Klippa SpendControl | Expense Management

Automated Expense Management Software

Reduce administrative hassle with advanced expense management software. Easily oversee team budgets with real-time visibility and manage custom approval workflows.

Trusted by 1000+ innovators and finance leaders worldwide

<img decoding=”async” src=”https://www.klippa.com/wp-content/uploads/2024/02/Banijay-grey-logo.png” alt=””/>

<img decoding=”async” src=”https://www.klippa.com/wp-content/uploads/2024/02/Online-Payment-Platform-grey-logo.png” alt=””/>

<img decoding=”async” src=”https://www.klippa.com/wp-content/uploads/2024/02/DZBank-grey-logo.png” alt=””/>

<img decoding=”async” src=”https://www.klippa.com/wp-content/uploads/2024/02/Nivea-grey-logo.png” alt=””/>

<img decoding=”async” src=”https://www.klippa.com/wp-content/uploads/2024/02/Krombacher-grey-logo.png” alt=””/>

<img decoding=”async” src=”https://www.klippa.com/wp-content/uploads/2024/02/Car-Offer-grey-logo.png” alt=””/>

<img decoding=”async” src=”https://www.klippa.com/wp-content/uploads/2024/02/Car-Offer-grey-logo.png” alt=””/>

Leave Tedious Expense Reports Behind,Choose Efficient Expense Management Software

99% Less Receipt Hassle

Avoid the hassle of receipt chasing with 99% of receipts processed on the go.

Let Data Entry Handle Itself

Eliminate errors by automatically capturing and categorizing expenses into digital archives.

Always Know What’s Going On

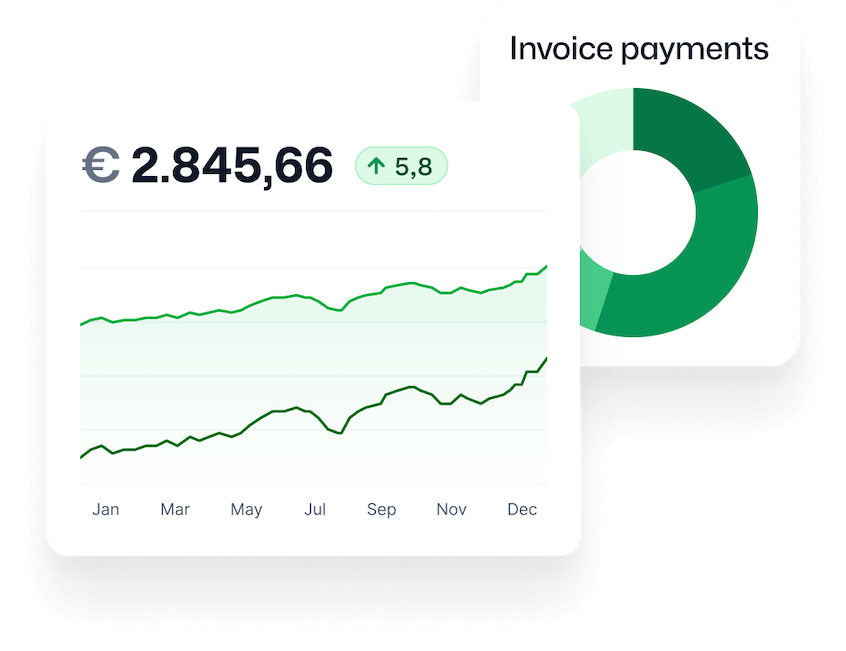

Solve delayed financial reporting with real-time expenditure insights.

Collect Smiles with Fast Payouts

Get rid of long waits and tedious paperwork. Make employees happy with fast, easy claims.

With SpendControl, UZA saves up to 3x on processing time

“With SpendControl, we save valuable time that we can now dedicate to our care tasks.” ~ Reinhart Maertens, IT Director UZA

Why Modern Finance Teams Choose SpendControl

99%

correct data extraction by Klippa’s leading OCR70%

of time saving on processing100%

insights into your operational expenses20+

integration possibilitiesto connect with

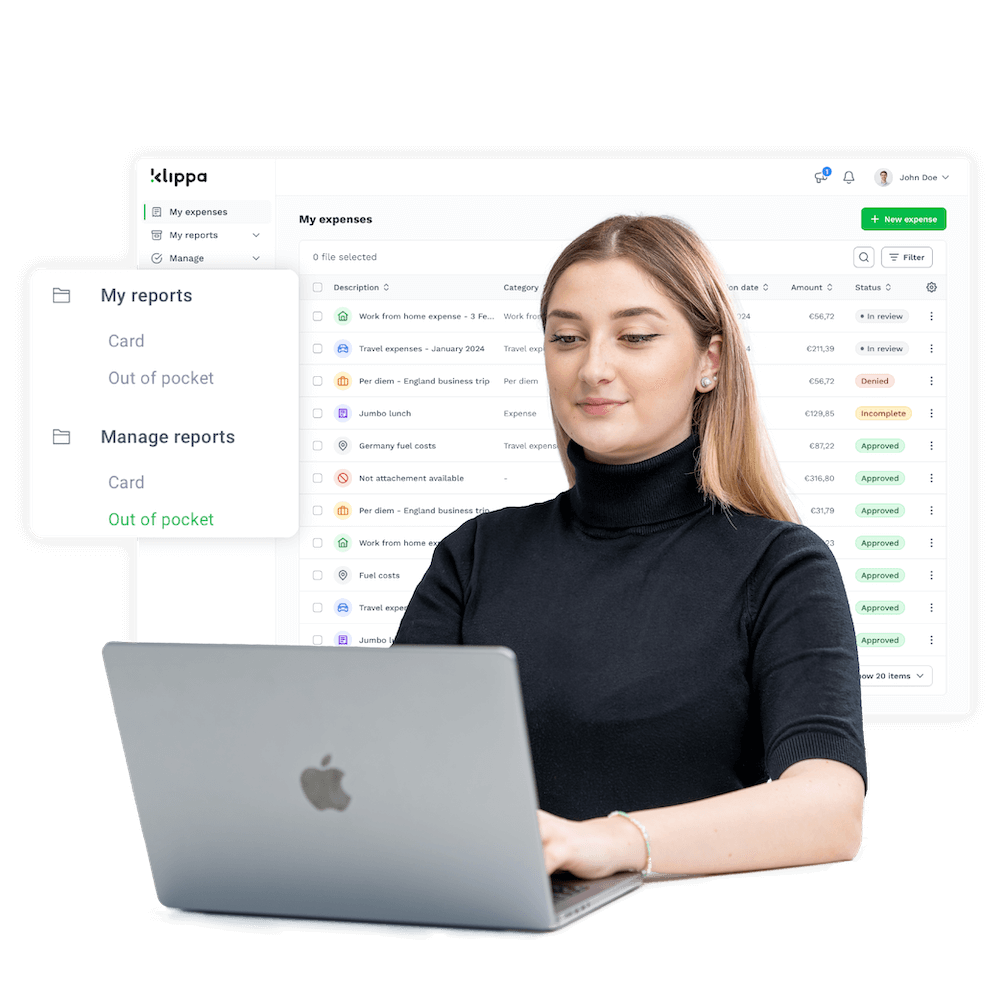

Automated Expense Management

Streamline your finances by automating expense management for timely payments and reduced hassle. A reliable expense controller that works for you.

Gain real-time visibility into spending, maintain control, and enjoy a seamless financial workflow. Benefit from fully customizable forms tailored to your specific needs.

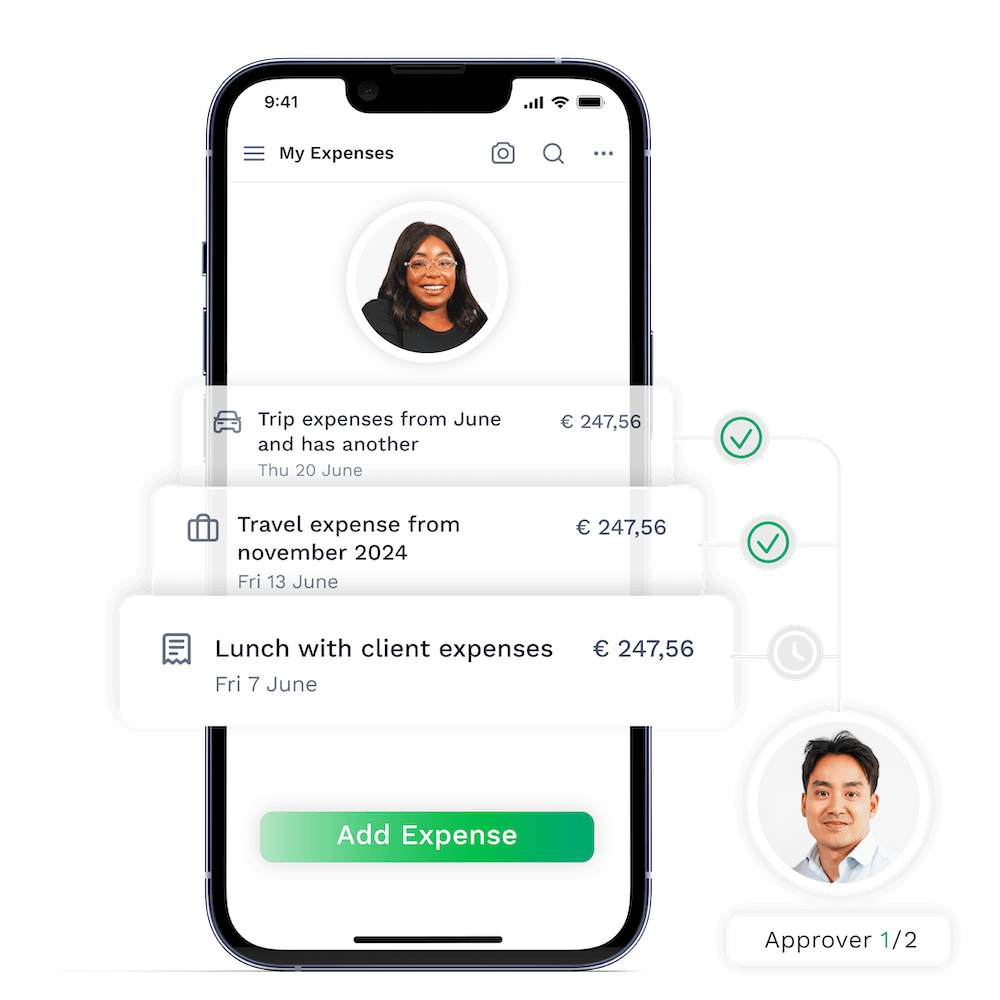

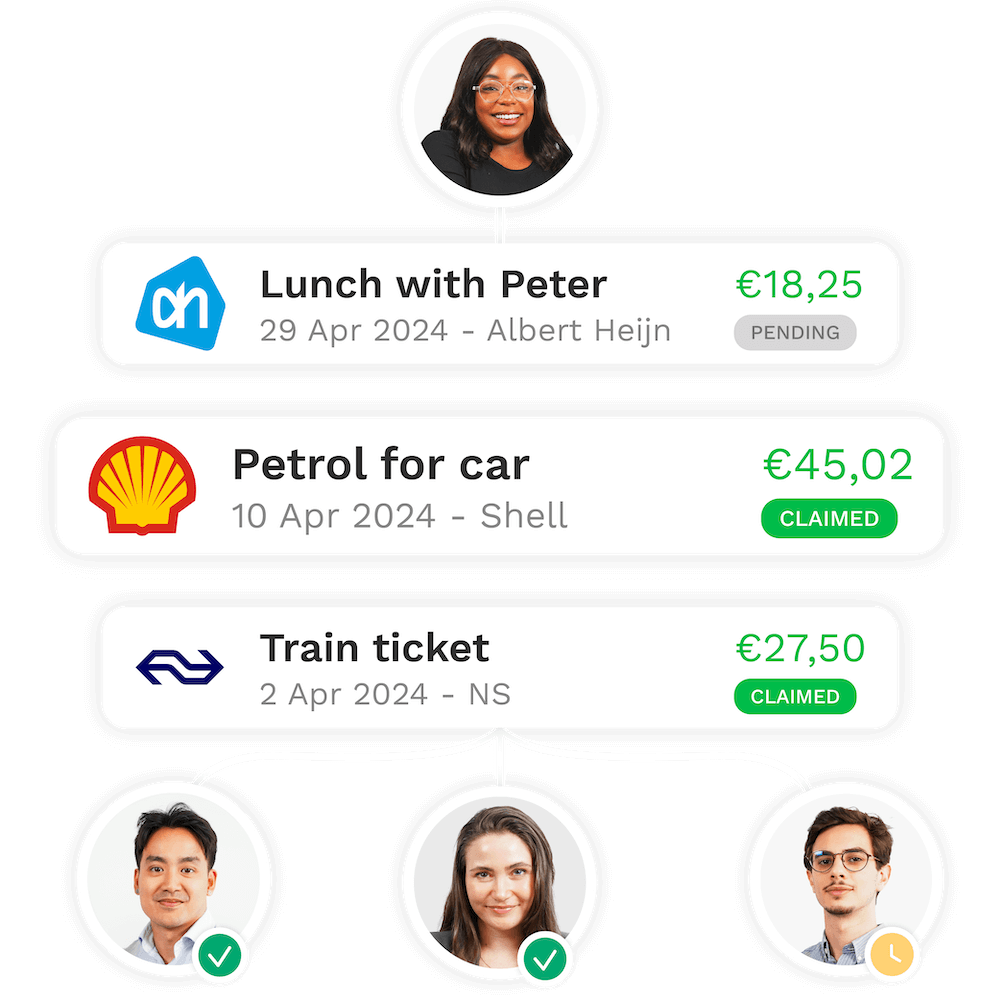

Boost Employee Satisfaction

Boost employee satisfaction with fast, easy claims and reimbursements. Employees can upload receipts on the go, receive real-time notifications, and get instant approvals.

Streamline submissions for claims, transactions, allowances, and mileage on web and app, with automatic currency exchange for hassle-free transactions.

Get Rid of Making Mistakes

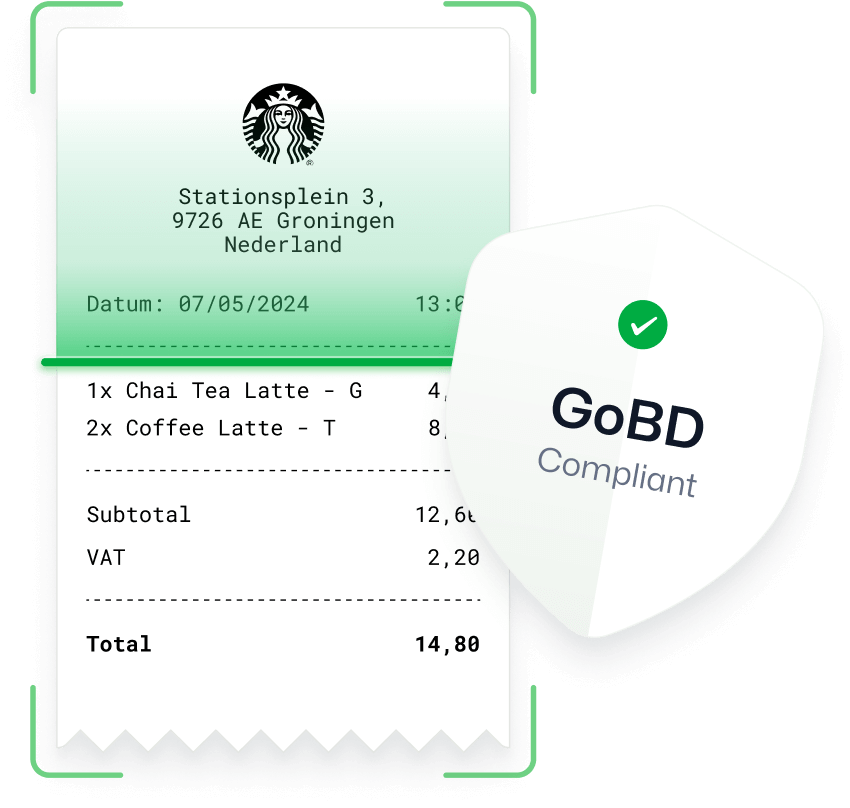

Eliminate mistakes with OCR expense management. Our leading OCR technology autofills, captures, categorizes and archives expenses for accuracy and efficiency.

Automate data entry to focus on what matters. Submit transactions individually or in bundled reports to approve multiple expenses in one go.

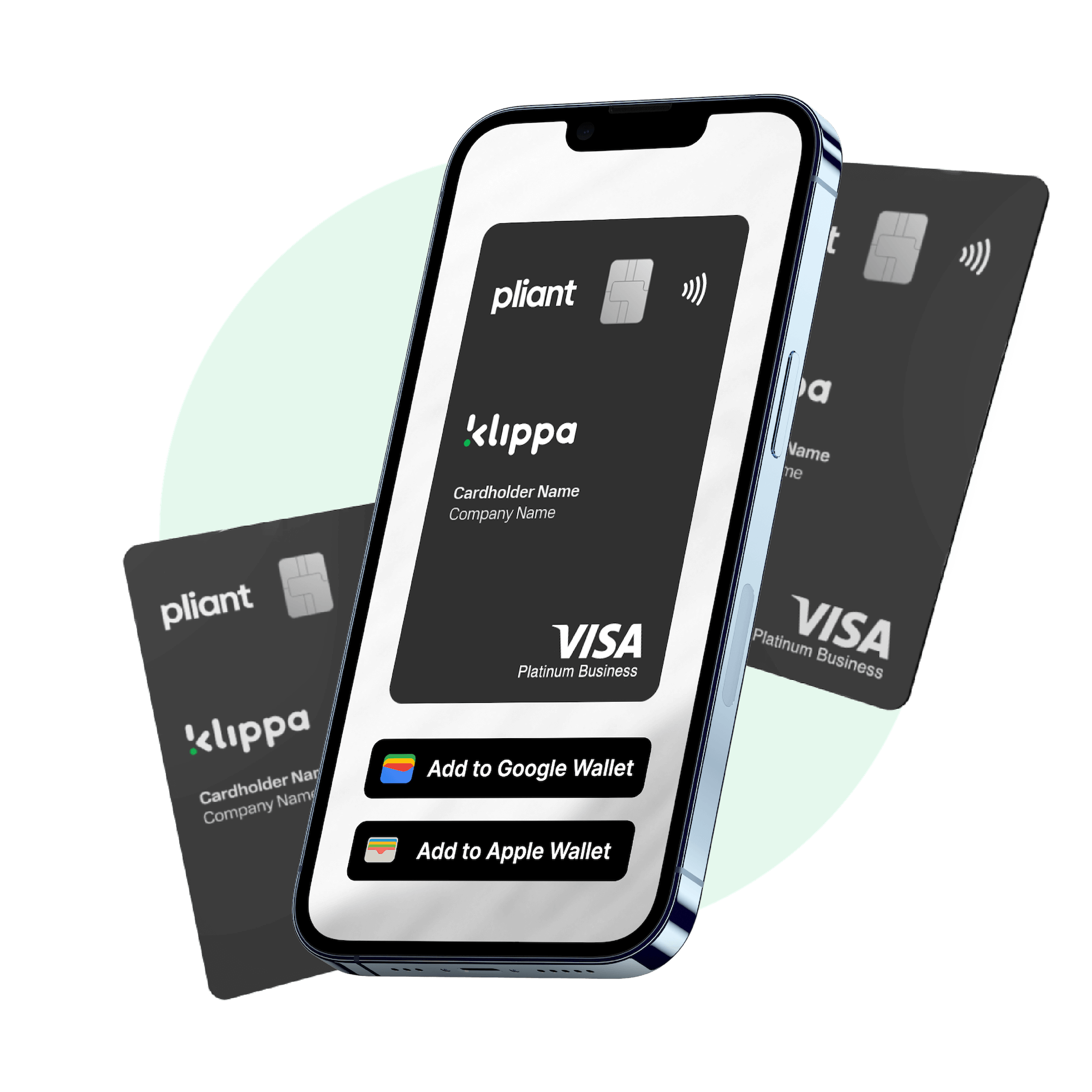

No More Out-of-Pocket

Get a grip on employee expenses with company cards. Track spending, set limits, and eliminate out-of-pocket costs with a complete expense card system. Enjoy easy tracking, management, and real-time processing of card transactions for effective budget control.

Take Full Control Over Spendings

Take control of spending with a seamless approval process, automated transfers, and reminders to enhance financial oversight. Approve expense in just 3 clicks.

Enforce company policies for compliance with complex expense regulations, including monthly limits on specific categories.

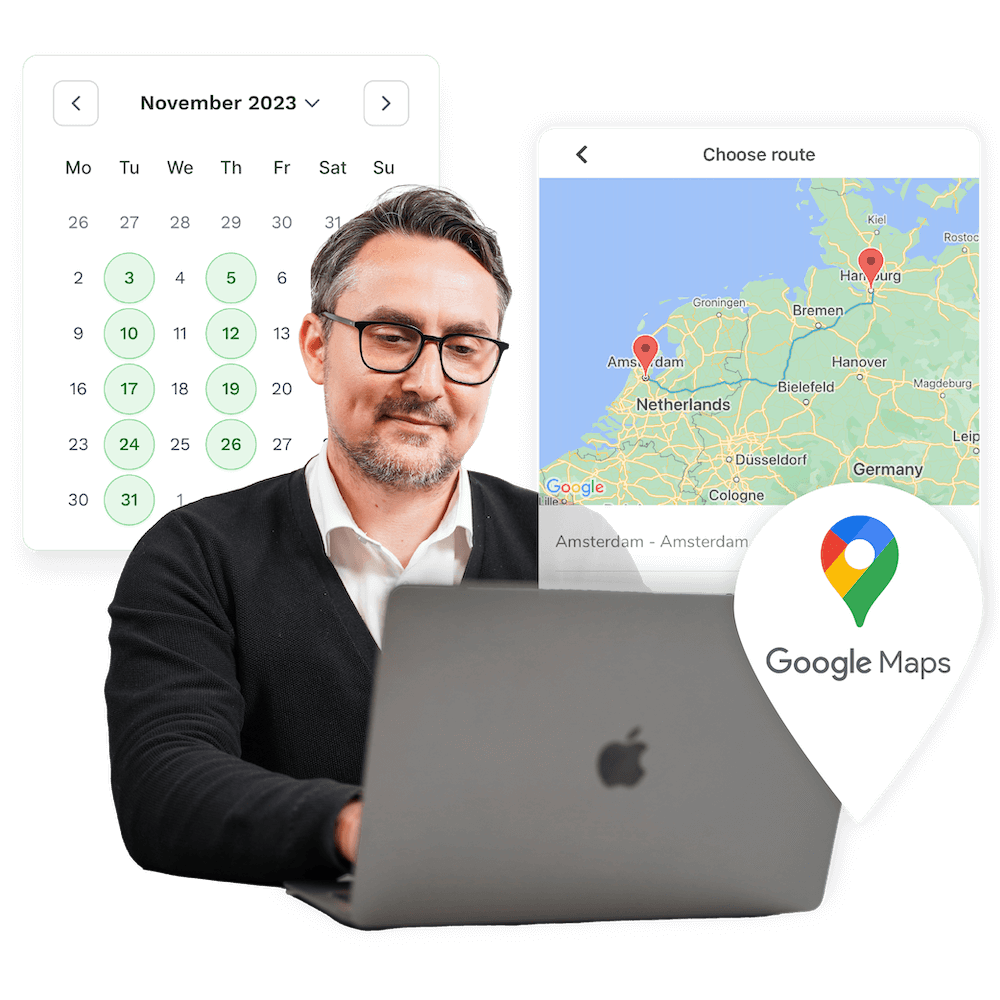

Simplify Allowance Calculations

Input travel information, and our system handles reimbursements for expenses, mileage, meals, hotel stays, and per diems.

Ensure compliance with vehicle and mileage registration and benefit from extensive reimbursement rules, including multiple travel rates, per diems (coming soon), and remote work allowances.

Sync All User Data in Seconds

Sync all user data in seconds, seamlessly integrating identity management systems. Enjoy the convenience of single sign-on and secure access, keeping everything effortlessly in sync.

Automate user management and synchronize user and company policies for smooth, efficient operations.

Made To Integrate With

<img decoding=”async” src=”https://www.klippa.com/wp-content/uploads/2023/07/googlemail.png” alt=””/>

<img decoding=”async” src=”https://www.klippa.com/wp-content/uploads/2023/07/googledrive.png” alt=””/>

<img decoding=”async” src=”https://www.klippa.com/wp-content/uploads/2023/07/onedrive.png” alt=””/>

<img decoding=”async” src=”https://www.klippa.com/wp-content/uploads/2024/05/Microsoft_Entra_ID_light.png” alt=””/>

<img decoding=”async” src=”https://www.klippa.com/wp-content/uploads/2023/07/sharepoint.png” alt=””/>

<img decoding=”async” src=”https://www.klippa.com/wp-content/uploads/2021/11/Oracle-NetSuite-partner-01-e1637526692391.png” alt=””/>

<img decoding=”async” src=”https://www.klippa.com/wp-content/uploads/2019/08/xero-klippa.png” alt=””/>

<img decoding=”async” src=”https://www.klippa.com/wp-content/uploads/2023/07/dropbox.png” alt=””/>

<img decoding=”async” src=”https://www.klippa.com/wp-content/uploads/2023/07/quickbooks-Round.png” alt=””/>

<img decoding=”async” src=”https://www.klippa.com/wp-content/uploads/2023/07/zohobooks_short.png” alt=””/>

See all of our integrations.

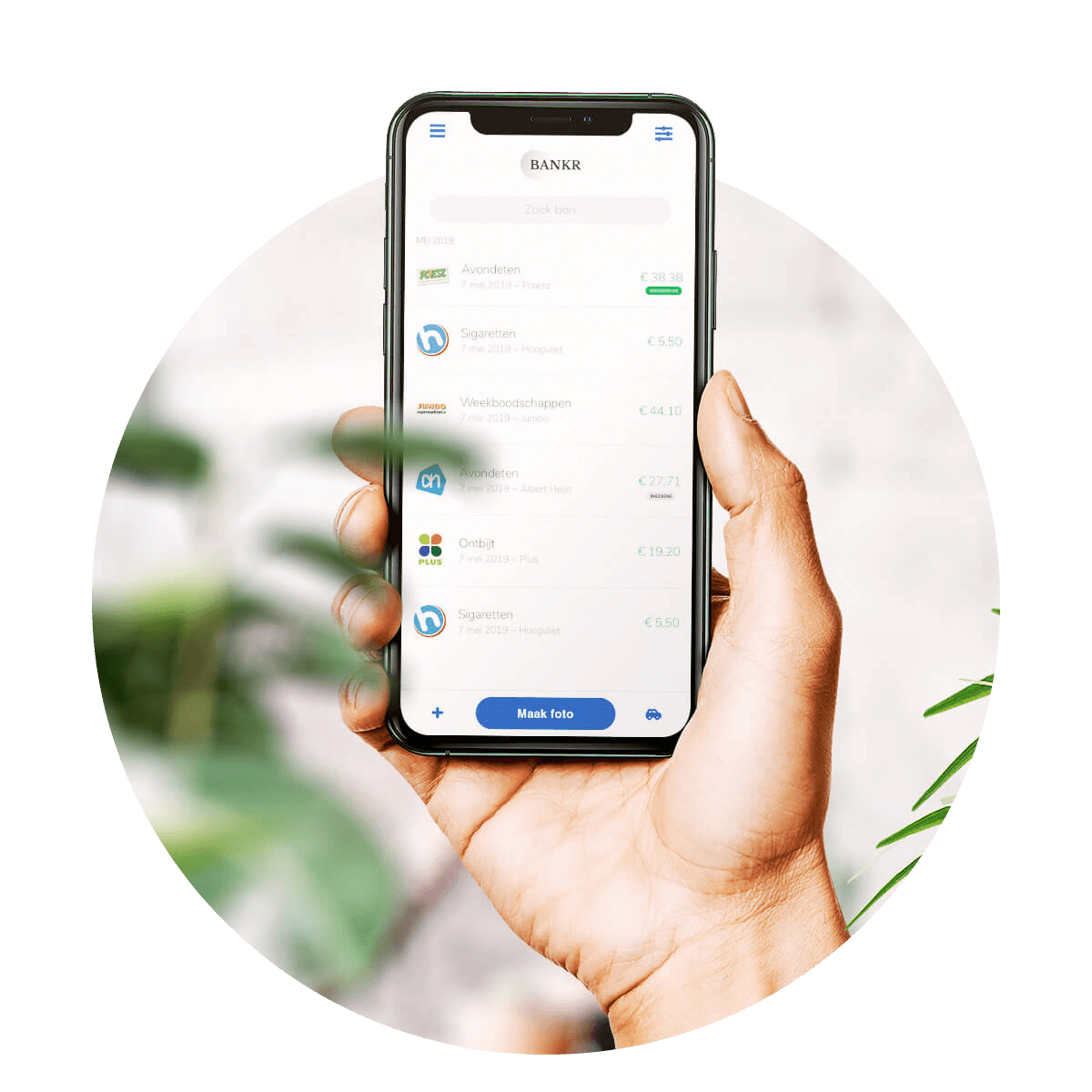

Expense Management in Your Corporate Style

Offer a customized Expense Management Solution in your corporate style with our White Label service. Enjoy a premium design with endless possibilities, built-in leading OCR for the highest recognition rate, and comprehensive training for self-onboarding and support.

Claim Your Expenses in 3 Easy Steps

Simplify your expense reimbursement process with 3 simple steps, making reimbursing expenses feel like a breeze.

Step 1 – Upload Receipt(s)

Simply take a picture of your receipt using the built-in camera functionality. No more worries about lost paper receipts.

For travel expenses, you can even utilize the Google Maps integration to claim the expense of your journey in seconds.

Step 2 – Add Description

Once uploaded, Klippa’s advanced OCR technology will recognize and automatically extract the relevant data, such as the merchant name, date, and amount.

All you need to do is provide a brief description to give context to your claim. No more tedious manual data entry.

Step 3 – Submit for Approval

After verifying and confirming the expense claim, it can easily be submitted with one touch, triggering an automated workflow that notifies the appropriate approver(s).

Once approved, the employee receives a notification confirming the success of the claim or indicating any required adjustments.

Why SpendControl is The Best Choice:

Discover the power of Klippa SpendControl –

Packed with features aimed at making the lives of finance professionals easier.

Join 1000+ Finance Teams in Carefree Spend Management

Klippa allows us to digitally register, approve, and process expenses and invoices in one user-friendly cloud environment.

With Klippa, colleagues can focus on key tasks as workload and manual processes are greatly reduced, achieving an ROI of 60–80%.

Employees can now submit their claims directly via the app. Managers approve them, and finance ensures proper receipt allocation.

We Take Your Data Privacy & Security Seriously

FAQ – Frequently Asked Questions

Does SpendControl have optical character recognition (OCR)?

Yes, SpendControl supports OCR with the highest recognition rate! OCR stands for Optical Character Recognition and enables the automatic reading of data from scanned receipts so that manual input is no longer necessary. The following data is recognized: Merchant, purchase date, total amount, VAT rate, VAT amount and more.

How does SpendControl deal with different types of costs?

Parking fees, business meals and promotional gifts are examples of categories that employees select when submitting. These categories are linked in the system to the correct general ledger and VAT coding so that the costs can be transferred to accounting with one click.

Is SpendControl secure and GDPR-compliant?

Yes, SpendControl is GDPR-compliant and ISO 9001 and ISO 27001 certified. Our solution is therefore suitable for use within and outside Europe. We use secure connections, automatic backups, firewalls, and encryption. Third parties perform penetration tests, and we provide detailed security documentation on request.

Can SpendControl integrate with my accounting or ERP system?

Yes, SpendControl can be easily integrated. We have acquired various software partners over the years and offer API integrations as well as intelligent export/import files. You can find more information about the integrations on our page about interfaces.

Can I download reports or export data from SpendControl?

Yes, reports and data can be exported in various formats such as CSV, XLSX, PDF and UBL. You can create your own template in the desired format and easily generate reports from SpendControl.

Does SpendControl also support credit card spending?

Yes, SpendControl supports credit card spending! For the relevant receipt or invoice, indicate that it was paid with a credit card. The document is then automatically compared with an entry in the imported credit card billing statement.

Does SpendControl have approval guidelines and individual workflows?

Yes, expense reports go to the manager for approval and then to the finance department. You can also create specific workflows, such as automatic approvals for parking tickets under 5 euros or additional approval by the CFO for amounts over 1000 euros.

What happens to foreign currencies on international business trips?

Do your employees travel abroad and have business expenses there? In SpendControl, the receipt data is automatically converted into the desired currency without you having to do anything. The original currency is also saved.

Discover Our Insightful Blogs

Stay informed with our insightful blogs on expense management, intelligent document processing and more.