As we all know, factoring is a challenging and sometimes cumbersome business. Purchasing an invoice requires a deep understanding of the industry. One mistake can set your company back if a legal document is misstated or a fraudulent invoice is bought.

This makes the required labor per transaction high and you must be very sharp-eyed to catch fraudulent transactions. Meanwhile, your clients demand their money quickly and payouts within 24 hours are becoming the rule rather than the exception.

You’re under constant pressure to make critical business decisions quickly and with limited resources (i.e. information and time). Unfortunately, hyper-vigilance and quick decisions rarely go hand in hand. A small mistake is easily made, especially when you face hundreds or even thousands of invoices per month.

So what can you do? How can you reduce the error rate to an absolute minimum? How can you scale your business in such a challenging market? We have the answer for you: by automating your factoring back office!

In this blog, we will discuss five reasons to prove our point and convince you of the need for factoring automation. But before we do this, we have to know which tasks are the actual time wasters in the process. Are you ready? Let’s go!

What are the most time-consuming tasks for factoring companies?

To understand how automation can help your business move forward, it’s important to identify the tasks that take up the most time. These tasks are your biggest opportunity to improve your efficiency.

Data entry

The factoring process starts when a client uploads or emails an invoice to your company. All the data from this invoice needs to be extracted and processed by one of your employees.

Research carried out by Levvel shows that 57% of companies still primarily open and scan invoices by hand. This is not only a very time-consuming and tedious process, it is also prone to errors and hard to control. The number of invoices processed per employee is extremely low and you’re in the dark as to where invoices are in the process.

Risk assessment

Perhaps the most important task in the factoring process is assessing the creditworthiness of the business owing the outstanding invoice. You have to do your best to accurately determine the risk of late payment or non-payment of the debt. These credit and background checks are expensive to run and can quickly eat away at your working capital.

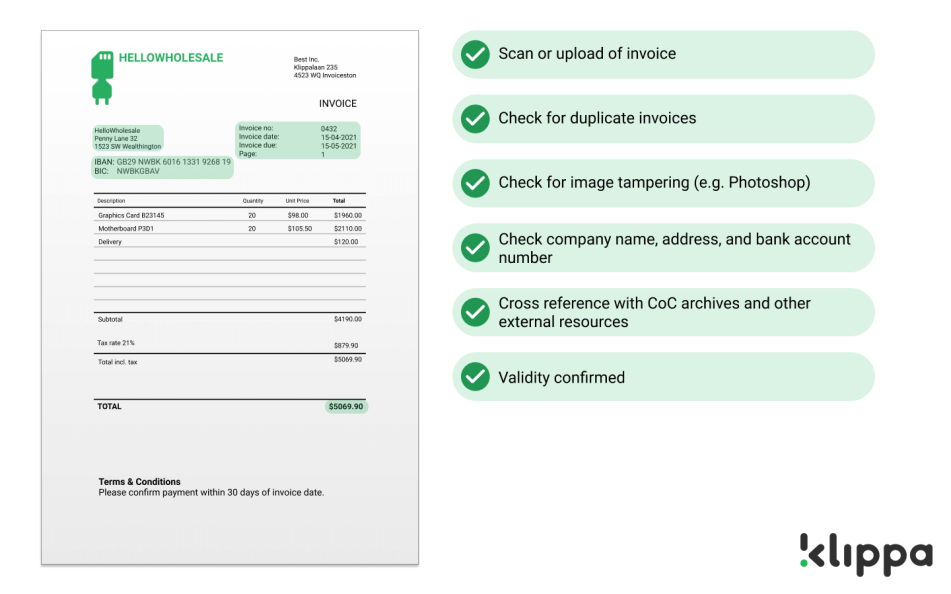

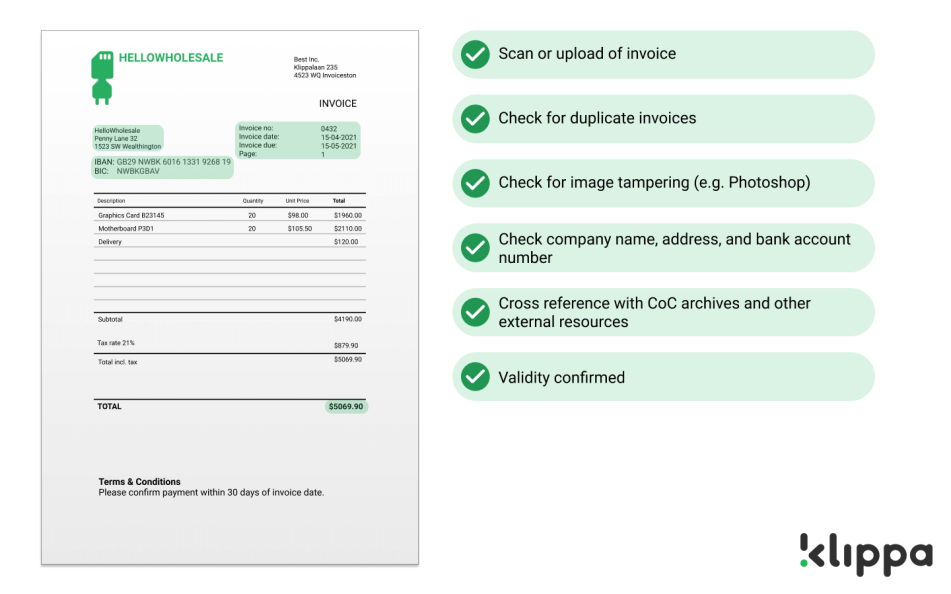

Also, to fully validate an invoice, you may need to cross-reference all the information on it with external sources (e.g. Chamber of Commerce or VAT number databases) and make sure that the invoice is not fraudulent, manipulated, or Photoshopped in any way. Errors made in this process can have serious consequences for both you and your client.

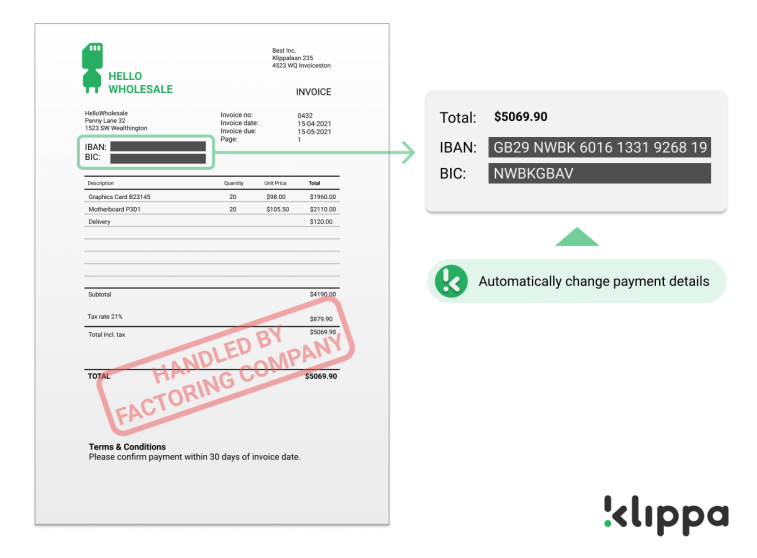

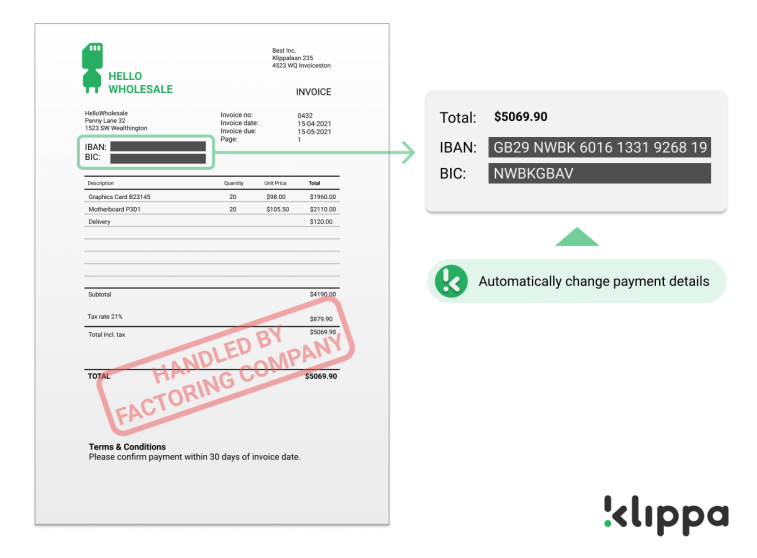

Change of remittance address

Once you take over the invoice, either you or your client has to change the remittance address on the invoice. The invoice should be adapted in such a way that it doesn’t contain your client’s payment details, but the ones of your factoring service.

Since this is a relatively small task, changing the remittance address is often overlooked. However, it is certainly an annoying routine if you have to do it every single time you receive an invoice. That asks for automation, doesn’t it?

Why should you automate your factoring back office?

In general, factoring has lagged behind other industries in terms of technology. With a relatively small market size and high transactional complexity, most factoring companies have avoided investing much money to modernize. In other words, you can gain a serious competitive advantage by being one of the forerunners in the digital transformation of your industry.

Next to that, there are many practical reasons why you should automate your factoring back office:

1. Offer the quickest turnaround rates

Remember, your clients make use of factoring because they want cash quickly. The length of the approval and funding process is therefore of utmost importance.

Most factoring companies typically pay out within 24 hours after receiving an invoice. Invoices from existing customers can usually be funded on the same day. Other factoring services take a little bit longer and funding can take up to seven days. Although that’s still considerably faster than the turnaround time without factoring (i.e. 15, 30, or 60+ days), it may feel like a long time for your client. That’s why they want to find a company that provides quick approvals and turnarounds.

The turnaround time depends on how you perform due diligence and the systems you have in place to accelerate the verification of accounts receivable and invoices. How nice would it be to be able to promise approvals within 5 minutes?

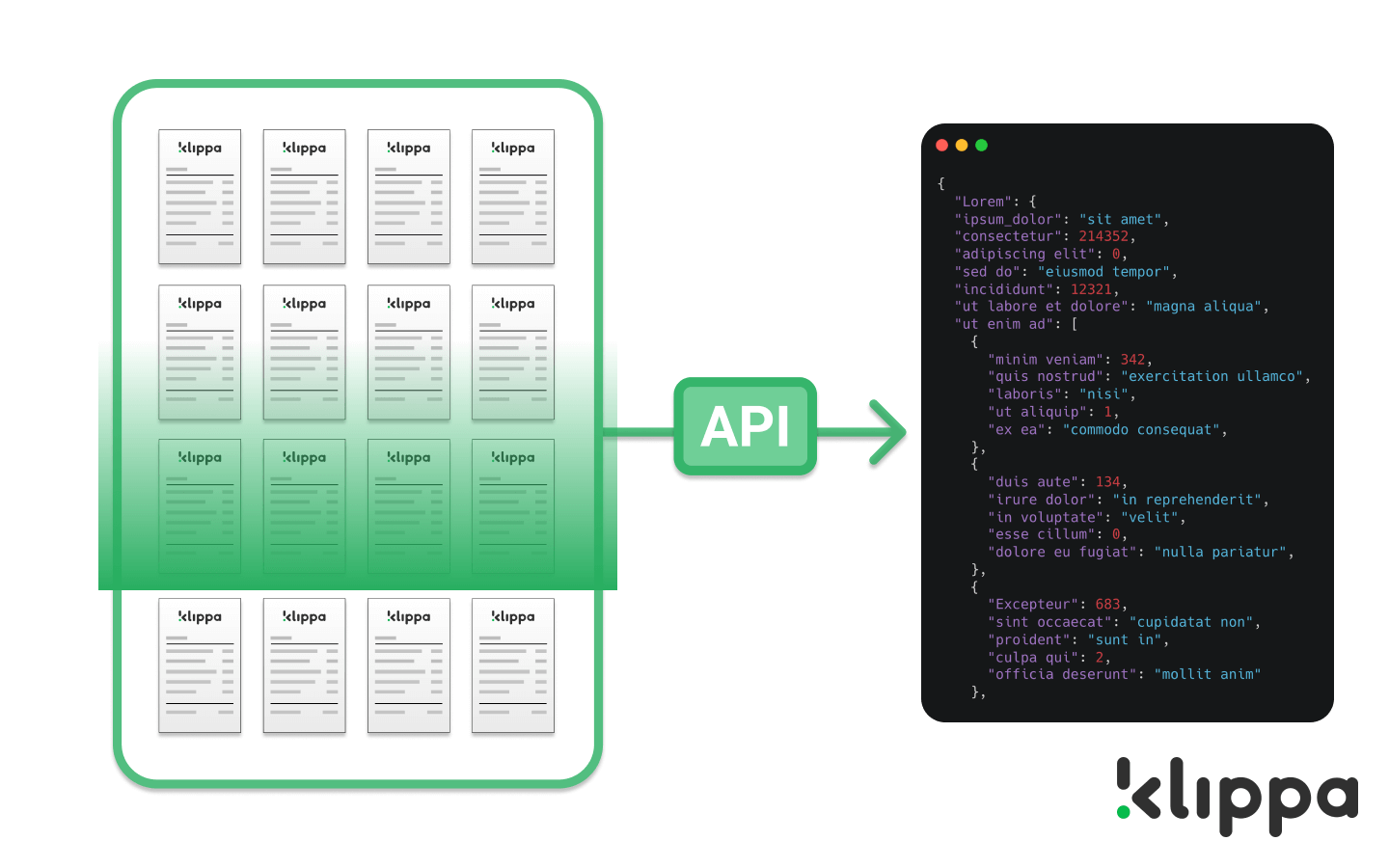

With an automation tool, like Klippa’s Factoring AI, this becomes a reality as it takes care of the tedious data-entry tasks, cross references with external sources (e.g. checking IBANs, VAT numbers, and CoC numbers), and other fraud detection mechanisms. A human check will suffice to give the final go. Say goodbye to waiting days on approvals, say hi to instant approvals!

2. Save 80% in labor costs

It may come as no surprise, but factoring is labor-intensive for several reasons, including the number of documents to review, data to enter, and extra work to inform customers that the accounts receivable have been assigned to your company (e.g. by sending them Notices of Assignment or changing the remittance address on the invoice).

OCR software can save you a lot of time, and thus labor costs, in this process by automatically extracting data from invoices and “reading” supporting documentation and payments. They can be matched with the correct transaction with the help of AI.

According to research from the American Productivity & Quality Center, companies that use little to no automation in processing invoices tend to spend more than $10 per invoice to process, while fully automated invoices cost only $2 or less per invoice to process. That’s a direct improvement of your bottom line by 80%!

As a nice little bonus, automation software can be used to automatically change the payment details on the invoice or formulate a Notice of Assignment based on information from the initial invoice. Imagine how customers would react if they didn’t have to modify their invoices themselves anymore. The number of manual handling in the process will truly be minimized.

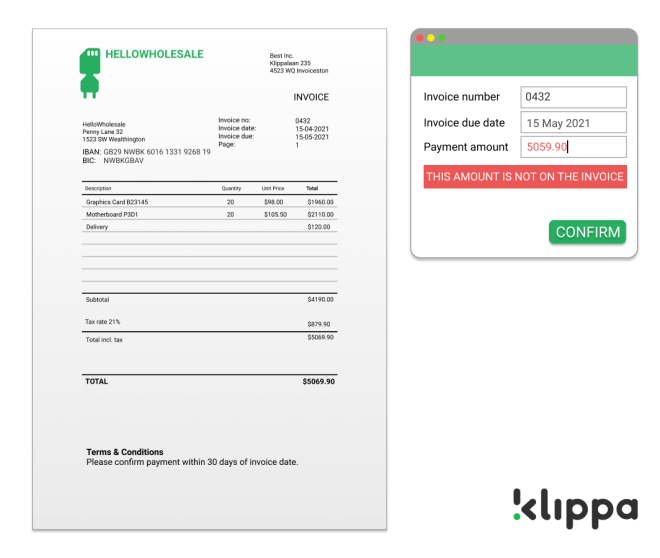

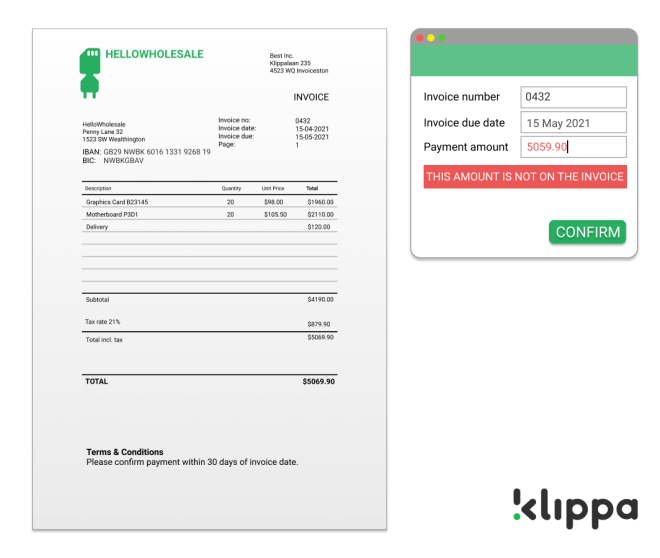

3. Make 97% fewer errors

In any manually operated process, mistakes are made. It’s what makes us human, right? Well, although it’s true, it can still be pretty frustrating from time to time. A small mistake can easily lead to bigger issues such as nonpayments of large invoices.

Luckily, automated processes and computer programs do this substantially better. They repeat time-consuming, boring tasks endlessly without errors, they never sleep and they never take a day off.

In practice, the OCR technology will extract all the data from the invoice. You can use this data to check or complement the data entered by your employees. For example, you can auto-suggest when someone starts typing or show an alert message when someone fills in an amount (e.g. €500) that doesn’t appear on the invoice. It will become very difficult to make a mistake, even if you want to.

4. Be better protected against fraud

We already discussed why it is important to accurately assess the risk of a new client or invoice. How can technology help you with this?

First of all, OCR technology can help you to identify fraudulent invoices because the software checks for forged documents. Forged documents are quite common these days, and manual verification cannot identify all tampered documents. Hence, you need something more stringent than simple document analysis.

Klippa’s OCR software deploys metadata and pixel structure recognition techniques to see whether a document is manipulated. This involves detecting incoherent pixel structures, such as strange changes in lighting or sudden color changes in text. It detects forged documents in seconds, making it easier for you to filter out fraudulent invoices before they can cause any trouble.

In addition, the tool checks the clients’ financial information. Fraudulent invoices are usually issued under fake company names or they use a legitimate name but a fake address or bank account number. The software automatically checks the legitimacy of a certain client by matching the CoC number, bank account number, and VAT number to the archives of the Chamber of Commerce. If there is a mismatch in the information, users are notified to verify.

Also, a client’s address can be cross-checked with Google Maps— if the address is residential or a post-office box, there is a big chance the invoice is fraudulent—and the system automatically identifies duplicate invoices.

As a result, employees do not have to invest the effort to extract data from every invoice and verify it for legitimacy. Everything relies on the software and employees oversee any discrepancies in the technology. While manual processes consume several hours or days for one invoice’s verification, OCR takes a few minutes to do the job.

5. Scale your business with extreme ease

We saved the best reason for last. While it’s fine to manually process a few hundred invoices per month, just imagine what happens if you need to process millions of invoices per month. Will you scale up your team from 10 to 1000 FTEs? Or will you try to automate this task?

It is of course theoretically possible to scale your workforce, but the operational complexity that comes with it makes it very hard in reality. An automated solution, on the other hand, can multiply its servers on demand without any additional recruitment, office space, or contracts. You will be able to scale your business without breaking a sweat!

In short, the rapid decision-making of AI will offer huge improvements in profitability and efficiency. Data that was previously unavailable digitally, or could only be gathered manually, will now be integrated into every process automatically. This will lower costs, increase speed, and reduce fraud.

How can Klippa help your business?

With the factoring solution of Klippa, the capture, verification, and processing of documents is fully automated and includes machine learning and AI technology. As we’ve outlined, it:

- Makes it easier to capture documents and invoices through an OCR SDK

- Extracts data from invoices within seconds

- Checks for forged documents with Document Verification

- Cross references data with external resources, like CoC databases and Google Maps

- Automatically changes the remittance address on invoices

The entire process can be integrated into your current back-end so that you can continue with the contract management and approval workflow in an end-to-end, fully integrated, continuous system. Instead of days or weeks to complete the factoring process, you can make decisions in just a few minutes to accelerate market growth while reducing fraud and ensuring compliance.

If you’re still wondering if Klippa is the right solution for your business or if you have a unique use case that you would like to discuss, please feel free to contact us.

It’s also possible to plan a free 30-minute demo below, in which we show you how our software works and how it will benefit your organization.