Fraudsters no longer need printers or scissors to fake a document — all it takes is Photoshop, a template, and ten minutes. From forged utility bills and pay stubs to AI-generated bank statements and IDs, fraudulent files have become more sophisticated, scalable, and convincing than ever.

For industries such as banking, insurance, real estate, and HR, this poses a serious risk. Business decisions increasingly rely on the authenticity of a single document. And while the human eye might catch a spelling mistake or an unusual logo, altered metadata, synthetic identities, or deepfake PDFs can slip through undetected.

That’s why businesses in 2026 are investing in AI-powered document fraud detection tools. These solutions analyze documents beyond the surface level, using metadata checks, image forensics, and anomaly detection to flag tampered files instantly.

But with so many options on the market, how do you know which one is right for your organization? Below, we’ll explore what document fraud looks like, how it can be detected, and the best fraud detection tools available today.

Key Takeaways

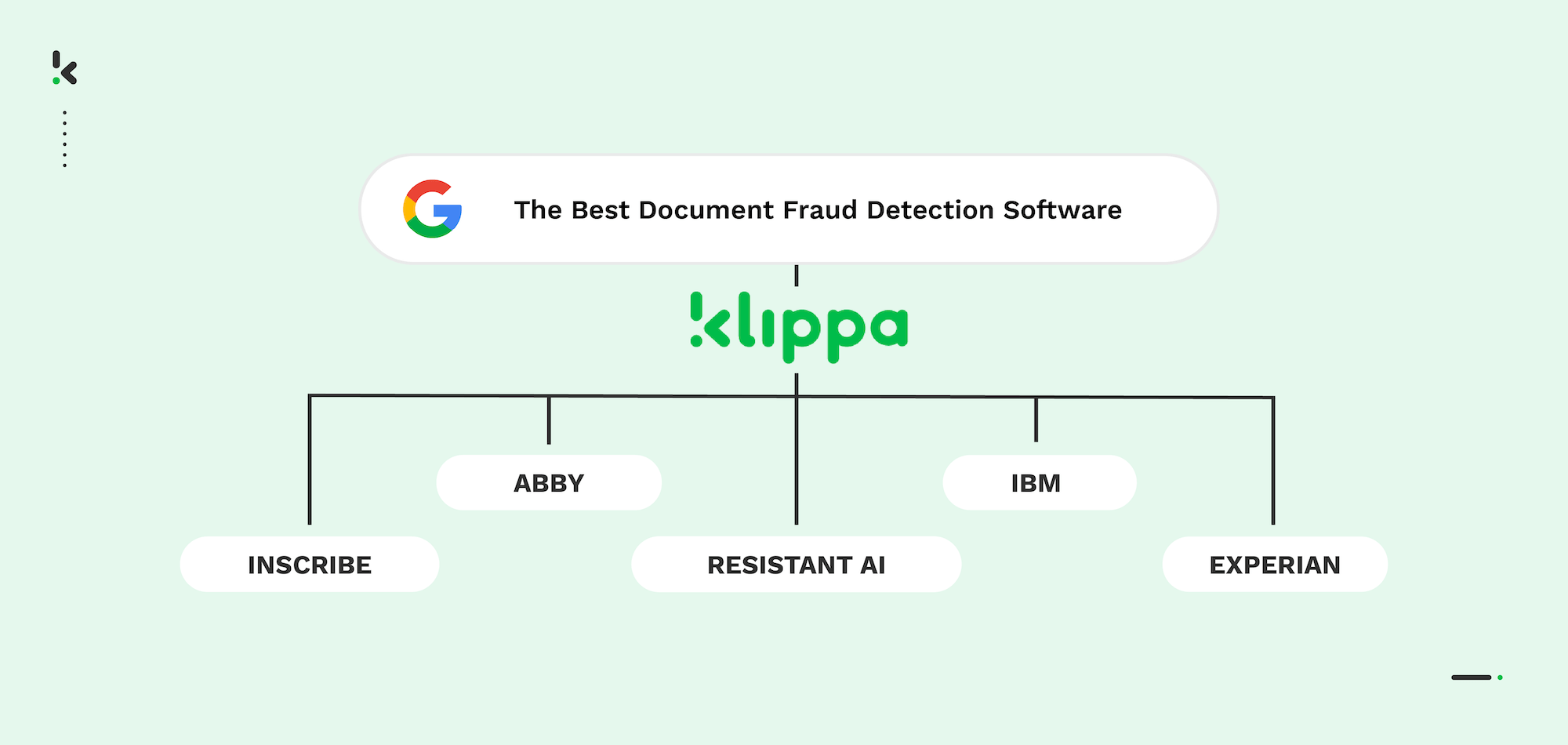

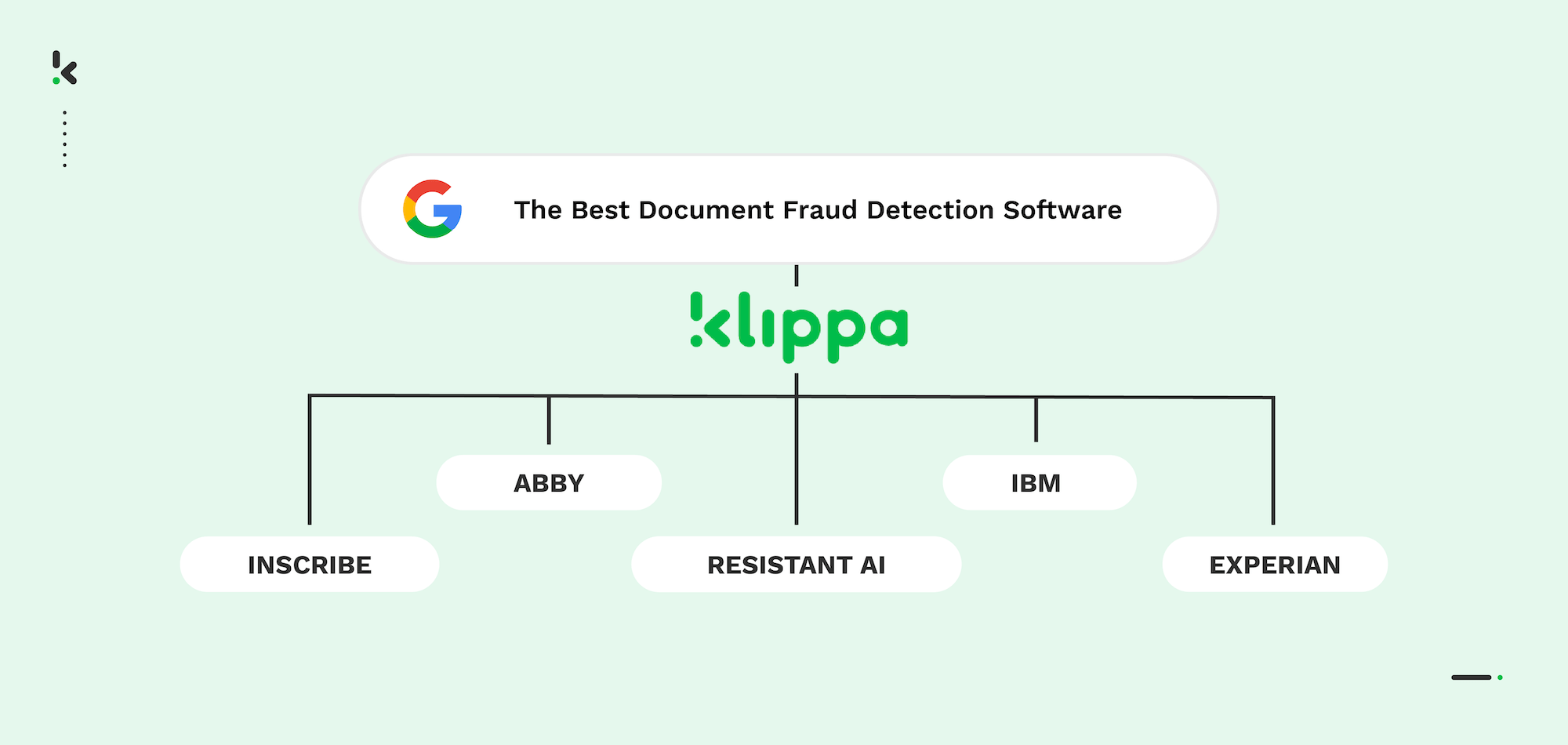

The 7 Best Document Fraud Detection Tools in 2026:

- Klippa DocHorizon — All-in-one fraud detection with OCR, metadata forensics, and compliance features.

- FraudDetectionSoftware — Targeted AI fraud detection with metadata analysis, instant risk scoring

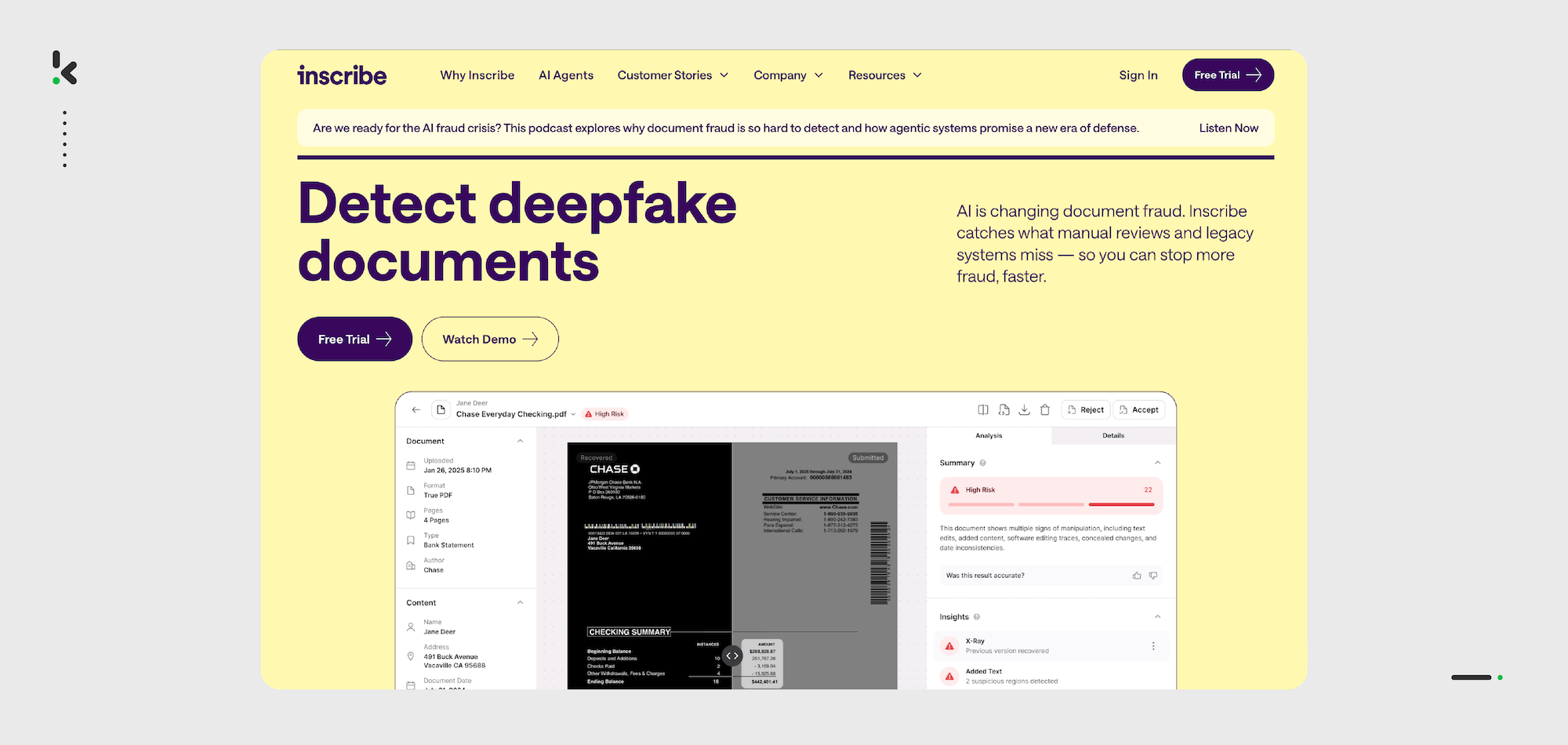

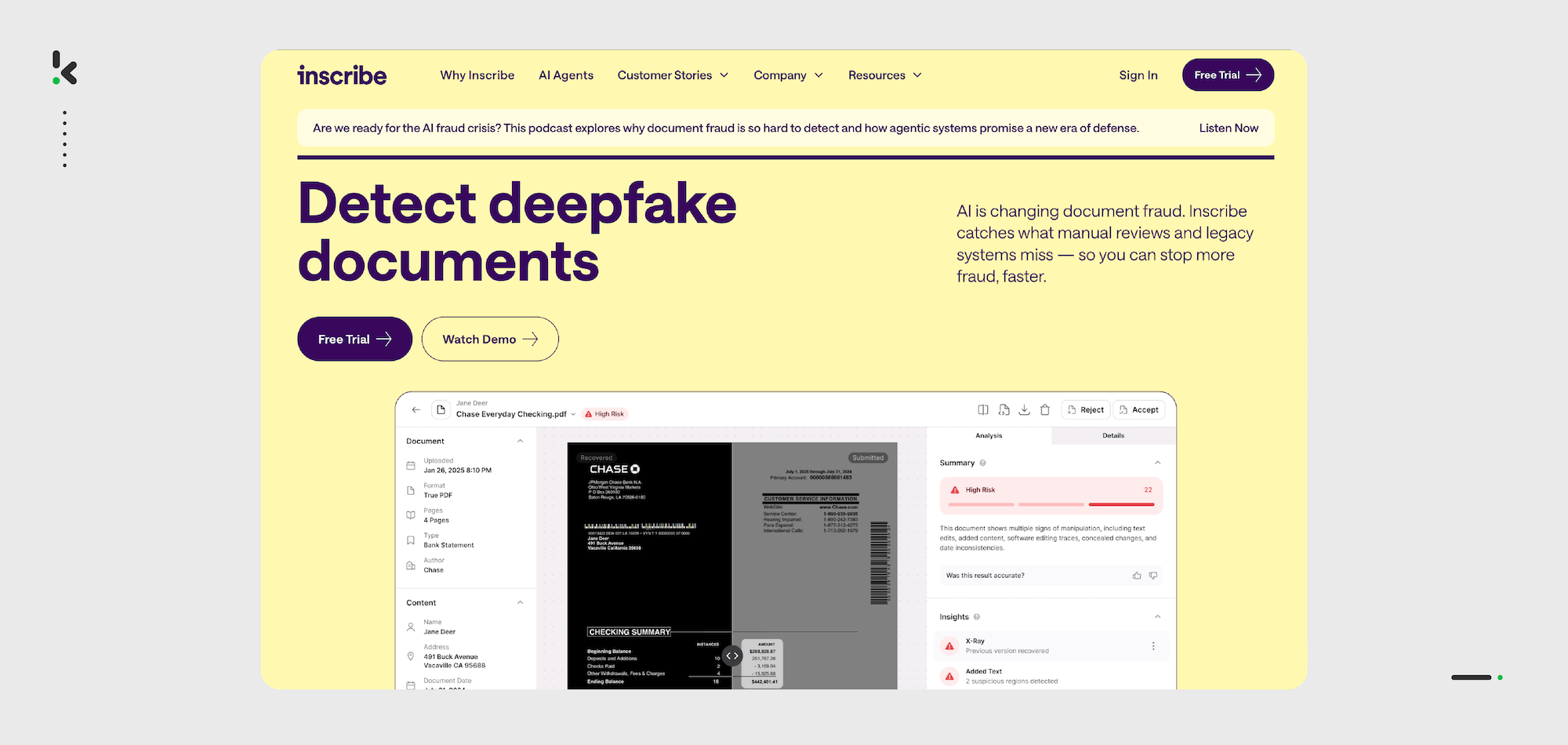

- Inscribe — Used for synthetic identity fraud detection in fintech.

- ABBYY — Strong OCR accuracy with metadata checks.

- Resistant AI — Advanced fraud forensics for lending and crypto.

- IBM Security Trusteer — Good option for large-scale behavioral and device intelligence.

- Experian CrossCore — Multi-layered fraud prevention with credit and identity data.

What Is Document Fraud?

Document fraud is the deliberate creation, alteration, or use of falsified files to bypass verification systems and gain unauthorized access to loans, housing, jobs, or financial services.

Fraudsters manipulate everything from bank statements and invoices to passports and tax forms. Sometimes, documents are fabricated entirely from scratch. Other times, subtle edits such as a date change, a new photo, or a different amount are enough to slip through.

Common types include:

- Forgery – Fully fake documents created with templates or editing software

- Alteration – Real documents edited to change critical details

- Template Fraud – Mass-produced fakes using one document design

- Synthetic Identity Fraud – Combining real and fabricated information to create “new” identities

- Pre-Digital Editing – Printing, altering by hand, and rescanning to mimic imperfections

- Serial Fraud – Reusing a fraudulent file hundreds of times across systems

The result? Financial loss, regulatory non-compliance, and reputational damage.

How to Detect Document Fraud

Detecting document fraud requires more than a quick visual check. Fraudsters are using advanced digital tools to alter files in ways that are nearly invisible to the naked eye. The right approach combines human insight with AI-driven analysis to uncover inconsistencies, manipulations, and hidden edits — before they become costly mistakes.

Manual Detection

Human reviewers can look for:

- Inconsistent fonts, logos, or formatting

- Data mismatches across sections

- Missing security features (like MRZ codes or watermarks)

- Pixelation or alignment errors

Manual checks help, but they are slow, inconsistent, and prone to error, especially under high volume.

AI-Powered Detection

AI-powered fraud detection tools analyze documents on multiple levels, including:

- Metadata forensics – Detecting edits, timestamps, or unusual file histories

- OCR + data validation – Extracting text and cross-checking field consistency

- Image analysis – Identifying Photoshop traces, copy-paste regions, or reused signatures

- EXIF & MRZ verification – Checking file origins and passport data zones

- Risk scoring – Generating instant fraud likelihood scores per document

This approach combines speed, accuracy, and scalability, reducing reliance on manual review. You can learn more and see this technology in action by watching our webinar How to Detect Document Fraud & Image Tampering:

The 7 Best Document Fraud Detection Tools in 2026

With document fraud becoming more sophisticated, relying on manual checks or outdated software isn’t enough. Modern fraud detection tools use artificial intelligence, image forensics, and metadata analysis to identify fake or manipulated documents in seconds.

Below are six of the most reliable and widely used fraud detection platforms in 2026, from all-in-one IDP solutions to specialized forensic tools.

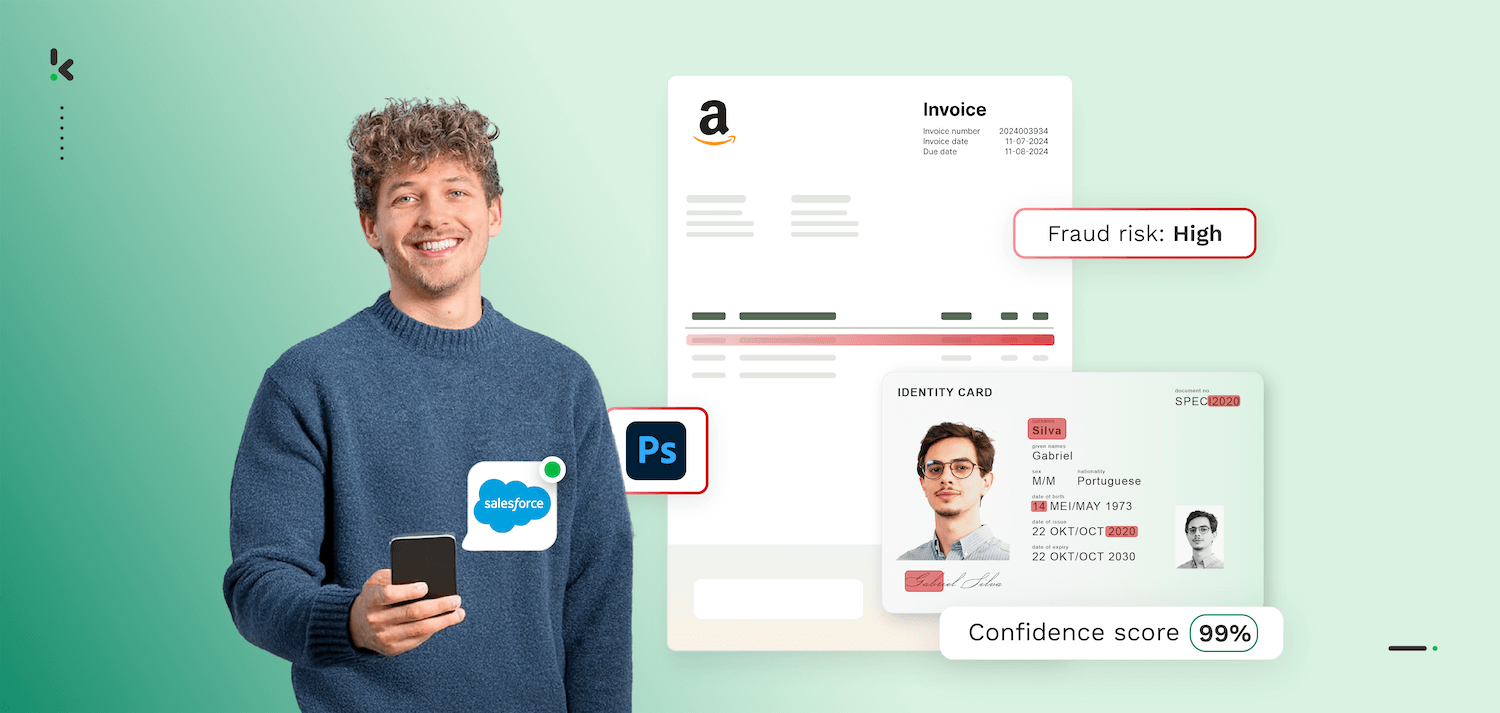

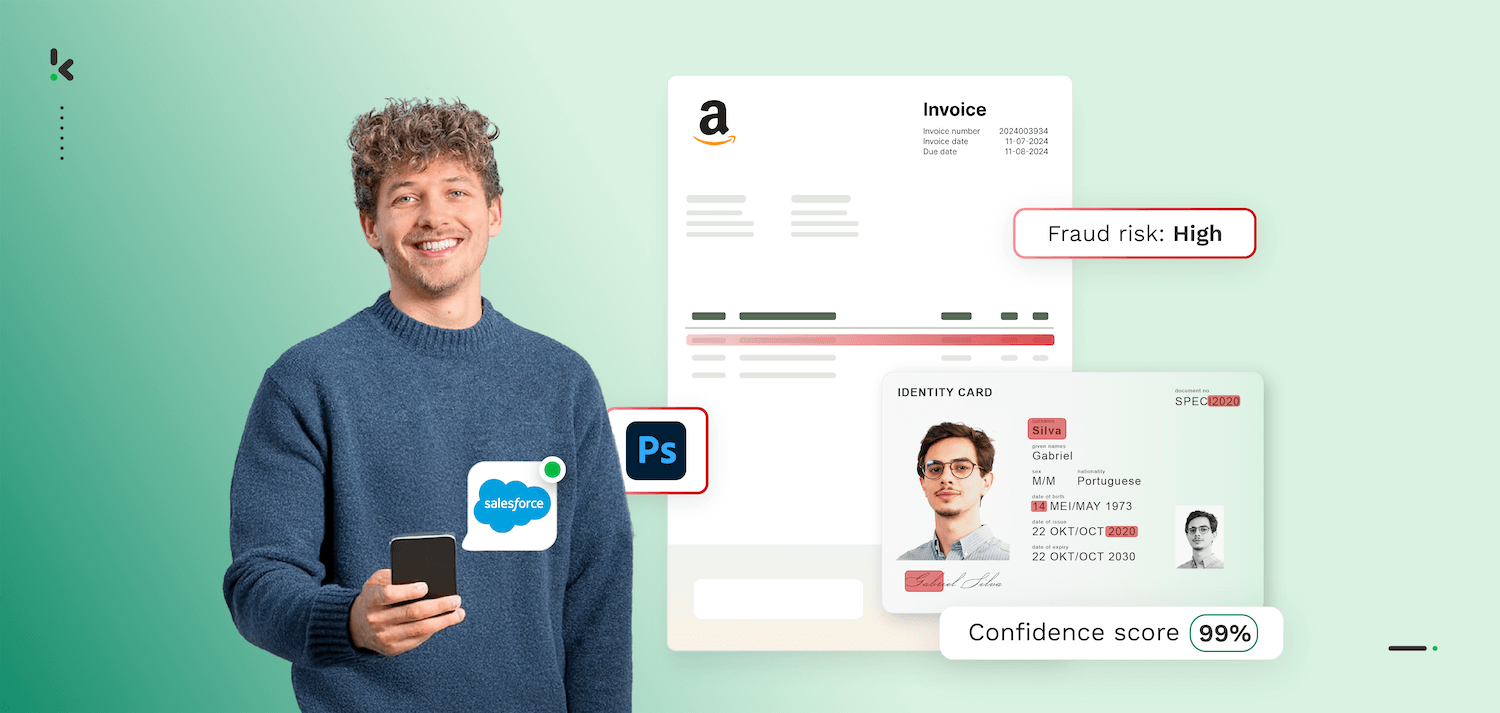

1. Klippa DocHorizon – Best Overall Fraud Detection Platform

Klippa DocHorizon is a leading Intelligent Document Processing (IDP) platform designed to stop fraud before it enters your system.

Unlike traditional OCR, it goes beyond extraction by offering multi-layered fraud detection: Photoshop and copy-move detection, metadata analysis, EXIF checks, and duplicate recognition. It also supports compliance-driven workflows like KYC with built-in identity verification.

Highlights:

- Real-time document fraud detection with automated risk scoring

- Over 200 integrations with ERP, CRM, and accounting systems

- Built-in NFC scans, selfie checks, and liveness detection

- ISO 27001, SOC I & II certified, and GDPR-compliant

2. FraudDetectionSoftware

FraudDetectionSoftware is purpose-built to identify and prevent document fraud with speed and precision. It applies AI-powered fraud analysis to a wide range of file types, detecting manipulation techniques such as copy‑move editing, font anomalies, and metadata tampering.

Designed as a focused solution, it fits seamlessly into verification workflows like KYC, onboarding, and transaction processing. The platform combines high detection accuracy with straightforward integration, making it an accessible choice for companies that need targeted fraud prevention without the complexity of a large enterprise system.

Highlights:

- Real-time document fraud detection with instant risk scoring

- Metadata and EXIF analysis to uncover hidden edits

- Upcoming features: AI Fraud Agent, font anomaly detection, and fraud report export

- GDPR-compliant with ISO 27001-certified hosting

3. Inscribe

Inscribe is widely used in fintech and lending to detect fake files during onboarding. It analyzes tampering patterns, fraud signals, and user behavior across thousands of cases.

Highlights:

- Focus on synthetic identity detection

- Transparent risk scoring

- Strong API for fintech integration

4. ABBYY

ABBYY is best known for its enterprise-grade OCR but also offers metadata and image analysis for fraud detection. It’s often used to validate large volumes of extracted data.

Highlights:

- Detects visual edits and digital manipulation

- Metadata and digital fingerprint analysis

- Integrates with RPA and AI ecosystems

5. Resistant AI

Resistant AI specializes in analyzing fraud at scale, particularly in lending and crypto. Its pre-trained AI models can spot subtle, layered edits.

Highlights:

- Advanced PDF structure analysis

- Large fraud dataset training

- API-first design for scalability

6. IBM Security Trusteer

IBM Trusteer monitors fraud beyond documents, focusing on session behavior and device fingerprints. It’s ideal for enterprises managing high-risk digital transactions.

Highlights:

- Combines behavioral analytics with document checks

- Scales across millions of transactions

- Backed by IBM’s enterprise security

7. Experian CrossCore

Experian CrossCore integrates document fraud detection with credit and identity verification, enabling multi-layered decision-making.

Highlights:

- Real-time orchestration of fraud signals

- Seamless integration with Experian databases

- Trusted by lenders and insurers

How to Choose the Right Document Fraud Detection Tool

When evaluating solutions, consider:

- AI-driven analysis – Ensure the tool goes beyond rule-based checks

- Real-time detection – Fraud should be flagged instantly

- OCR + validation – High-accuracy extraction combined with cross-field checks

- Metadata and image forensics – Spotting hidden tampering is key

- Integrated identity verification – For KYC and onboarding flows

- Security certifications – Look for ISO 27001, GDPR, and SOC 2

- Ease of integration – APIs, SDKs, and connectors for your stack

- Explainability – Transparent fraud scores with clear reasoning

Why Klippa DocHorizon Leads the Fraud Detection Market in 2026

Klippa DocHorizon isn’t just another fraud detection tool. It is a fully AI-powered document processing platform designed to verify authenticity, detect manipulation, and reduce risk in real-time.

Now part of Doxis, a recognized Leader in the Gartner® Magic Quadrant™ for Document Management, Klippa brings enterprise-grade document forensics and automation to industries where accuracy and compliance are critical — from finance and insurance to logistics, real estate, and HR.

Klippa DocHorizon offers a fully equipped Intelligent Document Processing platform that seamlessly integrates data extraction, image forensics, and compliance automation. With our solution, you can:

- Detect forged or altered documents instantly using AI-powered image forensics

- Perform EXIF and metadata analysis to uncover hidden manipulation and editing traces

- Run copy-move and grayscale analysis to reveal pixel-level tampering

- Cross-check documents and data with third-party databases via API

- Match invoices and purchase orders automatically to prevent invoice fraud

- Extract and validate data with 99% accuracy using AI-powered OCR

- Save up to 90% of manual processing time

- Ensure full data security with ISO 27001–certified servers and GDPR compliance

- Integrate effortlessly via API, SDK, SFTP, or 200+ prebuilt system connections

Whether you’re verifying KYC documents, processing invoices, or onboarding customers, Klippa DocHorizon helps you detect fraud before it enters your system, in seconds, not hours.

Ready to see how AI-powered fraud detection can safeguard your workflows? Contact our experts or book a free demo below to experience Klippa DocHorizon in action.

FAQ

It’s a type of AI-powered solution that analyzes files for tampering, inconsistencies, and anomalies. It goes beyond visual checks to examine metadata, file origins, and image manipulation.

For businesses looking for an all-in-one solution that combines OCR, AI-powered fraud analysis, and identity verification, Klippa DocHorizon stands out as the most complete option in 2026. It detects tampered or forged documents in real time using techniques like EXIF analysis, copy-move detection, and risk scoring.

Manual review is slow, error-prone, and not scalable. Fraudsters use sophisticated tools that can bypass the human eye, making AI-powered detection essential.

Banking, insurance, real estate, HR, government, and healthcare rely heavily on authentic documents and are frequent targets for fraud attempts.

AI models use image forensics to identify pixel-level edits, mismatched fonts, metadata discrepancies, and cloned regions that reveal hidden tampering.

Passports, ID cards, driver’s licenses, invoices, bank statements, utility bills, contracts, purchase orders, and insurance claims can all be processed.

Metadata reveals when and where a file was created, edited, or saved. Inconsistent timestamps or device signatures can indicate forgery.

Yes. Leading tools, like Klippa DocHorizon, offer APIs for integration with ERP, CRM, HR, and finance systems, enabling instant verification within existing workflows.

OCR extracts text from scanned or photographed documents, allowing the content to be cross-checked against trusted databases for inconsistencies.

Accuracy can exceed 95% with high-quality inputs. The level depends on the document type, resolution, and completeness of training data. For critical cases, adding a human-in-the-loop review helps achieve near-100% certainty.