For many, business travel is an unavoidable part of their everyday professional life. 90.6% of corporate travel managers even believe that business travel is crucial to company growth.

Although a business trip is often perceived as something positive, it can bring many challenges. Besides all the organizational things, you need to document all travel expenses during the trip, and keep receipts to get reimbursed by your company. Are you familiar with this?

This stress of travel and expense management is history, as in this blog we provide you with two travel expense report templates and explain an alternative solution, the digital travel expense report, in more detail.

Travel expense report template

During a business trip, costs are usually generated, for which a travel expense template is required. Often costs arise for meals, overnight stays, travel, or additional business travel expenses.

A travel expense report is usually filled out by employees and the costs are then reimbursed by the employer. Are you a freelancer or self-employed? Then you can deduct the occurring costs from your tax and invoice them to the client.

In order to create a clear overview, we want to answer the questions about what a travel expense report is and why you should create a travel expense report in the first place.

What is a travel expense report?

A travel expense report, also called an expense report, provides an overview of all costs incurred in connection with a business trip.

These expenses must have been incurred outside the usual workplace. It is also important that the relevant receipts and other documents are available and attached to the travel expense claim.

Now that it is clear what a travel expense report is, let us move on to the question of who is allowed to draw up a travel expense report.

Who is permitted to prepare a travel expense report?

Are you not sure whether you are allowed to create a travel expense report? In principle, everyone is allowed to claim a travel expense report for their business trip.

It makes no difference whether you are employed, freelance or self-employed. It is only important that you can prove all travel expenses with receipts or other documents. Discuss this with your employer before the business trip so that you are aware of the framework of the travel expense claim.

But why should you create a travel expense report in the first place?

Why should you create a travel expense report?

You should prepare a travel expense report so that you can claim your travel expenses free of income tax. In addition, employers can then also deduct travel expenses for tax purposes.

To do this, you must be able to prove to the tax office that the trip was indeed a business trip. This proof is the travel expense report, in which you list the costs incurred during the business trip.

For this purpose, it is essential to keep receipts and attach them to the travel expense report.

What can be claimed as travel expenses?

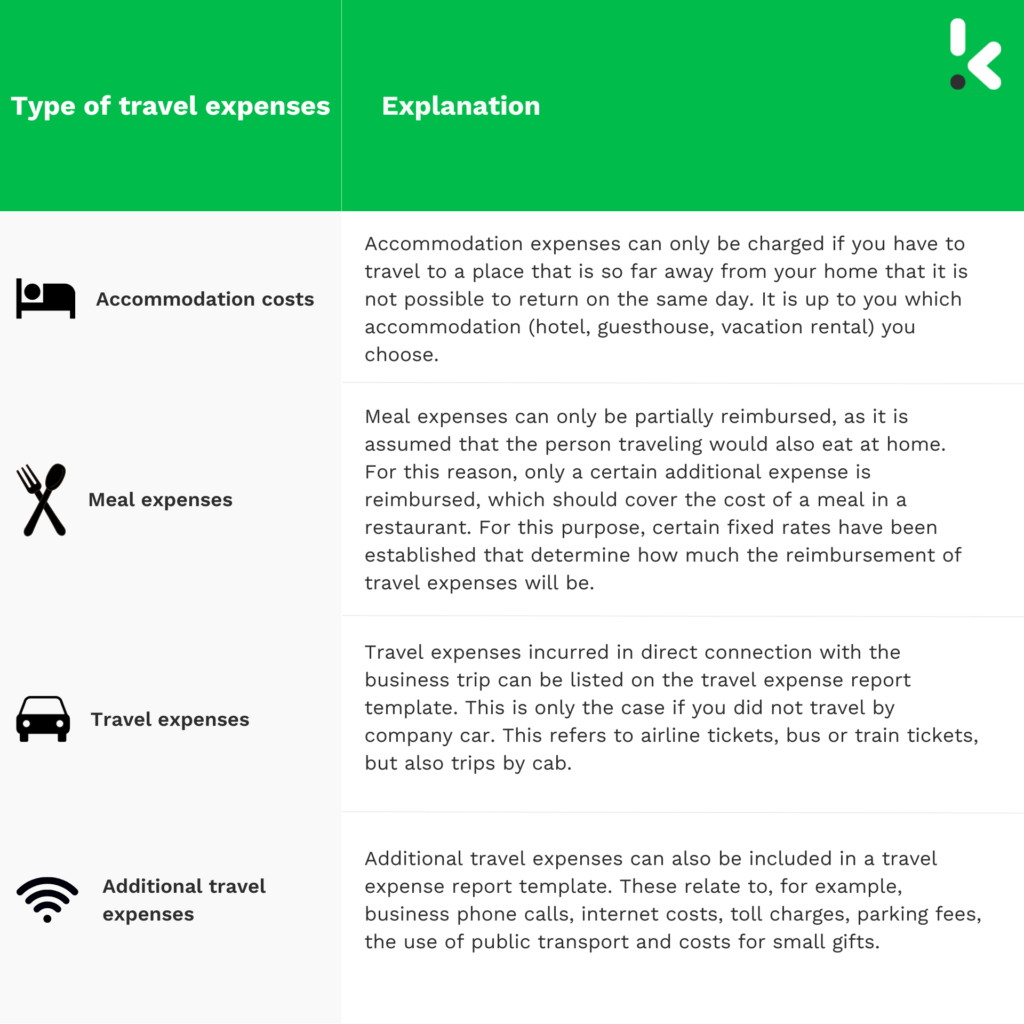

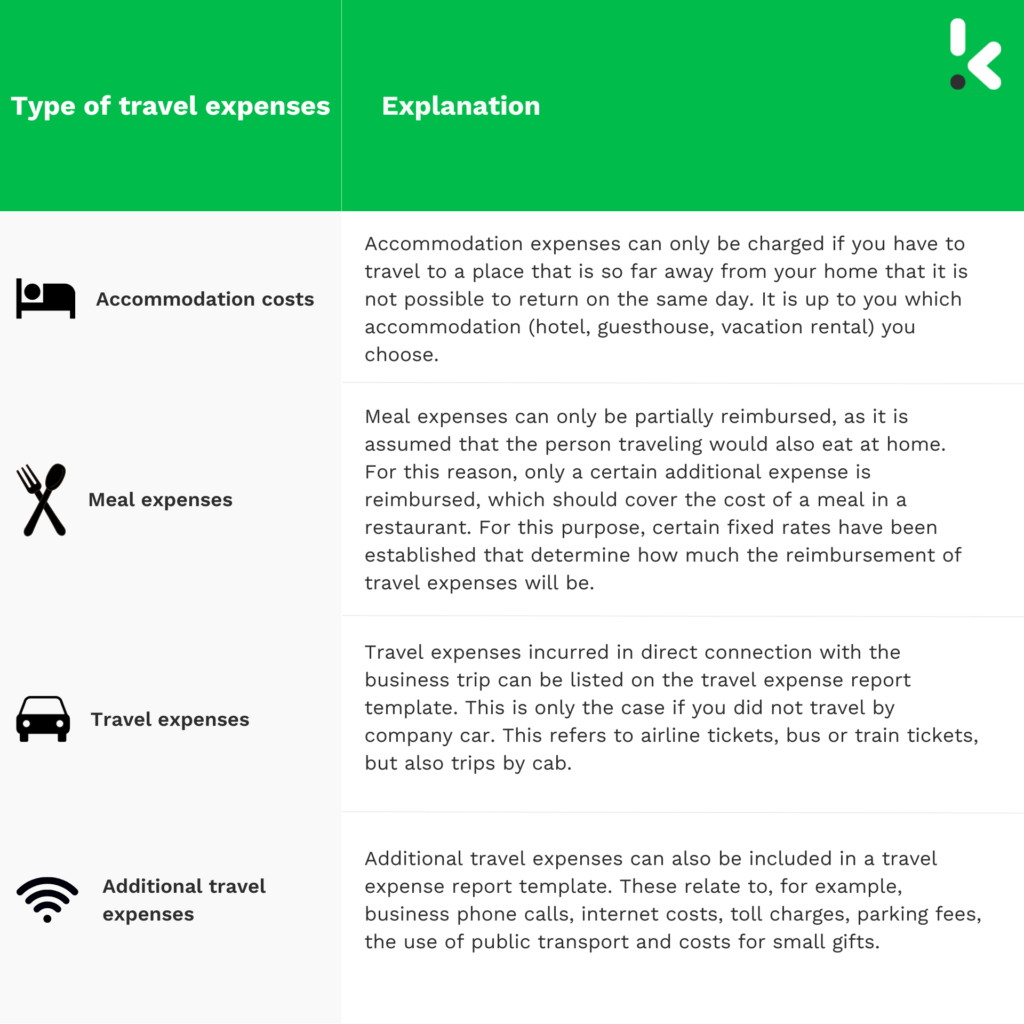

Next, we should discuss what you can claim as travel expenses so that you can fill in the travel expense claim template correctly. For this, we have created the following overview:

- Accommodation costs

- Meal expenses

- Traveling expenses

- Additional travel expenses

The following table describes the individual travel expenses in more detail and explains what may be charged as travel expenses.

Fixed meal allowance

There is one point we would like to go into more detail: the fixed meal allowance. The amount of the allowance for meals depends on the length of the business trip.

For a business trip of 8 hours or more, a different allowance applies than for a business trip of 24 hours or more. In addition, it depends on the country you are travelling to, as food and beverage prices vary from country to country.

Make sure to gather all necessary information before attending your travel.

However, it is also important to know what you are not allowed to include in your travel expense claim.

What can’t be claimed?

When claiming travel expenses, you should only claim necessary costs. For example, costs that you incur in the form of fines are not deductible. Think here, for example, of illegal driving, speed cameras, or parking tickets.

Massages, the minibar in the hotel, or PayTV also have no place on the travel expense claim template. If you travel with extra baggage that is not necessary for business purposes, you cannot expect a refund for this either.

Also, remember that tips are not included in the hospitality receipt. However, if you would like to include this in the expense report template, you should remember to request an extra receipt for it.

This brings us to our next point, in which we give a brief overview of the compulsory entries in the travel expense report.

Mandatory information for a travel expense report

When completing a travel expense report template, you should remember the following mandatory information:

- Name of the person who was on the business trip

- Duration of the business trip

- Dates of travel with exact time from beginning to end

- The destination (city & country)

- Purpose or reason for the business trip

- Date of settlement

- Signature of the traveler

As already mentioned, it is also mandatory to submit all receipts in order for the tax office to acknowledge the travel expense claim.

Sample Travel Expense Report

This is a sample travel expense report. Specific fields may vary depending on company policy. However, it should give you an overview of the information typically included in a travel expense report.

Employee Name: [Employee Name]

Department: [Department]

Business Trip: [City, Dates]

Purpose of Trip: [Purpose of Trip]

| Date | Description | Amount | VAT | Total |

| [Date 1] | [Description of expense 1] | [Amount 1] | [VAT 1] | [Total 1] |

| [Date 2] | [Description of expense 2] | [Amount 2] | [VAT 2] | [Total 2] |

| … | … | … | … | … |

| [Date n] | [Description of expense n] | [Amount n] | [VAT n] | [Total n] |

Total Expenses: [Total Expenses]

Employee Signature: [Employee Signature]

Date: [Date]

Approver: [Approver Signature]

Date: [Date]

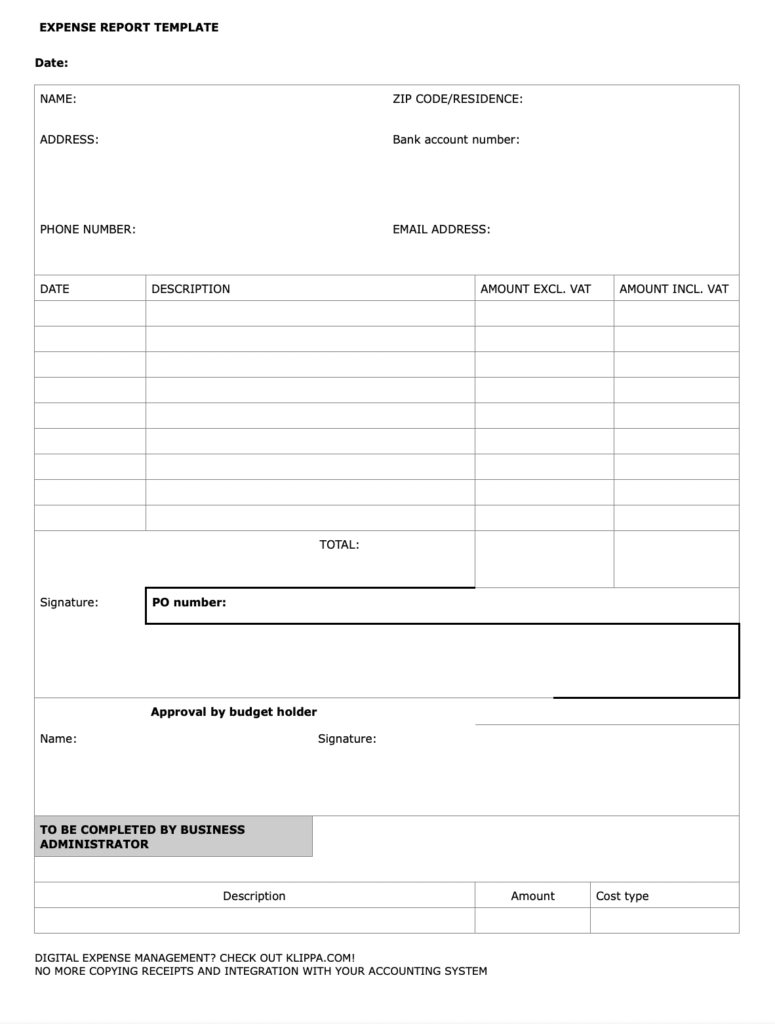

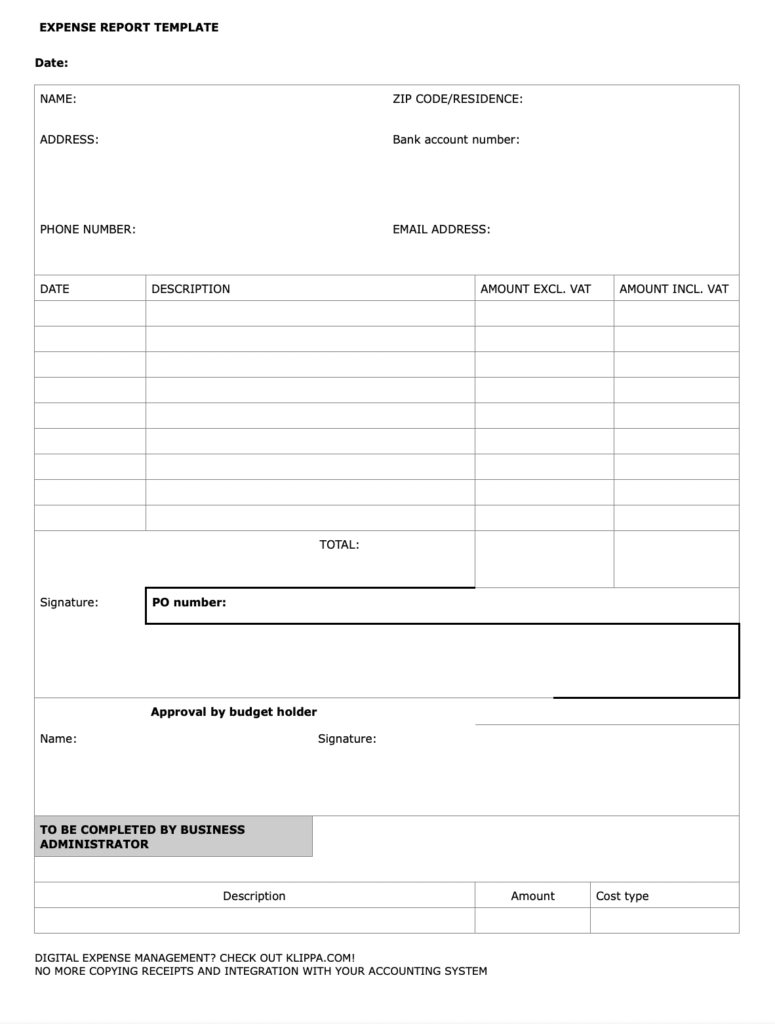

Travel Expense Report Template Word

In order to submit a travel expense report correctly, it can be helpful to have a template. Therefore, we would like to provide you with a travel expense report template as a Word version.

Here you will find the mandatory entry fields, as previously discussed, which you should fill in. Otherwise, the processing of travel expenses cannot take place properly.

The middle columns provide space to add purchased products or services. Next to this, you can note the date of purchase, a description of the cost, and an amount without VAT and with VAT.

Finally, the template provides space for total amounts and the employer’s signature.

Download your free travel expense report template here.

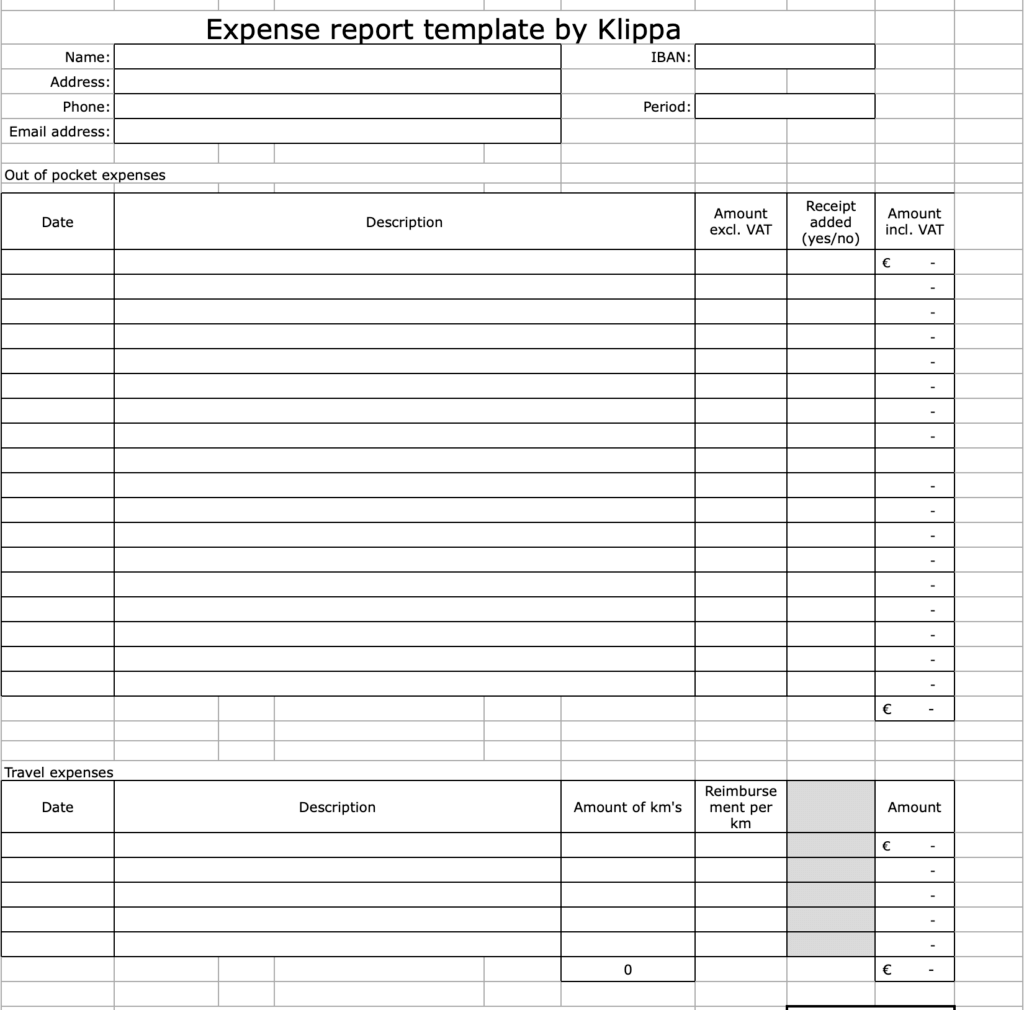

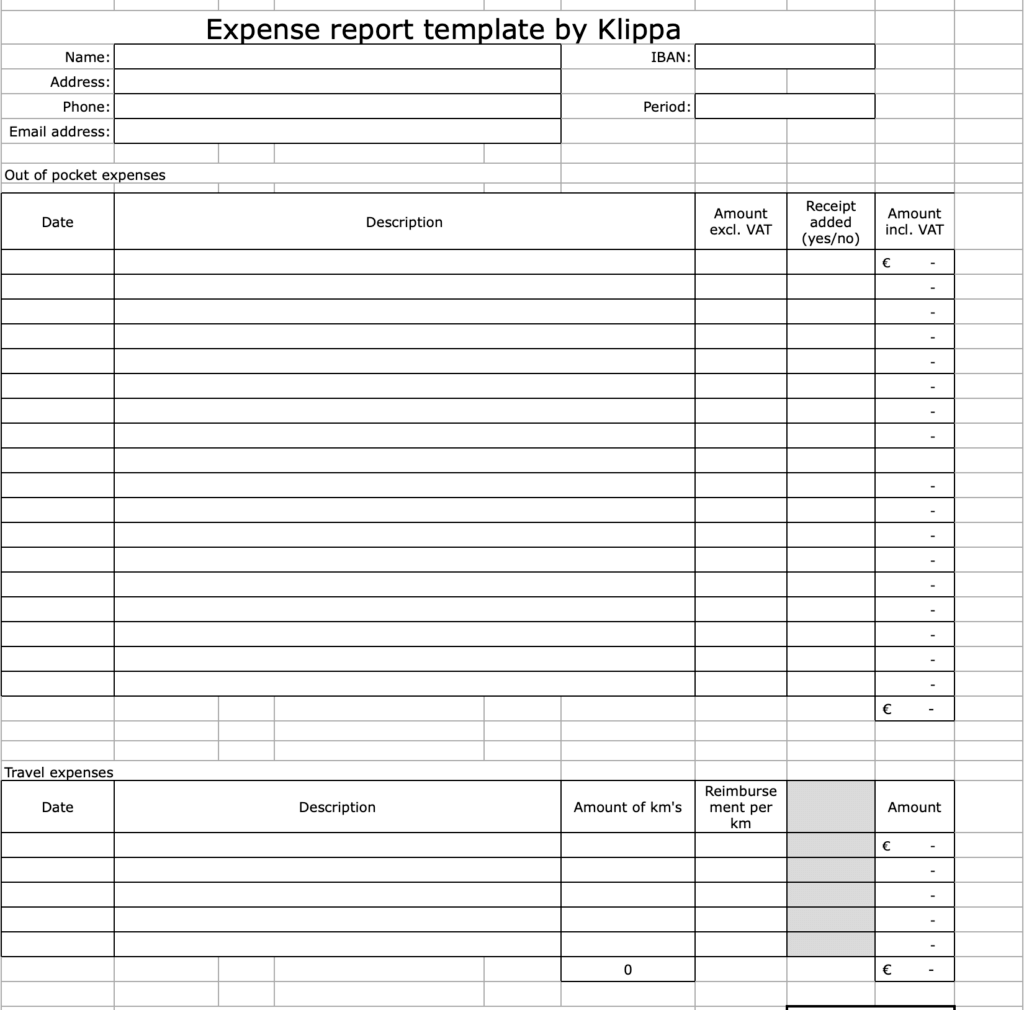

Travel Expense Report Template Excel

An alternative to the Word template is the travel expense spreadsheet template for Excel. Like the Word template, the Excel travel expense template also has mandatory fields.

First of all, you should enter your name, account number, settlement date, and email address at the top. In the next part, you have space for the description of the travel expenses, the amount without VAT, and the amount with VAT.

You can also indicate whether you are attaching a receipt. In the bottom field, you have the option of claiming a kilometer allowance and specifying the corresponding kilometer allowance.

The last columns are for the employer’s signature. Download your travel expense report template here:

Disadvantages of the manual travel expense report

Unfortunately, using a travel expense report template in Word or Excel also comes with disadvantages.

- Formatting difficulties → For some years, companies have preferred programs that run on the cloud. However, this can lead to using different variations of Excel or Word, which in turn can lead to formatting issues.

- No real-time updates → Changes made in the expense report template can only be seen when a person downloads the latest version of the Word or Excel document.

- Inefficient and lengthy process → Employees have to wait a long time for their compensation.

- Difficult to share documents → When using Excel, receipts and other documents have to be sent separately. That means important attachments can be lost easily.

- Long turnaround times → Manual travel expense reporting is slow and doesn’t allow for automatic calculation of travel expenses.

- High error rate → The high error rate is one of the most significant disadvantages. Often, data is entered incorrectly into the travel expense report template, or receipts are forgotten.

- Difficulties with the tax office → If the travel expense report template is filled in incorrectly or receipts are missing, travel expenses may not be reimbursed.

Travel expense guidelines

Every company should establish travel expense policies from the outset. These should be adapted to the company, but also be in line with generally known guidelines.

This defines, for example, which expenses are reimbursable and which are not. In addition, the travel expense policy should explain and determine the process of reimbursement.

The European Commission provides an overview of travel expense guidelines in Europe that state clearly, which travel expenses are compensated and which allowances apply.

Digital travel expense report

Are you completely fed up with manually filling in the travel expense report template? We have good news for you!

Instead of manually filling in the expense report template, you can simply choose one of the numerous digital solutions. Some of these solutions can be integrated directly with your accounting system, others with HR systems.

Most solutions have the option to export outputs in standard formats such as .csv or .xml. You can then import this into your financial system.

Advantages of digital travel expense reporting

Of course, manually entering travel expenses into an Excel or Word template has its advantages. Employees are familiar with the programs, Excel offers easy adding and multiplying of amounts, and costs are generally rather low.

Nevertheless, digital travel expense reporting offers multiple advantages that cannot be achieved with a manual solution. We have listed these advantages below:

- Save time → With the digital expense report, you save a lot of time as submitting expense reports becomes quick and easy with user-friendly software. You simply upload a photo of the receipt and the OCR software does the rest.

- Automatic duplicate detection → Some digital expense reporting solutions, such as SpendControl, can automatically detect when an invoice has been submitted more than once. This way, fraud can be detected quickly and easily.

- Simplified workflow → The digital expense report offers an easy workflow setup where you decide which requests are sent to which managers. This brings more structure to your workflow.

- Better overview → You can see at any time who has already approved refunds and whose turn it is within workflow.

- Satisfied employees → The reimbursement process is much faster with digital expense reporting. In addition, employees no longer have to fill out a printed expense report template, which saves time and nerves.

- Fewer errors → Filling in a travel expense report template manually often leads to errors, such as incorrect information, or forgotten receipts. This in turn can lead to problems with the tax office. With a digital expense report solution, you no longer need to worry about this. OCR is able to read data correctly and without errors.

- Easy integration → A digital solution can be easily and quickly integrated into your accounting system. This way, approved reimbursement requests are forwarded directly.

- Real-time data → Most digital solutions are cloud-based. This means that employees have access to up-to-date data everywhere.

Now that we have discussed the benefits of digital expense reporting, let’s get clarity on whether you need to pay tax over expense reporting.

Travel expense report: Do I have to pay taxes?

Employees must first pay for the costs incurred during travel themselves. In retrospect, thanks to the travel expense report, the money is reimbursed to employees.

You wonder if you then have to pay tax over this extra income? The answer is no. If all original receipts are available, the travel expenses are settled as “tax-free income”.

Unfortunately, you will also have cases on your business trip where you don’t receive any receipts. In this case, you need to provide adequate verification for the expense.

However, as adequate verification doesn’t prove VAT, a tax reduction is not possible. Therefore, make sure to ask for tax-compliant receipts if possible.

Submitting a travel expense report to the tax office

Should you wish to submit your travel expense report with a digital solution, you need to remember to apply for digital archiving at the tax office.

To do this, you should contact your responsible tax office and ask for the electronic archiving of original receipts.

Now that we have covered all relevant questions about travel expense reporting, we would like to present a solution for digital travel expense reporting.

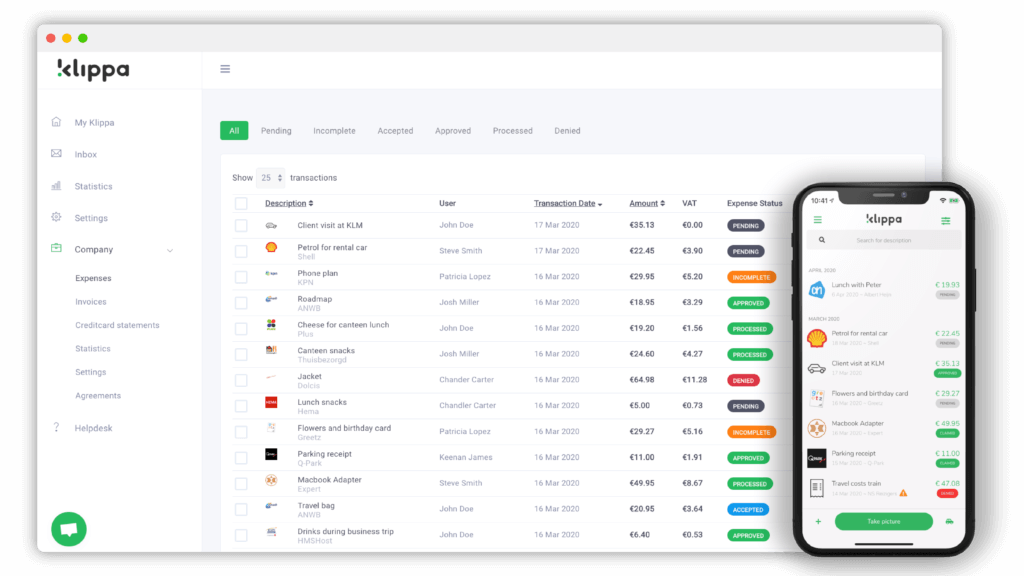

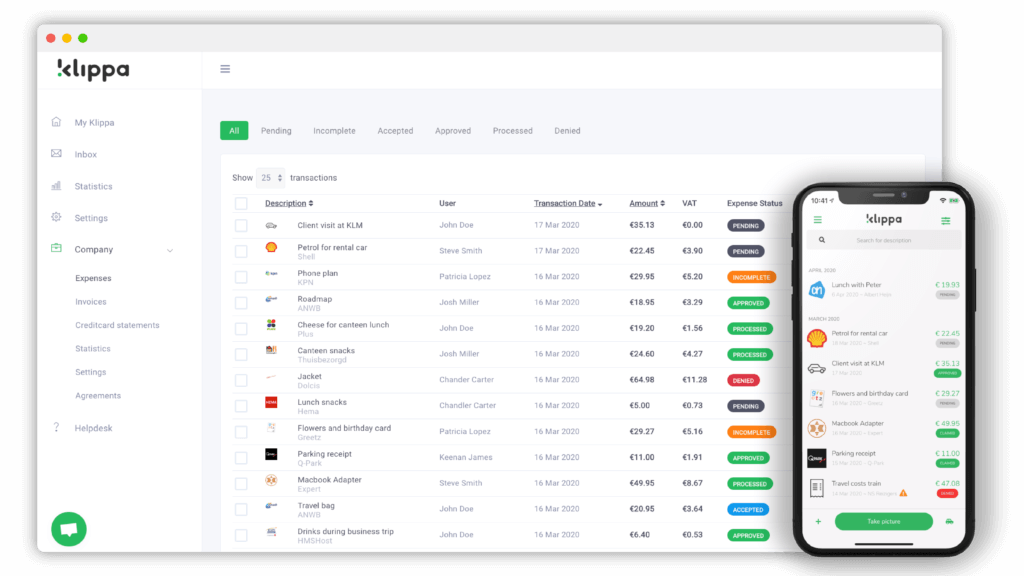

Klippa’s solution for travel expense reporting

Even though manual travel expense reporting has been done for years, it is prone to error and not the ideal solution for future-oriented companies. The good thing is that you can now automate the process with available solutions in the market.

Klippa for one, offers one of these travel expense reporting solutions that digitize and automate your accounting.

Not only do you save time and make fewer mistakes, but you also have the ability to automatically detect duplicates, expense fraud, simplify your workflow and view data in real time.

Solutions such as SpendControl replace the manual completion of the expense report template and speed up the reimbursement process. Employees are happier and processes are optimized.

Would you like to receive more information? Feel free to book a 30-minute demo below or contact one of our experts.

FAQ

A travel expense report provides an overview of all costs incurred during a business trip. It is used to document expenses like accommodation, meals, and transportation, ensuring accurate reimbursement by the employer.

To write a travel expense report, list all expenses incurred during the trip, including dates, descriptions, and amounts. Attach relevant receipts for each expense and ensure all details align with your company’s travel expense policy.

Record travel expenses by keeping all receipts and logging each cost with relevant details, such as date, purpose, and category (e.g., meals, transportation). Use a template or digital tool to keep records organized and ensure compliance with company guidelines.

Travel expenses typically include accommodation, meals, transportation (e.g., flights, rental cars, public transport), and any additional business-related costs such as conference fees or parking. Personal expenses like minibar charges or fines are usually not included.

The amount you can write off for travel expenses varies by country and local tax regulations. Generally, you can deduct expenses that are essential for the business trip, provided you have receipts and the trip’s purpose is clearly documented. Always consult with a tax advisor for precise limits.