Fake invoices are among the most common tactics fraudsters use to steal from businesses, and they’re getting harder to spot.

Maybe you’ve seen one before: a perfectly formatted invoice from what looks like a trusted vendor, complete with all the right details. But buried in the fine print is a fake account number. Or the totals don’t quite add up. Or worse — it’s a billing request for an order you never placed.

The rise in invoice fraud costs organizations millions every year. The bigger your supplier network, the more exposed you are.

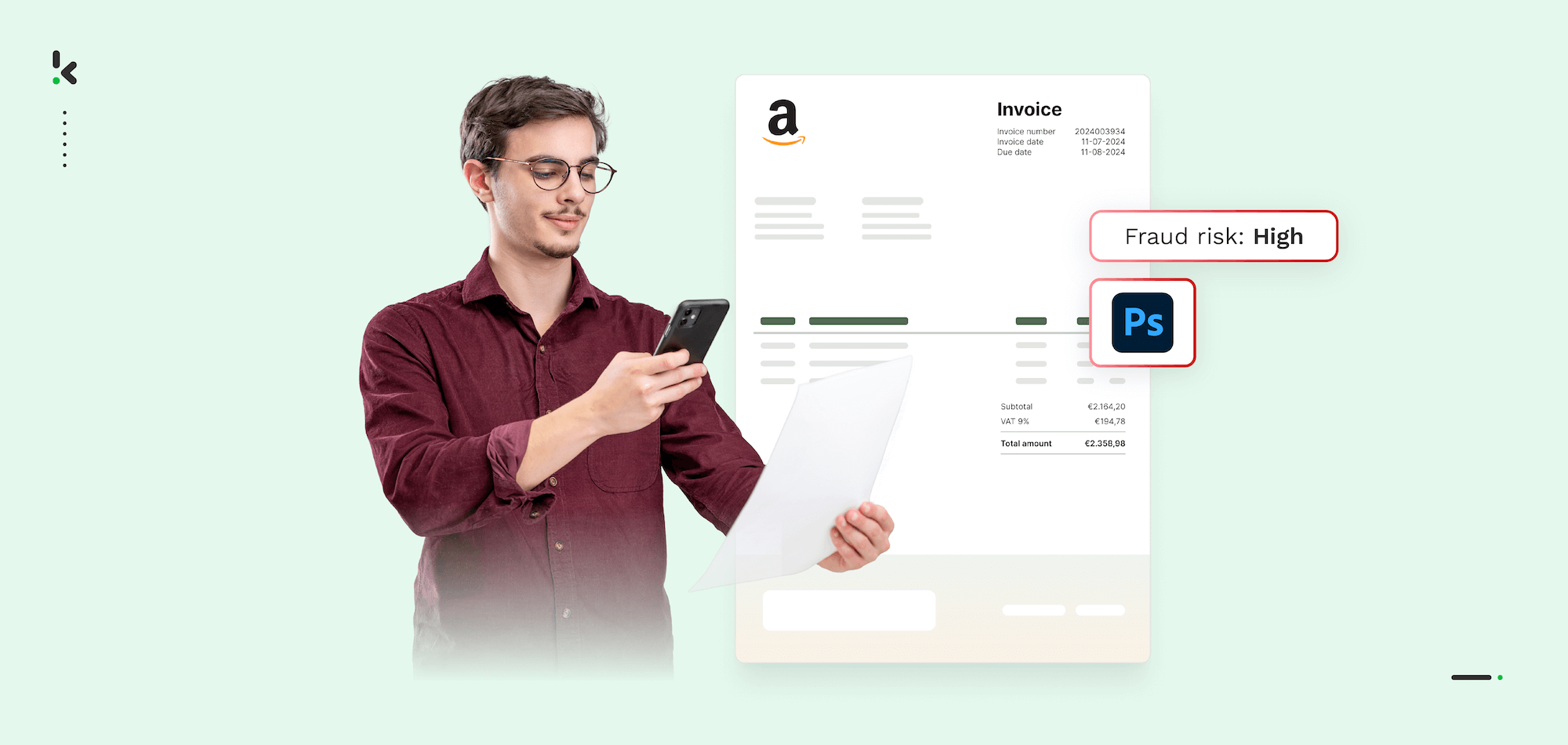

The problem? You can’t rely on manual checks anymore. Sophisticated scammers use digital editing tools, AI, and social engineering to create invoices that fool even the most experienced finance teams.

The good news? With the right document fraud detection tools and processes in place, you can protect your business. In this guide, we’ll walk you through how to spot fake invoices, which red flags to look for, and how to use AI to combat AI-generated fraud.

Key Takeaways

- Fraudsters use multiple tactics — including cloning real invoices, fabricating orders, inflating prices, and changing supplier bank details.

- Know the red flags — such as mismatched company details, sudden bank account changes, arithmetic errors, inconsistent formatting, or rushed payment requests.

- Manual checks aren’t enough — Sophisticated scams can pass visual inspection and slip through traditional approval workflows.

- AI-powered layered detection catches more scams — Klippa DocHorizon uses metadata analysis, image forensics, mathematical checks, database cross-referencing, font anomaly detection, and external registry lookups.

- Layered approach = higher fraud detection rate — if one method doesn’t catch the fraud, another likely will.

What is Invoice Fraud?

Invoice fraud is when a fraudster sends you an invoice that looks legitimate but isn’t. The goal is simple: trick your business into making a payment you don’t owe.

Sometimes the scammer pretends to be an existing vendor. Sometimes they impersonate a new supplier you’ve just started working with. In other cases, they send completely fabricated invoices in the hope that someone in finance just pays them without checking.

The scope of the problem is huge. According to the Association of Certified Fraud Examiners (ACFE), organizations lose around 5% of their revenue to financial fraud each year, with invoice fraud making up a significant share. For medium-to-large companies, even one successful attempt can mean hundreds of thousands in losses.

What makes invoice fraud particularly dangerous is that it often blends in with your normal Accounts Payable (AP) workflow. Fraudsters know invoices are processed in bulk, finance teams are under time pressure, and approval chains can be long and fragmented – making it easier for fake invoices to get through.

How Fake Invoices are Created

Similar to fake receipts, fraudsters are deliberate in how they prepare fake invoices, and they’ve learned how to avoid obvious mistakes. Below are common techniques we regularly see in fraudulent invoices:

Invoice Cloning

The scammer obtains a legitimate invoice from an actual supplier (through phishing attacks, hacked email accounts, or intercepting paper mail). They then copy the layout, branding, and details exactly, but change the payment details to a bank account they control.

Fabricated Invoices

The fraudster invents a completely fake order or service. Businesses with multiple departments are particularly vulnerable here: the finance team may assume another department placed the order.

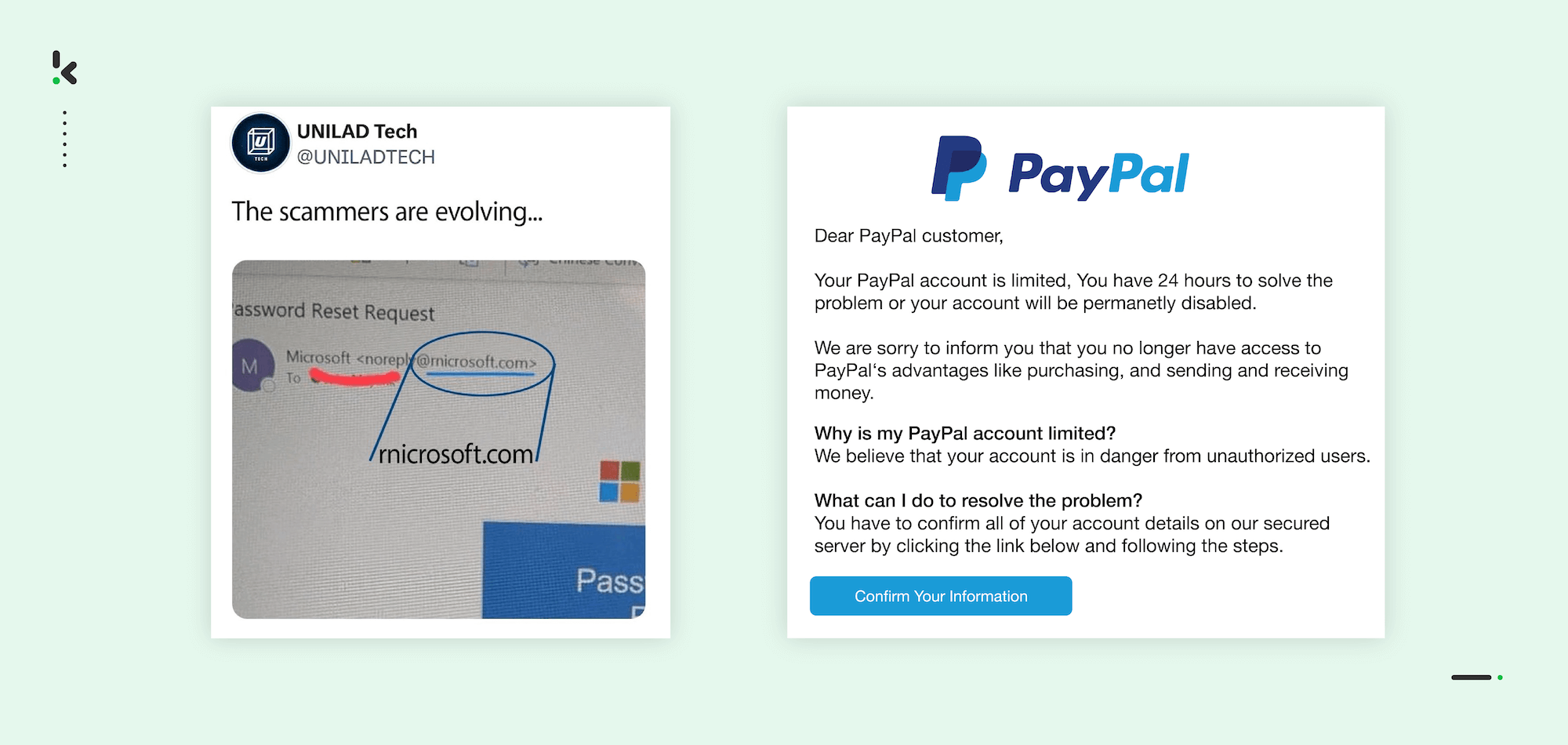

Social Engineering Payment Changes

Often combined with CEO fraud or business email compromise (BEC), the attacker appears to be a senior employee or vendor requesting “urgent” payment to a new account.

Price Inflation

The invoice references real goods or services, but the prices are altered post-approval, sometimes by modifying a PDF in Photoshop or other editing software.

Overlapping Invoice Numbers

A more subtle trick: send the same invoice twice over several months in the hope it will be paid again by mistake, or send it with a slight change (e.g., incrementing the invoice number).

Small, High-Volume Frauds

Rather than one large fake invoice, fraudsters submit many low-value invoices that fly under the radar, adding up to large losses over time.

Real example: An AP clerk at a multinational received an invoice for €1,823 from what appeared to be a marketing agency they worked with. The branding and contact details matched exactly. Only after a targeted document fraud detection check revealed the bank account was linked to an unrelated company in another country did the finance team flag it as fake.

How to Spot Fake Invoices: The Red Flags

Before we dive into AI-powered fraud detection, here’s what your team should keep an eye on when reviewing invoices:

Unexpected or Unfamiliar Invoices

- If you don’t remember placing the order or the contact name is unfamiliar, that’s your first warning sign.

- Example: An invoice for a “software renewal” you never subscribed to.

Bank Account Changes Without Explanation

- A legitimate supplier will inform you in advance (often via official channels) if they change their banking details.

- Fraudsters create urgency to bypass standard verification steps.

Mismatched Supplier Details

- Phone numbers, physical addresses, tax IDs, or domains that don’t align with official vendor records could point to impersonation.

- Example: [email protected] instead of [email protected].

Rushed Payment Requests

- Emails marked “URGENT” asking for same-day transfers are classic signs of social engineering tied to fake invoices.

Inconsistent Invoice Formatting

- Using different fonts or font sizes in critical areas (like totals and bank details), a common tell when a number has been digitally inserted.

Arithmetic Errors

- VAT amounts that don’t match, totals that aren’t the sum of line items, or strange rounding indicate possible data tampering.

Suspicious Dates

- Creation date after the due date, or service dates listed on weekends/public holidays, should raise concerns.

- Example: A delivery date during a supplier’s known holiday closure.

Duplicate Invoices

- The same invoice number and amount were submitted multiple times with slight variations (different file types, slightly altered dates) to bypass manual duplication checks.

Non-standard Contact Methods

- If a supplier reaches out on WhatsApp or a personal email to discuss an invoice, be cautious; it’s an attempt to avoid traceable business communication.

Pro tip: Your AP team should never rely solely on visual judgment. Sophisticated invoice fraud can pass the “look test” and still be fake once checked against metadata, databases, and other AI-led validation methods.

Test yourself by guessing which invoice is fake in our video:

How to Protect Your Company from Fake Invoices with AI

Manual invoice checks can help you catch the obvious scams, but fraudsters are now using advanced methods (from deepfake invoices to AI-written emails), making even trained eyes miss them.

At Klippa, we use AI-powered layered fraud detection to inspect every detail of an invoice, from the visible layout to the hidden file data. Each layer focuses on a different manipulation technique, meaning if one check misses it, another will catch it.

Let’s break down the fraud detection methods and how they connect directly to the red flags above:

1. Metadata and Editor Checks

Red flags they catch: suspicious file creation dates, last-minute bank detail changes.

Every saved file carries hidden “metadata” – the creation date, last modified date, editing software used, and sometimes even the author’s name. Fraudsters rarely scrub all metadata.

Example: You receive an invoice dated 02 March 2024 claiming to be from a supplier you’ve worked with for years. Metadata shows it was created on 28 March 2024 in Adobe Photoshop, not the supplier’s ERP software – a classic sign of tampering.

2. Photoshop & Image Manipulation Detection

Red flags they catch: inconsistent fonts, altered totals, pasted signatures.

- Copy-move detection: Detects duplicate clusters of pixels, e.g., a “5” duplicated in quantity fields to inflate totals.

- Splicing: Finds parts of an image inserted from another source, like moving an authorized signature from one contract to another.

Example: Invoices with pasted “paid” stamps or modified tax rates often show small graphical inconsistencies that the human eye misses, but Klippa DocHorizon spots instantly.

3. Duplicate Invoice Checks

Red flags they catch: resubmitted duplicate invoices with slight edits. Fraudsters often resend the same invoice, maybe months apart, changing a date or adding an extra digit to the invoice number to slip past manual filters.

Klippa DocHorizon generates a hash based on invoice details (total, number, date) and flags anything 100% or near-identical.

4. Mathematical Validation

Red flags they catch: wrong VAT amounts, totals not matching line items. Our system recalculates totals from line items and compares them with the stated total. If VAT % doesn’t match the calculated VAT amount, it’s flagged.

Example: If the invoice says 21% VAT on €1,000 and lists €250 VAT, you’ve found a tampered document.

5. Two- and Three-Way Matching

Red flags they catch: mismatched purchase orders, fabricated invoices. The invoice is automatically matched against the originating purchase order and delivery note. If quantities, descriptions, or prices differ, the invoice is sent for review before payment.

Example: An invoice for 120 units is submitted, but your PO and packing slip both say 100. This is likely intentional overbilling.

6. Price Validation via AI Agents

Red flags they catch: overbilling, inflated unit prices. Klippa’s fraud detection AI agents automatically search the vendor’s public webshop or catalog, comparing the invoice price to the publicly listed price. Any discrepancy above a set threshold is flagged.

7. Font Anomaly Detection

Red flags they catch: patchwork invoices with altered totals or bank details. Fraudsters often edit PDFs without matching fonts perfectly. Our system detects differences in font type, size, or weight (e.g., a heavier bold in bank account numbers).

8. Chamber of Commerce & Address Validation

Red flags they catch: new or fake suppliers, bankrupt vendors. Klippa cross-references business registration databases:

- Validates business existence

- Matches the official address vs the invoice address

- Checks operational status (e.g., bankrupt, deregistered)

Real-Life Invoice Fraud Caught by AI

Imagine you receive an invoice from a contractor you often use. It’s the right logo, the same template, but slightly higher than usual. Here’s how Klippa DocHorizon’s layered checks would catch it:

- Metadata check: Reveals it was opened in Photoshop last week.

- Font anomaly: The bank account section has a mismatched typeface.

- Price validation: Shows the hourly rate is €15 higher than the contractor’s own posted rate.

- CoC validation: Confirms the bank account does not belong to the registered business.

Even if a human approved it at step one, it would be stopped by steps two to four.

Why a Layered Approach Works Best

Fraudsters often focus on one manipulation (e.g., changing bank details, inflating prices, or duplicating invoices) but rarely cover every trace. By running multiple AI-powered checks on every invoice, you dramatically reduce the chance of payment fraud. And because Klippa DocHorizon does this in seconds, your AP team stays efficient without slowing invoice cycles.

Watch our webinar “How to Detect Document Fraud & Image Tampering” to see this in action:

Klippa DocHorizon: The Best Invoice Fraud Detection Software

Invoice fraud isn’t going away; on the contrary, it’s evolving. But with a layered, AI-powered fraud detection system, you can stay ahead of scammers and protect your business from costly mistakes.

Klippa DocHorizon is a fully AI-powered document processing platform designed to verify authenticity, detect manipulation, and reduce the risk of invoice fraud in real-time.

Now part of the SER Group, a recognized Leader in the Gartner® Magic Quadrant™ for Document Management, Klippa brings enterprise-grade document forensics and automation to industries where accuracy and compliance are critical – from finance and insurance to logistics, real estate, and HR.

Klippa DocHorizon offers a fully equipped Intelligent Document Processing platform that seamlessly integrates data extraction, image forensics, and compliance automation. With our solution, you can:

- Detect forged or altered invoices instantly using AI-powered image forensics

- Perform EXIF and metadata analysis to uncover hidden manipulation and editing traces

- Run copy-move and grayscale analysis to reveal pixel-level tampering

- Cross-check documents and data with third-party databases via API

- Match invoices and purchase orders automatically to prevent invoice fraud

- Extract and validate data with 99% accuracy using AI-powered OCR

- Save up to 90% of manual processing time

- Ensure full data security with ISO 27001–certified servers and GDPR compliance

- Integrate effortlessly via API, SDK, SFTP, or 200+ prebuilt system connections

Want to see how it works? Book a demo or contact us to let our team walk you through real-world fraud detection examples tailored to your industry.

FAQ

Invoice fraud is when a person or organization sends a fake or altered invoice to trick a business into making a payment that isn’t owed. This can involve creating entirely fictitious invoices, duplicating real invoices, or altering payment details like bank accounts or totals. Fraudsters often impersonate legitimate suppliers to make the scam harder to detect.

Invoice fraud detection refers to the processes, tools, and techniques used to identify suspicious invoices before they result in unauthorized payments. This usually involves data analysis, pattern recognition, and verification procedures to flag potentially fraudulent activity.

You can identify a fake invoice by looking for red flags such as:

1. Unexpected invoices or charges

2. Bank account changes without prior notice

3. Supplier contact details not matching official records

4. Arithmetic errors in totals or VAT amounts

5. Inconsistent fonts or formatting in key fields

6. Using AI-powered fraud detection tools like Klippa DocHorizon automates these checks and catches what humans might miss.

Invoice cloning – Copying a legitimate invoice but changing the payment details.

Fabricated invoices – Charging for products or services never ordered.

Duplicate invoicing – Submitting the same invoice twice with small changes.

Price inflation – Altering totals or unit prices without changing the product details.

BEC scams – Using fake emails from executives or suppliers to request urgent payment.

AI detects fake invoices by combining multiple fraud detection methods, including:

– Metadata checks to spot tampering dates or editing software.

– Image analysis (copy-move, splicing) to catch altered text/images.

– Mathematical validation to ensure totals match line items.

– Database cross-checking with purchase orders, delivery notes, and official business registries.

– Font anomaly detection to spot mismatched text formatting.

– Klippa uses a layered approach, so if one method doesn’t catch the fraud, another will.

Layered fraud detection means running multiple, independent checks on every invoice. Each layer tests for a different manipulation (e.g., metadata change, price inflation, or mismatched supplier data). Because fraudsters rarely eliminate all traces of tampering, a layered system like Klippa DocHorizon catches a much higher percentage of scams than single-method checks.

Yes, but it’s difficult and time-consuming – especially at scale. Trained finance teams can spot obvious mistakes, but sophisticated scams can pass manual review. AI speeds up the process, reduces human error, and catches subtle manipulations that are invisible to the naked eye.

Best practices include:

– Verifying all new supplier bank details via an independent source.

– Using two- or three-way matching to compare invoices, purchase orders, and delivery notes.

– Training AP teams to recognize common red flags.

– Implementing AI-powered fraud detection like Klippa DocHorizon to automate and strengthen controls.

Not with the right system. Klippa DocHorizon operates in real-time or near real-time, so invoices are checked seamlessly without delaying approved payments.