Fraud, rapidly evolving regulations, and outdated customer information make compliance a constant challenge for financial institutions and regulated businesses. Know Your Customer (KYC) ensures your existing customer records remain accurate, complete, and compliant throughout the relationship, not just at onboarding.

By proactively updating and verifying customer data, you reduce fraud risks, meet strict Anti-Money Laundering (AML) requirements, and avoid penalties. In this guide, you’ll learn what KYC remediation is, why it matters, the triggers for when to perform it, and a step‑by‑step process you can follow — plus how automation tools like Klippa DocHorizon can make it faster and more cost‑efficient.

Key Takeaways

- KYC remediation reviews and updates customer data to stay accurate and compliant with AML/CFT rules.

- Triggers include scheduled reviews, profile changes, new regulations, unusual account activity, and PEP/Sanction alerts.

- 8‑step process: identify outdated data → collect documents → verify identity → screen lists → reassess risk → cleanse → update systems → monitor.

- Automation with AI and OCR speeds communication, document checks, validation, and fraud detection while reducing errors.

- Benefits: faster processing, higher accuracy, stronger compliance, lower fraud risk, cost savings, and better risk insights.

What is KYC Remediation?

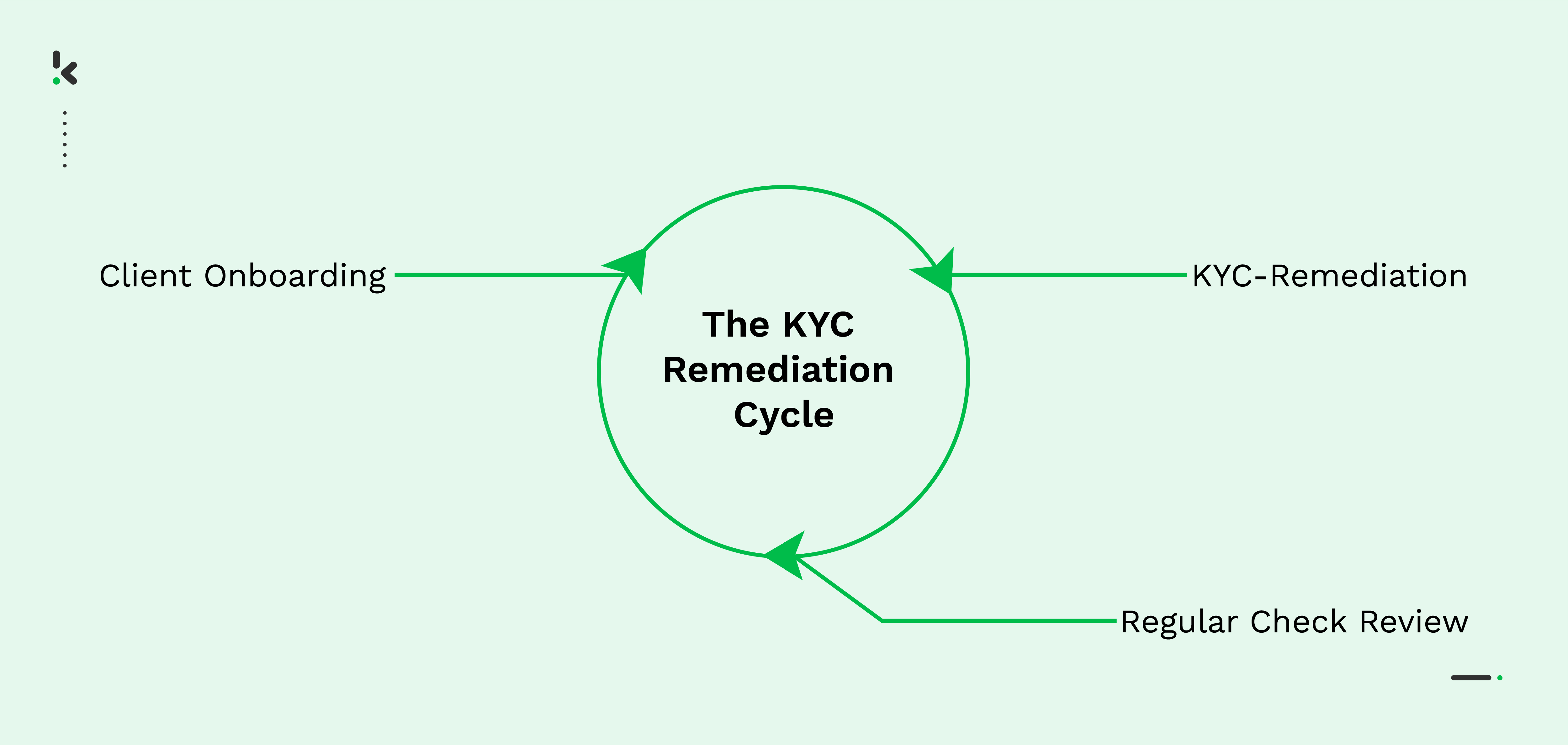

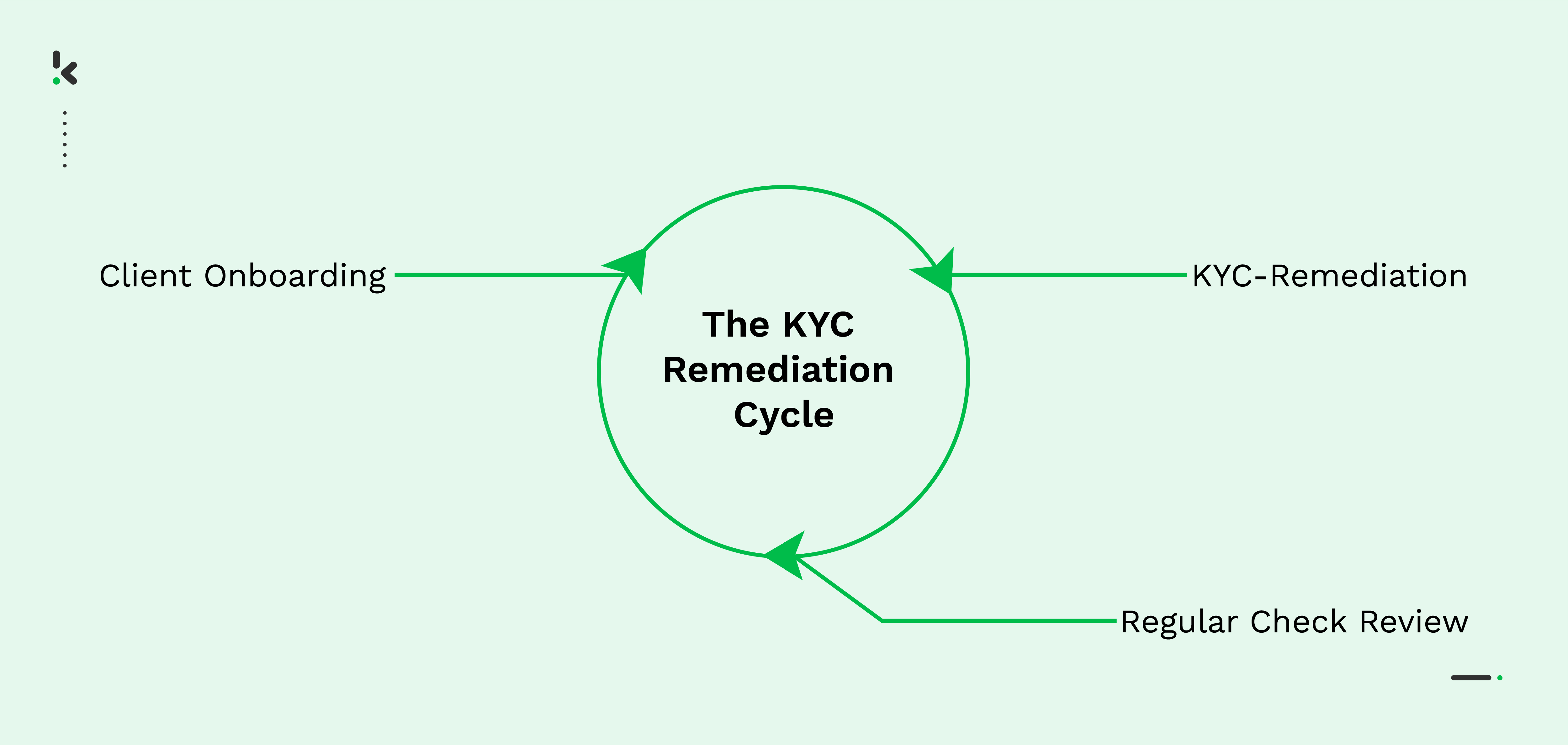

KYC remediation is the systematic review, updating, and cleansing of existing customer data to ensure accuracy, completeness, and compliance with current Anti-Money Laundering (AML) and Countering the Financing of Terrorism (CFT) regulations.

It involves identity re-verification, renewal of expired documents, reassessment of risk profiles, and continuous monitoring to prevent illegal activity, maintain customer trust, and avoid regulatory fines.

Benefits – Why KYC Remediation is Crucial

- Regulatory compliance – Keeps records aligned with evolving AML/KYC laws.

- Risk mitigation – Reduces exposure to money laundering, fraud, and terrorism financing.

- Updated risk assessment – Enables accurate scoring with current data.

- Fraud prevention – Identifies high-risk customers via regular screening.

- Improved customer relationships – Maintains trust through proactive data upkeep.

- Avoidance of fines – Prevents costly penalties for outdated or incomplete records.

Keep in mind that the main reason to perform KYC remediation is to remain compliant with KYC and AML regulations. Companies not performing KYC remediation risk violating these regulations and facing a severe fine. In 2020 alone, the number of fines imposed by AML Intelligence was more than 20 billion euros.

Triggers – When to Perform KYC Remediation

- Periodic review cycles – e.g., low-risk: every 24–36 months; medium-risk: 12–24 months; high-risk: 6–12 months.

- Changes in customer profile – New address, name change, occupation change.

- Regulatory updates – New AML/KYC requirements per jurisdiction.

- Significant activity/inactivity – Large transactions, sudden spikes, dormant accounts.

- Risk profile change – Triggered by PEP/Sanction screening results or adverse media.

Step-by-Step KYC Remediation Process

Here are the key steps in the KYC remediation process:

Step 1: Identify At-Risk or Outdated Records

Proactively scan your customer database to flag profiles with incomplete, expired, or inconsistent information. This includes expired IDs, outdated addresses, mismatched details across accounts, or missing proof of source of funds.

Step 2: Collect Missing or Updated Documents

Reach out to customers to request updated identity documents (passport, driver’s licence), proof of address (utility bill, bank statement), tax identification numbers, or source‑of‑funds documentation.

Secure channels, such as encrypted email links or self‑service client portals, help maintain confidentiality. Clearly communicate regulatory requirements, submission deadlines, and consequences of non‑compliance, as expected under Customer Identification Program (CIP) obligations under the U.S. Patriot Act.

Step 3: Verify Customer Identity

Authenticity checks involve comparing submitted documents against authoritative sources like government registries, credit bureaus, or utility databases. Use biometric technologies (e.g., facial recognition against a photo ID or liveness detection) to prevent impersonation or forged identities.

For high‑risk clients, conduct Enhanced Due Diligence (EDD) by verifying employment, beneficial ownership structures, or corporate filings, aligning with your AML and risk management policies.

Step 4: Screen Against PEP & Sanction Lists

Run updated profiles through global regulatory watchlists, such as the U.S. OFAC Sanctions List, EU Consolidated List, UN Sanctions List, and trusted Politically Exposed Persons databases. Add adverse media screening to identify negative press or litigation risks.

Step 5: Reassess Risk Profiles

Update each customer’s risk score based on newly verified information, transaction monitoring results, and changes in jurisdiction‑specific regulations. Apply pre‑defined key risk indicators (KRIs) such as transaction size, type, and frequency to classify customer risk levels.

For higher‑risk categories, adapt monitoring intensity and review cycles (e.g., semi‑annual instead of annual assessments) and consider implementing stronger onboarding checks for similar future profiles.

Step 6: Data Cleansing & Standardization

Standardise the format of all customer records for consistency, ensuring names, addresses, and dates follow uniform templates. De‑duplicate profiles to remove redundant entries, correct data entry errors, and eliminate irrelevant data to comply with privacy laws such as GDPR’s “right to be forgotten” or CPRA deletion mandates.

This step reduces operational risk and ensures your compliance systems can reliably process and report customer data.

Step 7: Update Customer Profiles in Core Systems

Integrate the newly validated data into your internal systems, such as CRM, core banking, and compliance management solutions, via secure API connections to eliminate manual re‑entry. Adding tags such as “PEP risk,” “EDD required,” or “High‑risk jurisdiction” helps trigger appropriate workflows.

Ensure audit trails capture who updated the record and when, supporting transparency for regulators and internal governance.

Step 8: Implement Continuous Monitoring

Establish periodic review cycles based on risk category (e.g., low‑risk every 24–36 months, medium‑risk every 12–24 months, high‑risk every 6–12 months). Pair these with real‑time transaction monitoring to detect anomalies, sudden spikes in activity, or suspicious behaviour.

Automated alerts tied to KRIs and regulatory thresholds allow compliance teams to intervene quickly when risk indicators change between scheduled reviews.

How to Automate KYC Remediation

Automation transforms KYC remediation from a manual, resource‑intensive task into a streamlined, auditable, and scalable process. Advanced solutions such as Klippa DocHorizon combine AI-powered OCR, data validation, and secure integrations to handle the most time‑consuming aspects.

Key ways to automate your KYC remediation:

1. Automated Customer Communication

- Deploy email/SMS workflows that send document update requests before proof of identity or proof of address expires.

- Configure triggers based on risk scores or regulatory timelines (e.g., 12‑month review for high‑risk clients).

2. AI‑Powered Document Processing

- Use OCR to extract key fields (name, date of birth, address, ID number) directly from submitted documents with 99% accuracy.

- Parse structured data from unstructured sources such as scanned forms, utility bills, or bank statements.

3. Real‑Time Data Validation

- API connections to third‑party databases (government registries, credit bureaus) to confirm identity and address without manual checks.

- Cross‑check details against PEP/Sanctions lists automatically.

4. Fraud Detection and Security

- Integrate document fraud detection, such as Photoshop detection, EXIF metadata analysis and duplicate detection, to flag alterations, image manipulations, or forged scans.

- Assign confidence scores to each verification, triggering human review for lower‑confidence results.

5. Workflow Integration via API

- Push validated data directly into CRM, core banking, or compliance systems, eliminating duplicate entry.

- Tag records with updated risk ratings, expiry dates, and next review schedule.

6. Automated Monitoring and Alerts

- Real‑time transaction monitoring triggers immediate remediation cycles if suspicious activity occurs between scheduled reviews.

- Custom dashboards for compliance teams track progress against remediation KPIs.

Practical example:

A bank handling 10,000 customer records can schedule automated reminders, receive updated documents securely through a web portal, run validations via OCR and sanction screening in seconds, and sync results into compliance systems, all with minimal manual input.

Benefits of Automated KYC Remediation

Automating KYC remediation delivers measurable operational, compliance, and risk‑management advantages. Beyond reducing manual workload, it strengthens data integrity and governance in line with evolving AML/KYC regulations.

Core benefits:

- Time Efficiency & Scalability – Reduce document review times from minutes to seconds. Handle thousands of records in parallel without adding headcount.

- Improved Accuracy – AI/OCR minimizes human input errors and ensures clean, standardised data formats. Automatic data validation catches issues at the point of entry.

- Compliance Assurance – Continuous screening against regulatory lists keeps profiles current. Automated proof‑of‑record updates create clear audit trails for regulators.

- Fraud Risk Reduction – Immediate detection of document tampering through metadata analysis. Flags anomalies in customer behaviour between review cycles.

- Cost Savings – Reallocate compliance staff from repetitive checks to complex investigative work. Lower penalties and remediation costs by catching issues before audits.

- Actionable Insights – Enterprise dashboards provide granular visibility into remediation status, bottlenecks, and risk distribution. Analytics inform adjustments to KYC policies for higher efficiency.

Simplify your KYC remediation process with Klippa

The obligation to comply with AML and KYC regulations can be a real pressure on organizations. Each new update on those regulations can lead to a modification of your KYC process and can change the list and documents required from your clients.

We already introduced you to the importance of automating the KYC remediation process. You just read about all the benefits you can expect from it.

It is now time for you to find the right KYC remediation solution provider to help you automate some of the steps mentioned above. You can start your journey to automation and reap the benefits with Klippa DocHorizon, which can be customized according to your needs.

Want to reduce time, ensure compliance, and minimize fraud? All you need to do is contact our specialists to get more information, ask for a quotation, or schedule a free online demo with the form below!

FAQ

The KYC remediation process involves reviewing, updating, and validating customer data to ensure it is accurate and compliant with the latest regulatory requirements.

While the regular KYC process focuses on onboarding and verifying new customers, KYC remediation deals with maintaining and updating existing customer data to reflect current regulations and risk profiles.

KYC remediation should be conducted periodically or when regulatory requirements change, customer data becomes outdated, or a reassessment of a customer’s risk profile is necessary.

The main steps include reviewing existing customer data, identifying outdated or missing information, updating and validating data, and ensuring it aligns with current AML and regulatory standards.

Businesses can streamline KYC remediation by leveraging automation tools like AI and OCR to quickly review, update, and validate customer data, reducing manual effort and ensuring compliance efficiently.