KYC Automation That Speeds Up Onboarding & Ensures Compliance

AI-powered ID verification that ensures compliance, and smooth onboarding. Automate KYC checks with document verification and fraud detection from Klippa.

Trusted by 1000+ brands worldwide

<img decoding=”async” src=”https://www.klippa.com/wp-content/uploads/2024/02/Online-Payment-Platform-grey-logo.png” alt=””/>

<img decoding=”async” src=”https://www.klippa.com/wp-content/uploads/2024/02/DZBank-grey-logo.png” alt=””/>

<img decoding=”async” src=”https://www.klippa.com/wp-content/uploads/2024/02/Nivea-grey-logo.png” alt=””/>

<img decoding=”async” src=”https://www.klippa.com/wp-content/uploads/2024/02/Krombacher-grey-logo.png” alt=””/>

<img decoding=”async” src=”https://www.klippa.com/wp-content/uploads/2024/02/Car-Offer-grey-logo.png” alt=””/>

<img decoding=”async” src=”https://www.klippa.com/wp-content/uploads/2024/02/Car-Offer-grey-logo.png” alt=””/>

Why Compliance Teams Choose Klippa KYC Automation

10x

faster onboarding workflows98%

less manual document review100%

digital archiving & audit trail+100

countries supported for ID verification

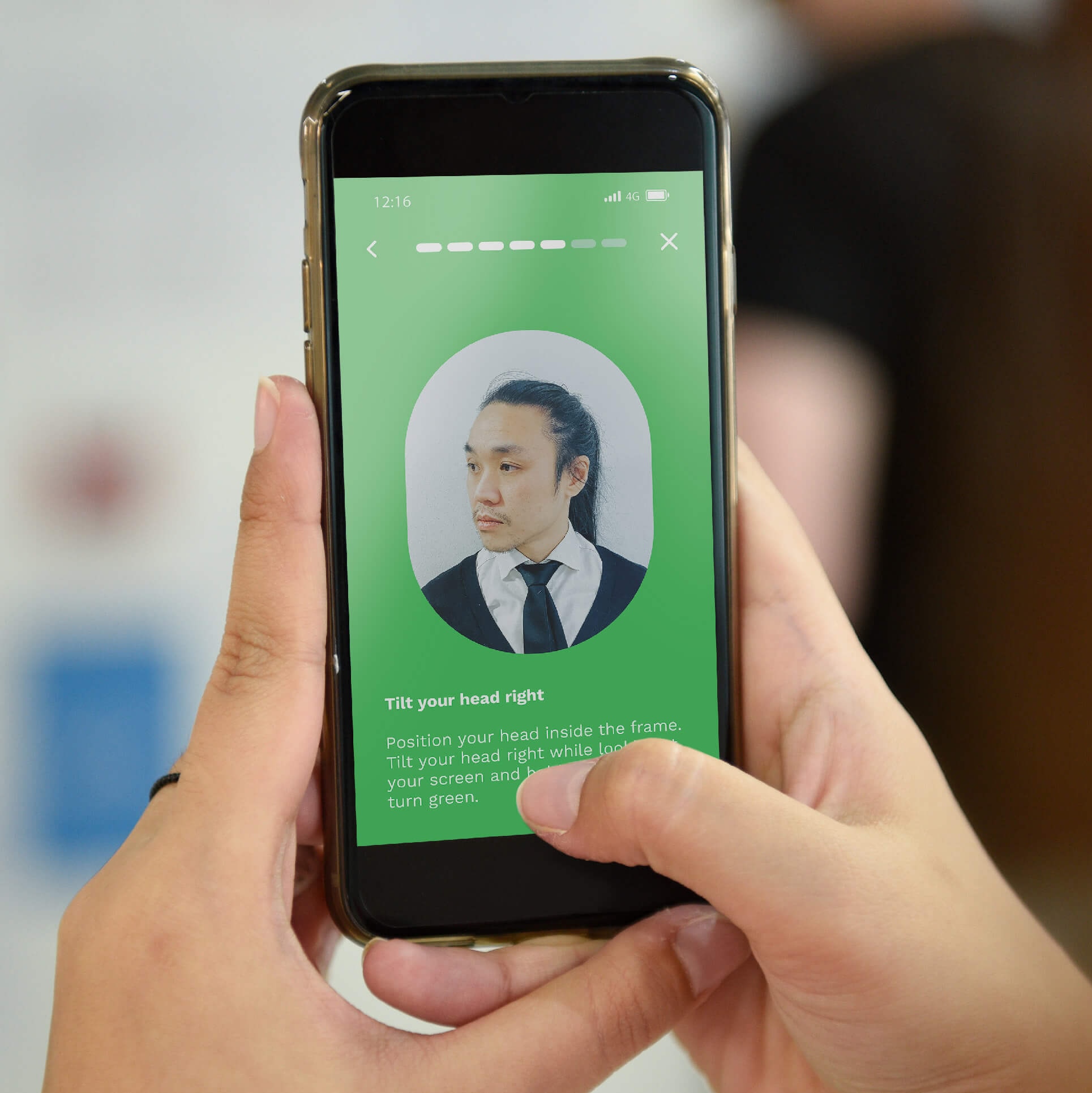

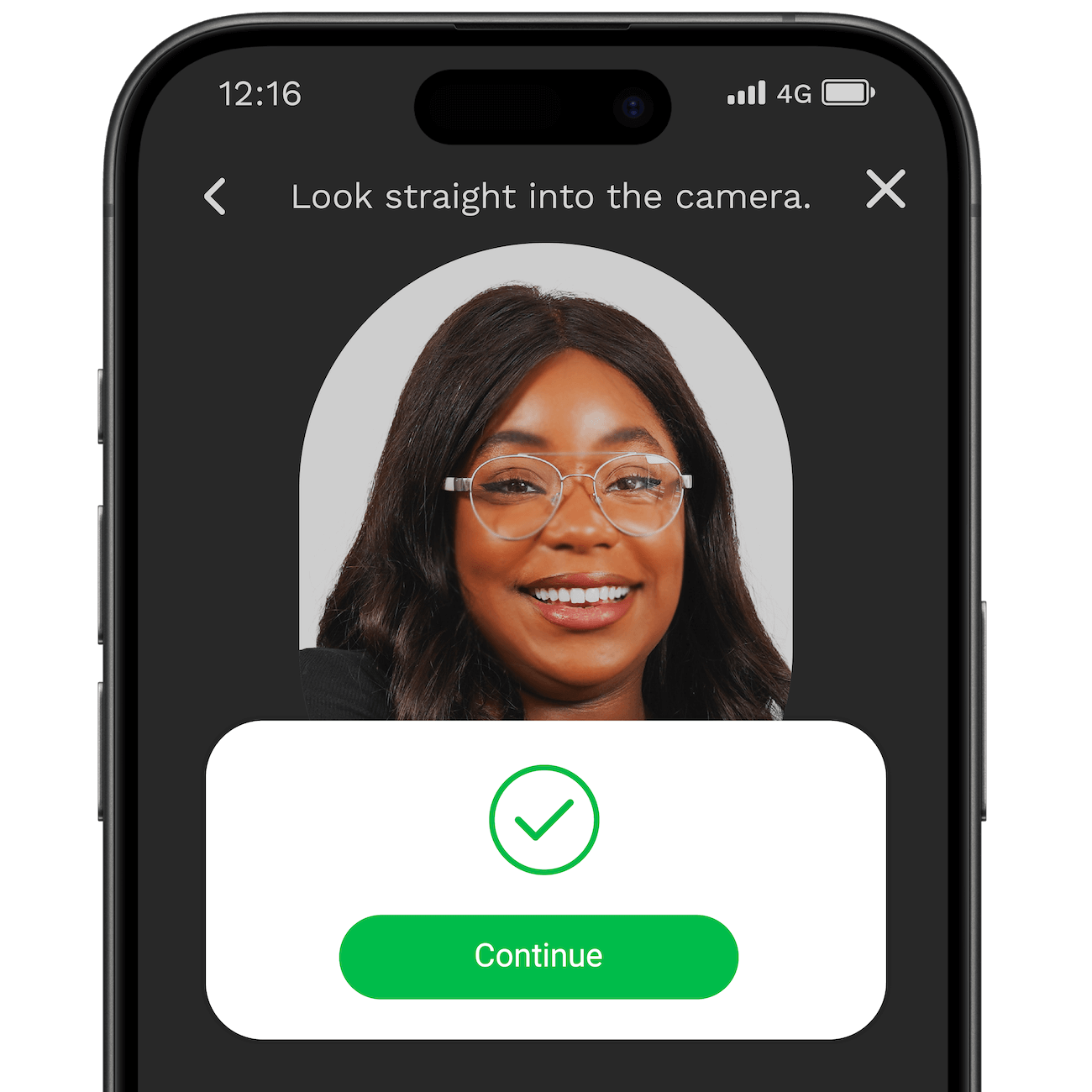

AI-Driven Identity Verification

Klippa’s AI-driven KYC solution combines OCR, biometric verification, liveness detection, image recognition, and document fraud detection to verify identities fast, securely, and in full compliance.

What’s Possible With Klippa’s KYC Automation

From onboarding to compliance checks, automate time-consuming identity verification tasks with intelligent KYC workflows tailored to your industry and risk profile.

How Transport Giant SNCF Automates ID Verification Checks

Klippa’s automated ID verification solution fulfills all our requirements: it is accurate, fast, and secure. The seamless integration into our operations was definitely a great bonus.

KEY FEATURES

Why Choose Klippa For KYC Automation

Automate your identity verification workflows from end to end — with speed, accuracy, and compliance built in.

Smart data capture

Extract key data points from images or scans of IDs including names and dates with up to 99% accuracy.Fraud detection

Automatically identify altered, forged, or manipulated identity documents using advanced forensic analysis.Global coverage

Verify identity documents from 150+ countries and 500+ document types to ensure global compliance.Seamless integrations

Customized workflows

Create custom workflows tailored to your KYC use case needs without writing a single line of code.20+ formats supported

We support JSON, CSV, PDF, XML, XLS, XLSX, UBL, PNG, TIFF, DOC, DOCX, JPG, and many more.AI-based ID verification

Turn complex ID verification into a fast, automated step in your onboarding process at scale.Ensured data protection

By default, we do not store any data that is being processed on our servers to ensure regulatory compliance.

Industries That We Help With KYC Automation

Frequently Asked Questions

What is KYC automation?

How does Klippa handle document verification?

Which documents can be verified with Klippa?

How long does it take to verify an identity?

Can I review and approve documents manually?

How accurate is Klippa’s identity verification?

Can Klippa detect fake or altered documents?

Does Klippa offer API and SDK integration?

Can I test your solutions before committing?

Does Klippa store processed data?