Receipt processing should be fast, accurate, and compliant. In reality, it is often the opposite. According to Forbes, 61% of finance executives say travel and expense policies are frequently violated, and employees waste an estimated 360 hours a year searching for the information they need to submit or approve expense reports.

OCR technology solves this by digitizing receipts and automatically capturing key details like dates, amounts, and vendor names. This removes manual entry from the workflow entirely. In 2026, leading tools combine OCR with AI to boost accuracy, handle multiple languages and currencies, and integrate directly with expense management or accounting systems.

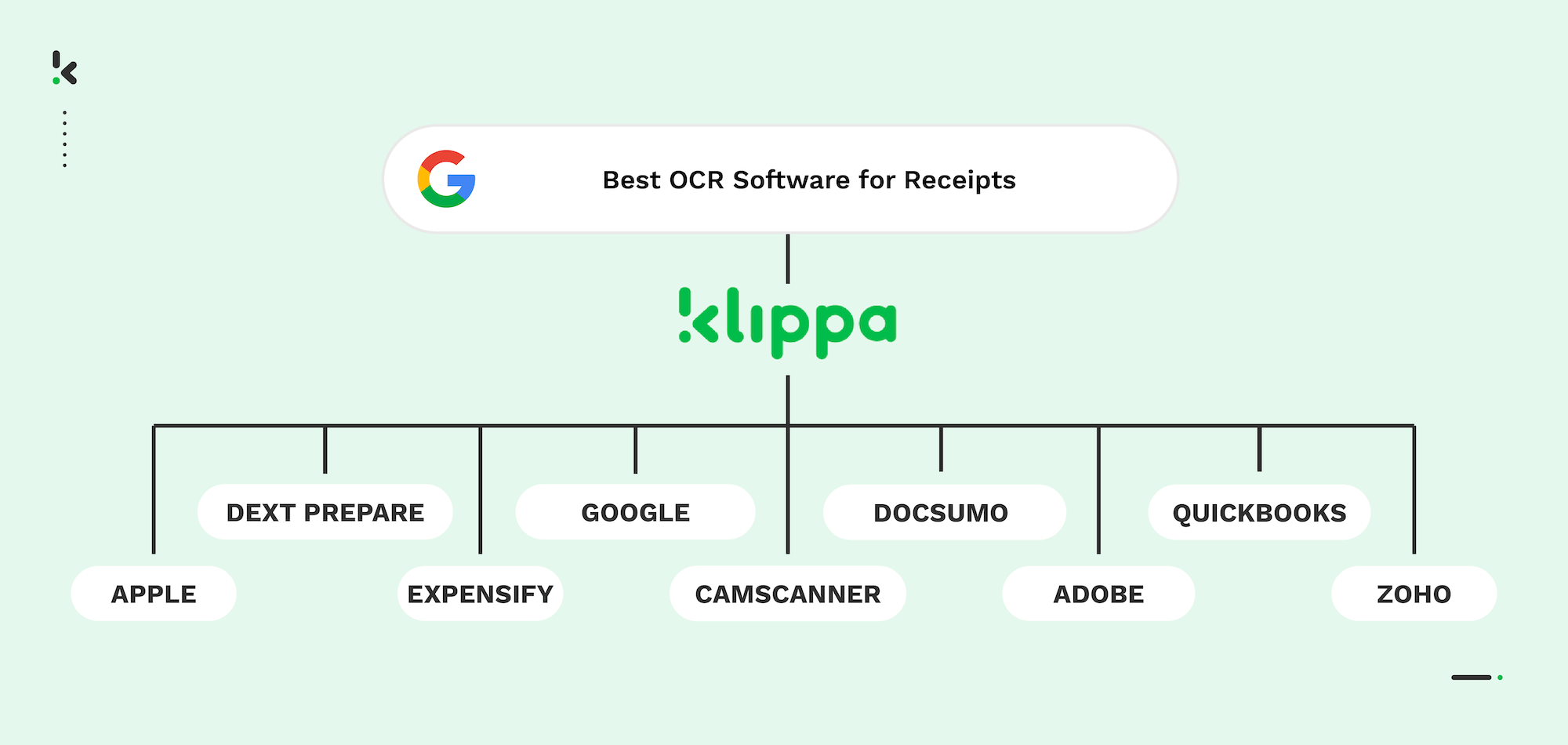

In this guide, we compare the best OCR software for receipts in 2026, covering accuracy, integrations, automation features, and compliance credentials so you can choose the right fit for your organization.

Key Takeaways – The Best OCR Software for Receipts in 2026

- Klippa DocHorizon: AI-powered OCR with fraud detection, multi-language and currency support.

- Dext Prepare: Mobile-ready capture, and advanced categorization for accountants.

- Docsumo: Structured data extraction, bulk automation, and API integrations for finance documents.

- QuickBooks Online: Captures receipts directly into QuickBooks with automatic categorization.

- Zoho Expense: Fast receipt digitization, multi-currency recognition, and expense approvals.

- Expensify: Mobile-friendly, with expense tracking tools and configurable approval chains.

- Adobe Scan: Free mobile scanning with OCR for various document types.

- Google Lens: Handwriting recognition, translation, and visual search via Google services.

- Apple Notes: Simple, free OCR for iOS devices with direct text capture into notes.

- CamScanner: Feature-rich OCR scanning with multi-format export and options for text translation.

What is Receipt OCR?

Receipt OCR, or receipt optical character recognition, is a technology that captures physical or digital receipts and converts text into machine‑readable data.

The OCR engine analyzes the image, identifies characters, and extracts receipt data such as the vendor name, date, total amount, tax, and currency.

Modern receipt OCR goes far beyond simple text capture. Leading solutions use artificial intelligence to handle different receipt layouts, detect multiple languages, and correct for poor image quality. They can process large volumes in seconds and feed the captured data directly into expense management software, ERP systems, or accounting platforms.

The result is faster and more accurate expense reporting, automated data entry, and stronger compliance. With digital records stored securely, finance teams can locate and audit receipts instantly, supporting better policy adherence and regulatory readiness.

Best OCR Software for Receipts in 2026

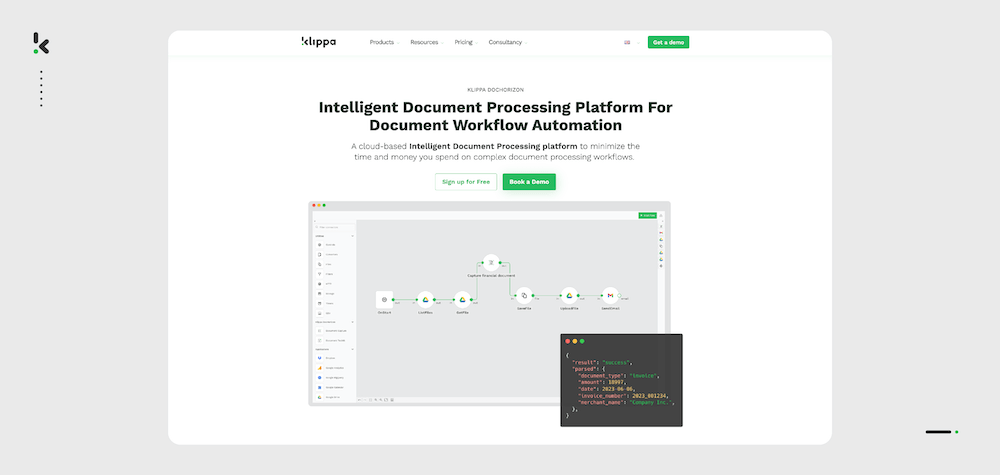

1. Klippa DocHorizon

Klippa DocHorizon is an intelligent document processing platform built to automate the capture, extraction, and validation of receipt data at scale. Its AI-driven OCR handles multiple receipt formats, languages, and currencies without templates. For finance teams, this means faster reimbursement, fewer errors, and stronger expense policy compliance.

Key Features

- Above 99% field-level accuracy for receipts

- Built-in fraud detection for duplicates or fake receipts (e.g., AI-generated)

- Multi-language and multi-currency recognition

- Role-based compliance with ISO 27001, SOC 2, and GDPR

- REST API, SDKs, and no-code workflow builder

- Batch or real-time processing capabilities

Pros

- Consistently high accuracy across varied receipt formats

- Enterprise-grade security and compliance measures

- Flexible deployment in existing workflows

Cons

- Advanced workflows may require initial configuration

- Best suited for larger organizations with medium to high receipt volumes

Best for: Businesses needing secure, accurate, and scalable receipt OCR with compliance and fraud prevention as standard.

2. Dext Prepare

Dext Prepare specializes in receipt capture for accounting and bookkeeping workflows. It claims accuracy above 99% for extracting structured data from receipts. The mobile app allows receipts to be submitted instantly from anywhere, supporting faster expense categorization and client collaboration.

Key Features

- AI-powered receipt text recognition

- Categorizes expenses automatically by vendor and type

- Integrations with QuickBooks, Xero, and Sage

- Mobile-ready for on-the-go capture

- Secure cloud storage for digital receipts

Pros

- High claimed accuracy for receipt data extraction

- Strong accounting software integrations

- Mobile-first user experience

Cons

- Limited customization for advanced workflows

- Primarily targeted at accountants and finance professionals

Best for: Accountants and bookkeepers who need fast, client-friendly receipt capture and categorization.

3. Docsumo

Docsumo offers AI-based OCR capable of processing structured and semi-structured documents, including receipts and invoices. It supports batch processing and custom field mapping, making it a fit for teams handling large volumes and varied layouts.

Key Features

- Trained AI models for receipts and invoices

- Custom field mapping and data export

- API integrations with ERP and accounting systems

- Processing for multiple document types

- Image preprocessing for improved accuracy

Pros

- Flexible for customized receipt data outputs

- Handles diverse layouts without strict templates

- Works smoothly with finance-focused integrations

Cons

- Requires setup for non-standard formats

- Smaller integration library compared to some larger platforms

Best for: Finance teams needing a flexible OCR engine that adapts to varied receipt and invoice layouts.

4. QuickBooks Online

QuickBooks Online includes a native receipt OCR function that captures receipts via its mobile app or desktop upload and posts the data directly into the accounting ledger. This is aimed at businesses already using QuickBooks for bookkeeping, making receipt capture part of a unified financial workflow.

Key Features

- Integrated receipt scanning within accounting software

- Automatic expense categorization

- Syncs with bank feeds for transaction matching

- Mobile and desktop capture options

- Searchable receipt archive for audits

Pros

- Direct integration into QuickBooks workflows

- Automatic transaction reconciliation with bank feeds

- Eliminates the need for separate receipt scanning software

Cons

- Only ideal for businesses already using QuickBooks Online

- Fewer advanced OCR customization options compared to standalone tools

Best for: Businesses that manage their finances in QuickBooks and want receipt OCR built directly into their accounting environment.

5. Zoho Expense

Zoho Expense offers OCR-powered receipt scanning as part of its expense management platform. It is targeted at businesses with international operations, providing quick digitization, multi-currency recognition, and automated expense routing for approvals.

Key Features

- AI-driven auto scan for vendor, date, and amount extraction

- Multi-currency recognition with automatic conversion

- Expense categorization and policy rule application

- Approval workflows for expense claims

- Integration with Zoho Books, QuickBooks, and other ERPs

Pros

- Supports global teams with multi-currency processing

- Built-in expense approval workflows

- Part of a full expense management system

Cons

- Best within the Zoho ecosystem

- Interface can feel complex for first-time users

Best for: Companies managing international expenses that need OCR tied directly into approval and policy management workflows.

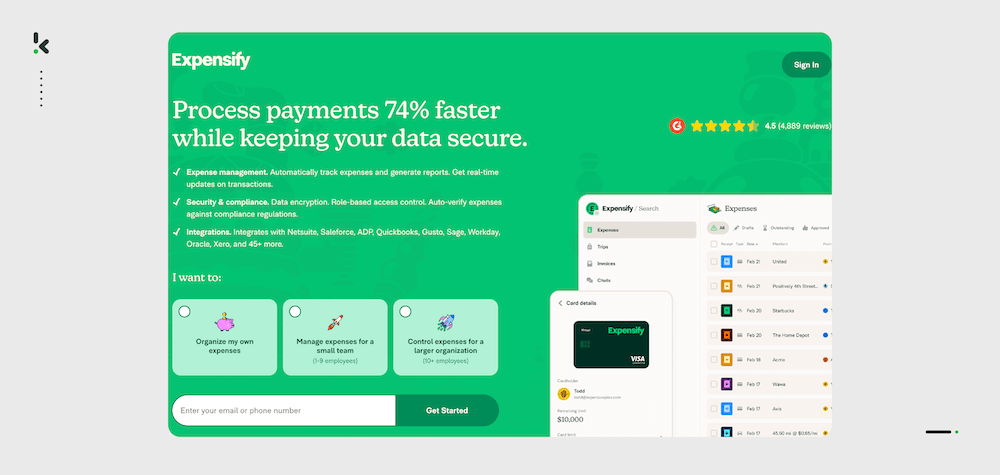

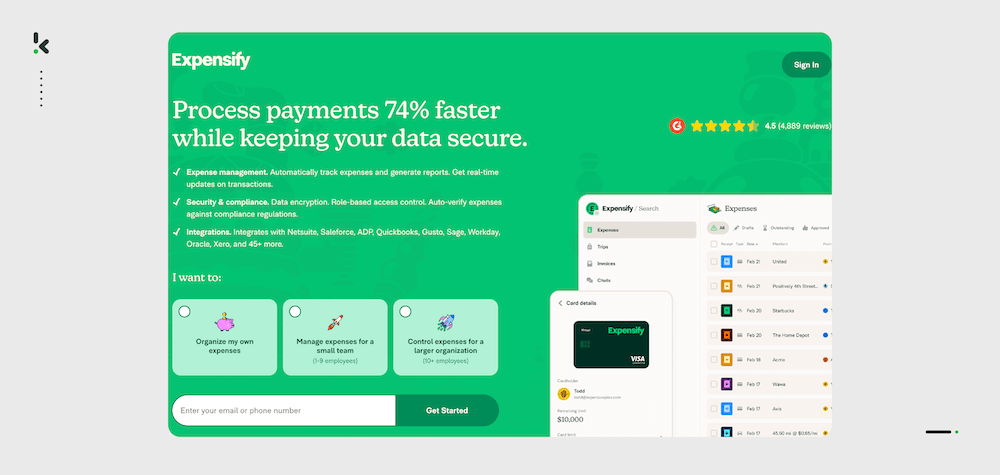

6. Expensify

Expensify combines mobile OCR for receipts with expense categorization, report generation, and approval routing. The SmartScan feature captures key fields automatically and matches them with expenses in linked payment accounts.

Key Features

- SmartScan OCR for automatic data capture

- Bank and credit card transaction matching

- Mobile and desktop expense submission

- Approval chain customization

- Policy enforcement for expenses

Pros

- Strong automation between receipt capture and bank feeds

- Mobile-friendly with quick submission process

- Flexible approval workflows

Cons

- Processing time for OCR can vary

- Some policy enforcement features are locked to higher tiers

Best for: Businesses or teams seeking a blended solution for receipt scanning, expense tracking, and policy enforcement.

7. Adobe Scan

Adobe Scan is a free mobile app that uses OCR to digitize receipts, documents, business cards, and more. For receipts, it detects borders, enhances image quality, and captures key text fields, with options for exporting to PDF or other Adobe tools.

Key Features

- Free OCR scanning for up to 25 pages per document

- Automatic text recognition for receipts

- Clickable recognized phone numbers and URLs

- Integration with Adobe Acrobat and Adobe PDF services

- Save and share receipts as PDFs or JPEGs

Pros

- High-quality scans with free access to basic features

- Broad document capture support beyond receipts

- Works seamlessly with Adobe’s ecosystem

Cons

- Some advanced features require a paid subscription

- Accuracy can vary for receipts with small or faint print

Best for: Individuals or small teams seeking a free, easy-to-use OCR tool for occasional receipt scanning.

8. Google Lens

Google Lens is an AI-powered app that can recognize text on receipts, make it editable, and integrate with translation and search tools. While it does not store scanned receipts natively, it works well for quick capture and copy into Google Docs or Sheets.

Key Features

- OCR for printed and handwritten text

- Instant translation for multi-language receipts

- Integration with Google Workspace tools

- Visual search based on receipt images

- Voice read-aloud for captured text

Pros

- Free with strong AI-based recognition

- Ideal for capturing receipts in multiple languages

- Strong ecosystem integration for Google users

Cons

- No built-in receipt archival or storage

- Lacks native expense management features

Best for: Users who need fast OCR capture with translation and research capabilities inside the Google ecosystem.

9. Apple Notes

Apple Notes includes a built-in OCR capability that lets users scan and digitize text from receipts directly into a note. Scans can be searched, tagged, and organized within the app, making it a light but effective option for iPhone or iPad users.

Key Features

- Free OCR built into iOS devices

- “Scan Text” mode for immediate digitization

- Organize and tag scanned receipts

- Searchable text within stored notes

- Works across iPhone, iPad, and Mac devices

Pros

- Completely free for Apple users

- Very quick for small-scale receipt capture

- No external app download required

Cons

- Limited suitability for bulk scanning

- No direct integrations with accounting systems

Best for: iOS users needing a fast, no-cost OCR option for occasional receipts.

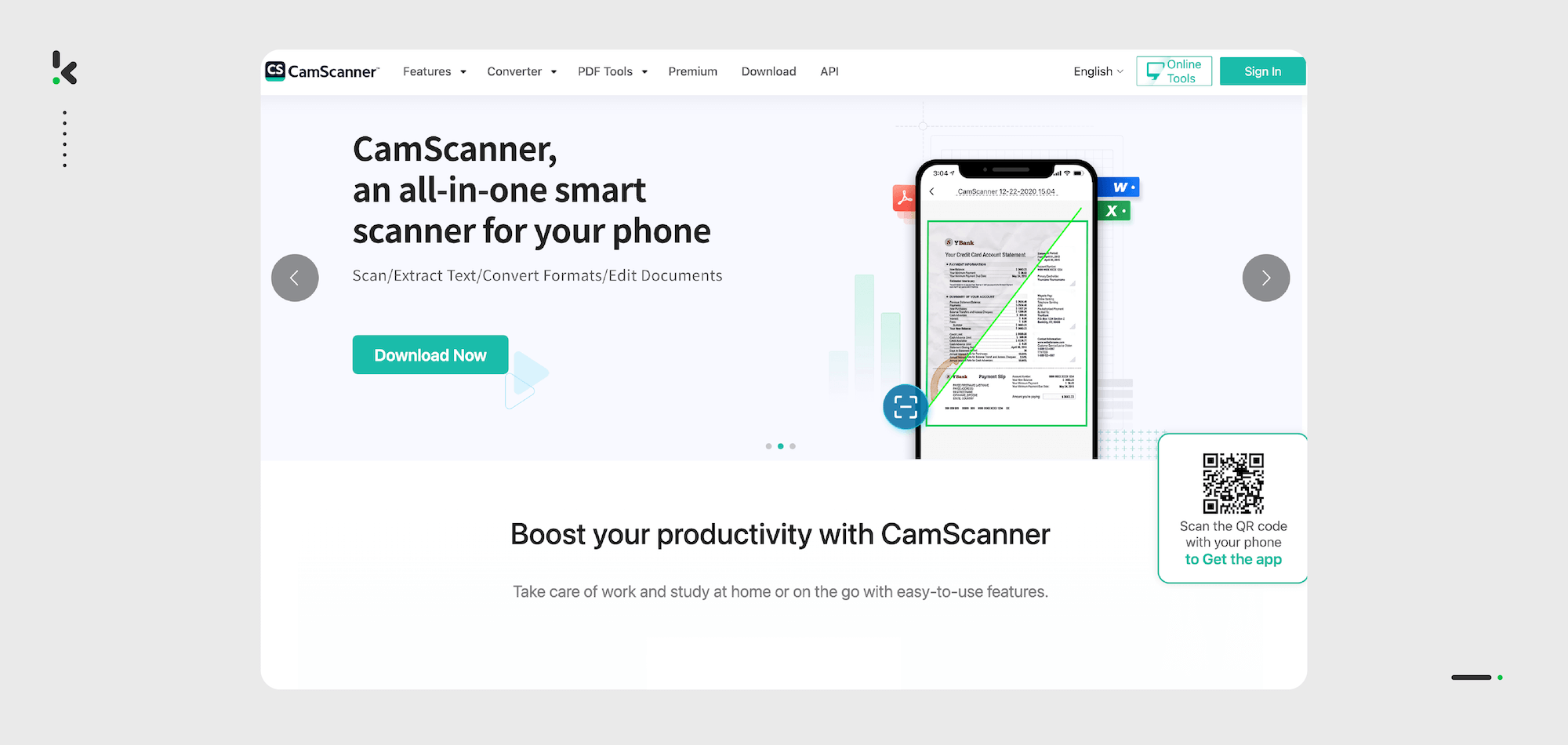

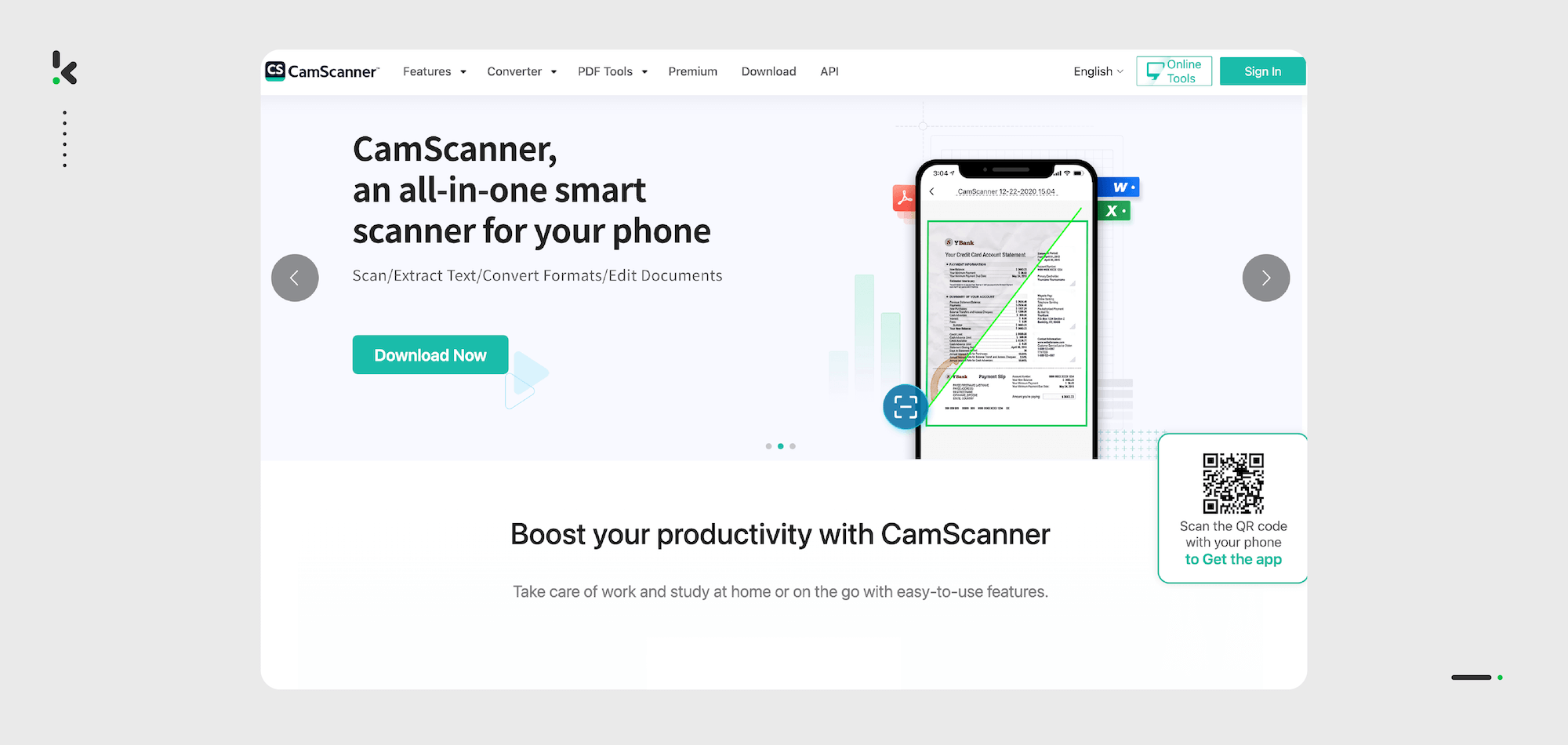

10. CamScanner

CamScanner is a mobile-first document scanning app with extensive customization options. Its OCR feature can extract text from receipts and export them in formats like Word, Excel, or PDF. It also includes extras such as translation and annotation.

Key Features

- OCR for receipts and other document types

- Export to Word, Excel, PDF, or image formats

- Built-in translation and annotation tools

- Watermark and passcode protection options

- Cloud storage sync across devices

Pros

- Wide range of document customization features

- Multiple export formats available

- Accurate border detection and enhancement

Cons

- OCR accuracy can vary with spacing and punctuation

- Premium subscription required for most advanced features

Best for: Users who want a versatile mobile scanning app with OCR for receipts and wide export flexibility.

Key Features to Consider in 2026

Choosing the best receipt OCR software is not just about scanning accuracy. The right platform should match your expense workflows, integrate with your existing tools, and support compliance needs. Below are the factors finance and operations teams evaluate most often in 2026.

Accuracy Across Multiple Receipt Formats

Receipts vary by merchant, country, and printing style. Look for OCR engines that maintain consistent accuracy on faded, crumpled, or low‑contrast images. Leading solutions achieve above 95% field‑level accuracy across vendor names, dates, amounts, and tax lines.

Language and Currency Support

If you manage international expenses, language and currency recognition are critical. The best platforms identify multiple languages in one document and apply the correct currency code and symbol automatically, avoiding manual conversions.

Integration with Finance Systems

Without integration, receipt OCR is just a stand‑alone scanning tool. Solutions should connect directly to ERP, accounting, or expense management software. Native connectors or well-documented APIs enable receipt data to flow into systems like QuickBooks, Xero, Oracle NetSuite, or SAP without duplicated entry.

Workflow Automation

OCR should be part of a broader expense workflow. Features like automatic categorization, approval routing, and policy-based flagging reduce manual effort and speed reimbursement. Batch upload and queue management help during high-volume periods such as month-end close.

Fraud Detection and Data Validation

Duplicate receipt submissions, altered amounts, or mismatched currency conversions can cost organizations money and impact compliance. Advanced receipt OCR can run automated checks to flag irregularities and detect fake receipts before they reach approval.

Scalability for High Volumes

Seasonal travel, project spikes, or annual events can cause sudden increases in receipt volume. The platform should process at full speed even when handling thousands of documents, whether in real time or batch mode.

Security and Compliance

Receipts often contain sensitive personal and financial data. Choose a platform that meets recognized standards such as ISO 27001, SOC 2, and GDPR. Encryption in transit and at rest, role-based permissions, and anonymization features help protect data integrity.

Ease of Use

Even the most advanced OCR engine is limited if staff find it hard to use. A clear interface, straightforward mobile app, and minimal training requirements encourage adoption across finance and non-finance teams.

Why Klippa DocHorizon Stands Out Among the Best Receipt OCR Software

When it comes to processing receipts with speed, accuracy, and compliance, Klippa DocHorizon delivers far more than basic OCR. It fuses AI‑driven text extraction, real‑time data validation, and automation features into one platform built for modern expense workflows.

Unlike standard OCR systems, Klippa handles diverse receipt formats without templates, detects potential fraud, and enriches extracted data to increase effective accuracy. Whether processing single receipts on the go or large volumes in batches, results are delivered in under five seconds.

Now part of the Doxis, recognized as a Leader in the Gartner® Magic Quadrant™ for Document Management, Klippa brings enterprise‑grade AI document automation capabilities to receipt processing for organizations worldwide.

What sets Klippa apart?

- Receipt OCR software with an accuracy above 99% for all formats, layouts, and languages

- Fraud detection and rule‑based validations to catch duplicates, altered totals, or irregular entries

- GDPR‑compliant data handling with masking and anonymization capabilities

- Seamless integrations with ERP, expense management tools, and accounting systems

- Developer‑friendly REST API, SDKs, and intuitive no‑code automation options

- Real‑time and batch processing for scalable deployment

- Optional human‑in‑the‑loop verification for edge cases requiring absolute precision

If you want to reduce manual receipt handling while improving compliance and turnaround time, request a live demo today to see how Klippa DocHorizon can automate, validate, and accelerate your receipt processing workflows.

FAQ

Top choices include Klippa DocHorizon, Dext Prepare, Docsumo, Zoho Expense, QuickBooks Online, and Expensify for business needs, and Adobe Scan, Google Lens, Apple Notes, and CamScanner for lighter use. For maximum accuracy, compliance, and automation, Klippa DocHorizon is the standout.

Receipt OCR is used to scan and digitize receipts, automatically extracting details such as the vendor name, transaction date, total amount, tax, and currency. This removes the need for manual data entry in expense reporting and accounting workflows.

Leading receipt OCR solutions achieve above 95% field‑level accuracy, and advanced platforms like Klippa DocHorizon can reach over 99% by using AI‑driven extraction, validation rules, and optional human review.

Yes. Modern OCR engines trained on diverse layouts can recognize both printed and handwritten text, though accuracy may be lower for illegible handwriting. AI‑based image enhancement can improve results.

Many leading solutions support multi‑language and multi‑currency recognition, allowing receipts from different countries to be processed without manual conversion or translation.

Receipt OCR creates accurate digital records that can be stored securely for audit purposes, ensuring policy adherence and supporting regulations such as GDPR, SOX, and local tax requirements.

Yes. Top solutions offer native integrations with ERP and accounting systems like QuickBooks, Xero, and SAP, as well as APIs for custom connections to expense management platforms.

Enterprise‑grade solutions include encryption in transit and at rest, role‑based access controls, and compliance with standards such as ISO 27001, SOC 2, and GDPR, ensuring that sensitive data is protected.

Processing time varies by platform, but advanced AI OCR systems like Klippa DocHorizon deliver validated results in under five seconds for both single receipts and bulk upload batches.