Duplicate invoices slip into financial workflows more often than most teams realize. In fact, financial companies collectively lose billions each year to simple errors like paying the same invoice twice.

According to the Institute of Finance and Management (IOFM), duplicate payments make up around 1.5% of an organization’s total outgoing cash flow. That means a company with $1 million in annual expenses could lose $15,000 without even noticing it.

Scale that to a large financial institution, and the cost climbs into the billions.

In this blog, we’ll show you how to spot duplicate invoices before they hit your ledger, which signals to look for, and how automation can catch what the human eye often misses.

Key Takeaways

- Duplicate invoices are instances where the same invoice is submitted more than once for the same transaction.

- They may arise through simple human errors (e.g. data‐entry mistakes, lack of tracking) or through intentional fraudulent activity.

- If undetected, duplicate invoices lead to real financial consequences: overpayments, strained cash flow, compliance risks, and damaged vendor relationships.

- Manual checks alone aren’t enough. Automation and robust invoice-processing workflows significantly reduce the risk of duplicates slipping through.

- Software solutions like Klippa DocHorizon use OCR, AI, hashing, and real-time alerts that flag possible duplicates before they get paid.

- The benefits are two-fold: cost savings (reducing duplicate payments) and time savings (cutting manual efforts and improving accuracy).

What is a Duplicate Invoice?

A duplicate invoice is a second or subsequent invoice for the same transaction, which can happen accidentally or through fraud. Accidental duplicates are often caused by manual errors, system glitches, or receiving both paper and electronic versions of an invoice. Fraudulent duplicates may involve slight changes to an original invoice to bypass controls.

Both types can lead to financial losses from overpayments if not detected, so businesses use manual checks, cross-referencing techniques, or intelligent software to catch duplicates.

Why Duplicate Invoices Occur

Duplicate invoices and duplicate payments can occur due to a wide range of reasons. Here are some of the most common causes:

- Human error: This can occur at various stages of the invoicing process, from the data entry step to the invoice reconciliation process or even the approval. Humans make mistakes, which can lead to double invoicing or undetected duplicate submissions.

- Financial fraud: Duplicate invoices could also be a result of intentionally fraudulent efforts on the part of your employees or suppliers, intending to commit expense fraud or invoice fraud.

- Lack of oversight: Inadequate controls or oversight in the invoicing process can also contribute to duplicate invoices. Without proper checks and balances in place, duplicate invoices may go unnoticed until they are processed for payment.

- Lack of centralization: A lack of a central destination where all incoming invoices can be submitted can lead to duplicate invoices being sent via different methods and getting lost in the system until it’s too late.

Whether accidental or intentional, duplicate invoices always come at a cost. Let’s take a closer look at the impact they can have on your business.

The Impact of Duplicate Invoices

Undetected, duplicate invoices can have far-reaching consequences on all facets of your business. Here are some of the issues that often arise:

- Financial loss: Duplicate invoices lead to overpayment, resulting in financial losses for your business, which would negatively impact your bottom line and overall profitability.

- Cash flow problems: Duplicate invoices can disrupt cash flow management, as the funds tied up in payments for duplicate invoices may affect the company’s ability to meet its financial obligations, causing liquidity issues.

- Compliance and auditing issues: Duplicate invoices often raise compliance concerns and result in failed audits. If auditors flag inconsistencies in financial records, it can lead to further scrutiny and potential fines or penalties.

- Deterioration of vendor relationships: Duplicate invoices that result in delayed payments or even incorrect payments can lead to frustration for suppliers and strain long-term partnerships.

- Accounting errors: Duplicate invoices can cause discrepancies in financial records and accounting systems. This can lead to inaccuracies in financial reports, making it challenging for businesses to track their expenses and revenue accurately.

Duplicate invoices can be costly, but the good news is that they’re highly preventable. In the next section, we’ll walk through the key steps to detect and avoid them.

How to Prevent and Detect Duplicate Invoices

Preventing duplicate invoices starts with building a workflow that leaves little room for human error. While duplicate payments can happen for many reasons, most can be avoided with the right structure, checks, and technology.

Below are the most effective ways to keep duplicates out of your financial operations.

Manual Detection Methods

- Compare key fields: Look for identical or near-identical matches in invoice number, vendor name, invoice date, and the total amount.

- Check for variations: Be vigilant for slight differences that basic systems might miss, such as “INV1001” versus “INV-1001”.

- Match to POs and receipts: Check if a purchase order has already been fully paid and received; a new invoice linked to it may be a duplicate.

- Keep a log: Maintain a centralized log of all incoming invoices to quickly check if a new invoice is already on file before processing it.

Automated Detection Methods

- Use AP automation software: These systems can automatically compare new invoices against existing records to flag potential duplicates before they are paid.

- Implement three-way matching: This feature in automation software compares invoice data against both the purchase order and the receiving document to ensure accuracy.

- Leverage fuzzy matching: Use software that can identify “close” matches, even if there are slight variations in the invoice number or other details.

- Run periodic audits: Regularly run reports on your existing invoice data to identify duplicates that may have slipped through daily checks.

- Use AI and machine learning: Some advanced tools use AI to group suspected duplicates and provide a confidence score to help users prioritize review.

With the right mix of process discipline and smart technology, businesses can drastically reduce the financial and operational risks of duplicate invoices.

In the next section, we’ll explore how Klippa’s solutions take this a step further with advanced detection features that catch duplicates long before they can impact your bottom line.

How Klippa Helps You Detect Duplicate Invoices

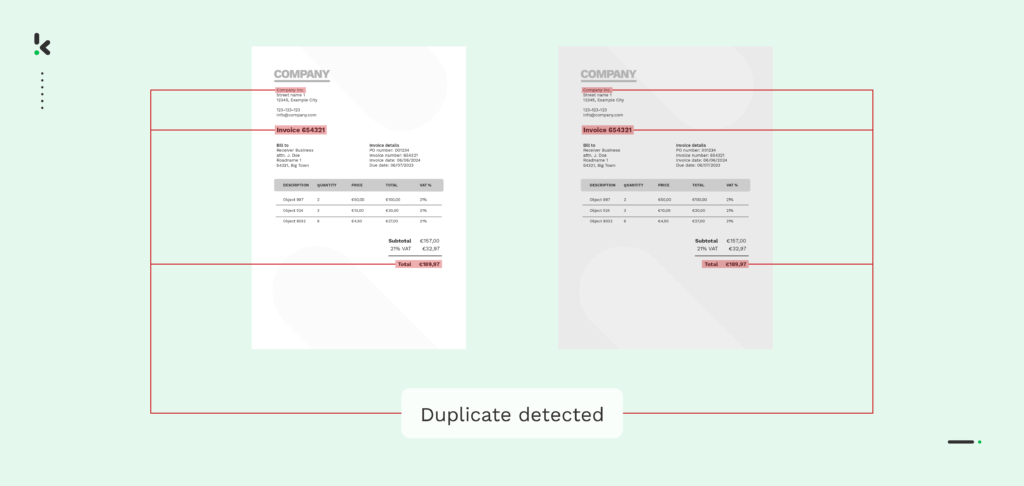

Detecting duplicate invoices becomes far easier and more reliable when you move beyond manual checks. Klippa DocHorizon uses a combination of OCR, AI, and smart validation rules to catch duplicates, even when they’re subtle or intentionally altered.

Advanced OCR and data extraction

Klippa reads and structures all invoice data automatically, ensuring consistent fields for comparison. This eliminates human-entry errors and creates a clean data layer that’s easy to check for duplicates.

Document fingerprinting (hashing)

Instead of relying only on invoice numbers or amounts, Klippa generates a unique “fingerprint” of each invoice. This allows the system to detect:

- Exact duplicates

- Near-duplicates with small changes

- Fraud attempts where the layout or values have been slightly altered

Real-time duplicate detection

As soon as an invoice enters the workflow, Klippa checks it against existing documents in your system. If something looks suspicious, users receive an immediate alert, long before the invoice reaches approval or payment.

Flexible validation rules

You can define your own matching logic, such as checking for duplicates based on supplier name, invoice number, date, amount, or any combination of extracted fields. Klippa adapts to your existing financial processes instead of forcing new ones.

Smooth integration with your tools

Whether you use an ERP, accounting system, or procurement software, Klippa easily integrates with your existing stack. Duplicate-detection insights flow directly into your AP workflow, ensuring that nothing gets lost between systems.

Conclusion

Duplicate invoices may seem like simple mistakes, but their financial and operational impact adds up quickly. The good news is that with the right processes and technology, most duplicates are entirely avoidable. By strengthening your procurement workflow, automating key steps, and using advanced detection tools, you can significantly reduce the risk of paying the same invoice twice.

Klippa takes this one step further with intelligent OCR, document fingerprinting, and real-time alerts. These features help you stop duplicates before they ever reach your approval flow. With a smarter, more automated approach, your AP team can work faster, more accurately, and with greater confidence.

Ready to find out how Klippa can be integrated into your business processes? Book a demo below or contact one of our experts for more information!

FAQ

A duplicate invoice is an invoice that has been submitted more than once for the same goods or services, whether by mistake or with fraudulent intent. If not caught in time, it can result in double payments.

What causes duplicate invoices?

Common causes include manual data-entry errors, unclear procurement processes, vendors resending invoices, mismatched invoice formats, and internal communication gaps. In some cases, duplicates are created intentionally as part of fraud attempts.

How can duplicate invoices affect my business?

They can lead to unnecessary expenses, strained cash flow, compliance risks, and operational inefficiencies. Over time, even small duplicate payments can add up to significant financial losses.

How can I prevent duplicate invoices?

Establish clear procurement workflows, automate AP processes, use unique invoice identifiers, perform regular audits, and rely on software with built-in duplicate detection.

How does automation help reduce duplicate invoices?

Automation eliminates manual data entry, one of the main sources of duplicates. AP automation tools extract and standardize invoice data, flag potential duplicates, and apply consistent checks at every step.

What should I do if I discover a duplicate payment?

Contact the vendor immediately, request a refund or credit note, and document the issue internally to prevent recurrence. A review of your AP workflow can help identify the root cause.

Can accounting software alone detect all duplicate invoices?

Not always. Basic accounting systems typically catch exact matches but may miss near-duplicates with small changes in layout, wording, or values. Advanced tools using OCR, AI, or document hashing provide stronger protection.

How does Klippa help with duplicate invoice detection?

Klippa uses AI, OCR, and document-fingerprinting techniques to detect both exact duplicates and near-duplicates, even when formatting changes. It provides real-time alerts and integrates seamlessly into AP workflows to prevent double payments.