In industries like banking, insurance, and healthcare, client onboarding often involves collecting, checking, and validating multiple documents, passports, proof of address, contracts, and income statements before an account, policy, or service can be activated.

When handled manually, these document-heavy processes are slow, error-prone, and compliance-risky, leading to customer frustration and high abandonment rates. According to the 2023 Digital Onboarding Report by ebankIT 90% of financial institutions report losing customers during onboarding, costing millions in lost potential revenue.

Automated document processing changes the game, using OCR, AI, biometric verification, and real-time fraud checks to capture, validate, and integrate customer data seamlessly. This not only cuts onboarding from days to minutes but boosts compliance and customer satisfaction while reducing operational costs.

Key Takeaways

- Automated document processing replaces slow, manual onboarding checks with OCR, AI, biometrics, and real-time fraud detection for faster, compliant workflows.

- Manual verification of IDs, proof of address, contracts, or income statements creates bottlenecks, increases error risk, and leads to customer drop-offs.

- A seven-step automation workflow: capture, classify, extract, validate, verify identity, integrate with systems, and archive securely, speeds onboarding from days to minutes while maintaining KYC/AML, GDPR, HIPAA, and SOC-2 compliance.

- Industries like banking, insurance, healthcare, and real estate benefit most, realizing higher accuracy, improved customer experience, reduced costs, and stronger fraud prevention.

Challenges in Manual Document Processing for Onboarding

Even with digitized forms, manual document handling still causes major bottlenecks in onboarding:

- Time-Consuming Verification – Front-office or compliance teams must manually review each document, cross-check details, and enter them into onboarding systems, slowing the process.

- Error-Prone Data Entry – Human input errors in names, numbers, or dates can cause failed verifications, forcing document resubmissions and frustrating clients.

- Multi-Channel Document Submission – Documents arrive via email, PDFs, scans, courier, or in-person, creating inconsistent formats and validation challenges.

- Privacy & Compliance Risks – Manual handling increases exposure to sensitive data, risking breaches of GDPR, HIPAA, KYC, and AML regulatory requirements.

- Poor Customer Experience – Lengthy verification and repeated requests for documents lead to drop-offs. Clients may choose competitors with faster onboarding.

What is Automated Document Processing for Client Onboarding?

Automated document processing for customer onboarding is the use of technologies like Optical Character Recognition (OCR), Artificial Intelligence (AI), and Intelligent Document Processing (IDP) to capture, extract, validate, and store data from customer-submitted documents.

Instead of compliance or onboarding staff manually reviewing IDs, proof-of-address, income statements, contracts, or other required documents, automation tools process these files in seconds. The extracted data is verified for authenticity, checked against compliance rules such as KYC and AML, and then integrated directly into onboarding systems.

How to Automate Document Processing for Customer Onboarding

Automating document processing for client onboarding replaces slow, manual checks with a fast, secure, tech-driven workflow. Here’s how organizations in regulated industries, from banking and insurance to healthcare and real estate, can set it up.

Step 1: Capture & Upload Customer Documents

The onboarding process begins when the customer submits required documents, passports, driver’s licenses, proof of address, bank statements, contracts, through a secure web portal or mobile app.

OCR technology is applied at the point of capture to pre-scan the document, ensuring that text can be extracted accurately. Combined with real-time image quality checks, this reduces rejections by ensuring clarity, completeness, and correct formatting before submission.

- Tech: OCR pre-processing with real-time quality feedback on resolution, orientation, and completeness.

- Example: A mortgage lender prompts applicants to upload income statements via an app that instantly checks if all pages are present, readable, and contain extractable text.

Step 2: Classify Documents by Type & Origin

AI-powered classification identifies the document type, issuing country, and language, routing them into the correct onboarding workflow.

- Tech: Pre-trained models on 500+ ID types from 150+ countries.

- Example: Automatically detects whether a document is a French passport or a German utility bill, and applies the relevant compliance rules.

Step 3: Extract Key Data Fields

OCR reads machine-readable zones (MRZ) and visual zones to pull essential details like names, addresses, dates of birth, account numbers, or transaction values.

- Tech: OCR with 99% field accuracy and multi-language support.

- Example: In healthcare onboarding, OCR extracts patient ID numbers and insurance policy details from submitted health cards.

Step 4: Validate Data & Check for Fraud

Extracted data is verified against the customer’s submitted info, business rules, and compliance databases. AI algorithms detect signs of document fraud like tampering, mismatched fonts, or altered image metadata.

- Tech: Fraud detection tools, MRZ check digit verification, anti-forgery computer vision models.

- Example: An insurer spots an altered claims history document with inconsistent text alignment using automated fraud analysis.

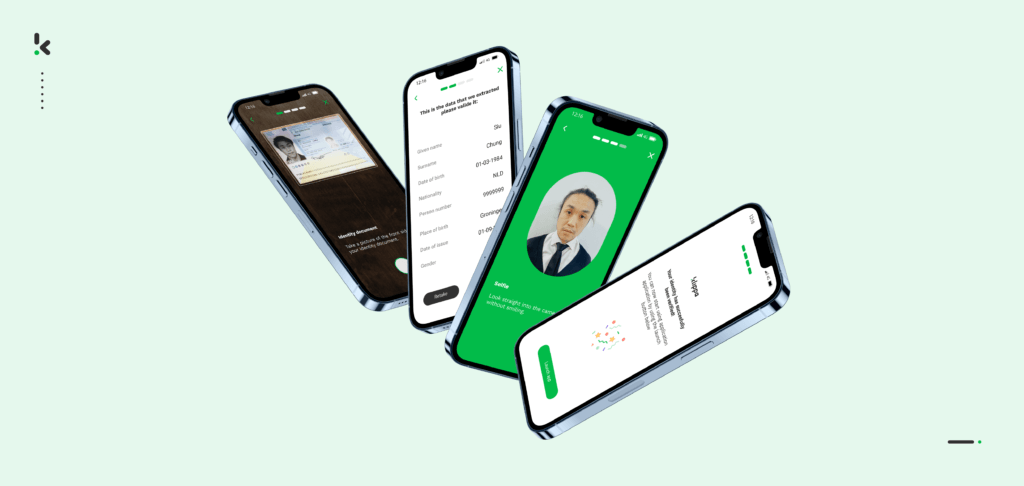

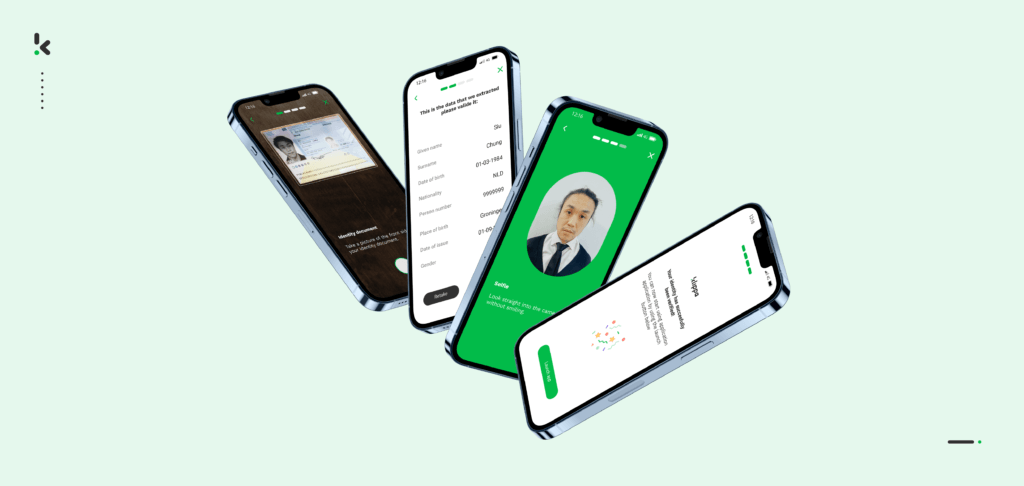

Step 5: Verify Customer Identity

Biometric verification confirms that the document holder is the person submitting it. Techniques like facial matching and liveness detection ensure authenticity, while NFC-enabled ID scanning retrieves encrypted chip data for 100% accuracy.

- Tech: Face match algorithms, liveness checks, NFC chip reading.

- Example: A bank scans an e-passport’s RFID chip to verify embedded data matches the OCR-extracted details.

Step 6: Integrate with Onboarding & Compliance Systems

Once verified, structured document data is pushed into CRM, ERP, or onboarding software, triggering account creation or service activation.

- Tech: API or SDK integrations for real-time updates.

- Example: A loan provider’s onboarding platform auto-updates application status to “Approved” when all documents pass verification.

Step 7: Archive & Secure Data for Compliance

Personal data is anonymized when not needed for operational purposes, and stored securely under applicable regulations (GDPR, HIPAA, SOC-2, KYC, AML).

- Tech: Automated redaction for sensitive fields, encrypted cloud storage.

- Example: A healthcare provider anonymizes medical history data after patient onboarding is complete, keeping only compliance-required fields accessible.

This workflow ensures client onboarding teams spend their time on exceptional cases rather than routine checks. The result is faster service, fewer errors, reduced compliance risk, and higher client satisfaction.

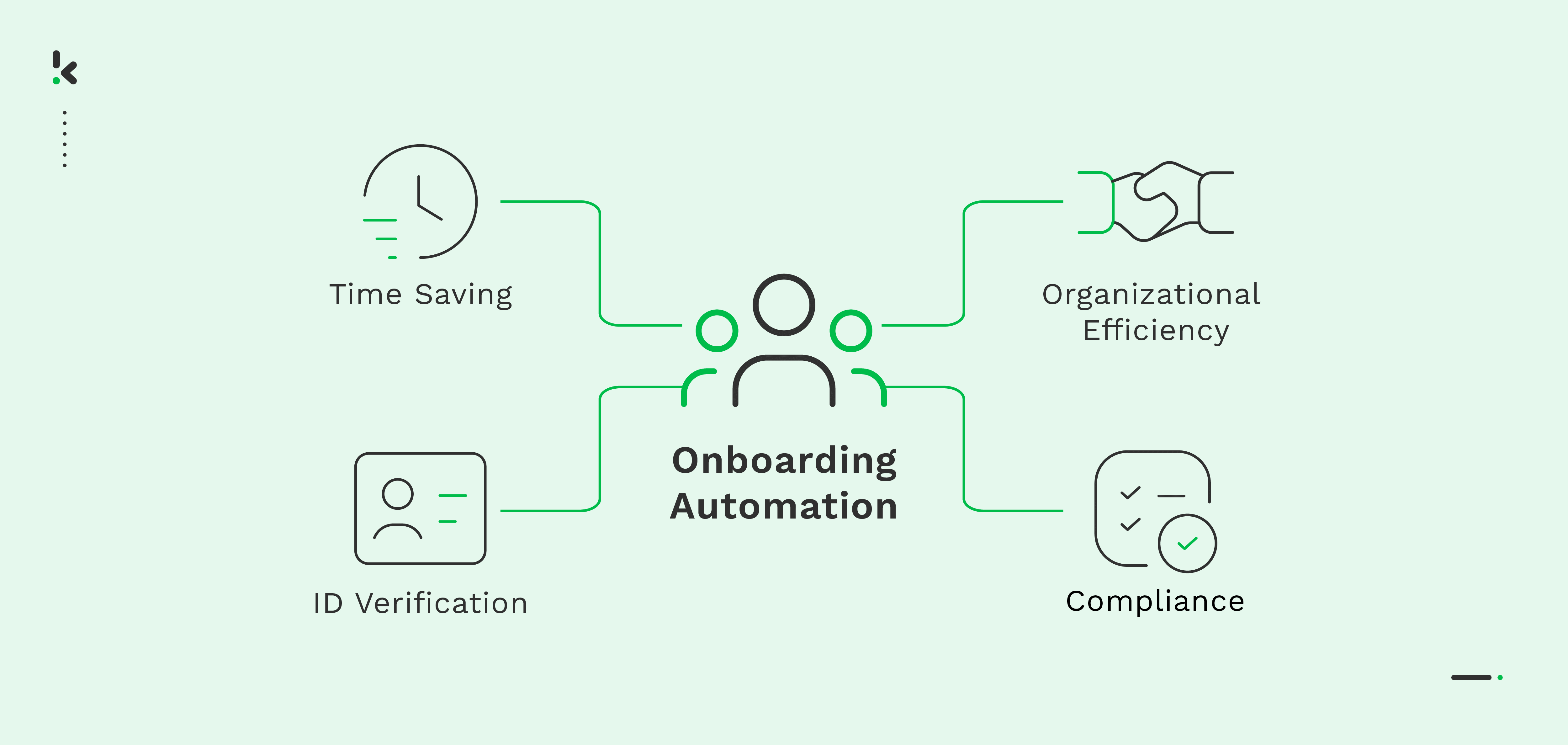

The Benefits of Onboarding Automation

Automated onboarding processes are becoming more of an industry standard, with the ability to enhance the customer experience while improving the efficiency and inner workings of a business. There are many benefits to moving towards automated solutions.

The most impactful benefits include:

Improved Efficiency

Automated onboarding empowers you to reduce manual paperwork and in-person meetings, thus lowering your overhead costs and increasing efficiency.

Enhanced Security

The digital space introduces a variety of smart features like NFC checks or liveness detection. With these identity verification technologies (IDVT), you can ensure a more secure way to onboard newcomers.

Compliance with Regulations

Using automatic ID checks enables you to meet regulatory requirements such as KYC and AML rules efficiently, all while reducing costs and mitigating the risk of severe fines.

Better User Experience

You can seamlessly onboard users with automated onboarding, removing the necessity for them to visit a physical location in person. This means tasks like filling in forms take less time and can be completed from anywhere in the world.

Increased Data Accuracy

With OCR technology, you avoid human errors common in manual data entry, ensuring accurate and up-to-date user information.

Industry Use Cases

1. Banking & Lending

Opening an account, approving a loan, or issuing a credit card requires verifying multiple documents: passports, proof of address, financial statements, and often income proof.

Automated document processing uses OCR to instantly capture and extract data, AI to verify authenticity, and AML/KYC checks for banks to ensure compliance.

- Impact: Cuts onboarding time from days to minutes, maintains audit-ready compliance, and reduces human error.

- Example: A retail bank automates proof-of-income verification, cross-checking extracted data against payroll records to approve loans faster.

2. Insurance

Insurance onboarding involves collecting ID documents, proof of address, previous policy records, and health questionnaires.

Automation classifies each document type, validates data for any inconsistencies, and integrates verified data directly into policy issuance systems.

- Impact: Accelerates policy activation, ensures data accuracy for regulatory compliance, and reduces manual workloads for brokers.

- Example: An insurer automates health declaration forms using OCR and AI validation, enabling instant policy underwriting.

3. Healthcare

Patient onboarding requires secure verification of insurance documents, medical history forms, and ID cards under HIPAA compliance.

Document automation scans and extracts key data, anonymizes sensitive fields when not operationally needed, and stores data securely.

- Impact: Shortens registration times, reduces physical form handling, and ensures compliance with healthcare privacy standards.

- Example: A clinic pre-registers patients by OCR-scanning insurance cards and extracting policy numbers directly into its patient portal.

4. Real Estate

Tenant or buyer onboarding demands ID verification, proof of income, reference letters, and contract execution.

Automation identifies document types, verifies identity via biometric comparison, and archives signed contracts in compliance with local regulations.

- Impact: Speeds up lease signing or closing processes, enhances fraud detection, and keeps all records audit-ready.

- Example: A property rental platform automates document processing for proof-of-income, reducing rental approval times from 5 days to 24 hours.

Tips for Successful Implementation

Automating your onboarding process doesn’t have to be complicated, but the way you roll it out makes all the difference. A thoughtful setup ensures a smooth experience for both your team and your users from day one.

Start with a Clear Goal

Before diving into tools and integrations, define what success looks like. Do you want to reduce drop-offs, cut onboarding time, ensure compliance, or scale globally? Knowing your priorities helps shape the right automation flow.

Choose the Right Partner

Look for a solution that aligns with your industry needs and offers flexibility. Features like identity verification, OCR, and biometric checks should be customizable, not one-size-fits-all. Also, make sure your vendor understands compliance requirements relevant to your region or sector.

Focus on Integration

Your onboarding flow shouldn’t live in a silo. Make sure the solution integrates smoothly with your existing systems, like HR platforms, CRMs, patient portals, or internal databases. A good API setup will save time and reduce double data entry.

Design for the User

The process should feel intuitive. Use clear instructions, mobile-friendly interfaces, and real-time guidance to reduce friction. A smooth experience leads to higher completion rates and happier users.

Test, Learn, and Adapt

Start with a pilot, gather feedback, and optimize from there. Look at where users drop off, how long the process takes, and what support questions come up. Small adjustments can lead to big improvements over time.

Once everything’s in place, onboarding becomes one less thing to worry about – for your team and for the people you’re welcoming in. And while the process itself matters, the tools you choose make all the difference. That’s where Klippa comes in.

Klippa DocHorizon for Automated Client Onboarding

If you’re looking to make onboarding faster, safer, and less manual, Klippa is designed to help you get there.

Our Identity Verification platform doesn’t just streamline the process; it brings together all the tools you need to automate onboarding from end to end. That includes:

- Information extraction from identity documents using advanced OCR

- Authenticity checks for IDs like passports, driver’s licenses, and national cards

- Document classification based on country or language

- Support for over 500 ID types from more than 150 countries

- Anonymization of personal data to meet privacy regulations

- Fraud detection powered by AI to flag risks in real time

- Biometric verification, including selfie matching and liveness detection

- NFC checks that read encrypted chip data for maximum accuracy

All of this is available in a flexible solution that integrates seamlessly into your existing systems. Whether you’re onboarding customers, patients, or employees, Klippa gives you the speed, security, and scalability you need, without the complexity.

If you’re ready to take the manual work out of onboarding and give your users a smooth, secure start, we’d love to show you what Klippa can do. Book a demo and let’s build a better onboarding experience together!

FAQ

Not at all. Most onboarding automation solutions, including Klippa, are designed to integrate with your existing systems, like HR platforms, CRMs, or patient portals, so you can enhance your current process without starting from scratch.

It depends on your setup, but most businesses can get up and running within a few days to a few weeks. With Klippa’s flexible ID Verification API and support, the rollout is fast and doesn’t require heavy development resources.

Yes. A robust solution like Klippa supports document classification across languages and countries and recognizes over 500 types of IDs from more than 150 countries: ideal for global or multilingual operations.

Look for solutions that include biometric checks (like liveness detection and selfie matching), NFC scanning for chip-based IDs, and compliance with standards like GDPR, KYC, AML, and HIPAA. Klippa includes all of this as part of its platform.

Most systems offer clear guidance to users if verification doesn’t go through. They may be asked to resubmit documents or provide additional information. This reduces drop-offs and keeps the onboarding process moving forward without manual intervention.

Not at all. Businesses of all sizes use automation to save time, reduce errors, and improve compliance. Whether you’re onboarding ten users a month or ten thousand, automation can help you scale efficiently.