Our State of Automation in Finance report shows that more than half of finance departments continue to manage accounts payable manually. Without automation, catching errors such as overbilling, missing items, or duplicate invoices relies on careful manual checks, and in busy periods, these are easily missed.

By comparing each invoice with the purchase order and the receiving report, you can confirm that what you are paying for is exactly what was ordered and delivered. It helps stop unnecessary payments, improves accuracy, and keeps a clear record for audits.

In this blog, you will learn what three‑way matching is, how to set up a workflow that works in practice, and how to deal with exceptions that could otherwise slow down payments or cause mistakes.

Key Takeaways

- Three‑way matching verifies POs, receiving reports, and invoices before payment.

- Over 50% of finance teams still manage AP manually.

- Common mismatches include price, quantity, delivery, and duplicates.

- A clear step‑by‑step workflow makes three‑way matching consistent and faster to manage.

- Exception handling is essential for resolving mismatches and preventing payment delays or losses.

- Automation with AI‑powered OCR improves speed, accuracy, and fraud detection.

- Klippa DocHorizon automates three‑way matching with layered fraud detection.

What is Three‑Way Matching?

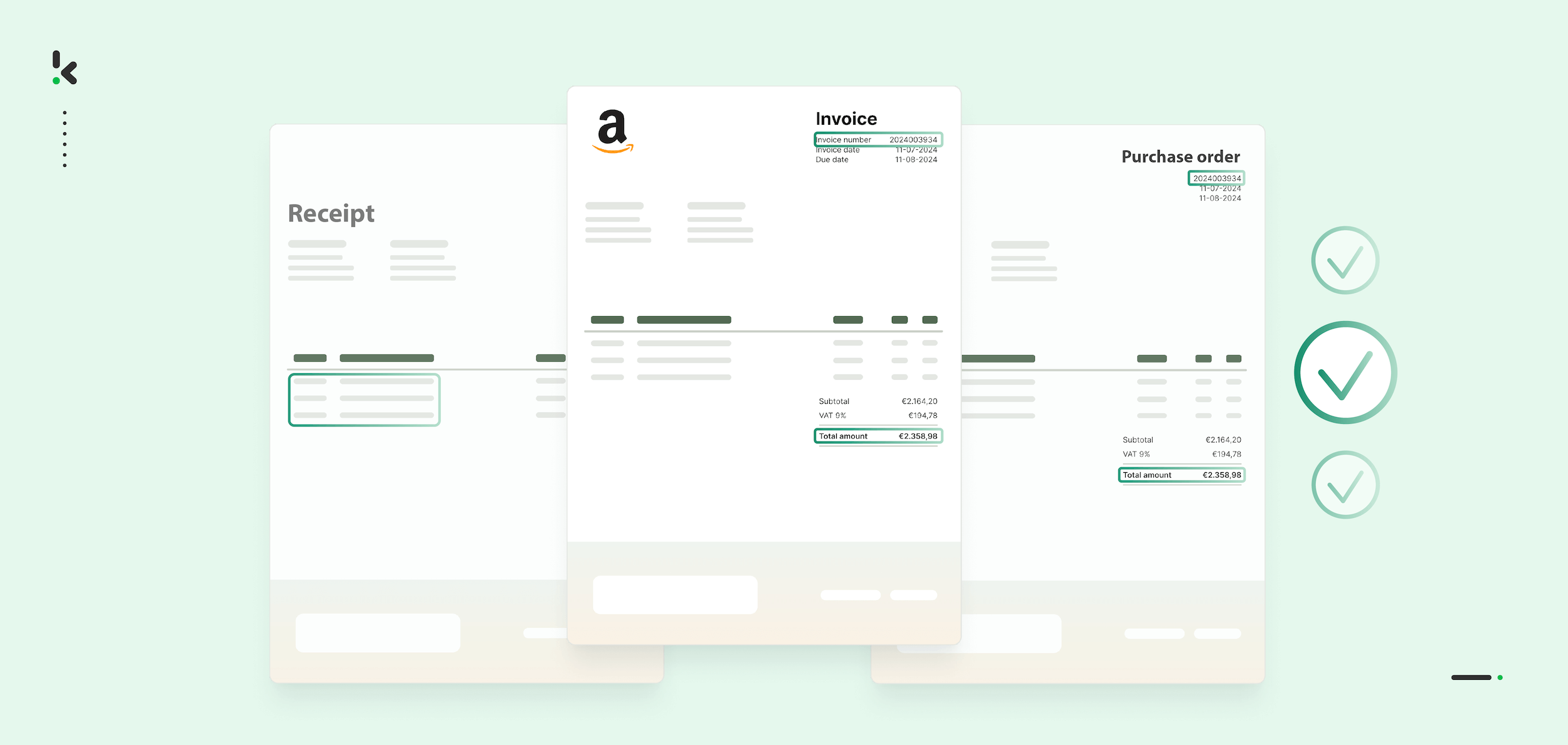

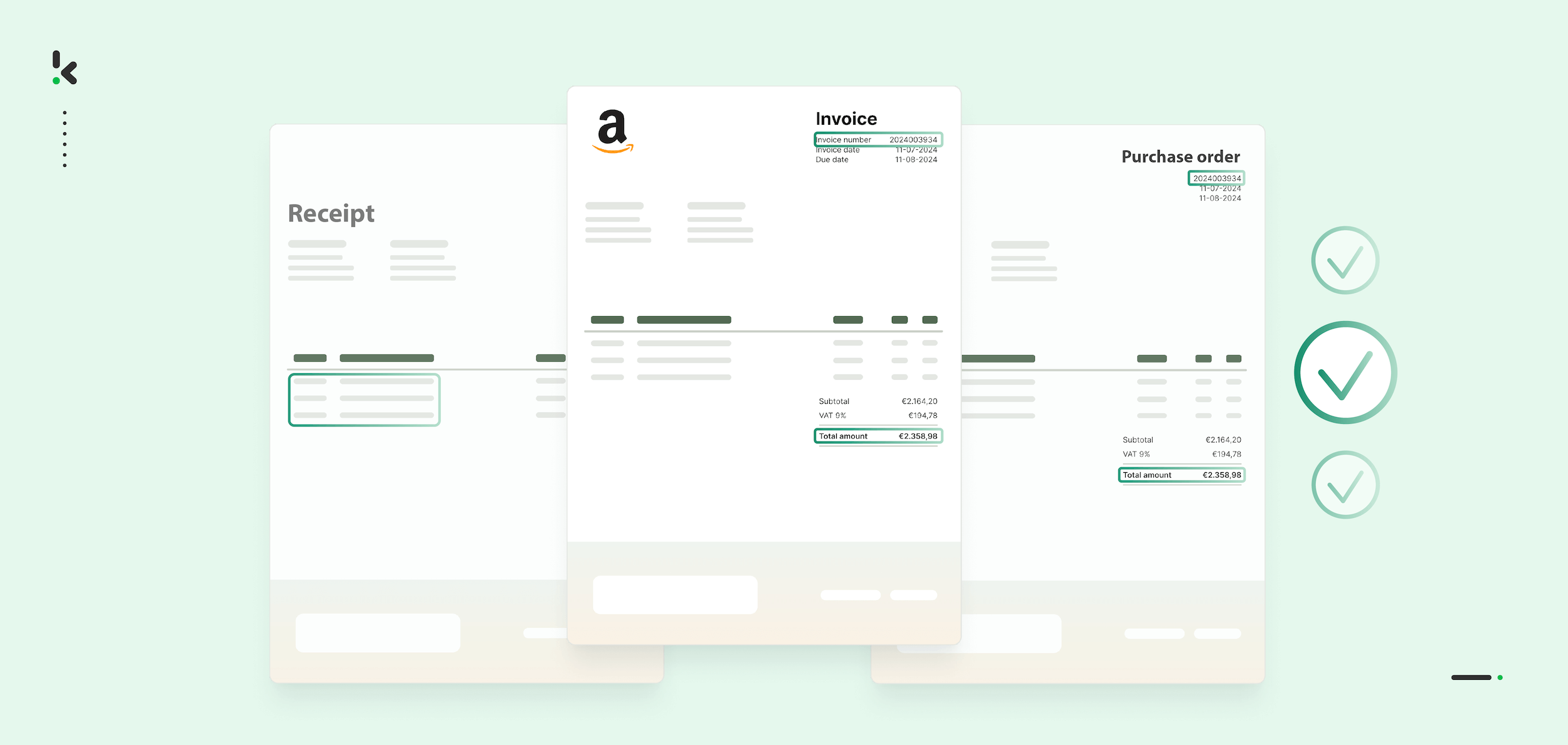

Three‑way matching is an accounts payable (AP) control process used to ensure that your company only pays for goods or services that were actually ordered and received.

It works by comparing three key documents before approving payment:

- Purchase Order (PO) – Created when the order is placed, detailing the items or services, quantities, agreed‑upon prices, and delivery terms.

- Receiving Report (sometimes called a goods receipt) – Created when the delivery arrives, confirming what was received, in what quantity, and in what condition.

- Supplier Invoice – The bill sent by the supplier, listing the charges and the due date for the payment.

The goal is to confirm that the details in all three documents match. If the quantity, description, or price differs in any of them, the payment is put on hold until the issue is resolved.

This extra step helps you:

- Catch pricing or quantity errors before money leaves your account

- Prevent paying for items that haven’t arrived

- Spot duplicates or detect fraudulent invoices

- Maintain a complete audit trail

Three‑way matching is most useful when dealing with physical goods or inventory, where both an order record and a delivery confirmation are available.

For lower‑risk purchases or services, companies may use two‑way matching (PO + invoice), and for critical, high‑value goods that require quality checks, four‑way matching adds an inspection report to the process.

Why Three‑Way Matching Matters in AP

Without a structured check between orders, deliveries, and invoices, it is easy for errors to slip through your accounts payable process. Even small mismatches can lead to overpayments, delayed closings, and unnecessary disputes with suppliers.

The scale of the risk is larger than many teams realise. Our 2024 State of Automation in Finance report found that duplicate and fraudulent invoices are the norm rather than the exception.

- 41.4% of finance professionals encounter up to 10 duplicate invoices every month

- Another 44% face even higher frequencies

- Nearly 47% detect up to 10 fraudulent invoices per month, and in some cases, large enterprises report more than 100 fraud attempts monthly

Three‑way matching is one of the most effective ways to reduce these risks. It offers several key benefits:

1. Prevents Costly Errors

Matching all three documents ensures you do not pay for goods you did not receive, or pay more than the agreed price. It also catches duplicate charges before they reach the payment stage.

2. Reduces Fraud Risk

79% of organizations were victims of payment fraud attacks/attempts in 2024, according to the 2025 AFP® Payments Fraud and Control Survey. Requiring both a purchase order and a goods receipt alongside the invoice makes it much harder for fraudulent submissions to slip through undetected.

3. Improves Supplier Relationships

Discrepancies can be resolved before money changes hands, avoiding the awkward and time‑consuming process of reclaiming incorrect payments.

4. Creates a Solid Audit Trail

Each matched set of documents provides clear, verifiable evidence of a transaction, which is invaluable during internal or external audits.

5. Supports Compliance

In regulated industries and public sector environments, three‑way matching helps demonstrate that robust financial controls are in place.

For finance teams managing high invoice volumes, these benefits are crucial in maintaining secure, accurate, and efficient payment workflows.

How to Implement Three‑Way Matching

A strong three‑way matching process ensures that every payment you make is accurate, authorized, and supported by documentation. The following steps will help you set it up in a way that works in real-world conditions, whether you’re starting from scratch or improving an existing process.

Step 1: Create a Clear Purchase Order (PO) Process

The purchase order is the foundation of 3-way matching. If it’s incomplete or inconsistent, the rest of the workflow will suffer.

- Standardize PO templates so all required fields (item description, quantity, unit price, delivery date, supplier details) are always included

- Assign unique PO numbers for tracking throughout the workflow

- Require approval for all POs before sending them to suppliers

Tip: Avoid vague descriptions. “Office chairs” leaves too much room for interpretation. “5 × ergonomic mesh office chairs, black, model XY123, $150 each” avoids disputes later.

Step 2: Record Deliveries with a Receiving Report

The receiving report, sometimes called a goods receipt, confirms what physically arrived and its condition.

- Have warehouse or receiving staff check each delivery against the PO immediately

- Note any shortages, damages, or substitutions directly on the receiving report

- Date-stamp the document to track supplier history

Step 3: Collect Supplier Invoices in One Place

If invoices arrive in different formats and through different channels (email, mail, EDI), they’re easy to lose track of.

- Create a single point of entry for all invoices, such as a dedicated AP email inbox or invoice portal

- Log invoice details as soon as they’re received

- Store electronic copies to prevent misplaced paperwork

Step 4: Match the Three Documents

This is the core of the process and where most errors are detected. Compare the PO, receiving report, and invoice for matches in:

- Item descriptions

- Quantities

- Unit prices

- Total amount

- Delivery date vs. invoice date

Flag mismatches for review right away.

Step 5: Resolve Exceptions Before Payment

Paying before resolving a mismatch risks overpayment and makes recovery difficult.

- Assign responsibility for investigating discrepancies (often within the AP team, with input from procurement)

- Contact suppliers as soon as possible to clarify and correct issues

- Keep detailed records of the resolution for audit purposes

Step 6: Approve and Process Payment

Once all three documents match, payment can be safely authorized.

- Follow an approval hierarchy so high-value payments require senior sign-off

- Record payment details (date, method, bank reference) in your accounting system for a complete audit trail

Tip: If your agreements offer early payment discounts, make sure the workflow allows payments to be approved in time to capture them.

By following these steps, you create a process that catches mistakes and keeps your AP operations running smoothly. For teams handling increasing invoice volumes, automation can speed up each step while improving accuracy, especially when it comes to real-time exception handling, which we’ll explore in the next section.

Exception Handling in Three‑Way Matching

Even with a solid three‑way matching process, mismatches between purchase orders, receiving reports, and invoices are bound to happen. These are called exceptions, and how you handle them can make the difference between a quick resolution and a long, costly payment delay.

Common exceptions include:

- Price differences – The price on the invoice is higher (or lower) than on the purchase order

- Missing items – The goods receipt lists fewer items than the invoice

- Overbilling – Being charged for more units or services than ordered

- Unreceived goods – Items not yet delivered but already billed

- Duplicate invoices – The same invoice is submitted more than once

Where Exceptions Come From

Most exceptions are the result of:

- Supplier errors such as incorrect quantities, prices, or SKUs

- Data entry mistakes within your own procurement or AP team

- Wrong or outdated SKUs/descriptions that don’t match current order details

- Timing differences when invoices arrive before goods are received, or deliveries are logged late

What an Effective Exception‑Handling Workflow Looks Like

A good process should be clear, structured, and documented. Key elements include:

- Defined rules and thresholds – Decide which variances require investigation and which can proceed (e.g., price differences under 1%).

- Clear escalation paths – Specify who investigates the issue first, and when it should be escalated to procurement managers or finance leadership (e.g. CFO).

- Direct communication with suppliers – Contact the supplier quickly to resolve mismatches, ideally with supporting documentation available.

- Automated alerts – Use AP automation tools that flag mismatches as soon as they are detected.

- Audit trail management – Maintain a complete record of the exception, how it was resolved, and any corrective action taken.

How Automation Helps

Manual exception handling often involves email chains, back‑and‑forth calls, and status updates that slow everyone down. Automated AP systems can:

- Flag mismatches instantly when comparing invoice, PO, and receipt data

- Route exceptions to the right person automatically

- Track resolution progress without relying on spreadsheets

- Store all related data together for fast retrieval during audits

When exceptions are handled efficiently, you reduce payment delays, prevent financial losses, and protect supplier relationships. The next step is deciding whether to manage this entirely in‑house or to use automation to remove the repetitive work so your team can focus on resolving the bigger issues.

Manual vs. Automated Three‑Way Matching

Three‑way matching works in any format, but the way you execute it has a big impact on speed, accuracy, and scalability. Some finance teams run the process manually, while others rely on automation software to streamline it. Understanding the differences will help you decide what works best for your concrete organization.

Manual Three‑Way Matching

Your AP team collects the purchase order, receiving report, and supplier invoice, then compares them side by side. Any mismatches are highlighted and investigated through emails or calls, and once everything aligns, the invoice is approved for payment.

Pros:

- Low initial cost, no software required

- Works with any format of documents

- Gives your team full control over every step

Cons:

- Time‑consuming: Invoices must be checked one at a time

- High error risk: Manual data entry and human checks can miss small discrepancies

- Hard to scale: As invoice volumes grow, so do delays

- Payment bottlenecks: Exceptions often take longer to resolve without automated alerts and routing

Automated Three‑Way Matching

Automation software imports or captures the PO, receiving report, and invoice digitally. Using rules and data recognition technology like optical character recognition (OCR), it compares them automatically. Exceptions are flagged instantly and sent to the right person or team for resolution.

Pros:

- Fast processing: Matches documents in seconds

- Lower error risk: Eliminates manual data entry and applies consistent checks

- Scalable: Handles hundreds or thousands of invoices with minimal added effort

- Better fraud prevention: Detects duplicate or altered invoices automatically

Cons:

- Requires setup and training time

- Software costs vary depending on the provider and features

Bottom Line

Your AP team should never rely solely on visual judgment. An honest mistake or a sophisticated invoice fraud can pass the “look test” and still be detected once checked against metadata, databases, and other AI-led validation methods.

For teams looking for an automation solution, Klippa DocHorizon is one example of how this process can be transformed. It uses OCR and AI to:

- Read and interpret POs, receiving reports, and invoices from any format

- Match them automatically and flag mismatches in real time

- Route exceptions to the right approver instantly

- Keep a complete digital audit trail

- Integrate with accounting and ERP systems for seamless workflow

This means your team spends less time hunting down paperwork and more time resolving the exceptions that matter

Are you curious how easily and convincingly one can commit document fraud without automated three-way matching? Test yourself by guessing which invoice is fake in our video!:

Conclusion: Making Three‑Way Matching Smarter

Three‑way matching is one of the most reliable ways to prevent payment errors and fraud in accounts payable. By verifying every invoice against its purchase order and goods receipt, you confirm that you are paying only for what was ordered and delivered.

When done manually, this process works, but it can be slow, resource‑heavy, and prone to human error. Automated, AI‑driven matching speeds up approvals, catches discrepancies earlier, and keeps your suppliers paid accurately and on time.

That’s where Klippa DocHorizon can make a difference.

Klippa helps finance teams set up end‑to‑end three‑way matching workflows that fit their existing tools and processes. Here’s how:

- Flexible document intake and output: Capture vendor documents from any source, such as email, cloud storage, or vendor portal, and send processed results directly to your accounting or ERP system.

- AI‑powered OCR and document classification: Read any invoice, PO, or goods receipt format, then automatically classify and extract all relevant details.

- Fraud detection: Run layered fraud detection analysis, including image forensics, EXIF and metadata checks, and pixel‑level tampering detection, to uncover altered or duplicate invoices before they reach payment.

- Data matching database: Store extracted data in secure datasets, compare invoice details against related POs and receipts, and flag mismatches automatically.

- Human‑in‑the‑loop review: Route alerts to authorized personnel via human-in-the-loop for quick decisions when an exception or suspected fraud is detected.

- Batch or single‑document processing: Handle documents one by one or in bulk, and include historical records for reference and matching.

- Security and compliance: Operate on ISO 27001‑certified servers with GDPR‑level data protection to maintain compliance in regulated industries.

AI‑powered matching combined with layered fraud detection makes it much harder for incorrect or fraudulent invoices to pass through your AP process. Because these checks run in seconds, your AP team can maintain accuracy without slowing down payment cycles.

Want to see how it works? Book a demo or contact us to see firsthand how you can speed up your three-way matching process.

FAQ

You need a purchase order, a receiving report (goods receipt), and a supplier invoice. Comparing these three ensures that the items billed match what was ordered and delivered.

Two‑way matching compares only the purchase order and the supplier invoice. Three‑way matching adds the receiving report, making it more reliable for verifying deliveries and preventing payment for goods not received.

It is usually applied to physical goods. For services, a receiving report may not exist, so two‑way matching is more common. In some cases, service completion certificates can be used as the third document.

Common mismatches include price differences, quantity discrepancies, incorrect SKUs, missing deliveries, and duplicate invoices.

An exception occurs when the purchase order, receiving report, and invoice do not align. The mismatch must be investigated and resolved before payment is approved.

It prevents paying for incorrect or incomplete orders, stops duplicate payments, and ensures accurate financial records. Well‑managed exceptions also help maintain good supplier relationships.

Automation speeds up the process by reading and comparing documents instantly, reducing manual data entry, and flagging mismatches in real time. It also routes exceptions to the right people and keeps a complete audit trail.

Yes. Optical Character Recognition (OCR) allows automation software to read data from invoices, purchase orders, and goods receipts, even if they are scanned or in image formats.

Most automation systems allow you to define tolerance levels, such as accepting small differences in price due to rounding or currency conversion, without triggering an exception.

Klippa DocHorizon uses AI‑powered OCR to capture and compare data from your POs, receiving reports, and invoices. It can detect discrepancies, run fraud checks, route alerts to authorized personnel, and integrate seamlessly with your accounting or ERP system.