Receipts, whether paper slips handed to a customer or digital proofs delivered by email, are more than just purchase records. In business, they’re a vital source of information for bookkeeping, compliance, expense tracking, and financial analysis.

Yet for many organisations, managing them is tedious. Collecting, categorising, and manually entering receipt data into systems can consume valuable hours, increase the risk of errors, and slow down accounting workflows.

This is where receipt processing comes in: the systematic way of capturing, extracting, validating, and storing data from receipts so it’s ready for accounting, reporting, or compliance.

And in modern operations, receipt automation, powered by Optical Character Recognition (OCR) and Artificial Intelligence (AI), is changing the game. It turns a repetitive chore into a fast, accurate, and scalable process that keeps finance teams focused on higher‑value work.

In the sections ahead, we’ll look first at how manual and automatic receipt processing differ, and why automation is becoming essential for businesses of every size.

Key Takeaways

- Receipt processing is the method of turning paper or digital receipts into accurate financial data, done manually or through automation.

- Manual processing provides human judgment but is slow, error-prone, and difficult to scale for large volumes.

- Automated processing uses OCR and AI to capture, validate, and integrate receipt data quickly, accurately, and at scale.

- Klippa offers DocHorizon for seamless data extraction and SpendControl for complete expense management, scalable to any business size.

What is Receipt Processing?

Receipt processing is the method businesses use to capture, extract, and organise information from purchase receipts so it can be used for accounting, compliance, expense management, or auditing.

Receipts may be physical paper slips or digital records, but both hold key details such as the vendor name, purchase date, total amount, and any taxes or line items.

There are two main ways to process receipts:

- Manually, by typing information into spreadsheets or accounting systems.

- Automatically, by using tools with Optical Character Recognition (OCR) and Artificial Intelligence (AI) to read, validate, and categorise receipt data.

While each method is different, most receipt processing workflows follow the same steps:

- Capture: Collect receipts via mobile app, scanner, email, or upload.

- Digitise: Convert the receipt into a standard digital format.

- Extract data: Pull key fields such as vendor, date, amount, and VAT.

- Validate: Check accuracy and spot potential errors or fraud.

- Archive or integrate: Store securely or send directly to accounting or ERP software.

In short, receipt processing turns unstructured purchase records into reliable financial data, ready for reporting and compliance.

Manual Receipt Processing vs. Automated Receipt Processing

As mentioned before, managing receipts is a crucial part of any business’s operations, but how you handle it can make all the difference in efficiency, accuracy, and scalability. Let’s compare manual receipt processing with automated receipt processing to see which one is the better choice.

Manual Receipt Processing

Manual receipt processing involves collecting physical or digital receipts and entering the data into systems by hand. It means relying entirely on human effort to manage receipts from start to finish. For smaller businesses or those with low transaction volumes, this might feel manageable, but as volumes grow, it can quickly become a bottleneck.

How it works

- Collect receipts – Gather paper or digital receipts from employees, suppliers, or customers.

- Organise – Sort and store them physically or in shared digital folders.

- Enter data manually – Type merchant names, dates, amounts, VAT, and categories into spreadsheets or accounting software.

- Categorise expenses – Assign the correct codes or cost centres.

- File for compliance – Keep copies for audits and tax purposes.

Downsides

- Time-consuming: Hours of repetitive data entry per week.

- Error-prone: Typos, missed entries, and miscategorisations lead to costly mistakes.

- Hard to scale: Increased volume requires proportional staffing.

- Data loss risk: Paper can be lost/damaged; inconsistent digital storage.

Automated Receipt Processing

In contrast, automated processing replaces much of the repetitive human effort with software designed to capture and interpret receipt data. This approach uses Optical Character Recognition (OCR) to “read” printed or digital receipts, and Artificial Intelligence (AI) to validate and standardise the information.

How it works

- Capture receipts – Via mobile app, scanner, email, or API upload.

- Digitise the format – Standardise receipt images for processing.

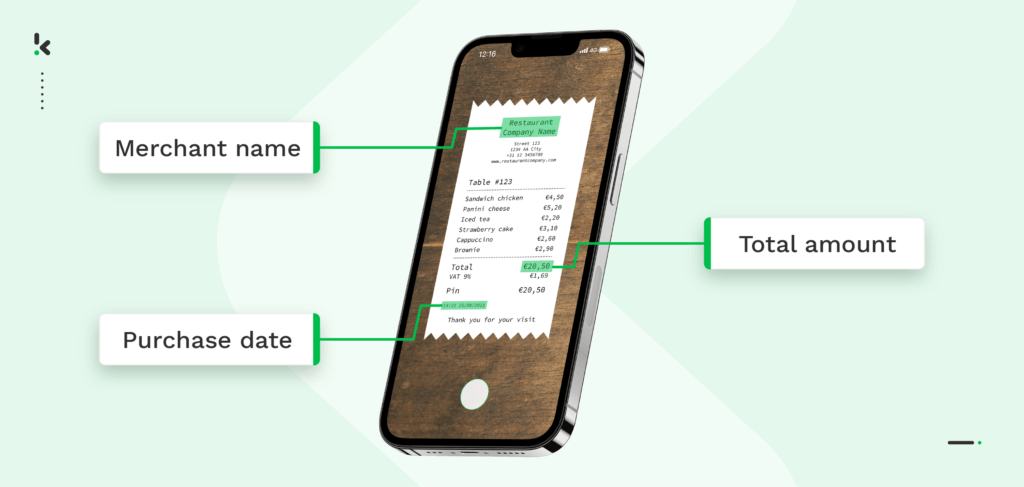

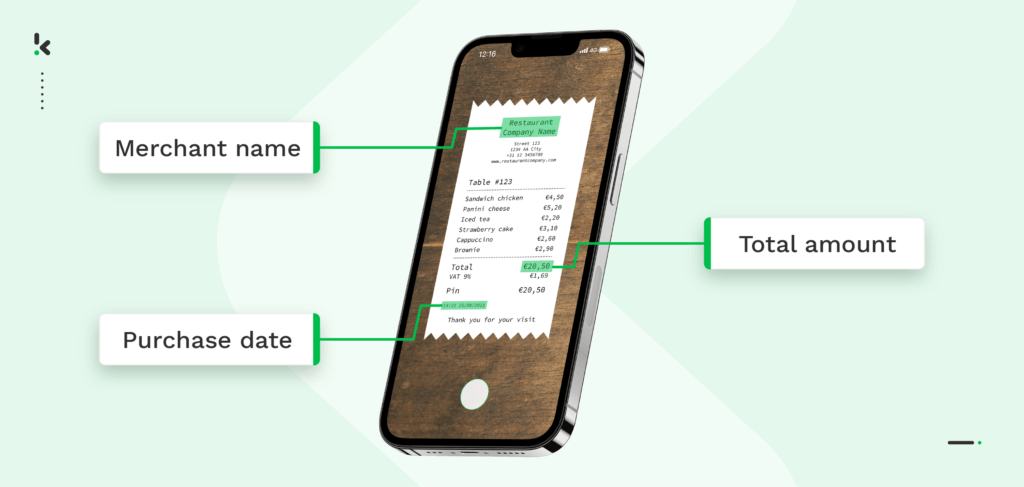

- Extract data with OCR – Automatically read key details: merchant name, date, totals, VAT, and line items.

- Validate with AI – Check for missing data, flag anomalies, and detect duplicates.

- Integrate or archive – Send directly to ERP/accounting systems or store in secure cloud archives.

Key benefits of receipt automation

- Speed and efficiency: OCR scanning and AI validation reduce processing times from minutes to seconds, capturing and verifying data instantly so finance teams can focus on higher-value tasks.

- Improved accuracy: Advanced receipt processing technology pulls data directly from receipts, standardises fields, and flags anomalies, reducing the chance of costly mistakes.

- Scalability: Easily handle thousands of receipts per day without extra staffing, scaling operations during peak periods or business growth.

- Cost savings: Lower labour costs by reducing manual entry, and prevent error-related expenses by catching issues early.

- Real-time visibility: Feed validated data into accounting or ERP systems for immediate expense tracking, reporting, and cash flow insights.

- Enhanced fraud detection and compliance: Detect duplicates, altered images, or missing fields before approval, and securely store receipts for audits.

While both methods can achieve the same end goal — turning receipts into accurate financial data — the path they take, and the resources they require, are very different.

Manual processing offers human oversight but struggles with speed, scalability, and error control. Automation, on the other hand, streamlines workflows, reduces mistakes, and adapts easily to growing volumes, making it an increasingly popular choice for modern businesses.

Challenges in Receipt Automation and How to Overcome Them

Modern receipt processing technology has clear advantages over manual methods, but no system is without its hurdles. To get the best results, it’s important to be aware of potential challenges and understand how to overcome them before you implement an automated solution.

Image Quality and Consistency

Automation relies on OCR to read receipt details accurately, and poor image quality can impact results. Blurry captures, shadows, cropped sections, or faded printing may prevent data from being recognised correctly.

How to overcome it: Use capture tools that provide real‑time feedback during scanning or photographing, ensuring receipts meet minimum resolution and clarity standards.

Variability in Receipt Formats

Receipts can vary widely in layout, language, currency, and detail. Complex designs or unconventional structuring may challenge extraction models.

How to overcome it: Choose OCR solutions with multilingual and multi‑format support, and configure custom extraction rules to handle specific variations.

Fraud Risks

Automated systems can process large volumes quickly, but without adequate checks, duplicated or altered receipts could slip through.

How to overcome it: Deploy fraud detection measures such as duplicate image hashing, metadata analysis, and image manipulation detection.

Integration Complexity

Connecting automated receipt processing tools to existing ERP, accounting, or expense platforms can be challenging, especially in older or highly customised systems.

How to overcome it: Opt for solutions offering API or SDK integration, and ensure your provider offers documentation and support to guide the process.

Change Management in Teams

Employees used to manual processing may be hesitant to trust automation, fearing job changes or reduced control.

How to overcome it: Implement gradual adoption, provide training, and communicate the benefits, focusing on how automation frees time for more strategic work.

Addressing these challenges early not only prevents disruptions but also maximises the impact of automation, making it a sustainable, long-term improvement to your finance workflow.

How to Set Up Automated Receipt Processing

Moving from manual processes to automation doesn’t have to be overwhelming. While each organisation’s setup will look slightly different depending on existing systems and workflows, most successful implementations follow a similar sequence of steps.

1. Capture Receipts Efficiently

Start by defining the capture channels you’ll use. Common options include mobile apps for employees, dedicated scanners for batch processing, email forwarding for digital receipts, or integrations with existing expense management platforms. Ensure consistent image quality by applying minimum resolution standards and training staff on best capture practices.

2. Digitise and Organise Files

Receipts should be converted into a standardised format, typically high-resolution images (JPEG/PNG) or searchable PDFs. Organise them in secure, accessible storage, either in the cloud or via internal servers, ready for automated extraction.

3. Extract Key Data Using OCR

Configure your OCR tool to recognise the specific data fields you need: merchant name, purchase date, total amount, VAT, and, if relevant, line-item details. Ensure multi-language and multi-currency support if your business operates internationally.

4. Validate and Clean the Data with AI

Apply automated rules or AI models to detect missing fields, unusual amounts, or duplicates. This is where fraud detection measures can be embedded, such as duplicate image matching and metadata checks, to ensure accuracy before integration.

5. Integrate with Financial Systems

Connect your receipt processing tool to accounting software (e.g., QuickBooks, Xero), ERP systems (e.g., SAP, Oracle), or expense management platforms. This ensures processed data flows directly into your existing workflows for reporting, reimbursements, or compliance.

6. Monitor, Optimise, and Scale

Regularly review processing speed, accuracy rates, and exception volumes. Use this data to fine-tune extraction rules and workflows, and to decide when to expand automation to other document types, such as invoices or purchase orders.

Following these steps helps you build a reliable, efficient automation workflow that scales alongside your business needs and sets you up for success when integrating advanced solutions.

Solutions for Automating Receipt Processing

Luckily, Klippa offers a flexible receipt processing solution that handles the entire workflow for you — from capture to accurate data delivery — so you can focus on your core business. And if your organisation processes large volumes of receipts or operates complex workflows across multiple systems, our team can manage the full setup and configuration on your behalf.

To fit different business needs, Klippa offers two powerful solutions: DocHorizon and SpendControl. Whether you need a straightforward way to extract and forward receipt data or a complete expense management system with submission, approval, and reporting, we have the right tool for the job.

DocHorizon Platform: Automated Data Extraction and Forwarding

Who is it for?

The DocHorizon Platform is designed for businesses that need a simple, efficient way to extract data from receipts and send it where it’s needed. It’s ideal for organizations that already have established workflows but want to integrate automated receipt processing.

Key Features

- Optical Character Recognition: Converts receipt text into machine-readable data with remarkable accuracy, even for complex layouts or multilingual receipts.

- AI-Powered accuracy: Advanced algorithms ensure data is validated, reducing errors and saving time for your team.

- Easy Integrations: It seamlessly integrates with your existing accounting software, ERP systems, or other tools, ensuring smooth data flow across your organization.

- Scalable and flexible: Handles varying volumes of receipts effortlessly, from small-scale operations to large enterprises.

SpendControl: Comprehensive Expense Management

Who is it for?

SpendControl is perfect for organizations that want a pre-accounting solution for expense management. It’s designed for businesses looking to automate the receipt process from start to finish, including submission, approval, and reporting.

Key features

- Advanced spend management solution: From receipt scanning and data extraction to setting up approval workflows, SpendControl covers it all.

- Integration with accounting software: Automatically synchronize processed data with bookkeeping software like QuickBooks, Xero, or SAP, keeping your financial systems updated without manual effort.

- Comprehensive reporting: Gain actionable insights into expenses with detailed, customizable reports. Monitor spending patterns, identify trends, and ensure compliance with company policies.

- User-friendly interface: SpendControl’s intuitive design makes it easy for employees and finance teams to use, reducing the learning curve and boosting adoption rates.

To see how SpendControl works in action, watch the SpendControl expense management video for a comprehensive visual demonstration.

With Klippa’s DocHorizon and SpendControl solutions, you can say goodbye to manual receipt processing and hello to efficiency, accuracy, and scalability.

Now let’s look at how to set up and run automated receipt processing with DocHorizon step‑by‑step.

How to Automatically Process Receipts with the DocHorizon Platform

Using the DocHorizon Platform to process receipts automatically is straightforward and efficient. Here’s a step-by-step guide to get you started:

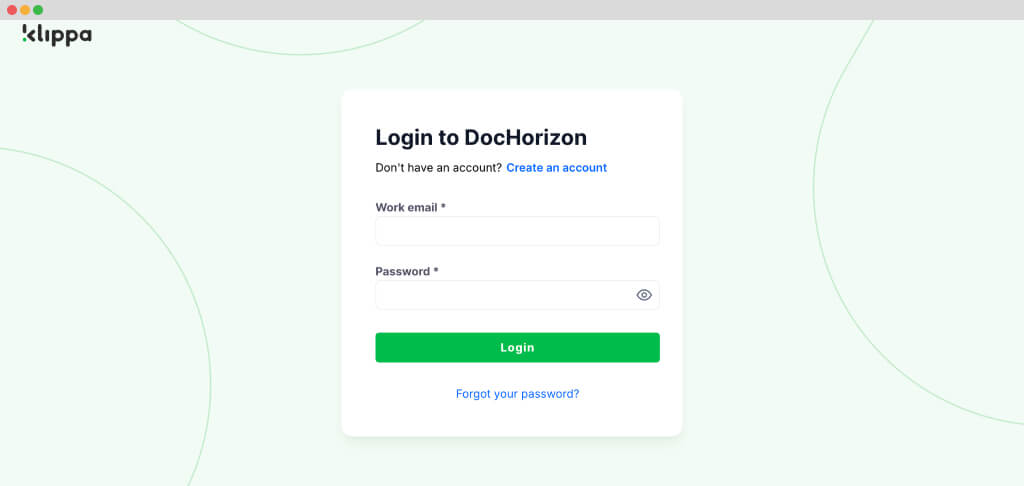

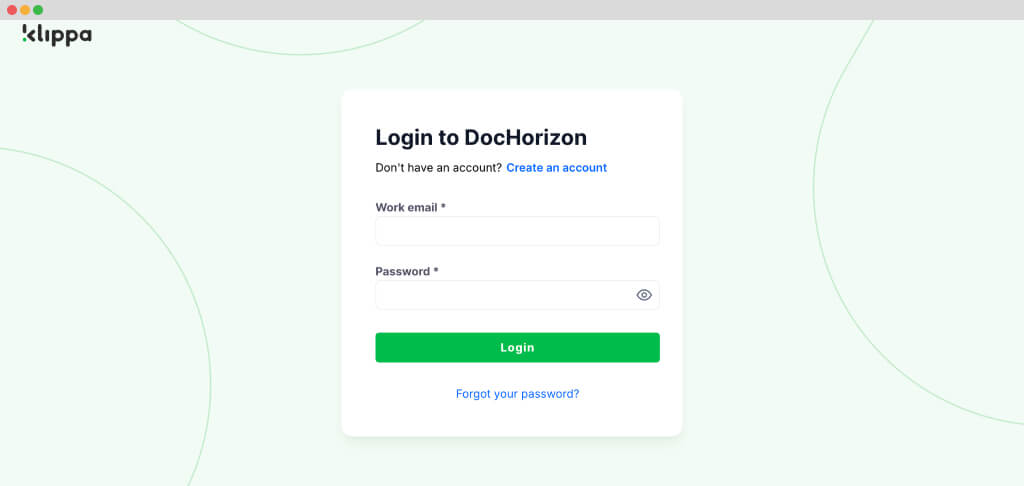

Step 1: Sign up on the platform

To get started, sign up for free on the DocHorizon platform by entering your email address and password. After that, you’ll need to provide basic details such as your full name, company name, intended use case, and document volume. Once registered, you’ll receive €25 in free credits to explore the platform’s features and capabilities.

Step 2: Scan and upload your receipts

Before you start your workflow, it is necessary to digitize your receipts. You can do this by taking a picture of the receipt with a mobile device or using a scanner. With Klippa’s mobile scanning SDK, for example, you can benefit from enhanced image detection quality, thanks to the AI image processing features. These scanned images can then be saved to a folder or drive, depending on the preferred application within your organization. In our example, we upload the receipts to a Google Drive folder.

Step 3: Create an organization

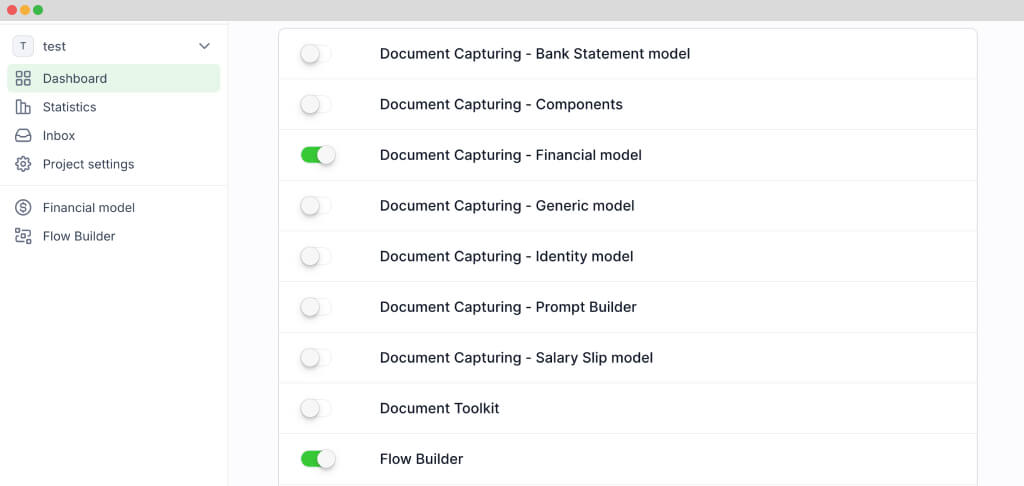

After signing up and uploading your receipts, create an organization within the platform and set up your first project to access the available services. If your goal is to automate receipt processing, simply enable the Financial Model and the Flow Builder services. With this setup, you’re ready to begin your receipt processing journey!

Step 4: Create a preset

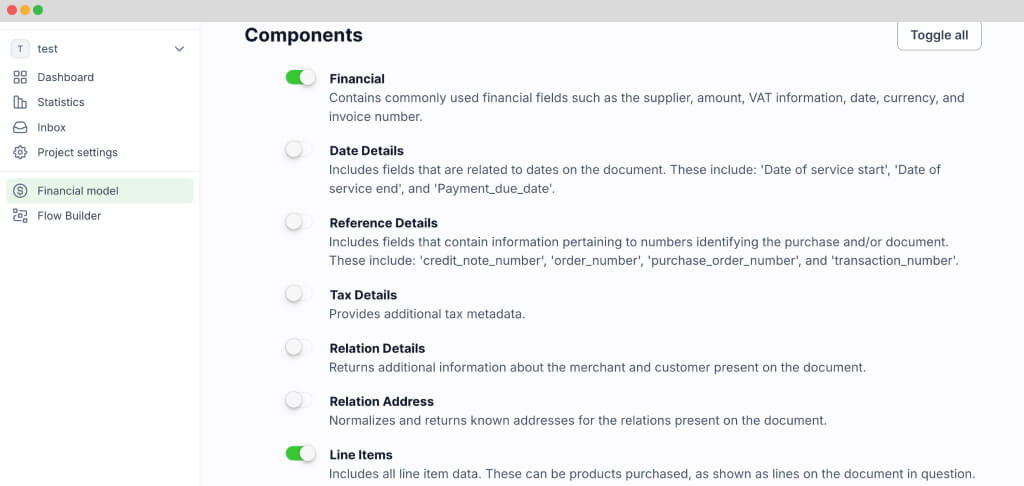

The next step in automating receipt processing is to create a document-capturing preset. Open the Financial Model service within the DocHorizon platform, create a new preset, and let’s name it “Receipt Automation.” This preset will serve as the foundation for extracting receipt data.

Select the components you need; for this example, choose the “financial” component for key fields like merchant name, transaction date, total amount, and VAT details. Enable the “line items” component if you need detailed data like purchased products and quantities. DocHorizon allows you to customize exactly what data to capture, tailoring the process to your needs.

Once configured, click “Save” to finalize your preset. With this setup, DocHorizon is ready to extract all relevant information from your receipts with precision. You’re now ready to build an automated flow for seamless processing!

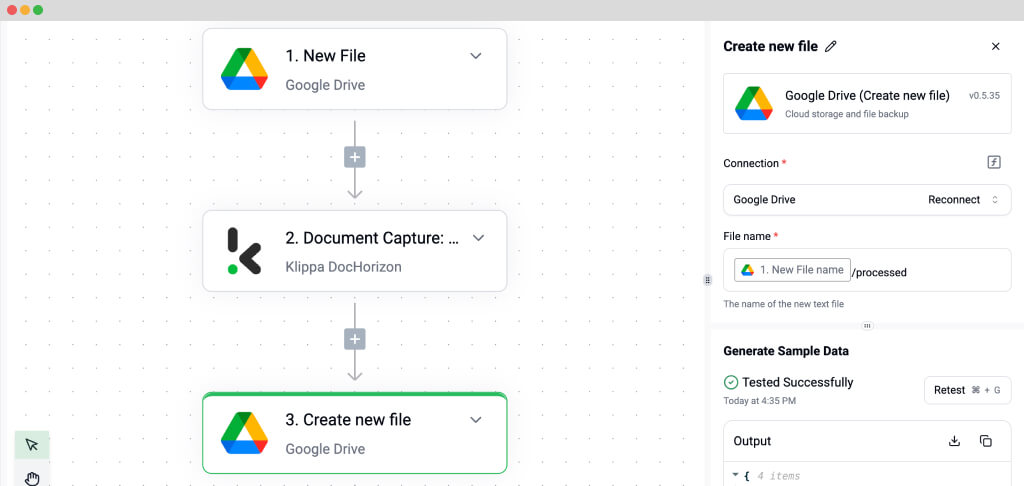

Step 5: Building your flow in the Flow Builder

Now that your preset is ready, it’s time to create a flow in the Flow Builder to automate the data capture process. A flow is a sequence of steps defining how your receipts are processed.

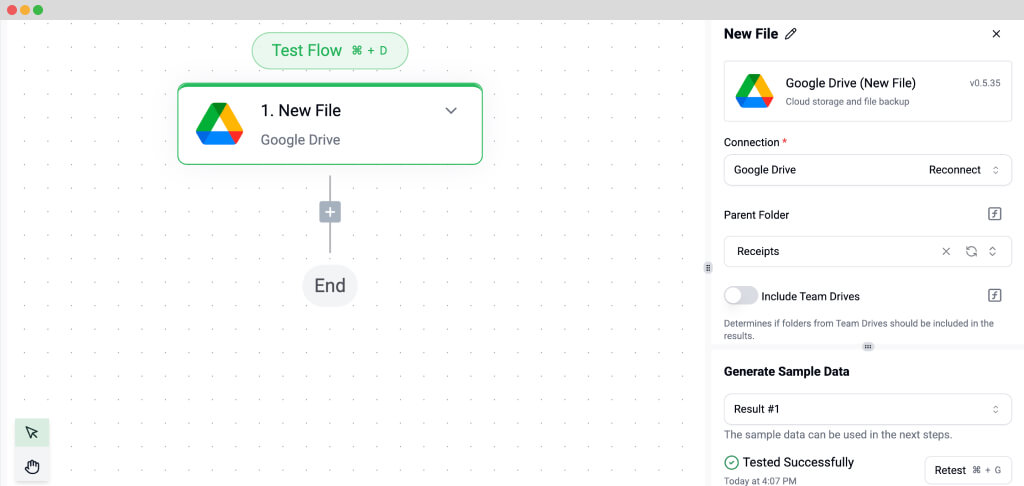

Start by navigating to the Dashboard and clicking on Flow Builder and then New Flow. Choose the From Scratch option to build your flow from the ground up. The first step is to select a trigger, a condition that initiates the process. This could be a new file uploaded to Google Drive, an email attachment, or an event in your database.

For this example, let’s use Google Drive as the trigger. Select New File, connect your Google account, and choose the parent folder where your receipts are stored. Make sure to check the box for Include File Content, which ensures the system processes the file’s data.

Test this step by clicking on Load Sample Data: remember to have at least one sample document in your input folder while setting up your flow.

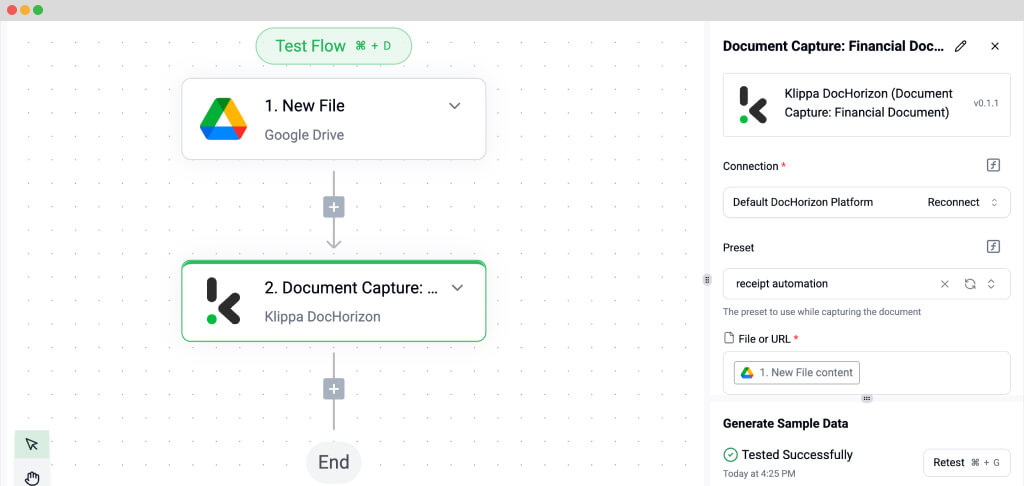

Next, it’s time to extract data from your receipts. Add another step, search for Klippa DocHorizon, and select the Financial Document Capture model, since we’re processing receipts. This step involves choosing the document type you’re working with. Connect it to DocHorizon, and choose the preset you created in Step 4.

Next, configure the File or URL field by selecting New File and adding the content to be processed. Use the data selector to specify exactly what information should be included. For this example, we want to include the content from the newly added file. We select the option “New File content” in the data selector, and after setting this up, we run a test to ensure everything works as expected. If the test is successful, you’re ready to move on to the next step: setting up where the processed data will be sent.

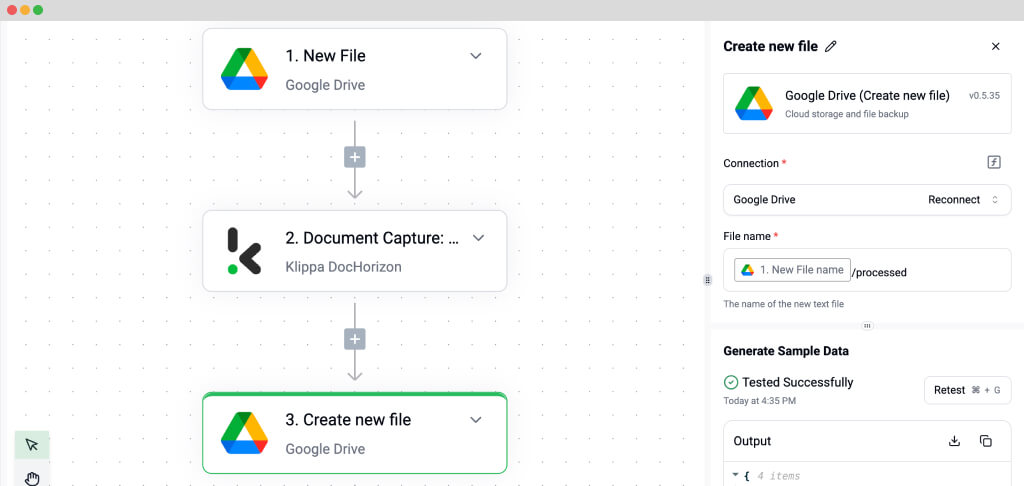

With your flow almost complete, the final step is to configure where the processed receipt data will be sent. DocHorizon allows you to store data in cloud storage, integrate it with an ERP system, or forward it to accounting software like QuickBooks or Xero. For this example, we’ll use Google Drive as the output destination.

Search for Google Drive in the platform and click “Create New File.” Connect your Google account and give the file a descriptive name using the Data Selector. For example, you could use the “Name” followed by “/processed” to indicate that the document has been processed.

Next, decide what content the file will include. In the Data Selector, navigate to Document Capture → Components to specify the information to be included. This ensures the file contains all the components extracted from your receipt, perfectly organized and ready for use.

Finally, choose the format for the new file. You can save it as text, CSV, or XML, depending on your specific needs.

With this setup, your new file will be named “receipt123/processed,” and its content will include all the relevant data from the original receipt. Test the flow to ensure everything works seamlessly, and you’re ready to automate your receipt processing.

Just know that you don’t have to do everything yourself. Feel free to reach out to us if you’re handling high document volumes or have a unique use case. We’d love to hear your story!

Industry Use Cases for Automated Receipt Processing

Automated receipt processing is a versatile solution that helps organisations across sectors streamline workflows, improve accuracy, and gain actionable insights.

- Corporate expense management: Speeds up employee expense claim validation, ensures policy compliance, and integrates directly with accounting software for faster reimbursements.

- Retail operations: Consolidates receipt data across multiple store locations, integrates with ERP/CRM systems, and provides a complete view of sales performance without manual collation.

- Hospitality and travel: Categorizes receipts from bookings, meals, and travel costs automatically, enabling quick invoicing and maintaining compliance for audits.

- Public sector and non-profits: Protects data integrity and enables detailed, transparent reporting to stakeholders and auditors.

- Loyalty programs: Validates customer purchases quickly and accurately, stops fraud, and generates insights for targeted marketing campaigns.

For example, one of Germany’s largest breweries, Krombacher, uses Klippa’s OCR and AI technology to process thousands of customer receipts in its loyalty program. This automation reduces validation time by 90% compared to manual checks, ensures accurate reward allocation, detects fraudulent submissions, and delivers rich insights into purchasing behaviours to inform marketing strategies.

Let Klippa Automate Receipt Processing For You

Automating receipts with Klippa’s receipt processing solutions, DocHorizon and SpendControl, empowers businesses to work faster, smarter, and with greater accuracy, turning what used to be a time‑consuming chore into a seamless, scalable workflow.

Klippa’s story began with providing intelligent solutions for processing receipts and invoices, and these remain at the heart of our expertise. Today, our technology handles a wide range of document types, but our focus on receipt and invoice automation continues to deliver measurable results for organisations worldwide.

Every Klippa solution is designed to:

- Save valuable time for finance teams and employees by removing manual data entry.

- Reduce errors through advanced OCR, AI validation, and fraud detection.

- Ensure compliance with company policies and data protection regulations.

With intuitive, user‑friendly interfaces and seamless integration with popular accounting software, Klippa connects directly to your existing systems, keeping your processes streamlined and your data flowing without disruption.

Ready to take the struggles out of receipt processing? Contact us or schedule a demo today and discover how Klippa can help your business save time, improve accuracy, and stay ahead of the curve!

FAQ

Receipt processing automation uses OCR (Optical Character Recognition) and AI to capture, extract, and validate data from receipts, eliminating manual data entry. It’s important because it reduces errors, speeds up workflows, and provides immediate visibility over expenses, helping businesses stay compliant and make better financial decisions.

Most systems can extract merchant name, transaction date, total amount, VAT/tax details, and, for detailed reporting, individual line items like product names and quantities. This data can then be validated, categorised, and sent directly into accounting or ERP systems.

Challenges include varied receipt formats, inconsistent image quality, handling multiple languages or currencies, and detecting fraud such as duplicate or altered submissions. Modern solutions use AI validation rules, image enhancement, and fraud detection tools to address these issues.

Any organisation dealing with high volumes of transaction receipts can benefit from corporate expense management and retail operations to hospitality, travel, public sector, and customer loyalty programs. Automation ensures speed, accuracy, and actionable insights across all these sectors.

Klippa DocHorizon is designed for automated data extraction and forwarding, integrating seamlessly into existing workflows and systems. SpendControl is a full expense management platform, covering receipt submission, approval workflows, reporting, and integration with accounting tools.

Security is a top priority! We use robust encryption for data in transit and at rest, comply fully with GDPR and other data protection regulations, and offer role-based access controls so sensitive information is only visible to authorised users.