Loyalty programs have become a vital tool for businesses aiming to build strong customer relationships and boost sales. However, the surge in their popularity has a dark side – the increasing threat of loyalty fraud. As 72% of customers view loyalty programs as integral to establishing a connection with brands, the stakes are high.

The challenge is clear: how can your company balance the benefits of loyalty programs and user experience while preventing fraud? The answer lies in using advanced technologies and strategies for fraud detection and prevention. This not only safeguards your business but also makes your customers feel secure and valued.

Join us as we explore the ins and outs of loyalty fraud detection. We’ll discuss different types, causes, risks, and effective prevention strategies. Let’s dive in!

Key Takeaways

- Loyalty fraud is on the rise due to the growing popularity of reward programs and the ease of exploiting loopholes using digital tools.

- Manual fraud detection is no longer enough, especially in high-volume loyalty campaigns with many invoices and receipts to validate.

- Klippa’s solution helps prevent fraud by automating document checks, verifying invoice authenticity, and blocking duplicate submissions.

- The Klippa DocHorizon platform allows for scalable protection, with AI-powered OCR, dataset filtering, and customizable workflows tailored to your program’s needs.

What is Loyalty Fraud?

Loyalty fraud occurs when individuals manipulate loyalty programs for personal financial gain. This includes redeeming loyalty rewards intended for other customers or exploiting non-personalized loyalty campaigns.

For a single customer, it’s often a result of accidentally finding a loophole in your terms and conditions. And if it’s organized fraudsters, they employ technical skills to access and drain customer accounts of loyalty rewards.

Having clarified loyalty fraud, let’s look at the most common loyalty fraud types.

What are the Most Common Types of Loyalty Fraud?

If you want to protect your loyalty programs, it’s essential to understand the common types of loyalty program fraud. After all, you can’t prevent something you’re not aware of.

Here are the most common fraud types you should know about:

- Account Takeover: Fraudsters can gain access to a customer’s loyalty account, exploiting it to redeem points and make unauthorized purchases, often leading to additional scams.

- Insider Threats: Cashiers enter their account information instead of the customer’s to gain additional bonus points.

- Coupon Abuse: Fraudsters may use fake or expired coupons to claim free products or discounts, resulting in financial losses for companies.

- Identity Theft: In the case of identity theft, criminals use stolen or fake credentials to create accounts, allowing unauthorized point accumulation and leading to activities like reselling rewards.

- Personal information manipulation: Members often change their birthdates on the membership page to benefit from birthday discounts.

- Fraudulent Submissions: When a program requires submitting proof of purchase, individuals can falsify the invoice or receipts to fraudulently obtain cashback points.

What Is the Cause of the Increase in Loyalty Fraud?

By default, the more businesses participate in loyalty campaigns, the more attractive it becomes for fraudsters. This means your company becomes a target as soon as a campaign goes live.

What makes the allure even stronger is the many online platforms sharing different tactics to exploit loyalty campaigns. Economic challenges also add fuel to the fire, making many individuals eager to find ways to take advantage of the system.

Sometimes it’s even too easy. As customers reduce their non-essential spending, they might neglect their old accounts with loyalty points. This creates an opportunity for fraudsters to gain access to these accounts without being detected. Traditional in-store verification may overlook manipulated receipts or invoices, leading to delayed fraud detection.

It’s an unfortunate combination where an increase in loyalty campaigns meets a growing pool of knowledge and available technologies for fraudsters. And often, businesses struggle to keep up.

But what makes it so dangerous? Let’s explore the various potential risks that could impact your business.

What Are the Risks of Loyalty Fraud?

Loyalty program fraud brings significant risks to your business, impacting both your finances and reputation. If fraudsters exploit your loyalty programs, it can lead to:

- Revenue Loss: Hacking into customer accounts and redeeming fraudulent points can result in direct monetary losses for the business.

- Reputational Damage: Negative public perception, arising from loyalty fraud, can erode trust and brand loyalty, potentially affecting customer retention.

- Operational Costs: Businesses may spend money to fight loyalty fraud, involving activities like hiring teams for manual reviews, which can increase their operating costs.

Moving ahead, the next section is all about empowering you with effective strategies for loyalty fraud detection and prevention. Get ready to outsmart the fraudsters and keep your loyalty programs safe!

How to Detect Loyalty Fraud: Detection Methods

To protect the integrity of your loyalty program, you need robust detection measures capable of spotting suspicious activity before it escalates. Even the most sophisticated fraud can be uncovered with the right monitoring and analysis tools.

1. Monitor Account Activity

Regularly review redemption patterns across accounts. Look for:

- Unusually rapid point accumulation

- Frequent high-value redemptions

- Multiple accounts or logins from the same IP address or device

2. Analyze Behavior Patterns with AI

Leverage analytics platforms or AI algorithms to detect anomalies, such as:

- Unusual session times or login frequency

- Device inconsistencies (sudden new devices accessing accounts)

- Credential reuse across different accounts

3. Audit Employee Access

Internal fraud can be just as damaging. Keep audits of system access logs to flag:

- Unauthorized account balance changes

- Reward redemptions initiated outside standard processes

- Access to accounts without legitimate customer service reasons

4. Flag Authentication Failures

Multiple failed login attempts or repeated password resets could indicate brute-force attacks. Automated alerts can catch these events in real time and prompt further review.

5. Use Real-Time Alerts

Configure your loyalty system to send alerts when:

- Contact details (email, phone number) change suddenly

- Reward balances change unusually

- Redemption requests exceed predefined thresholds

By combining these detection methods, you create multiple layers of defense and reduce the chance of fraud slipping through unnoticed.

How to Prevent Loyalty Fraud: Best Practices

Prevention is far cheaper and far less damaging to your brand than dealing with a loyalty fraud incident after it’s occurred. To safeguard your program, combine proactive security measures with clear rules and regular customer engagement.

1. Implement Multi-Factor Authentication (MFA)

Adding an extra step to logins greatly reduces account takeover risk.

- How to implement: Require a one-time code via SMS, email, or an authenticator app when customers log in from new devices or unfamiliar IP addresses.

- Practical tip: Make MFA mandatory for high-risk actions like redeeming large point balances or changing contact details.

- Example: An airline loyalty program triggers MFA whenever an account attempts to transfer over 10,000 miles.

2. Enforce Strong Password Policies

Weak passwords are a major entry point for fraudsters.

- How to implement: Require at least 12 characters, combining uppercase/lowercase letters, numbers, and symbols. Prohibit dictionary words and reused passwords from known breaches.

- Practical tip: Offer a password strength meter in your signup/login forms and nudge users to update passwords every 6–12 months.

- Example: A retail chain’s loyalty app prompts members to reset passwords after logging in from a device not used in the last year.

3. Encrypt Data and Secure Access Points

Ensure even if attackers gain entry, stolen data is unreadable.

- How to implement: Use AES-256 encryption for stored customer data and TLS 1.2+ for transmitting data. Secure APIs with authentication tokens and IP whitelisting.

- Practical tip: Conduct periodic vulnerability scans on loyalty program web portals and mobile apps.

- Example: A hospitality group encrypts all transaction logs related to point redemptions, preventing data leaks even if the database is compromised.

4. Limit Point Transfers and Redemptions

Capping transactions reduces the potential damage from fraud.

- How to implement: Restrict point transfers to verified recipients and set daily/weekly redemption limits.

- Practical tip: Flag and require manual approval for transactions exceeding normal user behavior.

- Example: A coffee chain cancels redemptions beyond 5 free drink coupons per month unless verified by customer support.

5. Educate Your Customers

Your members can be your first line of defense if they understand the risks.

- How to implement: Share security tips in loyalty program newsletters, account dashboards, and at checkout. Explain why points are valuable and worth protecting.

- Practical tip: Use gamification, such as rewarding customers with bonus points for enabling MFA or updating passwords.

- Example: A grocery store offers 50 bonus points when members complete a short “Secure Your Account” tutorial in the app.

6. Audit Program Rules and Terms Regularly

Loopholes in program design are easy targets for fraudsters.

- How to implement: Quarterly reviews of terms and conditions with legal and fraud teams to close gaps in rewards structures, referral programs, or promotions.

- Practical tip: Align reward value with actual purchase engagement, avoid rewards for actions that can be automated or exploited without meaningful transactions.

- Example: A ride-sharing app updated its referral program to require a completed ride before awarding points, reducing bot abuse.

7. Schedule Regular Security Testing

Even strong controls need validation.

- How to implement: Partner with cybersecurity experts for penetration testing and “red team” exercises simulating fraud attempts.

- Practical tip: Include social engineering tests in your scope, employee awareness is as crucial as tech defenses.

- Example: A gaming platform discovered a vulnerability in its reward redemption API during quarterly testing, patched it within hours, and avoided a mass exploitation.

Layering these strategies, combining customer education, restrictive program rules, and advanced technical safeguards, creates multiple barriers for fraudsters. That makes your loyalty program not just harder to exploit, but also more trustworthy in the eyes of genuine customers.

Automating Loyalty Fraud Detection with Klippa DocHorizon

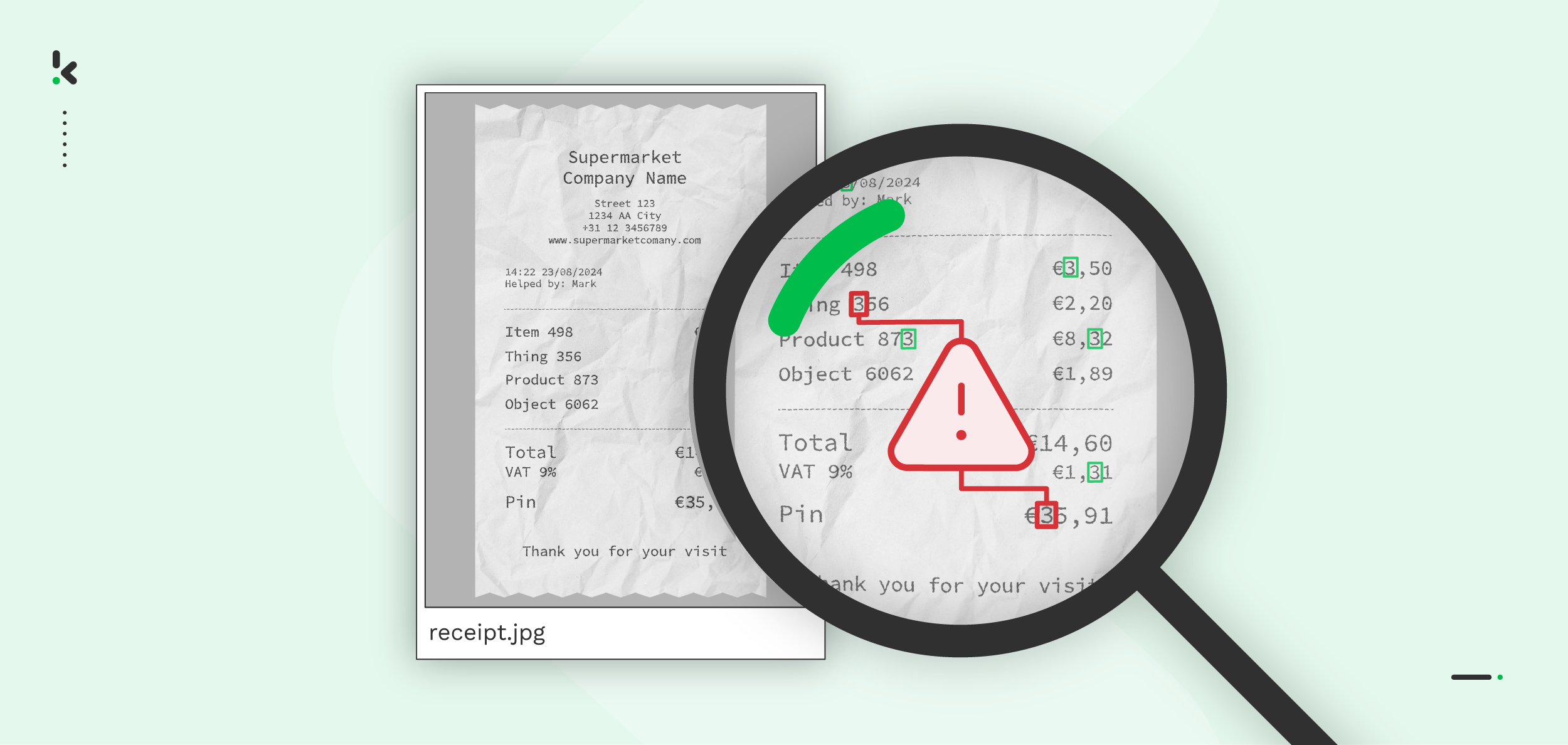

Let’s say your company has a reward for clients who buy a certain product in a certain period. To prove that the product and the period were the ones in the promotion, they will need to send you, among others, the invoice for their purchase.

How can you know if the invoice is new or has already been claimed? The easiest method is to use an automated solution that can check if the invoice number is already in the database.

Klippa DocHorizon is an Intelligent Document Processing (IDP) platform that enables you to automate all various document workflows, including fraud detection. Below, we present the necessary steps to create a flow that can guard your business from unfortunate fraudulent submissions.

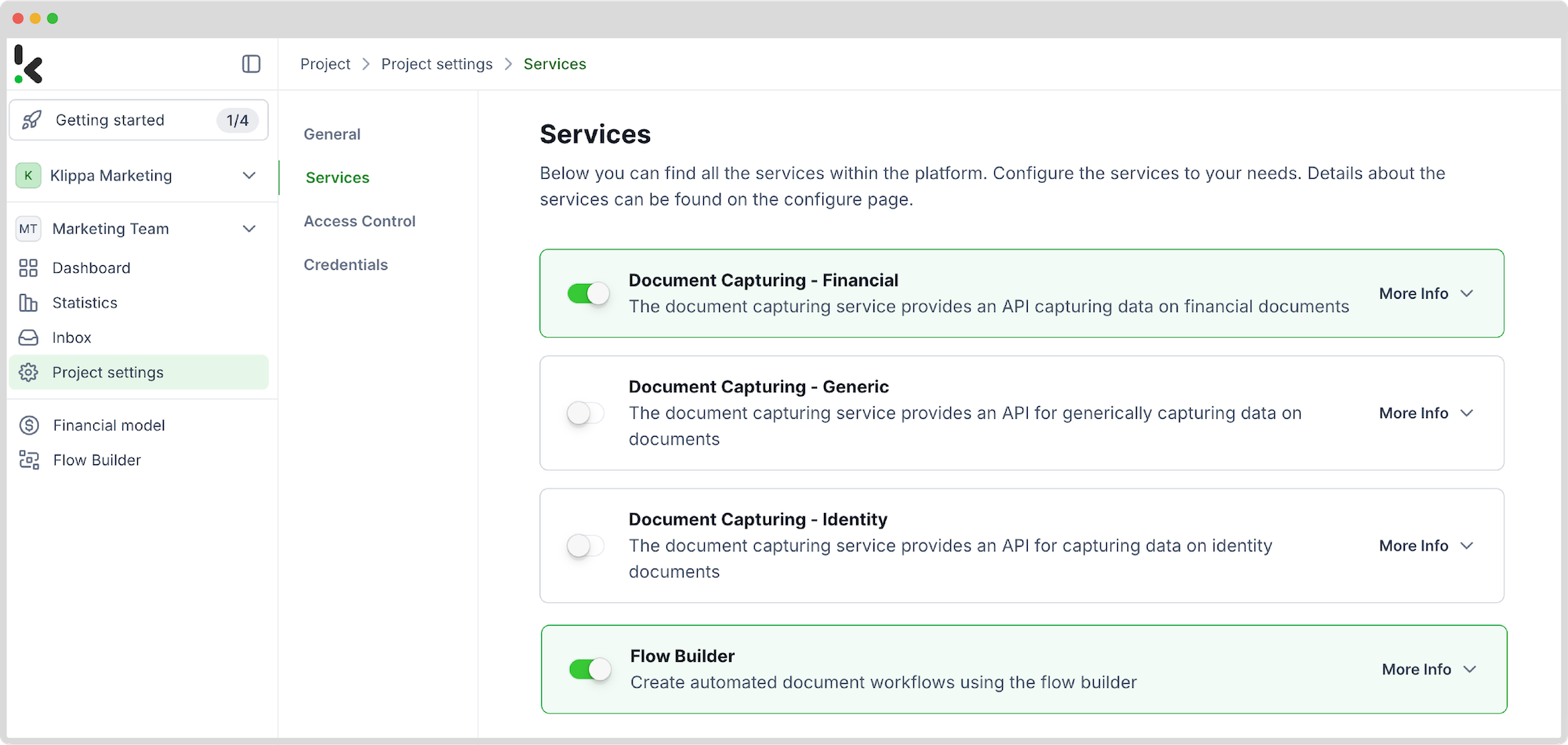

Step 1: Sign up and select the needed services

Before creating your first workflow, sign up for an account on the DocHorizon Platform. You can do this by simply filling in your name and email address, and you will instantly receive a free credit of €25 to test our platform out. Nice, right?

Once logged in, create an organization and set up a project to access the services. Go to Project Settings and then Services. After, enable the Document Capturing – Financial Model and the Flow Builder to get started. This setup ensures you have everything you need right from the start!

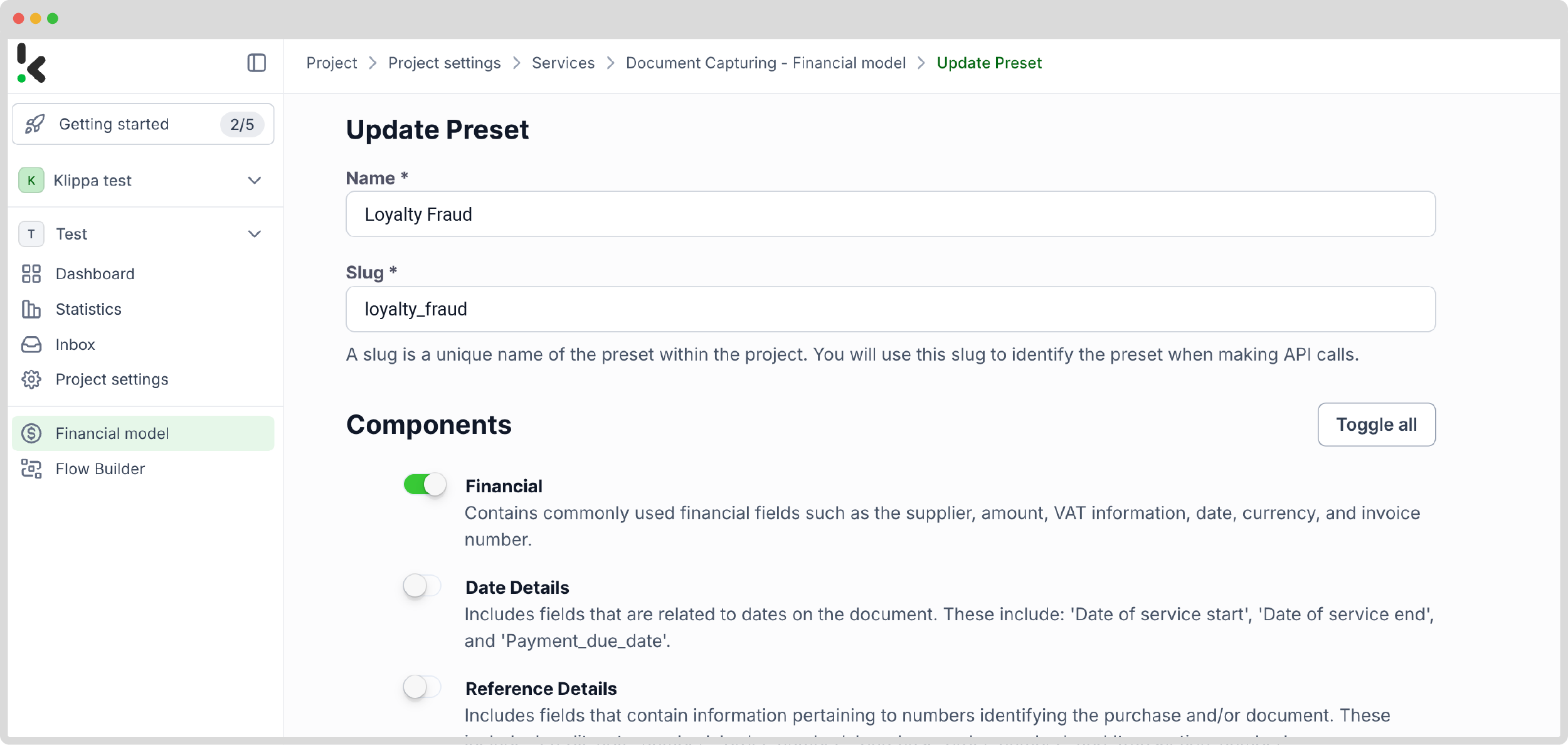

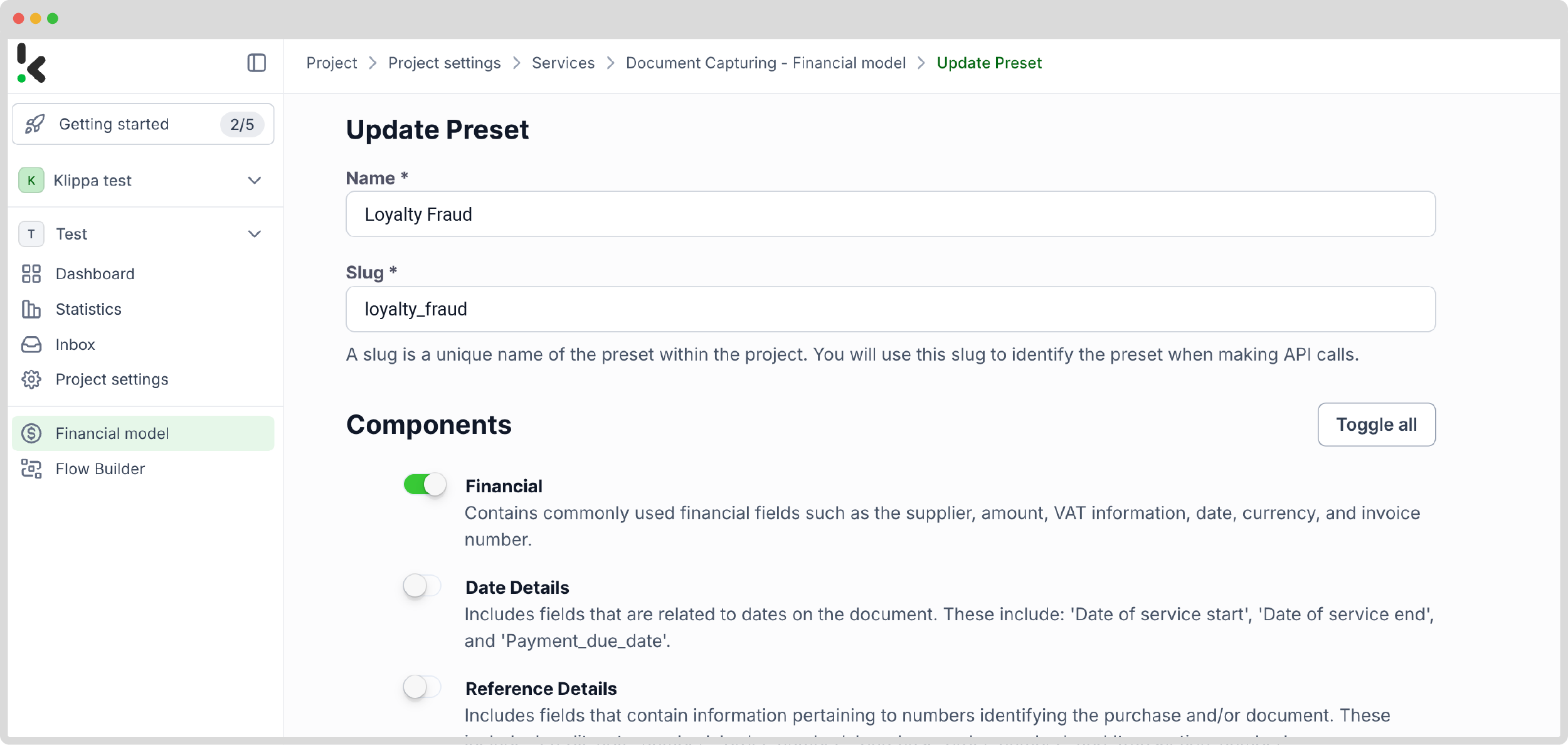

Step 2: Create a preset to get the data you need

To extract the fields you need from the files, you should create and configure a preset. Klippa’s presets were trained and perfected on thousands of documents, so their accuracy is really high.

To do this, go to the column on the left side. Select Financial Model and then New Preset. Click on Create and name your preset. Let’s call it “Loyalty fraud”. For components, the most general one is Financial, but you can choose other items that are specific to your situation. Lastly, click on Save.

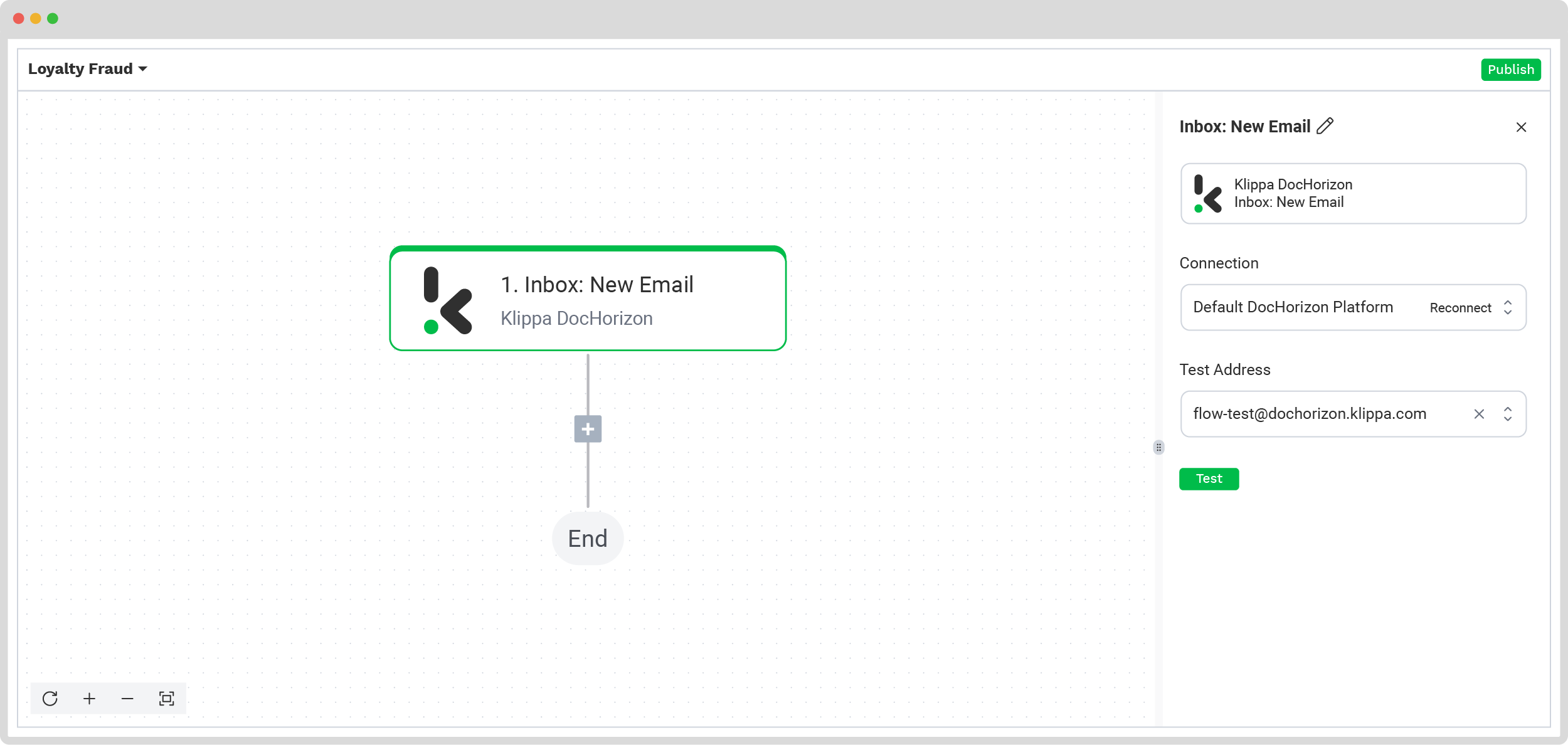

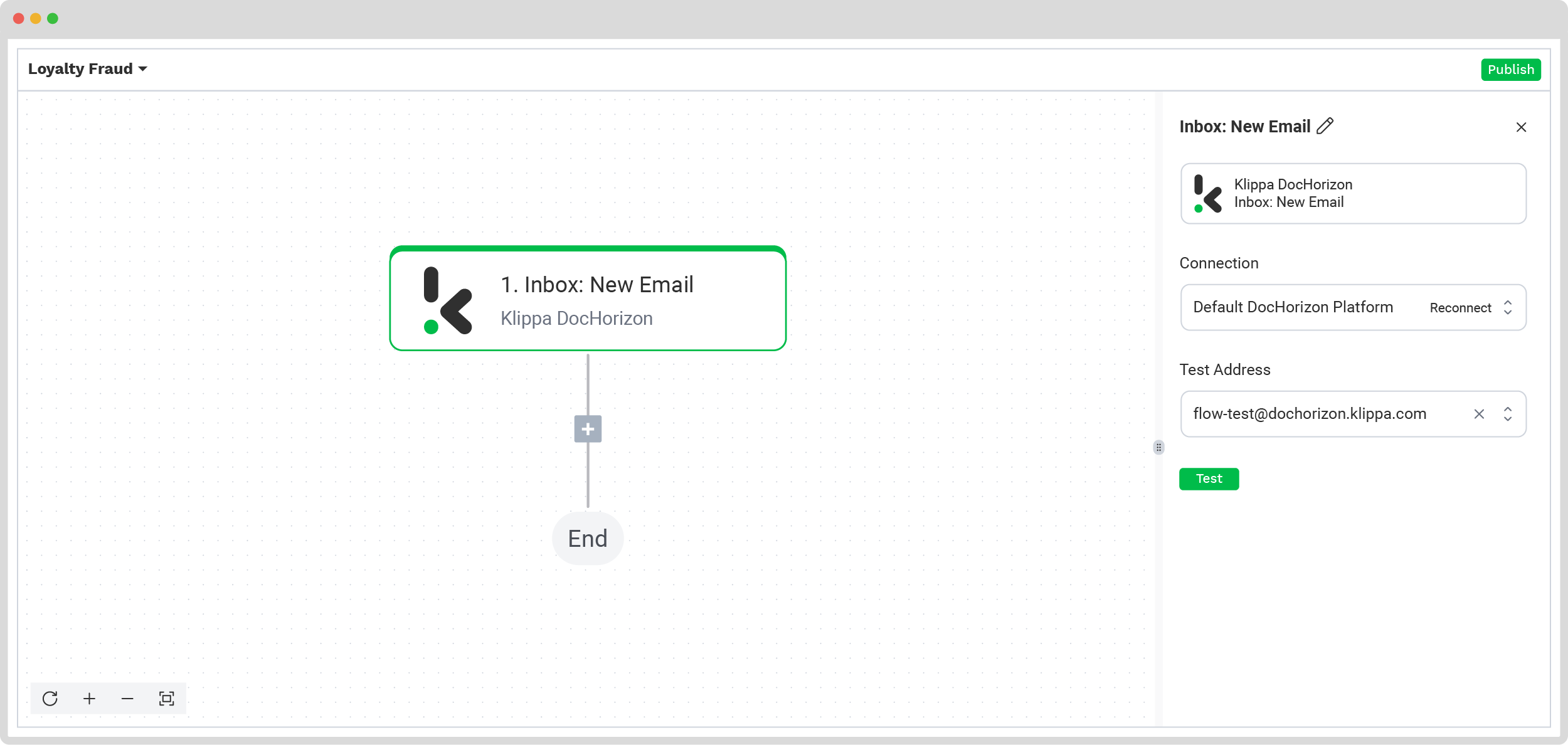

Step 3: Select the input source

The best input source is the inbox Klippa created for you. After selecting it as the trigger by clicking on 1. Select Trigger -> Klippa DocHorizon -> Inbox:New Email, connect it to the platform.

Don’t forget to test this step and the following ones by clicking on Load Sample Data. You should have at least one sample document sent to this email address while creating your flow. If the testing was successful, you can go to the next step.

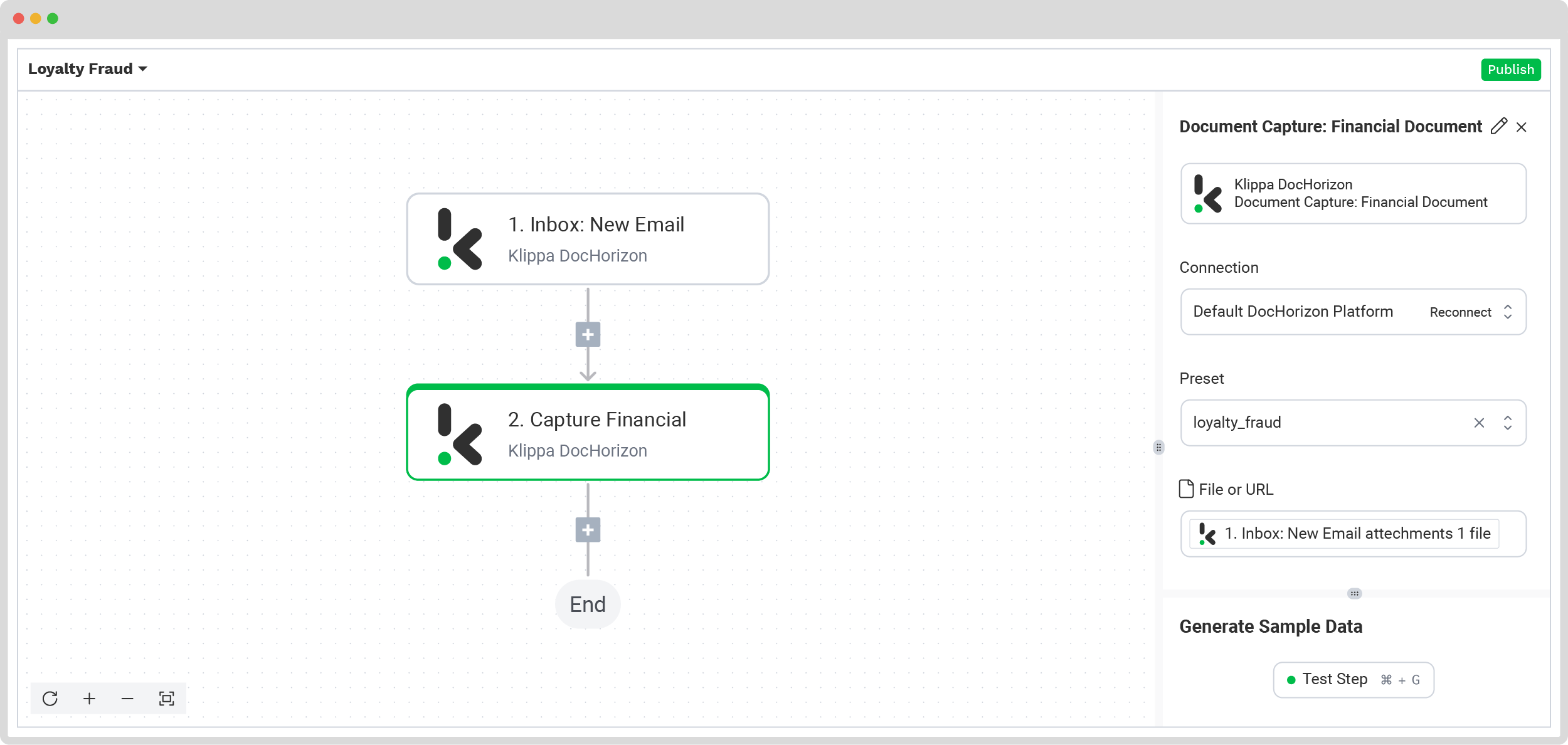

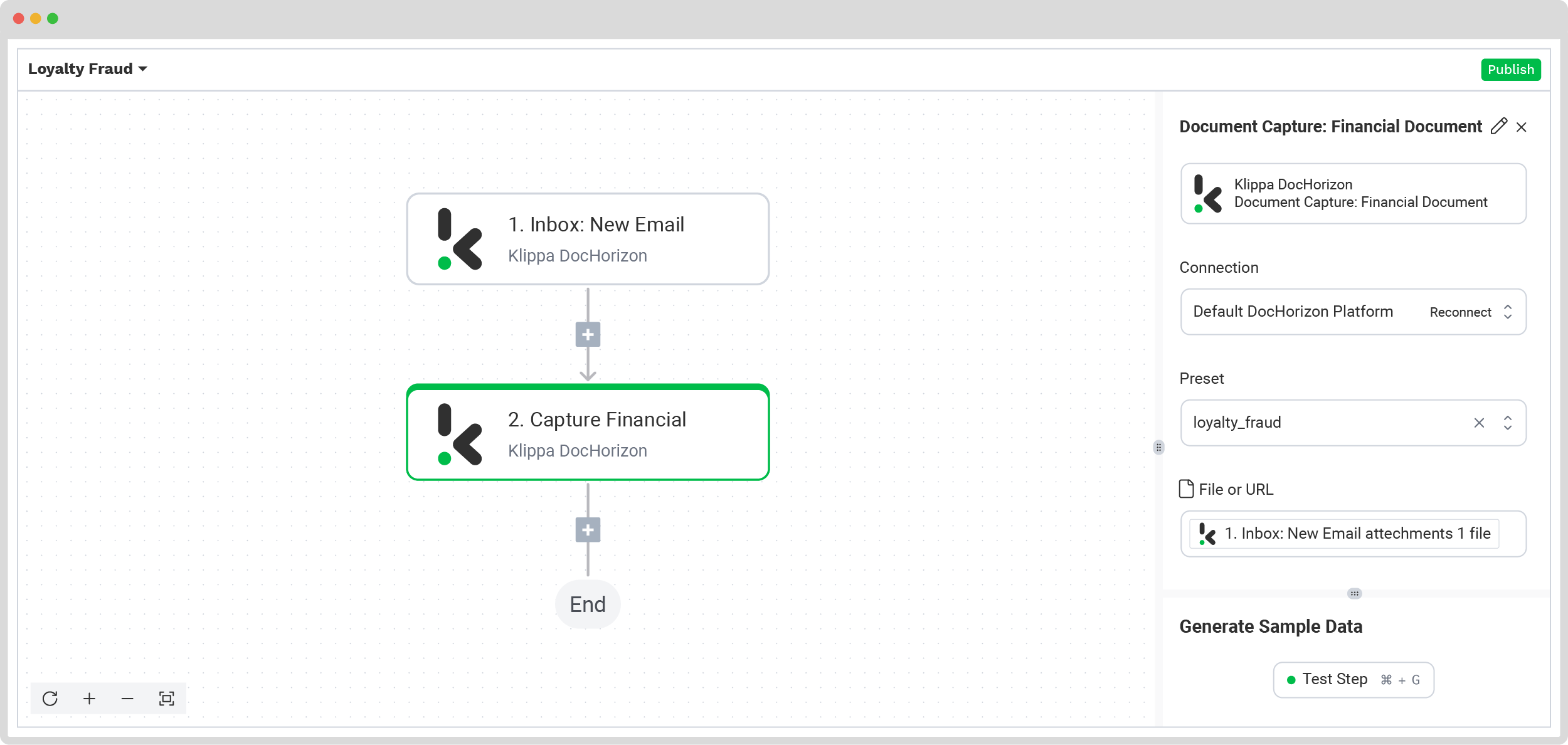

Step 4: Select the document capture model

To extract all the necessary fields, select the document capture module as the second step. Since you already created a specific preset for this use case, simply select the Document capture: Financial Model module from the list.

Create again a connection with the Default DocHorizon Platform. Next, select the preset we’ve created in step 2, namely “Loyalty fraud”. Next, for File or URL, click on the box and pick from the menu Inbox: New Email attachments -> attachments-> attachments 1 -> file.

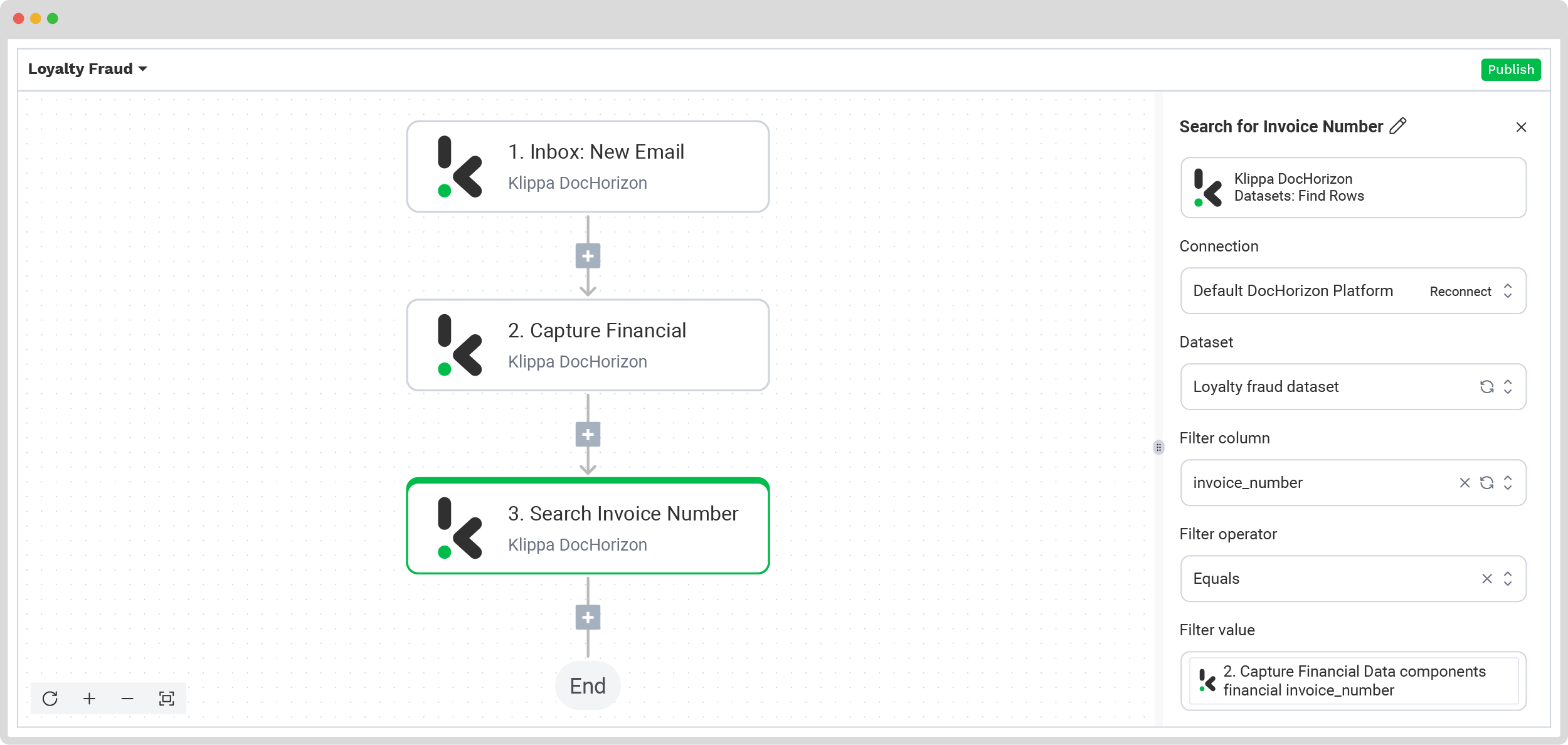

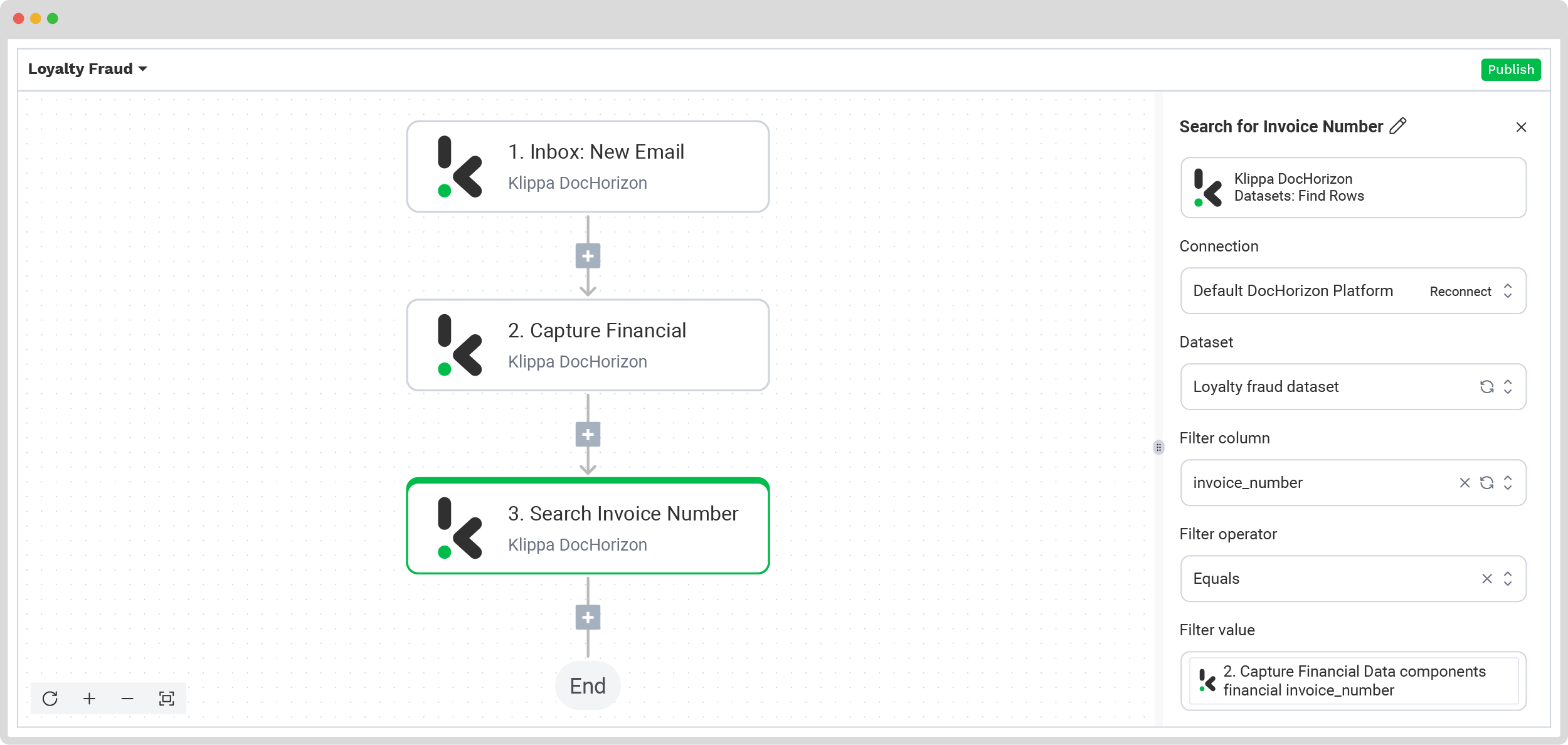

Step 5: Search for the invoice number

The next step is to filter through a database and see if the invoice was sent before. To do this, you first need to create a CSV file (unless you already have it) containing all the numbers of the previous invoices you received. The only requirement is that the file includes a header row to define the columns, and one or more rows containing data.

If you don’t have such a file, you can create it with the DocHorizon platform by following the steps from How to Extract Data from Invoices: Manual, OCR & AI Solutions.

To create a dataset, go back to the DocHorizon platform and, on the left side of the main screen, you can find Datasets. Click on New Dataset, name it, and upload the CSV file. Ours is named “Loyalty fraud dataset”.

Go back to the flow builder and choose Klippa DocHorizon -> Datasets: Find Rows as the flow’s next step. Connect it to the platform and, for the sections on the right, please fill in this information:

- For Datasets: Loyalty fraud dataset

- For Filter column: invoice_number

- For File operator: Equals

- For Filter Value: Capture Financial Data -> components -> financial -> invoice_number

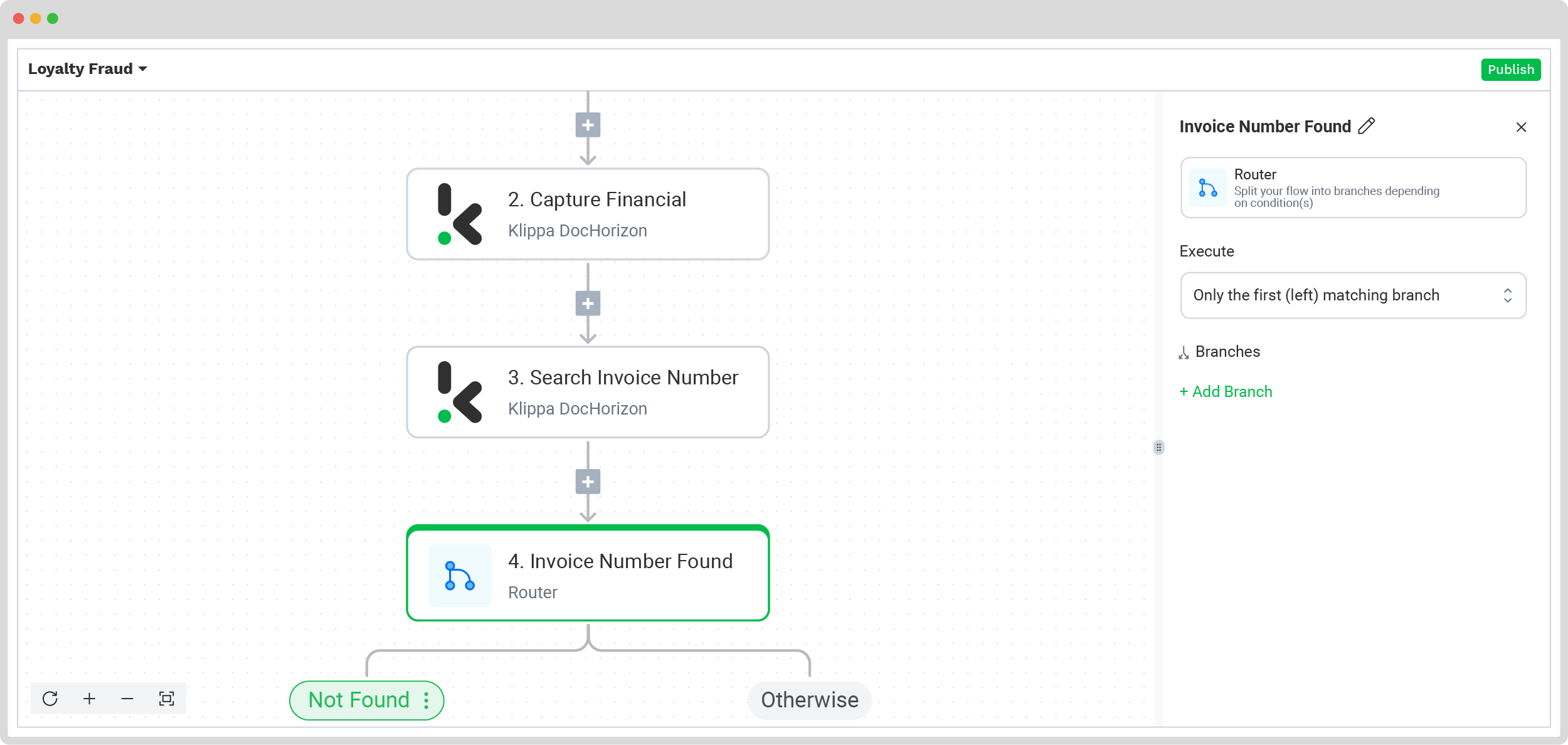

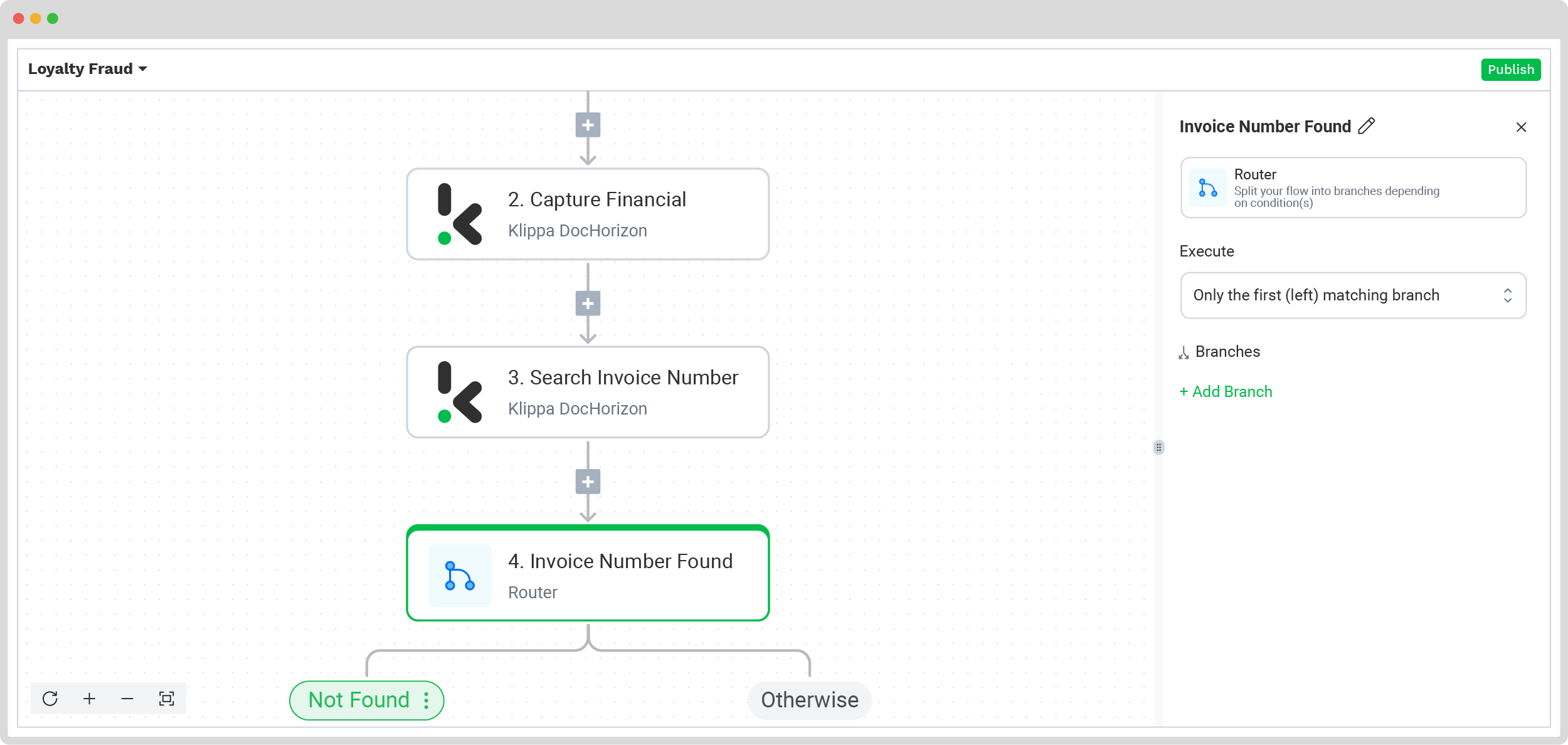

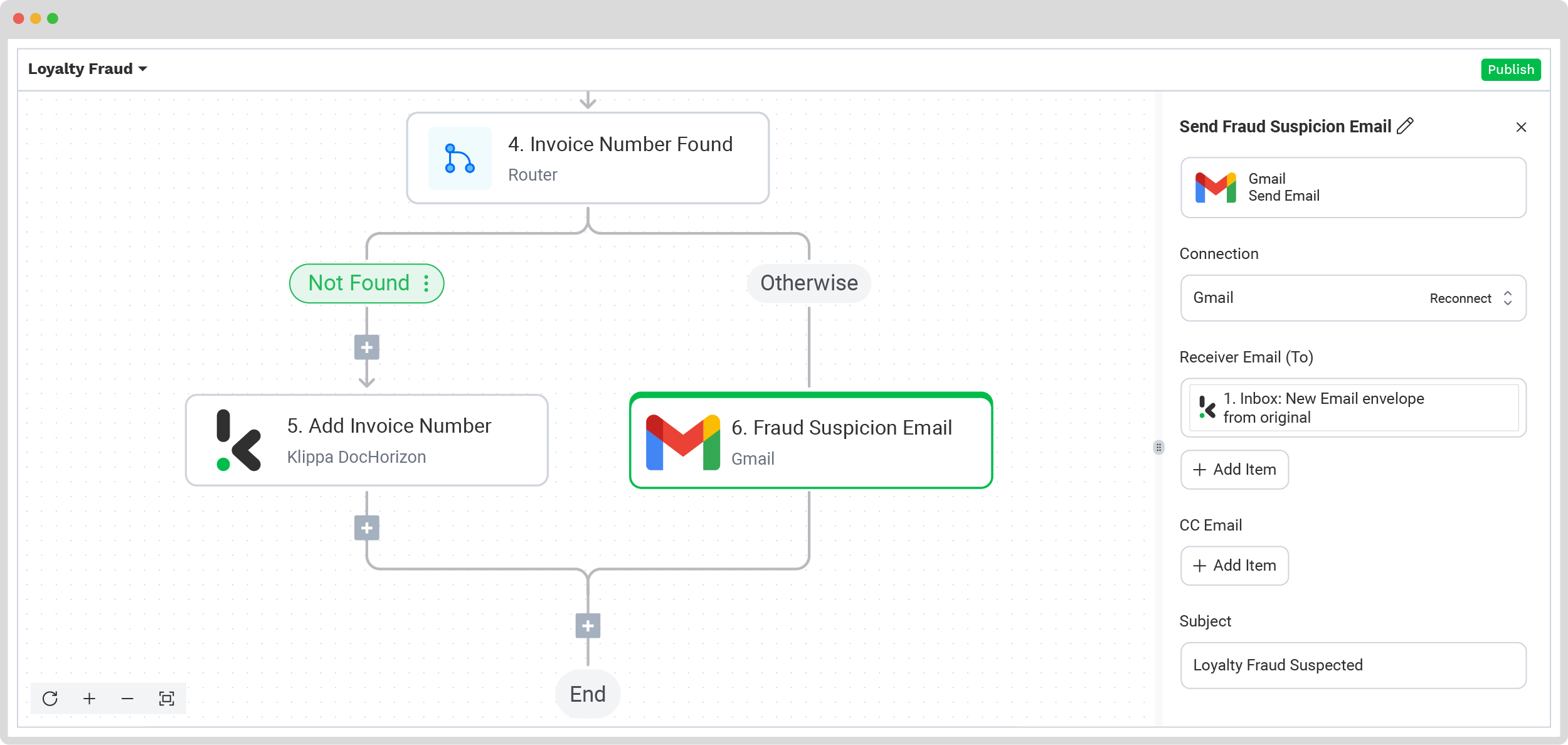

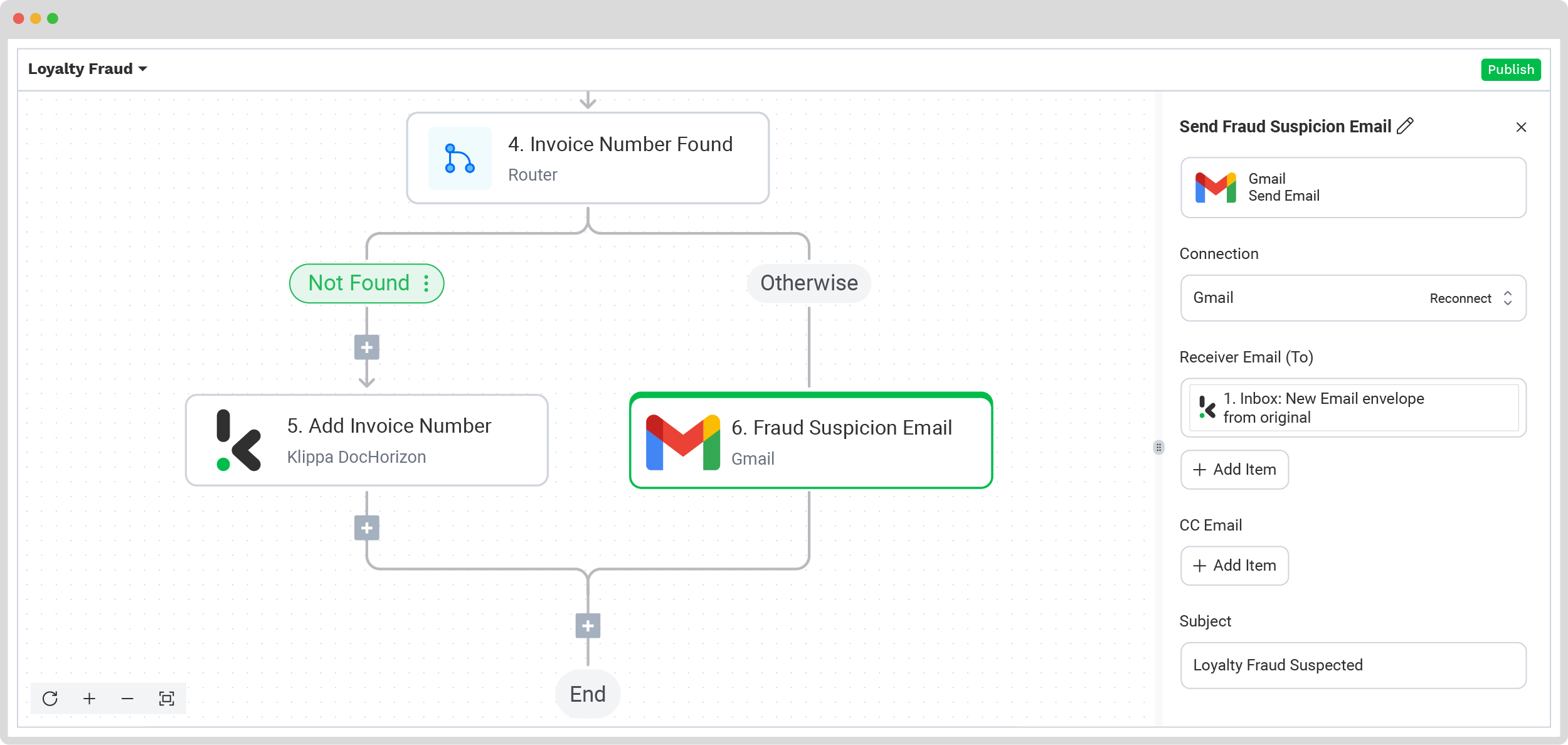

Step 6: Create a conditional routing

The next step is to define what happens in the following 2 scenarios: the invoice number is not found/is found in the list. To do this, you’ll be using the Router option, setting the possible solutions as Not found or Otherwise.

For this, you’re going to select Execute: Only the first (left) matching branch, and set the rules by clicking on Branch 1. For Execute if, choose Search for invoice number -> Does not exist.

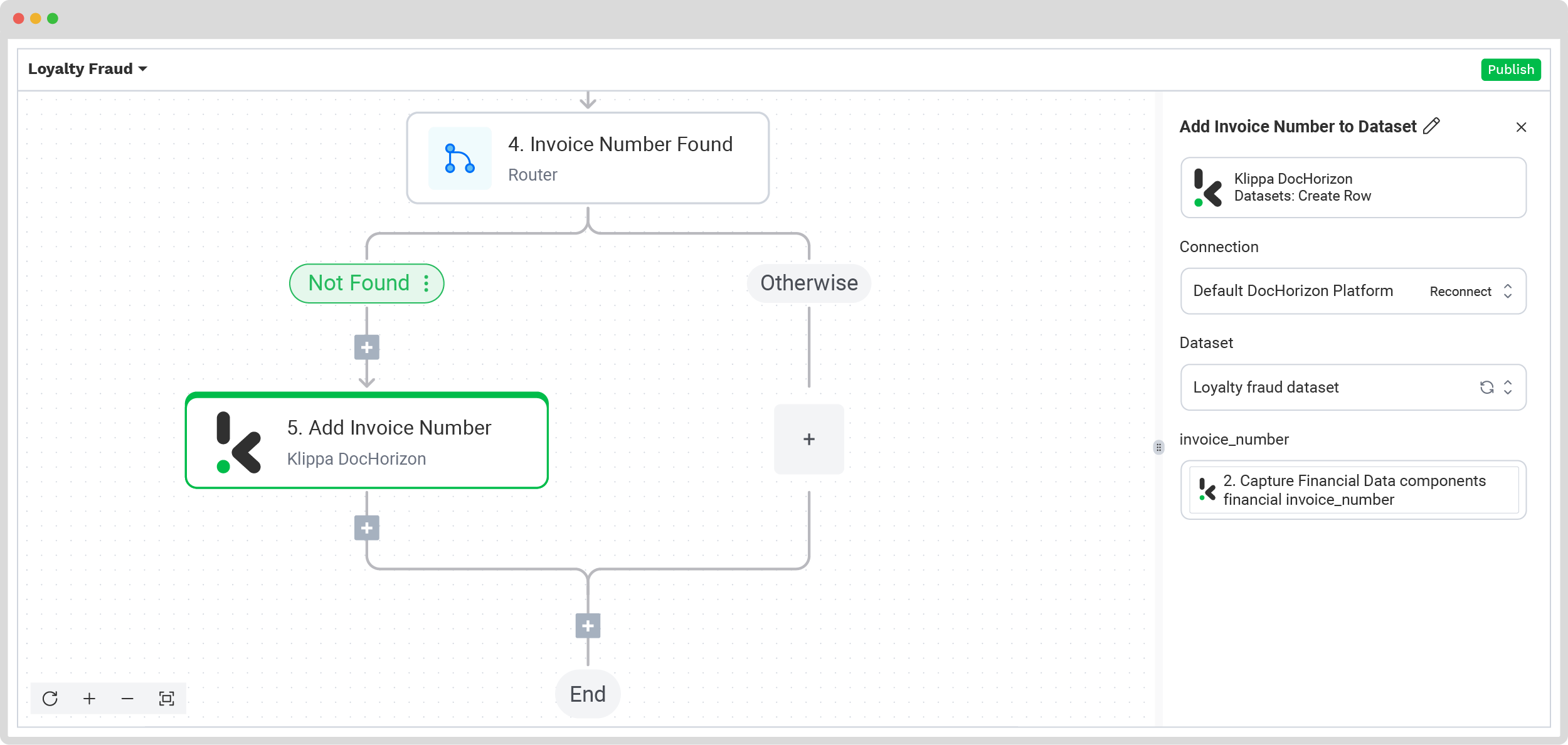

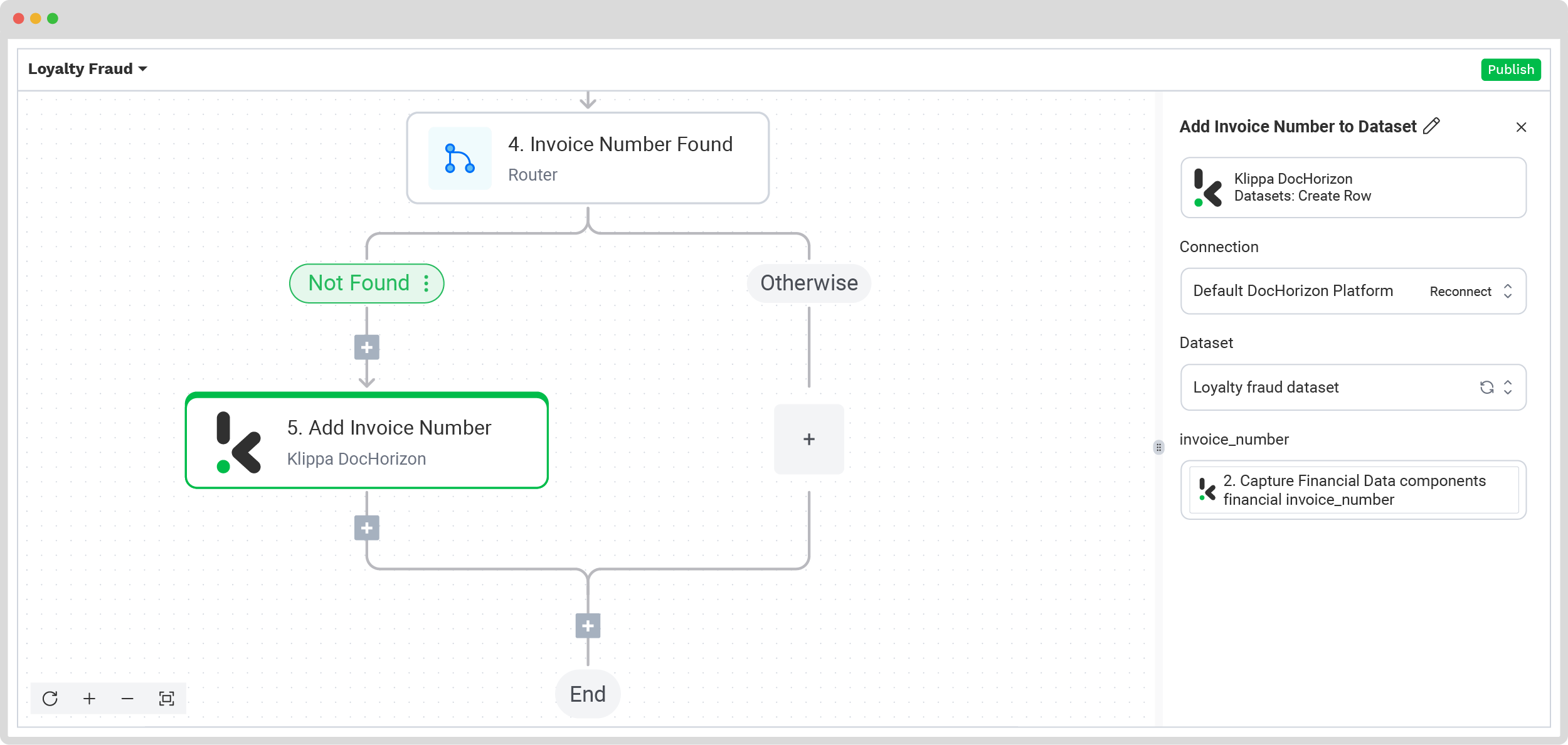

Step 7: Add Invoice Number to the Dataset

If the invoice number is not found in the dataset, the invoice wasn’t uploaded before, so it can be added to the list. You can search in the list for Klippa DocHorizon -> Datasets: Create Row and fill the boxes on the right side with:

- For Connection: Default DocHorizon Platform

- For Dataset: Loyalty fraud dataset

- For invoice_number: Capture Financial Data -> components -> financial -> invoice_number

Step 8: Send Fraud Suspicion Email

If the invoice number is found, the chances are high that this is a fraudulent attempt. For this situation, you can choose what needs to happen. For example, you can decide to send an email back to the sender in which you explain that the invoice you received raised suspicions as its number already exists in your system.

To do this, you need to go under the Otherwise branch and add Gmail -> Send Email as the next step of the flow. After, create a connection between your Gmail account and the DocHorizon platform.

For Receiver Email (To), choose from the Data Selector menu Inbox: New Email -> envelope -> from-> original. For Body text, please select plain text. The subject, the body, and other email sections are highly customizable, so it’s up to you to decide what you write.

And… Mission accomplished! Now you’re ready to outsmart loyalty fraud and protect your rewards program with ease.

Don’t forget that you don’t have to do everything yourself. Feel free to reach out to us if you’re handling high document volumes or have a unique use case. We’d love to hear your story!

Now that you know how to prevent loyalty fraud, it’d be interesting to take a look at the causes and inherent dangers associated with this issue.

Ready to Detect and Prevent Fraud With Klippa DocHorizon?

To fortify your loyalty program against fraud, implementing robust measures is crucial. Klippa DocHorizon offers many protective features out-of-the-box, including but not limited to:

- Automated duplicate checks that detect repeated receipt submissions and serve as a primary defense.

- Automated checks for a receipt’s legitimacy, for example, comparing receipt data with promotion criteria (purchase date, location, etc.).

- Advanced techniques like Photoshop detection and metadata analysis.

By incorporating such measures, you can significantly enhance your ability to prevent and spot fraudulent activities in your loyalty programs.

Next to that, our intelligent document processing solution employs advanced algorithms to thoroughly analyze data and automate every step in the receipt-clearing process.

With our versatile solution, you can streamline your loyalty and cashback program processes by:

- Scanning and extracting receipt data for cashback or loyalty programs with AI-based OCR

- Capturing any document with a mobile device scanning

- Verifying receipts to reward only eligible claims

- Safeguarding your loyalty program’s integrity by detecting document fraud

- Securing customer accounts with foolproof identity verification

- Reducing time and costs for document workflow automation to stay on top of your loyalty campaigns

Ready to put your ideas into action? Reach out to our experts or schedule a demo today!

FAQ

earned. This includes actions like creating fake accounts, stealing points from legitimate users, or manipulating transactions to accumulate rewards illicitly.

The most effective strategies include implementing multi-factor authentication, monitoring unusual account activities, educating customers about security best practices, and using advanced fraud detection tools like Klippa DocHorizon.

Yes. With automated workflows, DocHorizon can instantly employ duplicate detection to identify repeated submissions, metadata analysis to detect document alterations, and cross-validation to check data consistency across multiple documents, among others.

Klippa is ISO 27001 and ISO 9001 certified, meaning it follows internationally recognized standards for information security and quality management. These certifications help ensure data confidentiality, integrity, and availability at all times.