Processing loan applications can be a slow, repetitive, and error-prone process, especially when your team handles dozens or even hundreds of forms daily. From ID verification to proof of income, each document needs to be reviewed, classified, and entered into your loan system. When this is done manually, small mistakes can lead to approval delays, compliance issues, or even financial losses.

Borrowers today expect speed. But many financial institutions are still using outdated workflows that rely heavily on human input. The result is bottlenecks in your lending pipeline, rising operational costs, and a borrower experience that leaves customers frustrated.

The solution is to leverage Optical Character Recognition (OCR) technology combined with Intelligent Document Processing (IDP) to handle loan document processing. With OCR, you can instantly convert information from loan-related paperwork into digital, structured data. This enables faster decisions, fewer mistakes, stronger compliance, and a smoother experience for your customers.

In the following sections, you will learn exactly how to implement OCR in your loan processing workflow.

Key Takeaways

- OCR transforms loan processing by automating document data extraction from applications, IDs, bank statements, and income proof.

- Benefits include faster approvals, fewer errors, lower costs, and stronger compliance with regulations such as KYC and AML.

- High-quality OCR solutions offer features like document classification, field-level extraction, multi-language support, robust security, and seamless integration with Loan Origination Systems.

- AI-powered OCR platforms like Klippa continuously improve accuracy and scalability, making them suitable for small lenders and large financial institutions.

- Klippa’s Intelligent Document Processing enables processing in seconds, real-time compliance validation, and secure handling of sensitive borrower data.

- Investing in OCR positions your lending operation for growth, allowing you to handle higher volumes without additional staffing.

What is OCR in Loan Processing?

In loan processing, OCR is a technology used to automate the extraction and digitization of data from various documents, transforming physical or scanned paperwork into machine-readable text for faster, more accurate, and efficient processing.

OCR is not only about reading text. Advanced OCR solutions use Artificial Intelligence and Natural Language Processing to classify documents, detect relevant fields, and understand context within financial records. This allows your loan processing system to capture borrower names, addresses, account numbers, income figures, and transaction details directly from documents with minimal human intervention.

For lenders, OCR is a key building block in creating a fully automated loan origination workflow. By instantly digitizing and structuring data, it eliminates manual input errors, accelerates decision-making, and ensures that all information is available in a consistent format for compliance checks and credit assessments. This technology enables your team to focus on evaluating applications rather than spending valuable time on repetitive data entry tasks.

Why Loan Document Data Extraction Matters

Loan processing is one of the most document-heavy operations in the financial sector. Every application involves multiple files such as identification documents, bank statements, proof of income, tax statements, and credit history reports. Each of these contains critical information that needs to be verified, entered into the system, and checked against compliance requirements.

When this extraction is done manually, it becomes a time-consuming process that involves repetitive data entry and increases the risk of human error. Even small mistakes can cause compliance failures, delay approvals, and damage customer trust. Manual processing also makes it difficult to scale operations, as adding more staff is often the only way to handle growing application volumes.

Automated loan document data extraction changes the equation entirely. With OCR and IDP, you can capture and verify key borrower details in seconds. This speeds up approvals, improves data consistency, strengthens compliance, and reduces operational costs. It transforms loan processing from a bottleneck into a streamlined, efficient workflow that meets the expectations of modern customers.

Benefits of OCR in Lending

Adopting OCR for loan processing delivers benefits that go far beyond faster data entry. It transforms the entire lending workflow and improves the experience for both your team and your customers.

Faster Loan Approvals

OCR instantly captures borrower information from application forms and supporting documents, enabling faster eligibility checks and credit assessments. This means you can process applications in hours rather than days.

Improved Accuracy and Consistency

Manual data entry is prone to mistakes that can delay approvals or cause compliance issues. OCR reduces these errors by consistently extracting information exactly as it appears in the source documents.

Lower Operational Costs

Automation removes the need for large data entry teams, reducing labor costs. Resources can be redirected to higher-value tasks such as customer service or loan portfolio analysis.

Enhanced Compliance

Modern OCR platforms can validate extracted data against government or financial databases, ensuring compliance with KYC and AML regulations without additional manual checks.

Better Customer Experience

A faster, smoother loan process leaves customers satisfied and more likely to recommend your business or return for future financing. Meeting the expectations of today’s borrowers strengthens your competitive edge.

Scalability for Growth

OCR-based workflows can handle growing volumes of applications without additional strain on your team. This scalability allows you to expand your client base without sacrificing service quality.

Fraud Prevention with OCR in Loan Processing

Fraudulent loan applications can cost lenders significant amounts of money and damage their reputation. Common fraud risks include forged identification documents, altered payslips, and falsified bank statements. Detecting these manually can be difficult and time-consuming.

OCR technology combined with intelligent document processing helps identify fraud by:

- Verifying document authenticity through watermark, seal, and signature detection.

- Cross-checking extracted data against official databases to confirm identity and financial details.

- Detecting tampering by identifying inconsistencies in fonts, alignments, or image metadata.

- Flagging suspicious patterns in financial statements or transactional histories using AI-driven anomaly detection.

By integrating fraud detection into your OCR workflow, you can approve legitimate applications faster while intercepting fraudulent ones before they cause loss. Klippa’s platform offers these capabilities, ensuring a secure and compliant loan processing pipeline.

Use Cases for OCR in Loan Processing

OCR technology can streamline multiple stages of the loan lifecycle. Here are some of the most impactful applications:

- Automated Data Entry for Loan Applications: Instantly extract borrower details such as name, address, employment status, and income from application forms, eliminating the need for manual data input.

- KYC and Identity Verification: Capture and validate key information from passports, driving licenses, national IDs, or residence permits to meet regulatory requirements and reduce onboarding time.

- Bank Statement Analysis: Read and structure transaction data from bank statements, enabling quick evaluation of borrower spending habits, income flow, and repayment capability.

- Payslip and Income Verification: Extract salary amounts, employer details, and pay frequency directly from payslips to confirm declared income against documented proof.

- Mortgage Document Processing: Retrieve property details, contract clauses, and valuation data from lengthy mortgage agreements without manual review.

- Fraud Detection: Identify altered documents by detecting inconsistencies in layout, fonts, or image metadata, and cross-check information against official sources.

- Archiving and Searchability: Convert paper-based loan archives into searchable digital formats, making compliance audits and borrower history retrieval faster and more efficient.

Key Features to Look for in an OCR Solution for Lending Documents

Not all OCR solutions are created equally, especially when it comes to the complexity of loan processing. Choosing the right platform can make the difference between a minor improvement and a complete transformation of your lending workflow. When evaluating options, keep the following features in mind.

- High Accuracy Recognition: Capable of correctly reading printed, handwritten, and stamped text, even in complex financial document layouts.

- Automated Document Classification: Ability to automatically identify document types such as loan applications, ID documents, pay slips, and bank statements without manual sorting.

- Field-Level Data Extraction: Capability to capture and structure specific data points needed for loan approvals rather than just retrieving raw text.

- Compliance and Security: Built-in support for regulatory compliance; features like encryption, GDPR adherence, and role-based access control are essential for sensitive borrower data.

- Multi-Language and Currency Support: Useful for lenders serving diverse markets with different languages and financial formats.

- Seamless Integration Capabilities: APIs or connectors that work with Loan Origination Systems, CRM platforms, and compliance tools to ensure smooth automation.

- Scalability: Ability to handle increasing volumes without losing accuracy or speed; cloud options can offer flexible scaling.

- AI-Driven Performance Optimization: Tools that use Artificial Intelligence to improve extraction accuracy over time and adapt to new document formats.

- Fraud Detection Capabilities: Ability to detect altered or forged documents, verify authenticity through watermark or seal analysis, and cross-check extracted data against official databases to prevent fraudulent applications.

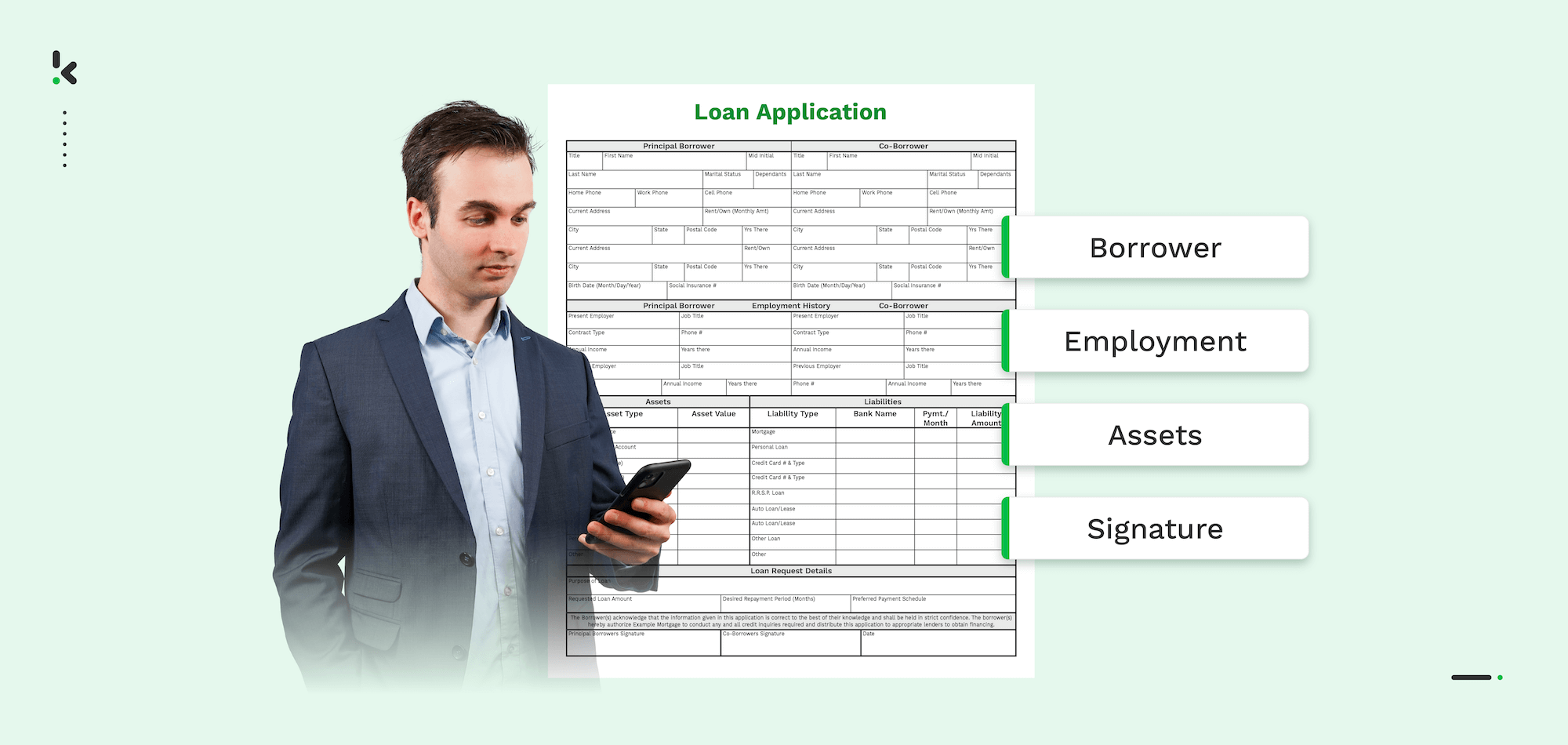

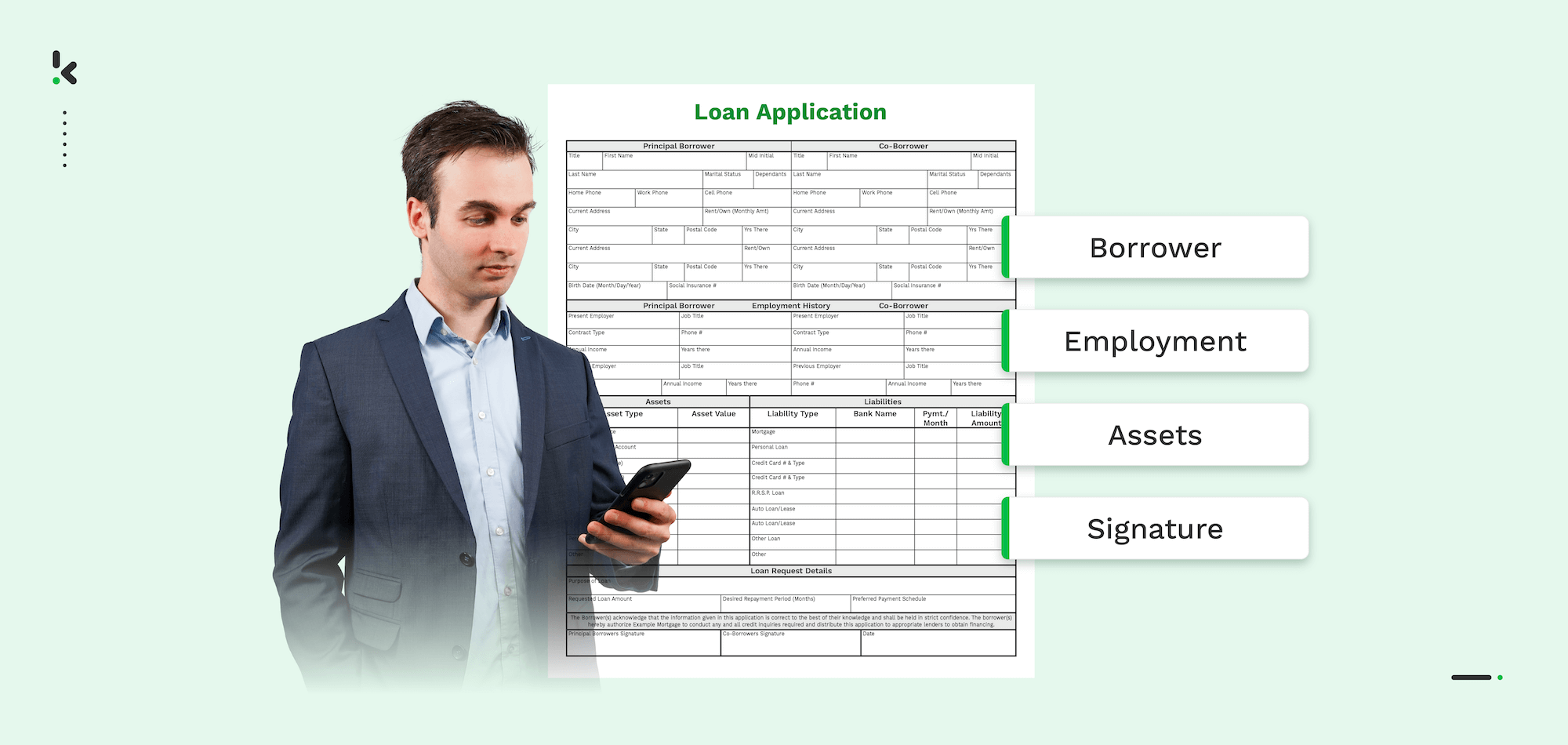

Step-by-Step: How to Automate Loan Document Data Extraction with OCR

Automating loan document data extraction is about creating a clear, repeatable workflow where every step is optimized for accuracy and speed. Below is the process on how to move from raw loan documents to structured, validated data ready for decision-making.

1. Document Capture

Collect loan-related documents from various sources, such as scanned paper forms, email attachments, mobile uploads, or secure customer portals. Ensure that all files are captured in a high-resolution format to prevent data loss during processing.

2. Image Processing

Prepare the captured documents for optimal OCR performance. This may include adjusting brightness and contrast, de-skewing tilted pages, removing background noise, and cropping out irrelevant sections. Image pre-processing greatly increases character recognition accuracy, especially for handwritten or stamped content.

3. Optical Character Recognition

Apply OCR technology to convert printed or handwritten information into machine-readable text. Advanced OCR solutions use AI and Natural Language Processing to recognize text across different fonts, languages, and layouts, even in challenging document conditions.

4. Data Extraction

Identify and capture specific data points like borrower names, addresses, income details, account numbers, and transaction history from the OCR output. This step should map extracted fields directly to the data requirements of your loan processing system.

5. Data Validation and Verification

Cross-check extracted information against official databases, credit bureaus, or customer records to ensure authenticity. This step is essential for KYC and AML compliance and for reducing fraud risk by spotting inconsistencies.

6. Output

Export the validated, structured data to your Loan Origination System (LOS) or CRM for immediate use in credit assessment and approval workflows. Data can also be archived securely for audits or future reference.

Why Klippa DocHorizon is the best solution

Implementing OCR and intelligent document processing in loan workflows requires more than just software. You need a reliable, secure, and adaptable solution that fits seamlessly into your existing processes. That is exactly where Klippa comes in.

Klippa DocHorizon combines advanced OCR, Natural Language Processing, and automation to streamline loan document data extraction from start to finish. With Klippa, your business can:

- Capture and process data from loan applications, identification documents, bank statements, and proof of income in seconds.

- Automatically classify documents to eliminate manual sorting and speed up workflows.

- Extract field-level data with high accuracy for faster credit assessment and decision-making.

- Validate data against official records to meet strict KYC and AML compliance standards.

- Integrate seamlessly with your Loan Origination System, CRM, and compliance tools through robust APIs.

- Scale your processing capacity during peak periods without compromising accuracy or speed.

- Ensure security and privacy with encryption, GDPR compliance, and role-based access controls.

By partnering with Klippa, you can transform loan processing from a bottleneck into a competitive advantage. Your team will spend less time on repetitive data entry and more time on strategic activities that grow your lending business.

Book a free demo to see how Klippa can digitize, extract, and validate your loan documents with unmatched speed and accuracy.

FAQ

OCR (Optical Character Recognition) in loan processing is the technology used to automatically read and extract data from loan-related documents. This includes application forms, ID cards, bank statements, and income proof. It converts this data into structured digital formats, enabling faster approvals, and reducing manual data entry.

OCR automates the extraction of essential borrower information directly from scanned or digital documents. This data is instantly available to loan officers and credit assessment tools, cutting processing times from days to hours, and improving the borrower’s experience.

Modern, AI-powered OCR solutions achieve accuracy rates above 95 percent when configured for specific loan document formats. Advanced systems like Klippa also validate extracted data against official sources to ensure compliance and accuracy.

OCR can process a wide range of documents including mortgage applications, personal loan forms, business loan applications, KYC identification, pay slips, tax returns, and bank statements. It can handle both printed and handwritten content.

Yes, OCR solutions designed for financial services follow strict compliance standards such as GDPR in Europe, PCI DSS for payment data, and KYC/AML rules in most regions. Klippa ensures data is encrypted, securely stored, and processed in accordance with local laws.

Absolutely, advanced OCR solutions support multiple languages and regional formats, making them ideal for lenders operating across different countries or serving multicultural client bases. Klippa’s OCR technology supports over 100 languages.

OCR platforms with API integration can connect directly to Loan Origination Systems, CRMs, and compliance tools. This ensures extracted data flows seamlessly into your existing loan processing pipeline without the need for manual uploads.

Costs vary depending on document volume, complexity, and system integration needs. Many providers, including Klippa, offer scalable pricing models so smaller lenders can start affordably and expand usage as needed. Requesting a demo and custom quote is the fastest way to get accurate pricing for your specific situation.