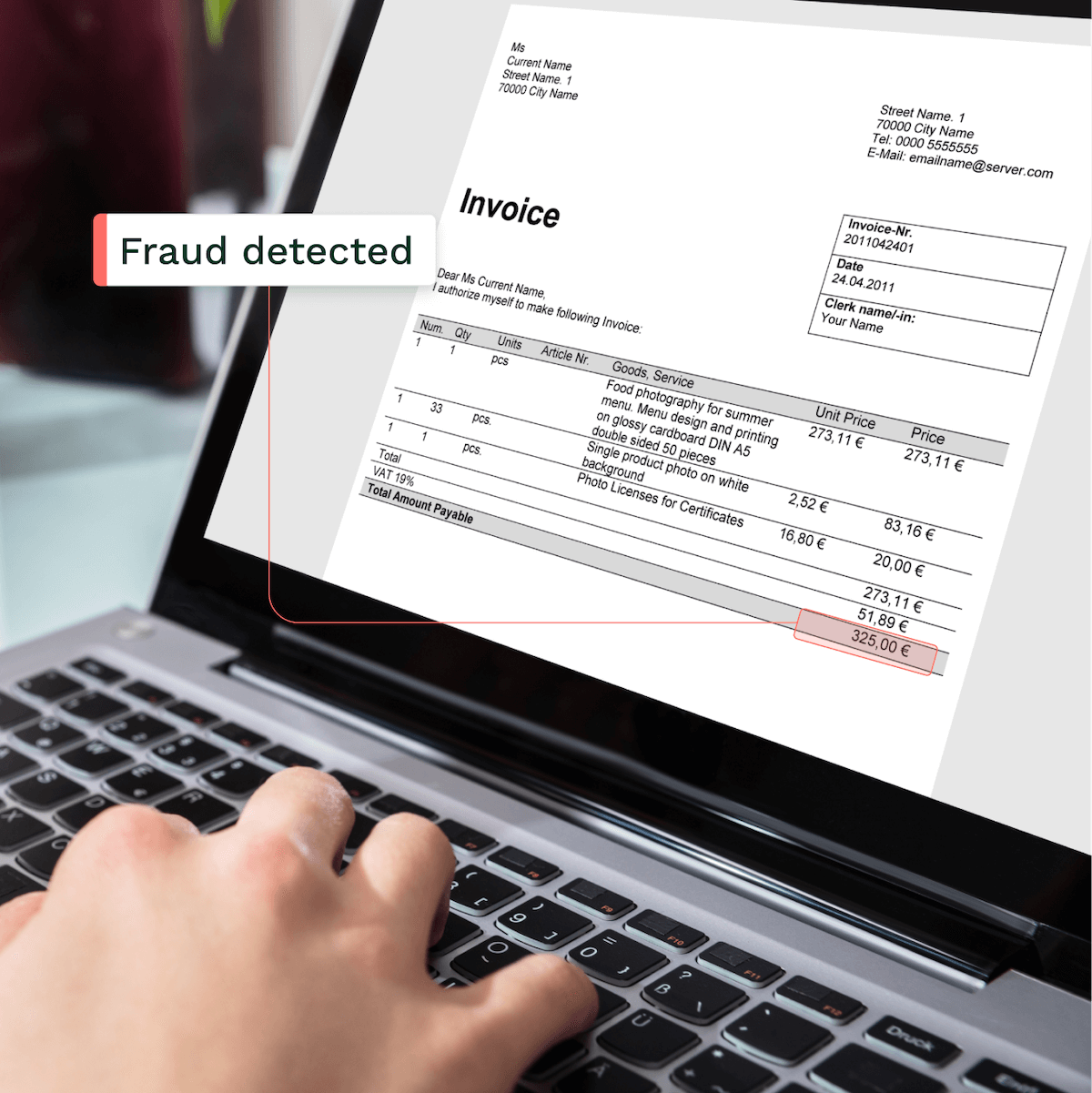

PDF Fraud Detection to Detect Fake Documents

Stop fake PDFs before they enter your digital workflows. Klippa DocHorizon automatically analyzes, validates, and flags PDF documents for fraud.

Trusted by 1000+ brands worldwide

<img decoding=”async” src=”https://www.klippa.com/wp-content/uploads/2024/02/Online-Payment-Platform-grey-logo.png” alt=””/>

<img decoding=”async” src=”https://www.klippa.com/wp-content/uploads/2024/02/DZBank-grey-logo.png” alt=””/>

<img decoding=”async” src=”https://www.klippa.com/wp-content/uploads/2024/02/Nivea-grey-logo.png” alt=””/>

<img decoding=”async” src=”https://www.klippa.com/wp-content/uploads/2024/02/Krombacher-grey-logo.png” alt=””/>

<img decoding=”async” src=”https://www.klippa.com/wp-content/uploads/2024/02/Car-Offer-grey-logo.png” alt=””/>

<img decoding=”async” src=”https://www.klippa.com/wp-content/uploads/2024/02/Car-Offer-grey-logo.png” alt=””/>

CHALLENGES

The Challenges of PDF Fraud In Document Workflows

Detecting PDF fraud is harder than ever. AI tools and sophisticated PDF editing software make it hard for the naked eye to detect altered or fake PDFs. This is the case for both manual and automated document workflows. Major challenges that many industries are now facing:

How Klippa DocHorizon Detects Fraud in PDFs

Klippa DocHorizon takes any PDF you send, whether it comes in by upload, email, app or API, and quickly checks its structure, content and metadata for signs of tampering. Within seconds, you get a clear fraud score, a short explanation of what looks suspicious and guidance on whether to approve, reject or send the document to manual review.

KEY FEATURES

Why Choose Klippa for PDF Fraud Detection

Klippa combines AI technology with user-friendly tools to help you detect and prevent fraud more efficiently and accurately. From document verification to anomaly detection, Klippa helps you reduce fraud risks, improve PDF handling efficiency, and stay compliant.

AI-based fraud detection

Klippa’s AI models flag suspicious PDFs, helping you identify over 66% of fraudulent documents.Document classification

Automatically recognize and sort various claim documents (e.g. ID cards, receipts, invoices, damage reports) for smoother digital workflows.Faster fraud reviews

Klippa flags high-risk documents and organizes supporting data to help your team review cases faster and make decisions with confidence.Seamless integration

No code platform

Build custom digital document review workflows and automatically flag for suspicious cases.20+ formats supported

Process documents in JSON, CSV, PDF, XML, XLS, XLSX, UBL, PNG, TIFF, DOC, DOCX, JPG, and many more.Multi-page processing

Review long or multi-page PDF files, such as bank statements or invoices, with high speed and efficiency.Ensured data protection

At Klippa, we ensure that our solutions process files in full compliance with regulatory standards.

Read What Our Customers Say About Us

Frequently Asked Questions

What types of PDFs can Klippa check for fraud?

Can we combine PDF fraud detection with other Klippa use cases?

Does Klippa store our PDFs and data?

How accurate is the fraud detection, and how do you handle false positives?

How does Klippa integrate with our existing systems?

How fast is the analysis?