If you run rewards or loyalty programs, you already know that activation campaigns like cashback promotions can be expensive and time-consuming to manage.

Every submitted receipt, invoice, or proof of purchase has to be checked manually. A process that slows campaigns, drives up back-office costs, and often results in human errors. Some companies try to reduce costs by outsourcing this manual validation to low-wage countries, but that approach can create quality issues, slower turnaround times, and even GDPR compliance risks.

There’s a better way. By using automated cashback processing powered by OCR and AI, brands can instantly verify purchases, apply campaign rules, detect fraud, and disburse rewards — all without manual review. This means faster payouts for customers, significant cost reductions for your business, and more successful marketing activations overall.

In this blog, you’ll find out how to achieve a fully automated cashback campaign processing setup with Klippa.

What is Cashback Processing?

Cashback processing is the method businesses use to verify customer purchases and issue rewards such as cash, loyalty points, or digital credits as part of a promotional campaign.

It typically involves three core actions:

- Confirming the proof of purchase is genuine,

- Checking that it meets the campaign’s eligibility criteria, and

- Calculating and delivering the reward to the customer’s account or wallet.

This process is essential in loyalty programs and marketing activation campaigns to ensure payments are accurate, fraud is prevented, and customer trust is maintained.

Steps of Cashback and Marketing Activation Campaigns

Cashback and marketing activation campaigns typically follow a three-step process to handle customer submissions and issue rewards. These steps are designed to ensure purchase validity, adherence to campaign rules, and accurate payment.

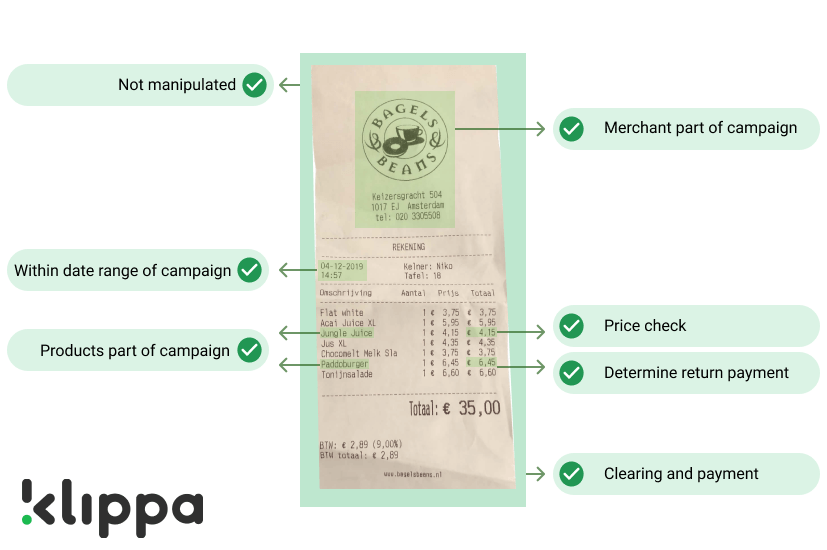

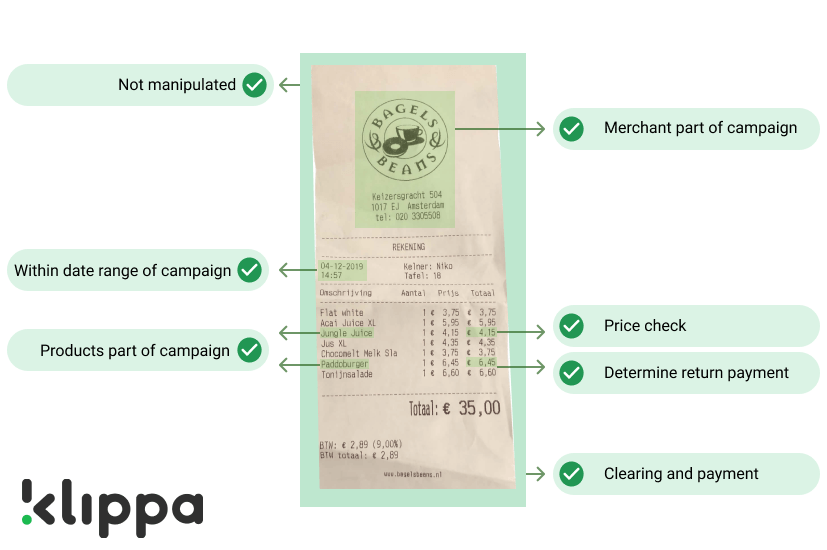

Step 1 — Purchase Validation (Fraud Prevention)

The first step is verifying that the submitted proof of purchase, such as a receipt, invoice, or product photo, is genuine and untampered. This protects the campaign budget from fraudulent claims.

Step 2 — Campaign Eligibility Check

Once validated, the purchase must be matched against the campaign’s predefined rules:

- Product is on the eligible list

- Purchased from a participating merchant

- Transaction date falls within the promotion timeline

Step 3 — Payment Clearing & Disbursement

After eligibility is confirmed, the cashback amount is calculated and delivered to the customer via their account, digital wallet, or loyalty balance.

Even though these steps appear straightforward, processing thousands of submissions manually is time-consuming, costly, and prone to human error. This is why many organizations are shifting from traditional workflows to automated systems that offer speed, scalability, and higher accuracy.

Manual Cashback Processing Workflow

Manual cashback processing is the traditional, human-driven method of handling customer reward claims. Each submission — whether it’s a receipt, invoice, or product photo — is individually reviewed by a back-office team before any cashback reward is issued.

This process generally follows three steps:

- Manual Purchase Validation: Staff examine the proof of purchase to confirm authenticity, looking for visible signs of tampering, duplication, or forgery.

- Manual Campaign Eligibility Check: The purchase details are compared against the campaign’s rules — such as product eligibility, participating store lists, and purchase dates. This often involves manually reading receipts and cross-referencing them against spreadsheets or printed guidelines.

- Manual Payment Clearing & Disbursement: Once approved, the cashback amount is calculated based on campaign rules, and the payout is arranged via bank transfer, digital wallet credit, or loyalty points update, followed by manual reconciliation.

Downsides of Manual Cashback Processing

While manual cashback processing can work for small, occasional campaigns, it faces significant hurdles when scaled:

- Slow Turnaround Times: Claims can take days or weeks to validate and pay out, reducing customer satisfaction.

- High Labor Costs: Large campaigns need substantial staffing, especially during peak redemption periods.

- Inconsistent Quality: Human error in reading documents or applying rules can lead to incorrect payouts or missed fraud detection.

- Scalability Issues: Handling thousands of claims often requires outsourcing, which introduces potential compliance risks and quality control problems.

- Limited Fraud Detection: Manual checks struggle to catch subtle tampering or duplicate claims at scale.

Manual cashback processing remains prevalent in certain industries due to established workflows and minimal tech investment, but its inefficiencies become increasingly visible in high-volume or time-sensitive campaigns.

These challenges have led many businesses to explore automation, which handles the same steps quickly, accurately, and with greater scalability. Next, we’ll look at how cashback automation works in practice.

How Cashback Automation Works

Cashback automation uses technologies like Optical Character Recognition (OCR), Artificial Intelligence (AI), and integrated payment systems to handle the same verification, eligibility, and payment steps found in manual cashback processing but with far greater speed, accuracy, and scalability.

Instead of relying on human staff to review each submission, automated workflows process claims end-to-end in seconds.

Here’s how it works in practice:

Purchase Tracking

Customers upload a proof of purchase (receipt, invoice, or product photo) through a campaign website, mobile app, or email. Some systems can also track transactions automatically via linked payment cards or merchant integrations.

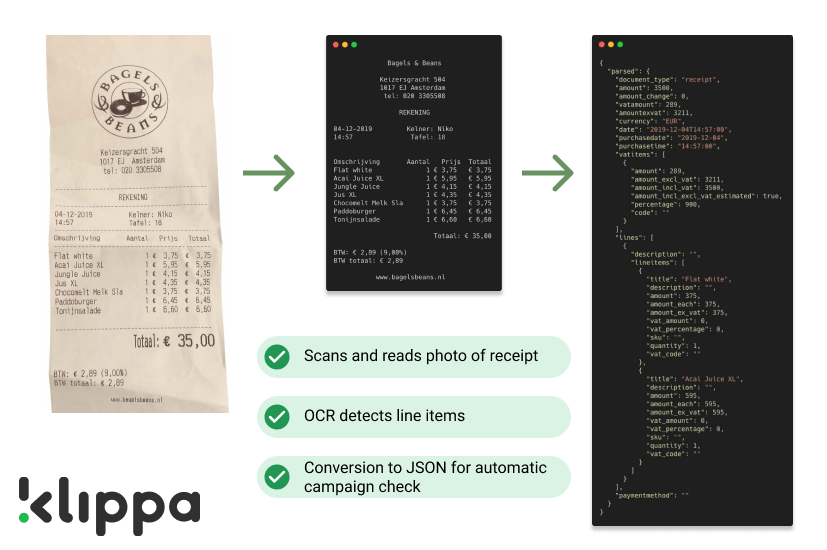

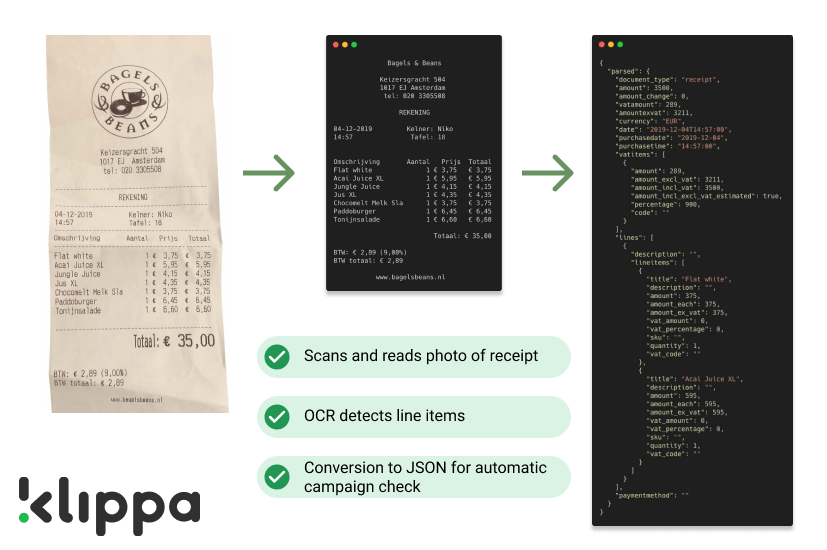

OCR Data Extraction

Optical Character Recognition scans the document image and extracts key details such as product line items, merchant name, purchase price, date, and product codes (e.g., EAN or UPC).

Automated Campaign Rule Matching

AI checks the extracted data against campaign rules to confirm the purchase meets all eligibility criteria, including product type, retailer participation, and valid purchase period.

Fraud Detection

The system runs anti-fraud checks, including duplicate image detection, metadata verification, and pixel analysis to identify altered or counterfeit proofs.

Reward Calculation

The cashback amount is computed automatically based on predefined campaign logic (e.g., fixed value or percentage of purchase price).

Instant Payment Disbursement

Integrated payment APIs transfer the reward to the customer’s bank account, digital wallet, or loyalty points balance immediately after approval.

Financial Reconciliation (Optional)

For B2B campaigns, automated reconciliation matches payouts to campaign budgets and verifies against accounting records.

How to Automate a Cashback Campaign

Automating a cashback campaign involves replacing manual verification and payment processes with technology that can process claims instantly, accurately, and at scale.

Here’s a step-by-step guide to planning, launching, and managing an automated cashback program:

1. Define Your Campaign Rules

- Decide which products or services are eligible for cashback.

- Set promotion dates and participation limits.

- Determine reward amounts and payout methods (fixed value, percentage of purchase, points).

2. Choose an Automation Platform

- Look for solutions that combine OCR (Optical Character Recognition) for data extraction with AI for eligibility and fraud checks. If you’re unsure where to start, see Klippa’s guide to the best OCR software for key features and selection tips.

- Ensure the system can handle your required document types (receipts, invoices, product photos).

3. Integrate Payment Systems

- Connect the automation tool to your bank, payment gateway, or loyalty points system via secure APIs.

- Support multiple payout methods for customer flexibility.

4. Set Up Fraud Detection Parameters

- Enable duplicate image detection, metadata checks, and pixel pattern analysis.

- Define rules for flagging suspicious submissions for manual review.

5. Test the Workflow

- Run trial submissions to ensure accurate data extraction, rule matching, and payment.

- Test edge cases like incomplete documents, unusual formats, or borderline eligibility.

6. Launch the Campaign

- Promote it through your website, email marketing, social media, and in-store materials.

- Ensure customers know how to submit proofs and receive rewards.

7. Monitor and Optimize

- Use dashboards and reporting tools to track submissions, approvals, payouts, and fraud flags.

- Adjust campaign rules, reward structures, or fraud filters based on real-time data.

Best Practices for Smooth Automation

- Keep campaign rules simple to avoid submission confusion.

- Use OCR models trained for your industry’s typical receipt or invoice formats.

- Clearly communicate turnaround times to customers, even if rewards are instant.

- Regularly update fraud detection algorithms to counter new tampering techniques.

Once an automated cashback campaign is up and running, the benefits become clear: from faster payouts to lower costs and improved fraud prevention.

Benefits of Automatic Cashback Processing

Automatic cashback processing transforms the traditional, manual reward claim workflow into a fast, accurate, and scalable system. By using OCR and AI, businesses can verify purchases, match campaign rules, detect fraud, and pay rewards — all within seconds.

For Customers

Automatic cashback processing greatly improves the redemption experience:

- Instant rewards: Payouts are delivered in seconds, not days or weeks.

- Minimal effort: No need to mail receipts, fill out lengthy forms, or wait for manual checks.

- Greater transparency: Customers can track claim status in real time via apps or portals.

- Multiple payout options: Rewards can be sent to bank accounts, wallets, or loyalty points balances.

For Businesses

Automation delivers measurable operational and financial advantages:

- Significant cost reduction: Lower back-office labor needs, often saving up to 70% compared to manual processing.

- Scalability: Handle thousands of claims during peak campaigns without proportional staffing increases.

- Improved fraud detection: AI can identify duplicate claims and tampered proof with far greater accuracy than manual review.

- Higher customer engagement: Faster payouts improve satisfaction, loyalty, and repeat purchase rates.

- Compliance assurance: GDPR-compliant workflows protect customer data while meeting regional privacy requirements.

Automatic cashback processing benefits both sides: customers enjoy seamless and rewarding experiences, while businesses gain efficiency, security, and profitability.

One of automation’s most valuable strengths is its ability to detect and prevent fraudulent claims. In the next section, we’ll explore how fraud prevention works in cashback programs.

Fraud Prevention in Cashback Programs

Fraud prevention is a critical part of running cashback and loyalty campaigns. Without proper safeguards, fraudulent claims can quickly drain budgets, undermine trust, and distort campaign performance results.

Modern fraud prevention strategies in cashback programs combine data checks, image analysis, and transaction monitoring to identify suspicious submissions before a reward is issued.

Key techniques include:

- Duplicate claim detection – Comparing new submissions against a database of past proofs. This can involve image similarity scoring and hash-based matching of key receipt or invoice fields (e.g., date, merchant, product line).

- Metadata verification – Checking hidden file data, such as timestamps, device information, and GPS location, to confirm authenticity and flag anomalies.

- Pixel structure & image integrity analysis – Detecting signs of editing in proof-of-purchase images, such as inconsistent lighting, irregular font rendering, or mismatched backgrounds.

- Transaction cross-checks – Matching claim details against merchant or payment processor records where integrations exist.

- Automated rule-based flags – Identifying high-risk submissions that exceed campaign limits, come from unapproved channels, or show unusual patterns (e.g., multiple claims from the same person in a short period).

To explore these techniques in more detail, watch our video below. It demonstrates how advanced AI tools can detect tampered images, verify metadata, and identify duplicate claims in real-world cashback scenarios.

Use Cases of Cashback Processing Automation

Automated cashback processing can work with various types of proof of purchase. Here are three practical examples of how different campaigns can be handled automatically:

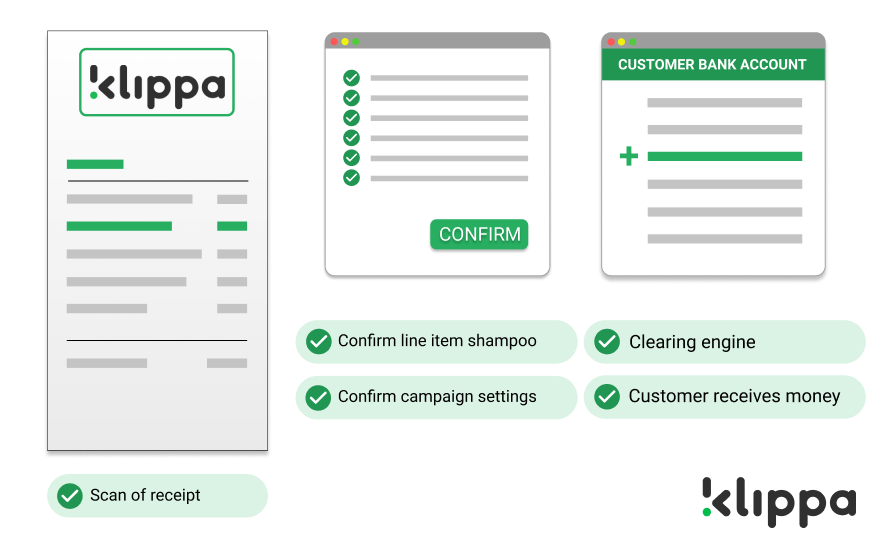

Receipt‑based cashback automation

Example: A shampoo brand runs a cashback campaign. Customers upload a photo of a receipt showing the qualifying shampoo purchase. The system verifies the image, scans line‑item data via OCR, and matches it to campaign rules. If eligible, the clearing engine calculates the cashback amount and triggers payment with no further manual effort.

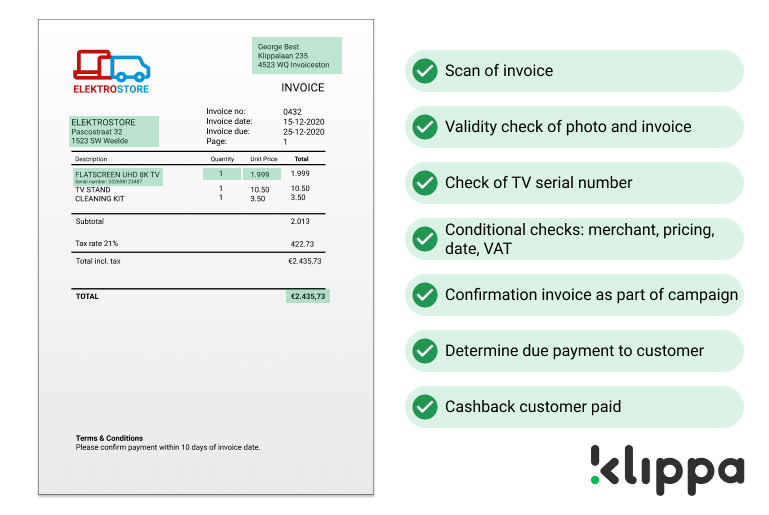

Invoice‑based cashback processing

Example: An electronics brand offers cashback on new smart TVs. Customers buy online and upload purchase invoices. OCR reads the serial number, validates it against the campaign database, and confirms the reward. The clearing engine determines the cashback total and processes payment seamlessly.

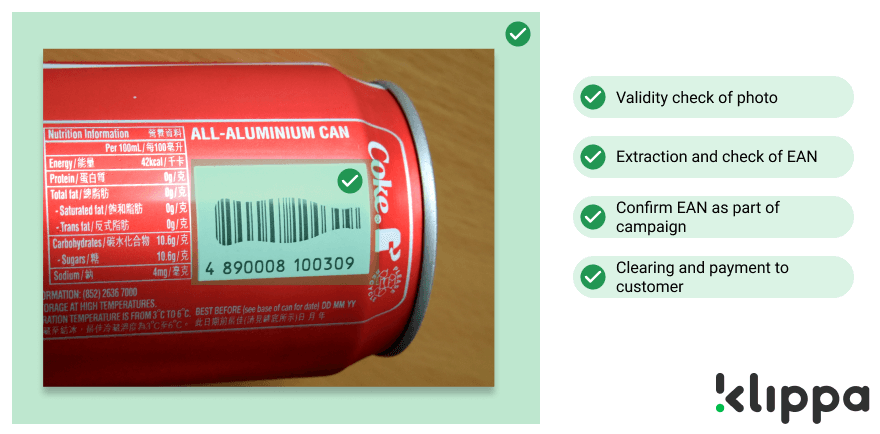

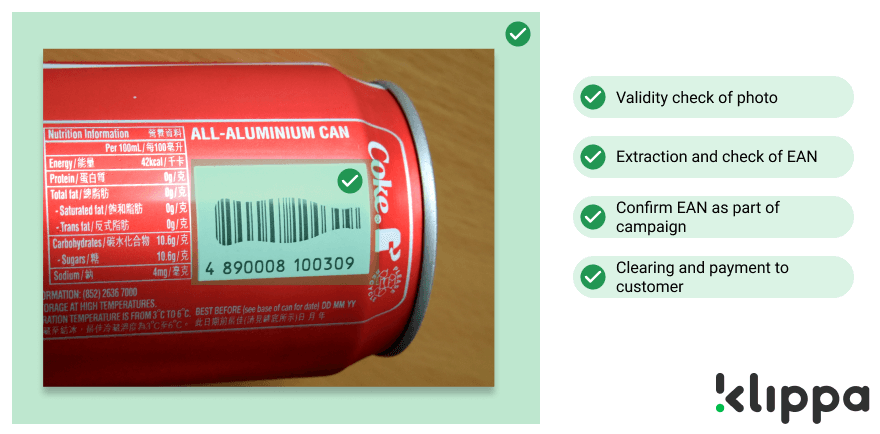

Product photo cashback validation

Example: A cola brand promotes a rewards program based on EAN codes on product packaging. Customers take a photo of the purchased product showing the promotional code. The system verifies the image, confirms the EAN against campaign records, and initiates the clearing and payout process.

Automation adapts to receipts, invoices, product photos, or other proof types, making it suitable for campaigns in retail, FMCG, and e‑commerce.

The versatility of automated cashback processing means it can be applied to nearly any proof‑of‑purchase format. In the closing section, we’ll look at how Klippa can help you run secure, compliant, and cost‑effective campaigns from start to finish.

Automate Your Cashback Campaigns with Klippa

Running high-volume cashback or loyalty programs doesn’t have to involve days of manual paperwork or outsourced back-office teams. Klippa DocHorizon automates the full process, from verifying purchases to delivering rewards, using advanced OCR and AI technology.

Here’s how Klippa can help simplify and scale your campaigns:

- End-to‑end purchase validation — Instantly scan receipts, invoices, or product photos. Extract line items, merchant details, purchase dates, prices, and product codes.

- Automatic eligibility checks — Compare extracted data to your campaign rules in seconds, ensuring only qualifying purchases receive rewards.

- Advanced fraud prevention — Detect duplicates, image tampering, and metadata anomalies before payout. Protect your budget without slowing down legitimate claims.

- Instant payout processing — Connect with payment gateways, bank APIs, or loyalty systems to clear and deliver rewards immediately.

- GDPR‑compliant data handling — All processing occurs securely within the EU or in custom-deployed regional environments.

- Multi-language and multi-format support — Run campaigns across multiple markets with OCR models trained for European languages and adaptable to different proof document types.

With Klippa, you can:

- Cut operational costs by up to 70% compared to manual workflows.

- Scale effortlessly during large promotions without adding staff.

- Increase engagement through fast, frictionless reward delivery.

Ready to revolutionize your cashback and loyalty programs? Book a demo today to see Klippa DocHorizon in action, or contact our team to discuss how we can tailor a secure, scalable cashback automation workflow to your exact campaign needs.

FAQ

Cashback processing automation can handle receipts, invoices, product photos, and other proof‑of‑purchase formats. OCR technology extracts key details such as line items, merchant name, date, price, and product codes to verify campaign eligibility.

Rewards can be paid within seconds once a claim is approved. Automation replaces manual checks with instant data extraction, rule matching, and integrated payment processing, reducing turnaround from days or weeks to near‑real time.

Fraud detection combines duplicate image checks, metadata verification, and pixel structure analysis to identify tampering or altered proofs. Suspicious claims can be flagged for manual review before payouts are released.

Yes. Secure API integrations connect automation platforms to banks, payment gateways, loyalty programs, and mobile apps, allowing rewards to be disbursed directly to accounts, wallets, or points systems.

Currently, Klippa supports all Latin alphabet languages natively, but depending on the case, we can train our OCR models for other scripts on request. Campaigns can be deployed globally with region‑specific compliance settings.

Yes. With Klippa, all customer data is processed securely within the EU or in designated regional environments, ensuring compliance with GDPR and other local privacy regulations.

Klippa’s pricing depends on factors such as campaign volume, document types, integrations, and additional features like custom OCR training. You can try the platform for free with €25 in credits to test its capabilities, and request a tailored quote for your specific needs. Many clients achieve up to 70% cost savings compared to manual cashback processing.