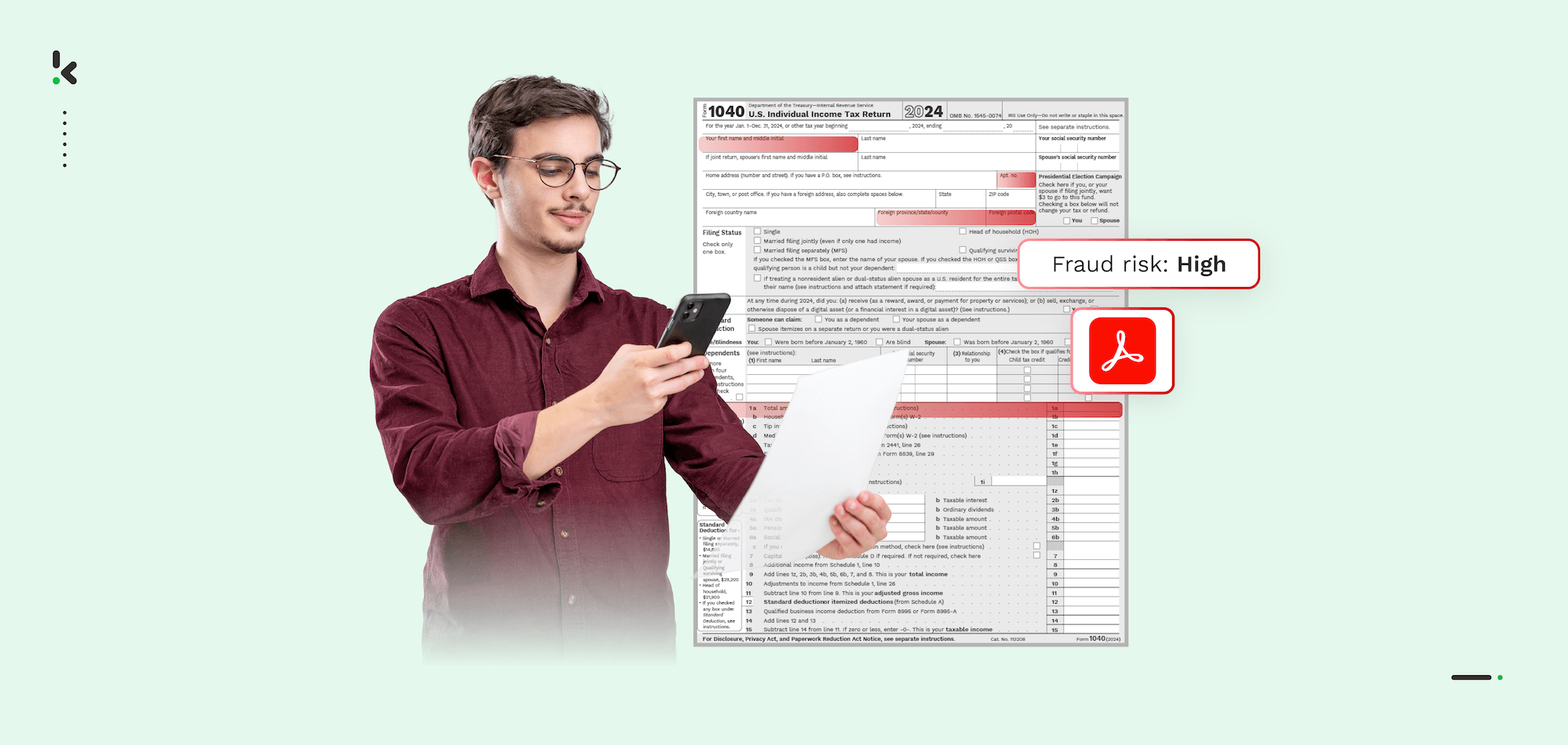

Think of the last time your team reviewed a tax document during a loan application, a background check, or an internal audit. The numbers added up, the formatting looked correct, and nothing stood out at first glance. Then, with a closer look, something did not match.

These forgeries are easier to create than most people realise. Genuine IRS forms can be found online with no difficulty. With Photoshop and generative AI, it takes very little time to change names, Social Security Numbers, income totals, or even entire sections of a scanned tax document.

If they are not detected, fake tax documents can push loan approvals for applicants who cannot repay, influence hiring decisions based on false historical data, or delay audits until financial damage is already done.

In this guide, we will explain how fake tax documents are created, the warning signs that can reveal them, and the steps your business can take to identify fraud before it causes loss.

Key Takeaways

- Fake tax documents are falsified government or employer-issued forms that misrepresent income, tax obligations, or compliance status.

- The most commonly manipulated forms include IRS returns, W‑2s, 1099s, and tax transcripts.

- Fraudsters can fabricate forms entirely or alter authentic ones using easily accessible templates and editing software.

- Manual checks catch only obvious discrepancies, but subtle edits require structured verification methods.

- You can reduce the risk of fraud by training your staff to spot fraud and implementing specialized document fraud detection software.

What is a Fake Tax Document?

A fake tax document is any tax-related form that has been fabricated, altered, or duplicated to mislead the recipient. These documents may look legitimate, often replicating the exact format, typography, and layout of genuine government-issued or employer-generated tax forms. The intent is to present false information that supports an application, claim, or filing.

Common examples of falsified tax documents are:

- W‑2 Forms showing inflated wages or altered employer details

- 1099 Forms listing higher annual payments than received

- IRS Tax Returns with falsified line items to increase reported income or reduce declared taxes

- Business Tax Filings edited to show higher revenue or altered expense categories

Why Are Tax Documents Falsified

The motivation for forging tax documents typically falls into a few categories:

- Loan and Credit Applications – Meeting income thresholds required for approval.

- Employment or Background Checks – Passing verification steps with an inflated earnings history.

- Tax Avoidance – Reducing liability through fake deductions or expense claims.

- Government Benefit Qualification – Meeting minimum income or contribution requirements through false reporting.

The Main Tax Fraud Types

- Fully Fabricated Documents – Designed from scratch using templates or graphic design software.

- Altered Authentic Forms – Based on a genuine form but edited to change key details.

- Duplicated Authentic Documents – Resubmitting a real form multiple times for different purposes.

How Fake Tax Documents Are Created

Fraudsters rarely make mistakes that are obvious to an untrained reviewer. When it comes to tax documents, they use precise techniques to replicate the look and layout of genuine forms while changing the details that serve their purpose.

These methods range from building a document from scratch to slightly editing a legitimate file. Below are the most common techniques we encounter.

Tax Document Cloning

In this method, a fraudster starts with a genuine tax document, often obtained through phishing, stolen mail, or shared files. The original layout remains intact. They then replace key fields such as names, Social Security Numbers, wage totals, or tax due amounts.

Because the cloned document mirrors the authentic version exactly, it can pass visual inspection unless the altered fields are closely compared to verified data.

Fully Fabricated Forms

Some fraudsters do not bother with an authentic template at all. Instead, they build a tax document from the ground up using publicly available form images or downloadable blank IRS templates. They type all values and personal details manually, often sourcing form design elements from online government databases.

Example: An independent contractor applying for a rental property creates a 1099 form in a word processor using IRS codes copied from an online sample. The payer listed is a legitimate company, but the amounts and the payer’s signature are invented.

Data Substitution

Rather than changing the overall document, data substitution focuses on replacing one or two critical fields. This could include changing an SSN to match another identity, swapping an address to match the applicant’s current residence, or replacing the reported wages with a higher figure.

Example: A job applicant alters their W‑2 to show the same employer but changes the wage total from $46,000 to $61,000 in order to meet the salary requirement for a position.

Template Manipulation

Many tax forms have a consistent layout year to year. Fraudsters exploit this by using an older legitimate form as a backdrop and updating the year, codes, and data fields to make it appear current. Editing tools allow for precise alignment, keeping the visual integrity of the original form.

This technique is common with IRS tax transcripts and wage statements submitted for bank loans.

Example: An applicant submits an IRS transcript dated for the current tax year. Metadata analysis later reveals the base file was from three years prior, with the date and tax figures updated to fit the year’s application requirements.

Digital File Alterations

Modern editing tools such as Adobe Acrobat, Photoshop, or specialised software make altering tax documents straightforward. With the right skills, fraudsters can adjust font size, spacing, and positioning so altered fields blend seamlessly with the original content.

This can include removing negative balances, changing refund amounts, or inserting deductions to reduce tax liability.

Each creation method presents its own detection challenges. Cloning and data substitution tend to pass visual review but often fail verification against records. Fully fabricated and template manipulation attacks rely on the absence of trusted example forms for comparison. Digital file alterations require detection methods that can spot hidden changes at the pixel or metadata level.

When you understand how a fake tax document is made, you can better train your team to look beyond surface details and deploy targeted detection checks that match each technique.

How to Spot Fake Tax Documents: The Red Flags

Fraudulent tax documents almost always leave traces. These might be inconsistencies in the formatting, discrepancies with known data, or details that simply do not match how the original form should appear.

The following red flags are the most common indicators of forgery, and your review process should train staff to watch for them.

Mismatched Personal Information

Genuine tax documents must align perfectly with the personal information of the individual or business they represent.

If the name, Social Security Number, or address differs between the document and official records, it is a strong signal that the form may have been altered or fabricated.

Formatting Inconsistencies

Official IRS and employer-issued tax forms use consistent fonts, spacing, and margins. Alterations often create slight differences: text that sits higher or lower, spacing that does not match, or characters that appear darker than the surrounding text.

Arithmetic Errors in Calculations

Tax returns and transcripts follow strict calculation structures. Gross income must align with reported wages, deductions must correspond to allowable limits, and refund or payment amounts must match taxable totals. Any discrepancies may reveal tampering.

Example: A transcript shows gross income of $85,000 and taxable income of $67,500, yet lists a tax liability that does not match the IRS tax table for that year. Even minor deviations here suggest manipulation.

Incorrect or Missing Form Codes

IRS forms and transcripts contain unique identifiers, reference numbers, or barcodes to link them to official records. Fake documents often have incorrect codes, missing sections, or formatting of identifiers that do not match official standards.

Suspicious Filing Dates

Altered documents may show filing or issue dates that are inconsistent with the form’s tax year or the date range of declared transactions. This is common with template manipulation, where old forms are updated without adjusting the date logic.

Example: A tax return dated March 2023 contains references to deductions taken under the 2021 law. The mismatch signals that the base document may be from an earlier year.

Employer or Payer Discrepancies

For W‑2 and 1099 forms, the listed employer or payer details should match official registry and IRS records. Fraudulent documents sometimes list employers that do not exist, have been dissolved, or use altered names to mimic real businesses.

Example: A W‑2 lists an employer called “National Consulting Services LLC.” Registry checks show that the actual company is “National Consultation Services LLC.” The similarity is intentional but misleading.

Duplicate Forms Across Applications

One of the most common scams involves reusing an authentic tax document for multiple applications. A single W‑2 or transcript may appear in separate loan, rental, or job applications with identical figures and dates.

Training reviewers to detect these specific issues is essential. However, even the most experienced staff cannot catch every fraud attempt, especially those with subtle changes. That is where structured verification and automated detection add value, ensuring that any document raising one or more of these flags is investigated thoroughly before approval.

How to Protect Your Company from Fake Tax Documents

Spotting red flags is essential, but prevention is even more important. By building processes that make falsified tax documents harder to submit and easier to detect, you can reduce the risk before fraud reaches your decision-making stage.

Here are proven measures your business can take:

- Create a Library of Genuine Forms – Store examples of authentic tax documents you process most often, such as IRS transcripts, W‑2s, and 1099s. Use these as a baseline for comparing font styles, layout structure, form codes, and placement of key data fields.

- Implement Duplicate Detection – Track key document details across submissions. Generate a unique fingerprint (hash) for each tax document using the SSN, reported income, and filing year. Any hash match should trigger a duplicate alert.

- Match Against Verified Data Sources – Compare the reported figures on the tax document with payroll records, IRS databases, or state revenue records. Employer information should be confirmed against business registries.

- Require Original Source Files – Request tax forms directly from the tax authority, the issuing employer, or other official channels. Avoid accepting screenshots, scanned copies, or forwarded files whenever possible.

- Combine Human and Automated Review – Human reviewers provide contextual judgment, while automated tools detect technical anomalies such as altered metadata, inconsistent fonts, or pixel-level changes. Using both layers sharply increases detection rates.

Pro tip: Prevention and detection complement each other. Strong, regular audits and up-to-date training reduce the number of fraudulent tax documents entering your workflow and make it easier to catch the ones that do.

How to Identify Fake Tax Records with AI

Manual checks are vital, but sophisticated tax document fraud is often designed to bypass them. Klippa DocHorizon uses multiple independent detection layers, ensuring that if a forged W‑2 or altered IRS transcript escapes one check, another will catch it.

Here are the core layers adapted specifically for tax documents.

Metadata & EXIF Analysis

Every digital tax document carries hidden data about when it was created, last modified, and the software used. If a W‑2 claims an issue date in January but metadata shows it was created in a PDF editor in March, the discrepancy signals possible fraud.

Copy-Move Detection

Copy-move detection identifies repeated clusters of pixels in an image. On tax forms, this can expose figures like wages or withholding amounts being copied and pasted across lines to create a consistent but fraudulent narrative.

For example, a fraudster might copy the same inflated income number onto multiple wage statement boxes to meet loan requirements.

Image Splicing Detection

Identifies elements inserted from external sources. A “Paid” stamp or employer logo pasted onto a tax document can be revealed through compression analysis and edge detection.

Duplicate Hash Checks

Creates a unique digital fingerprint from key fields such as SSN, income, and tax year. Any repeat fingerprint across submissions flags the document as a suspected duplicate.

Mathematical Validation

Recalculates declared income, withheld tax, and refund amounts to ensure they match IRS tables or the legal calculation process. Inflated refunds or inconsistent withholding rates are common fraud signs.

Font Anomaly Detection

Scans the document for differences in font style, size, or weight. Altered fields, such as wages or employer names, often have subtle font mismatches compared to original entries.

Employer & Registry Verification

Cross-checks employer names and payer details against official business registries and IRS databases to confirm they exist and match the document.

AI Data Verification

Uses automated lookups to compare reported values against authoritative data, such as IRS maximum deduction limits or standard withholding rates, to flag entries outside allowable ranges.

Why a Layered Approach Works Best

Fraudsters usually focus on changing one area of a tax document, such as an income figure, a date, or an employer name. If your review process checks only that one aspect, they can succeed simply by avoiding detection in that area.

Layered detection solves this problem by running multiple independent checks on every document. If the forgery passes visual inspection, metadata analysis may still catch it. If metadata looks clean, duplicate detection or calculated value checks can uncover inconsistencies.

This redundancy dramatically increases the number of fraudulent tax documents that are caught. It works at scale, scanning large volumes in seconds, while genuine submissions pass through without delay.

In short: Fraudsters can hide one mistake, but they can’t hide them all, and Klippa DocHorizon checks them all in seconds. Watch our webinar “How to Detect Document Fraud & Image Tampering” to see this in action:

Klippa DocHorizon: The Best Tax Document Fraud Detection Software

Fraudsters are increasingly moving from crude, easy-to-spot tax document alterations to precise, highly convincing edits that mimic authentic IRS forms and employer-issued statements.

Klippa DocHorizon is a fully AI-powered IDP platform with advanced fraud detection features, designed to automatically verify authenticity, detect manipulation, and reduce the risk of tax document fraud in real time, whether you process dozens or thousands each month.

Our solution combines intelligent data extraction with advanced image forensics and document validation, providing a layered defence against fraudulent transcripts.

With our solution, you can:

- Extract and validate data with 99% accuracy using AI-powered OCR

- Detect altered tax forms using copy‑move and splicing analysis

- Perform metadata and EXIF analysis to identify dates, editing traces, and suspicious software

- Run duplicate detection with hash-matching to stop the multiple applications of the same document

- Validate income, withholding, and refund amounts against IRS tax tables with mathematical checks

- Spot hidden formatting changes using font anomaly detection

- Cross-check employer and payer information with official registries and IRS databases

- Integrate effortlessly with 200+ systems via API, SDK, or SFTP, aligning with your existing workflows

- Ensure compliance with ISO 27001-certified hosting and GDPR-compliant data processing

Want to see how it works? Book a demo or contact us and let our team walk you through real-world tax document fraud detection scenarios tailored to your industry.

FAQ

Look for mismatched names, SSNs, or addresses, inconsistent fonts or spacing, incorrect calculations, impossible filing dates, and employers or payers not found in official registries.

Inflating income to meet loan or rental requirements, reducing liabilities to appear debt‑free, fabricating employment history, reusing genuine forms across multiple claims, or creating entirely fake IRS transcripts.

Yes. AI-powered software, like Klippa DocHorizon, can uncover hidden metadata changes, image manipulation, font inconsistencies, and numerical errors that often go unnoticed in manual checks.

Check for inconsistencies in personal or company details, formatting and layout differences, unusual file metadata, and discrepancies when compared against verified records or official registries.

Confirm the letter’s contact details with the IRS website. Fake letters may have incorrect logos, generic greetings, payment instructions to non‑IRS accounts, or reference forms and case numbers that do not match IRS records.

False tax documents are forms that contain fabricated, altered, or duplicated data. They are designed to mislead, often to inflate income, hide liabilities, or falsify compliance status.

Verify with the issuing authority, such as the IRS or your state’s revenue department. Authentic checks have secure printing features, correct payee details, and amounts exactly matching your official return.