For accounts payable teams, manual invoice handling is still one of the most time-consuming tasks in finance – I’ve seen it firsthand. It’s not just the hours spent typing data… every delay increases the risk of mistakes and slows down cash flow.

According to Gartner’s Finance Survey, organizations investing in automation technologies like OCR (Optical Character Recognition) have cut invoice processing time by up to 72% compared to manual methods.

If 2024 was the year OCR proved it works, 2026 is the year finance leaders make it standard. In this guide, I break down the top OCR solutions for invoice processing and accounts payable, and share what to look for when choosing the right tool.

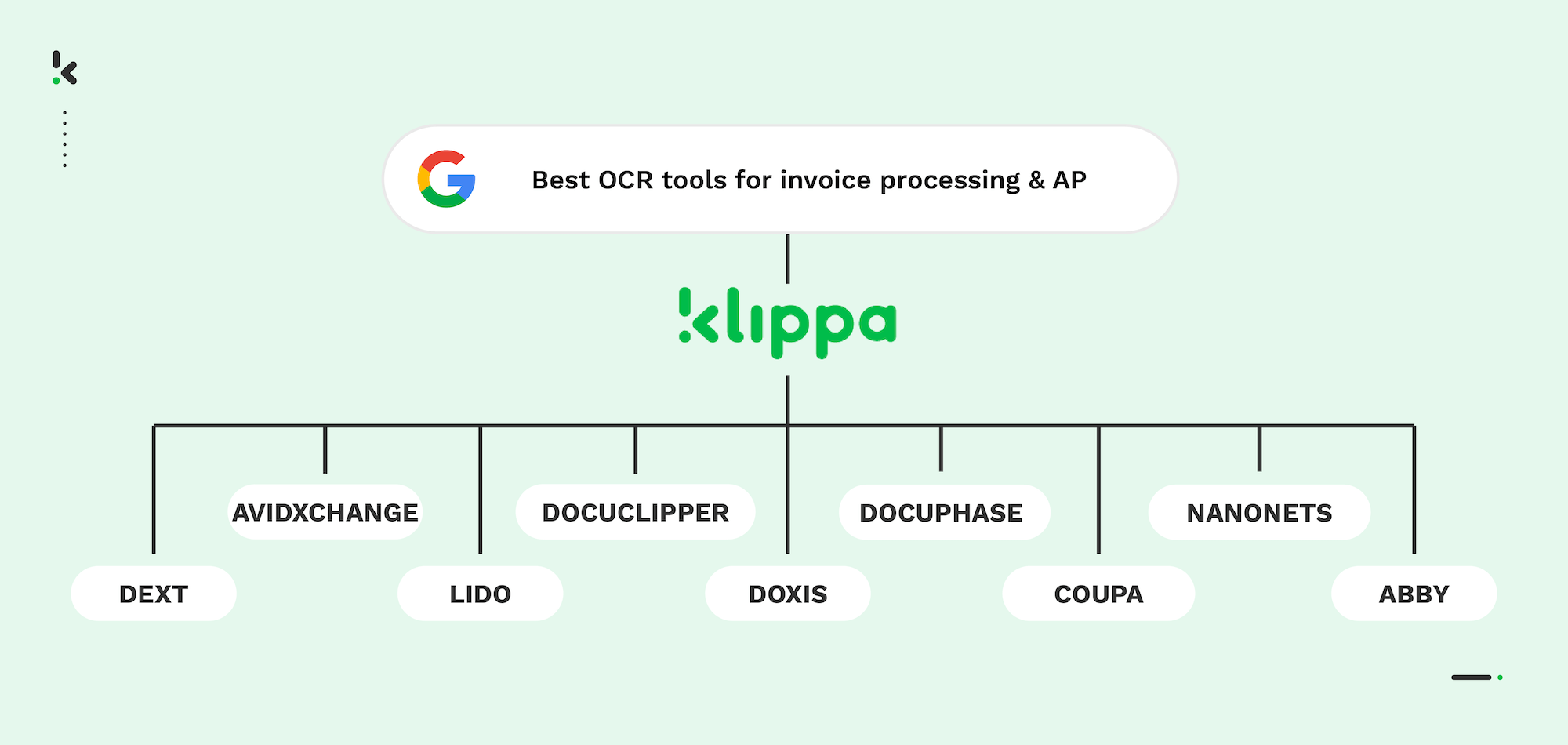

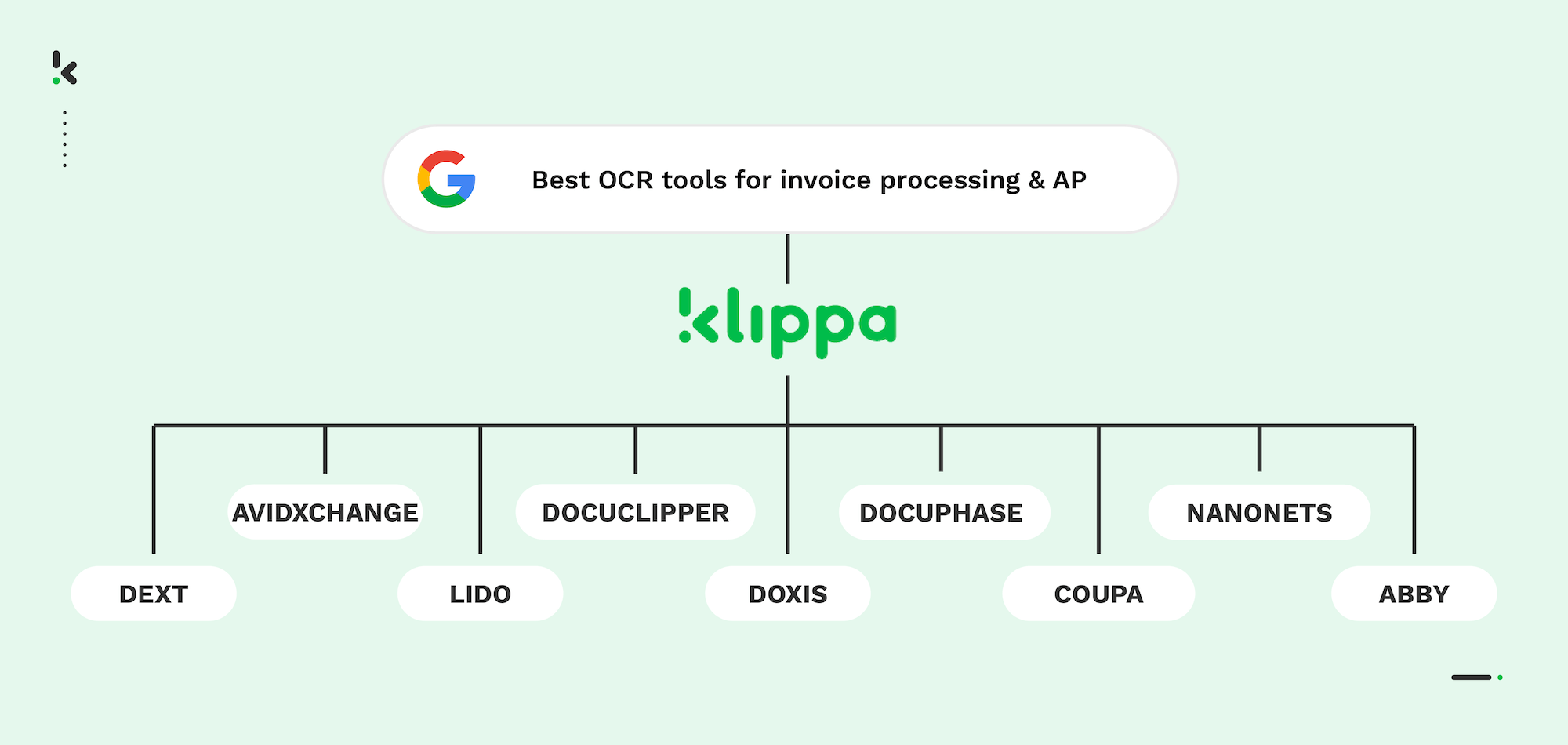

Key Takeaways – The Best Invoice OCR Tools in 2026

Here’s the shortlist before we dive deeper into the details:

- Klippa DocHorizon – All-in-one intelligent document processing with fraud detection, advanced AI, and multilingual support.

- Doxis – Enterprise-grade document management with strong OCR for complex workflows.

- Lido – Template-free, AI-powered OCR built for finance & AP teams.

- Nanonets – Customizable deep learning OCR for high-volume, unstructured invoices.

- DocuClipper – Specialist in financial documents with direct export to accounting systems.

- ABBYY FlexiCapture – Multilingual, enterprise-ready capture and classification.

- Avidxchange – Full accounts payable automation suite with integrated OCR.

- Coupa – Procurement plus AP automation with embedded OCR capabilities.

- DocuPhase – OCR combined with workflow automation for complex approval chains.

- Dext Prepare – Mobile-friendly invoice, bill, and receipt capture.

What is OCR for Invoice Processing & Accounts Payable?

OCR for invoice processing and AP, also known as invoice OCR, uses technology to automatically read printed or scanned invoice text and convert it into structured, machine-readable data for accounts payable workflows.

Modern OCR goes beyond simple text capture. The best tools use AI to locate specific fields like invoice number, dates, totals, line items, and vendor details, then validate that data before integrating it into your ERP or finance system. This reduces repetitive data entry, improves accuracy, and speeds approvals.

Top OCR Tools for Invoice Processing & AP in 2026

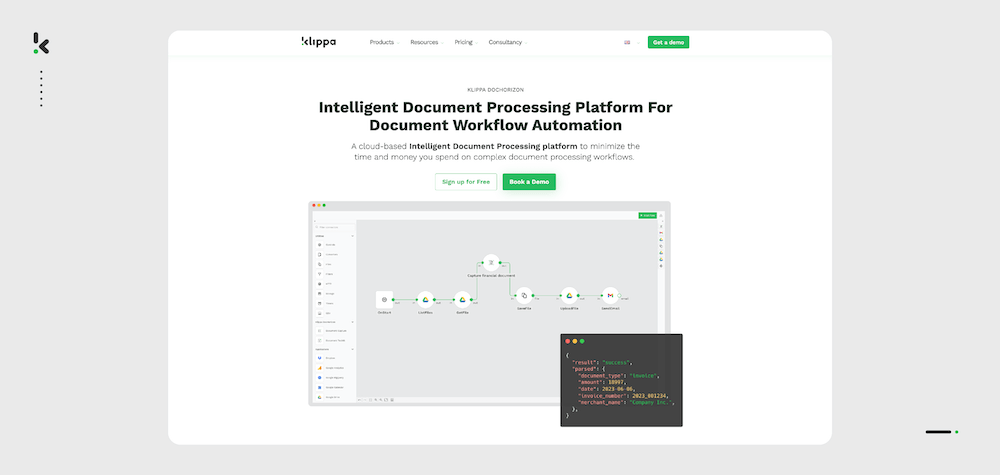

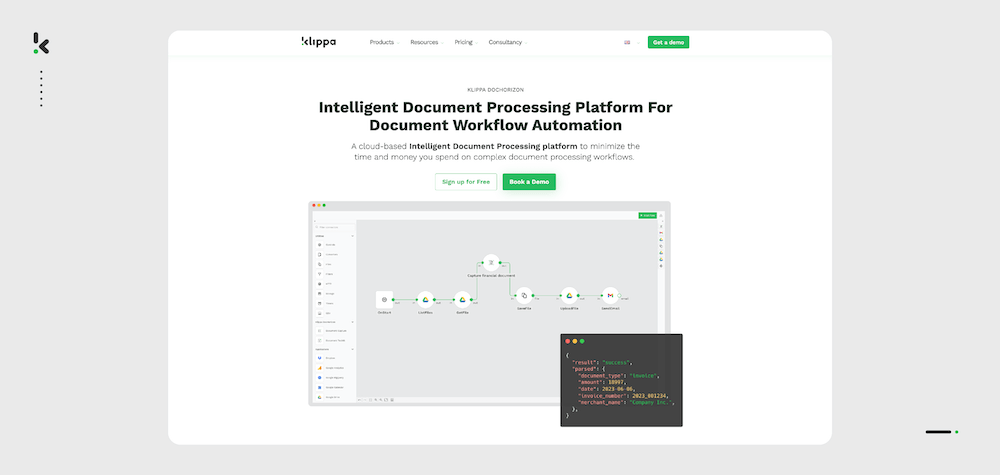

1. Klippa DocHorizon

Klippa DocHorizon is a no-code intelligent document processing (IDP) platform designed to automate document workflows at scale. It uses AI-powered OCR to extract structured data from invoices, receipts, contracts, and other financial documents, enabling faster processing and reduced manual input.

The platform supports multilingual data extraction, integrates with over 50 business applications, and includes fraud detection to help identify duplicate or manipulated invoices.

Key Features

- 95%+ field-level accuracy

- Human-in-the-loop verification for critical checks

- Built-in fraud detection & duplicate invoice checks

- Multi-language OCR

- Integrates with 50+ business apps

Pros

- Consistent accuracy across complex layouts

- Built for compliance with ISO 27001, GDPR, HIPAA, and SOC standards

- Flexible workflows and integrations

Cons

- Setup may require initial workflow mapping

- Designed for teams handling high volumes

Best For: Enterprises and mid-sized organizations needing secure, scalable OCR integrated directly into AP systems. Suitable for organizations operating in regulated industries such as finance, logistics, and manufacturing.

2. Doxis

Doxis is more than an OCR; it’s a full document management and workflow automation suite designed for enterprises. What I like about Doxis is how its OCR capability sits inside a highly structured, compliant environment, perfect for industries where regulatory control is a priority.

It processes multilingual invoices, organizes them into a searchable archive, and ensures every approval step is logged for audit purposes. The integrations with SAP, Microsoft Dynamics, and other ERPs make it easy to pull OCR data directly into complex workflows.

Key Features

- Multilingual invoice OCR

- Document classification and archival

- Workflow automation with role-based approvals

- ERP integrations

- Strong compliance measures

Pros

- Ideal for regulated industries

- High customization flexibility

- Enterprise-grade support

Cons

- Larger learning curve for non-technical teams

- Built primarily for enterprise scale

Best For: Large organizations needing OCR within a broader, compliant document management system.

3. Lido

Lido is an AI-powered OCR solution designed specifically for finance and accounts payable teams. It processes invoices from various formats without requiring template setup, enabling faster onboarding and data capture.

The platform’s OCR engine can extract fields from diverse invoice layouts with high accuracy and supports shared inbox parsing to process invoices received via email automatically. Lido also offers export options to accounting and reporting tools such as Excel, Google Sheets, and QuickBooks.

Key Features

- 99%+ accuracy without templates

- Handles PDFs, images, and email attachments

- Exports to Excel, Google Sheets, QuickBooks

- Shared inbox automation

- Customizable extraction logic

Pros

- Extremely fast onboarding

- Works instantly with varied formats

Cons

- No mobile app

- Narrow focus on structured outputs

Best For: AP teams wanting speed and simplicity without sacrificing accuracy.

4. Nanonets

Nanonets blends OCR with deep learning for cases where invoice volumes are massive and layouts vary constantly. The ability to train custom models is a game-changer for companies dealing with international suppliers, as you can teach the system to handle your exact document structures.

It also auto-classifies documents, extracts line items, and provides audit trails, essential for compliance in finance and procurement processes.

Key Features

- AI-powered custom model training

- Document auto-classification

- Line item extraction with audit trails

- ERP, CRM, and Zapier integrations

- Multi-language support

Pros

- Scales well for high document volumes

- Highly customizable via API

Cons

- Requires technical skill for advanced features

- Starter plan more limited

Best For: Large enterprises processing varied invoice formats at scale.

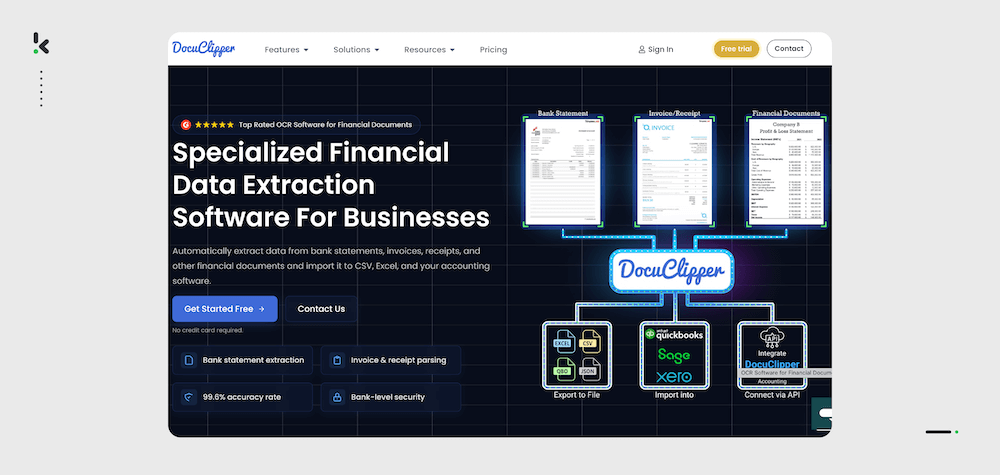

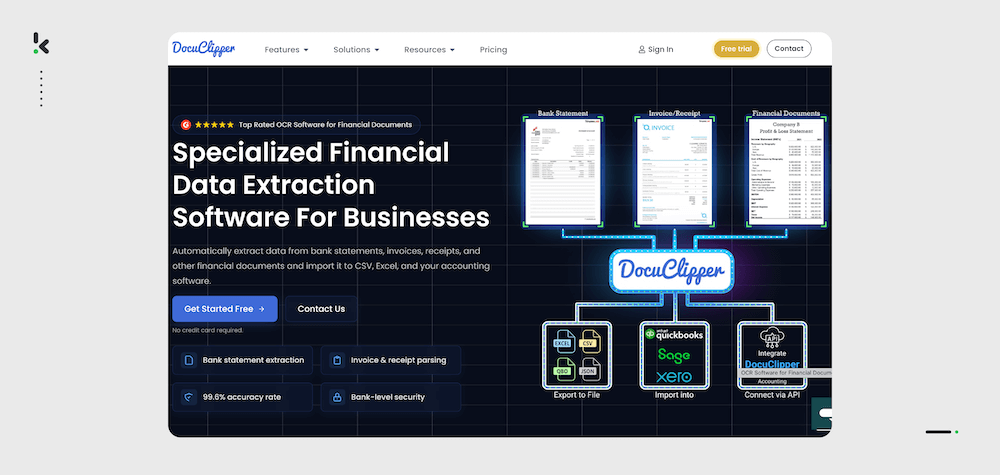

5. DocuClipper

DocuClipper is purpose-built for finance workflows, so it handles invoices, bank statements, and other financial documents without the need for heavy customization. The focus here is accuracy for numbers – totals, decimals, and table structures are captured cleanly, which is crucial for financial reports and reconciliations.

Bulk processing and QuickBooks integration make it straightforward for accountants and finance teams to slot it into daily operations.

Key Features

- Bulk processing for invoices/statements

- Direct export to accounting systems

- Custom extraction fields

- SOC 2 compliant

Pros

- Strong financial document specialization

- Easy accounting software integration

Cons

- Fewer features outside finance workflows

- Limited automation beyond capture

Best For: Accountants, finance teams, and AP needing perfect data capture for statements and invoices.

6. ABBYY FlexiCapture

ABBYY is a veteran in enterprise OCR, and FlexiCapture reflects years of refinement. It handles multiple languages, complex layouts, and integrates into high-volume capture environments.

For teams in global finance or logistics, multi-language OCR with advanced document classification is a critical edge.

Key Features

- High-accuracy field capture

- Document classification and routing

- Cloud/on-premise options

- Supports complex invoice designs

Pros

- Flexible deployment

- Strong multi-language capabilities

Cons

- Software can be expensive for users who don’t need the full feature set

- Longer configuration time

Best For: Enterprises processing invoices from multiple countries and formats.

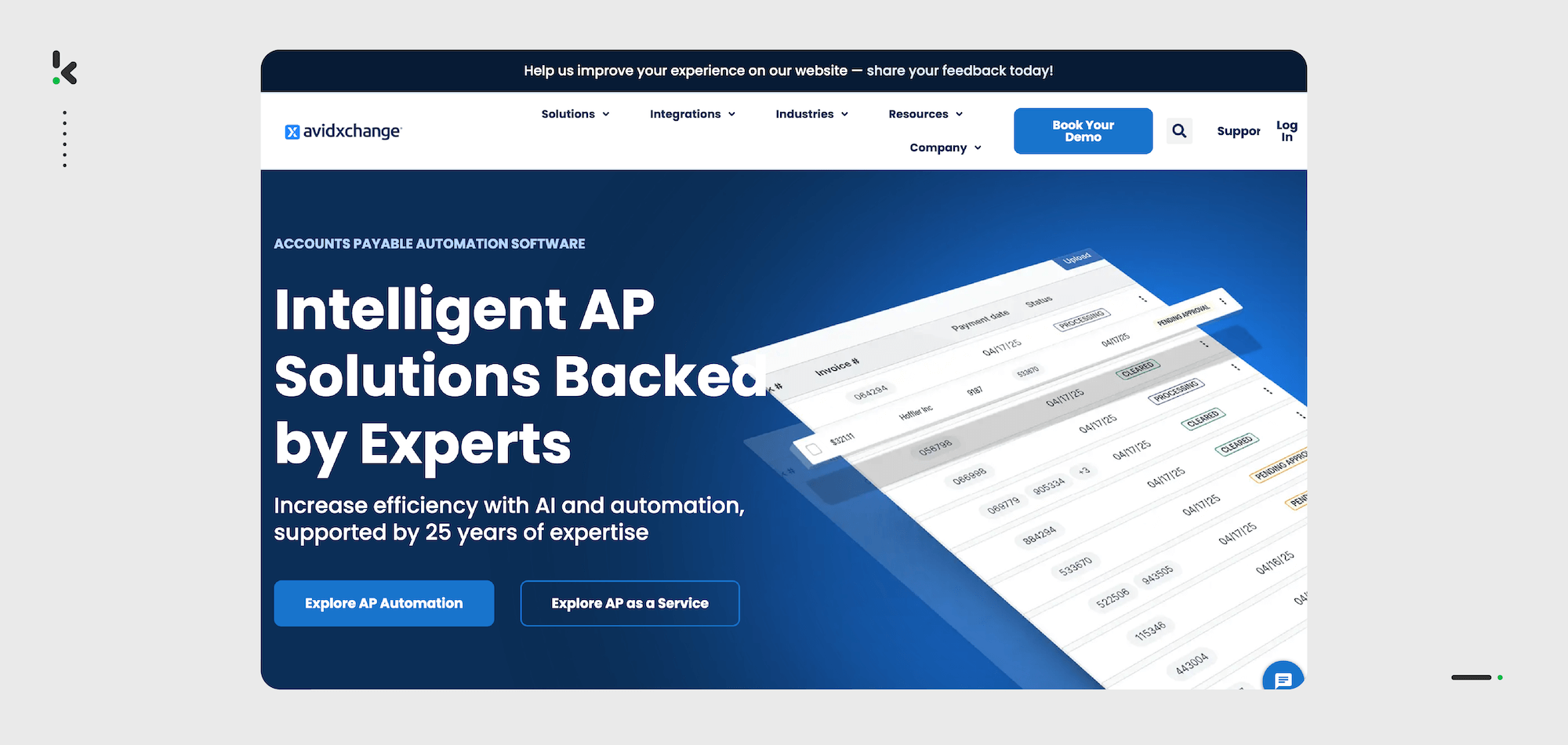

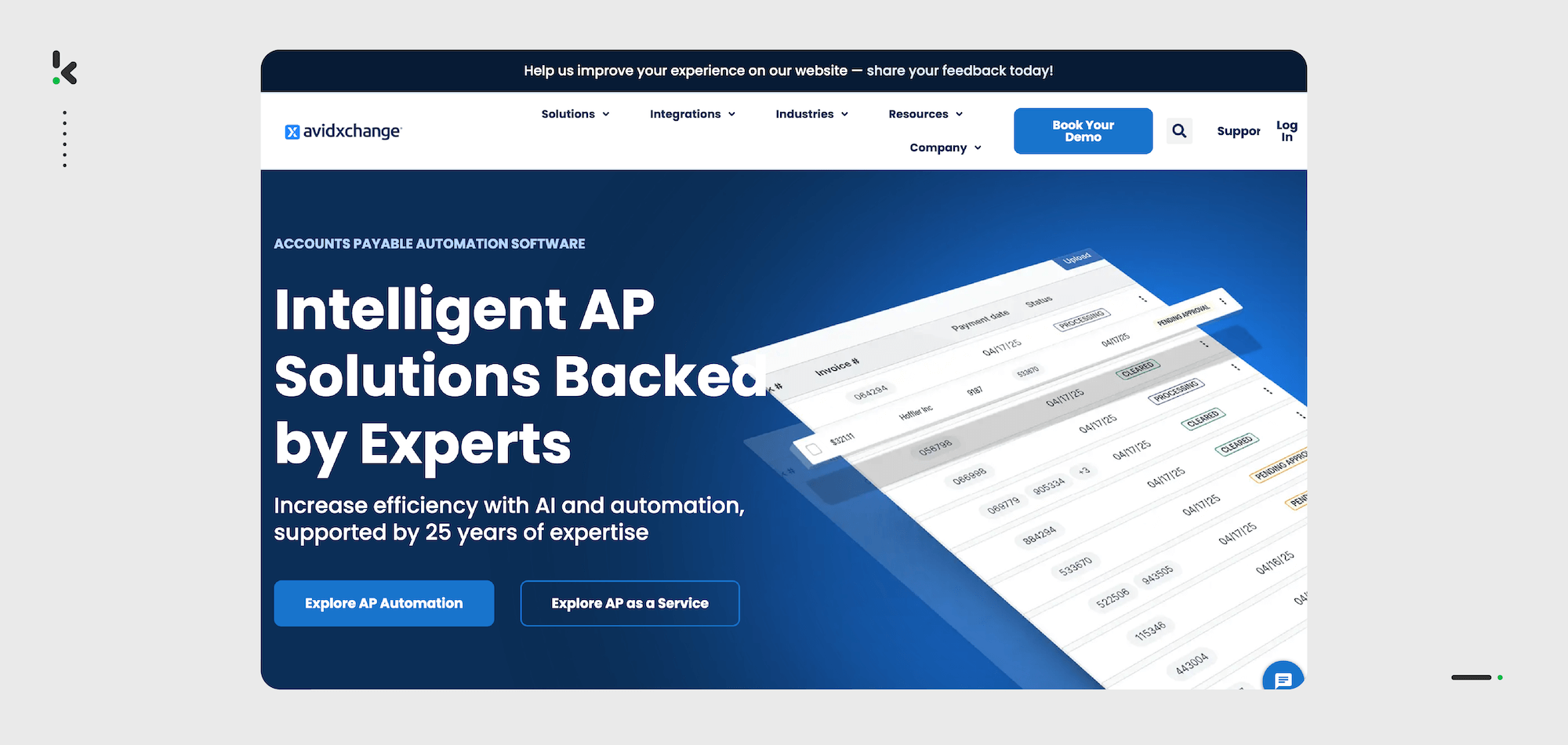

7. Avidxchange

Avidxchange is a full AP automation platform with OCR embedded into its workflow. The suite handles invoice capture, purchase order matching, fraud detection, and payment processing in one ecosystem.

It’s designed for enterprises that want the OCR function to feed directly into payment workflows without relying on separate software.

Key Features

- Embedded invoice OCR

- PO matching

- Fraud detection

- ERP integrations

Pros

- All-in-one AP automation

- Compliance-ready

Cons

- Only custom pricing

- Longer setup times

Best For: Enterprises that want a turnkey AP automation suite with OCR built in.

8. Coupa

Coupa takes a broader approach by mixing procurement, AP automation, and OCR in one platform. The advantage here is visibility – you can track spending from purchase order creation to invoice payment.

OCR invoice capture is part of a much bigger spend management system, ideal for businesses that want tight integration between procurement and AP.

Key Features

- OCR invoice capture

- Procurement workflows

- Spend analytics

- ERP integrations

Pros

- End-to-end visibility

- Cloud-native scalability

Cons

- Enterprise-focused complexity

- Pricing tailored to larger organizations

Best For: Businesses seeking unified procurement, AP, and OCR.

9. DocuPhase

DocuPhase’s OCR capability is tied to its strong workflow automation engine. This is helpful for companies with layered approvals and complex routing needs.

Invoices can trigger rules, route for approval, or feed directly into accounting systems.

Key Features

- OCR capture for invoices

- Custom workflow routing

- ERP integrations

- Real-time AP dashboards

Pros

- Highly flexible automation

- Designed for complex approvals

Cons

- Smaller OCR focus vs workflow features

- Pricing on request

Best For: Organizations embedding OCR in larger automation strategies.

10. Dext Prepare

Dext’s mobile-first approach makes it a favorite for teams on the go. Capturing invoices, receipts, or bills from a smartphone keeps AP workflows moving even outside the office.

It’s also strong in categorization, automatically sorting documents by vendor, expense type, or project.

Key Features

- Mobile OCR via camera upload

- Invoice categorization

- Integrations with thousands of apps

- Multi-vendor line item capture

Pros

- Highly mobile-friendly

- Good for expense organization

Cons

- Vendor match can be inconsistent

- Mixed support reviews

Best For: SMBs and tax professionals needing mobile capture.

Key Features to Consider in 2026

Choosing OCR software for invoice processing and accounts payable is not just about selecting the most popular product. The right choice depends on your document types, existing systems, compliance needs, and processing volume.

Below are the factors that I’ve found are most commonly evaluated by finance and AP teams across industries in 2026.

- Accuracy: High field-level accuracy reduces the need for manual correction. Look for solutions consistently reporting 95%+ accuracy and the ability to capture both header and line items reliably.

- Customization: Invoices vary by vendor, and formats often change. OCR tools that allow dynamic field mapping, custom extraction rules, or model training offer greater flexibility.

- Integrations: The OCR software should connect smoothly with your ERP, AP automation software, or accounting platform. Direct integrations and API support help eliminate duplicate data handling and speed up workflows.

- Speed & Scalability: Processing speed is critical during high-volume periods. Check whether the software can maintain performance under load and if it scales easily without impacting accuracy.

- Compliance & Security: Ensure the provider meets industry standards such as ISO 27001, SOC 2, and GDPR. Sensitive financial data must be encrypted in transit and at rest, and access controls should be role-based.

- Document Type Support: Verify the OCR can handle all your invoice sources – PDFs, scanned images, emails with attachments, and even photographed documents from mobile devices.

- Ease of Use: The platform should be straightforward for AP staff to operate without requiring constant IT support. A good interface can significantly cut training time and errors.

Why Klippa DocHorizon Stands Out Among the Best Invoice OCR Tools

When it comes to high‑volume, multi‑format document processing, Klippa DocHorizon stands out as a leading AI‑powered solution that blends speed, accuracy, and compliance into one seamless platform.

Unlike standard OCR tools, Klippa isn’t just about text conversion. It combines industry‑trained machine learning, real‑time data validation, and built‑in fraud detection to ensure the data you capture is not only fast but trusted. It’s capable of processing documents in dozens of languages across diverse layouts (from invoices and receipts to contracts and shipping records) without heavy configuration.

Now part of the Doxis, recognized as a Leader in the Gartner® Magic Quadrant™ for Document Management, Klippa offers enterprise‑grade AI document automation backed by decades of expertise.

What sets Klippa apart?

- Accuracy above 99% across formats, layouts, and languages

- Fraud detection and rule‑based validations for financial workflows

- GDPR‑compliant data handling with masking and anonymization built in

- Seamless integration with ERP, DMS, and accounting systems

- Developer‑friendly REST API, SDKs, and intuitive no‑code options

- Scalable implementations — from start‑ups to global enterprises

If you want to see Klippa in action, request a live demo today and discover how to automate, validate, and accelerate your document workflows while reducing operational risk.

FAQ — OCR for Invoice Processing & AP

OCR automates the capture of invoice data, reducing manual entry, minimizing errors, and accelerating payment approval processes.

Yes. Most modern OCR tools capture detailed line items, including quantities, prices, and descriptions, in addition to header fields such as invoice number and date.

Top-performing solutions reach field-level accuracy between 95% and 99%, particularly when enhanced with AI-based extraction and document validation processes.

Commonly supported formats include PDFs, JPEGs, PNGs, TIFFs, and email attachments. Many also offer mobile capture for photos of paper invoices.

Processing times vary, but template-free AI OCR tools can process an invoice in seconds. Workflow-heavy enterprise platforms may take longer due to multiple validation steps.

Yes. Certain platforms, like Klippa DocHorizon, include duplicate detection, anomaly spotting, and document authenticity checks to flag suspicious or altered invoices.

Most leading solutions offer native connectors or APIs for ERP and accounting systems, enabling seamless transfer of extracted data.

OCR solutions scale across organization sizes. Many providers offer lighter versions or flexible pricing models for small to mid-sized businesses.