Invoices, invoices, invoices. They’re a necessary part of running a business. But managing them on paper? That’s where things get messy.

Filing cabinets take up space. Searching for a missing invoice takes more time than it should. And when an audit comes around, paper systems rarely make things easier.

That’s why more businesses are choosing to store invoices digitally. It’s a simple change that helps you stay organized, save time, and reduce manual work.

In this article, we’ll walk through the benefits of digital invoice storage and how to implement it effectively.

Key Takeaways

- Transitioning to digital invoice storage helps businesses save time, minimize manual work, and improve accuracy across financial processes.

- Use OCR technology and clear file naming conventions to keep invoices organized, searchable, and audit-ready.

- Cloud storage and accounting software offer secure, flexible access to invoices from anywhere, ensuring compliance and easy collaboration.

- Automating invoice capture, approval, and archiving streamlines workflows and significantly boosts efficiency.

- Klippa SpendControl brings everything together by combining invoice processing, expense management, and digital storage in one AI-powered platform.

- With Klippa SpendControl, finance teams gain real-time visibility, secure storage, and automated approval flows. This enables faster, safer, and smarter financial management.

Why Businesses Are Switching to Digital Invoice Storage

The environmental argument for going paperless is well known, but the financial case is just as important and often overlooked.

Storing physical invoices comes with hidden costs. Filing cabinets, storage rooms, and off-site facilities don’t just take up space; they cost money. And the more invoices you generate, the more those costs grow.

Additionally, employees spend valuable time filing, retrieving, and managing paper invoices – time that could be allocated to more productive tasks. Add in overhead costs like lighting, climate control, insurance, and general maintenance, and the price of keeping paper systems quickly adds up.

And then there’s the risk: paper invoices can be damaged, lost, or thrown out by mistake. Replacing them isn’t always easy or cheap.

Switching to digital storage helps you avoid these pitfalls and gives you a more scalable, secure, and cost-effective way to manage your financial records.

Top Methods for Storing and Organizing Invoices Digitally

There’s no one-size-fits-all approach to digital invoice storage. Depending on your tools, budget, and workflow, different methods offer different advantages. Here are three commonly used approaches and how they can help your business.

1. Invoice Storage Software

Specialized invoice storage software solutions are designed to manage digital documents, including invoices. These solutions often come with features such as Optical Character Recognition (OCR), allowing automatic data entry by converting scanned documents into editable and searchable text.

This can significantly reduce manual data entry efforts and improve accuracy. Many invoice storage software options also offer integration with accounting systems, automating workflows and improving financial management.

Features like audit trails, version control, and advanced search capabilities can also help businesses manage and retrieve invoices efficiently, enhancing productivity and reducing operational costs.

Best for: Teams looking for a scalable, fully integrated solution with automation and reporting.

2. Cloud Storage

Cloud storage provides a robust solution for digital invoice storage, addressing concerns such as data loss due to system crashes or hardware failures. With cloud storage, your invoices are stored on remote servers managed by service providers, which ensures regular backups and high availability.

This means you always have access to the most recent versions of your documents without needing to perform backups manually. Popular cloud-based storage services like Google Drive, Dropbox, and Microsoft OneDrive offer scalable storage options and allow access to invoices from any internet-connected device.

These platforms provide additional security features such as encryption and multi-factor authentication to protect sensitive financial information from unauthorized access. Furthermore, cloud storage facilitates collaboration, enabling multiple users to access and work on the same document simultaneously from different locations.

Best for: Businesses looking for a low-cost, flexible way to store and share files but willing to manage documents manually.

3. Scan and Save

The scan and store method converts paper invoices into a digital format by scanning them and storing the electronic copies on a computer or server. This straightforward approach is ideal for companies switching from paper to digital storage. The quality of the scans is critical to the readability and accuracy of the data, which is why it is important to use a reliable scanner.

Once scanned, digital files can be organized and categorized into folders for easy retrieval. While this method is simple, it requires a systematic approach to naming and organizing the files to ensure efficient management and quick access to the invoices. Organizations may also consider using PDF software to annotate, bookmark, or tag scanned documents to improve searchability.

Best for: Small teams or companies just starting the transition, or those with limited budgets or data security concerns that prefer on-premise storage.

Which Digital Storage Method Is Right for You?

To help you make an informed decision, we’ve compared the key features of each digital storage method. Take a look at the table below to find the best solution for your business.

| Feature/Method | Invoice Storage Software | Cloud Storage Platforms | Scan and Save Locally |

|---|---|---|---|

| Automation (OCR, tagging) | ✅ Full automation | ❌ None | ❌ None |

| Integration with tools | ✅ Yes (ERP, accounting) | ⚠️ Limited (manual linking) | ❌ None |

| Searchability | ✅ Advanced search/filtering | ⚠️ Folder-based search | ⚠️ Manual search by filename |

| Security | ✅ High (access control, logs) | ✅ Depends on the provider | ⚠️ Depends on local setup |

| Scalability | ✅ Scales with volume | ✅ Scales with storage | ❌ Manual and hard to scale |

| Audit readiness | ✅ Audit trail, exportable | ⚠️ Manual file checks required | ❌ Manual effort required |

| Setup complexity | ⚠️ Moderate (initial config) | ✅ Simple | ✅ Simple |

| Best for | Mid-sized to large businesses | Small to medium businesses | Solopreneurs or early-stage |

The Benefits of Digital Invoice Storage

Once your invoices are stored digitally, managing them becomes faster, easier, and far more reliable. Here’s what changes when everything is organized and accessible online:

- Find Invoices Instantly: No more digging through filing cabinets or sorting through stacks of paper. With a digital archive, you can locate any invoice in seconds using filters like supplier, date, or keyword, even from your phone.

- Less Paper, More Space: Going digital means less printing, less filing, and less physical storage. Without paper piles and filing cabinets taking up space, your team has more room to focus and fewer distractions to manage.

- Stay Compliant and Audit-Ready: Invoices are safely stored for at least 10 years and are easily retrievable for audits or regulatory checks. With digital backups and access logs, you’re always ready when documentation is needed.

- Access Files Anytime, Anywhere: Whether you’re working remotely, checking an invoice while traveling, or sharing a document with a colleague, your archive is always just a few clicks away, no matter where you are.

- Export in Multiple Formats: Need to send a batch of invoices or analyze them by project or period? Digital systems let you export documents in formats like PDF, CSV, XLSX, or UBL – no scanning required.

- Keep Financial Data Secure: Cloud-based systems come with built-in encryption, access controls, and regular backups. Your data is protected from both physical risks and unauthorized access.

How to Transition Smoothly to Digital Invoice Storage

Moving from paper to digital invoice storage doesn’t have to be complicated. With the right approach, you can create a streamlined, searchable, and secure system for all your financial documents.

Below are the key steps to make your transition seamless.

1. Digitize Your Invoices

Start by turning all paper invoices into digital files.

- Scan or photograph: Use a scanner or mobile app such as FreshBooks, Evernote, or CamScanner to capture clear images of your invoices.

- Forward email invoices: If you receive invoices digitally, forward them to a dedicated folder or use software that automatically detects and stores invoices from your inbox.

- Use OCR technology: OCR tools can extract data from scanned documents, making your invoices searchable and easier to organize.

2. Choose the Right Storage and Organization Method

Decide where and how you’ll store your invoices.

- Cloud storage: Services like Google Drive, Dropbox, or OneDrive allow you to access your invoices anywhere and automatically back them up.

- Accounting software: Platforms such as QuickBooks, Xero, or Zoho Books go a step further by integrating invoice storage with accounting, reporting, and automation features.

- Digital spreadsheets: If you prefer a simple system, use Microsoft Excel or Google Sheets to log key details like date, vendor, and amount.

3. Implement a Consistent Organization System

A well-structured system saves time and reduces errors.

- Create a clear folder structure: Set up a main folder for each year, then subfolders for each month or expense category.

- Use a consistent naming convention: For example, follow a format like YYYY-MM-DD_VendorName_Amount.pdf to make files easy to search.

- Add tags or categories: In accounting or document management software, tagging invoices by project, client, or expense type makes retrieval fast and intuitive.

4. Secure Your Invoices

Digital doesn’t mean risk-free. Take steps to protect your data.

- Back up regularly: Even if you use cloud storage, keep additional backups on an external drive or secondary service.

- Use strong passwords: Secure your accounts with complex passwords and enable two-factor authentication.

- Consider professional solutions: For growing businesses, dedicated invoice management software provides enhanced security, automation, and integration with ERP or accounting systems.

Final tip: Transitioning to digital invoice storage is more than just scanning and saving files. It’s about creating an efficient, reliable workflow. In the next section, we’ll explore how to automate the entire process with Klippa SpendControl.

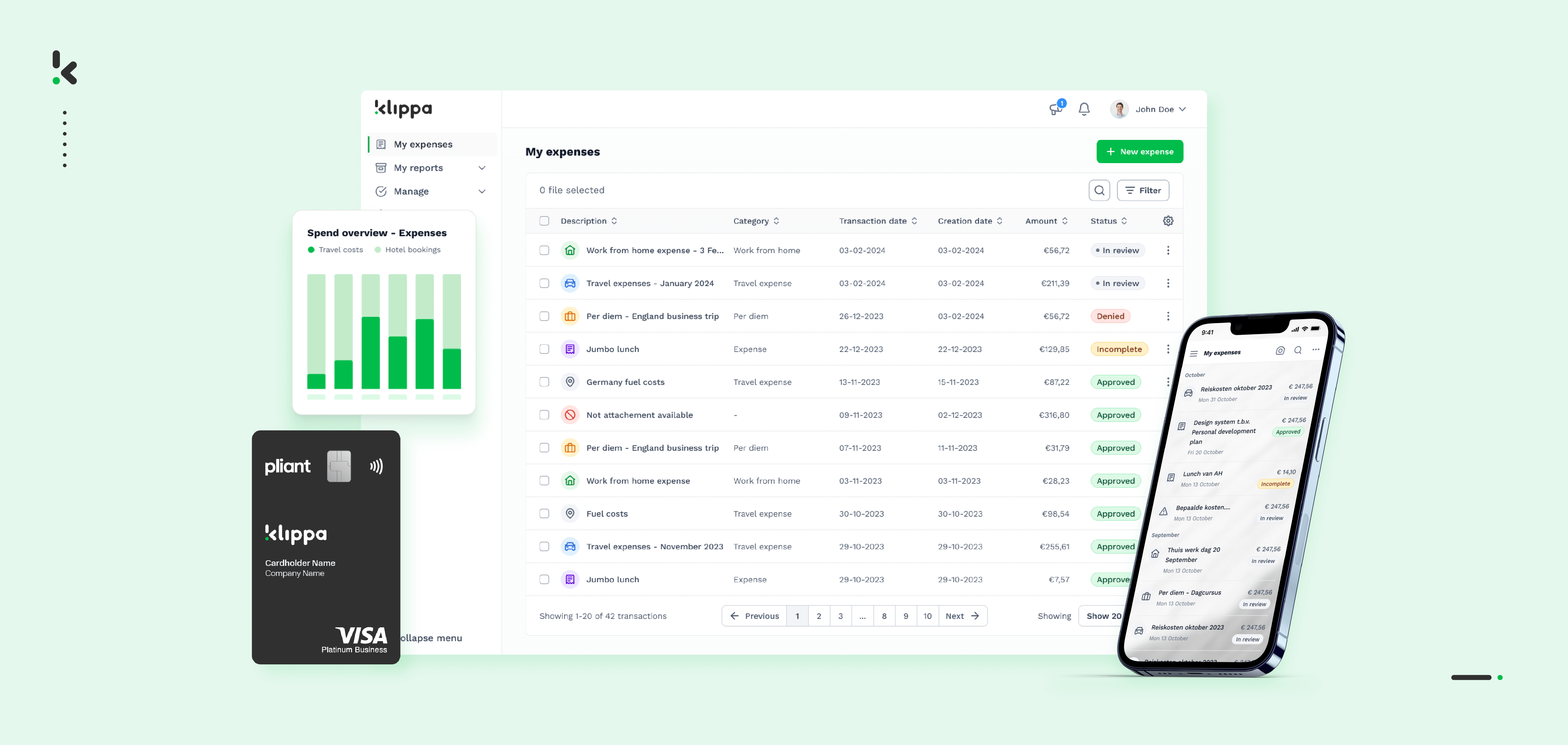

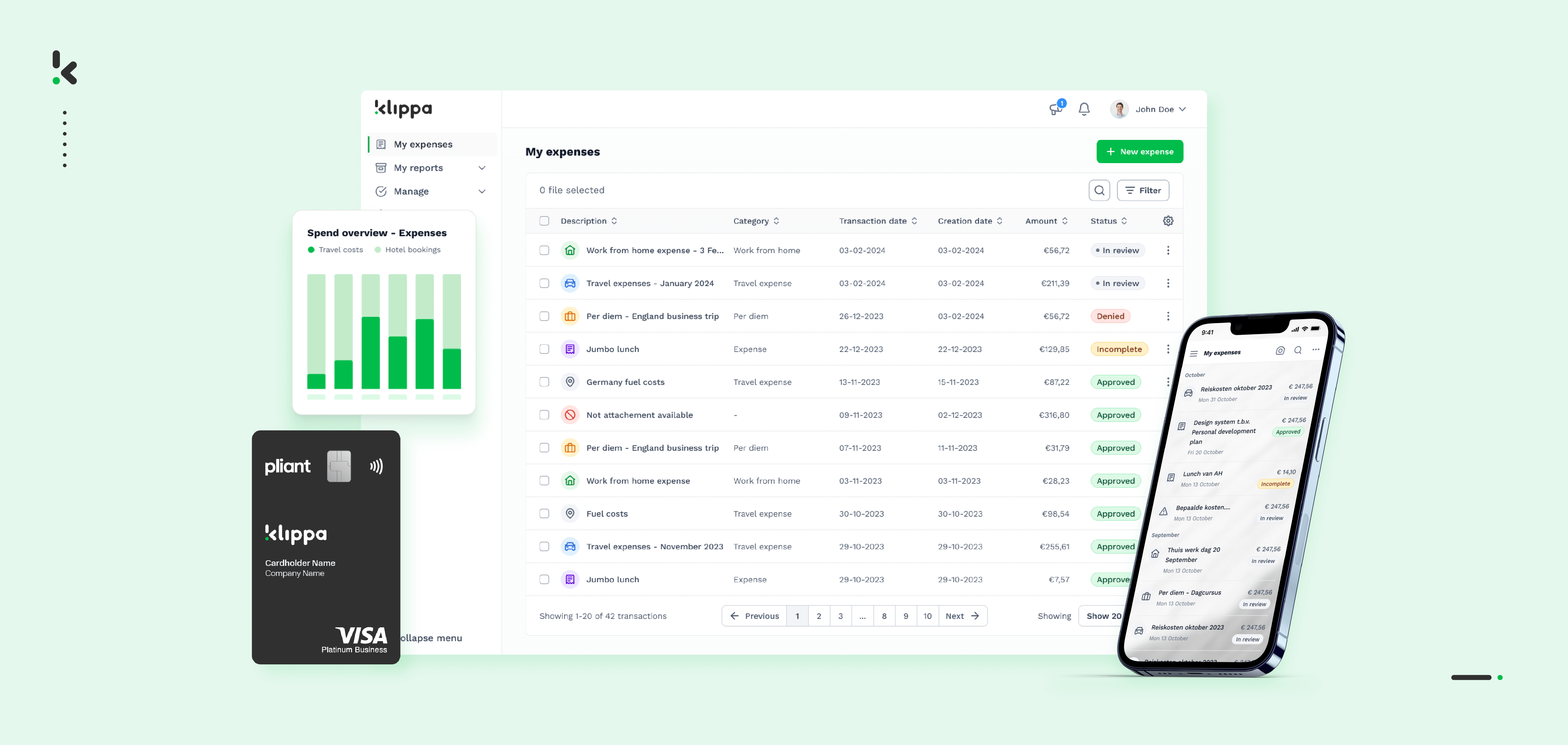

Automatically Store and Organize Invoices with Klippa SpendControl

Once your invoices are digitized, the next step is automation. And that’s where Klippa SpendControl comes in. It’s an all-in-one platform that helps finance teams capture, process, approve, and store invoices automatically, so you can forget about manual data entry and folder chaos.

Here’s how Klippa SpendControl makes digital invoice storage truly effortless:

1. Capture and Extract Invoice Data Automatically

With AI-powered OCR, Klippa SpendControl instantly extracts key details like supplier names, dates, amounts, and VAT numbers from both paper and digital invoices.

- No more typing or manual uploads. Simply drag, drop, or forward invoices by email.

- The system reads and processes files in seconds, whether they’re PDFs, scans, or images.

- Extracted data is automatically structured and stored for easy access.

2. Automate Invoice Approvals and Workflows

SpendControl does a lot more than just store invoices. It manages the entire invoice approval process.

- Smart routing: Automatically send invoices to the right approver based on cost center, amount, or department.

- Custom rules: Set up approval chains that fit your internal policy, with automated notifications and reminders.

- Real-time visibility: Track every invoice from submission to payment in one dashboard.

3. Organize and Store Invoices Securely in the Cloud

All invoices processed through Klippa SpendControl are automatically archived in a secure, searchable cloud environment.

- Automatic naming & categorization: Each invoice can be saved with standardized file names and tags for quick retrieval.

- Centralized access: Team members can view, approve, and download invoices from anywhere. Ideal for hybrid or remote teams.

- Audit-ready archive: Every document is stored with a full audit trail for compliance and transparency.

4. Integrate with Your Existing Financial Systems

Klippa SpendControl seamlessly integrates with popular accounting and ERP platforms such as NetSuite, Xero, SAP, Microsoft Dynamics, and more.

- Automatic syncing: Approved invoices are transferred directly to your accounting software.

- No duplicate work: Data extraction and posting happen in one flow.

- Consistent accuracy: Reduce human errors and maintain a single source of truth for all financial records.

5. Gain Full Control Over Company Spending

Beyond invoice automation, Klippa SpendControl also centralizes expense management and company card transactions, giving you a complete view of your organization’s spend.

- Track invoices, receipts, and payments in one dashboard.

- Identify spending patterns and bottlenecks instantly.

- Make informed decisions based on accurate, real-time financial data.

Conclusion

With Klippa SpendControl, automated digital invoice storage becomes part of a larger, smarter finance ecosystem. From invoice capture to approval and archiving, every step is faster, safer, and more transparent. This gives your team more time to focus on what really matters.

Book a demo with Klippa SpendControl and experience how effortless invoice automation can be.

FAQ

Digital storage can save space, reduce the risk of loss or damage, and facilitate easy searching and sharing.

Scanning invoices can help streamline the accounts payable and receivable processes, improve accuracy, and reduce the need for physical storage.

Invoice management software can automate the invoice scanning process, extract data from invoices, and store them digitally.

Businesses can use a filing system, tagging system, or dedicated invoice management software to organize their digital invoices.

Businesses should implement strong security measures, such as access controls, encryption, and regular backups, to protect their digital invoices.