Undoubtedly, bank statement data is a big part of any business. It helps you reconcile accounts, monitor cash flow, prepare for audits, and meet regulatory requirements. Having all these under control means you’re on top of your finances and keep things compliant.

But this is not that easy when you’re manually extracting data from bank statements. Constant errors, lost time, inconsistent formats, and delays slow down reporting and take a toll on your financial team.

What if there’s a better way to do this? A way in which you don’t have to type line by line anymore, but instead you have key details from bank statements at your fingertips, with ready-to-use data?

This is what a bank statement extraction software stands for! With Intelligent Document Processing (IDP), you can automate bank statement extraction, reduce errors, and give your team back the time they need to focus on what really matters.

Curious how? Let’s dive in!

Key Takeaways

- Bank statement data is business-critical – But manual processing wastes time and increases the risk of costly errors.

- Not all tools handle complexity well – Online solutions often struggle with varied formats and lack consistent accuracy.

- Automation means precision at scale – Optical Character Recognition and Artificial Intelligence extract, validate, and structure your data in seconds, no matter the volume.

- Klippa gets you up and running fast – With ready-to-use presets, integrations, and free credits to test, automation has never been this accessible.

What is Bank Statement Data Extraction?

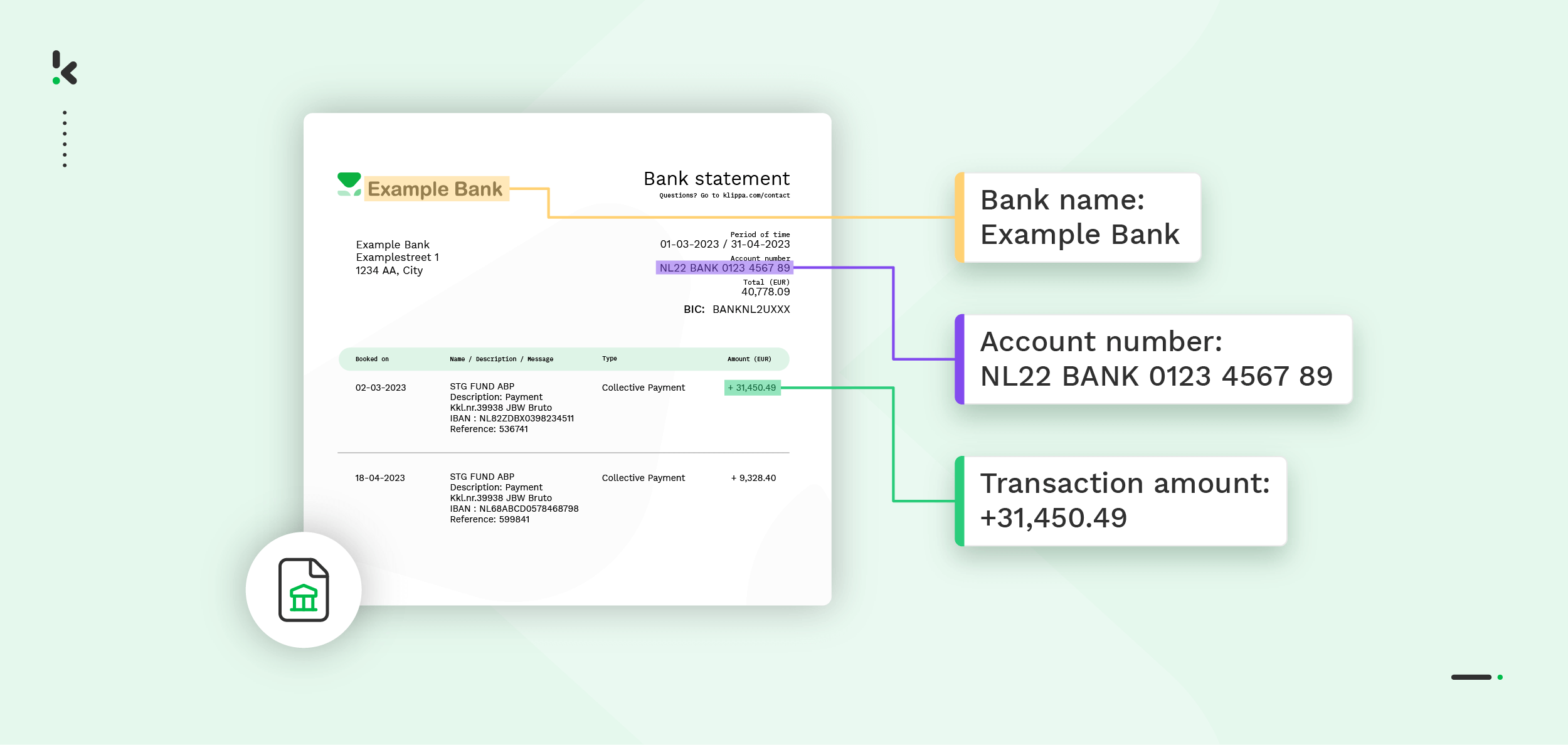

Bank statement data extraction is the process of pulling key financial information from your bank statements and turning it into structured, usable data. This allows you to easily track cash flow, spot unusual transactions, and reconcile accounts faster.

Here are the most common data fields that you can extract:

- Account holder details: Name, address, and account number.

- Transaction dates: The exact dates when money moved in or out.

- Transaction descriptions: Merchant names, payment references, or notes.

- Amounts: Debit and credit values for every transaction.

- Balances: Opening, closing, and running balances.

- Currency information: Especially useful for international accounts.

- Bank branch information: Such as IBAN, SWIFT, or BIC codes.

While understanding what bank statement data extraction is and which data fields can be captured is essential, the next step is knowing how to actually perform the extraction. Let’s take a closer look at the most common methods used to extract data from bank statements.

Methods to Extract Data from Bank Statements

The most commonly used methods to extract data from bank statements are:

Manual extraction

The manual method is a popular method to extract data. It entails an employee opening each bank statement, scanning for the right details, and manually typing them into a spreadsheet or accounting system. In short, scrolling, copying, and pasting. Again and again.

Even though this method is cost-effective, it’s also time-consuming and resource-heavy. The risk of errors is really high, not to mention that your business’s compliance and security are at stake. And what happens if you want to scale up your company? Practically impossible.

Thanks to technological advancements, there are better methods on the market, such as using online tools to handle the extraction for you.

Using online tools to extract data

In this method, you simply upload your digital bank statement – whether it’s a PDF, image, or scanned copy – and the tool takes care of the rest. Perfect! Why would you even look for something else?

Extracting data with online tools may seem like a quick fix, but it comes with challenges. These tools struggle with different layouts or formats, which results in inaccurate data extraction. Data is often unorganized, and formatting errors are quite common. Even though validation checks are included, errors can still lead to discrepancies or compliance issues.

As helpful as online tools can be, they often fall short when it comes to accuracy and scalability. That’s where automated data extraction steps in as a more reliable alternative.

Automatic extraction

Automated data extraction is simply something else. It captures information quickly and accurately from digital, scanned, or even printed statements. This results in faster workflows, fewer errors, and more time for high-value tasks.

It works like this: Optical Character Recognition (OCR) converts images and scanned text into machine-readable data, no matter the format. Then, machine learning and AI models classify and extract the key elements you need. No matter if one statement or a thousand, the process stays fast, accurate, and consistent every time.

Now that you understand how automated extraction works in theory, let’s move on to how you can put it into practice. With platforms like Klippa DocHorizon, setting up a fully automated bank statement data extraction workflow is easier than you might think.

How to Automatically Extract Data from Bank Statements

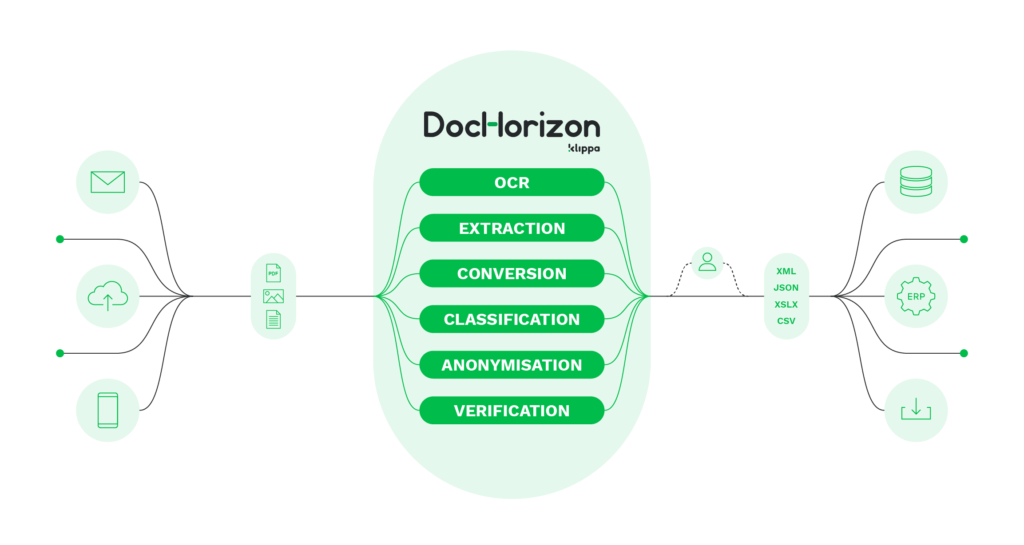

Klippa DocHorizon is an Intelligent Document Processing (IDP) platform that enables you to automate all kinds of document workflows, from bank statement verification to document digitization.

For this specific use case, it employs Bank Statement OCR, a technology that automatically extracts data from bank statements, transforming scanned documents, PDFs, or images into structured, machine-readable formats.

And the best part? You can try it out for free!

Let’s take you through the process step by step.

Step 1: Sign up on the platform

To start, sign up for free on the DocHorizon Platform. Enter your email address, password, and other relevant details. You will instantly receive a free credit of €25 to test all the platform’s capabilities.

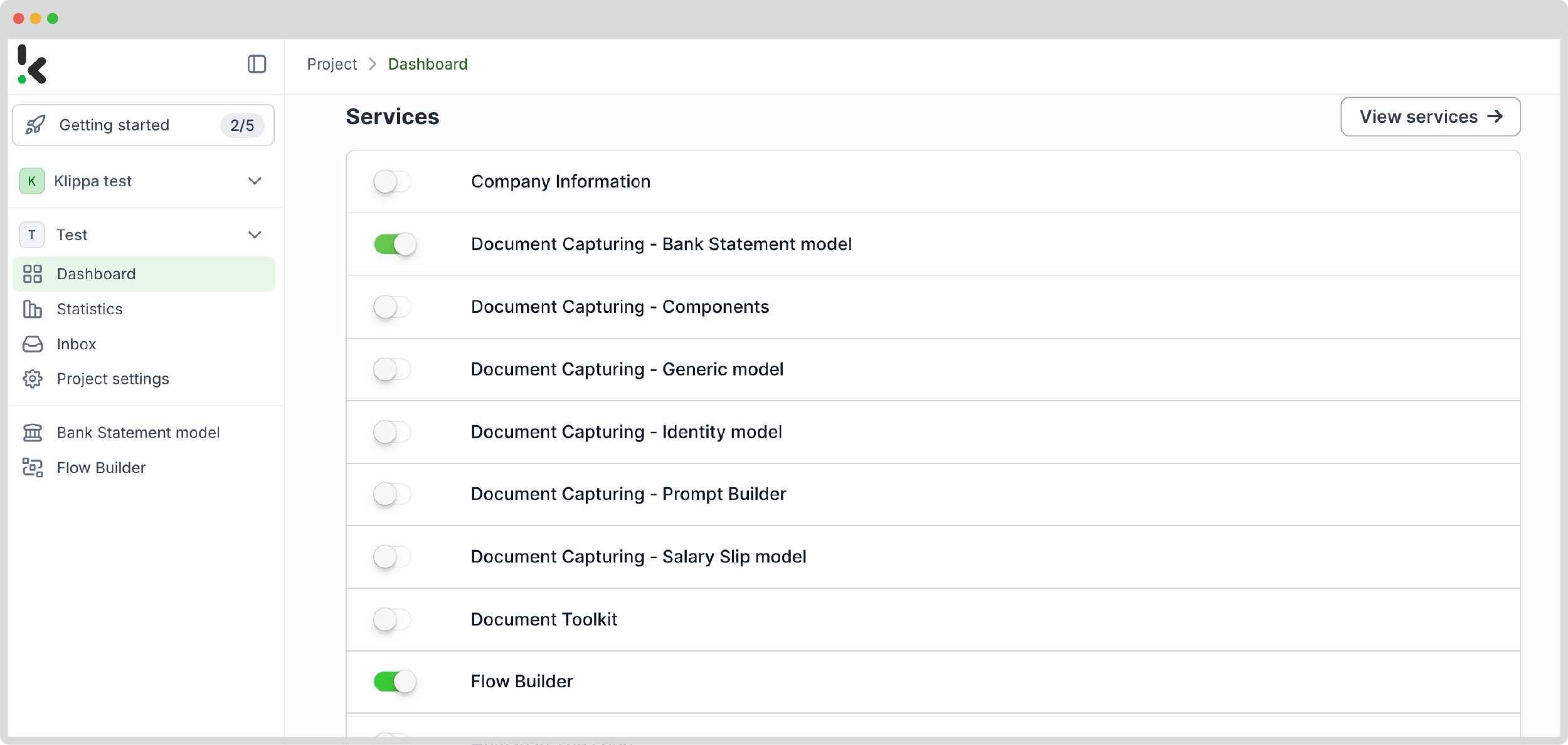

Now, create an organization and a project to access the available services. For extracting data from bank statements, enable the Flow Builder and Document Capture: Bank Statement Model services. This way, you have all the necessary tools to begin your workflow.

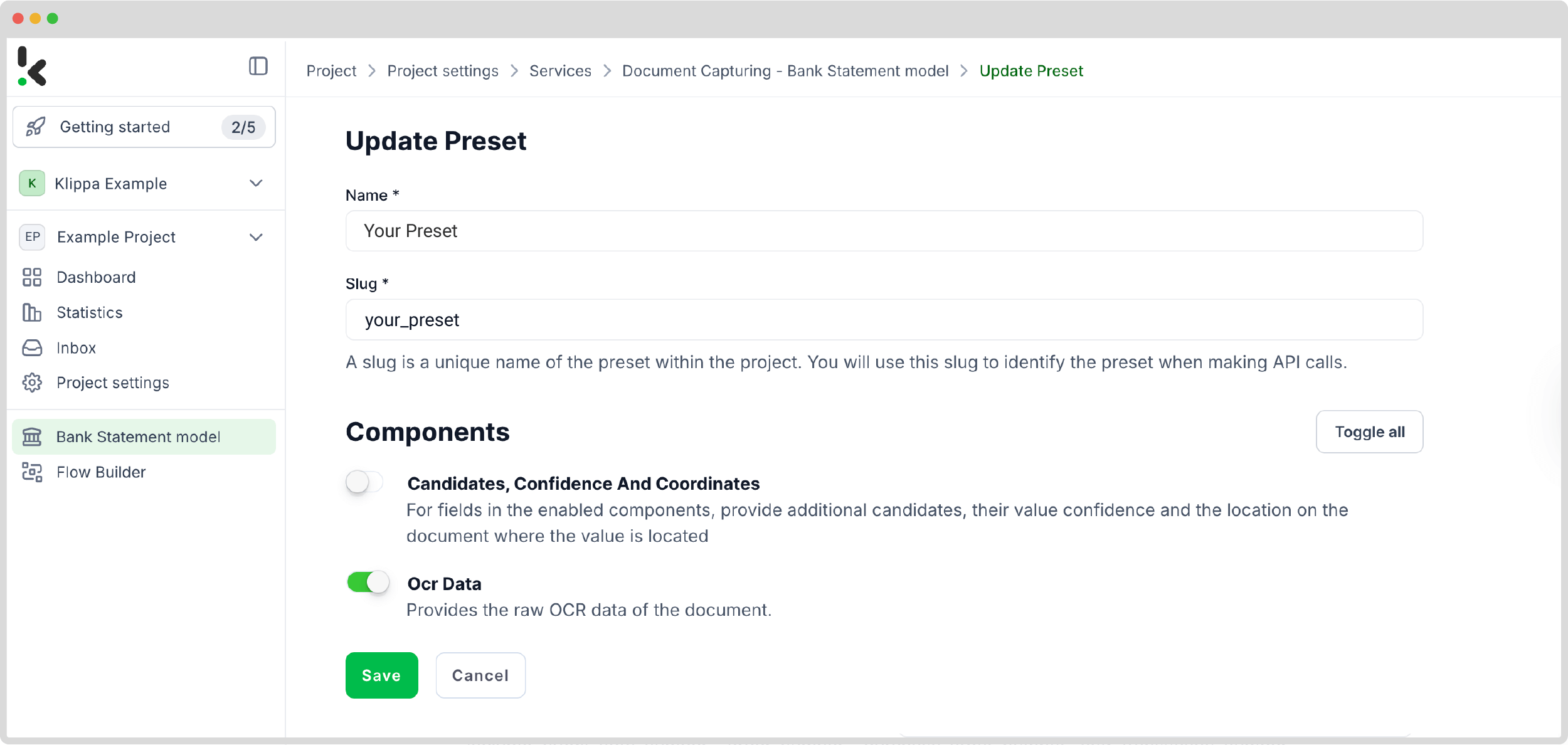

Step 2: Create a preset

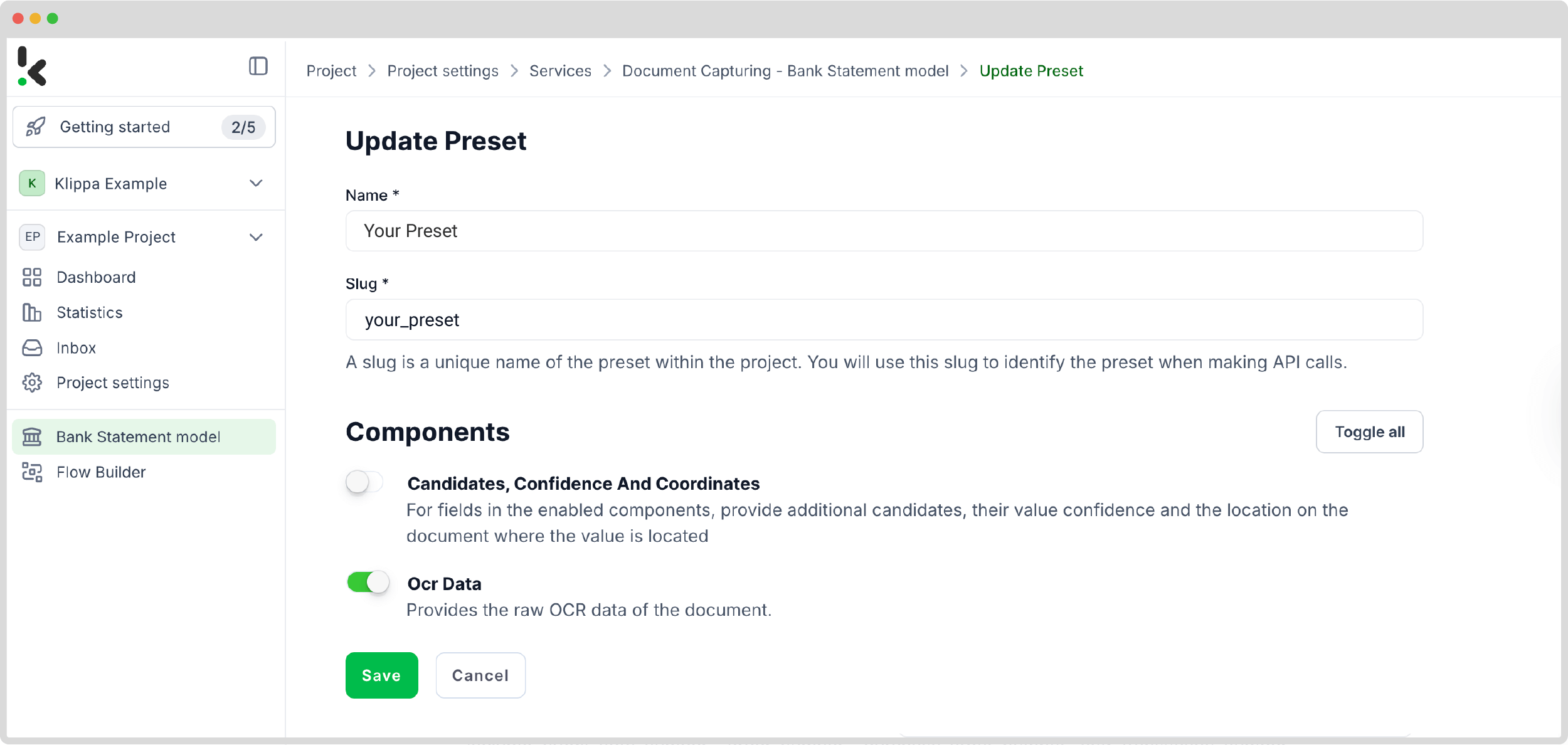

Next, let’s set up a document-capturing preset. A preset is a custom configuration where you can specify which data fields should be extracted for your specific project. This preset will be the foundation of your workflow.

Setting up a preset is really easy! Click on the Bank Statement Model on the left side of the screen. There, you can create a new preset and assign it a name.

If you want something specific, you can customize the preset depending on your use case by adding extra components like raw OCR data. Otherwise, the default option will work just as fine. Click on Save, and it’s done!

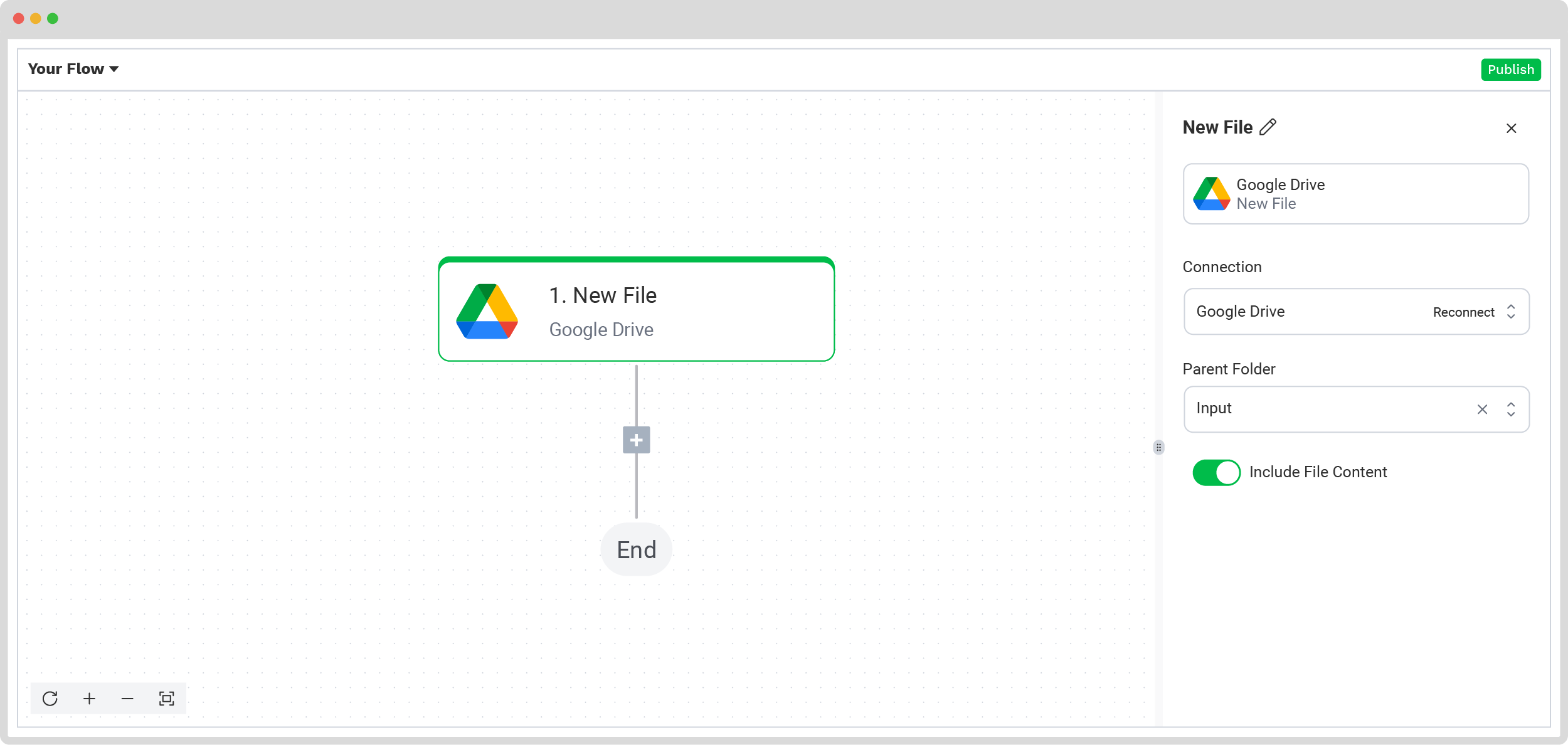

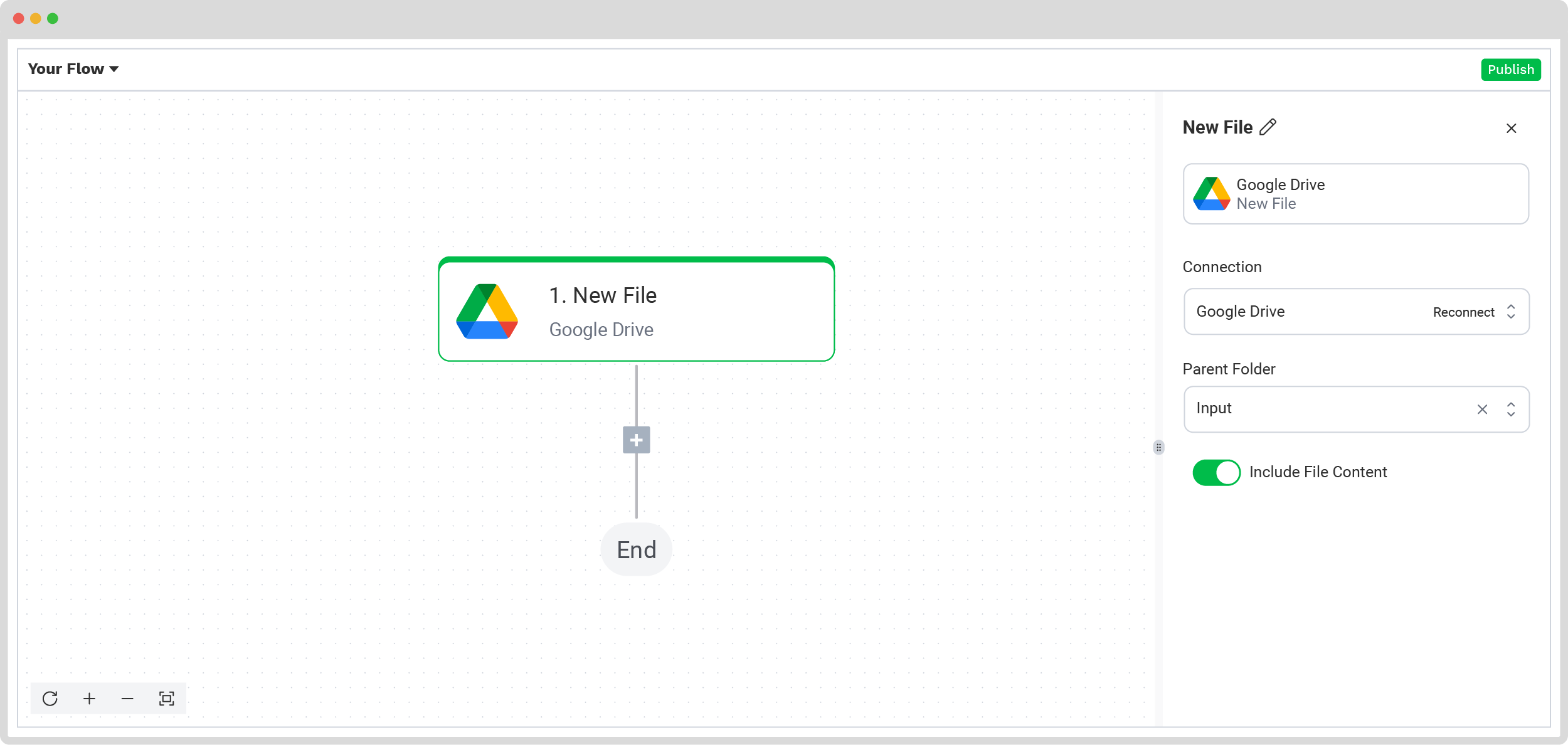

Step 3: Select your input source

You’re ready to start building your flow, a sequence of steps that defines how your bank statements are processed. Return to the services interface and select the Flow Builder to do this. Once there, create a new flow from scratch and assign it a name.

This way, you granted the platform access to retrieve the bank statement for processing.

Let’s use Google Drive as the input source.

But, before going forward, create a new folder (or use your existing one) in Google Drive and upload all bank statements there.

To choose it as your input source, select Google Drive -> New File as your trigger. This is going to start your flow. On the right side, start filling out these sections:

- For Connection: Connect your drive by authenticating with your Google account.

- For Parent Folder: Name of your input folder

- Include File Content: Check this box to ensure file content is processed.

Test this and the following steps by clicking Load Sample Data. Remember to have at least one sample document in your input folder while setting up your flow!

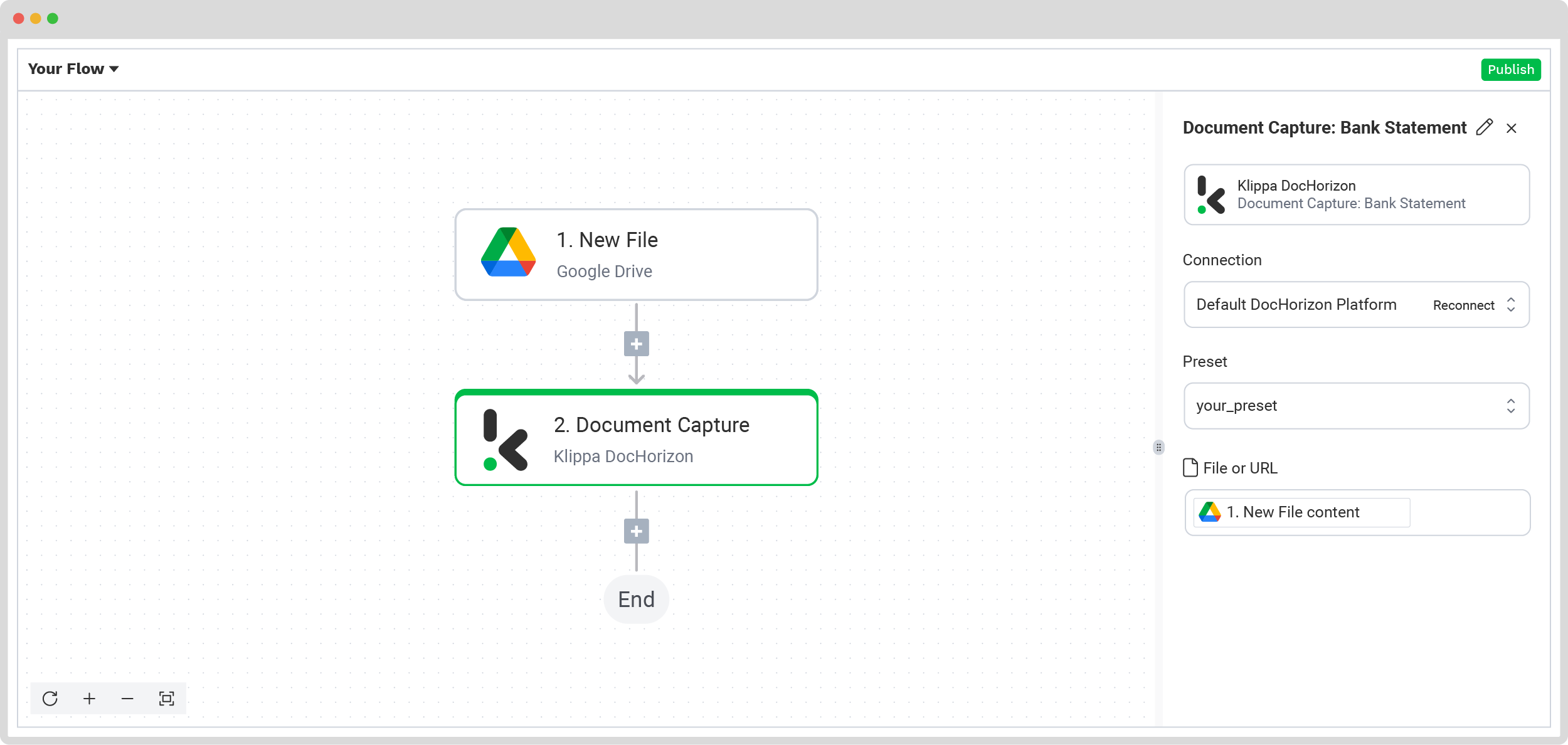

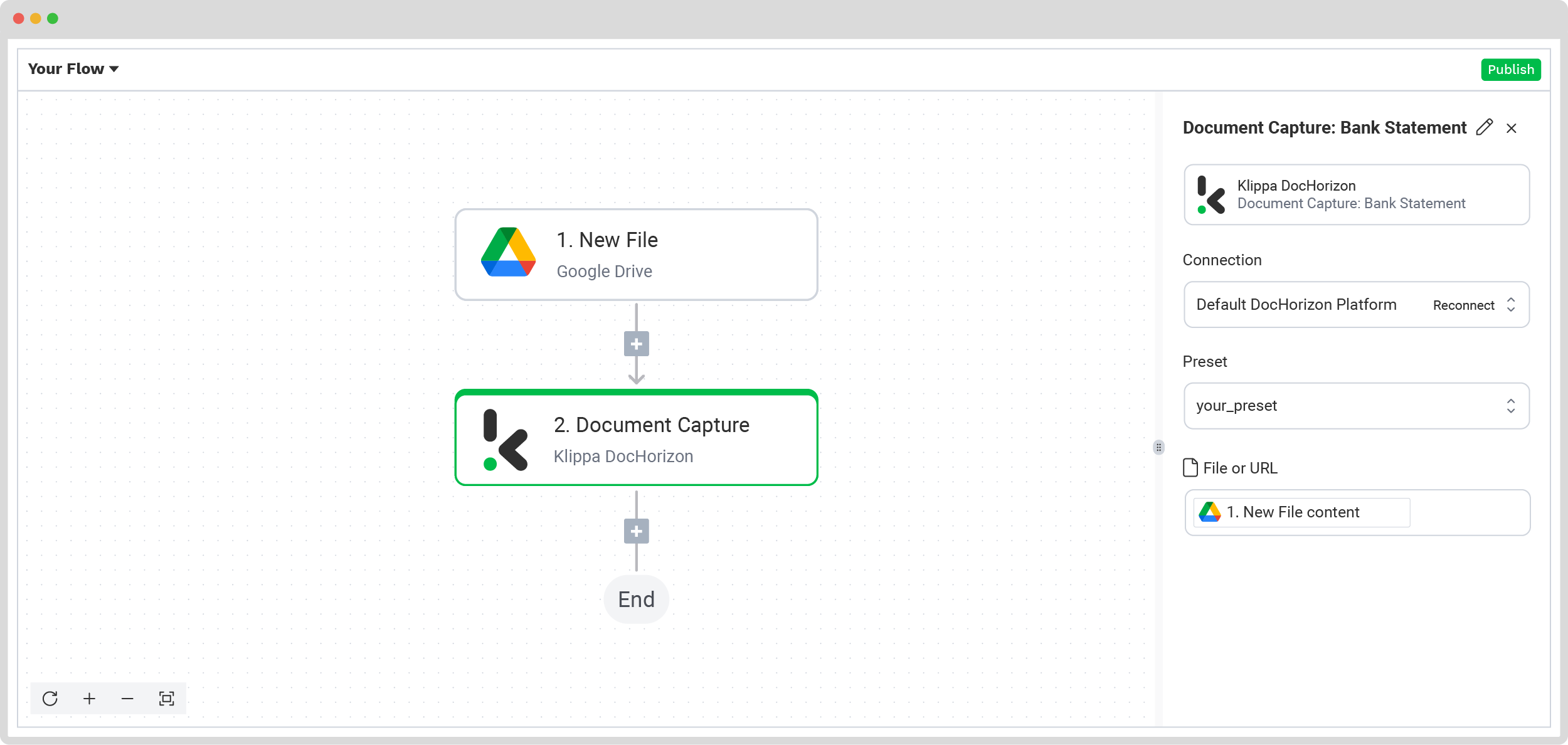

Step 4: Capture and extract data

This step is about processing all the selected data fields from the bank statements in the input folder. For this, we need to use the preset you’ve created in step 2.

In the Flow Builder, press the + button and choose Document Capture: Bank Statement, and configure the following:

- For Connection: Default DocHorizon Platform

- For Preset: The name of your preset

- For File or URL: New file -> Content

Step 5: Save the file

In the final step of this flow, it’s time to decide where the already-processed bank statements will be uploaded. You can choose one of the many software integrations Klippa supports.

To keep it simple, let’s create a new file in Google Drive through the platform. Click the + button, select Google Drive -> Create new file, and set up the following configurations:

- For Connection: google-drive

- For File Name: Document Capture: Bank Statement -> components -> bank -> name (string).

- For Text: Document Capture: Bank Statement -> components

- For Content Type: Text

- For Parent Folder: Output (the name of your output file)

The final step is to test the entire flow by clicking the Test Flow button to confirm everything is functioning as expected.

Congratulations! Your automated flow for processing bank statements is complete and ready for action.

And remember: if you’re processing a high volume of documents, you don’t have to set up the flow yourself! Feel free to reach out to us because we’d love to help you out!

You can also check out our detailed video tutorial below! It walks you through everything we’ve covered so far, making it easier to follow along.

Why Automate Bank Statement Data Extraction?

You’ve seen how simple it is to set up automated bank statement extraction with Klippa DocHorizon. But the real value lies in what it brings to your business. From time savings to security, here’s what automated bank statement extraction adds to your business:

- Saved time and reduced errors. Compared to manual data typing, which is slow and full of errors, automation extracts the right data instantly and accurately. Now your team can focus on analysis and decision-making instead of data entry.

- Improved accuracy. Overlooking details or making typos is normal even for the most careful employee. Thanks to using OCR and AI, automated extraction captures information consistently and precisely, thus reducing the risk of errors or reporting issues.

- Enhance security. Because bank statements contain highly sensitive data, it’s better if fewer people handle them. Automation minimizes human access, helping you comply with privacy and security standards.

- Boost efficiency at scale. Whether you process ten statements a week or ten thousand, automation keeps the workflow smooth and fast. No scaling issues, no extra hires, just consistent high performance that grows along with your business.

Automating your bank statement data extraction clearly delivers value across accuracy, speed, security, and scalability. But what kinds of businesses benefit most from this technology? The answer might surprise you.

Let’s explore the industries that have transformed their operations with automated bank statement processing.

Industries That Benefit from Bank Statement Data Extraction

Bank statement data extraction isn’t just for banks; it solves real problems across many industries. Almost all can gain value from faster, more accurate financial workflows.

Below is a list of the sectors that benefit the most from it, with a real-world example of companies that improved their processes from collaborating with Klippa.

Banking and Finance

Banks, lenders, and fintech companies process an incredible amount of bank statements daily. Automated extraction simplifies processes like account verification, transaction monitoring, and regulatory reporting. This reduces manual workloads, improves accuracy, and helps institutions comply with financial regulations.

Mitsubishi UFJ Financial Group (MUFG), one of the world’s leading financial institutions, has now fully digital expense and invoice processing, greater financial control and accuracy, and reduced administrative workload.

Legal and Compliance Sectors

Law firms and compliance teams rely on financial data for case preparation, due diligence, and fraud detection. Automating bank statement extraction speeds up document reviews, helps uncover hidden patterns, and ensures full regulatory compliance in industries with strict reporting standards.

The Council for the Judiciary, a Dutch governmental organization, now benefits from fully digital expense management, reduced administrative workload, and seamless integration with its ERP database.

Insurance and Healthcare Billing

Insurance providers and healthcare organizations deal with complex billing and claims processes. Automated extraction helps track premium payments, match payments with claims, and validate transactions efficiently. It reduces back-office workloads and improves billing accuracy.

Antwerp University Hospital (UZA), one of the largest organizations in Antwerp, now enjoys 70% time savings in submitting expense claims, fewer errors in processing claims, and a shorter turnaround time from submission to disbursement.

E-Commerce and Retail

Retailers and online businesses must track cash flow and manage vendor payments. Automated bank statement data extraction helps identify trends, flag unusual activity, and ensure smooth payment reconciliation. This results in more control, fewer surprises, and healthier margins.

Roamler, a leading Dutch company that specializes in crowd-supported solutions, enjoys a 91% reduction in document processing time, up to 99% accuracy with the Human-in-the-Loop feature, effortless scalability across Europe, and document processing in multiple languages.

Conclusion: Transform Bank Statement Data Extraction with Klippa

Manual data extraction is yesterday’s problem. With Klippa DocHorizon, you can automate the entire process – from document upload to structured data output – with speed, accuracy, and security. Whether you’re handling a handful of statements or thousands, the setup stays simple and scalable. Here’s what you get:

- Saved Time: Automate data extraction with Klippa’s OCR technology, eliminating tedious manual entry and speeding up verification.

- Cut Costs: Reduce operational expenses by streamlining fraud detection and document processing.

- Tailored Outputs: Generate customized JSON files to fit your needs, making data management easy.

- Minimized Fraud Risks: Detect altered or forged bank statements instantly, protecting your business from financial crime.

- Compliance: Keep up with KYC, AML, and industry regulations while avoiding hefty fines.

- Seamless Integration: Connect Klippa DocHorizon to your existing systems via API or SDK for a hassle-free experience.

At Klippa, simplicity is a core value; that’s why we are constantly improving our documentation to make it easier for you to implement and integrate our platform.

Moreover, all of Klippa’s workflows comply with HIPAA, GDPR, and ISO standards to ensure secure and reliable data processing.

Curious to find out how Klippa’s solution can help you extract data from bank statements? Contact our experts today or book a free online demo below!

FAQ

Bank statement data extraction is the process of retrieving key financial information from bank statements and converting it into structured, machine-readable data. This can be done manually, with online tools, or through automation.

Yes, with limitations. Basic tools may struggle with inconsistent formats, but intelligent systems, like Klippa, can adapt to layout variations over time. The more documents processed, the better the model becomes at recognizing and extracting the right data.

Klippa combines OCR, AI, and rule-based logic to deliver up to 99% accuracy in real-world use cases. For high-stakes use cases like compliance or audits, Klippa offers a human-in-the-loop feature to review and verify data before it’s finalized.

Absolutely. Klippa supports multilingual OCR and various currency formats, making it ideal for global organizations. Whether you’re processing European SEPA statements or international wire transfer documents, Klippa extracts the data consistently.