Synthetic identity fraud, sometimes called synthetic identity theft, is a fast‑growing form of financial crime that blends real and fake personal information to create a convincing new identity. These fabricated identities often contain just enough authentic data to pass as genuine, enabling criminals to open accounts, secure credit lines, make purchases, and move money through the financial system without detection.

According to Federal Reserve payments fraud expert Mike Timoney, losses from synthetic identity fraud have skyrocketed from $8 billion in 2020 to more than $30 billion in 2025. Generative AI is now accelerating the problem by helping criminals create more convincing, harder‑to‑detect synthetic profiles in less time.

With identity fraud ranking among the world’s most costly and pervasive crimes, organizations are under pressure to adopt advanced Identity Verification software equipped with AI, biometrics, and liveness detection to stop synthetic identities before onboarding is complete.

In this article, we’ll look at how synthetic identity fraud works, its impact on businesses, and how Klippa’s AI‑powered Identity Verification can help you detect and block it, protecting your revenue, reputation, and compliance.

Key Takeaways

- Synthetic identity fraud combines real and fake data to form convincing identities used for financial crimes.

- Losses have surged from $8 billion in 2020 to over $30 billion in 2025 (Boston Fed), with generative AI increasing the sophistication of attacks.

- Fraudsters often exploit unmonitored identities such as those of children, the elderly, or incarcerated individuals to avoid quick detection.

- AI‑powered verification using biometrics, liveness detection, and NFC chip checks is the most effective way to prevent synthetic identities during onboarding.

What Is Synthetic Identity Fraud?

Synthetic identity fraud is sometimes referred to as the “Frankenstein” of identity crime. Unlike traditional identity theft – where a criminal assumes the complete identity of a real person – synthetic identity fraud involves piecing together elements from multiple real and fabricated records to build a profile that looks legitimate but does not correspond to any single, actual individual.

Why It’s Hard to Spot

Synthetic identities are built to blend in. They may be nurtured for months or years, with criminals paying small transactions on time to build a credible credit history before executing a major fraud. Because there’s no singular victim monitoring activity, organizations often only detect the fraud once accounts are maxed out – or not at all.

How Does Identity Theft Occur?

Identity theft is the crime of obtaining another person’s personal or financial information to use their identity to commit fraud, such as making unauthorized transactions or purchases. Identity theft is committed in many ways, and its victims are typically left with damage to their credit, finances, and reputation. But how does it happen?

Identity theft occurs when someone steals personal information such as a Social Security Number, bank account number, or credit card information.

Some identity fraudsters search through trash deposits, looking for credit card or bank account statements. However, more sophisticated methods, such as hacking or phishing, are increasingly being used by identity fraudsters to obtain people’s personal information to commit identity fraud.

To find such information, they may search the hard drives of stolen computers, hack into computers or computer networks, access computer-based public records, use information-gathering malware to infect computers, or use deceptive emails or text messages.

Once identity thieves have the information they are looking for, they can use the personal information or create a fake, modified version of it to commit identity fraud. This is also known as synthetic identity theft.

Methods of Synthetic Identity Theft

Generally speaking, there are two methods used by fraudsters when creating synthetic identities:

- Manufactured synthetic fraud

- Manipulated synthetic fraud

Let’s have a look at each of them in detail below.

Manufactured Synthetic Fraud

Manufactured synthetic identities originate from valid pieces of data that are assembled from multiple identities and then stitched together. For example, a fake identity is created after one person’s social security number is paired with another person’s address and a third person’s name.

Although this method is still being used today, fraudsters build these identities using invalid information instead. In the USA, for example, fraudsters create random Social Security numbers using the same structure as the Social Security Administration uses to issue Social Security numbers to genuine citizens.

Then, fraudsters add Personal Identifiable Information (PII) that doesn’t belong to any citizen. Criminals switched to using this technique as this form of synthetic ID fraud is much more difficult to detect.

Manipulated Synthetic Fraud

Manipulated synthetic identities, on the other hand, are generated based on real identities. In these instances, the change is done to only one specific identity document. For instance, the social security number or personally identifiable information is altered on a real ID card.

Individuals often use a manipulated identity to hide their credit history and gain access to a new credit record. For example, someone with a bad credit history may create a fictitious identity in order to be approved for mortgage applications, loans, or credit services.

Now that we know how fraudsters create synthetic identities, let’s have a look at the potential impact it can have on your business.

Why Synthetic Identity Fraud Is Rising in 2025

Synthetic identity fraud is not new, but its frequency, sophistication, and financial impact have escalated dramatically in recent years. Several trends make 2025 a critical turning point for this type of crime.

Generative AI Has Changed the Game

Generative AI tools allow fraudsters to:

- Assemble massive datasets from data breaches into unique, credible synthetic profiles in seconds.

- Forge convincing identity documents, down to microprint and barcode formatting, that can bypass standard visual inspections.

- Create deepfake images and videos to trick outdated liveness checks during remote onboarding. Federal Reserve payments fraud expert Mike Timoney warns that AI can make synthetic identities “less noticeable that they’re fake” by tailoring each profile to avoid common detection patterns.

From Credit Card Fraud to Benefit and Account-Opening Fraud

Fraud tactics have evolved:

- Pre‑2020 — Criminals built up synthetic credit profiles slowly, behaving like “good customers” until limits were high enough to cash out large sums.

- 2020–2021 — Pandemic relief programs offered faster payouts, prompting a shift to benefit fraud (PPP loans, unemployment claims).

- 2022–2025 — With relief funds gone, the focus moved to fraudulent online account openings to move stolen funds through accounts they control.

Targeting Vulnerable Populations

In 2025, synthetic identity fraud disproportionately exploits identities that are less likely to be actively monitored:

- Children’s Social Security numbers: unused for years, allowing fraud to go undetected until adulthood.

- Elderly citizens: high credit scores, infrequent credit applications.

- Incarcerated individuals: minimal financial activity, increasing exploitability.

Fuelled by Record Data Breaches

In 2024, there were more than 3,200 reported U.S. data breaches, affecting up to 1.7 billion records. Each exposed dataset provides another trove of personally identifiable information (PII) that fraudsters can re‑mix into synthetic identities.

The bottom line is: In 2025, businesses cannot rely on legacy verification methods alone. Criminals are evolving faster than traditional defenses.

What is the Impact of Synthetic Identity Theft on Businesses?

Synthetic identity theft is a growing threat, costing businesses billions of dollars and countless hours spent chasing down people who don’t even exist. Given the scale of data breaches, compromised Personal Identifiable Information, and ease of access to the dark web, it’s no longer enough to rely on social security numbers and credit bureaus alone.

Next to that, businesses suffer from the following challenges:

- Traditional tools are not fraudster-proof anymore: Tools that are meant to help reduce identity fraud aren’t able to catch synthetic identity fraud. Criminals are always looking for new ways to commit fraud, and not all organizations are keeping up with them.

- It’s a significant problem for the financial sector: Synthetic fraud is incredibly dangerous and is a major problem for the financial industry. Unlike third-party fraud, where an entire identity is stolen and used to defraud enterprises and victims, synthetic fraud frequently has no specific victim. Without a specific victim, it becomes challenging for a business to detect and stop fraud from taking place.

- The victim is the business: If the original owners of the ID documents are not aware of fraud, there’s also nobody to alert the organization that fraudulent activity is taking place. Due to this, a fraudster who successfully opens an account with a synthetic identity can keep that account open for months or even years. While doing so, they can make payments and increase the amount of credit available, max out the credit available to them, and then disappear without a trace.

On top of these challenges, customers who are victims of identity theft will realize that their data is not safe. This can lead to reputational loss and a lack of trust in the company.

But what can businesses do to conduct a more rigorous onboarding process that can identify potential cases of synthetic identity fraud? Let’s have a look at your potential solution.

How to Prevent Synthetic Identity Fraud with Klippa’s AI-Powered Identity Verification

In today’s regulated world, businesses can no longer afford to operate without a secure customer onboarding solution that is smart enough to prevent synthetic identity theft. This is exactly where Klippa comes into play.

With Klippa’s automated Identity Verification solution, you can make sure that your customer onboarding process is robust and secure. Our software uses OCR technology to extract data from identity documents, and AI to classify and verify data, detect document forgery, and analyze the facial biometrics of a person.

Whether your use case is to verify age, proof of address, or ID cards, our Identity Verification solution can easily be integrated into your workflow or applications via API or SDK.

The following features of our ID verification software are the reasons why we can support various use cases:

- Biometric verification

- ID verification

- Liveness checks

- NFC scanning

1. Biometric Verification

Biometric verification is the process of identifying individuals through unique biometric features like face recognition and fingerprints. This way, people can prove who they are in both a digital and a physical environment.

For some systems, this is the only way people can get access to the desired service, device, or location.

Take the latest smartphones as an example. With the proper configuration of your biometric verification, no one else can access your smartphone.

Within our ID verification software, biometric information can be matched with an ID document, making sure it comes from the real owner of the ID, avoiding synthetic identity fraud.

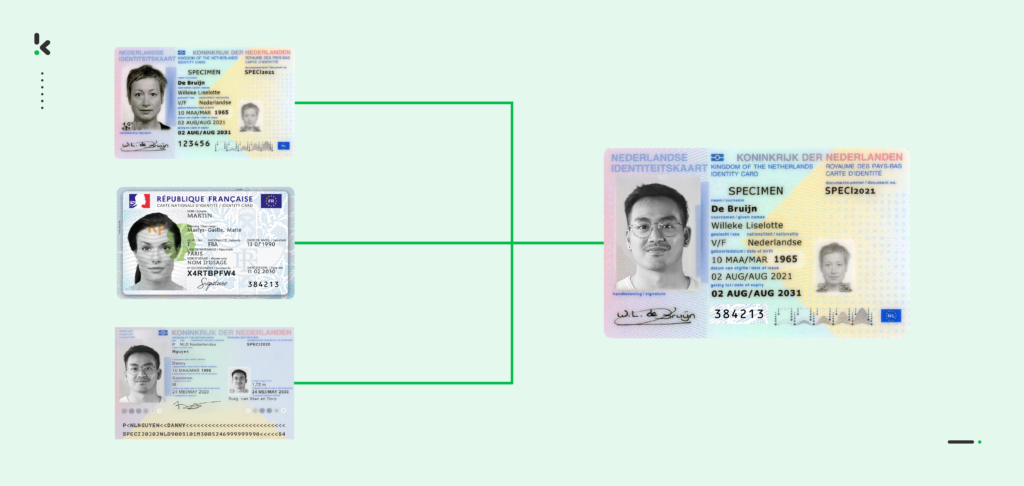

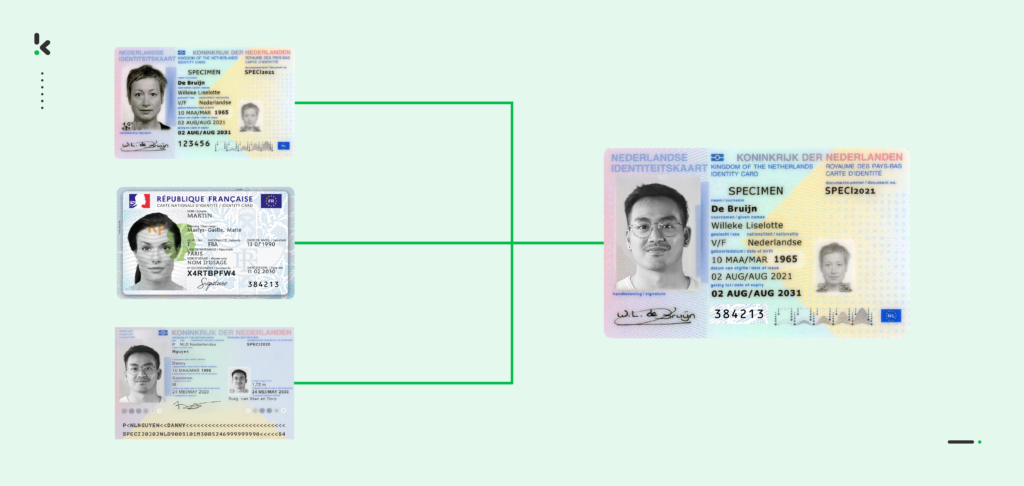

2. ID Verification

ID verification is a necessary procedure during onboarding, payment, booking, check-in, or check-out. There are multiple techniques involved in verifying an ID document’s authenticity. These include Photoshop detection using computer vision technology, metadata analysis, and performing third-party data verification checks.

Using an identity verification solution will reduce or avoid onboarding with synthetic ID documents.

3. Liveness Detection

Liveness checks are used to verify the person behind the camera, making sure that it is not someone with a printed picture of someone else’s face. Liveness checks work by capturing the movement of the person behind the camera or a number of selfies to validate the user and determine if it’s a real person or a passive fake in real-time.

This way, you can easily detect synthetic ID fraud and avoid spoofing that can be detrimental to your business.

4. NFC Scanning

The NFC identity verification technology is used to read encrypted data in the RFID chip of identity documents for user verification. With the help of a smartphone, NFC technology can be used to access a user’s data from identity documents and validate the document’s authenticity.

In the video below, you can see what Identity Verification with NFC looks like:

Every feature of Klippa’s Identity Verification solution adds layers of security to your identity verification process and can help you prevent synthetic identity theft, ultimately enhancing your AML & KYC compliance.

Conclusion and Next Steps

Synthetic identity fraud is no longer a fringe threat. It’s a $30 billion problem in 2025 that’s accelerating with the help of generative AI. Fraudsters are refining their methods, exploiting vulnerable populations, and blending real and fake data to create identities that traditional verification tools can’t catch.

The risks for businesses are clear:

- Financial losses from fraudulent accounts.

- Reputation damage that weakens customer trust.

- Compliance exposure under AML, KYC, and GDPR regulations.

Klippa’s AI-powered Identity Verification adds multiple security layers: from OCR + AI analysis to biometric matching, active liveness detection, and NFC chip verification, to stop synthetic profiles in their tracks. Every feature is designed for accuracy, speed, and seamless integration, giving you a robust defense without sacrificing customer experience.

Do you still have questions about our Identity Verification solution? Feel free to contact us or book a demo below to see how our solution works.

FAQ

Synthetic identity fraud happens when criminals combine real personal data, such as Social Security numbers, with fabricated details to create a new and convincing identity. These identities are used to open accounts, apply for credit, and commit various forms of financial fraud.

Detection requires advanced identity verification tools that go beyond basic checks. AI‑powered solutions analyze document authenticity, match biometrics to official records, perform liveness tests, and read encrypted NFC chip data to identify inconsistencies.

Common red flags include mismatched personal information across records, unusual account activity such as rapid credit building, and repeated difficulties verifying identity during onboarding. These patterns often indicate a synthetic profile.

Verification involves matching facial or fingerprint biometrics to document data, using active liveness detection to ensure a real person is present, and validating NFC chip data against issuing authority sources. Cross‑checking details in trusted databases adds another layer of protection.

Organizations can protect themselves by implementing AI‑driven ID verification with biometrics, liveness detection, and NFC checks. Coupling these with strict AML, KYC, and GDPR compliance protocols improves onboarding security and fraud prevention.

Because synthetic identities do not belong to one real victim, there is often no one to report suspicious activity. Fraudsters may nurture these identities for months or years, building creditworthiness that allows them to blend into legitimate customer behavior.

Yes. Generative AI can process vast datasets to uncover subtle anomalies, detect deepfake attempts, and adapt detection models as fraud tactics evolve. When used ethically, AI is a powerful tool for identifying and stopping synthetic identities before they cause harm.