AI-powered OCR is transforming how finance teams process invoices and financial statements. A July 2025 Deloitte poll found that 80.5% of finance professionals believe AI tools will become standard within five years, yet only 13.5% are currently using agentic AI in their workflows, with trust identified as the main barrier.

This makes choosing the right, reliable AI OCR platform essential. In this guide, we compare the best AI OCR tools for finance, looking at accuracy, integrations, and standout features so you can make a confident choice for your organization.

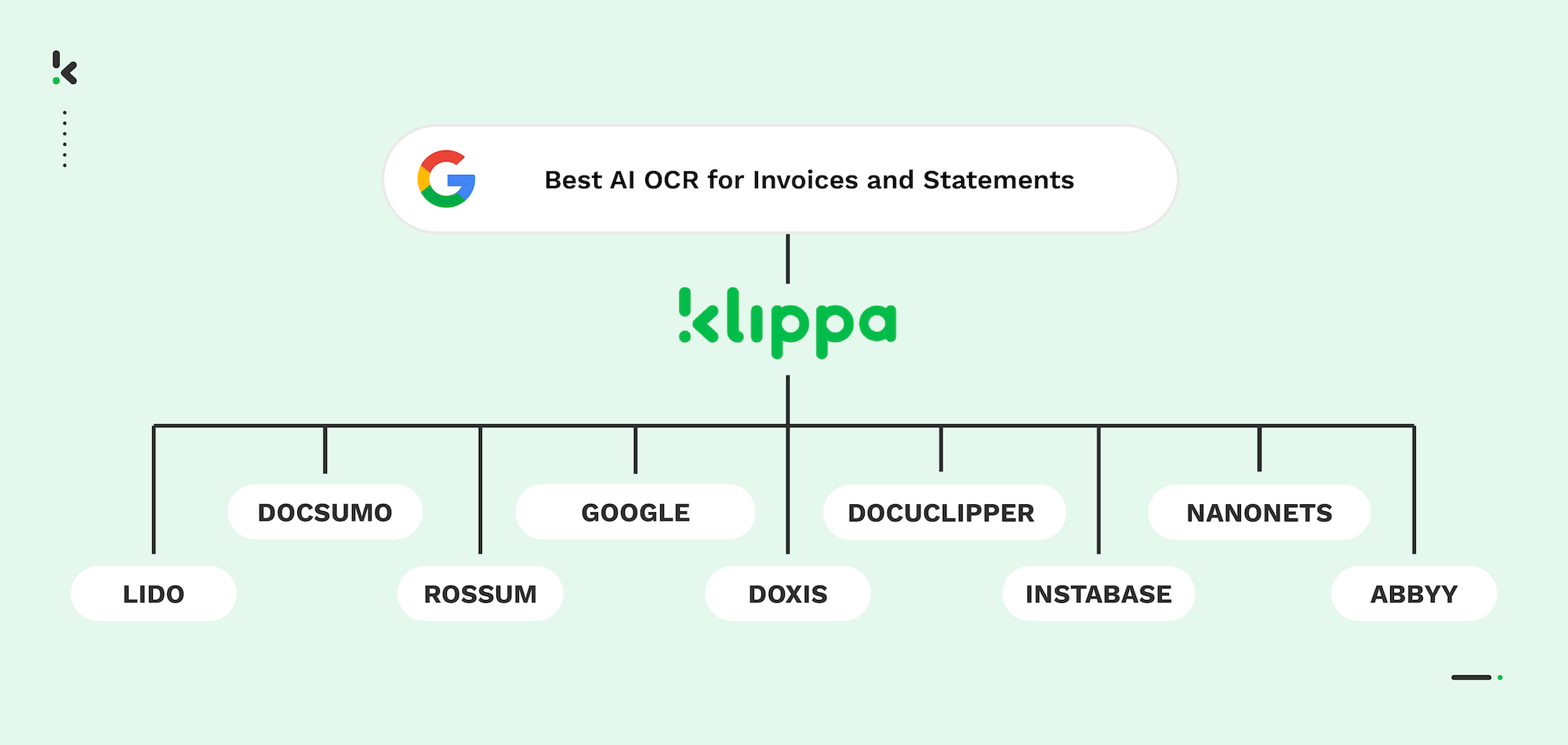

Key Takeaways – The Best Invoice OCR Software in 2026

- Klippa DocHorizon: Best Invoice OCR with fraud detection, currency & language support, plus compliance certifications.

- Doxis: Enterprise document management with strong OCR for complex finance workflows.

- Lido: Finance-focused AI OCR with high accuracy and no-template setup.

- Docsumo: Flexible AI models for invoices, statements, and financial records.

- Rossum: Template-free data capture with built-in document understanding.

- ABBYY FlexiCapture: Feature-rich OCR with specialized financial projects.

- Instabase AI Hub: GenAI-powered flexible extraction from varied layouts.

- Nanonets: Trainable AI OCR for advanced financial use cases.

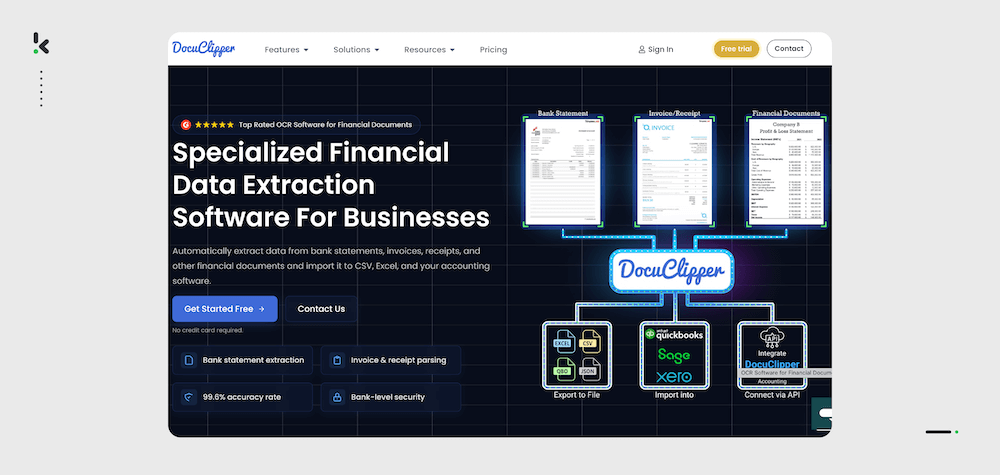

- DocuClipper: Designed for invoices, bank statements, and reconciliation tasks.

- Google Cloud Vision OCR: Developer-focused API with broad language support.

What is AI OCR?

AI OCR (Artificial Intelligence Optical Character Recognition) combines traditional OCR with machine learning models to enhance accuracy, handle varied layouts, and process unstructured documents.

In finance, AI OCR makes it possible to capture invoice and statement data even from complex, multi-language, or low-quality scans. This speeds up processes, reduces human error, and increases document handling efficiency.

Top AI OCR for Invoices in 2026

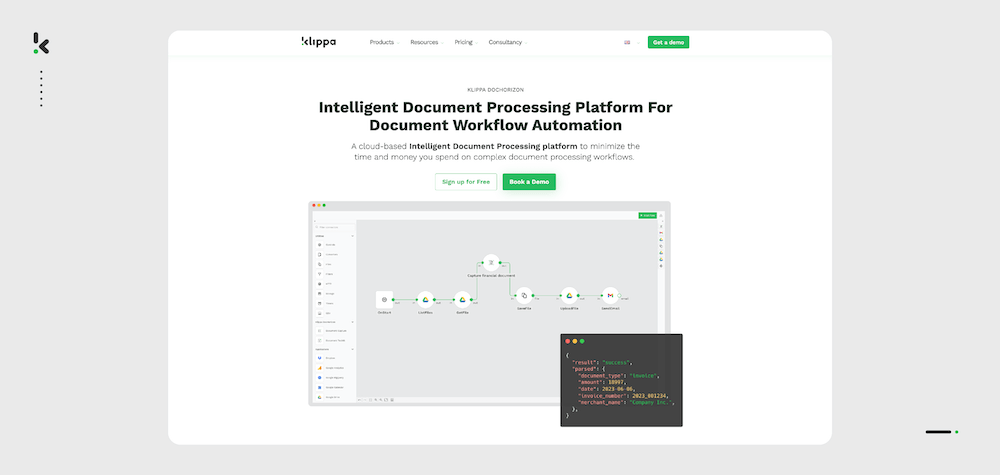

1. Klippa DocHorizon – Best Invoice OCR Software

Klippa DocHorizon is an intelligent document processing (IDP) platform that utilizes AI-powered invoice OCR to extract data from invoices and financial statements across various formats, including PDFs, images, and email attachments.

Fraud detection features identify duplicates and manipulated invoices, while multi-language support with multi-currency handling makes it globally ready. Compliance standards such as ISO 27001, GDPR, HIPAA, and SOC 2 ensure data security in highly regulated industries.

💡 Note: Klippa also offers Klippa SpendControl, an all-in-one pre-accounting platform combining automated invoice processing, expense claims, approval flows, and corporate credit cards. It’s aimed at SMBs needing both automation and financial control in one place.

Key Features

- 95%+ accuracy AI invoice OCR

- Fraud detection & authenticity checks

- Multi-language & currency support

- ERP/accounting integrations

- Batch document processing

Pros

- Global-ready compliance

- Strong fraud prevention tools

Cons

- Best suited for mid-to-large enterprises

- Initial configuration for advanced workflows

Best for: Companies needing secure, scalable AI OCR for structured and unstructured finance documents.

2. Doxis

Doxis combines robust document management with advanced OCR capabilities tailored for enterprise finance workflows. It handles multilingual invoices and statements, routing captured data into approval chains and compliance reviews.

It integrates natively with ERPs like SAP and Microsoft Dynamics, making it a fit for organizations with complex data flows.

Key Features

- Multilingual OCR for finance documents

- Customizable workflows

- ERP integrations

- Document classification & archiving

- Role-based permissions

Pros

- Strong fit for regulated industries

- Flexible workflow designs

Cons

- Steeper initial learning curve

- Enterprise-focused complexity

Best for: Large organizations with multi-step finance document workflows.

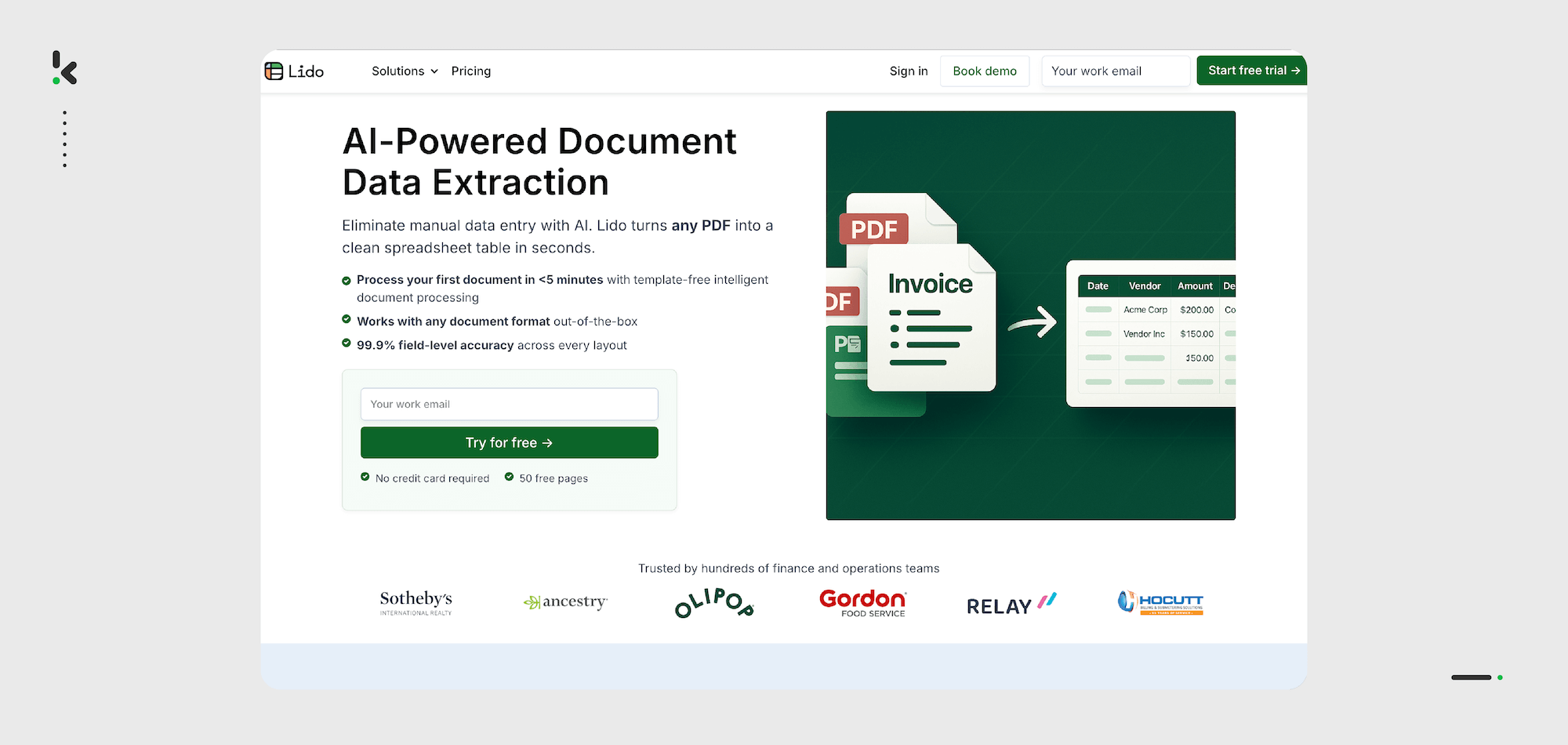

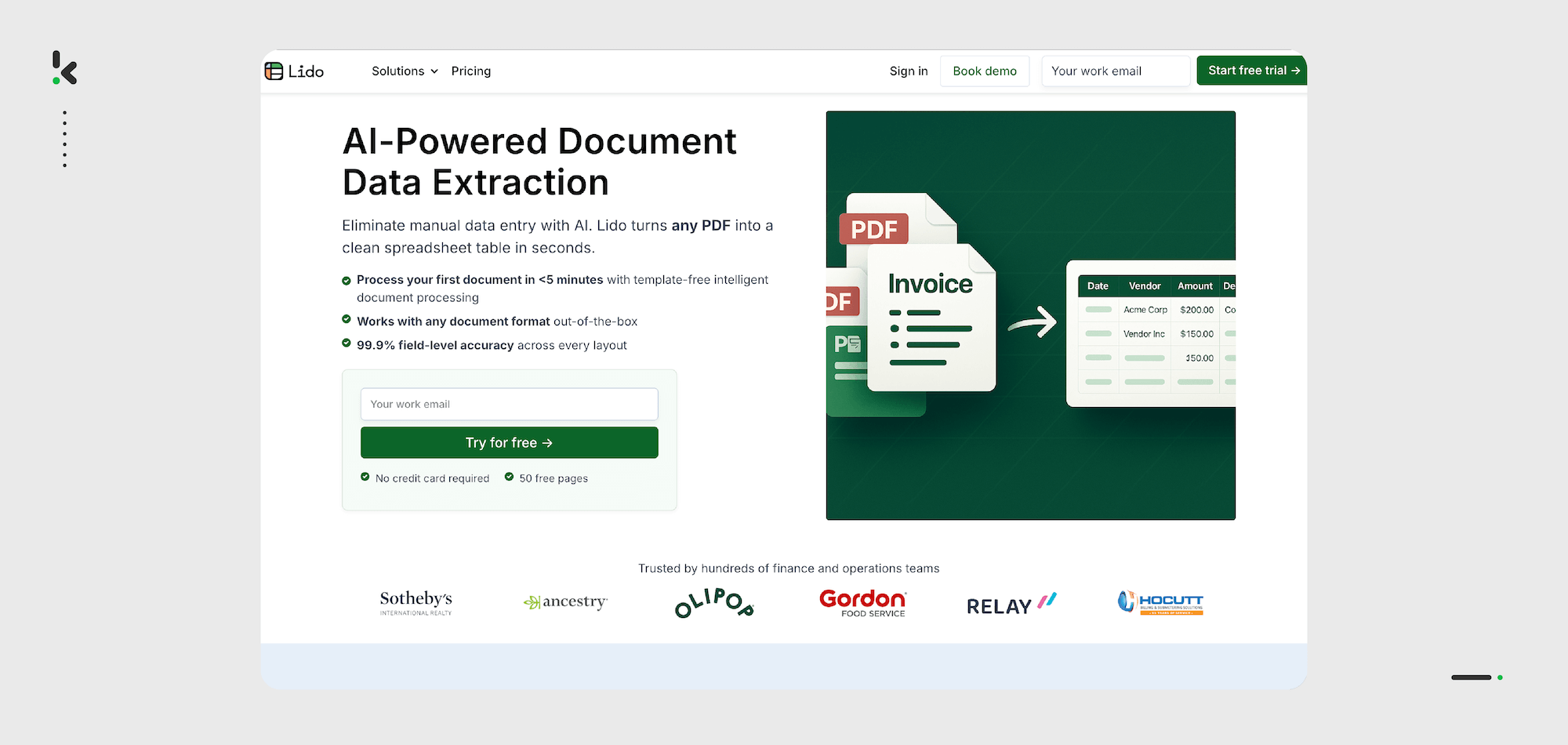

3. Lido

Lido is an AI OCR platform built for finance and AP teams, known for achieving high accuracy without templates. It processes invoices and statements from PDFs, images, and email attachments quickly, with direct export to accounting tools like Excel, Google Sheets, and QuickBooks.

Shared inbox parsing automates capture from email-based documents, cutting manual handling significantly.

Key Features

- Template-free AI OCR

- Shared inbox parsing automation

- Multi-format invoice & statement capture

- Direct export to accounting apps

- Customizable extraction rules

Pros

- Fast setup and deployment

- Works with diverse document formats

Cons

- No dedicated mobile app

- Narrower focus beyond structured data export

Best for: Finance teams needing quick, accurate OCR without template setup.

4. Docsumo

Docsumo applies AI models to extract structured data from invoices, bank statements, and other finance documents. Pre-trained templates speed deployment, and custom rules adapt outputs to business needs.

API connections support integration with ERP and accounting systems.

Key Features

- Pre-trained AI models

- Custom field mapping

- API connectivity

- Multi-document type support

- Bulk processing

Pros

- Flexible & customizable

- Specialized in financial workflows

Cons

- Smaller integration ecosystem

- Occasional setup for non-standard layouts

Best for: Businesses handling diverse finance documents.

5. Rossum

Rossum uses AI-driven document understanding to capture structured data without templates. It’s adaptable to varied invoice and statement layouts, with validation workflows to ensure accuracy.

ERP and AP software integrations make it versatile across industries.

Key Features

- Template-free OCR extraction

- AI model validation

- ERP/AP software integration

- Multi-language support

- Real-time data capture

Pros

- Minimal prep work for deployment

- Flexible integrations

Cons

- May require tuning for rare formats

- Advanced features on higher tiers

Best for: Companies with varied supplier formats.

6. ABBYY FlexiCapture

ABBYY FlexiCapture delivers enterprise-grade OCR, with predefined projects for invoices, statements, and financial records. Multi-language support and data validation enhance accuracy.

It offers both on-prem and cloud deployment.

Key Features

- Predefined financial document projects

- Multi-language OCR

- Validation workflows

- Cloud & on-prem deployment

- ERP integration

Pros

- Highly accurate results

- Versatile deployment options

Cons

- Complex initial setup

- Pricing on request

Best for: Enterprises needing flexible deployment.

7. Instabase AI Hub

Instabase AI Hub takes a GenAI approach, letting users define what to extract via natural language prompts. It handles varied layouts and handwritten inputs effectively.

Ideal for enterprises exploring AI-assisted document workflows.

Key Features

- GenAI-powered extraction

- Handwriting recognition

- Flexible field definition

- Multi-format capture

- Cloud-native design

Pros

- Very adaptable

- Handles diverse sources

Cons

- Suitable mainly for large organizations

- Requires AI expertise internally

Best for: Innovative enterprises adopting GenAI in finance workflows.

8. Nanonets

Nanonets provides trainable AI OCR models suited for complex finance documents. Models can be tailored to company-specific layouts for improved accuracy.

Integrations cover ERP and accounting tools.

Key Features

- Custom model training

- Multi-language OCR

- ERP/accounting integrations

- API-first platform

- Batch processing

Pros

- Highly trainable models

- Scales easily

Cons

- Needs technical resources for customization

- Smaller ready-made template pool

Best for: Organizations with unique finance document formats.

9. DocuClipper

DocuClipper is built for financial documents, including invoices, bank statements, and receipts. Features like reconciliation and PO matching set it apart.

Exports fit directly into Excel, CSV, or accounting platforms.

Key Features

- Specialized in finance documents

- Bank reconciliation support

- PO matching

- Multi-format export

- Batch capabilities

Pros

- Finance-focused features

- Easy export options

Cons

- Limited non-finance document use

- Fewer automation features

Best for: Finance teams needing reconciliation alongside OCR.

10. Google Cloud Vision OCR

Google Cloud Vision OCR is developer-focused, offering API access to powerful OCR capabilities. It’s suited to teams building OCR into existing workflows.

Supports multiple languages and integrates easily with Google’s ecosystem.

Key Features

- API-based OCR

- Multi-language support

- Integration with Google Cloud tools

- Image & document analysis

- Scalable processing

Pros

- Flexible integration possibilities

- Strong language coverage

Cons

- Requires developer resources

- Less turnkey than dedicated platforms

Best for: Tech teams needing OCR capabilities inside custom apps.

Key Invoice OCR Features to Consider in 2026

Choosing AI-powered OCR for finance isn’t only about raw accuracy scores. The right selection should align with your document types, integration needs, and industry-specific compliance requirements.

Here are the factors finance leaders are evaluating most often in 2026:

- Accuracy Across Complex Layouts: Beyond standard fields, invoices and statements often include multi-column tables, footnotes, and mixed-language text. Look for ≥95% capture rates for both header and line items, with AI validation to reduce human review.

- Language & Currency Support: Global finance teams need OCR that can handle multilingual documents and multiple currencies. Prioritize solutions with built-in language models and currency recognition to avoid manual conversion errors.

- Template Flexibility: AI OCR should work without rigid templates, learning from your documents and adapting to layout changes over time. This is essential for vendors with diverse formats.

- Fraud Detection & Data Validation: Advanced tools can flag duplicate or suspicious documents, mismatched totals, or payment anomalies, reducing fraud risk and compliance issues.

- Integration with Finance Systems: Your OCR should connect seamlessly to ERPs, accounting platforms, and AP automation suites, ideally with native connectors or robust APIs.

- Scalability for High Volumes: Ensure the system sustains performance during month-end or audit cycles, with batch processing capabilities and queue management.

- Security & Compliance: Vendors should meet ISO 27001, SOC 2, and GDPR standards, with encryption in transit and at rest. Financial documents often contain sensitive PII, so security can’t be optional.

- Ease of Use: A user-friendly interface can cut training time and improve adoption rates, especially in teams without deep technical backgrounds.

Our Top AI-Powered Invoice OCR Choice for 2026: Klippa DocHorizon

When evaluating AI OCR platforms, Klippa DocHorizon distinguishes itself as more than just a text‑extraction engine. It combines high‑accuracy data capture with advanced fraud detection, multilingual and multi‑currency capabilities, and strict enterprise‑grade compliance, making it an ideal choice for organizations handling sensitive, high‑volume documents.

Unlike traditional template‑based OCR systems, Klippa’s adaptive AI learning automatically understands and processes diverse document formats without the need for extensive manual configuration. This means invoices, receipts, contracts, shipping documents, and more can be processed in seconds while maintaining precision above industry standards.

Designed with integration in mind, Klippa connects seamlessly to ERP, AP, DMS, and accounting platforms, streamlining workflows and reducing repetitive, manual tasks. Its developer‑friendly REST API and SDKs support custom automation, while intuitive no‑code tools make it accessible to non‑technical teams.

Key differentiators include:

- Accuracy rates exceeding 99% across varied layouts and languages

- Real‑time data validation and rule‑based fraud prevention

- GDPR‑compliant processing, with built‑in anonymization and masking

- Scalable deployment from small teams to enterprise environments

If you’re ready to see how it could streamline your workflows, you can request a demo or visit the official website for full details.

FAQ

AI OCR uses machine learning to recognize complex document structures, adapt to changing layouts, and handle noisy or low-quality scans. Traditional OCR relies more on static templates and fixed rules.

Yes. Advanced platforms train models to detect and parse multi-row tables, column headers, and even page footnotes, making them ideal for detailed financial documents.

Top solutions report 95–99% field-level accuracy across varied layouts, often improving further with continued AI training on your specific documents.

Some platforms include fraud detection, checking for duplicates, altered amounts, or mismatches between totals and line items. Klippa DocHorizon offers built-in duplicate detection and anomaly spotting.

Most leading options provide native connectors to systems like SAP, Oracle, or QuickBooks, and expose APIs for custom integrations.

Many advanced platforms handle documents in multiple languages and currencies, important for global organizations.

Yes, provided the vendor meets recognized compliance standards such as ISO 27001, SOC 2, and GDPR, and applies end-to-end encryption.

Klippa offers €25 in free credits so you can start using our OCR solution immediately, with no upfront cost. After using the free credits, we provide pricing customized to your document volume and complexity. Request a pricing quote here.