Millions of receipts and invoices travel through organizations all over the world. In SMEs and corporates, it’s quite common for employees to receive credit cards from their employer to use for business expenses. But many still manually match data on credit card statements to receipts and invoices.

In one of their annual payments survey, AutoRek revealed that 84% of UK and US payment firms rely heavily on manual tasks and spreadsheets to perform the reconciliation control process. This is very time-consuming and tedious and should definitely be avoided!

Why spend your precious time on manual data entry when you can automate the process? In this blog, we’ll explore what credit card statements matching is, what the drawbacks of manually matching are, and the only solution that might come in handy all year round.

Key Takeaways

- Matching credit card transactions to receipts is critical for control – Without a clear link between statements and documentation, companies risk fraud, policy violations, and inaccurate financial reporting.

- Automated matching brings speed, accuracy, and peace of mind – OCR and other technologies make it possible to instantly and reliably extract, compare, and validate receipt and invoice data against statement lines.

- Real-time fraud detection and audit trails become effortless with Klippa – Klippa’s auto-matching tool flags duplicates and inconsistencies as they happen, while also creating transparent records for compliance and review.

- Klippa makes it simple to get started – With seamless mobile capture, automatic transaction linking, fraud detection, ERP integration, and real-time insights, SpendControl is built for modern finance teams.

What is Credit Card Statements Matching and Why is It Important?

As SMEs and corporates opt for company credit cards to enable their employees to pay for business hotel stays, flights, meals, and tickets without relying on their own credit cards or cash, the volume of transactions increases.

This is where credit card statement matching becomes essential.

Simply put, credit card statement matching to receipts and invoices is exactly this: comparing transactions listed on a credit card statement with the corresponding receipts or invoices that support those charges.

When done manually, this may mean extra work for the finance department, but for employees, using a business expense card means no more long waits for reimbursement. This is extremely important since one in four professionals have postponed or canceled a meeting to avoid fronting business costs, according to the Out of Pocket Employees report.

Let’s see why manually matching credit card statements to receipts and invoices is actually a hassle and what you should do instead so both you and your employees are happy.

Drawbacks of Manually Matching Credit Card Statements

While company credit cards offer convenience and flexibility, manually matching credit card statements to receipts and invoices is not always the best option. This method is inherent in some disadvantages and risks, such as:

Challenges with Fraud and Personal Expenses

Without proper controls, how easy is it for employees to simply use the business card for personal expenses? Even if employees can restrain themselves, they are still indirectly encouraged to spend company money more freely. And, since there’s no real-time audit, it’s difficult for finance teams to catch issues until long after the transaction has occurred.

The Time-Consuming Reconciliation Process

How much time does your finance team spend chasing down receipts, checking transaction dates, and verifying amounts? Matching credit card statement lines to receipts or invoices is a slow, repetitive, and error-prone process. The more employees and transactions you have, the harder it becomes to keep things accurate and up to date.

Employee Frustration

It’s not hard to assume that no one enjoys digging through emails or wallets to find that one missing receipt from last week’s meeting. Manually tracking and submitting documentation wastes time and creates friction. And when reimbursements are delayed or policies are unclear, employees are left frustrated and distracted from more valuable work.

Without automation, business credit card programs risk becoming more of a hassle than a help. Luckily, there are user-friendly solutions on the market that automatically match credit card statements’ lines with the respective receipt or invoice.

The Solution: Auto-Matching Credit Card Statements to Receipts and Invoices

Business processes should be fast, easy, and reliable. Automated credit card statement matching solutions do just that.

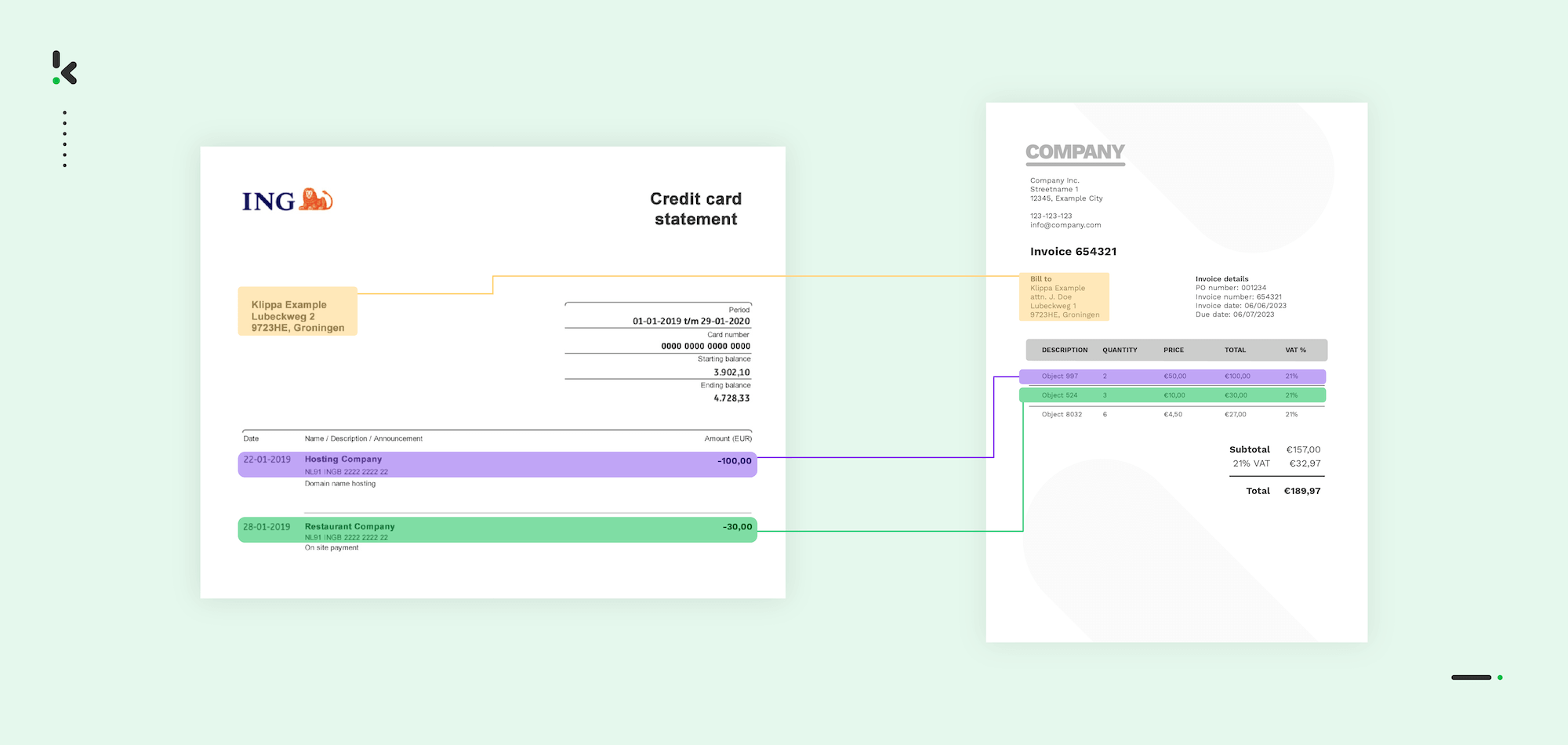

Incorporating technologies like OCR (Optical Character Recognition) and Machine Learning, these financial software automate expense management and invoice processing workflows. They can instantly read, extract, and understand data from scanned receipts, invoices, and digital documents – just like a human would, but faster and without errors.

Behind the scenes, the system applies intelligent matching logic – comparing not just totals, but vendors, dates, currencies, and even line items. It can detect duplicates, recognize multi-currency transactions, and adapt to your company’s expense policy rules. That means even when receipts are messy, incomplete, or vary in format, the system can still match them accurately and reliably.

Simple as that, the process contains three steps:

- The employee takes a picture of the receipt/invoice with their smartphone and submits the receipt/invoice to the finance department.

- The finance department receives and processes the document automatically.

- The system automatically matches receipts and invoices with the credit card statement entered.

With manual work out of the picture, your business gains more than just streamlined processes; you have better control over spending, fewer mistakes, and faster workflows. Let’s take a closer look at the key benefits automatic credit card statement matching brings for your finance team.

Benefits of Auto-Matching Credit Card Statements

If you feel like what should be a simple process often turns into frustration, it’s time to rethink your approach. With the right auto-matching tool in place, credit card reconciliation becomes fast, accurate, and – dare we say it – painless. Here’s how it makes life easier for finance teams and employees alike.

Improved Efficiency

Nobody wants to spend their Friday afternoon clicking through spreadsheets to match credit card statements with receipts and invoices. Manual reconciliation is and always will be repetitive, tedious, and slow everything down. Automatically matching them eliminates the need for manual reconciliation; transactions are now linked to the right document instantly, so your team can prioritize the things that matter.

Fraud Prevention and Transparency

When faced with hundreds or thousands of transactions, it’s hard to control everything. A missing receipt or a duplicate can quickly create a real mess for you and your team. Fortunately, auto-matching helps catch those red flags early by flagging inconsistencies in real-time.

Thanks to the fact that the system also creates a clear audit trail for every expense, accountability across teams gets a boost with every processed transaction.

Simplified Expense Management

Keeping track of expenses shouldn’t feel like solving a puzzle. With auto-matching, you know for sure where your money is going, without any guesswork and definitely without chasing people down for receipts. Everything’s categorized, accounted for, and ready when you need it.

Real-Time Tracking

You don’t have to wait until the end of the month to understand what your team spends money on! Auto-matching gives you real-time visibility into your company’s expenses as they happen. So instead of reacting to problems later, you can react quicker and make smarter decisions about your finances on the spot.

We know everything must sound too good to be true, but don’t take our word for it. Take, for example, Label A’s. Label A is a leader in the digital product development sector, specializing in creating apps for brands like Porsche, Greenwheels, and Swapfiets.

The issues with manual submission, waiting for approval/reimbursements, or a lack of expense tracking led this company to Klippa. Which was a great decision! Now, Label A enjoys a 74% reduction in the processing time of its expenses, increased employee satisfaction, a 95% reduction of errors, and improved financial control.

If this is something you want for your company, keep on reading!

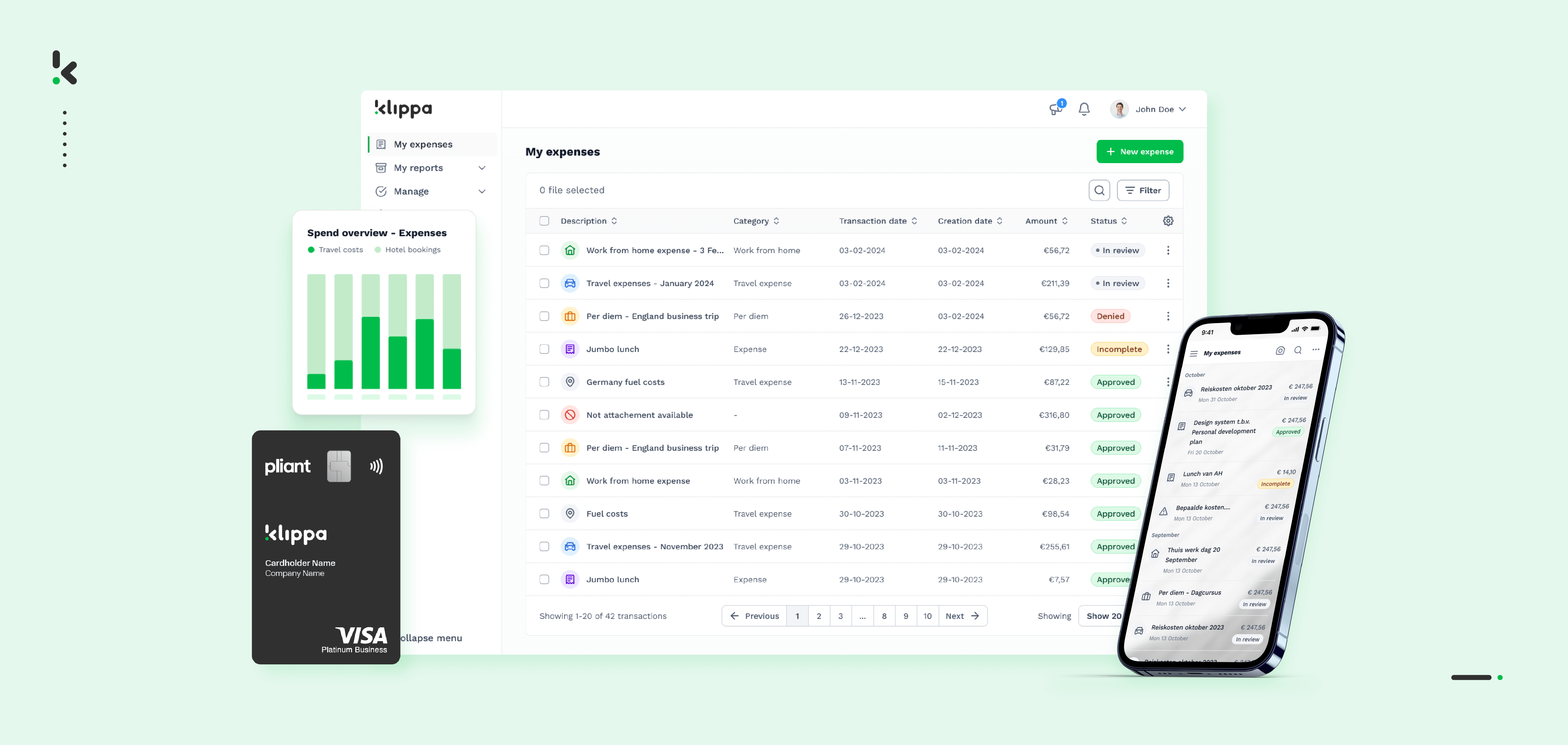

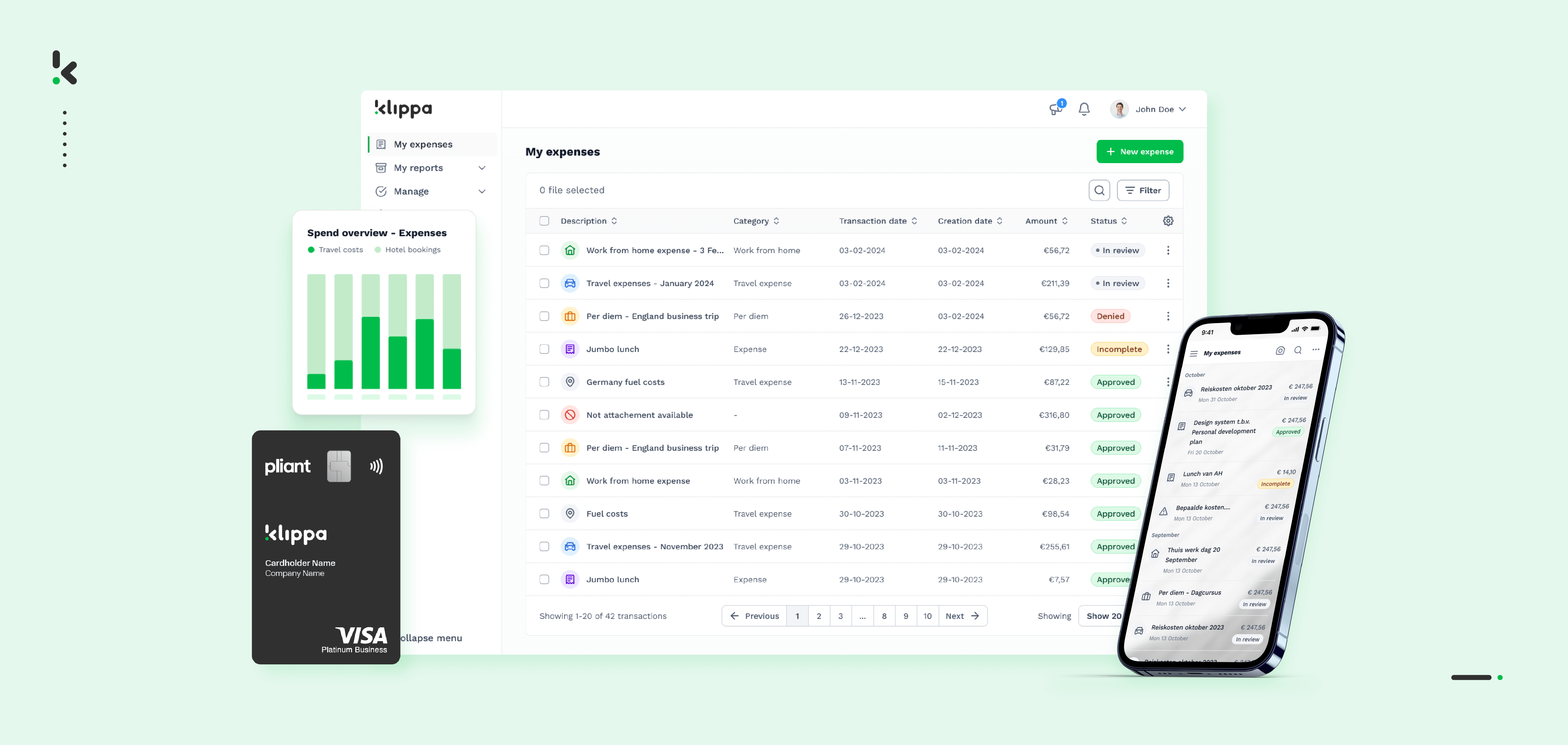

Ready to Auto-Match Credit Card Statements with Klippa’s SpendControl?

Are you facing missing receipts that make it almost impossible to link transactions to the associated expenses, unclear transaction descriptions, human errors, or additional costs and time? Not anymore!

With Klippa’s SpendControl, you can enjoy faster audits, alerts for out-of-policy transactions, compliance with expense policies, reduced processing time, and significantly lower administrative overhead.

In addition, your financial and accounting teams are now able to:

- Simplify receipt and invoice submission through the mobile app or web application, allowing employees to easily capture and send documents for approval.

- Automate the matching process by automatically linking receipts and invoices to the corresponding credit card statement transactions, eliminating manual reconciliation.

- Detect discrepancies and prevent fraud through automatic flagging of mismatches, missing receipts, and duplicate claims.

- Increase accuracy in cost tracking by automatically categorizing transactions and associating them with the right cost centers, departments, or projects.

- Easily integrate with ERP, accounting, or RPA systems, ensuring a smooth transition without requiring major adjustments or disruptions to existing workflows.

- Automate transaction reconciliation by intelligently matching payments to invoices and credit card charges, streamlining your financial close process.

Ready to streamline your day-to-day operations? Let’s make it happen together. Contact our experts today or book a free demo to see how Klippa can help you automate your workflows with precision and ease.

FAQ

Credit card statement matching refers to reconciling each transaction listed on a company credit card statement with its corresponding proof of payment, typically a receipt or invoice. The goal is to ensure that every expense is legitimate, accurately recorded, and policy-compliant.

Yes, most modern automated matching solutions are built to handle complexities such as multiple currencies, different languages, partial payments, and split expenses. These systems apply intelligent rules to match based on more than just totals.

Klippa’s platform uses advanced OCR technology to extract data from scanned or uploaded receipts and invoices. Its AI-driven engine then analyzes the extracted data and automatically matches each document to the corresponding transaction on your credit card statement based on multiple criteria.

Absolutely. Klippa is fully compliant with major data protection standards, including GDPR and ISO 27001. All data is processed securely using end-to-end encryption and hosted in certified European data centers, ensuring full compliance and peace of mind.