Managing bank statements can be a tedious task for financial teams everywhere, however, it remains an essential part of the task for finance teams, accountants, and businesses of all sizes. From reconciling accounts to tracking transactions, bank statement processing often requires significant time and effort.

But what if you could automate this process using AI? In this blog, we’ll explore how automating bank statement processing can streamline your approach to bank statement processing, improve financial operations, and free up valuable resources for more strategic tasks.

Key Takeaways

- Bank statement processing is critical but time-consuming – Manual reconciliation and data entry take hours and are prone to human error.

- OCR and AI can automate the entire process – With intelligent document processing, you can extract, convert, and organize bank statement data in minutes.

- High accuracy with pre-trained financial models – Klippa’s bank statement capture is trained on thousands of documents, ensuring reliable data extraction.

- Klippa DocHorizon offers a simple, step-by-step setup – From signing up to exporting results, everything is configurable in a few clicks, without any code needed.

What is Bank Statement OCR?

Bank Statement OCR (Optical Character Recognition) is a technology that automatically extracts data from bank statements, transforming scanned documents, PDFs, or images into structured, machine-readable formats.

Bank Statement OCR is a core component of automated bank statement processing, as it enables the seamless extraction of financial data without manual intervention. By converting bank statements into structured formats, this technology lays the foundation for fully automated workflows, where data can be instantly processed, categorized, and reconciled with other financial systems.

Now that we have a clear idea of what it is, let’s dive into the crux of this blog and explore how bank statement extraction software can streamline and simplify the process.

How to Automate Bank Statement Processing with Klippa DocHorizon

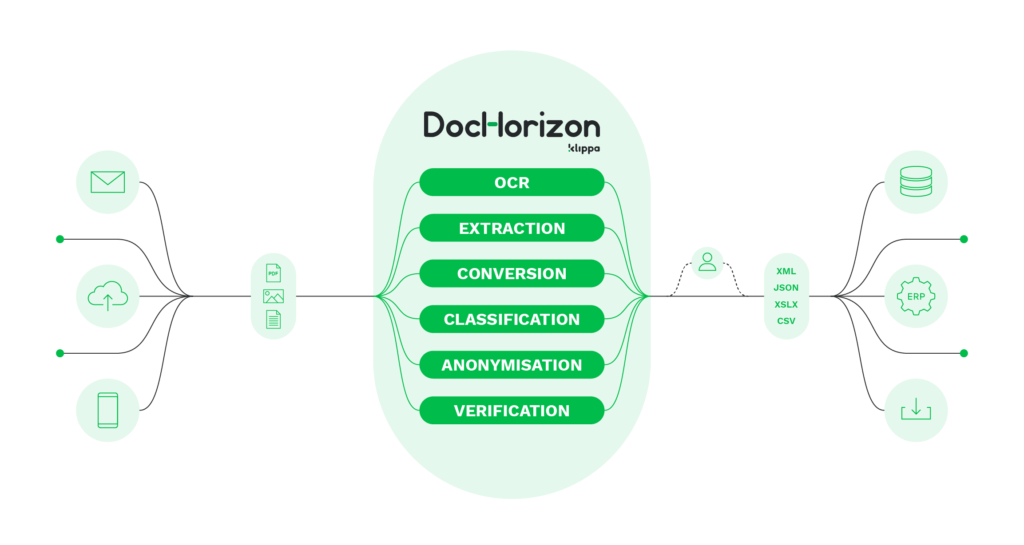

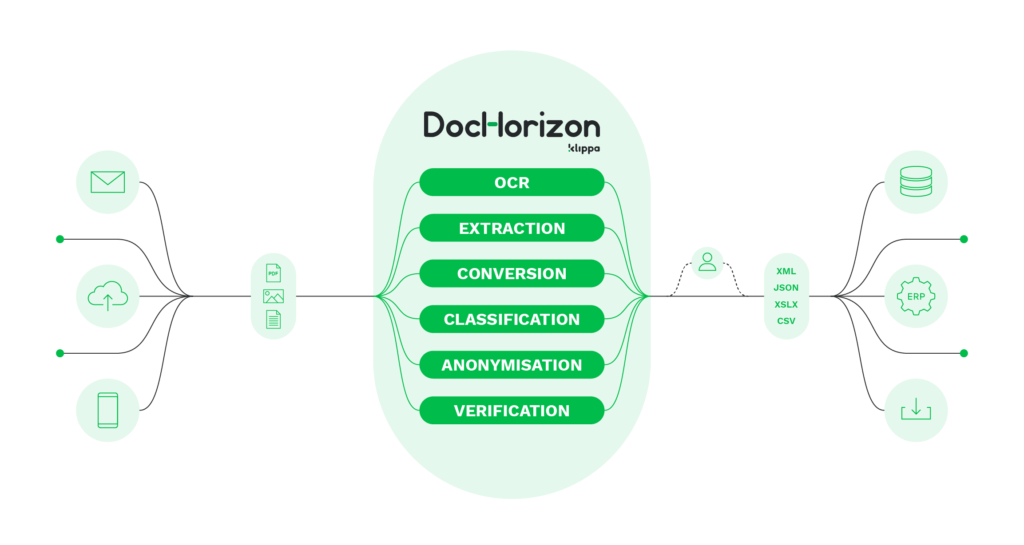

Klippa DocHorizon is an Intelligent Document Processing (IDP) platform that enables you to automate all kinds of document workflows, from bank statement verification to document digitization.

And the best part? You can try it out for free!

Let’s take you through the process step by step.

Step 1: Sign up on the platform

As a first step, you have to sign up for free on the DocHorizon Platform. Enter your email address, password, and other details to complete your registration. You will instantly receive a free credit of €25 to test all the platform’s capabilities.

Now, create an organization and set up a project so you can access the services. To automate bank statement processing, enable the Flow Builder and Document Capture: Bank Statement Model services. This setup ensures that you have all the necessary tools to begin your workflow.

Step 2: Create a preset

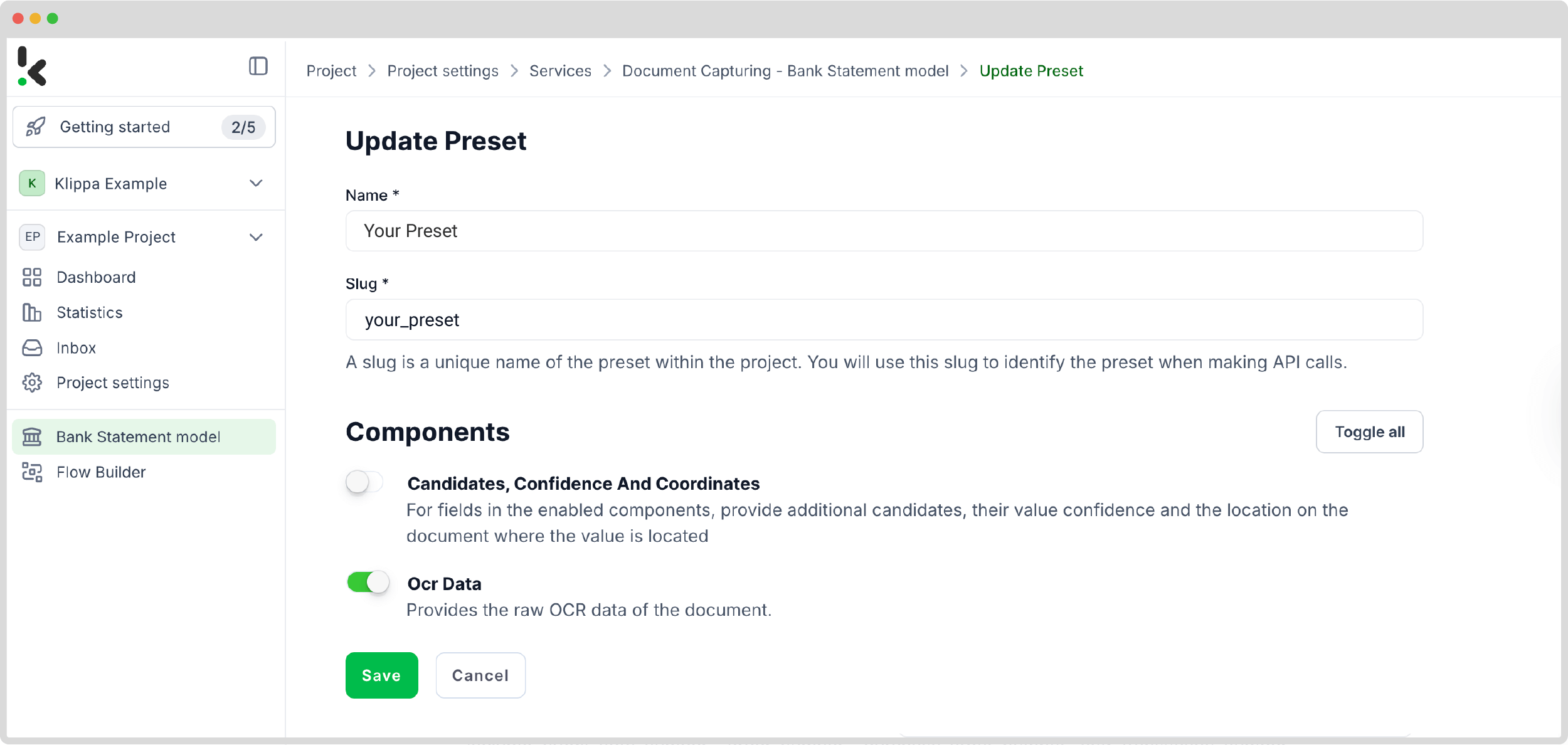

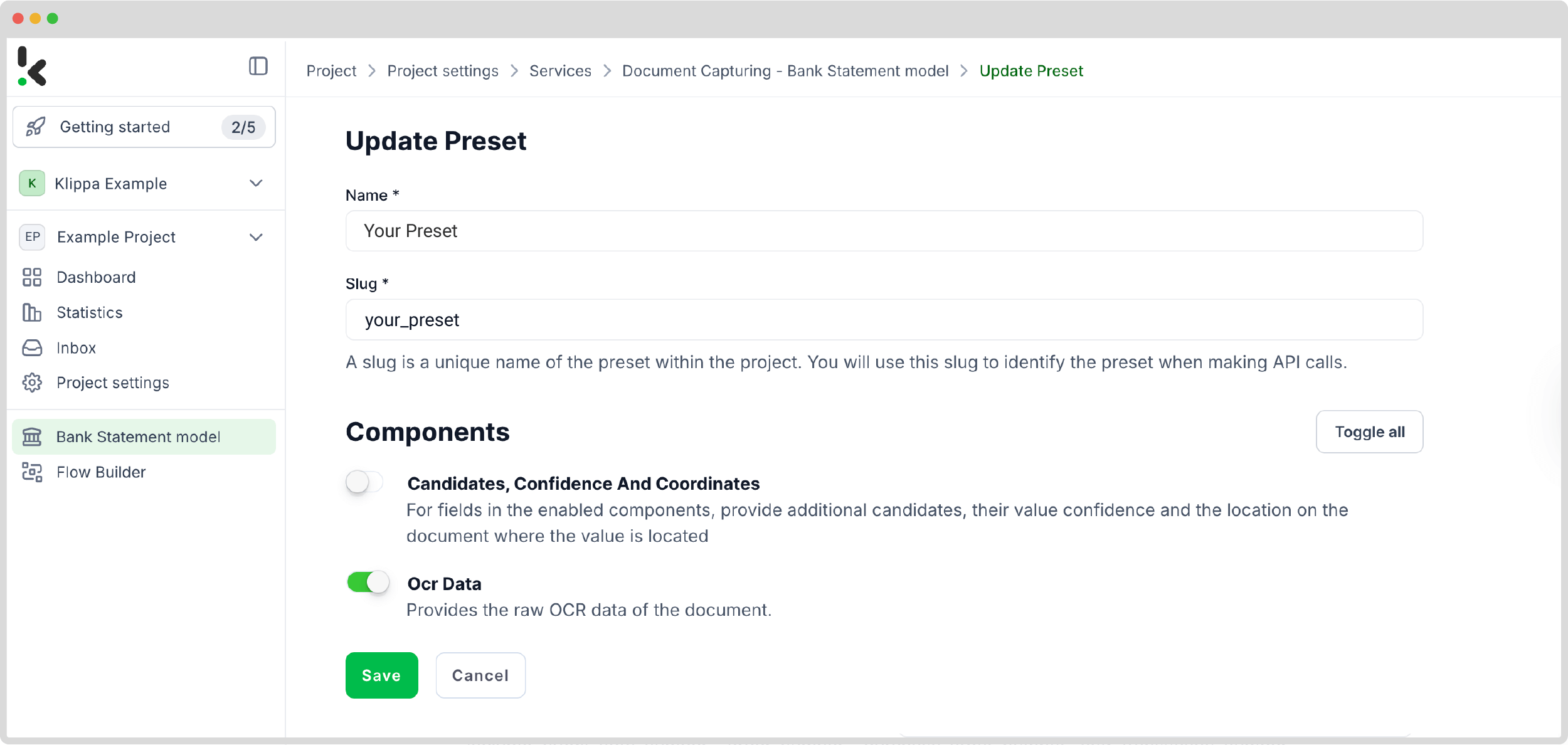

The next step is to set up a document-capturing preset. A preset is a custom configuration where you can specify which data fields should be extracted so that it meets your needs.

Setting up a preset is a breeze. Click on the Bank Statement Model on the left side of the screen. There, you can create a new preset and assign it a name. This preset will be the foundation of your workflow.

If you want something specific, you can further customize the preset depending on your use case by adding extra components like OCR data. Otherwise, the default option will work just as fine. Simply press Save, and it’s done!

Step 3: Select your input source

Let’s start building the flow, a sequence of steps that defines how your bank statements are processed. To do this, return to the services interface and select the Flow Builder. From there, create a new flow from scratch and assign it a name.

In this step, you grant the platform access to retrieve the bank statement for processing. If your documents are digitized and ready for retrieval, they can be processed in bulk if necessary. Let’s use Google Drive.

Before going forward, create a folder named Input in Google Drive and upload all bank statements there.

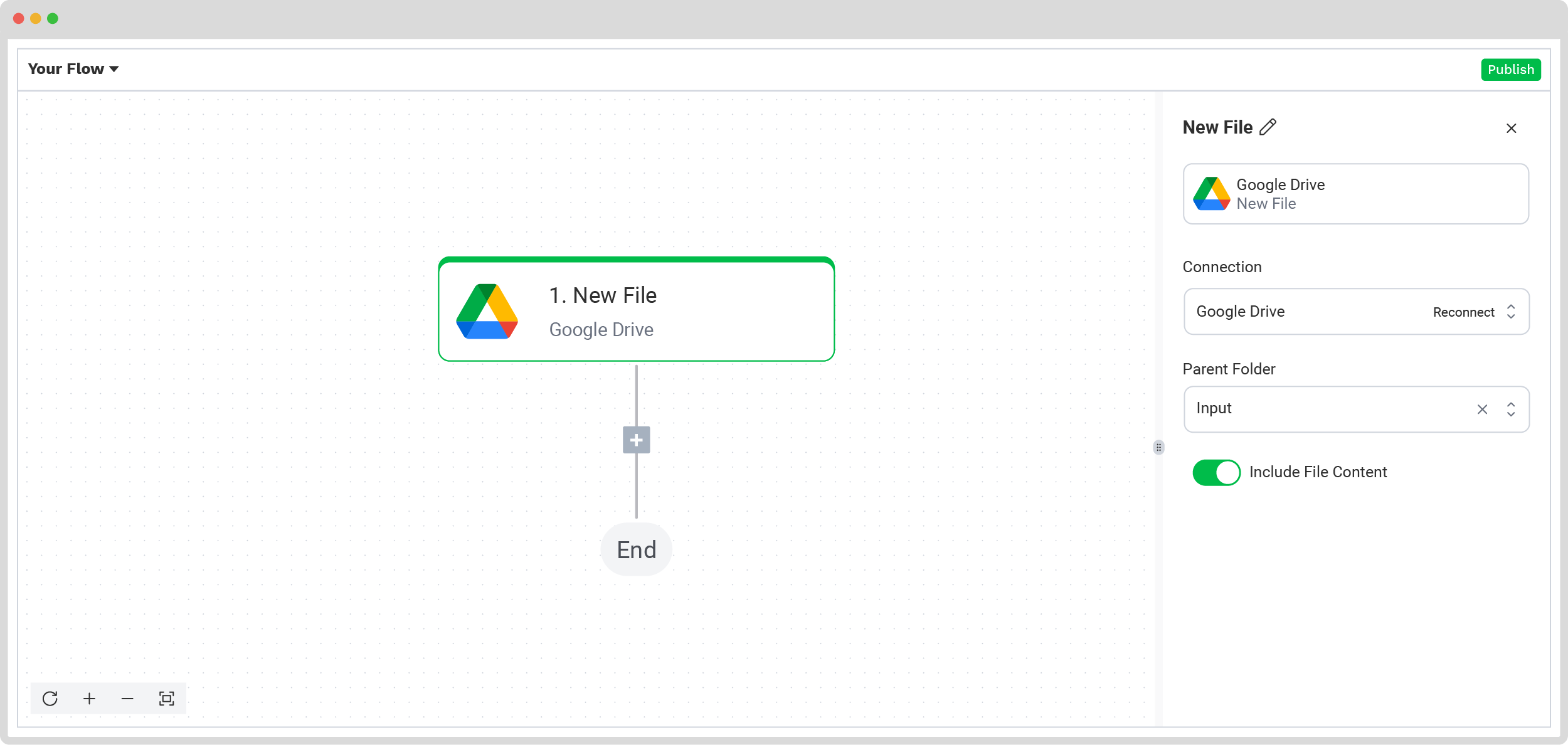

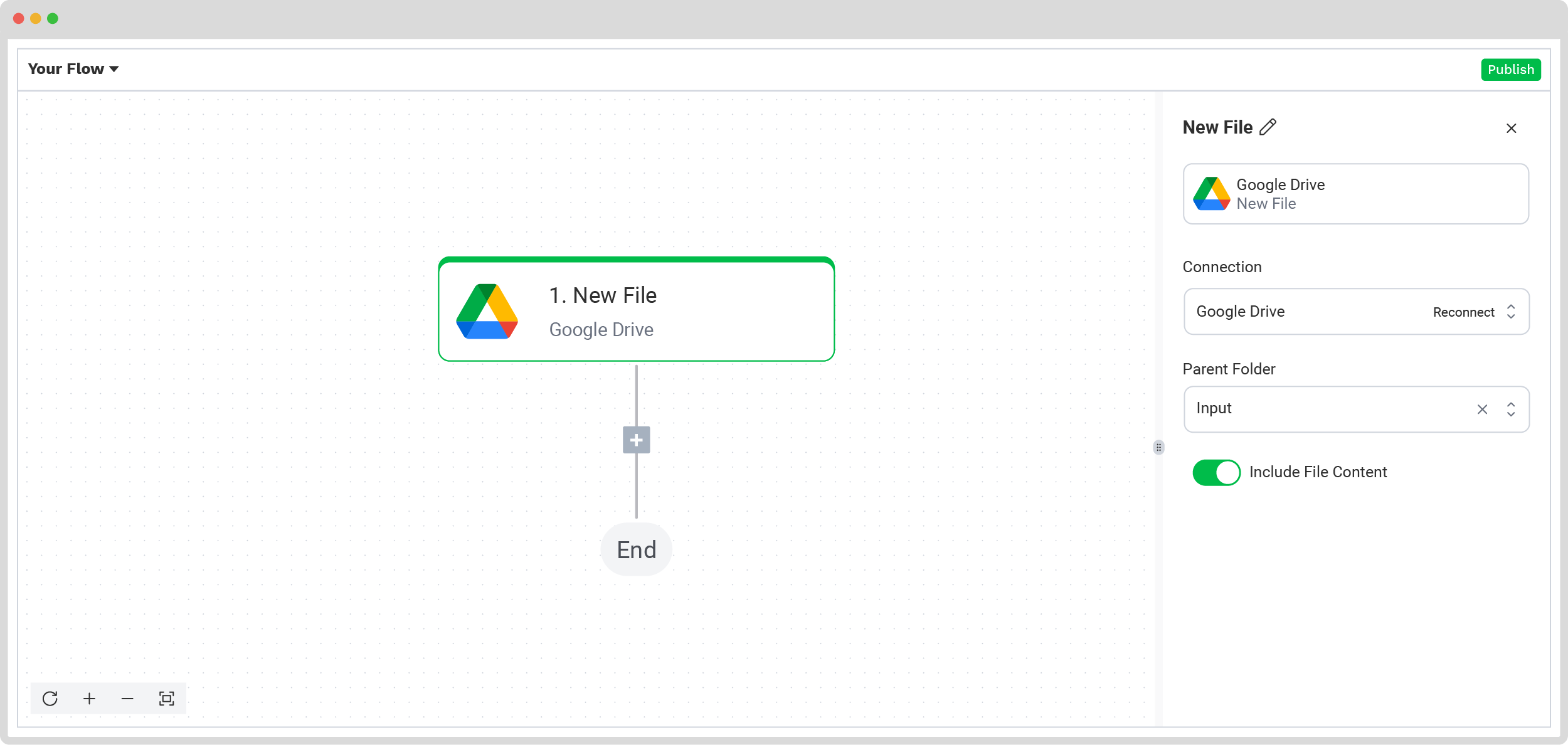

Next, choose your input source by selecting Google Drive -> New File as your trigger. This is going to start your flow. On the right side, fill out the following sections:

- For Connection: Connect your drive by authenticating with your Google account.

- For Parent Folder: Input

- Include File Content: Check this box to ensure file content is processed.

Test this and the following steps by clicking Load Sample Data. Remember to have at least one sample document in your input folder while setting up your flow!

Step 4: Capture and extract data

It’s time to use the preset, which will process all the selected data fields from the bank statements in the input folder.

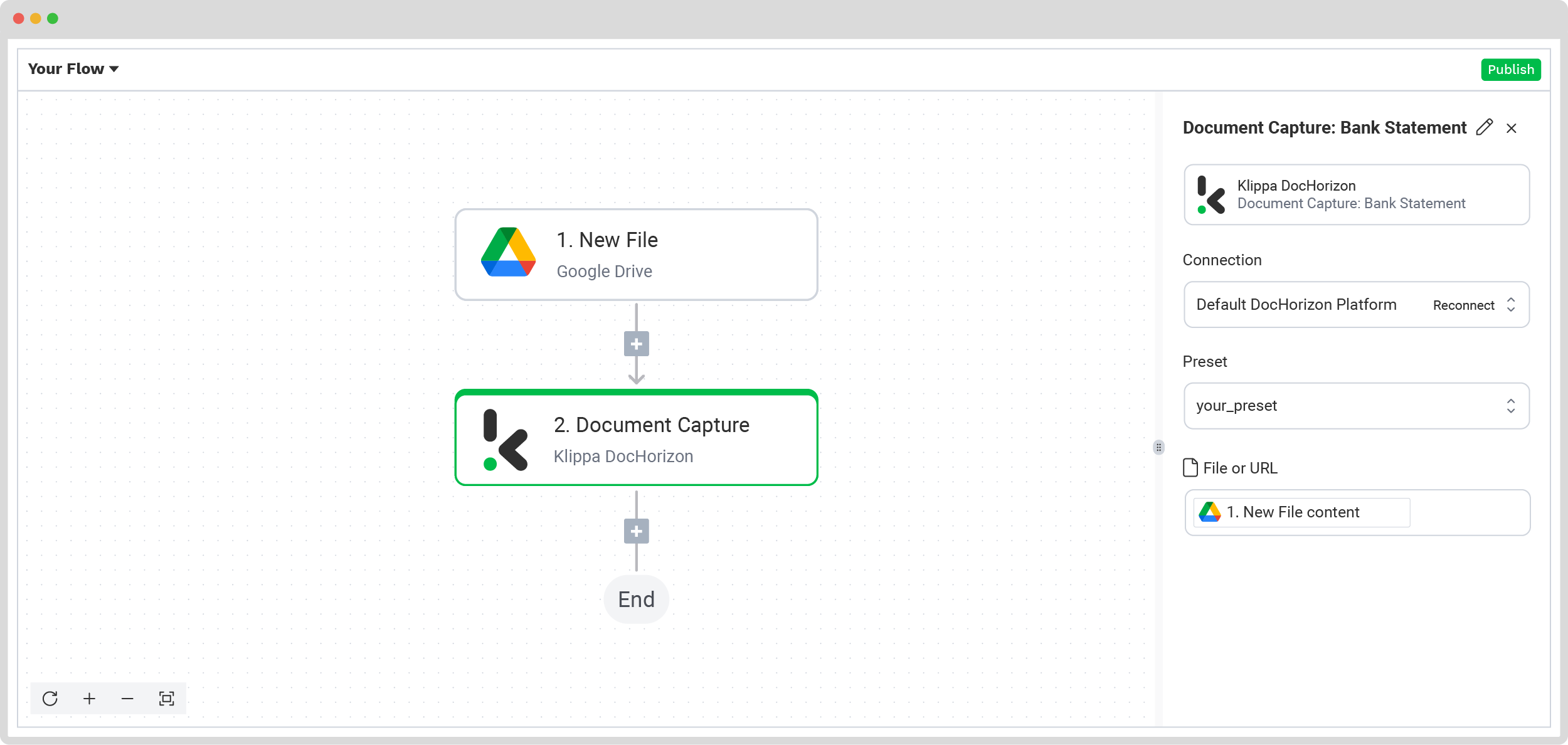

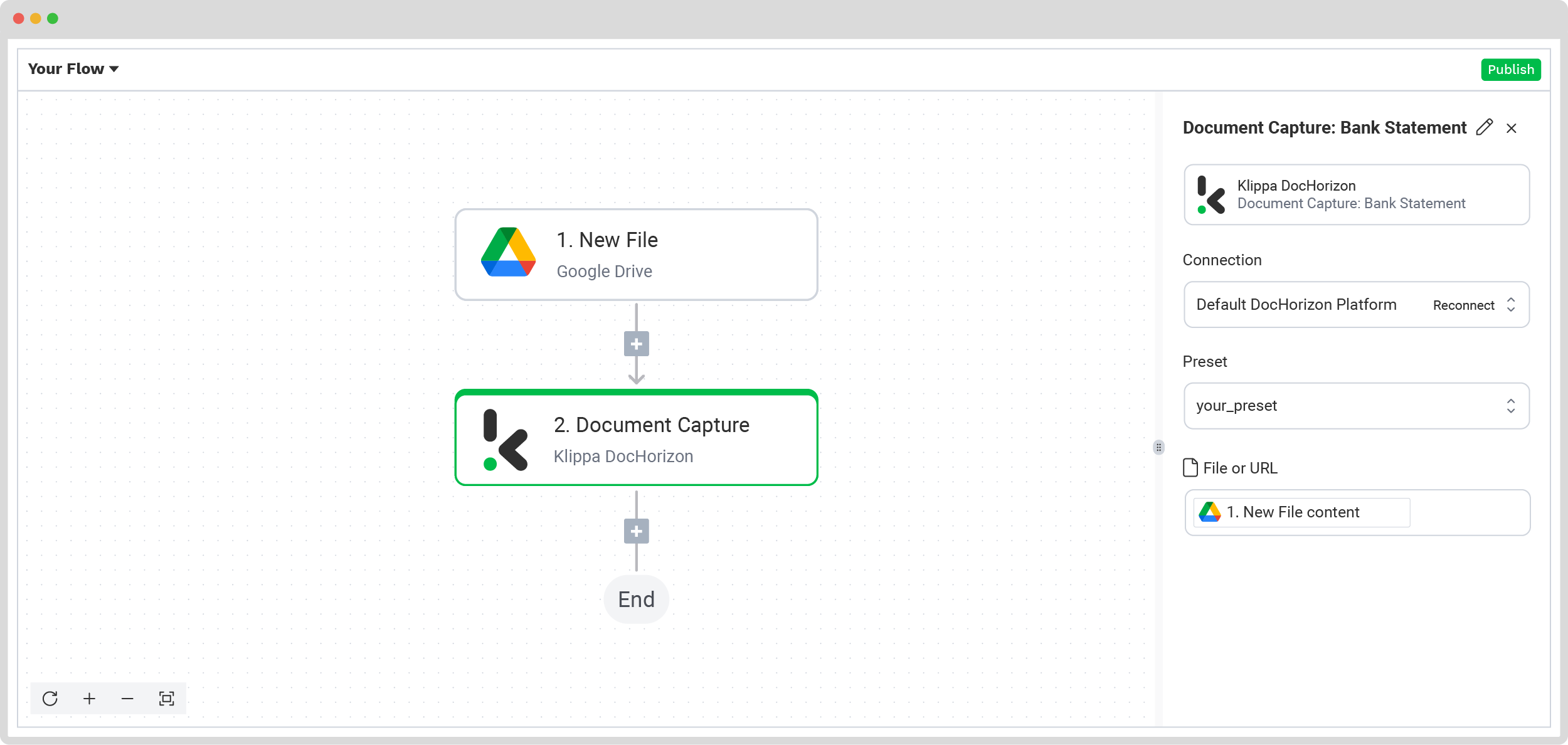

In the Flow Builder, press the + button and choose Document Capture: Bank Statement, and configure the following:

- For Connection: Default DocHorizon Platform

- For Preset: The name of your preset

- For File or URL: New file -> Content

Step 5: Save the file

At this point, all the credit card statements were successfully processed, and it’s time to decide where the result will be sent. In this case, you can create a new file in Google Drive through the platform.

To do this, press the + button, select Create new file -> Google Drive, and set up the following configurations:

- For Connection: google-drive

- For File Name: Document Capture: Bank Statement -> components -> bank -> name (string).

- For Text: Document Capture: Bank Statement -> components

- For Content Type: Text

- For Parent Folder: Output (the name of your output file)

The final step is to test the entire flow by clicking the Test Flow button to confirm everything is functioning as expected.

Congratulations! Your automated flow for processing bank statements is complete and ready for action.

And remember: if you’re processing a high volume of documents, you don’t have to set up the flow yourself! Feel free to reach out to us because we’d love to help you out!

You can also check out our detailed video tutorial below! It walks you through everything we’ve covered so far, making it easier to follow along.

Benefits of Automated Bank Statement Processing

Automating bank statement processing offers a host of advantages that go beyond just saving time. Leveraging AI and OCR technologies can transform the way businesses handle financial data, enhancing everything from accuracy to compliance.

Here are the key benefits of automated bank statement processing:

- Improved Data Accuracy: Manual data entry is prone to errors, especially when dealing with complex statements or high transaction volumes. AI-powered automation ensures that data is extracted and processed accurately, reducing the risk of mistakes that could lead to financial discrepancies, compliance issues, or customer dissatisfaction.

- Improved Time Management: Manually processing bank statements can take hours, if not days, especially for businesses with large transaction volumes. Automation can extract, categorize, and reconcile data within minutes, freeing up valuable time for finance teams to focus on more strategic tasks like financial analysis and forecasting.

- Cost Savings: Automating repetitive tasks such as data extraction and reconciliation can lead to significant cost savings by reducing the need for manual labor. Additionally, the improved accuracy of automated processes means fewer costly errors and less time spent on correcting mistakes.

- Scalability: As your business grows, so does the volume of financial transactions. Automating bank statement processing ensures that your financial operations can scale efficiently, without the need to hire additional staff.

- Enhanced Compliance: Staying compliant with financial regulations such as anti-money laundering (AML) and Know Your Customer (KYC) can be challenging. Automated bank statement processing helps ensure compliance by automatically extracting and analyzing transaction data, and flagging any anomalies or suspicious activities for further review.

- Increased Security: AI-powered systems come with enhanced security features that help protect sensitive financial data. Automated tools can be configured to ensure that only authorized personnel have access to bank statements, reducing the risk of data breaches or unauthorized use.

The benefits of automating your bank statement processing can be far-reaching and revolutionary for your business. In the next section, we will go over some of the most prominent use cases of automated bank statement processing.

5 Use Cases for Automated Bank Statement Processing

Here are five example use cases of how automated bank statement processing can be utilized and how it can benefit your business:

Source of funds verification

When verifying the legitimacy of funds for high-value transactions, financial institutions need to track the flow of money over time. Automated bank statement processing facilitates easy extraction of transaction histories, allowing for a quicker review of incoming and outgoing funds.

This helps compliance teams verify whether the source of funds is legitimate, reducing manual oversight and improving compliance with anti-money laundering (AML) regulations.

Know Your Customer (KYC) compliance

KYC processes require detailed financial documents to validate a customer’s identity and financial health.

With OCR technology, you can simplify this by automatically extracting and analyzing data from bank statements. Instead of manually sifting through statements to verify account ownership, transaction patterns, and risk factors, OCR can pull the necessary data in seconds.

Proof of income verification

For businesses like banks, insurance, or rental services, verifying an individual’s income is crucial to assess risk and eligibility.

Automated bank statement processing can automatically pull relevant details, such as salary deposits and recurring payments, to generate an accurate picture of an individual’s income.

Mortgage and Rental Applications

During mortgage or rental applications, verifying an applicant’s financial stability is crucial. OCR technology can automate the extraction of data such as monthly income, recurring expenses, and account balances from bank statements.

This streamlines the application process, enabling faster decision-making for property managers and mortgage lenders while ensuring all necessary financial details are considered.

Financial Auditing and Reporting

Organizations that conduct internal or external audits need to meticulously review financial statements. Automated bank statement processing reduces the time spent manually processing these documents by automatically extracting and categorizing transactions.

This ensures that auditors can quickly access the necessary financial information, identify discrepancies, and prepare detailed reports, leading to more efficient and accurate financial auditing.

Automate Your Bank Statement Processing with Klippa

With Klippa DocHorizon, you can automate all your financial document workflows. Our platform lets you customize your bank statement processing workflows using an intuitive drag-and-drop builder tailored to your needs. Plus, you can leverage our human-In-the-loop functionality for 100% data accuracy, ensuring you only process valid bank statements.

- Data extraction – Automatically extract data from your bank statements.

- Document conversion – Convert bank statements into many data formats, such as JSON, XLSX, CSV, TXT, XML, and many more.

- Data anonymization – Comply with privacy regulations by masking and anonymizing sensitive data, such as client names or financial information.

- Document verification – Automatically verify documents in numerous ways and detect document fraud effortlessly.

Ready to find out more about how our bank statement processing solution can benefit your business? Book a free demo below or contact our experts for any questions you might have!

FAQ

Bank statement OCR (Optical Character Recognition) is a technology that extracts data from scanned or digital bank statements and converts it into structured, machine-readable formats like JSON or CSV.

Yes, advanced OCR tools include pre-processing features like brightness correction and noise reduction to ensure accuracy even with poor-quality scans.

Yes, for workflows requiring maximum accuracy, Klippa offers human-in-the-loop (HITL) options to manually verify extracted data before final export.

Yes, when using GDPR-compliant and ISO-certified platforms like Klippa DocHorizon, automated processing keeps financial data secure and helps meet compliance standards like AML and KYC.