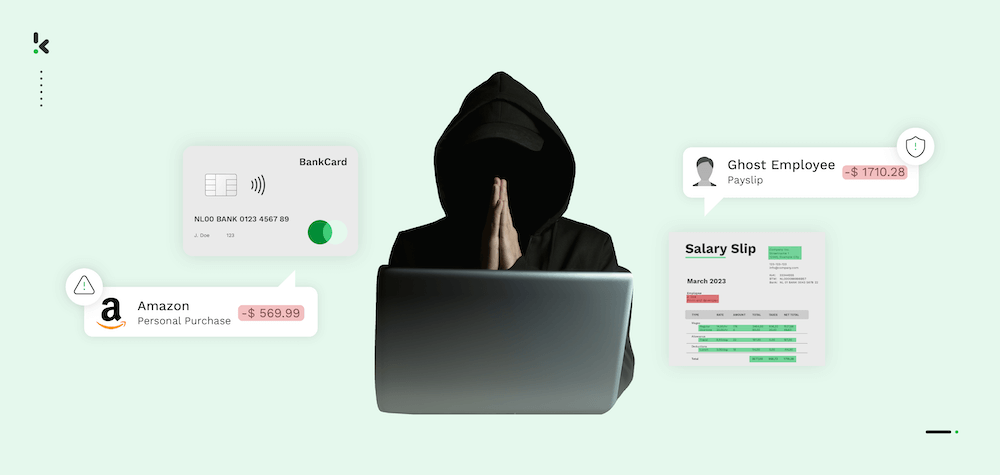

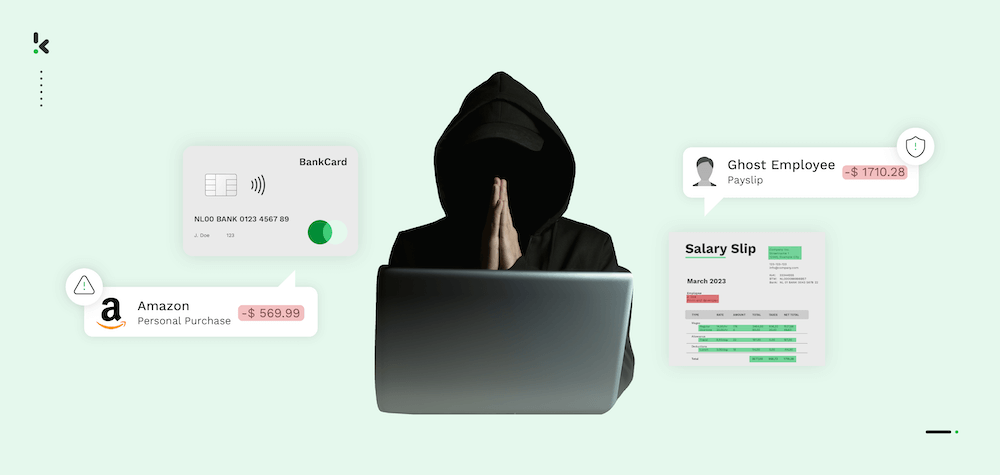

Business credit card fraud is far from a minor inconvenience—it is a pervasive issue that can threaten the financial stability of your company. In 2022 alone, incidents of such fraud rose dramatically, increasing from 26% to 36%. Looking ahead, projections suggest that the cost of credit card fraud could escalate to an alarming $43 billion by 2026.

CEOs and CFOs face the daunting challenge of safeguarding their resources against external threats and addressing internal risks such as employee misuse of company cards. The stakes are high, and a comprehensive strategy to prevent these risks is critical.

In this blog, we’ll dive into the various types of corporate credit card fraud, uncover the common signs of fraudulent activity, and provide you with strategies to protect your business. Let’s explore how to tighten your safeguards and keep your operations secure.

What is Business Credit Card Fraud?

Business credit card fraud refers to the unauthorized usage of a business credit card or card information to make purchases or withdraw funds. External parties can commit this fraudulent activity through hacking and phishing or by employees who exploit their access for personal gain.

Business credit card fraud poses a significant risk to your company by affecting both financial stability and operational integrity, potentially leading to significant legal issues. As technology evolves, so do the methods of financial fraud. Projections indicate that losses from company credit card fraud will continue to rise, making it crucial for businesses to enhance their defensive strategies.

Common Types of Business Credit Card Fraud

Company credit card fraud encompasses various tactics that fraudsters use to exploit business credit card accounts. Here are some of the most common types of fraud your company should be on the lookout for:

Stolen or Lost Card Fraud

This occurs when a company credit card is lost or stolen, and unauthorized transactions are made before the card is reported missing.

- How employees become victims: Misplacing a card or having it stolen, especially in public places.

- Vulnerabilities and mistakes: Irresponsible use of the physical card or failure to report and block the card immediately.

- Fraudster tactics: Use of the physical card for unauthorized transactions until the card is blocked.

Card Not Present (CNP) Fraud

CNP fraud happens when stolen card information is used to make purchases online, over the phone, or through mail orders, without needing the physical card.

- How employees become victims: Sharing card details online or through insecure networks.

- Vulnerabilities and mistakes: Using unsecured internet connections or websites for transactions, which fraudsters can intercept. Saving card information on unsecured websites for future convenience.

- Fraudster tactics: Gathering card information through data breaches or network interceptions to make unauthorized online purchases.

Fake or Counterfeit Card Fraud

Fraudsters can create counterfeit cards using stolen credit card data. These fake cards are then used for unauthorized transactions.

- How employees become victims: Through skimming devices or data breaches where card details are stolen.

- Vulnerabilities and mistakes: Swiping cards on compromised terminals or ATMs.

- Fraudster tactics: Creating physical counterfeit cards using stolen credit card data.

Phishing and Social Engineering Attacks

By gaining access to personal and corporate email accounts, fraudsters can impersonate the employee and gain further access to corporate accounts. Obtained credentials are used to commit financial fraud under the employee’s name, damaging their credit history.

- How employees become victims: Falling for fraudulent emails, calls, or messages posing as the credit card provider or company’s upper management.

- Vulnerabilities and mistakes: Lack of awareness or training on recognizing phishing attempts.

- Fraudster tactics: Manipulating employees into disclosing sensitive information using sophisticated emails or fake websites.

Employee Misuse

Sometimes, the fraud is internal. Employees might misuse their issued company credit cards for personal purchases or expenses not authorized by the company.

- How companies become victims: Employees use corporate credit cards to make unauthorized purchases for personal benefit.

- Vulnerabilities and mistakes: Poor oversight of credit card transactions and lack of strict policies regarding corporate card usage.

The risk of credit card fraud can have a significant impact on your company’s finances and can be a stressful experience. To effectively detect and prevent credit card fraud within your organization, it is essential to identify any vulnerabilities in your company’s security measures and be aware of the common signs of compromised cards.

Risk Factors and Warning Signs

Any business is vulnerable to credit card fraud, but those who recognize their vulnerabilities and understand the warning signs of potentially compromised cards can significantly enhance their chances of detecting and mitigating fraud early.

Here are some of the most common factors and signs that may lead to company credit card fraud in your company:

Risk Factors That Increase Vulnerability

Lack of Internal Controls

- Poor Oversight: Businesses without strict processes for monitoring credit card transactions are more susceptible to fraud. This includes lacking verification processes for expenditures or having an ineffective credit card reconciliation process.

- High Employee Turnover: Frequent changes in personnel, especially in financial roles, can lead to inconsistencies and gaps in the monitoring of financial activities, providing opportunities for fraudulent behaviors.

Technological Shortcomings

- Outdated Systems: Companies using outdated technology fail to benefit from advanced security measures included in modern systems, such as encryption and multi-factor authentication, making them easy targets for cybercriminals.

- Lack of Secure Connections: Utilizing non-secure internet connections for transactions can expose credit card information to interception by hackers.

Centralized Use of Cards

- Single Card for Multiple Users: When one credit card is shared among multiple employees, tracing unauthorized transactions back to the perpetrator becomes challenging, increasing the fraud risk.

Inadequate Employee Training

- Uninformed Staff: Employees unaware of potential security threats and safe credit card practices tend to be negligent in handling card information securely, inadvertently leading to security breaches.

Warning Signs of Potential Fraudulent Activities

Unusual Spending Patterns

- Sudden Increase in Expenditure: A significant and sudden rise in spending that does not correlate with normal business operations can be a red flag.

- Transactions at Odd Hours: Purchases made outside of regular business hours may indicate that a corporate card has been compromised.

Frequent Chargebacks

- Repeated Disputes: Multiple chargebacks on the card statement could suggest that the card number is being used fraudulently. Chargebacks often occur when a legitimate cardholder disputes a transaction that they claim they did not authorize or receive.

Geographically Inconsistent Transactions

- Foreign Transactions: Charges appearing from countries where the company has no business trades are suspicious and warrant further investigation.

- Multiple Locations: Simultaneous transactions occurring in geographically diverse locations can be telling of cloned or stolen card details.

Unfamiliar Vendors or Inconsistent Charges

- Unknown Vendor Names: Charges from vendors that the business does not typically interact with or from businesses that are outside the company’s industry scope should raise concerns.

- Variations in Transaction Amounts: Regular payments to familiar vendors that suddenly change in amount without reason can be indicative of manipulated charges.

Anomalies in Statement Entries

- Mismatched Addresses: Billing addresses that do not match the company’s records can be a sign of an intercepted card.

- Duplicate Transactions: Seeing the same transaction recorded multiple times may be an error or intentional duplicate charging by a fraudster.

By understanding these risk factors and recognizing the early warning signs of fraud, businesses can significantly strengthen their defenses against company credit card fraud.

How To Protect Your Business from Credit Card Fraud

Business credit card fraud is a significant threat that can compromise your company’s financial health. Protecting your business requires a sophisticated approach to security that combines technology and an effective expense policy.

Here’s a comprehensive strategy to avoid, detect, and prevent fraud in your organization:

1. Implement Advanced Fraud Detection Techniques

Pattern Recognition: Utilize software that employs pattern recognition algorithms to monitor corporate card transactions. This technology compares each transaction against established spending patterns and flags activities that deviate from the norm, such as unusual purchase locations or abnormally high amounts.

Anomaly Detection: Incorporate systems that perform real-time anomaly detection to identify inconsistencies and suspicious behaviors. For instance:

- Multiple failed transaction attempts

- Mismatched billing and shipping details

- A rapid succession of high-value purchases

The immediate response to the triggered alerts facilitates swift action to prevent potential losses.

Authentication Processes: Strengthen transaction security by enforcing different authentication methods. These should include:

- Biometric Verification: Use fingerprint scans, facial recognition, or retina scans to confirm the identity of the person using the corporate card.

- Two-Factor Authentication (2FA): Require a second form of verification (a code sent to a phone number or email) next to the standard card information to authorize transactions.

- Card Auto-Blocking: Set parameters that automatically disable a card after suspicious activity is detected, pending investigation.

Risk Scoring: Deploy a dynamic risk scoring system that evaluates the risk level of each transaction based on set criteria, such as mismatched addresses and unusual purchase categories.

Transactions that score above a predefined threshold can be blocked or flagged for review. This system not only prevents fraudulent transactions but also helps in identifying potential security flaws in spending policies.

2. Utilize Compliant and Certified Software

Ensure all software used for monitoring and processing corporate card transactions complies with international data security standards, such as PCI DSS (Payment Card Industry Data Security Standard) and GDPR (General Data Protection Regulation).

Compliance guarantees that the software adheres to high security standards which protect data and reduce the chances of fraudulent activities.

3. Issue Virtual Company Credit Cards

Virtual credit cards (VCCs) are considered a highly effective practice for preventing business credit card fraud. Virtual credit cards offer several unique features that enhance security and provide control mechanisms that are not typically available with physical credit cards:

Single-use Numbers: Virtual credit cards generate a unique card number for each transaction or vendor. Once a transaction is completed, the card number becomes useless. If the card details are leaked before the transaction is finalized, they cannot be used by another merchant, which reduces the risk of vendor fraud.

Ease of Issuance and Cancellation: Virtual cards can be created and distributed instantly, which is crucial in time-sensitive situations. They can be canceled without affecting a primary account or other virtual cards, providing a quick response to any fraud detected.

Set Expiration Date: Virtual cards can be configured to expire within a fixed date range, making them useless after the set period, which is particularly useful for subscriptions and trial periods.

Using virtual cards is advisable when immediate issuance is needed or when physical swiping is not necessary. However, travel-related expenses and physical merchants often require physical credit cards, making it challenging to eliminate them from operations completely.

4. Enforce Strict Expense Policies

Create and strictly enforce corporate credit card expense policies. The policy should provide guidelines for the appropriate use of corporate credit cards, outline authorized purchases, detail the responsibilities of cardholders, and describe the procedures for transaction reporting and reimbursement.

An effective corporate credit card expense policy should include the following information relevant to fraud prevention:

- Eligibility and Issuance: Define issuance criteria, step-by-step application process and provide cardholder agreement that the employee should sign.

- Allowed Expenses: List business-related expense categories that are authorized for credit card use. Highlight the preferred use cases for the virtual and physical credit cards.

- Prohibited Expenses: Clearly state that personal expenses, withdrawals, and cash advances are prohibited. Present disciplinary actions.

- Predefined Spending Limits: Set limits for general transactions, daily spending, and the number of daily transactions to keep expenditures within a reasonable range.

- Authorized Vendor Lists: Specify approved vendors and service providers to prevent unauthorized transactions.

- Required Approvals: Mandate managerial approvals for transactions above a certain threshold and for all out-of-policy spends.

- Security and Compliance: Caution about the transaction monitoring and describe cardholder responsibilities. Provide an action plan for lost or stolen card reporting.

5. Adopt Real-Time Expense Monitoring

Use expense management software that offers real-time expense monitoring and integrates directly with business credit cards. This integration provides immediate visibility into all card transactions, facilitating instant review and approval processes, which are crucial for catching fraudulent transactions as they happen.

6. Educate Employees Regularly

Conduct regular training sessions for all employees about the risks and prevention of corporate credit card fraud. Education should cover:

- Recognizing Fraud: Teach how to identify suspicious activities. Inform on the steps to take when your employees suspect fraud, such as:

- Identify the suspicious activities: Regularly review statements, audit transactions and use digital fraud detection to identify unauthorized spending.

- Notify the authorities: Contact the card issuer, relevant internal personnel, and authorities (in case of significant fraud).

- Secure account: Freeze or cancel compromised cards and change the PINS and passwords of the associated accounts.

- Document the process: Document all actions taken from the moment fraud is suspected. Keep a log of whom you’ve contacted and when, and what steps have been taken.

- Security Best Practices: Educate on the importance of secure transactions, safe internet practices, and the risks of phishing attacks. Provide regular workshops or educational training on credit card fraud prevention for businesses. Stress the importance of adhering to the company’s spending policies and the consequences of non-compliance.

7. Regularly Review and Update Security Measures

Fraudsters continually refine their strategies and techniques. Regularly review and update your security measures, policies, and technologies in response to emerging threats. This proactive approach not only enhances your defenses but also keeps the entire organization alert to the dynamics of credit card fraud.

By implementing these practices, your business can significantly mitigate the risk of corporate credit card fraud, ensuring financial integrity and maintaining trust with partners and clients.

Prevent Company Credit Card Fraud with Klippa SpendControl

Don’t let fraud concerns interfere with your business, take charge against company credit card fraud with Klippa’s Corporate Credit Cards. Advance your financial management with the synergy of powerful credit cards and intuitive pre-accounting software – Klippa SpendControl.

Set spending limits aligned with your company’s expense policy, track spending anytime anywhere via the web or mobile app, and manage corporate credit cards with all business expenses in one centralized system. Save time and resources on manual document processing while gaining complete control over your business expenses.

Klippa offers corporate credit cards that come with essential features to protect your company’s transactions:

- Use physical and unlimited virtual corporate credit cards for your business purchases

- Manage your corporate credit cards, vendor invoices, and employee expenses in one platform

- Set and control spending limits for individual cards via web or mobile app

- Issue single-use cards and separate cards for specific merchants or purchases

- Customize your approval management with multi-level authorization flows

- Regain control and insights on real-time spending with a dedicated dashboard

- Prevent corporate credit card fraud with built-in fraud detection system powered by machine learning

- Secure your online transactions with our 3-DS protection layer

- Store and process credit card data in line with the PCI DSS data security standards

- Never fail to comply with tax and data privacy regulations with our ISO27001, SOC1, & SOC2 certified and GDPR-compliant solution

- Integrate SpendControl with your preferred accounting and ERP software

Are you ready to take control of your company’s transactions? Schedule a free demo to see our solution in action, or contact our SpendControl specialists for more details.

FAQ

Businesses can protect themselves from credit card fraud by adopting advanced fraud detection technologies, such as real-time expense monitoring, pattern recognition, and anomaly detection. Implementing strict corporate credit card policies, issuing virtual credit cards with single-use numbers, and ensuring PCI DSS compliance can further enhance security.

Companies handle credit card fraud by first identifying suspicious activities through regular statement reviews or real-time monitoring systems. Once fraud is detected, they immediately secure the account by freezing or canceling the compromised card and updating associated account credentials. Companies then notify the card issuer and relevant authorities while documenting all actions taken for future reference.

To report credit card fraud, businesses should contact the card issuer immediately to freeze or cancel the compromised card. They should also notify internal personnel responsible for financial management. Businesses need to provide detailed documentation, such as transaction records and logs of suspicious activities, to support the investigation. Keeping a timeline of all actions and communications ensures a clear fraud report.

Employee misuse of corporate credit cards is addressed by conducting a thorough review of unauthorized transactions, followed by discussing the issue with the involved employee. Companies should enforce disciplinary actions as per their corporate credit card policy. To prevent misuse, businesses should set predefined spending limits, require approvals for high-value transactions, and monitor expenses in real-time. Regular training on corporate credit card policies and consequences of non-compliance is essential to minimize risks.