Fraudsters are always finding new ways to scam businesses, no matter how advanced technology gets. One of the biggest threats today is vendor fraud, and it’s growing fast. A 2025 Trustpair report revealed that 69% of US companies were targeted by vendor fraud, up from 47% the year before.

Vendor fraud usually comes from one or more sources, and if not caught early, it can lead to huge losses for businesses.

That’s why it’s so important for businesses to understand vendor fraud and learn how to prevent it. Only then can they protect themselves from these attacks.

So, how can businesses spot and stop vendor fraud? In this blog, we’ll break down what vendor fraud is, how it affects businesses, and the best ways to prevent it.

Let’s start!

Key Takeaways

- Vendor fraud is on the rise, with schemes such as billing fraud, check tampering, and cyber fraud becoming more common and sophisticated.

- Small businesses are at higher risk due to limited resources, but even larger companies can fall victim to complex fraud.

- Preventing fraud requires a multi-step approach, including strong vendor management, employee safeguards, and invoice matching.

- Technology can streamline fraud detection, with tools like Klippa SpendControl automating processes and flagging suspicious activity to keep your business protected.

What is Vendor Fraud?

Vendor fraud refers to illegal activities aimed at personal gain, typically carried out by vendors, employees, or a combination of both. It is usually targeted at the Accounts Payable (AP) of a company by faking a vendor or recipient’s account information to redirect payments.

Fraud attempts are often conducted by the following parties:

- One or multiple employees

- One or multiple vendors

- Collaboration between vendor(s) and employee(s)

- An external entity that modifies a vendor’s payment information but is unknown to everyone

You can see that the multiple options of collaborations that make vendor fraud possible are adding complexity to the problem. So how does that impact businesses?

The 6 Most Common Vendor Fraud Schemes

Check Tampering

Altering, forging, or intercepting company checks to redirect funds to unauthorized accounts. This often occurs when physical check stock is inadequately secured.

Prevention Tip: Transition to secure electronic payment methods, store physical checks in locked, access-controlled locations, and review payment records regularly.

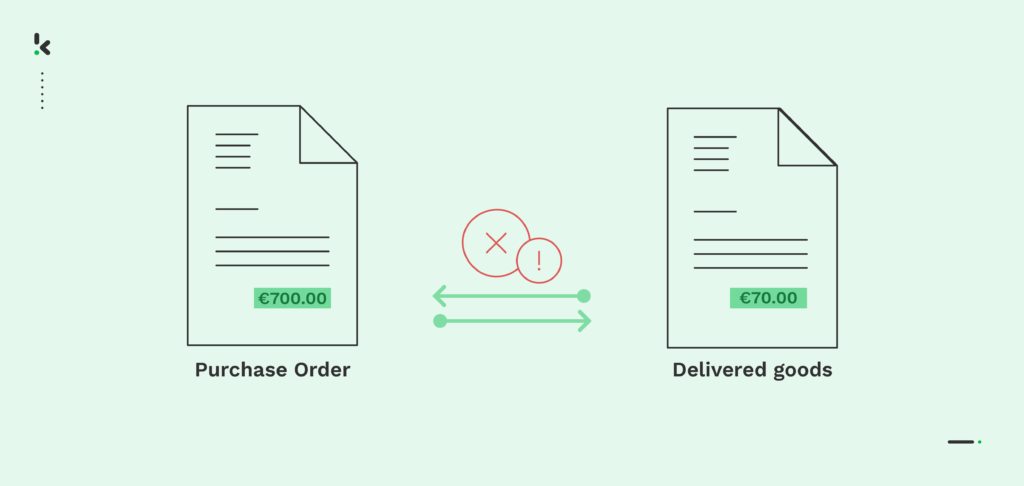

Billing Fraud (Invoice Fraud)

Creating fake invoices for goods or services never provided, or modifying legitimate invoices to increase payment amounts.

Prevention Tip: Use three-way invoice matching to verify every payment against a purchase order and goods receipt. Automate the process with OCR technology for faster detection.

Bribes and Kickbacks (Procurement Fraud)

Vendors and employees collude during contract negotiations or procurement. This may include overbilling, providing fewer goods than agreed, or charging twice for the same order.

Prevention Tip: Rotate procurement staff to reduce opportunities for collusion, enforce competitive bidding, and use controlled approval workflows for large purchases.

Cyber Fraud

Criminals use phishing emails, malware, or account takeovers to modify vendor payment information or intercept funds. Nearly all businesses conducting transactions digitally are vulnerable.

Prevention Tip: Enable multi-factor authentication on all financial systems, train employees to recognize phishing attempts, and monitor for unusual login or payment activity.

Price Fixing

Multiple vendors work together to set inflated contract prices, eliminating genuine competition. This tactic ensures businesses pay more regardless of the chosen vendor.

Prevention Tip: Maintain a pool of approved vendors, benchmark prices annually, and conduct independent market reviews for high-value contracts.

Employee Skimming

Employees take small amounts of money over time using methods such as false checks, unauthorized expense claims, or company credit card misuse.

Prevention Tip: Separate duties between accounts payable and goods receiving, schedule random internal audits, and track expense claims for anomalies.

The Impact of Vendor Fraud on Businesses

Businesses with weak security measures in their invoice management processes are at the highest risk of vendor fraud. This risk is often greatest for small to medium-sized organizations, where limited budgets and lean teams make implementing robust checks difficult. In many cases, one employee is responsible for the entire accounts payable process, which creates opportunities for manipulation and fraud.

Smaller teams may underestimate the danger of vendor fraud, believing it to be an unlikely occurrence. This can lead to a lack of oversight and minimal safeguards, making these organizations prime targets.

Larger companies generally have more resources, systems, and controls in place. They also comply with stricter laws and regulations, which makes it harder for scams to succeed. However, even well-protected businesses are not immune. Fraudsters continue to develop more sophisticated techniques capable of bypassing these defenses.

The consequences can be severe. For example:

- Utz Quality Foods lost 1.4 million dollars to a vendor who billed for products that were never received.

- Lincoln Land Community College’s telecommunications administrator forged signatures to authorize payments, stealing over 700,000 dollars.

These cases highlight that vendor fraud can affect any organization. Understanding the scale of the threat makes prevention an essential business priority.

How to Identify and Prevent Vendor Fraud

There is no single solution for stopping vendor fraud. The most effective strategy is a systematic approach that strengthens both internal processes and vendor relationships. Below are four proven steps that can protect your business.

Step 1: Implement Strong Vendor Management Practices

A thorough vendor onboarding process reduces the chance of partnering with dishonest suppliers.

Actions to take:

- Perform due diligence on every new vendor. Verify legal business names, bank details, tax registrations, email domains, contact numbers, and business references.

- Cross-check information against existing vendor records and employee data to identify matches that could indicate insider collusion.

- Maintain a central vendor database to track payment histories and flag high-risk accounts. This allows inconsistencies in billing volumes or payment timing to be spotted quickly.

Step 2: Establish Employee Safeguards

Since vendor fraud often involves employees, internal controls are essential.

Actions to take:

- Anti-fraud training ensures employees can recognize suspicious activity and know how to report it.

- Separate duties in accounts payable, purchasing, and receiving so no single person controls every step of a transaction.

- Rotate roles and conduct random audits to deter fraud attempts and reveal anomalies.

- Run background checks during hiring to reduce the chance of employing individuals with a history of fraud.

Step 3: Use Invoice Matching to Verify Payments

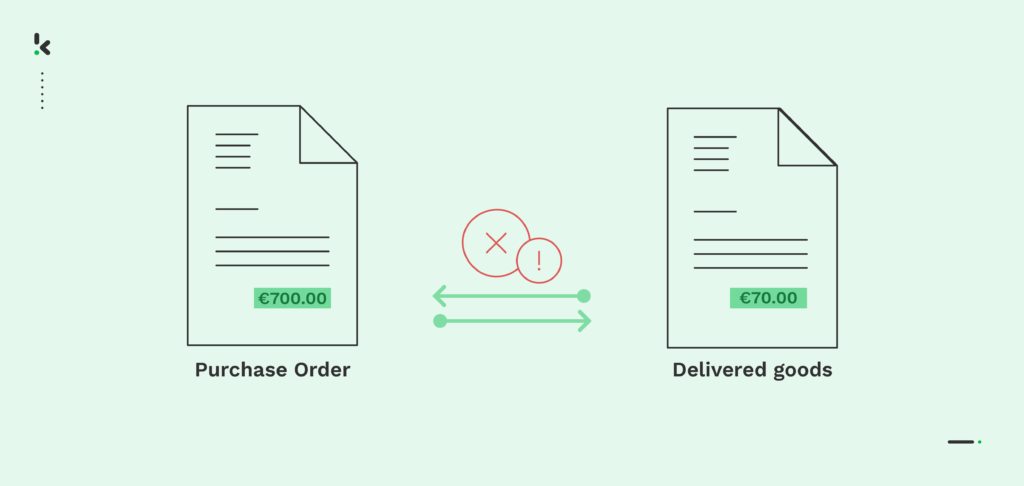

Invoice matching is an effective and structured way to confirm that payments are valid. Matching involves comparing invoices to related documents before money changes hands.

Methods include:

- Two-way matching: Compare invoice details with a purchase order.

- Three-way matching: Add a delivery note to verify delivery before payment.

- Four-way matching: Include an inspection slip for quality control before approving payment.

Automating invoice matching with AI-driven OCR software speeds up verification and reduces the risk of human error.

Step 4: Leverage Technology to Strengthen Fraud Prevention

Modern fraud prevention tools can detect suspicious activity faster than manual checks.

Actions to take:

- Use AP automation platforms that flag mismatches and duplicates in real time.

- Implement document analysis features, such as EXIF metadata checks and copy-move detection, to spot tampered invoices.

- Integrate fraud detection systems with ERP or accounting software for a seamless workflow.

Technology adds an extra layer of protection, enabling finance teams to respond to potential threats before they result in financial losses.

Why Klippa SpendControl Makes Vendor Fraud Detection Easier

Detecting and preventing vendor fraud requires fast, accurate, and reliable verification. Klippa SpendControl combines advanced OCR, AI-powered document analysis, and metadata integrity checks to ensure that fraudulent activity is flagged before payments are made. By automating invoice matching and fraud detection, Klippa SpendControl reduces dependence on time-consuming manual reviews and minimizes human error.

Designed to integrate seamlessly with existing financial workflows, Klippa SpendControl works across multiple formats, currencies, and languages, making it suitable for both local and global vendor networks. From small businesses looking to strengthen basic controls to large enterprises managing complex supply chains, the system delivers consistent, compliance-ready results.

- Duplicate Detection Accuracy: 99 percent accuracy prevents double payments instantly.

- Invoice Processing Speed: Up to 80 percent faster than manual verification.

- Data Extraction Accuracy: 99+ percent through AI-driven OCR.

- Compliance Coverage: Supports GDPR and multiple international financial standards.

- Loss Prevention: Proven to stop potential fraud cases before payment, protecting six- or seven-figure sums.

- Integration Capability: Compatible with leading ERP and accounting systems without additional hardware costs.

Do you want to know more about Klippa and how SpendControl can help you prevent fraud? Book a free demo below or contact one of our experts.

FAQ

Companies are at higher risk if they lack strong security measures in their accounts payable processes or if their teams are small and lack separation of duties. Regular audits, background checks on vendors and employees, and implementing invoice-matching methods can help detect fraud risks early.

To stop vendor fraud, it’s important to implement a multi-step approach: establish strong vendor management practices, educate employees on fraud risks, use invoice-matching techniques, and leverage technology to automate processes and detect suspicious activities.

The best way to prevent duplicate invoices is by using automated invoice matching tools. These tools, like Klippa SpendControl, can automatically flag duplicates in real-time, reducing the risk of paying the same invoice multiple times.

Manual invoice management increases the risk of fraud due to human error. Implementing checks such as separating invoice processing duties, performing random audits, and cross-referencing invoices with purchase orders or receipts can help minimize the risk.