42% of office workers said they would be more productive if they had fewer administrative tasks, such as sorting documents, maintaining databases, or checking documents for completeness. This is the outcome of a survey from Automation Anywhere, a global leader in Robotic Process Automation (RPA). Is this something that you experience in your daily work as well?

Think of all the times you had to go through a document over and over again to make sure that all fields were properly filled out by your client. Or when you received that long-awaited contract but you realized that it was missing a signature. Technicalities like these can result in delays of days or even weeks. In some cases, it can even result in compliance issues and all the risks associated with it.

Wouldn’t it be easier to automatically verify documents with an intelligent software solution, ensuring they are signed and contain all the necessary information?

In this blog, we will explain why it is important to say goodbye to manual checks and show how you can automate document completeness checks.

Why is It Important to Check Documents for Completeness?

Let’s start with the question of why you should bother checking documents at all. The answer is quite simple. If you don’t check documents for missing information or signatures, you can be in serious trouble.

Imagine a situation in which you do business with another company. Normally you would have a legally binding contract in place, in which both parties agreed to the terms and conditions of the cooperation. In case of any disputes, you can always rely on the contract and in the worst case, go to court to settle the issue.

If one of the signatures is missing, however, you just have a pile of papers with terms and conditions but nothing that is enforceable by law. This can not only lead to a loss of business but can do serious harm if you’ve been scammed.

In other situations, information is needed to properly assess business risks. For example, if you are a bank and need to determine whether a loan application should be approved or not, you need information about a person’s income situation. Without this information, you can’t properly assess the financial risks associated with the loan and will never be able to judge the application.

So clearly, it is important to have the right completeness checks in place. But what makes this sometimes so difficult? Let’s have a look at the challenges.

What Are the Challenges of Checking Documents for Completeness?

Today, many industries are still wrestling with reams of physical documents, which introduces many challenges. We discuss the most important ones below.

- Long turnaround times

Checking large volumes of documents manually is a time-consuming process, especially with multi-page documents. They may come in different forms, such as PDF files, pictures, Word documents, or spreadsheets. They can also have different layouts, meaning that the required information is in different places all the time.

In case you found an irregularity, asking for re-submissions requires more email back-and-forth and adds up to the turnaround time. So in short, it can take a long time before the process is finished, and all that time your client is waiting for an answer.

- Time-consuming

Having to check thousands of pieces of paper manually is not only time-consuming but also a tedious task. Such tasks can take days or even weeks to complete – what seems like a never-ending process!

- Human errors

A major drawback of any manual process is that it introduces human error. No one is flawless, so you will definitely miss the lack of a signature or that one piece of information from time to time. If you check only a few documents, this is probably not too bad. But if you have to check thousands of documents, an error rate of 1% already results in dozens of errors.

If you’re lucky, these errors will just wind up being an administrative nuisance; at worst, they can result in serious damage to your company.

- Scalability

There’s only so much a person can do in a day. Checking a few hundred documents per month is totally fine. But what happens if you need to check thousands or even millions of documents per month?

It is of course theoretically possible to scale your workforce, but the operational complexity that comes with it makes it very hard in reality.

Fortunately, better options are available in the form of automated solutions. Let’s see how they can help you to check documents for completeness.

The Solution: Automated Checking for Completeness

Most organizations now understand that they need a new approach that involves automation and machine learning to improve document-related business processes. But not everyone knows where to start, how it works, and which processes can be automated.

In the specific case of checking documents for completeness, almost every step can be automated and performed by Intelligent Document Processing software. An IDP solution like Klippa DocHorizon, for example, is able to check documents within seconds. In this way, clients can be provided with feedback in almost real time.

Does a client upload a document without the required information? Or a contract without a signature on the designated pages? Don’t worry, DocHorizon can automatically detect this for you.

But How Does This Work Exactly?

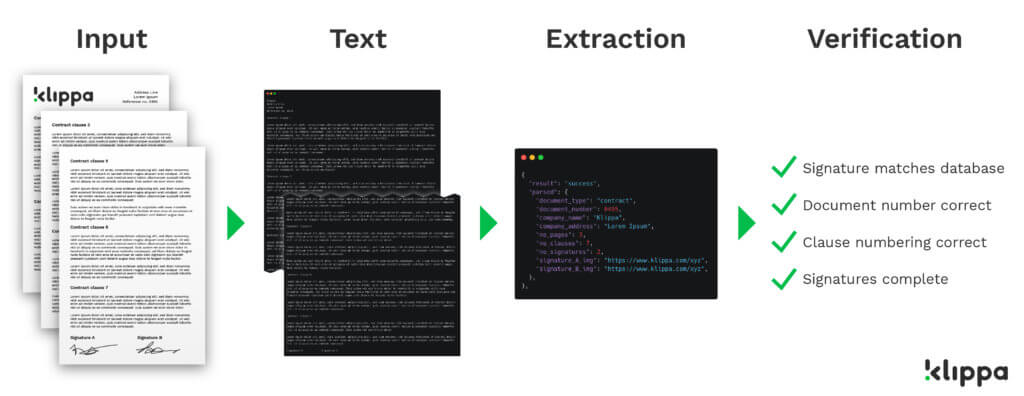

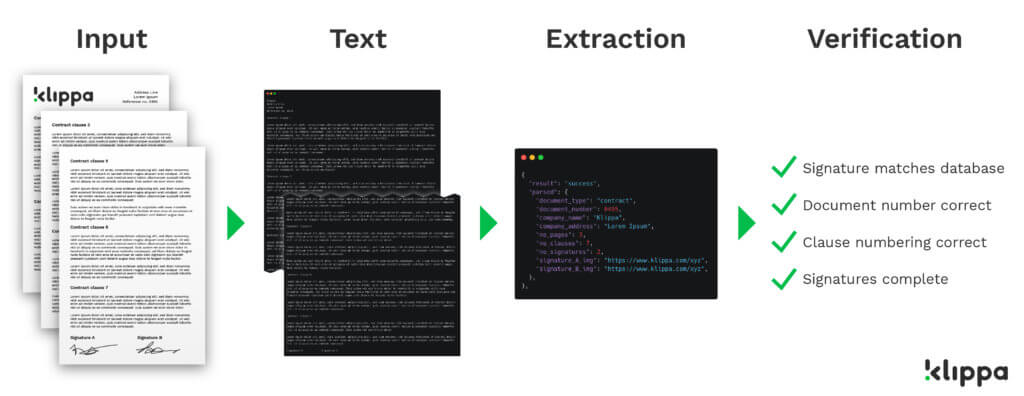

Klippa DocHorizon can automatically scan documents for completeness. The first step of the process is to provide an image or a PDF file to the platform. Once the document is received, Klippa DocHorizon turns it into text and identifies the meaning of each value by using AI (Artificial Intelligence). After this step, the software has a list of all the present fields on the document.

Now that the list of fields on the document is mapped out, the software can validate these fields based on the given requirements for that specific document. Based on the match between the fields on the document and the requirement, the software determines if a document is complete or not. The software can perform automated completeness checks such as:

- How many documents are present

- Determine the document type per document

- How many pages are present per document

- The presence and validity of specific fields, values, or other components (e.g. signatures, images, etc)

- Comparison of the presence and validity of the fields with a list of requirements or values

- Cross-check gave fields and values between documents (e.g. is the name on the contract the same as on the passport, etc.) or with third-party sources (e.g. your database, the Chamber of Commerce database, etc. )

In case any irregularities are found, the software will identify and communicate this mismatch within a few seconds so that it can be checked by your back office or immediately returned to the customer. Customers can then review and resubmit the document, and finish the process from their side right away. This will significantly reduce the turnaround times of your workflows.

Reduced turnaround time is just one of the benefits of automation. Replacing manual tasks with automated solutions comes with many other advantages as well, including reduced costs, greater efficiency, higher accuracy, and time savings.

For a better understanding of how automation can benefit your business, we will take a closer look at the comparison of checking documents manually vs automatically.

Manual vs. Automated Document Completeness Checking

As we stated before, manual checking comes with some serious challenges, while automatic checks become more and more common. Below we present a comparison of the manual way of document checking vs the automated way.

| Manual checking | Automated checking |

| Potential business loss High chances of business loss or business interruption due to delays. | Cost savings With automated completeness checks, you will get more efficiency for fewer costs. You will be able to reduce the time spent on validating or correcting information in the documents by at least 70%. |

| Fast An automated solution detects documents with missing information almost in real time. Instant alerts allow clients to quickly fill in the field and enter the correct value or information. | Minimization of errors As mentioned before, no one is flawless, not even a computer. But it does come pretty close! Software never gets bored, tired, or distracted and will consistently perform the task it’s programmed to do. You can expect an accuracy rate of almost 100%, meaning that you will receive complete data to continue the process and avoid delays. |

| Slow When you have a workflow within your company in which you have to check whether certain documents have certain information or values, it takes a lot of time. Which can result in longer turnaround times. | Fast An automated solution detects documents with missing information almost in real-time. Instant alerts allow clients to quickly fill in the field and enter the correct value or information. |

| Difficult to scale Manually verifying documents is a demanding and time-consuming task. Having to set up a team requires a significant investment in staff. This makes it difficult for an organization to scale upon demand. | Increased productivity Faster processing and time savings will allow your employees to concentrate on other more important tasks. |

| Customer dissatisfaction Delays and long turnaround times can result in customer dissatisfaction. | Increased customer satisfaction Improved efficiency and clearer communication with your customer is guaranteed. You will be able to minimize administrative hassles for your employees and customers. |

As you can see, automated checking can benefit your business in incredible ways. In the next section, we will have a look at some practical examples of how you can apply an automated solution.

How Automation Can Transform Your Business

Now that we have talked about the advantages of using software to scan documents for missing information, we will discuss a few practical examples. We hope to give you some inspiration on the type of tasks that you can automate.

Below you can find three common use cases:

- Automated receipt clearance for loyalty programs

- Automatically check contracts for completeness

- Automatically check proof of income for completeness

Automated Receipt Clearance for Loyalty Programs

Loyalty programs reward customers who repeatedly buy from or engage with a brand. They usually work as follows. A company has a loyalty program for a new product they want to promote. Customers who buy the product, can send in their receipts and get a percentage of the money back or be rewarded with loyalty points.

Can you imagine the amount of work it would be to manually check all receipts to see if the campaign requirements were fulfilled? Did the participants actually buy the product? Was it bought within the time frame of the promotion? Etcetera.

An automated solution can check if the cashback product is on the receipt in the blink of an eye. Next to that, it can check whether the same receipt has been uploaded before and verify all the other campaign requirements such as a certain data range or list of participating stores.

Once this is done, the software can automatically set up a payment that only needs to be confirmed. This will naturally result in faster processing and happier clients, as they will receive their reward a lot quicker.

Automatically Check Contracts for Completeness

Companies use contracts to protect their rights when they enter into an agreement with another party. But in order for them to be enforceable, contracts should contain certain fields and elements, such as a valid signature of both parties. How can we automate such checks?

Let’s take the example of an employee who is responsible for sending out a contract to a client.

Once the client sends the contract back, it can automatically be uploaded to the software and checked for completeness. If the software notices that it is missing a signature or a specific clause, it can automatically reply to the email and ask the client to include the missing element and resubmit the document.

This makes this process very efficient, resulting in happier clients and employees.

Automatically Check Proof of Income for Completeness

Showing proof of income is a requirement when applying for loans or mortgages. It helps banks to verify that an applicant has a steady source of income and will therefore be able to make monthly payments on time. Often payslips, bank statements, and/or employer letters are used for this purpose.

Let’s take the example of a mortgage provider that has to check whether a submitted payslip is complete.

Payslips may vary from employer to employer, but they have to contain at least the salary, name of the employer, starting date, and working hours (i.e. part-time or full-time). In case any information is missing, the mortgage provider has to contact the applicant and ask to resubmit the document.

Automated checking can be of great help for such procedures. The software can automatically check if the required information is on the document at the moment of submission, and give an instant alert if something is missing. This makes this process a lot easier and quicker. And no doubt it will give you some peace of mind!

Get Started with Klippa’s Intelligent Software

Companies that stand out will be those that have adapted to change by becoming more agile, and cost-effective, and providing better customer and employee satisfaction.

Klippa can be your best ally in checking any type of document and extracting data in real time. We can help you with all the cases mentioned in this blog, and much more.