Invoice processing is one of the key financial elements of any company. Research conducted by Levvel even stated that invoice processing tops all the other tasks that accounts payable employees are responsible for by a stunning 77%. With so many people involved, having a solid invoice processing workflow is essential.

At the same time, traditional methods are not seen as the holy grail of invoice processing anymore. Levvel, for example, concluded that manual data entry and inefficient processes are considered to be the biggest challenge that AP employees face during their work. Mostly as a result of traditional invoice processing.

To give you a deeper understanding of invoice processing, we will unfold everything you need to know about this subject. We will also discuss the other difficulties that come along with traditional invoice processing.

At the end of this blog, we disclose a method that can make this process much easier with the help of the right tools. Do you want to know how? Then stick with us.

What is Invoice Processing?

Invoice processing in accounts payable is the administrative task of receiving, reviewing, verifying, and approving invoices for payment. It ensures vendors or suppliers are paid promptly and accurately while maintaining accurate financial records.

The process typically includes verifying that goods or services have been received, checking for any discrepancies or errors, and ensuring that the invoice has been approved for payment by the appropriate parties. This allows companies to keep track of their expenses and make sure that they are not paying for services or products they did not receive.

Invoice processing methods can be used to process various types of invoices, including purchase invoices, sales invoices, expense invoices, and many more. Maintaining accurate financial records for a company also helps to improve vendor relationships, avoid late payment fees and comply with financial regulations. To do so, companies should have an invoice processing procedure in place.

Invoice Processing Workflow

A traditional invoice-to-pay process typically includes five steps:

- Receiving the invoice: Invoices are sent by the supplier to the merchant and can be received on paper, via mail, or e-mail.

- Verifying the invoice: The invoice is reviewed for accuracy, including checking that the correct goods or services have been received and that the correct prices have been charged. Any discrepancies or errors are identified and brought to the attention of the vendor for correction.

- Approval: Once the invoice has been verified, it is approved for payment by the appropriate parties within the organization. These can include a supervisor, manager, or other designated approver.

- Payment: After approval, the invoice is paid by the preferred method of the organization. This can be done either by issuing a check or making an electronic payment.

- Record keeping: Finally, the invoice, along with any supporting documentation, is filed and stored for future reference and compliance with financial reporting requirements. Adhering to the compliance requirement is especially important for potential audits that can be conducted.

These five steps can help you adhere to an adequate invoice processing procedure that can help your company stay organized and compliant. By keeping track of invoices, your company can keep track of its spending and make sure that it is not exceeding the budget.

For tax purposes, processing invoices correctly is also essential. Your company can make sure that it is reporting all of its income and expenses correctly, which prevents you from possible penalties from local tax authorities. All in all, it is a critical process and should be given the attention it deserves.

However, conventional methods of processing invoices come with challenges that companies have to face. In the next section, we will highlight the most crucial difficulties.

Difficulties of Traditional Invoice Processing

Traditional invoice processing can be a time-consuming and error-prone task, as it often involves manual data entry and document handling. Some difficulties of traditional invoice processing include:

Data entry errors

Manually entering invoice data into accounting software leads to errors, such as typos or transposed numbers, which can result in incorrect payments or disputes with vendors.

Delays in approval and payment

Conventional invoice processing takes longer than necessary to approve and pay off liabilities like Accounts Payable (AP), leading to delays in the AP process and potentially damaging vendor relationships. The average cycle time for processing a single invoice manually is 25 days.

Lack of insight

With manual invoice processing, it is difficult to track the status of invoices and to know who is responsible for approving them, especially when dealing with large invoice quantities.

Difficulty in maintaining compliance

Traditional invoice processing makes it difficult to comply with financial reporting requirements, as invoices and supporting documentation may be lost or misfiled.

Inefficiency

Processing invoices by hand is a very labor-intensive task. Moreover, it can be difficult to process a large volume of invoices in a timely manner.

Limited scalability

When a company scales up and the number of invoices increases, it is difficult to scale up traditional invoice processing methods to handle the increased volume. You would have to hire and train a lot of new employees.

Difficulty in detecting fraud

Traditional invoice processing methods rely on manual review and approval, which makes it more difficult to invoice fraud. Fraudulent invoices can be difficult to spot, as they may be disguised as legitimate invoices and may be mixed in with large volumes of legitimate invoices.

The difficulties that companies deal with in regard to traditional invoice processing can vary from minor effects to seriously impacting a company. The compounding effect of a mixture of these challenges can result in a catastrophe for the company and even its stakeholders.

But, as we mentioned before, there is a solution. Many companies still process their invoices the conventional way. If you want to stand out from the crowd and improve your invoice processing, the answer is automation.

Automation as a Solution

Invoice processing automation allows companies to abolish manual tasks involved within the invoice management workflow, such as data capture, validation, approval, invoice payment, and record keeping.

With the right automated invoice processing software, manual steps are streamlined, leading to quicker and more accurate results. Here’s how the process changes:

- Receiving the invoice: Invoices are automatically captured and processed, regardless of their format. This removes the need for manual data entry, as key details are extracted and stored electronically.

- Verifying the invoice: Instead of manually checking for errors, inconsistencies, or potential vendor fraud, the system matches the invoice details with purchase orders and delivery confirmations. Any discrepancies are flagged for further review, reducing the need for human intervention.

- Approval: Digital workflows send invoices to the appropriate person for review based on predefined rules. This eliminates delays caused by manual routing, allowing for quicker invoice approvals.

- Payment: Once approved, the system automatically schedules the payment. This ensures that payments are processed on time, reducing the risk of late fees or missed payments.

- Record keeping: Invoices and supporting documents are stored digitally, making them easy to access when needed for audits or compliance purposes. This also reduces the reliance on physical storage.

Automation simplifies the entire workflow, speeding up each step and minimizing the chances of errors. As one of the best practices in accounts payable, automation can make sure that all the difficulties of traditional invoice processing become history.

How Klippa Can Improve Your Invoice Processing

Invoice processing can be tedious and inefficient, but it doesn’t have to be. Forget about the challenges of manual workflow – entrust your invoices to Klippa SpendControl.

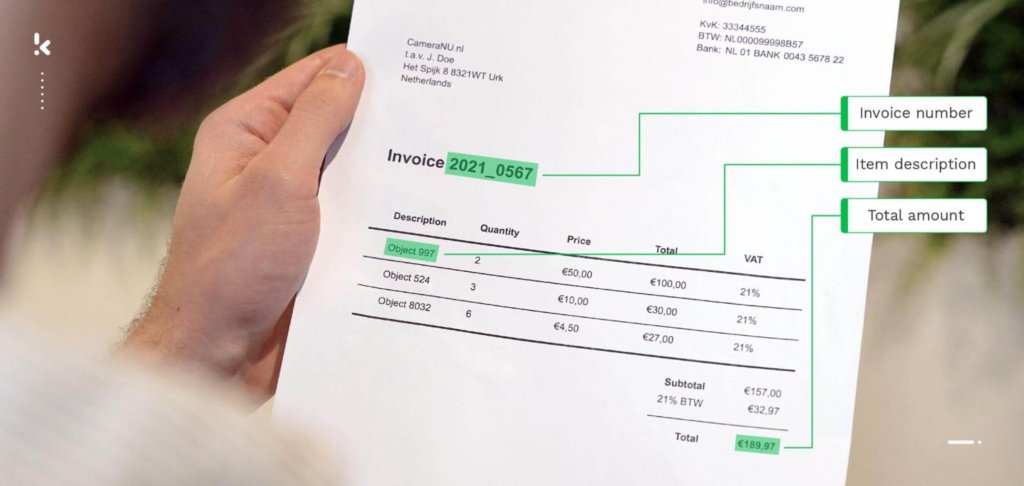

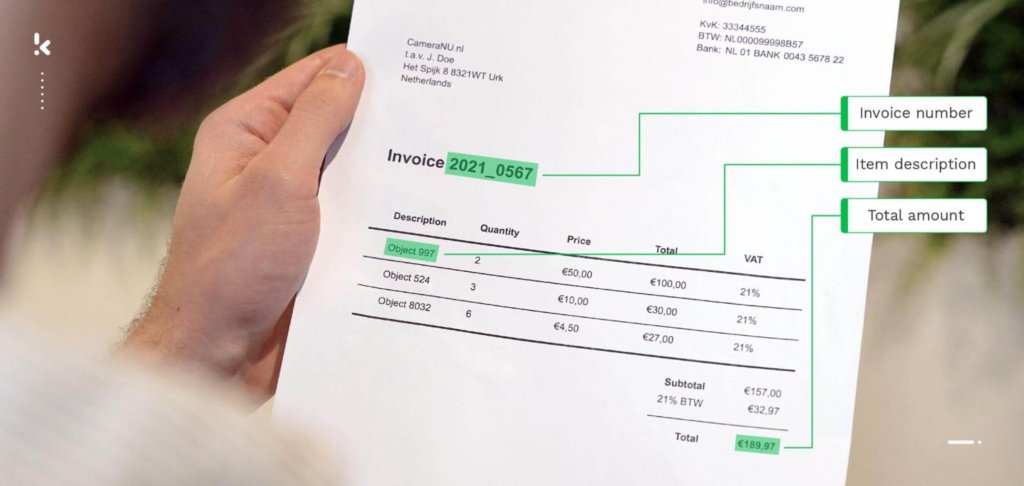

Process, approve, and manage all vendor invoices with our OCR-powered pre-accounting solution. Reduce the heavy workload into just a few clicks!

With SpendControl, you can:

- Manage your vendor invoices, employee expenses, and corporate credit cards in one platform

- Submit, process, and approve invoices via web or mobile app

- Achieve 99% invoice data extraction accuracy with Klippa’s OCR

- Regain control over your accounts payable with intuitive dashboards

- Customize your approval management with multi-level authorization flows

- Never fail to comply with tax and data privacy regulations with our ISO27001-certified and GDPR-compliant solution

- Rely on automatic multi-currency support for international payments

- Prevent invoice fraud with built-in duplicate and fraud detection

- Integrate SpendControl with your accounting and ERP software, like Quickbooks, NetSuite, or SAP

Take the next step in invoice processing – contact our experts for additional information or book a free demo below!

FAQ

The three key steps in invoice processing include receiving the invoice, verifying its accuracy, and approving it for payment. These steps ensure that the company is billed correctly for goods or services received and that the invoice is authorized before payment is made.

Invoice processing involves several tasks, such as receiving invoices from suppliers, checking them for accuracy, approving them for payment, issuing payments to the vendors, and maintaining records for compliance. Each task is crucial to ensuring proper financial management and vendor relationships.

Supplier invoice approval involves reviewing the invoice for accuracy, confirming that the goods or services were received, and ensuring that the pricing is correct. Once verified, the invoice is routed to the appropriate parties for authorization before payment is issued. In an automated system, this process is streamlined through predefined workflows that speed up approvals and reduce manual delays.

Invoicing software supports document management by automating data capture, organizing invoices in a centralized system, enabling easy retrieval, and ensuring compliance through secure storage and audit trails. It streamlines workflows, reduces manual errors, and integrates with other financial tools for efficient processing.