Invoices often don’t match what was originally ordered or delivered.

Line items vary, quantities change, and partial shipments are common. One supplier might bill you for 150 items while the warehouse confirms only 138 arrived. The related data is scattered across emails, PDFs, warehouse systems, and ERPs, making manual reconciliation slow for accounts payable, procurement, and warehouse teams.

Our State of Automation in Finance report found that more than half of finance departments still manage accounts payable without automation. This makes it harder to consistently catch mismatches, duplicate documents, or signs of fraud before payment is made.

Correspondingly, IFOL’s Finance Leaders Fraud Report 2025 shows that 47% of finance professionals reported that their companies had fallen victim to duplicate or false invoices in 2025.

In this guide, you will learn what reconciling invoices with delivery notes and purchase orders involves, why it is important for accuracy and fraud prevention, and how to create an automated process that works in practice.

Key Takeaways

- Reconciliation of invoices, delivery notes, and POs ensures that orders match the payment.

- Common mismatches include quantity changes, price deviations, and missing items.

- AP teams compare line‑item SKUs, quantities, prices, totals, and PO references.

- Manual reconciliation is time‑consuming and error‑prone at scale.

- Automation uses OCR and AI to match data, flag issues, and route exceptions.

- Klippa DocHorizon automates reconciliation, adds fraud checks, and integrates with ERP/AP systems.

What Does It Mean to Reconcile Invoices, Delivery Notes, and Purchase Orders?

Reconciling invoices, delivery notes, and purchase orders is the process of confirming that the details in these three key documents agree before authorizing payment to a supplier. This verification step helps you be certain that you only pay for items or services that were ordered, delivered, and billed correctly.

Here is how each document fits into the process:

Purchase Order (PO)

The PO is created when you place an order with a supplier. It lists the agreed‑upon items or services, quantities, unit prices, and delivery terms. It acts as the official record of what was ordered and at what cost.

Delivery Note

Also known as a goods receipt or packing slip, the delivery note is generated when the supplier ships and delivers the goods. It lists the items sent, their quantities, and sometimes their condition. The delivery note confirms what physically arrived at your location.

Invoice

The invoice is issued by the supplier after delivery. It is the payment request, listing the items or services provided, their prices, any applicable taxes, the total amount due, and the payment terms.

Why Compare Them?

All three documents should describe the same items, quantities, and prices. Checking them against each other verifies that what you ordered matches what was delivered, and that the invoice matches both. If there are differences, such as missing items, incorrect prices, or extra charges, the issue is resolved before payment is made.

Reconciliation at this level is sometimes called three‑way matching, and it serves as a control point that improves accuracy, prevents fraud, and creates a clear audit trail for compliance.

Why Reconciliation Matters

Reconciling invoices, delivery notes, and purchase orders is more than an administrative step. It is a safeguard that protects your business from avoidable costs, disputes, and compliance issues.

Common reasons these documents don’t align:

- Quantity mismatches, such as backorders or partial shipments

- Price deviations caused by outdated quotes or uncommunicated contract changes

- Missing items due to warehouse errors or supplier mistakes

- Different units of measure (for example, box vs. pallet)

- Incorrect or missing PO numbers make matching difficult

- Timing differences occur when invoices arrive before delivery notes are logged

- Human errors, such as miskeyed item codes or duplicated documents

What AP teams typically compare during reconciliation:

- Item numbers or SKUs

- Quantities ordered vs. delivered vs. invoiced

- Unit prices

- Taxes and additional fees

- Delivery terms

- PO numbers and references

- Units of measure

- Total amounts per line and per invoice

If these documents are not checked against each other before payment is made, problems can easily slip through. Even small differences can have a ripple effect on cash flow, supplier relationships, and financial reporting.

Here’s why reconciling invoices, delivery notes, and purchase orders matters:

1. Prevents Payment Errors

Matching the three documents ensures you are only paying for what was delivered, in the quantities and at the prices you agreed to. It stops accidental overpayments and avoids paying for items that never arrived.

2. Reduces The Risk of Fraud

Fraudulent invoices often contain discrepancies that only become obvious when compared to an original order and delivery record. Our 2024 State of Automation in Finance report found that 41% of finance teams deal with up to 10 duplicate invoices each month, while another 44% face even more. This makes reconciliation a critical step in invoice fraud prevention.

3. Speeds Up Dispute Resolution

When mismatches are found early, they can be addressed before payment is sent. This avoids the complications of recovering funds and helps maintain clear communication with suppliers.

4. Improves Supplier Relationships

Accurate and timely payments build trust with suppliers. By resolving any discrepancies before payment, you avoid payment delays caused by disputes and keep commercial relationships strong.

5. Strengthens Audit Readiness and Compliance

Reconciliation provides a documented trail of each purchase, from original order to delivery to payment. This record is invaluable for internal audits, regulatory compliance, and financial transparency.

For finance teams handling significant invoice volumes, consistent reconciliation offers an important layer of control. It not only ensures accuracy in each transaction but also protects the broader financial health of the business.

Manual vs. Automated Reconciliation

Some teams still rely heavily on manual checks to reconcile invoices, delivery notes, and purchase orders. While this can work at low volumes, it quickly breaks down as transaction counts rise and document formats vary. Automation replaces repetitive tasks with fast, accurate data checks, freeing your team to focus on resolving exceptions.

Manual Reconciliation

AP staff collect invoices, delivery notes, and POs, then manually review line items, quantities, and prices. They switch between PDFs, spreadsheets, ERP screens, and email threads to confirm every detail before payment.

Common challenges:

- Matching long tables with hundreds of line items by eye

- Switching between multiple systems that don’t share data

- Documents in different formats (PDF, scanned images, spreadsheets)

- Delayed approvals as stakeholders clarify mismatches via email

- No structured workflow for resolving discrepancies

- Risk of paying incorrect invoices or missing signs of fraud

When it works best: In low‑volume, low‑risk environments with consistent document formats and trusted suppliers.

Automated Reconciliation

Invoices, delivery notes, and POs are imported into a centralized system, read by AI‑powered OCR, and matched automatically against set rules and tolerances. Discrepancies are flagged instantly and routed to the right team for resolution.

Key advantages:

- Faster processing: Minutes instead of hours to verify documents

- Lower error risk: Consistent data checks eliminate manual misreads

- Scalability: Handles thousands of invoices with no increase in headcount

- Fraud prevention: Detects duplicate submissions and document tampering

- Clear workflows: Exceptions go to the warehouse, procurement, or AP automatically

- Audit‑ready: Every comparison and resolution is logged

When it works best: For any organization handling moderate to high invoice volumes, multiple suppliers, or varied document formats.

How to Automatically Reconcile Invoices, Delivery Notes, and Purchase Orders

Reconciling these three documents manually is slow and error-prone, especially when dealing with high invoice volumes. Automating the process saves time, reduces mistakes, and ensures every payment is accurate.

Follow these steps to set up an automated reconciliation workflow:

Step 1: Import and Digitize Your Documents

- Gather invoices, purchase orders, and delivery notes in a central system

- Accept multiple input sources such as email, cloud storage, EDI, or direct integration with your ERP

- Store digital copies for easy access and audit readiness

Step 2: Extract Key Data with OCR and AI

- Use OCR to read information from scanned or PDF documents

- Capture key fields like item codes, descriptions, quantities, unit prices, total amounts, PO numbers, and supplier details

- Standardize formats for dates, currencies, and units of measure so they match across documents

Step 3: Match and Compare Line Items

- Match quantities, SKUs, prices, units of measure, totals, tax structures, and references between invoice, PO, and delivery note

- Apply tolerance settings for minor, approved differences (for example, ±2 units or ±2% price variance)

Example: PO lists 250 units, delivery note shows 230, invoice shows 250 – flagged for review.

Step 4: Identify and flag discrepancies

- Highlight quantity mismatches, missing items, pricing errors, or extra charges not listed in the PO

- Use color‑coded or visual indicators so your team can spot issues quickly

Step 5: Route Exceptions For Review

- Configure rules to send quantity mismatches to the warehouse team, pricing issues to procurement, and irregularities to accounts payable

- Keep all communication and resolution steps logged for audit purposes

- Provide a side‑by‑side comparison view so each team works from the same evidence

Step 6: Approve and process matched invoices

- Once all fields match or discrepancies are resolved, approve the invoice for payment

- Send completed records to your accounting or ERP system automatically

- Keep a complete audit trail for compliance and reporting requirements

Automating reconciliation in this way ensures that every payment is based on verified, consistent data. It also frees your accounts payable team from repetitive checks, allowing them to focus on resolving the exceptions that matter most.

Automatically Compare Invoices, Delivery Notes, and POs

Comparing invoices against delivery notes and purchase orders is one of the most reliable ways to prevent payment errors and fraud in accounts payable. By verifying every invoice against its purchase order and goods receipt, you confirm that you are paying only for what was ordered and delivered.

When done manually, this process works, but it can be slow, resource‑heavy, and prone to human error. Automated, AI‑driven reconciliation speeds up approvals, catches discrepancies earlier, and keeps your suppliers paid accurately and on time.

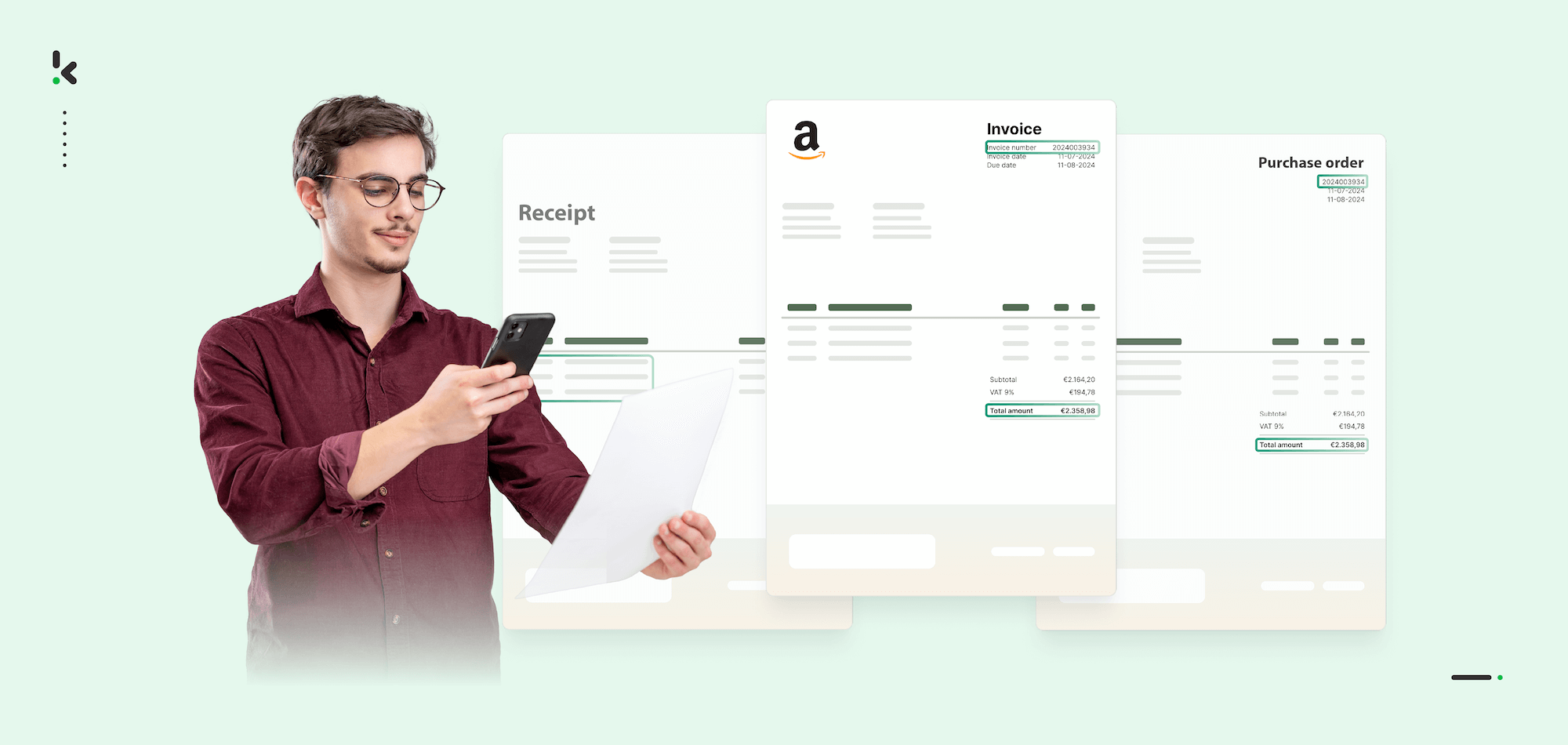

That’s where Klippa DocHorizon can make a difference.

Klippa helps finance teams set up end‑to‑end reconciliation workflows that fit their existing tools and processes. Here’s how:

- Flexible document intake and output: Capture vendor documents from any source, such as email, cloud storage, or vendor portal, and send processed results directly to your accounting or ERP system.

- AI‑powered OCR and document classification: Read any invoice, PO, or delivery note format, then automatically classify and extract all relevant details.

- Fraud detection: Run layered fraud detection analysis, including image forensics, EXIF and metadata checks, and pixel‑level tampering detection, to uncover altered or duplicate invoices before they reach payment.

- Data matching database: Store extracted data in secure datasets, compare invoice details against related POs and receipts, and flag mismatches automatically.

- Human‑in‑the‑loop review: Route alerts to authorized personnel via human-in-the-loop for quick decisions when an exception or suspected fraud is detected.

- Batch or single‑document processing: Handle documents one by one or in bulk, and include historical records for reference and matching.

- Security and compliance: Operate on ISO 27001‑certified servers with GDPR‑level data protection to maintain compliance in regulated industries.

AI‑powered document comparison combined with layered fraud detection makes it much harder for incorrect or fraudulent invoices to pass through your AP process. Because these checks run in seconds, your AP team can maintain accuracy without slowing down payment cycles.

Want to see how it works? Book a demo or contact us to see firsthand how you can speed up your reconciliation process.

FAQ

It means comparing the details in all three documents to confirm that what was ordered, delivered, and billed matches before approving payment.

Mismatches happen due to partial deliveries, price changes, incorrect units of measure, wrong PO numbers, timing differences, or human error.

Yes. Three‑way matching is the formal term for verifying a purchase order, delivery note, and supplier invoice before issuing payment.

Line‑item data such as SKUs, descriptions, quantities, unit prices, totals, taxes, delivery terms, and PO references.

It stops overpayments, catches missing or incorrect items, flags unapproved price changes, and helps detect duplicate or fraudulent invoices.

They are acceptable variance limits for quantities or prices, allowing minor differences (for example, ±2%) to pass automatically without manual review.

Automation uses OCR and AI to read document data, compare it instantly, flag mismatches, and route exceptions to the right team for resolution.

Yes. Modern systems process PDFs, scanned images, spreadsheets, and electronic data, standardizing them for easy comparison.

It is most common for physical goods, but services can be reconciled using delivery confirmation or completion certificates in place of a delivery note.

Klippa reads and extracts data from invoices, POs, and delivery notes, matches them automatically, applies tolerance rules, and flags any discrepancies before sending matched records to your ERP or AP system.