AP Automation That Saves Money and Reclaims Your Time

Bring full automation to your Accounts Payable workflows from invoice capture to approval and booking. Save time, cut costs and reduce errors.

Trusted by 1000+ brands worldwide

<img decoding=”async” src=”https://www.klippa.com/wp-content/uploads/2024/02/Online-Payment-Platform-grey-logo.png” alt=””/>

<img decoding=”async” src=”https://www.klippa.com/wp-content/uploads/2024/02/DZBank-grey-logo.png” alt=””/>

<img decoding=”async” src=”https://www.klippa.com/wp-content/uploads/2024/02/Nivea-grey-logo.png” alt=””/>

<img decoding=”async” src=”https://www.klippa.com/wp-content/uploads/2024/02/Krombacher-grey-logo.png” alt=””/>

<img decoding=”async” src=”https://www.klippa.com/wp-content/uploads/2024/02/Car-Offer-grey-logo.png” alt=””/>

<img decoding=”async” src=”https://www.klippa.com/wp-content/uploads/2024/02/Car-Offer-grey-logo.png” alt=””/>

Why Finance Teams Choose AP Automation

4x

more invoices processed per FTE90%

of time saving on AP processing100%

insights into your real-time spend€10-16

saved on every invoice processed

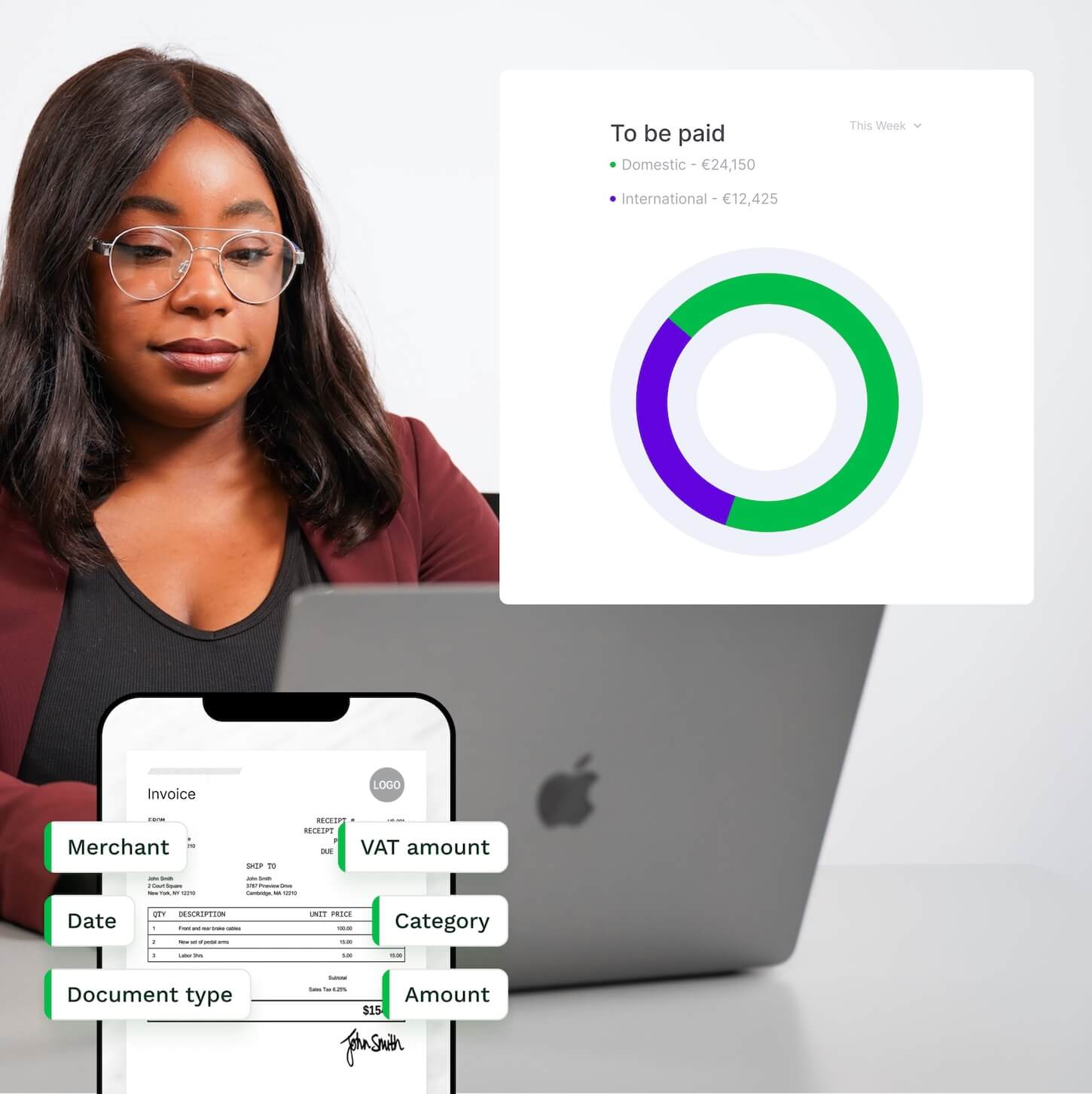

AI-Driven Invoice Processing

Capture, read, and validate invoices with intelligent OCR powered by AI, ensuring accurate data extraction and fast processing. With real-time visibility and fewer manual steps, your AP teams can focus on what truly matters.

Procure-to-Pay Automation

Standardize and streamline your procure-to-pay process while staying fully compliant. From purchase orders to invoice approvals, Klippa ensures every step is traceable and auditable with seamless ERP integration and customizable workflows.

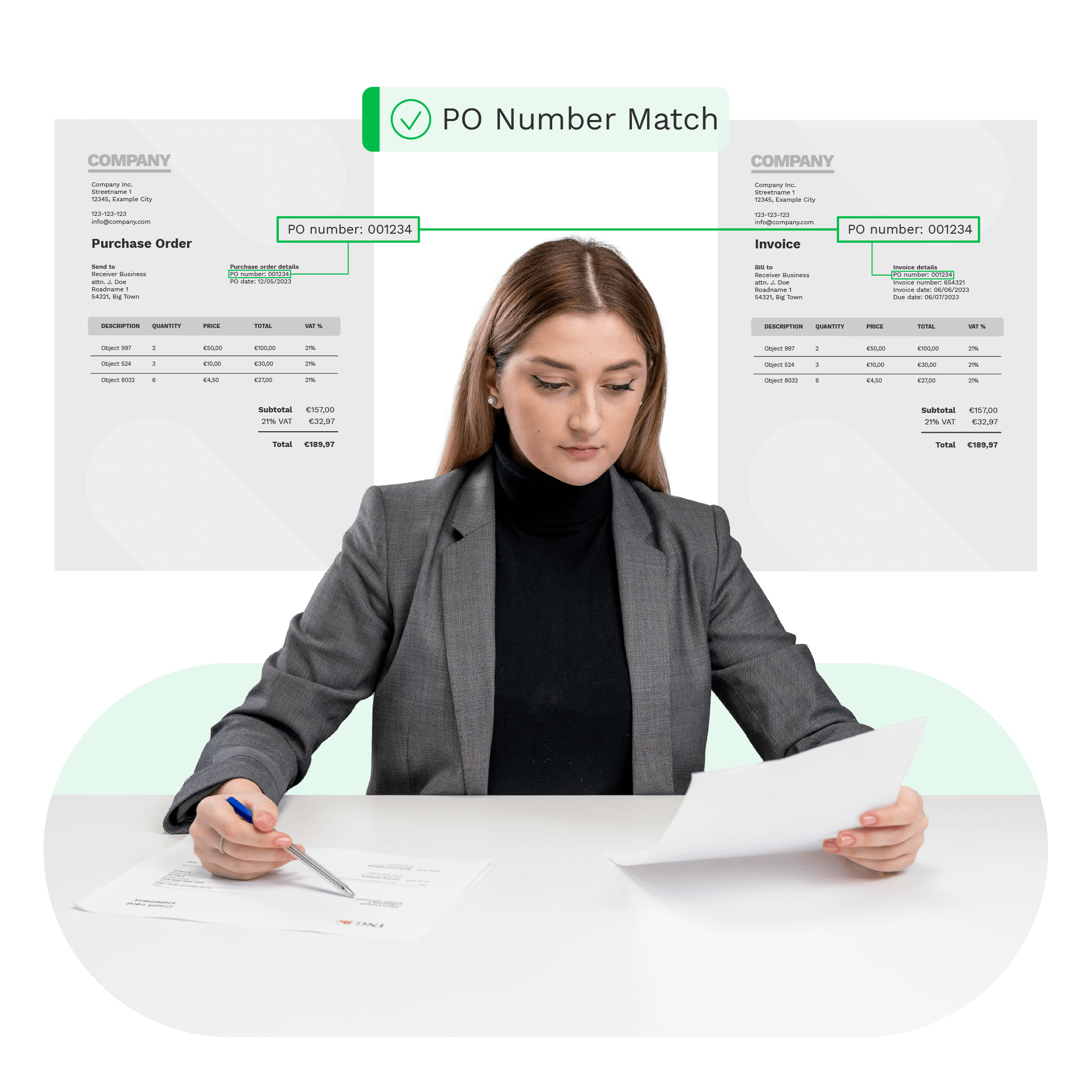

Smart PO Matching

Klippa handles 2-way and 3-way matching between invoices, purchase orders, and delivery receipts. Mismatches are flagged automatically, reducing the risk of overpayments or fraud without slowing down your team.

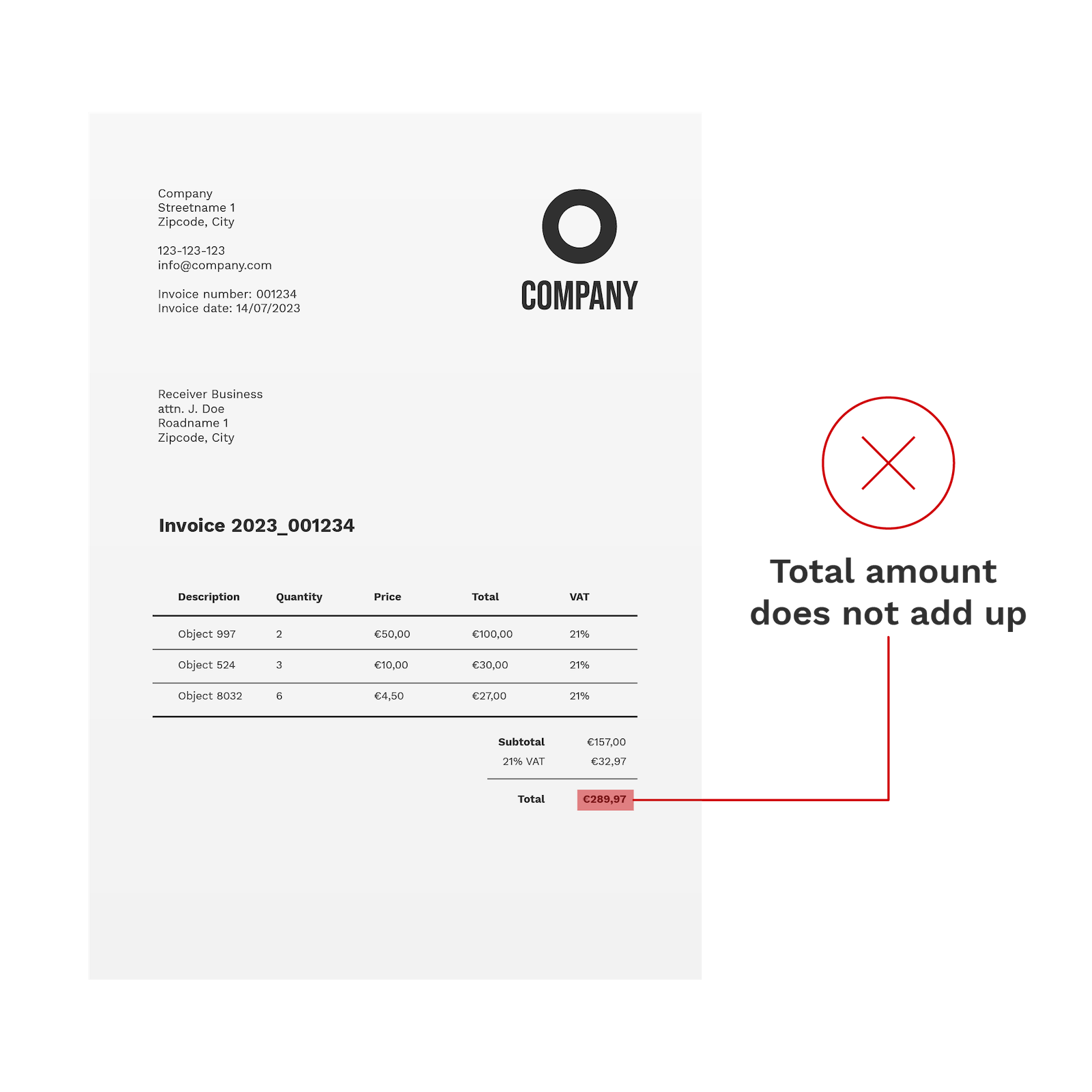

Fraud & Duplicate Detection

Instantly flag duplicates, anomalies, and suspicious edits to stop fraud and compliance risks before they arise. With built-in safeguards, your accounts payable process stays secure, intelligent, and audit-ready by design.

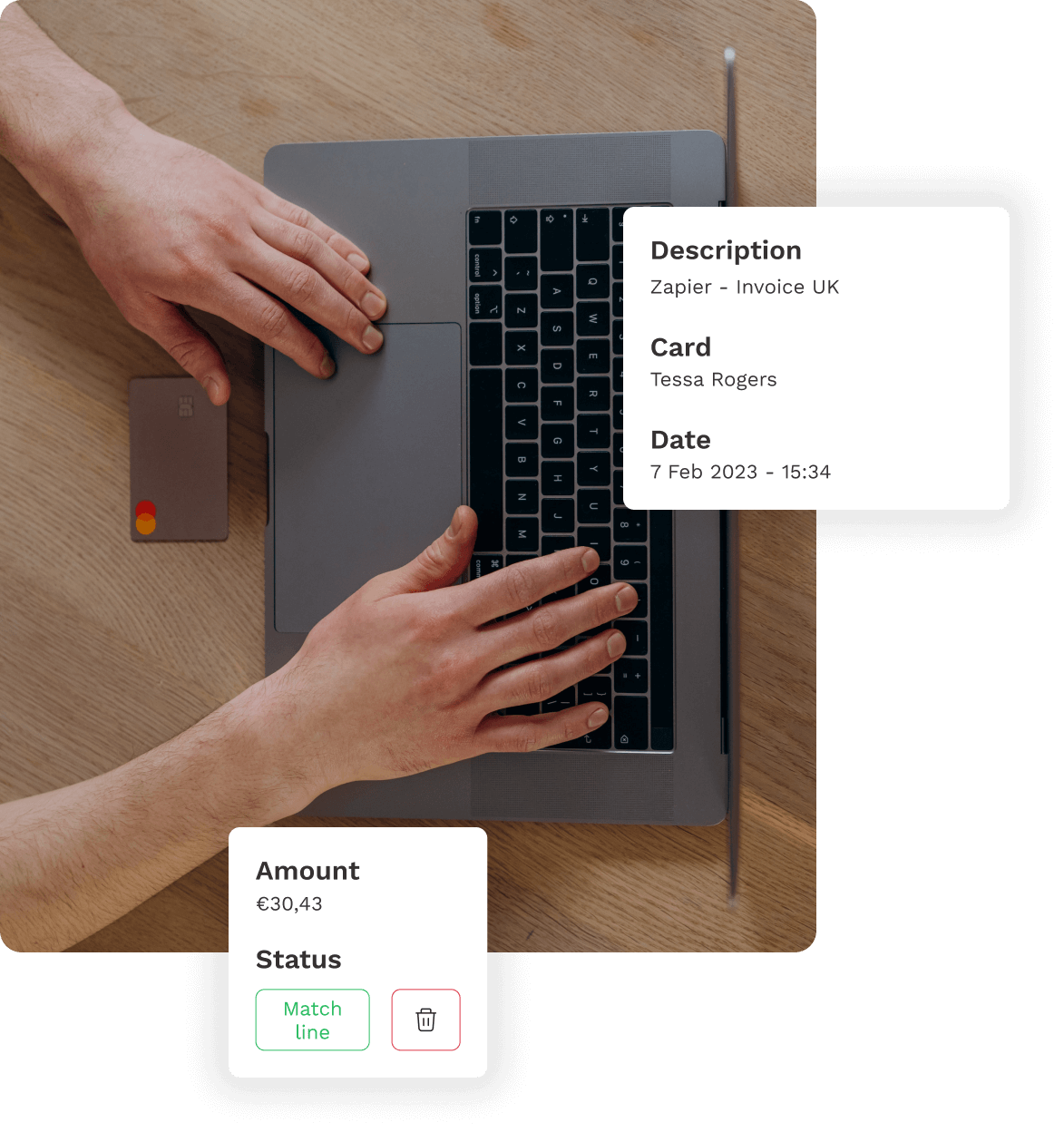

Automated Reconciliation

Automatically match payments and statements with corresponding invoices and purchase orders, simplifying the month-end close. This ensures that your accounts are accurate, and discrepancies are identified promptly.

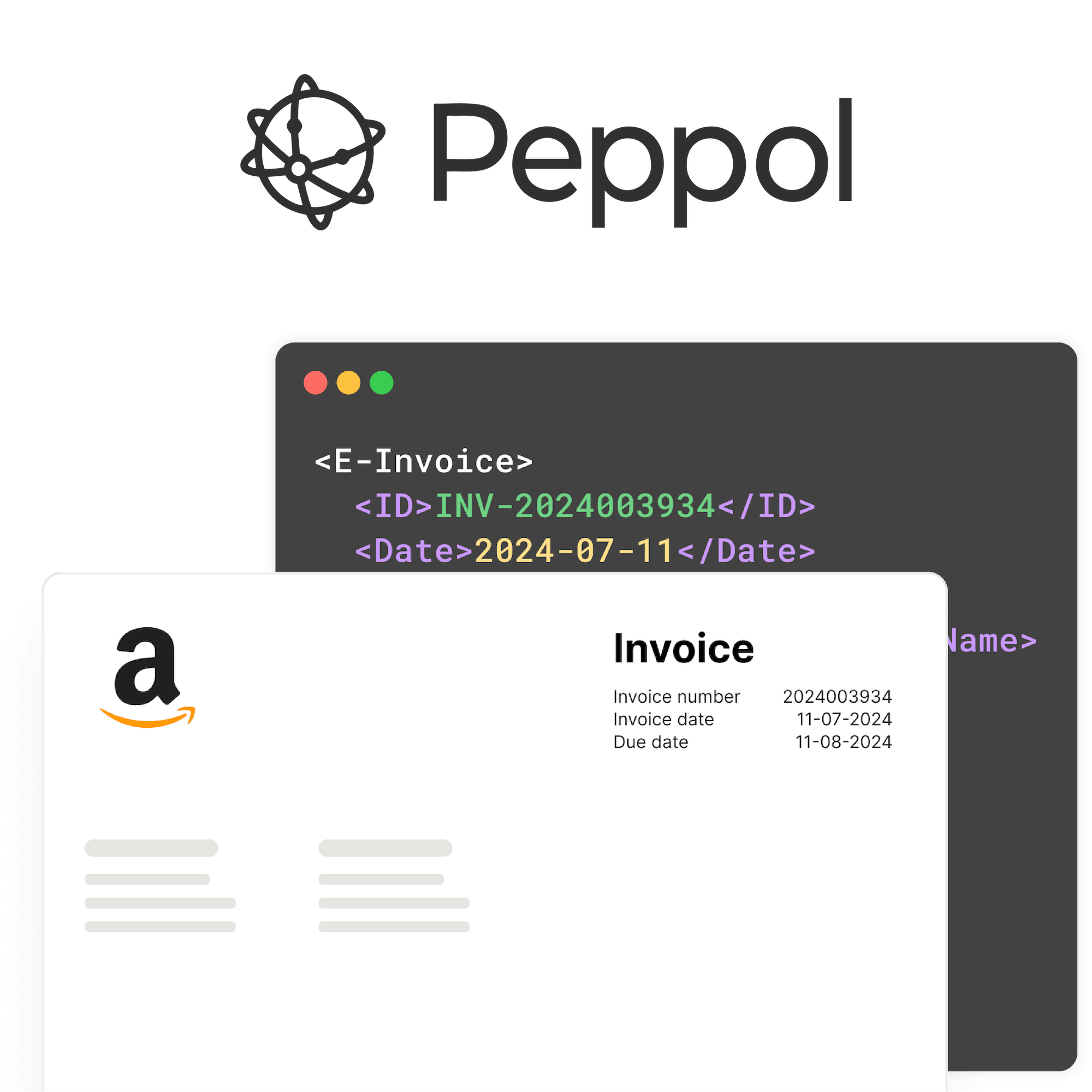

Paperless E-invoicing

Process structured e-invoices directly in formats like UBL or XML using the PEPPOL network eliminating the need for manual data entry. Speed up invoice handling and ensure compliance with local regulations with paperless approach.

KEY FEATURES

Why Choose Klippa AP Automation

Tired of chasing invoices and approvals? Here’s how Klippa helps finance teams like yours take back control and get more done with less hassle. Key features include:

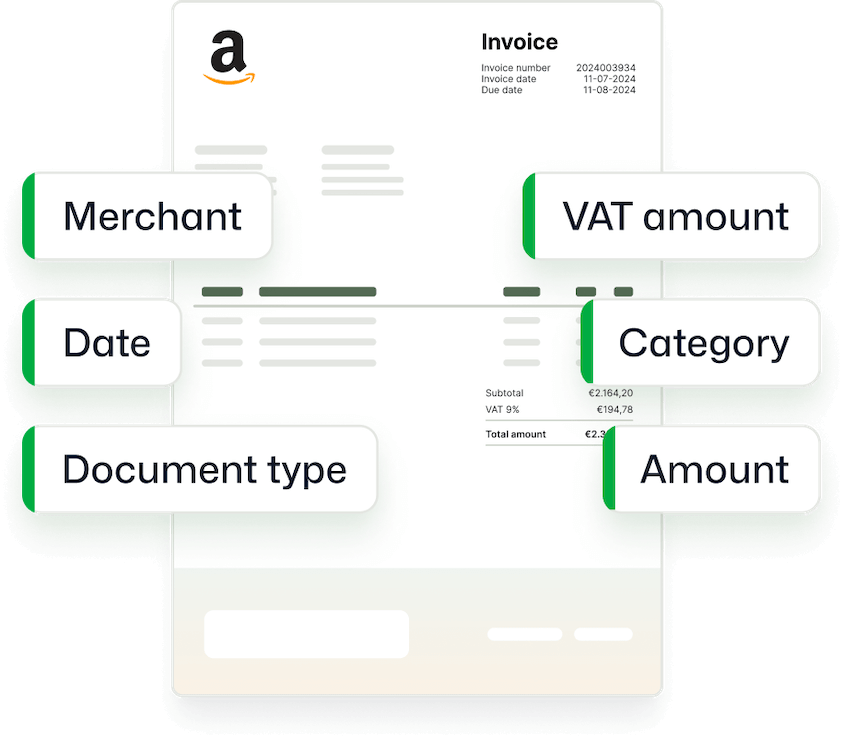

Smart invoice capture

Automatically capture invoice numbers, dates, line items, VAT and totals with up to 99% accuracy.2- & 3-Way Matching

Streamline approvals by comparing invoices against POs and delivery notes to prevent overpayments.Multi-currency support

Handle invoices in any currency, from EUR to USD to GBP without manual conversion.Seamless integrations

Integrate with SAP, Exact, Twinfield, QuickBooks, NetSuite, and more — via API or no-code.

Custom approval flows

Create flexible approval workflows that match your organization’s chart and policies.20+ formats supported

We support JSON, CSV, PDF, XML, XLS, XLSX, UBL, PNG, TIFF, DOC, DOCX, JPG, and many more.Multi-page processing

Upload multi-page documents to ensure scalable, efficient, and accuratedocument processing workflow.Built-in tax compliance

Stay on top of VAT, reverse charges, and regional tax rules to ensure compliance at every step.

Compatible With Your Favourite Tools

<img decoding=”async” src=”https://www.klippa.com/wp-content/uploads/2023/07/googlemail.png” alt=””/>

<img decoding=”async” src=”https://www.klippa.com/wp-content/uploads/2023/07/googledrive.png” alt=””/>

<img decoding=”async” src=”https://www.klippa.com/wp-content/uploads/2023/07/onedrive.png” alt=””/>

<img decoding=”async” src=”https://www.klippa.com/wp-content/uploads/2023/07/microsoftmail.png” alt=””/>

<img decoding=”async” src=”https://www.klippa.com/wp-content/uploads/2023/07/sharepoint.png” alt=””/>

<img decoding=”async” src=”https://www.klippa.com/wp-content/uploads/2021/11/Oracle-NetSuite-partner-01-e1637526692391.png” alt=””/>

<img decoding=”async” src=”https://www.klippa.com/wp-content/uploads/2019/08/xero-klippa.png” alt=””/>

<img decoding=”async” src=”https://www.klippa.com/wp-content/uploads/2023/07/dropbox.png” alt=””/>

<img decoding=”async” src=”https://www.klippa.com/wp-content/uploads/2023/07/quickbooks-Round.png” alt=””/>

<img decoding=”async” src=”https://www.klippa.com/wp-content/uploads/2023/07/zohobooks_short.png” alt=””/>

See all of our 50+ integrations.

Industries That We Help With AP Automation

Read What Our Customers Say About Us

Frequently Asked Questions

What is accounts payable automation?

How does AP software work?

How much does AP software cost?

Which languages are supported by Klippa?

Can AP automation software spot duplicate payments?

How accurate is Klippa?

How does the OCR response look like?

How can I implement Klippa’s solutions?

Can I test your platform before committing?

Does Klippa store processed data?