The unfortunate reality is that where there are employees, the potential for fraud exists. A 2024 study found that nearly a quarter of employees have committed expense reimbursement fraud. Of the 1,021 full-time employees surveyed, 24% said they had expensed personal expenses as business ones, and another 15% said they’d considered doing so.

This startling figure further illustrates the need for a robust expense management system with adequate checks and balances to detect and prevent fraud before it harms your business. In this blog, we’ll guide you through what expense fraud entails, how it can threaten your business, and how you can tackle it. Let’s jump right into it!

Key Takeaways

- Expense fraud is more prevalent than you might think – A significant percentage of employees have admitted to submitting false expenses, highlighting the importance of having strong systems in place to prevent and detect fraud early.

- Subtle red flags often signal potential fraud – Watch for round numbers, duplicate claims, overly clean receipts, and excessive “miscellaneous” charges. These patterns, though seemingly minor, can point to intentional misreporting or fraudulent activity.

- Detecting expense fraud requires both diligence and technology – Regular audits, comparing expense reports across similar roles, and using automated expense management software can help identify anomalies, duplicates, and potential fraud more efficiently.

- Prevention is key – Implementing clear, well-communicated expense policies, using business expense cards, and investing in automated tools to track and enforce spending limits creates a system of accountability that reduces opportunities for fraud and strengthens financial integrity.

What is Expense Fraud?

Expense fraud or expense reimbursement fraud occurs when employees intentionally submit false or inflated expense claims to their employer for personal gain. What does this mean for your business?

Not only does expense fraud impose significant costs on your business, including direct financial losses from unauthorized reimbursements, but it also leads to an erosion of trust between employees and management. In addition, it paves the way for legal and compliance risks, leading to potential lawsuits and fines. Altogether, these threaten the company’s financial stability, integrity, and long-term viability.

Now that we have outlined what it is and what it means for your business, we can explore how it happens and what it looks like in practice.

Why does expense fraud happen?

Expense fraud happens for several reasons, however, we’ll dive into 3 specific reasons that allow expense fraud to develop and continue, sometimes unchecked.

- Lack of Oversight: Inadequate monitoring and lax controls within an organization can create opportunities for employees to exploit loopholes and submit fraudulent expenses without detection. Without proper checks and balances, there’s less deterrence against fraudulent activities.

- Opportunity: When there are loopholes in the expense reimbursement process, there are greater opportunities for employees to exploit them. This might involve submitting fake receipts, inflating expenses, or misrepresenting personal expenses as business-related.

- Lack of Detection: When expense fraud remains unnoticed or unpunished, it fosters a culture of impunity. This emboldens employees to continue with their fraudulent activities, believing they won’t be caught or penalized. The lack of consequences worsens fraudulent behavior.

Understanding the underlying reasons behind expense fraud is crucial for implementing effective prevention strategies. Now, let’s take a closer look at the common types of expense fraud to better understand how these factors play out.

Common Expense Fraud Schemes

Expense fraud can manifest in various schemes designed to deceive and manipulate the expense reporting process for personal gain. However, it’s important to note that expense fraud isn’t always intentional; it can also occur as a result of errors or accidents in the reporting process.

Below are some common expense fraud schemes that employees may employ to defraud their organizations:

1. Fake Expenses: This scheme involves fabricating expenses that never occurred, such as creating fictitious receipts or invoices for goods or services that were never purchased. Fake expenses can be difficult to detect without thorough scrutiny of documentation and verification processes.

2. Duplicate Receipts: In this scheme, an employee submits multiple reimbursement claims for the same expense by using duplicate receipts. By submitting the same expense multiple times, an employee can make reimbursement claims for expenses they never actually incurred. Detecting multiples of the same receipts may be easier and straightforward with a small number of receipts but becomes significantly more challenging with a larger volume to process.

3. Inflated Expenses: Inflating expenses involves exaggerating the cost of legitimate business expenditures to receive higher reimbursements. This can be achieved by overstating the amount spent on items or services, inflating mileage claims, or adding unauthorized charges to expense reports.

4. Duplicate Expenses: Similar to duplicate receipts, duplicate expenses involve submitting multiple reimbursement claims for the same expense. However, in this scheme, the employee creates entirely separate expense reports for the same expenditure, effectively double-dipping for reimbursement.

5. Mischaracterized Expenses: This scheme involves misrepresenting personal expenses as legitimate business expenses to obtain unauthorized reimbursements. For example, an employee might classify personal meals or entertainment costs as client-related expenses to justify reimbursement.

What do each of these examples illustrate? They highlight the importance of robust controls and thorough review processes in the expense management process to detect and prevent fraudulent activities within organizations.

Through proactive measures such as regular audits, clear expense policies, and employee training, organizations can mitigate the risk of falling victim to expense fraud.

Red Flags That Could Signal Expense Fraud

Expense fraud doesn’t always announce itself with glaring irregularities. Often, it hides in the small details – patterns and behaviors that only become suspicious in context. For accountants and finance professionals, spotting these subtle cues early can prevent larger issues down the road.

Here are some of the most common, and often overlooked, red flags:

1. Round Numbers Across the Board

Multiple expense reports filled with perfectly rounded amounts (like $100.00 or $250.00) can be a sign that numbers are being estimated, or fabricated. Real-world expenses are rarely so neat.

2. Receipts That Look Too Clean

Be wary of receipts that appear unusually crisp, use inconsistent fonts, or are missing standard information (like tax, vendor details, or time stamps). Scanned or photocopied receipts without originals can also raise questions.

3. Duplicate Claims

Submitting the same receipt more than once, whether intentionally or accidentally, is a classic tactic. Watch for repeated vendor names, identical amounts, or recurring expenses submitted across different reports or employees.

4. Excessive “Miscellaneous” Expenses

If the miscellaneous category starts to become a catch-all, that’s a red flag. This vague labeling often conceals inappropriate or unapproved purchases.

5. Unusually High Claims for Location or Role

Compare expenses to peers in similar roles or locations. If one employee consistently claims more than others with similar travel schedules or job functions, it may warrant a closer look.

6. Personal Expenses Disguised as Business

Watch for charges that don’t fit the context, like meals on weekends, family-friendly venues, or retail stores not typically associated with business needs.

7. Frequent Manual Adjustments

If an employee often edits or resubmits reports due to “errors” or “missed items,” it could be a tactic to sneak in unapproved expenses once the initial scrutiny passes.

8. High Volume of Cash Transactions

Legitimate expenses are increasingly digital. A heavy reliance on cash can indicate a lack of transparency, and make it harder to verify the authenticity of purchases.

9. Expense Claims Just Below Approval Limits

Repeated submissions that sit just under a manager’s approval threshold (e.g., always $499 when the limit is $500) suggest someone may be gaming the system to avoid further scrutiny.

10. Resistance to Policy or Audit

Employees who push back on audits, delay submitting documentation, or become defensive when asked questions about expenses may be signaling a need for a deeper review.

How to Prevent Expense Fraud in Your Company

Effective expense management is vital for financial integrity and regulatory compliance. Preventing expense fraud requires businesses to implement robust preventive measures. Here are four best practices you can implement today to prevent expense fraud.

Use Business Credit Cards

With business expense cards, you can streamline expense management, enforce spending limits, and even enable real-time monitoring. These cards automate expense reporting, enforce policy compliance, and offer enhanced fraud protection. Dedicated expense cards promote transparency, accountability, and efficiency in managing business expenses.

Define Clear Expense Policies

Establish comprehensive expense policies that outline acceptable expense types, documentation requirements, spending limits, and approval procedures. Communicate these policies to all employees and ensure they understand the consequences of violating them.

Perform Regular Audits

Conduct regular audits of expense reports to identify any irregularities or patterns that may indicate fraud. These audits should be both random and systematic.

Invest in Technology

Implement expense management software with features such as automated expense tracking, receipt scanning, and business rules. Leveraging expense management software can help uncover patterns and identify possible instances of expense fraud.

Here are some ways technologies can be used in detecting and preventing expense fraud:

- Expense Management Software: This software automates the expense reporting process, enabling real-time tracking of expenses, facilitating invoice approval workflow, and enforcing policy compliance.

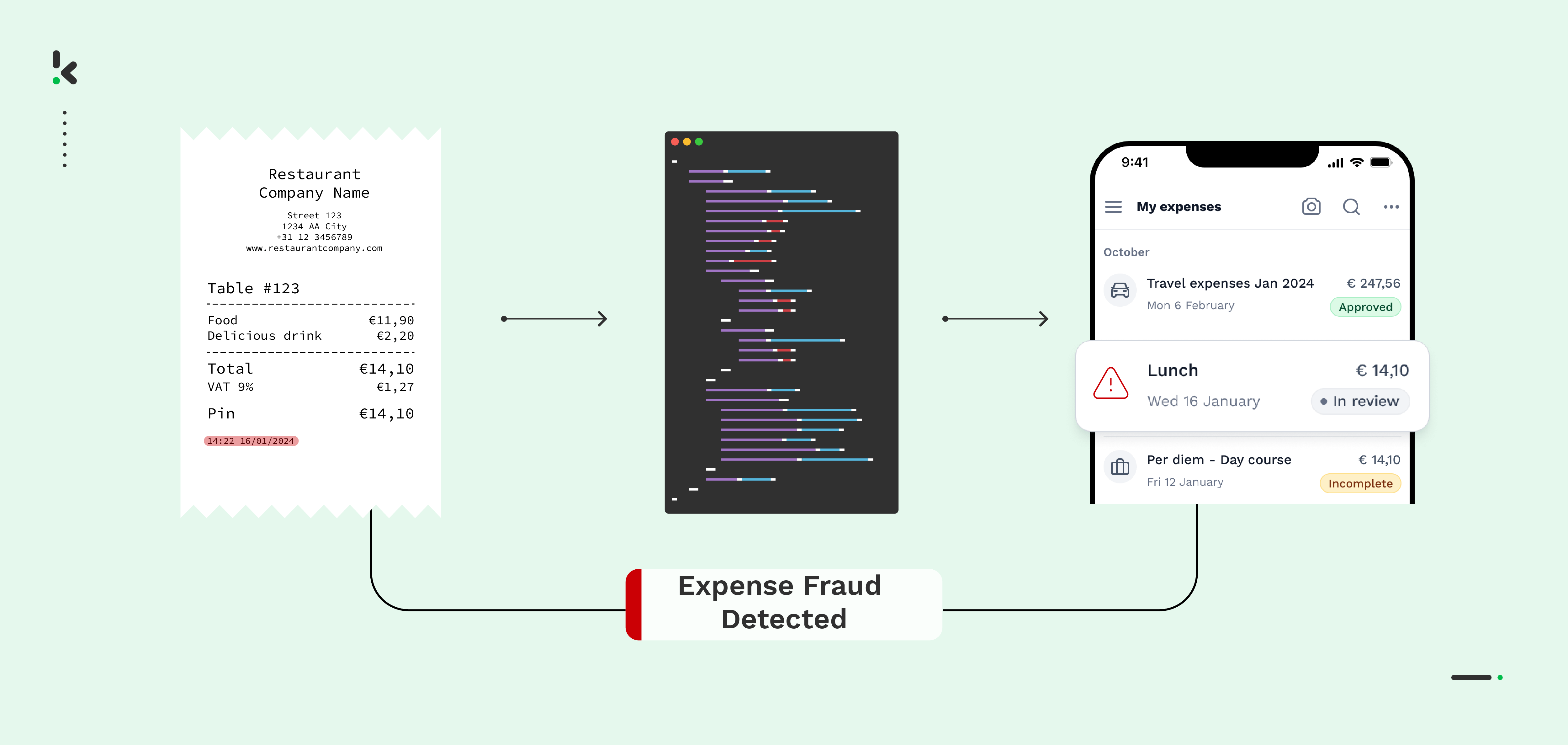

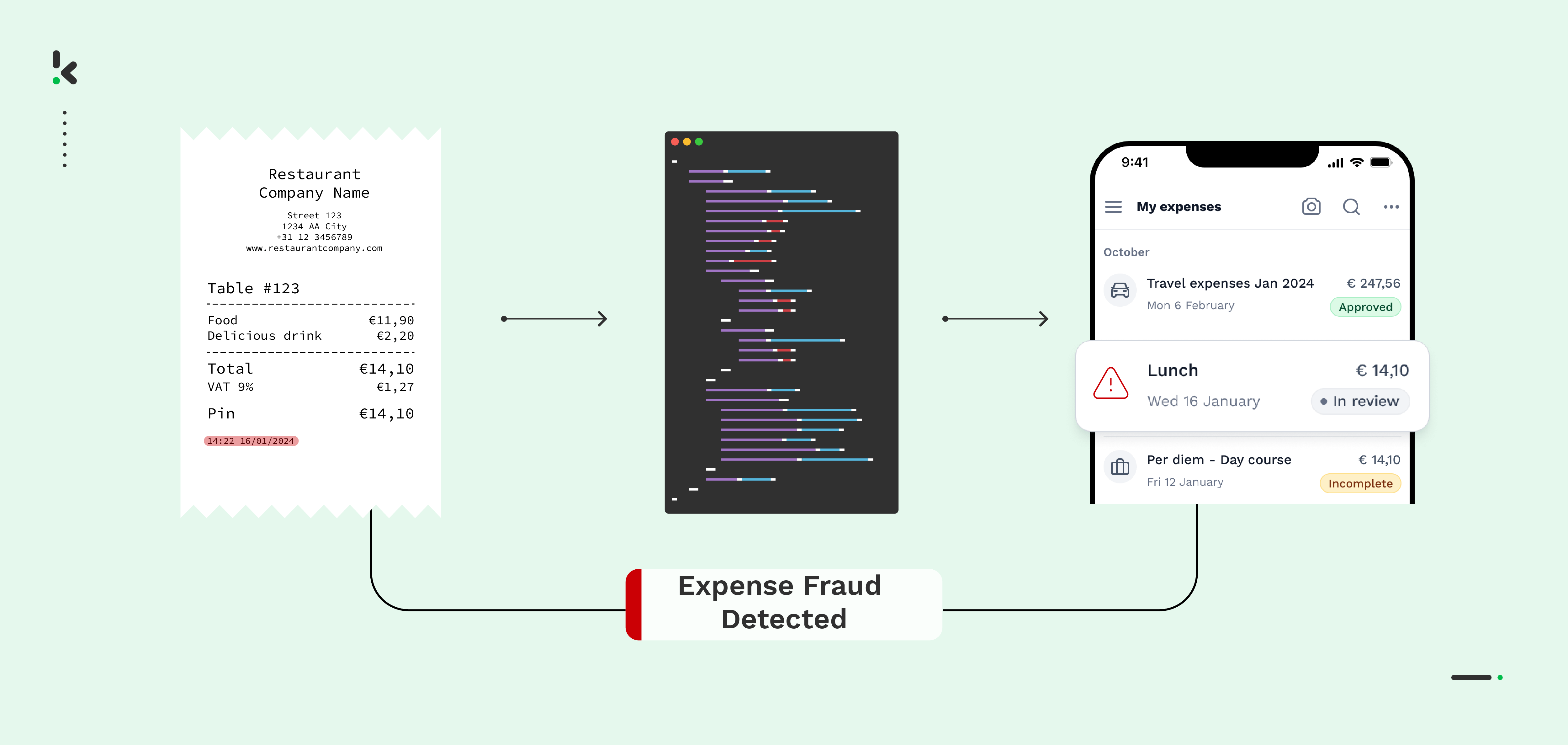

- Optical Character Recognition (OCR): OCR technology enables the scanning and digitization of receipts, reduces the chances of data extraction errors, and simplifies the verification process. This is done by accurately capturing important information such as date, amount, and vendor details.

- AI-Powered Analytics: With AI-powered analytics, you can analyze data for patterns and anomalies indicative of fraud. They identify unusual spending patterns, duplicate expenses, or mismatches between reported expenses and policy guidelines, flagging suspicious activities for further investigation.

- AI-powered fraud detection: AI models are better capable of identifying anomalies in submitted receipts, for example, than human eyes. They can better analyze and identify anomalies in submitted receipts, including digital manipulation.

It’s clear that by embracing an expense management solution, you can gain better control over the expense management process within your organization. Not only can it help streamline the process, but it also creates a digital trail, making it easier to track and audit expenses.

The good news is that there are many expense management software providers, including Klippa SpendControl.

Eliminate Expense Fraud with Klippa SpendControl

Klippa SpendControl is an all-in-one expense management solution that allows you to streamline and automate the expense claims process from A to Z. Our solution offers a fully digital and automated process for submitting, authorizing, and processing expenses via web and mobile applications.

In addition, Klippa SpendControl offers bountiful benefits to you and your business. With our solution, you can enjoy:

- Manage your invoices, expenses, and credit card transactions in one platform

- Control the submission, processing and approval of transactional documents via email, web or mobile app

- Ensure segregation of duties with custom roles and controls

- Customize your approval management with multi-level authorization flows

- Prevent expense report fraud with built-in duplicate and fraud detection

- Accurately track business mileage through our Google Maps integration

- Set strict business spending limits with our company credit cards

- Get real-time insights into your finances with our statistics dashboards

- Never fail to comply with your local tax and data privacy regulations with our ISO27001-certified and GDPR-compliant solution

- Integrate SpendControl with your accounting and ERP software, like QuickBooks, NetSuite, or SAP

Are you ready to take a stand against expense fraud and safeguard your organization? Then don’t hesitate to contact one of our experts or book a free demo.

FAQ

Expense fraud is when an employee intentionally submits false, inflated, or mischaracterized expenses for reimbursement. It leads to financial losses, damages trust, and creates compliance risks for the business.

Watch for round numbers, duplicate claims, suspicious receipts, excessive “miscellaneous” expenses, unusually high claims, and resistance to audits. These patterns often point to fraud or misuse.

Fraud can be detected through regular audits, comparing expenses across roles, and using software like Klippa SpendControl that flags duplicates, anomalies, and policy violations.

Prevention starts with clear policies, business expense cards, automated expense tools, and a culture of accountability supported by regular checks.