Managing accounts payable (AP) is often a complex challenge for finance teams, filled with manual tasks, tight deadlines, and the potential for high-stakes errors. These processes are vital yet frequently inefficient, affecting the financial health of many organizations.

AP automation offers a solution, transforming this critical function with advanced technology like Optical Character Recognition (OCR) and machine learning. It facilitates invoice processing, enhances accuracy, and accelerates payments, aligning the operational importance of AP with significant, immediate benefits like cost and time savings.

In this blog, we’ll explore the advantages of invoice and AP automation, tackle common challenges, and guide you through selecting the right automation solution. Discover how to simplify your AP process, improve vendor relationships, and gain strategic financial insights.

Key Takeaways

- AP automation uses AI and OCR to capture, validate, and process invoices without manual data entry.

- Automated matching of invoices with purchase orders and receipts helps prevent overpayments and errors.

- Routing invoices through digital approval workflows speeds up processing and improves transparency.

- Real-time reporting and reconciliation give finance teams visibility, control, and audit-ready records.

- Choosing a scalable, ERP-integrated AP automation system (such as the one by Klippa SpendControl) helps you reduce costs, errors, and manual work while improving speed and compliance.

What is AP Automation?

AP automation uses software to streamline the accounts payable process, which involves digitizing invoices, automating data entry, and handling payments to vendors.

This approach replaces manual, paper-based tasks with a digital workflow that includes automated invoice capture via OCR or e-invoicing, automated matching with purchase orders, and streamlined approval routing.

The main benefits include increased efficiency, reduced costs, improved accuracy, better cash flow management, and enhanced vendor relationships.

Why Should You Automate Your Accounts Payable?

For many finance specialists, managing accounts payable often means dealing with piles of invoices, pressing deadlines, and time-consuming, stressful processes that are crucial to the company’s financial health.

If we look back at 2024, we can see a new shift taking place: more and more businesses choose to automate their processes, especially in the accounting department. 2024’s most important insight is that 64% of companies have automated at least some part of their AP processes.

Why such a radical change, you might wonder. To understand the reason, we need to break down the manual accounts payable process.

Simply put, it starts with you receiving paper invoices and needing to enter their data into your accounting software. Then, you must send reminders and wait for approvals. You must also pay the invoices, ensure they match up with your purchase orders, and finally, integrate them into your bookkeeping.

This tedious process itself is reason enough to automate your AP workflows, right? Let’s see what other challenges you might face when having a manual AP process.

Challenges of Manual AP Processes

The most common challenges you might face are:

- Human errors. The possibility of human errors, such as typos, miscalculations, and the accidental processing of the same invoice twice, can significantly affect operational efficiency. These errors require additional time and resources to fix. Not to mention, there is a risk of undetected invoice fraud.

- High operational costs. Manual processing of invoices is inherently expensive, estimated to cost between $15 and $40 per invoice, increasing even further with the risk of human mistakes.

- Disorganized data. The lack of a centralized tracking system can lead to an additional interruption in your workflow. If the responsible employee is unavailable, the rest of the team is left uninformed, which may result in late payments, poor supplier relationships, and late payment fees.

Considering all these, it’s obvious that AP’s critical role frequently clashes with how messy and risky manual AP processing can be. By automating them, companies can start turning accounts payable into a strategic advantage instead of it being a burden.

How to Automate Your Accounts Payable in 4 Easy Steps

Automating your AP process can seem complex, but it’s easier than you think. By following four simple steps, you can transform how invoices are handled, approved, and paid. Instead of dealing with manual data entry and paper trails, automation gives your finance team full control, transparency, and efficiency from start to finish.

Step 1: Assess Your Current Process

Start by analyzing how your AP process works today. Identify bottlenecks, repetitive tasks, and common sources of error. Define clear goals, such as reducing processing time, improving accuracy, or eliminating paper-based approvals. Standardize your workflows so automation can build on a consistent and reliable foundation.

Step 2: Choose and Implement the Right Software

Select an AP automation solution that integrates seamlessly with your existing ERP or accounting systems. Look for features such as OCR to extract invoice data automatically, three-way matching to check invoices against purchase orders and receipts, and smart validation rules to catch discrepancies. Begin with a small pilot project to test the setup, gather feedback, and fine-tune before scaling company-wide.

Step 3: Set Up Automated Workflows

Once your system is live, configure it to reflect your organization’s approval structure and policies.

- Define approval hierarchies based on department, cost center, or budget.

- Set up exception handling to automatically route mismatched or incomplete invoices to the right approver.

- Enable automatic payments for recurring or low-value invoices to speed up processing and reduce manual work.

Step 4: Train Your Team

Technology is only as effective as the people using it. Provide clear, hands-on training so every team member understands how to use the new system, manage approvals, and resolve exceptions. Encourage feedback during the early stages to identify improvement opportunities and ensure everyone feels confident with the new workflows.

Automating your accounts payable process helps you save time, reduce errors, and increase visibility across your financial operations. Once these four steps are in place, your team will be ready to experience the real impact of automation.

Key Benefits of AP Automation

Here is a list of the most relevant benefits companies experience after deciding to automate their accounts payable:

- Cost Savings. By automating accounts payable, companies can see up to an 81% decrease in processing costs and allow for the reallocation of resources to more critical areas of the business.

- Improved Accuracy. The 99% precision of AP automation solutions drastically reduces human error, ensuring every transaction is executed correctly.

- Increased Efficiency. Automation speeds up every step of invoice processing, from data entry to payment. Companies that use AP automation can experience up to a 73% improvement in efficiency.

- Enhanced Vendor Relationships. AP automation’s reliability is key to avoiding late-payment penalties, receiving early-payment discounts, building lasting partnerships, and offering competitive advantages in negotiations and supply chain management.

- Strategic Insights. The real-time visibility into accounts payable processes allows companies to easily prepare reports, like month-end or year-end, with all AP data securely stored and easily accessible in one centralized environment.

- Clear Audit Trails. AP automation generates a detailed, real-time digital audit trail by meticulously recording each phase of every transaction. This allows auditors and reviewers to confirm the precision and adherence of financial records quickly.

In the end, AP automation does so much more than just improving processes. It makes everything go smoother, from operations to supplier relationships. Your business’s long-term success has now become something achievable. But how exactly does a small change like AP automation make all this happen?

How Does AP Automation Work?

AP automation streamlines the entire accounts payable process, from receiving an invoice to completing payment. The system captures, processes, and routes invoices automatically, ensuring accuracy, speed, and full visibility every step of the way. Here’s how it works:

Invoice Capture

Invoices enter the system digitally through e-invoicing or by scanning paper invoices. OCR technology converts each document into structured digital data, eliminating the need for manual data entry.

Data Extraction

The software automatically extracts key details such as the vendor name, invoice number, amount, and due date. This structured data becomes the foundation for matching, validation, and approval workflows.

Matching

Next, the system automatically matches invoice data with related purchase orders and receipts. Any discrepancies, such as pricing errors or missing items, are instantly flagged for review, helping prevent duplicate or incorrect payments.

Approval Routing

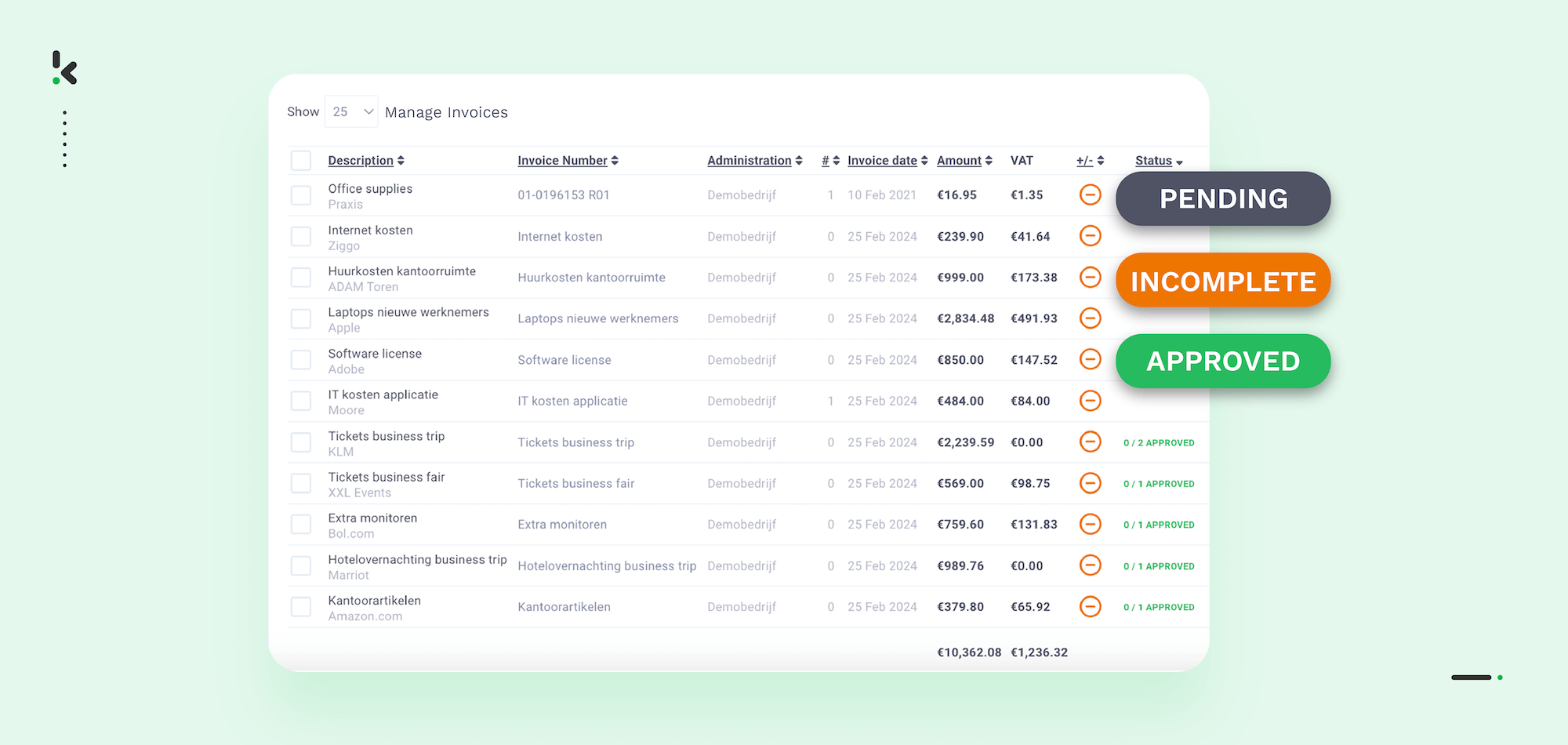

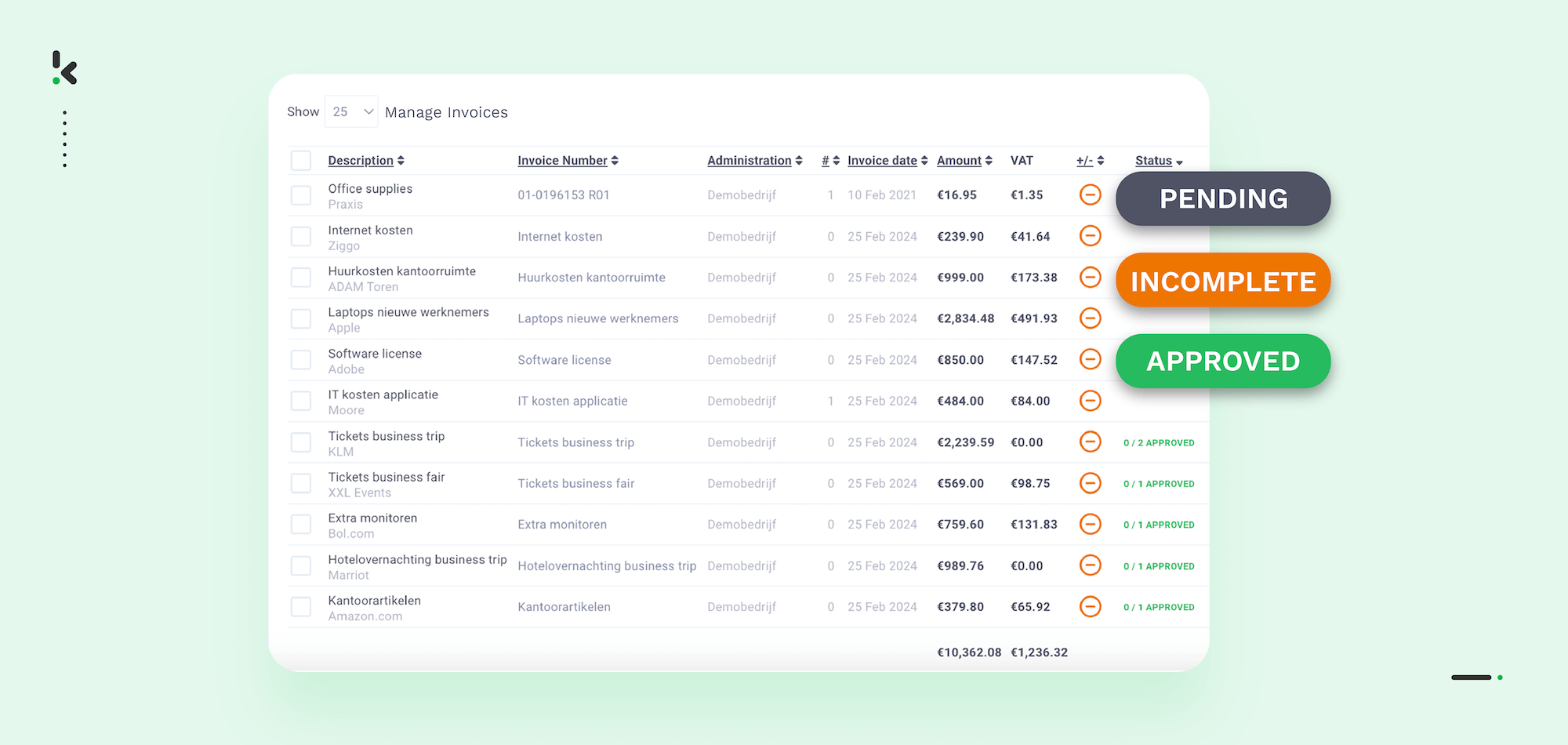

Once verified, invoices are automatically routed to the right manager or department for approval. Many systems offer one-click approvals or mobile notifications, making it easy for approvers to review and confirm invoices quickly, even on the go.

Payment Processing

After approval, the system triggers payment through integrated banking or ERP connections. Low-risk or recurring invoices can even be paid automatically, ensuring suppliers are paid on time and cash flow remains predictable.

Reconciliation and Reporting

Finally, AP automation software reconciles paid invoices with bank statements and updates accounting records in real time. Dashboards and reports give finance teams clear visibility into pending approvals, outstanding payments, and overall performance metrics.

By automating these steps, finance teams can shift from reactive data entry to proactive financial management. Next, let’s explore which accounts payable tasks are best suited for automation and how to prioritize them for maximum efficiency.

What Accounts Payable Tasks Can Be Automated?

The effectiveness of accounts payable workflow automation depends significantly on the specific tasks you choose to automate. Automating key areas of the AP process can dramatically reduce manual input, thereby enhancing efficiency, accuracy, and the overall financial health of your organization.

Let’s see which tasks within the accounts payable workflow stand out as particularly beneficial when automated.

Invoice Capture

Accounts payable automation starts with converting paper or e-invoices into structured digital data. By utilizing OCR technology, the AP automation solution automatically captures invoices by scanning, categorizing, organizing, and converting text or images into a digitized format such as PDF, JSON, CSV, XML, etc.

Data Entry

The AP automation solution utilizes AI-powered data extraction, allowing it to recognize crucial information from invoices, such as the due dates, the amount payable, and vendor details, ensuring the extraction of all the essential data and eliminating the need to go through every single invoice manually and manually enter data into the system.

Invoice Matching

AP automation solutions often include two-way matching as well. The system automatically compares invoices with purchase orders or delivery notes, ensuring the accuracy of the agreed-upon order. Any discrepancies are flagged for review, while cleared-out invoices are routed for approval or immediate payment, enhancing accuracy and preventing overpayments.

Approvals

Automated approval workflows utilize predetermined business rulesto route invoices to authorized personnel for review or allow automatic approval of invoices of a set category, like an amount, vendor, or project. This not only accelerates the approval process but also provides a clear audit trail and reduces bottlenecks.

Fraud Detection

Leveraging sophisticated algorithms, AP automation tools can identify unusual patterns, like trails of invoice data modification, that may indicate fraudulent activity in accounts payable, adding an essential layer of security to your financial processes.

Compliance

Automation ensures that all transactions comply with internal policies and external regulations. It simplifies the invoice management system, making it easier to adhere to compliance requirements and audits internationally.

Payment

Solutions connected to payment or banking platforms allow the scheduled or immediate reimbursement of approved invoices by selecting optimal payment methods tailored to each vendor’s contractual terms. This system helps companies in capturing early payment discounts and avoiding late payment fees.

Reconciliation

Automated payment reconciliation compares recorded transactions against bank statements, quickly identifying discrepancies, ensuring the accuracy of all transactions, and simplifying the financial close process.

Reporting

Automation provides comprehensive and real-time visibility into the AP process, generating detailed reports that help track performance, provide insights into cash flow and payment patterns, and allow businesses to have a complete overview of the company’s financial health.

Analysis

Beyond mere reporting, AP automation offers deep analytical insights into spending patterns and potential process improvements. This enables strategic decision-making and helps optimize the overall AP processing.

By automating these tasks, businesses can significantly reduce the time and effort associated with manual AP processes. This shift allows teams to concentrate on strategic activities that directly contribute to organizational value, among other benefits.

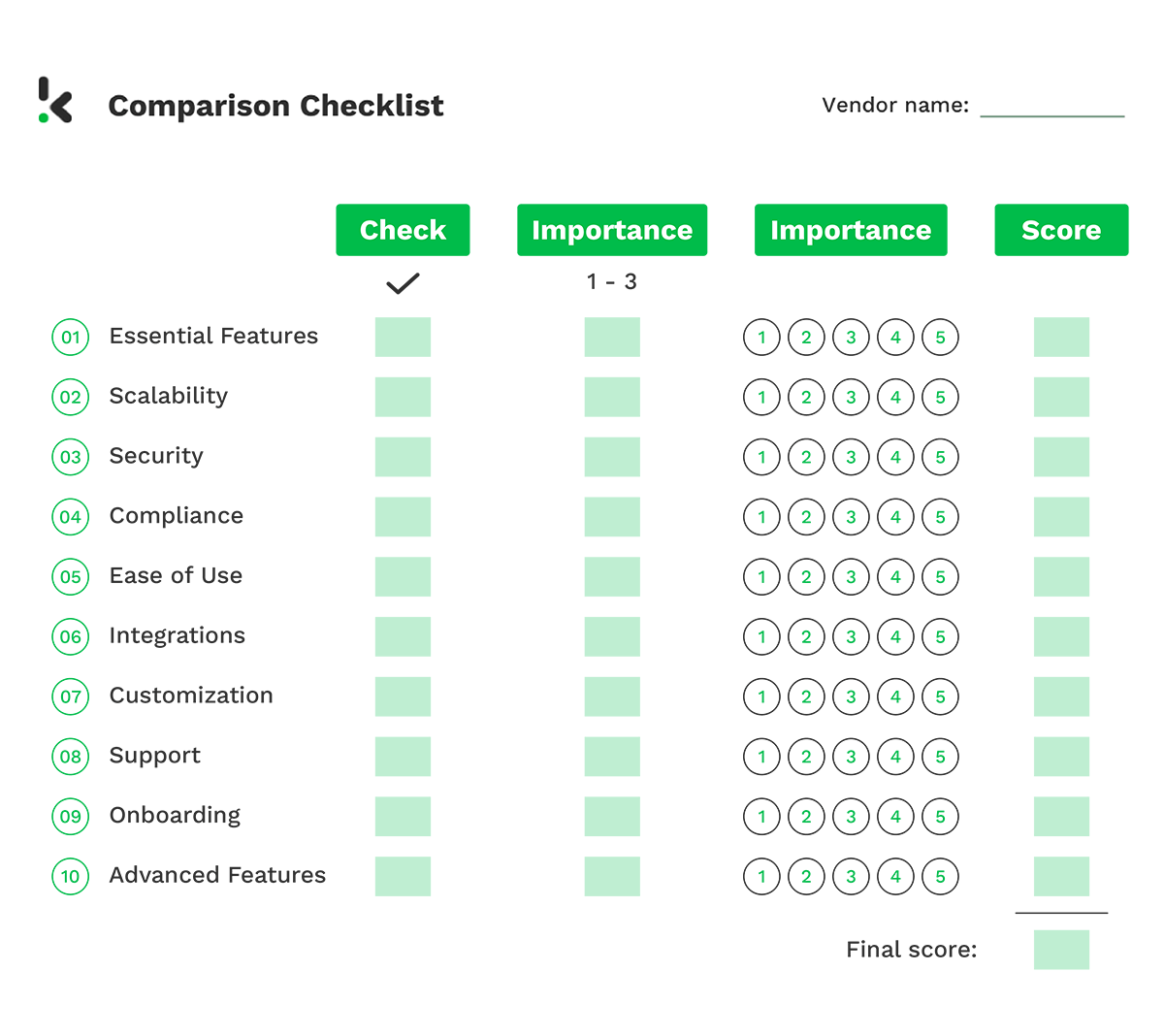

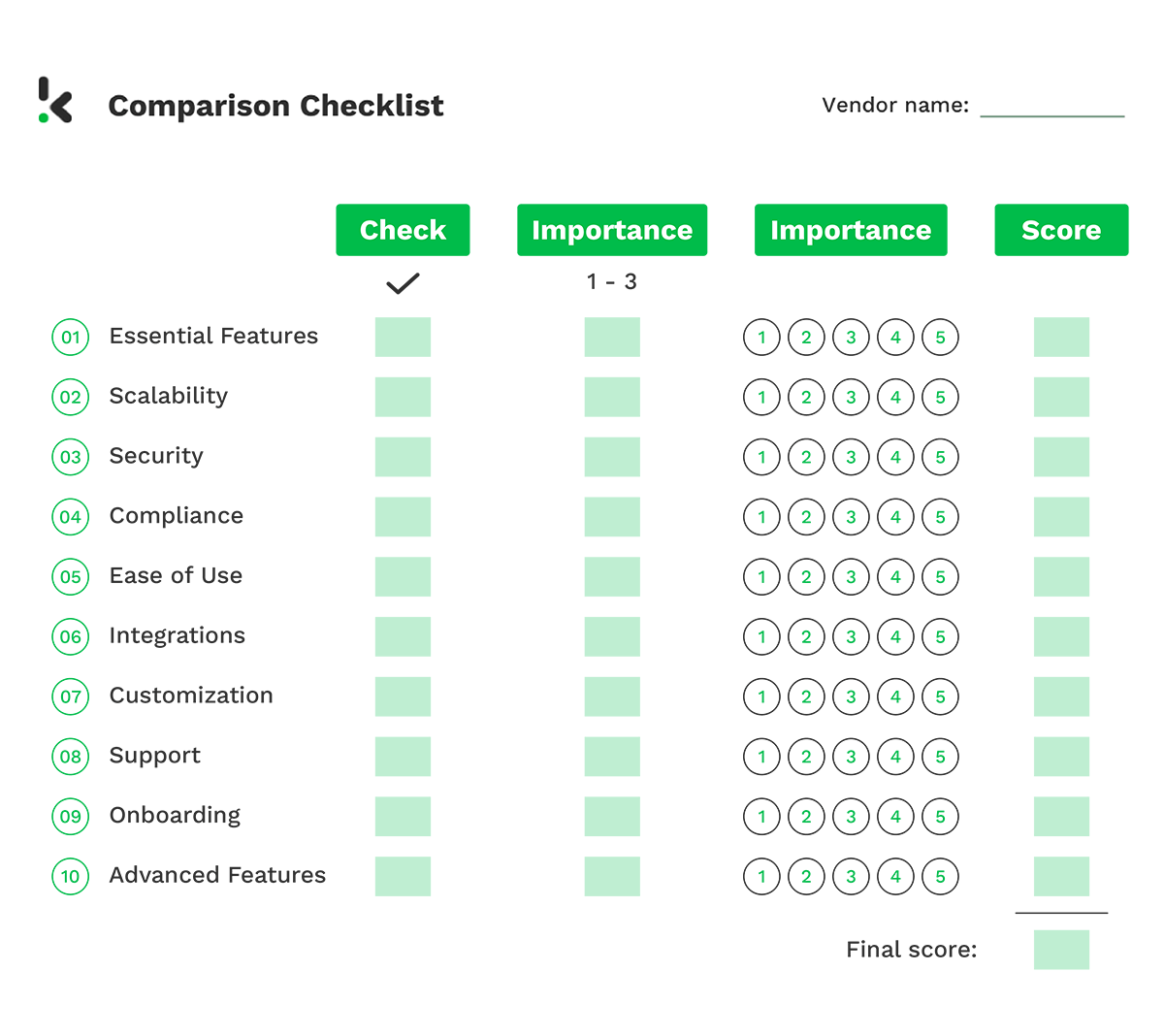

Essential Features to Look for in AP Automation Solutions

Choosing the right AP automation solution is crucial for advancing the many tasks involved in managing accounts payable. With so many options available, finding the perfect fit for your organization can be overwhelming. To simplify this decision, we’ve put together a guide highlighting the key features and factors you should consider:

- Basic Attributes: Look for solutions with functionalities such as electronic invoice capture, automated approval workflows, and real-time reporting. These features are essential for AP automation.

- Scalability: Opt for a solution that can accommodate your business’s growth and is capable of efficiently handling an increasing volume of transactions without compromising performance. Research which types of companies each solution is aimed at and inspect the limits on the volume of invoices processed in subscription plans.

- Security and Compliance: When selecting an AP automation solution to ensure it is safe, secure, and compliant, consider a comprehensive set of criteria that cover security certifications, data protection standards, and regulatory compliance. Key factors to look for are ISO 27001 certification, SOC 1 /SOC 2 Type II Attestations, and GDPR compliance.

- Ease of Use: A user-friendly interface is vital for facilitating smooth adoption by your team, minimizing training time, and enhancing productivity from the get-go. Request a live demonstration of the solution or opt for free trials to test it within your team before finalizing the purchase.

- Integration Capabilities: Integration with your current ERP and accounting software is essential for maintaining a unified financial ecosystem, ensuring end-to-end process automation. Check plug-and-play integration options or the possibility of a custom-built API connection.

- Customization: Assess whether the solution offers customization options that cater to the unique needs and workflows of your company, allowing for a more tailored and efficient AP process. Such customization options can be invoice approval workflows, custom data capture models, region compliance settings, support, and onboarding.

Choosing the right AP automation solution involves thoroughly analyzing your current processes, future needs, and the specific features that will improve your accounts payable operations. By prioritizing these factors, you will discover a solution like Klippa SpendControl that optimizes your financial workflows and provides strategic value to your company.

AP Automation with Klippa SpendControl

Forget the tedious AP process by automating your accounts payable with Klippa SpendControl. Our intuitive pre-accounting software combines all the essential features to reduce manual input from your accounts payable workflow.

Transform text and images into digital data, approve vendor invoices through custom workflows, detect errors and fraud, and comply with regulations, all within one dedicated platform. Improve supplier relationships while saving precious time and reducing manual labor.

Klippa SpendControl provides access to crucial features for your accounts payable automation:

- Invoice processing and expense management modules are available in one centralized solution

- Corporate credit cards synced to our expense management software deliver total control over employee expenses, with direct reconciliation and booking

- Data extraction with our in-house developed OCR technology

- Guaranteed compliance with country-specific financial reporting regulations

- Centralized financial data in one user-friendly expense dashboard

- Built-in fraud detection powered by machine learning

- Multi-level authorization flows for organized and accelerated approval processes

- Automatic foreign currency conversion for invoice processing from all regions

- Mobile & web environments with 24/7 access to your organized AP data

- Plug-and-play accounting and ERP software integrations

- Full support and onboarding by our product specialists

Do you want to automate your accounts payable? Are you looking for the ultimate solution for your company’s financial management? Book a free demo to see our product in action, or contact our SpendControl specialists for more information. Start investing your time in things that matter!

FAQ

If your business deals with many invoices, faces approval delays, or struggles with manual errors, then yes, AP automation is something for you! Automating these processes can improve efficiency, reduce costs, and minimize risks associated with manual accounts payable processes.

While there is an initial investment, AP automation can lead to significant cost savings by reducing manual processing expenses, minimizing errors, and optimizing resource allocation.

Vendors often provide comprehensive onboarding, dedicated account managers, and ongoing technical support to ensure a smooth transition and effective use of the AP automation system.

Yes, Klippa supports multi-currency transactions, automatically converting foreign currencies during invoice processing to accommodate international operations.

Klippa provides comprehensive support, including onboarding assistance, training, and ongoing customer service to ensure smooth implementation and continued satisfaction with their AP automation solutions.