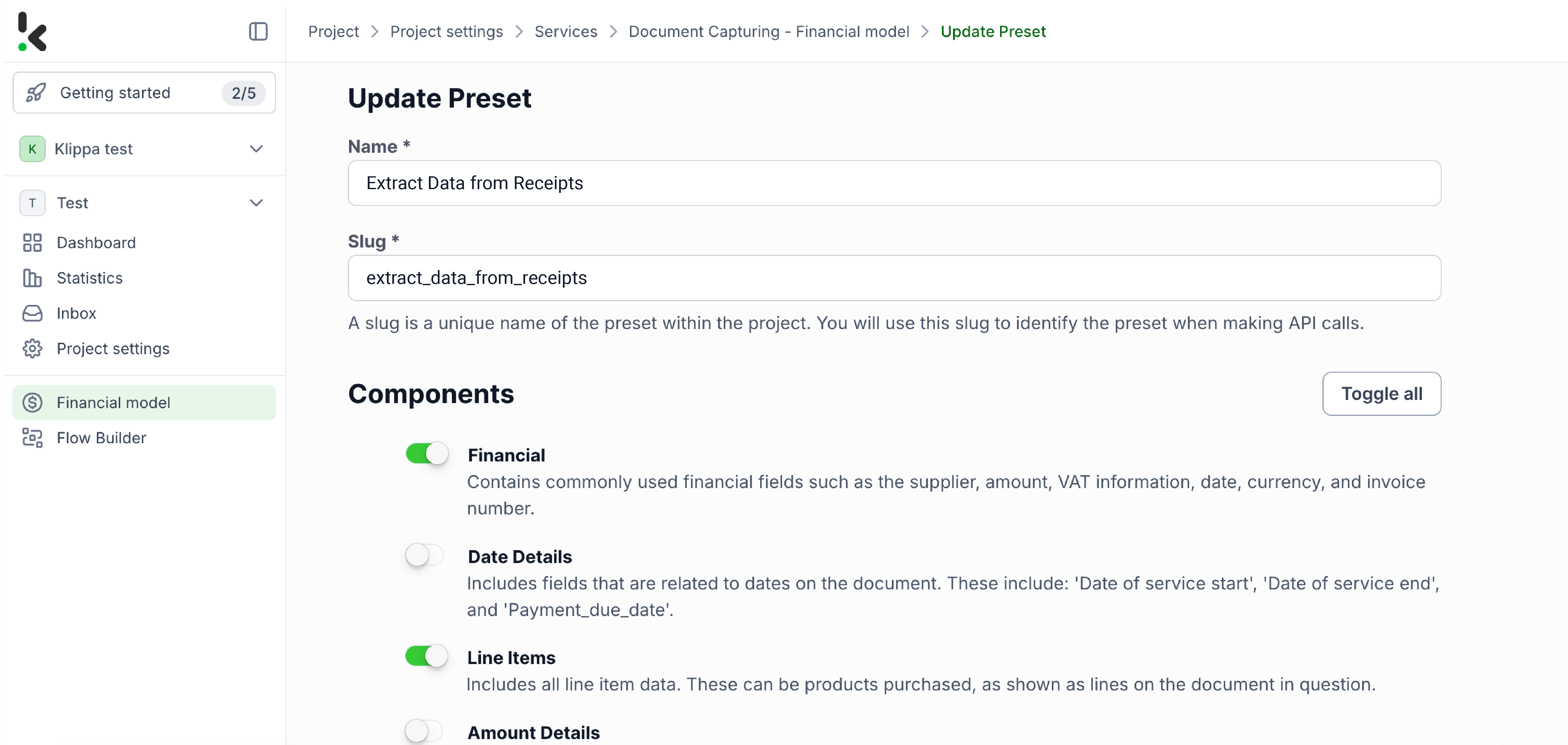

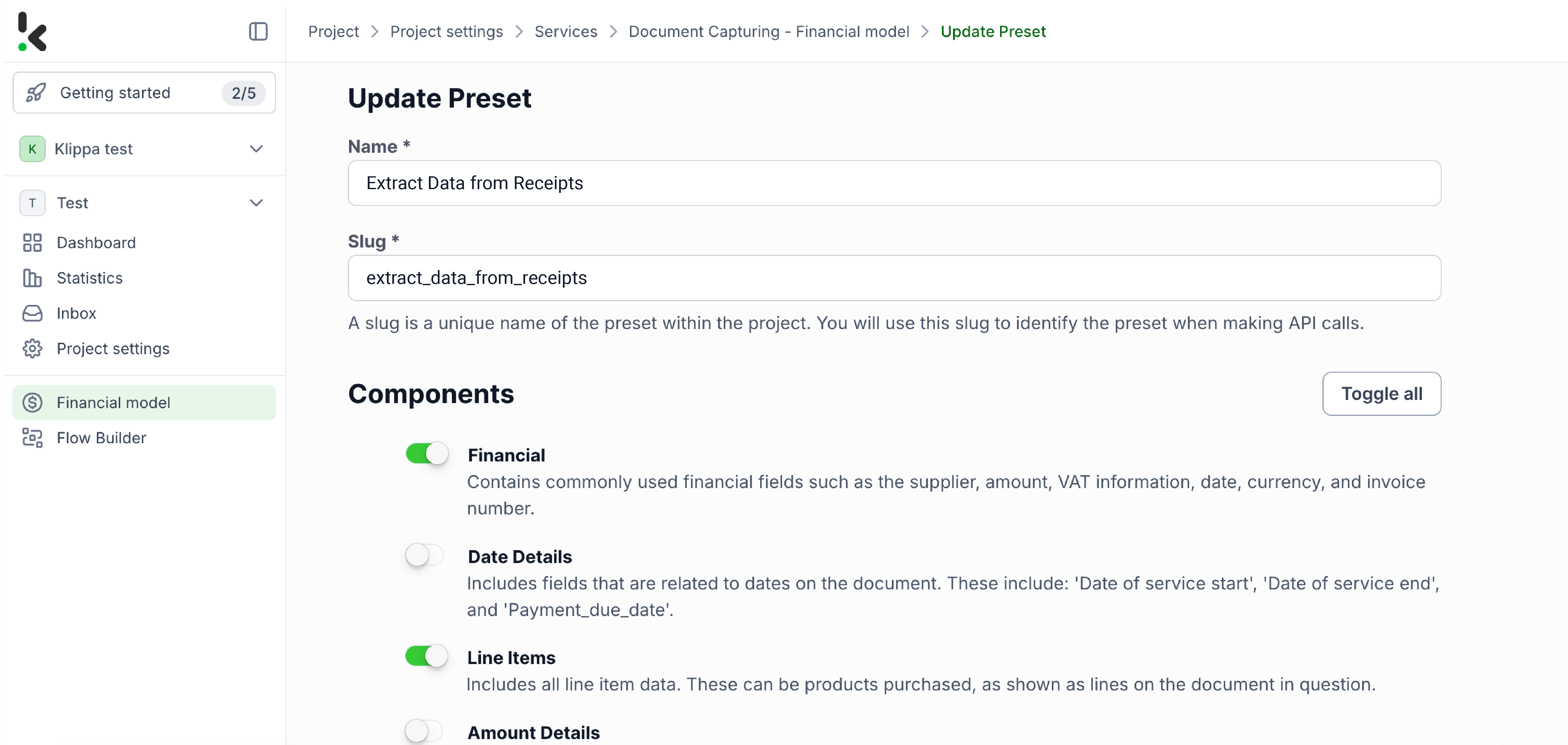

Step 2: Create a preset

You might wonder why we’ve chosen to enable the Financial Model over other options. The Financial Model is designed to streamline your financial workflows by automating the extraction, analysis, validation, and classification of data. It efficiently processes a wide range of financial documents, including receipts, invoices, purchase orders, bank statements, and more.

Once activated, you can create a new preset. Let’s name it “Extract Data from Receipts”. This preset lets you activate the components you need for your specific use case. For this case, you’ll enable the financial and line items components to process specific fields in your receipts such as receipt number, merchant, date, amount, currency, and VAT information.

Here’s a tip: You can customize the preset further depending on your use case by enabling more components such as Date Details, Reference Details, Amount Details, Document Language, Payment Details, etc.

You’re almost done! Click “Save” to finalize your settings and you’ll be ready for the next step in the Flow Builder.

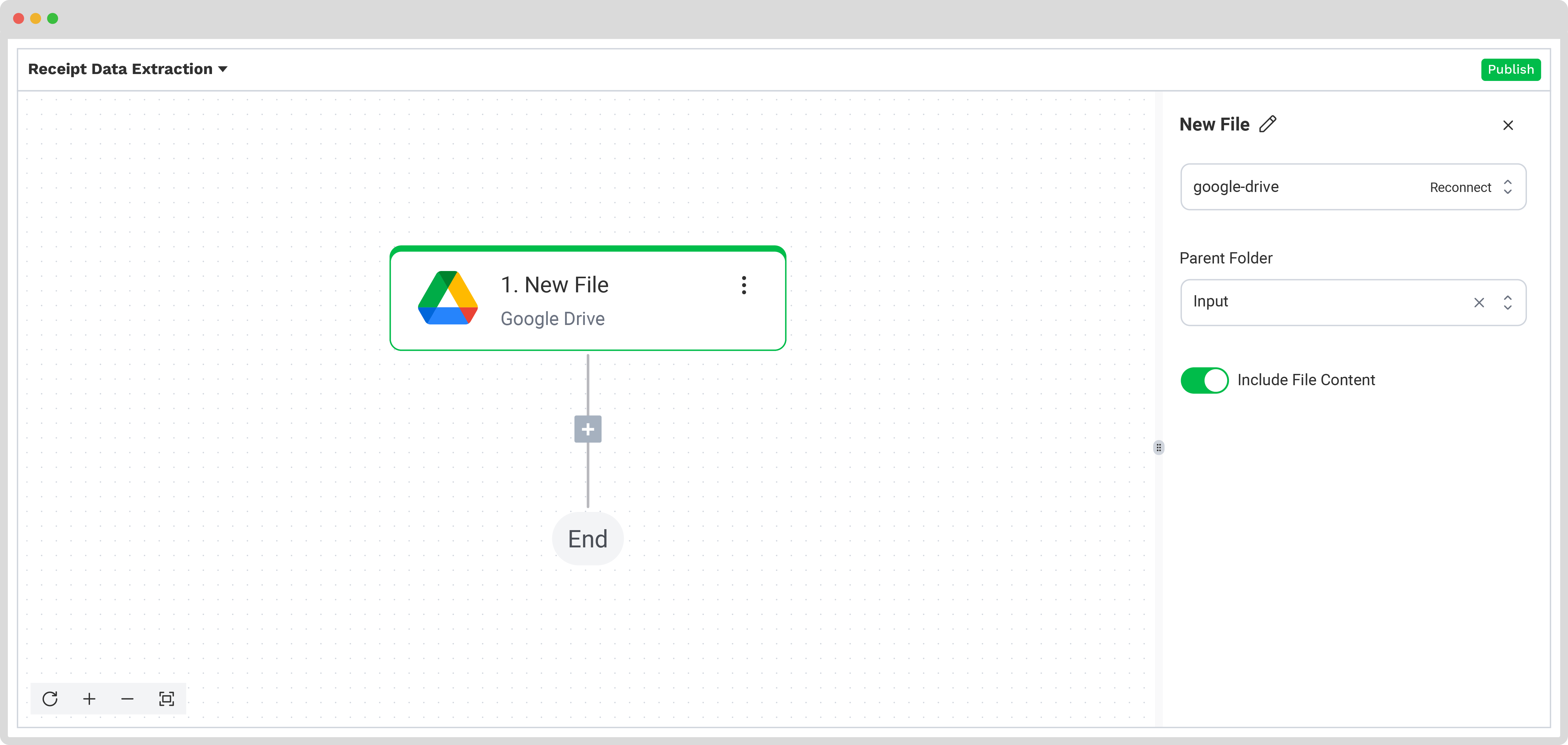

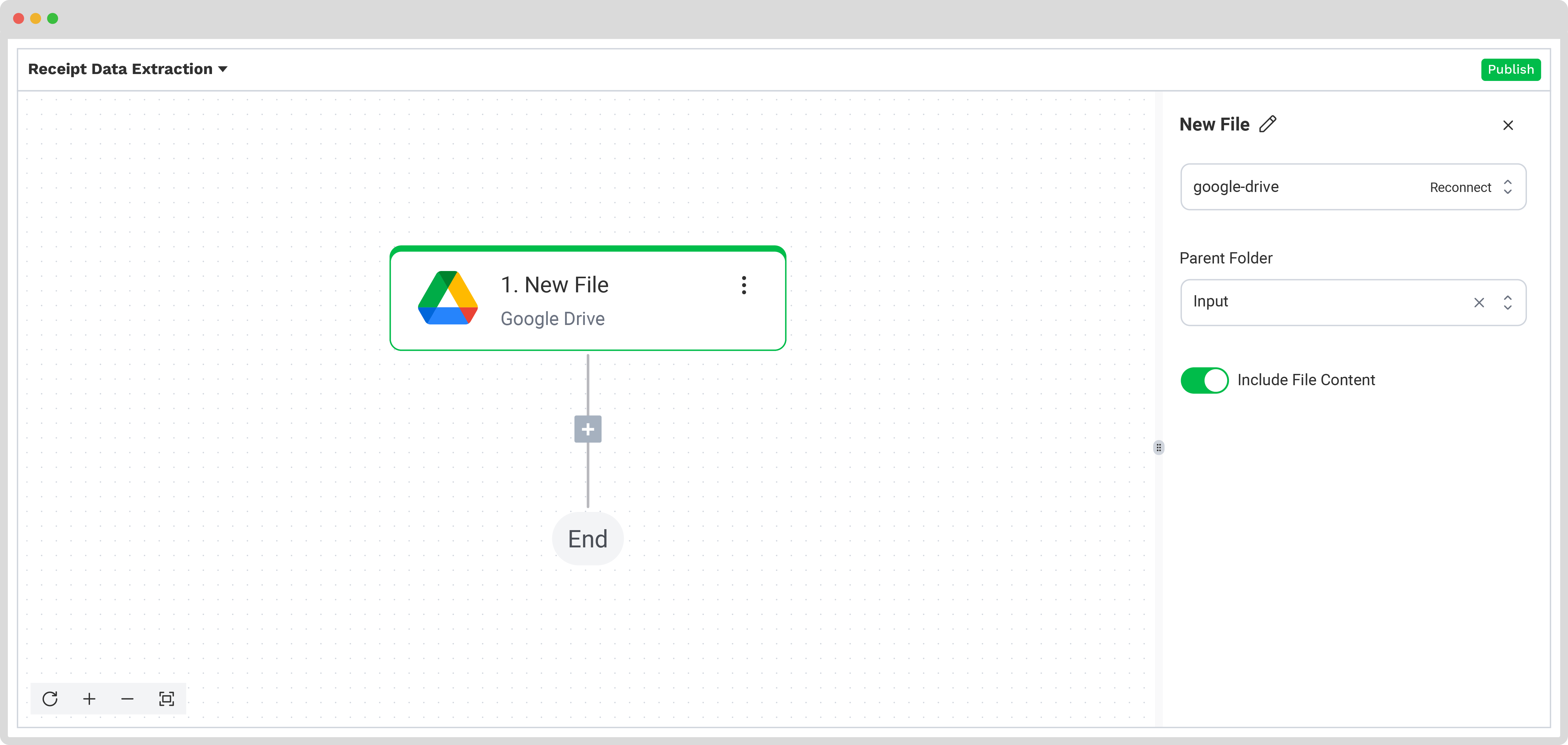

Step 3: Select your input source

After creating your preset and enabling the Flow Builder, it’s time to build your flow. A flow is essentially a sequence of steps that define how your receipts are processed and transferred to your output destination. In this step, we will choose Google Drive as our input source.

Click New Flow → + From scratch and assign your flow a name. We’ll name the flow “Receipt Data Extraction”.

Here’s a tip: The first step in building your flow is selecting your input source. You have several options: you can upload files directly from your device or connect to over 100 external sources, including Dropbox, Outlook, Salesforce, Zapier, OneDrive, your company’s database, or cloud storage solutions like Amazon S3 and iCloud. Make sure to place all receipts in the same folder so they can be processed in bulk if needed.

For this example, we’ll work with PDF receipts. We’ll create a folder named “Input” in Google Drive and upload your receipt there.

Next, choose your input source by selecting “Google Drive” and then “New File” as your trigger. This is going to start your flow. On the right side, fill out the following sections:

- Connection: You can assign any name to your connection. For instance, we’ve named ours “google-drive”. Once named, the system will prompt you to authenticate with Google.

- Parent Folder: Input

- Include File Content: Check this box to ensure file content is processed.

Test this step by clicking on Load Sample Data: remember to have at least one sample receipt in your input folder while setting up your flow.

Here’s a tip: Since the platform supports a wide range of document types to meet all business needs, you can check our comprehensive documentation to learn more.

Step 4: Capture and extract data

Now, it’s time to extract the necessary data by using the previously created preset to process all the selected data fields from the receipts in the input folder.

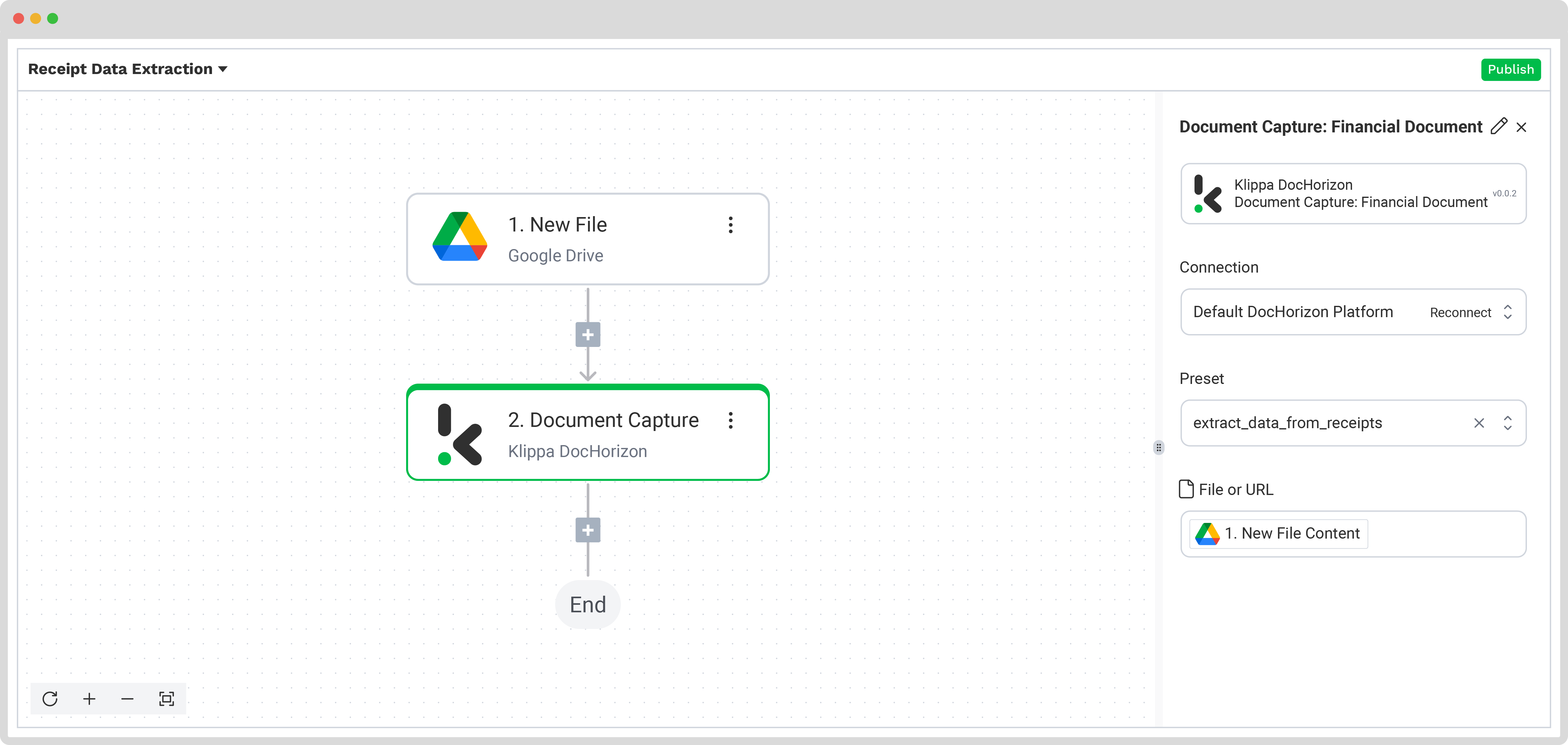

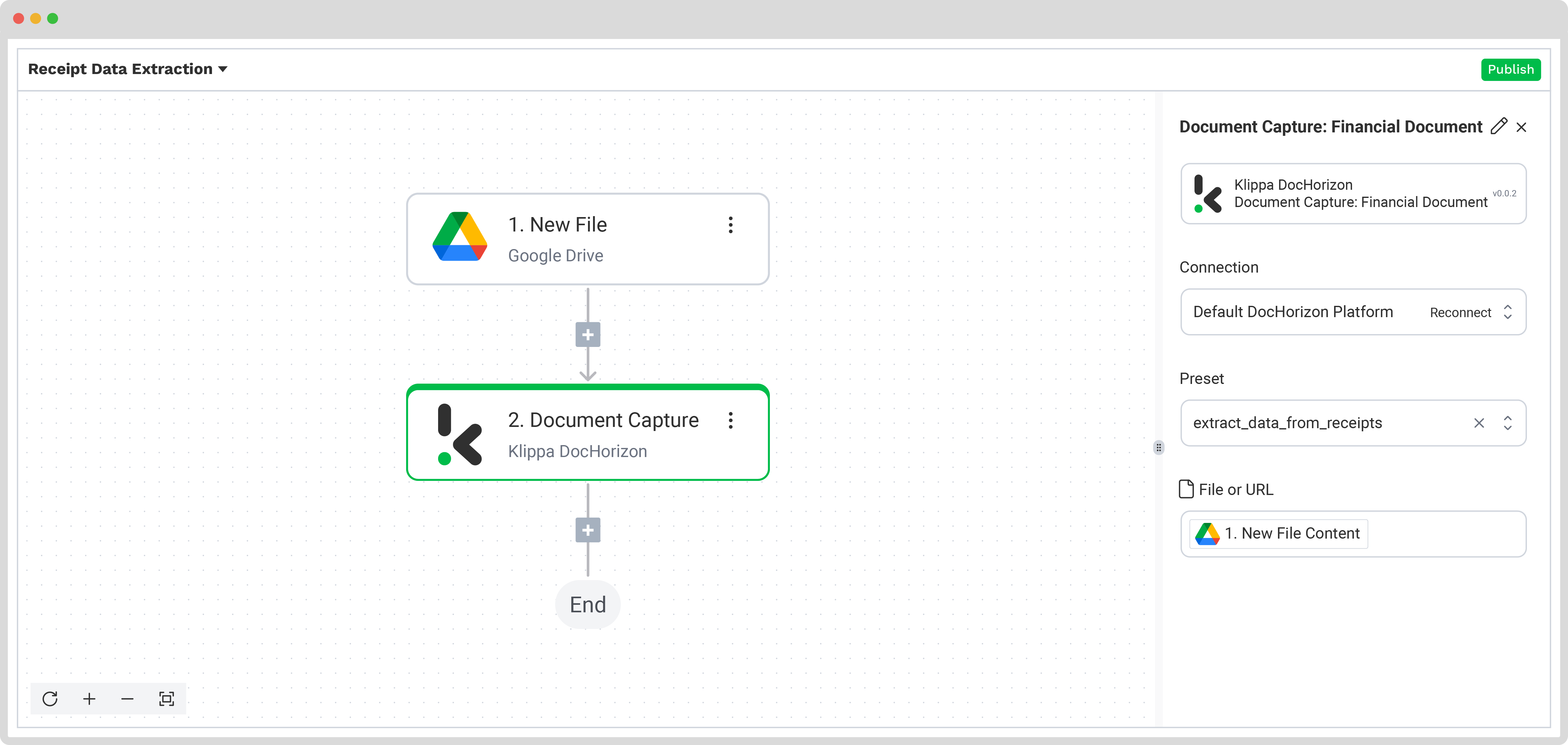

In the Flow Builder, press the + button and choose Document Capture: Financial Document.

To proceed, configure the following:

- Connection: Default DocHorizon Platform

- Preset: The name of your preset (in our case “extract_data_from_receipts”)

- File or URL: New file → Content

Then, test the step to ensure everything is working correctly. Once the test is successful, you’re ready to move on to the next step: saving your results!

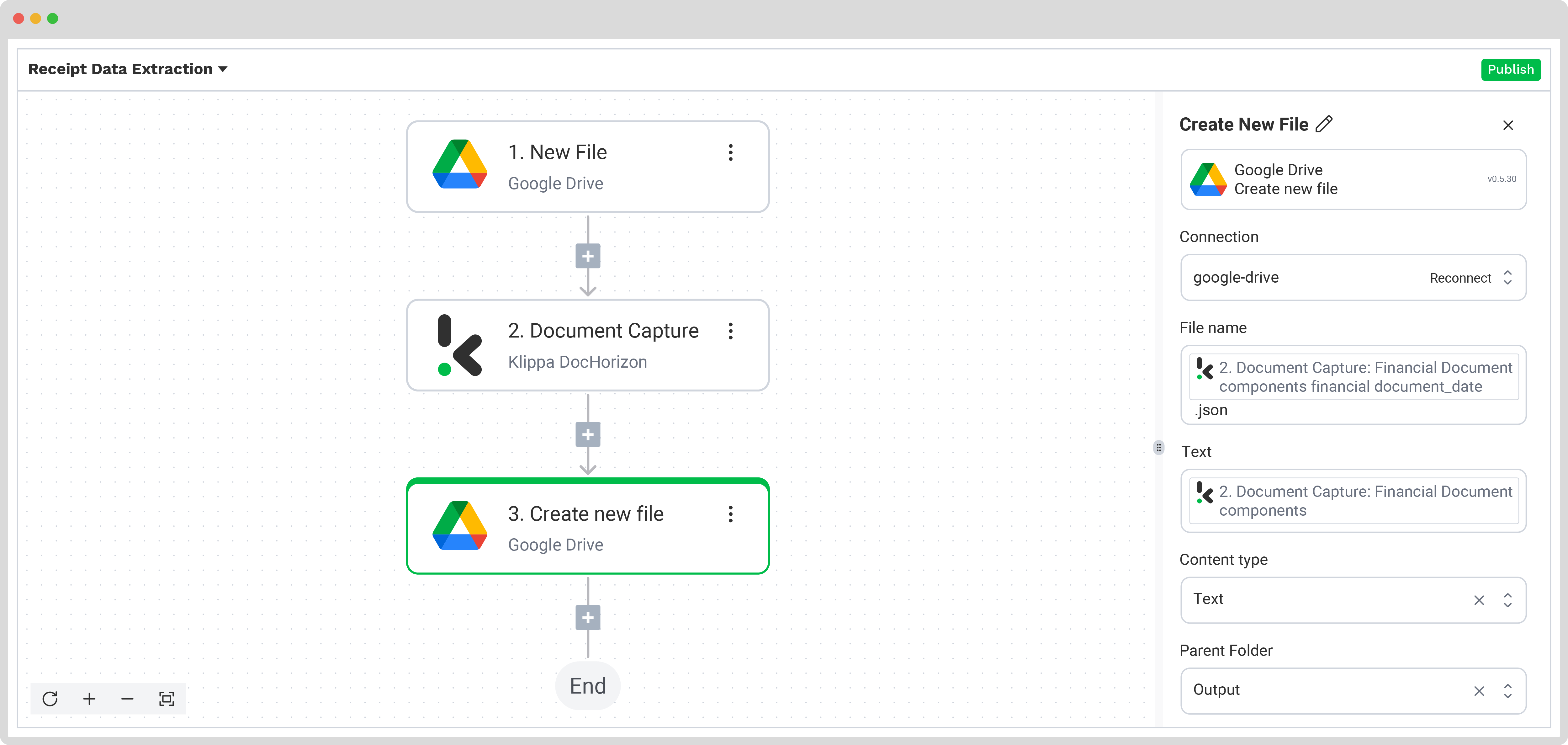

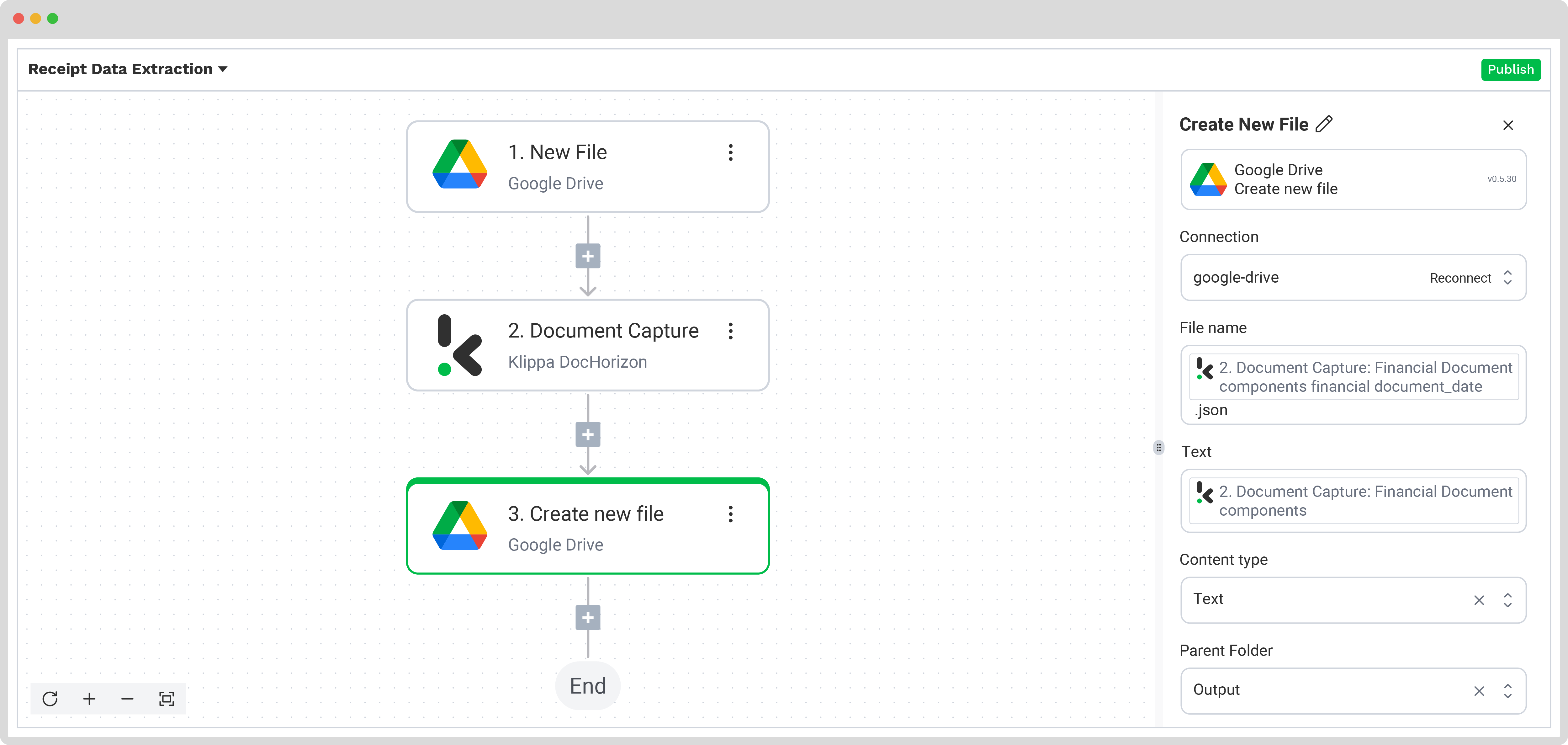

Step 5: Save the file

Once the receipt is processed, the final step is to choose the destination and the data format for the final output. The destination can be your database, ERP system, accounting software, or any other platform depending on your workflow. The data output format can be chosen from JSON, XML, CSV, XLSX, UBL, PDF, or TXT.

For this example, we will set the receipt number as a file name with the extracted data and save it in JSON format. We will create a new folder in Google Drive, name the output folder “Output”, and set it as a final destination for our file with the extracted data.

Press the + button and select Create new file → Google Drive

To proceed, configure the following:

- Connection: google-drive

- File Name: Document Capture: Financial Document → components → financial → receipt_number. Next to it, type .json

- Text: Document Capture: Financial Document → components

- Here’s a tip: Select the text you want to include in the new document. By selecting “components” you choose all the extracted elements.

- Content Type: Text

- Parent Folder: Output (the name of your output file)

Test this step by clicking the button at the right bottom, and you’re all set!

Congratulations! All the receipt data is now available in your Google Drive folder. With this setup in place, you can publish the flow, and any new receipts added to the folder will be processed automatically. That’s how you can save time while ensuring accuracy in your workflows.

Next to receipts, you might be processing invoices as well. If so, make sure to check out our invoice data extraction guide as well.

Just know that you don’t have to do everything yourself. Feel free to reach out to us if you’re handling high document volumes or have a unique use case. We’d love to hear your story!

Common Use Cases for Automated Receipt Data Extraction

Automated receipt data extraction improves speed, accuracy, and compliance across multiple business workflows. Common applications include:

Expense Reporting

Automatically capture receipt details and link them to employee expense reports, reducing manual entry time and improving accuracy in reimbursement processes.

Tax Filing & Compliance

Extract VAT, GST, or sales tax details to ensure accurate reporting and audit readiness. Automated categorization simplifies end‑of‑year filings and reduces compliance risks.

Employee Reimbursements

Streamline approval workflows by verifying receipt details, checking against policy rules, and issuing reimbursements faster.

Fraud Detection

Identify duplicate, altered, or forged receipts using verification checks and image hashing. Helps prevent excessive claims and financial losses.

Retail & FMCG Analytics

Analyze itemized receipt data to track product sales, customer preferences, and category performance. Supports loyalty programs and promotional campaign measurement.

Insurance Claims

Verify proof of purchase for claims validation, reducing processing times and minimizing fraudulent payouts.

Grant & Fund Management

Document allowable expenses for nonprofit and grant‑funded projects, ensuring transparency and adherence to funding rules.

Automate Receipt Data Extraction with Klippa DocHorizon

Looking to extract data from your receipts in Google Sheets, Excel, JSON, and more? We’ve got you covered! With Klippa DocHorizon, you can easily automate all your workflows:

- Data extraction OCR: Automatically extract data from any receipt.

- Loyalty program outsourcing: Automate receipt clearing for loyalty programs.

- Human-in-the-loop: Ensure almost 100% accuracy with our human-in-the-loop feature, allowing internal verification or support from Klippa’s data annotation team.

- Document conversion: Convert documents in any format – PDF, scanned images, or Word documents – into various business-ready data formats, including JSON, XLSX, CSV, TXT, XML, and more.

- Data anonymization: Protect sensitive information and ensure regulatory compliance by anonymizing privacy-sensitive data, such as personal information or contact details.

- Document verification: Authenticate documents automatically and identify fraudulent activity to reduce the risk of fraud.

At Klippa, we value privacy; that’s why all of our document workflows are compliant with the HIPAA, GDPR, and ISO standards, ensuring secure data processing. With peace of mind about data safety, take the next step and streamline your data extraction workflows.

If you’re interested in automating your receipt data extraction workflow with Klippa’s intelligent document processing solution, don’t hesitate to contact our experts for additional information or book a free demo!

FAQ

Use an OCR (Optical Character Recognition) tool that can scan and read receipt images or PDFs, then convert them into structured data such as JSON, CSV, or XML. AI-powered solutions improve accuracy by handling varied layouts, languages, and currencies.

Receipt OCR is a technology that reads text from scanned or photographed receipts and converts it into machine‑readable fields like merchant name, date, totals, and taxes. It replaces manual data entry in expense management and accounting workflows.

Accuracy depends on image quality, receipt format, and the OCR model used. Advanced solutions combining OCR, machine learning, and natural language processing routinely achieve >90% accuracy and can approach near‑perfect results with Human‑in‑the‑Loop validation.

Yes. Modern OCR and AI models can process multilingual and multi‑currency receipts in the same workflow, automatically adapting to different formats, tax terms, and numeric conventions.

Expense reporting, tax filing, reimbursements, fraud detection, retail analytics, insurance claims, and grant/fund expense tracking. These workflows benefit from fast processing, improved accuracy, and compliance‑ready data outputs.

Capture clear, high‑resolution images. Avoid shadows, folds, and glare. Use a tool that includes image preprocessing (cropping, de‑skewing, contrast adjustment) and validation rules to confirm field accuracy.

Choose platforms that meet data protection regulations such as GDPR or HIPAA and use encryption, secure cloud environments, and data anonymization for sensitive information.

Yes. We offer a free trial with €25 in credits so you can test receipt extraction workflows, explore integrations, and measure accuracy before deployment.

Klippa DocHorizon combines OCR with AI, advanced classification, fraud detection, compliance features, and flexible integration options, making it suitable for high‑volume, multi‑format, multilingual operations that need both speed and accuracy.

JSON, CSV, XML, XLSX, PDF/A, TXT and more. Ready to integrate into ERP, accounting, or analytics systems.