If you are still manually typing invoice data into your accounting or ERP system, you already know how frustrating the process can be. It is slow, it is prone to mistakes, and as your business grows, it becomes a costly bottleneck that eats away at productivity.

Every typo or misplaced decimal can trigger a chain reaction that causes delayed payments, inaccurate financial reporting, or even compliance trouble. In high-volume environments, the margin for error multiplies and so does the stress of keeping everything accurate and up to date.

The good news is that you do not have to keep struggling with manual invoice workflows. Invoice parsing uses AI-powered automation to read, understand, and structure invoice data in seconds. This gives your team back hours of productive time while improving accuracy and compliance.

In this article, we will discover what invoice parsing is, how it works, why it is essential for modern businesses, and the top solutions available in 2026.

Key Takeaways

- Definition: Invoice parsing automates the extraction and structuring of invoice data using OCR, machine learning, and NLP.

- Cost Savings: Manual entry costs ~$12.88 per invoice and takes 9.2 days; automation cuts this to seconds.

- How it Works: Capture invoice → Extract text with OCR → Classify and validate with AI/NLP → Send structured data to ERP/accounting software.

- Benefits: Faster processing, over 99% accuracy, lower labor costs, improved compliance, and scalable without extra staff.

- Formats: Works with PDFs, scans, images, XML, UBL, and varied layouts without pre‑defined templates.

What is Invoice Parsing?

Invoice parsing is the process of automatically extracting and structuring data from invoices using technologies such as Optical Character Recognition (OCR) and Natural Language Processing (NLP).

An invoice parser turns unstructured or semi-structured invoice content, whether in PDF, scanned image, or digital format, into clean, machine-readable data that can be instantly processed by accounting, ERP, or financial management systems.

Instead of a person manually reading an invoice and typing details like the invoice number, date, supplier name, and line item amounts into a database, an invoice parser automates the task. By recognizing key fields and converting them into structured formats such as JSON or XML, invoice parsers eliminate the bottleneck of manual data entry.

How Does Invoice Parsing Work?

Invoice parsing is not a single action but a sequence of automated steps that move an invoice from raw, unstructured data into clean, validated information ready for payment.

The process combines Optical Character Recognition (OCR) to extract text, Natural Language Processing (NLP) to understand context, validation rules to ensure accuracy, and integration with your business software to make the data actionable.

We will now break the workflow down into five stages. Each stage includes a real-world example so you can see how invoice parsing operates in a business setting.

Step 1: Document Capture

Invoices are collected from various sources such as email attachments, supplier portals, scans, or smartphone photos.

Example: A supplier sends your finance team a PDF invoice via email. The invoice parser automatically detects the email attachment and saves it to the processing queue.

Step 2: Text Extraction Using OCR

Optical Character Recognition (OCR) scans the invoice image or PDF to identify and extract every piece of text.

Example: The parser reads “Invoice Number: INV-34821”, “Total Due: $1,295.00”, and “Due Date: 2026-01-30” from the document, even if the font is handwritten or in a non-standard format.

Step 3: Data Classification Using NLP

Natural Language Processing (NLP) determines the meaning of the extracted text and correctly assigns each value to a data field.

Example: The parser understands that “30 Jan 2026” relates to the due date, while “INV-34821” is the invoice number and “$1,295.00” is the total amount.

Step 4: Validation Against Business Rules

The parsed data is automatically verified for accuracy and compliance.

Example: The system checks that the supplier’s name matches the approved vendor list and that the total amount matches the sum of all line items.

Step 5: Integration With Business Systems

The structured data is sent directly to your ERP or accounting software for payment processing.

Example: Invoices are posted automatically into systems like SAP, QuickBooks, or Oracle NetSuite without anyone typing the numbers manually.

Why Invoice Parsing Matters for Your Business

Invoice parsing is not just another workflow improvement. For many organizations, it represents a complete shift in how accounts payable operates, moving from manual, error-prone data entry to an intelligent, highly efficient process. By automating the extraction and structuring of invoice data, you can save time, cut costs, and ensure compliance, all while freeing your finance team to focus on strategic work.

The ROI in numbers

Industry research from Ardent Partners’ Accounts Payable Metrics That Matter in 2025 report shows that manual invoice processing costs an average of 12.88 US dollars per invoice and takes about 9.2 days to complete. For a company handling 5,000 invoices each year, that equates to more than 64,000 US dollars spent solely on manual entry, not including indirect losses caused by delayed payments and processing errors.

Invoice parsing can reduce this cost dramatically and shorten the timeline from days to minutes.

Key Benefits for Your Business

- Significant Time Savings: Automated parsing reduces end-to-end invoice processing time from over a week to a matter of seconds.

- Reduced Human Error: Automation eliminates mistakes caused by manual typing, misreading numbers, or overlooking line items.

- Lower Operational Costs: Cut down both labour expenses and indirect costs associated with slow approvals or payment delays.

- Improved Compliance and Audit-readiness: An invoice parsing solution ensures all required fields and documentation are collected and stored properly, supporting tax and regulatory requirements.

- Scalability without Additional Headcount: As your business grows, invoice volumes can increase without overwhelming your finance team.

Top Invoice Parser Solutions in 2026

Choosing the right invoice parsing solution can transform your accounts payable process from slow and error-prone to fast and reliable. Below are some of the top solutions available in 2026.

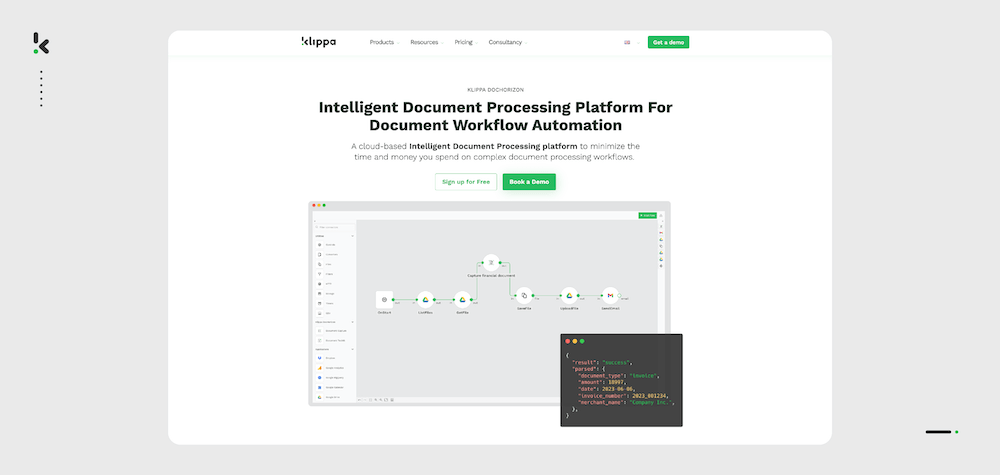

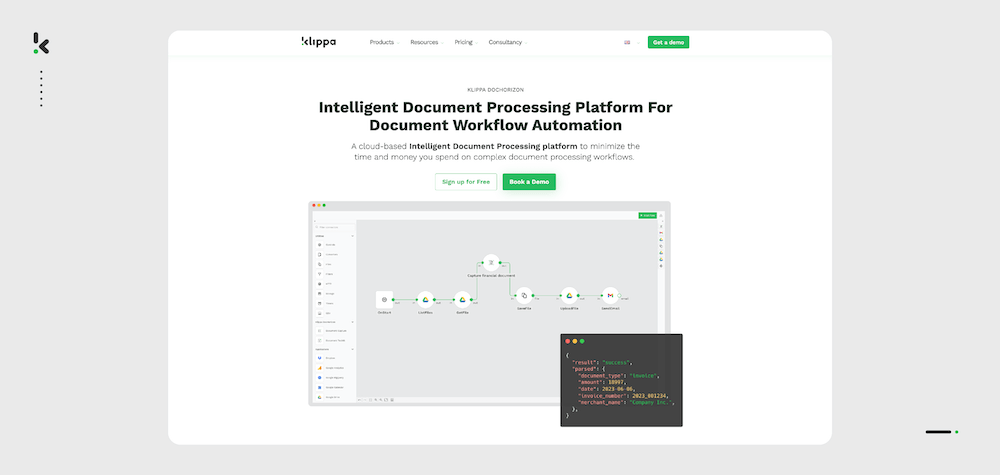

1. Klippa DocHorizon

Klippa DocHorizon is a leading AI-powered invoice parsing platform offering both API-first and cloud-based deployment. Its advanced OCR and NLP algorithms deliver exceptional accuracy, even for invoices with non-standard layouts or multiple languages.

It integrates seamlessly with ERP and accounting platforms and includes strong data validation to ensure compliance with GDPR and other privacy standards.

Key features:

- Industry-leading OCR and NLP accuracy

- Multi-format and multi-language support

- Real-time secure API integrations

- GDPR-compliant data handling

- Quick deployment on cloud or on-premise infrastructure

2. Rossum

Rossum is highly regarded for its self-learning AI engine that adapts automatically to diverse invoice layouts without the need for complex rule setup. It offers a “human-in-the-loop” validation interface, making it ideal for businesses with high-volume and complex processing needs.

Key features:

- Self-learning AI for layout adaptability

- Optional human validation workflow

- Strong fit for large volumes and varied formats

3. ABBYY FlexiCapture

ABBYY FlexiCapture is a powerful option for enterprises needing robust OCR capabilities and advanced analytics. Known for its enterprise-grade accuracy, it is well-suited for global organizations managing complex, multi-language document workflows.

Key features:

- Enterprise-grade OCR technology

- Advanced analytics and reporting

- Suitable for global and multi-language processing

4. Tipalti

Tipalti offers an end-to-end accounts payable automation platform featuring invoice capture, purchase order matching, and global payment capabilities. It is particularly strong for organizations making payments in multiple currencies while maintaining robust tax compliance.

Key features:

- Full AP automation, including PO matching

- Global payment capabilities in many currencies

- Advanced tax compliance automation

5. Tungsten Automation (formerly Kofax)

Tungsten Automation is known for its strong AI-powered solutions aimed at large enterprises, especially those with complex legacy systems. It focuses on robust, high-volume invoice automation with a scalable architecture.

Key features:

- AI-driven high-volume invoice automation

- Integration with legacy enterprise systems

- Scalable for large organizations

How to Choose the Right Invoice Parser for Your Business

Selecting the right invoice parsing solution is about more than just OCR accuracy. It requires evaluating your business processes, compliance needs, and integration goals. Use the checklist below to compare options and choose the parser that delivers the best results.

Key selection criteria include:

Accuracy rate and adaptability

Look for solutions with proven, high OCR accuracy and the ability to handle varied invoice layouts without extensive manual rule setup. This ensures consistent results even with diverse vendors and formats.

Multi-language and multi-currency support

If your business deals internationally, choose a parser that can process invoices in multiple languages and currencies while maintaining full recognition capability.

Integration capabilities

The solution should connect seamlessly with your existing ERP, accounting software, or workflow automation tools via APIs, pre-built connectors, or custom integrations.

Data security and compliance

Ensure the platform complies with relevant regulations such as GDPR or SOC 2 and supports secure data transmission and storage to protect sensitive financial information.

Scalability

Pick a solution that can handle increasing invoice volumes as your business grows, without requiring major changes or additional resources.

Validation and error handling

Advanced validation rules, data consistency checks, and error management features help maintain accuracy and reliability in financial data.

Why Klippa DocHorizon is the Best Option

Klippa DocHorizon is more than just an invoice parser. It is a full-featured Intelligent Document Processing (IDP) solution designed to adapt to your workflows, integrate seamlessly with your systems, and deliver consistent, high-quality data that drives business efficiency.

Key advantages of Klippa DocHorizon:

- High OCR and NLP accuracy: consistently above 99% on standard invoices, with strong results for complex layouts.

- Multi-language and multi-format support: handles over 100 languages and a wide range of file types including PDF, JPG, PNG, TIFF, XML, and JSON.

- Secure and compliant: fully GDPR-compliant, with encrypted transfers and on-premise deployment options for sensitive environments.

- Fast processing times: real-time API responses and ability to process thousands of invoices in minutes.

- Seamless integration: works with leading ERP and accounting systems such as SAP, Oracle NetSuite, QuickBooks, and Xero.

- Scalable infrastructure: adapts to increased invoice volumes without loss of performance.

Choosing the right technology matters. Klippa DocHorizon offers unmatched accuracy, multi-language capabilities, secure API integrations, and flexible deployment options, making it the ideal solution for businesses that value efficiency, scalability, and compliance.

FAQ

Invoice parsing is the process of automatically extracting and structuring data from invoices using technologies like OCR and NLP. Klippa DocHorizon uses advanced AI models to detect fields such as invoice numbers, dates, totals, and line items with high precision, and exports the data in formats like JSON or XML for seamless integration into your financial systems.

Klippa DocHorizon’s OCR and NLP technologies deliver accuracy rates upwards of 99% on printed invoices and maintain strong results even with complex or non-standard layouts. It is designed to handle multiple languages and currencies without needing manual template configuration.

Yes. Klippa DocHorizon supports over 100 languages and can extract and process data from invoices issued in different regions and formats. This is particularly valuable for companies working with international suppliers or operating across multiple markets.

Klippa supports processing of PDF, JPG, PNG, HEIC, and TIFF files, as well as text-based formats like XML, UBL, and JSON. It also offers batch processing for large volumes and can work with invoices captured by mobile devices.

Klippa adheres to strict data protection standards including GDPR compliance, encrypted data transfers, and secure API endpoints. Businesses can choose between fully cloud-based deployments or on-premise hosting for maximum control over sensitive financial information.

Using Klippa DocHorizon’s real-time API, invoices can be processed in seconds. High-volume batch imports can handle thousands of invoices per minute while maintaining consistent accuracy.

Yes. Klippa offers API connections and ready-made integrations for systems such as SAP, Oracle NetSuite, QuickBooks, Xero, and more. Custom integrations are also supported for proprietary systems.