Digital bookkeeping is a must for accounting firms, but also for every entrepreneur. Thanks to continuous developments in the digital domain, bookkeeping tasks can be automated more and more. Digitalization makes running a business and bookkeeping a lot more efficient and effective.

When making the final switch to digital bookkeeping, however, most entrepreneurs could use some help. In this blog you will read more about the benefits, about the best bookkeeping programs and we will help you on your way to automated bookkeeping.

What is Digital Bookkeeping?

Digital bookkeeping is the process of recording, managing, and storing financial transactions using digital accounting practices and software. Unlike traditional methods that rely on physical ledgers and paper documents, digital bookkeeping leverages technology to streamline and automate many aspects of financial management.

Streamlining Bookkeeping Services

Electronic bookkeeping tools allow you to automate many aspects of your bookkeeping process, making it more efficient and less time-consuming. Here are some key parts of bookkeeping that can be streamlined through automation:

- Bill Payment Automation: Automate recurring bill payments and set up reminders for due dates. This ensures that your bills are paid on time, avoiding late fees and maintaining good relationships with vendors.

- Invoice Automation: Create, send, and track invoices automatically. Automated invoicing helps you get paid faster and reduces the risk of errors in billing.

- Bank Reconciliation: Simplify the process of matching your bank statements with your recorded transactions. Automated bank reconciliation helps you quickly identify discrepancies and ensure accurate financial records.

- Document Management: Digitally store and organize receipts, invoices, and other financial documents. Document management systems allow you to easily retrieve any document when needed, reducing clutter and improving efficiency.

- Payroll Processing: Automate payroll calculations, tax withholdings, and direct deposits. Automated payroll systems ensure that your employees are paid accurately and on time, while also maintaining compliance with tax regulations.

- Financial Reporting: Generate financial reports such as profit and loss statements, balance sheets, and cash flow statements with just a few clicks. Automated reporting tools provide you with real-time insights into your business’s financial health.

- Tax Preparation: Automate the collection and organization of tax-related documents. Tax preparation tools can help you accurately calculate taxes owed and ensure timely filing, reducing the risk of penalties.

- Credit Card Account Management: Sync your credit card accounts to automatically record transactions and track spending. This helps you manage credit card expenses more effectively and maintain accurate records.

By automating these bookkeeping tasks, you can save time, reduce errors, and gain a clearer understanding of your financial situation, allowing you to focus on growing your business.

Benefits of Digital Bookkeeping

Digital bookkeeping offers several key benefits that can significantly improve the way you manage your business finances. Here are some of the main benefits of electronic bookkeeping:

- Less error-prone: virtual bookkeeping eliminates some of the human handling, greatly reducing the number of manual errors.

- Clear overview: all data is always digitally available in the bookkeeping system. You have real-time insight into your financial household.

- Always available: because the data is available in the cloud, it can be consulted at any place, any time.

- Saving space: filing cabinets full of documents are officially a thing of the past when you switch to digital bookkeeping.

- Less susceptible to fraud: with paper-based accounting, it is possible for an invoice to go unnoticed and be submitted twice. Digital bookkeeping systems, however, are able to detect erroneous and duplicate invoices and issue an alert.

Digital Bookkeeping Software

There are countless providers of digital bookkeeping programs. To keep things clear for you, we highlighted a few of our favorite ERP and electronic bookkeeping systems on the market:

Oracle NetSuite

NetSuite is one of the leading integrated cloud business solutions, including accounting, ERP, CRM and e-commerce software. By providing everything in one package, the platform can replace a company’s management system that is comprised of different pieces. One of the things we like most about NetSuite is that its SaaS-deployment model means it’s completely scalable and thus appropriate for both small and large companies.

SAP

SAP is a German software corporation that develops enterprise software to manage business operations and customer relations. The company is especially known for its ERP software, which enables its customers to run their business processes, including accounting, sales, production, human resources and finance, in an integrated environment.

Minox

The Minox ERP package makes digital bookkeeping very easy. Thanks to the simple structure of the software, you can book and correct records in no time. As a company or accountancy firm you can continue to grow unhindered. Minox is designed to be completely flexible. The setup can be continuously fine-tuned without complicated software updates.

Xero

Xero is a cloud-based accounting software that makes bookkeeping a lot easier for small and medium-sized businesses. Xero’s software has numerous advantages. For example, it is always possible to access your financial data and get real-time insight. Xero performs bookkeeping functions like invoicing and payroll, and allows you to connect the program to a live bank feed.

Microsoft Dynamics 365

Microsoft Dynamics 365 is a cloud-based business platform that combines components of CRM and ERP, along with productivity applications and artificial intelligence tools. It is beneficial to companies because it enables them to improve their sales and customer service processes, as well as to increase employee productivity.

Sage

Sage X3, formerly known as Sage Business Cloud Enterprise Management, is an ERP software that includes integrated functionality for financial management, sales, customer service, inventory, and business intelligence. It is an end-to-end solution that brings together all of the firm’s operations.

Quickbooks

QuickBooks is an accounting program developed by Intuit. QuickBooks is geared mainly toward small and medium-sized businesses and offers on-premise accounting applications as well as cloud-based versions that accept business payments, manage and pay bills, and payroll functions.

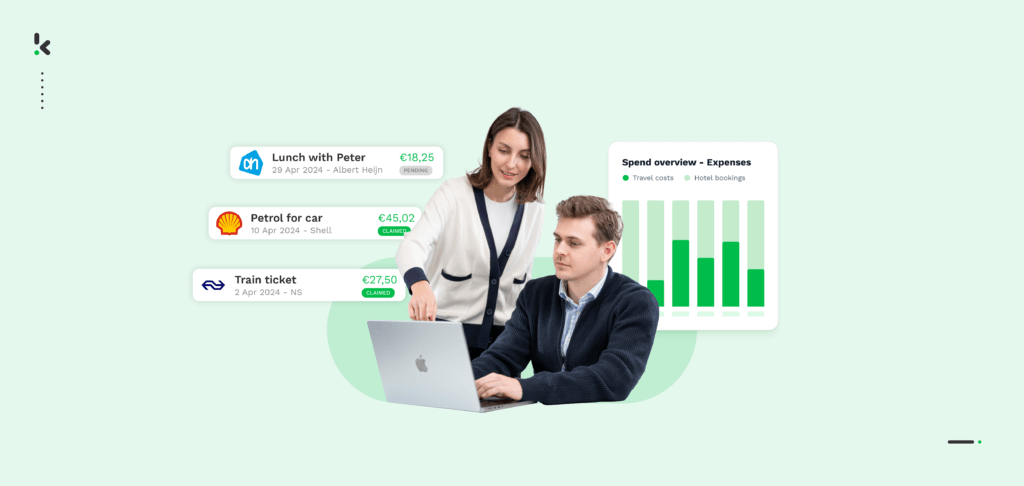

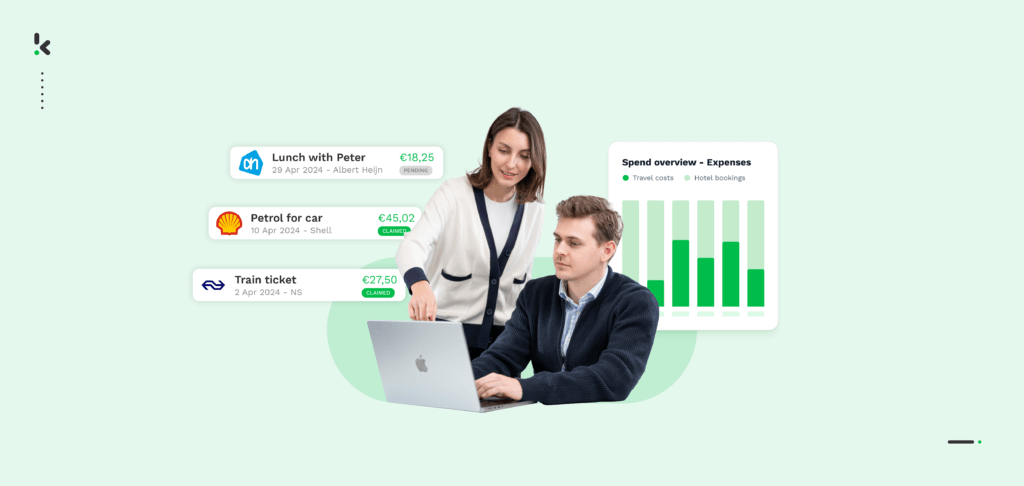

Integrate Klippa into Your Bookkeeping System

Once you have chosen the right ERP or bookkeeping program, digital bookkeeping can begin. Link your solution and a world of possibilities opens up for you. Processes can be further optimized and automated. This is also called pre-accounting.

Choose Klippa SpendControl as your all-in-one digital pre-accounting software that combines invoice processing, expense management, and corporate credit card modules.

Receipts and invoices are submitted via our mobile app, online or via email. Managers can then approve or reject them with just one click. Finally, the receipts and invoices automatically arrive in your chosen ERP or accounting program.

Our software utilizes Optical Character Recognition (OCR) technology to ensure accurate data capture and enable data scanning, approval, archiving and booking directly to your financial administration.

- Manage your vendor invoices, employee expenses, and corporate credit cards in one platform

- Submit, process, and approve transactional documents via web or mobile app

- Achieve 99% data extraction accuracy with Klippa’s OCR

- Regain control over your finances with intuitive dashboards

- Customize your approval management with multi-level authorization flows

- Never fail to comply with tax and data privacy regulations with our ISO27001-certified and GDPR-compliant solution

- Rely on automatic multi-currency support for international payments

- Prevent financial fraud with built-in duplicate and fraud detection

- Integrate SpendControl with your accounting and ERP software, like Quickbooks, NetSuite, or SAP

Are you ready to completely digitize your bookkeeping process? Schedule a free demo to see our solution in action, or contact our SpendControl specialists for more details.