Financial statements are a goldmine of business-critical insights, but they can also be a nightmare when it comes to extracting specific information, such as revenue data. If you’ve ever spent hours combing through income statements, balance sheets, or cash flow reports to isolate a company’s revenue, you’re not alone.

Whether you’re working in finance, audit, accounting, or investment, manually retrieving this data is not only time-consuming but also prone to errors.

The good news? With automation and the right tools, you can extract revenue and other financial data in seconds.

In this blog, we’ll explore the key challenges of revenue data extraction and show you, step by step, how to automate the process with Klippa DocHorizon—so you can turn financial documents into structured, actionable data.

Key Takeaways

- Revenue extraction is essential but complex – Revenue data is hidden across income statements, annual reports, and auditor documents, often under different labels like sales or turnover.

- Manual extraction is inefficient – Copy-paste errors, inconsistent terminology, and low-quality scans make manual processes slow and unreliable.

- Validation improves accuracy – Automated validation flags missing fields, inconsistencies, or potential fraud in financial statements.

- Klippa DocHorizon streamlines financial workflows – The platform saves time, cuts costs, reduces fraud risks, and integrates seamlessly with existing finance systems while ensuring compliance with GDPR, HIPAA, and ISO standards.

What is Revenue Data Extraction?

Revenue data extraction is the process of identifying, isolating, and converting revenue-related information from financial statements into structured, machine-readable data. This allows businesses to analyze, report, and integrate revenue figures into various systems without manual input.

Revenue data is usually found in income statements (also called profit and loss statements), but it can also appear in annual reports, auditor documents, and internal financial summaries.

Depending on the document, revenue can appear under different labels like:

- Revenue

- Sales

- Turnover

- Top-line income

To extract revenue data accurately, you often need to capture more than just the number itself. Common related fields include:

- Reporting period

- Company name

- Currency used

- Revenue breakdowns (e.g., by region, product, or service)

- Recurring vs. one-time revenue

Whether you’re auditing, forecasting, or populating dashboards, automating this process ensures accuracy and consistency. It becomes especially valuable when working with large volumes of documents, where scalability is crucial.

But before you start automating, it’s important to understand what kind of data you actually need to extract.

What Data to Extract from Financial Statements

Financial statements contain a wealth of information that businesses need for reporting, forecasting, auditing, and compliance. When extracting revenue data, it’s important to identify all related financial elements that provide context and accuracy. Below are the key data points typically extracted from financial statements:

1. Company Information

Details that identify the reporting entity and period.

- Company Name – The name of the business or organization issuing the report.

- Registration Number / Tax ID – Legal identifiers for verification and compliance.

- Reporting Period – The specific fiscal period covered by the statement (e.g., Q1 2025, FY 2024).

- Currency Used – The currency in which financial figures are reported.

2. Revenue Details

Core data points that reflect income generation and business performance.

- Total Revenue – The total income earned before expenses.

- Revenue by Category – Split by product, service, region, or business unit.

- Net or Adjusted Revenue – After discounts, returns, or allowances.

- Deferred or Unearned Revenue – Payments received for future periods.

3. Expense and Cost Data

Relevant cost details help verify margins and validate revenue figures.

- Cost of Goods Sold (COGS) – Direct costs of producing goods or services.

- Operating Expenses (OPEX) – Administrative and overhead costs.

- Tax and Interest Expenses – Essential for reconciling net income.

4. Cash Flow Information

Revenue recognition often ties to actual cash inflows.

- Cash Flow from Operations – Cash generated from core business activities.

- Cash Flow Timing – When revenue is actually received versus when it’s recorded.

- Deferred Cash Flow Items – Prepaid or delayed payments tied to recognized revenue.

Once you know which data points to capture, it’s equally important to understand the challenges that come with extracting revenue data from financial statements, especially when dealing with varying formats and document quality.

Challenges of Revenue Data Extraction

Extracting revenue from financial statements may sound simple, but in reality, several issues get in the way:

- Unstructured Layouts- PDFs and scanned financials often contain tables and notes without a consistent structure.

- Multiple Formats- Multiple Formats Documents may come in Excel, scanned PDF, Word, or image formats.

- Inconsistent Terminology- Revenue could be labeled as “Sales”, “Turnover”, or “Operating Income”.

- Low-Quality Scans- Poorly scanned files result in OCR misreads

- Manual Errors- Copy-paste errors or misinterpretation of line items can lead to reporting inaccuracies.

These challenges make it clear that relying on manual processes is not sustainable, especially at scale. That’s where automation steps in.

How to Automate Revenue Extraction with Klippa DocHorizon

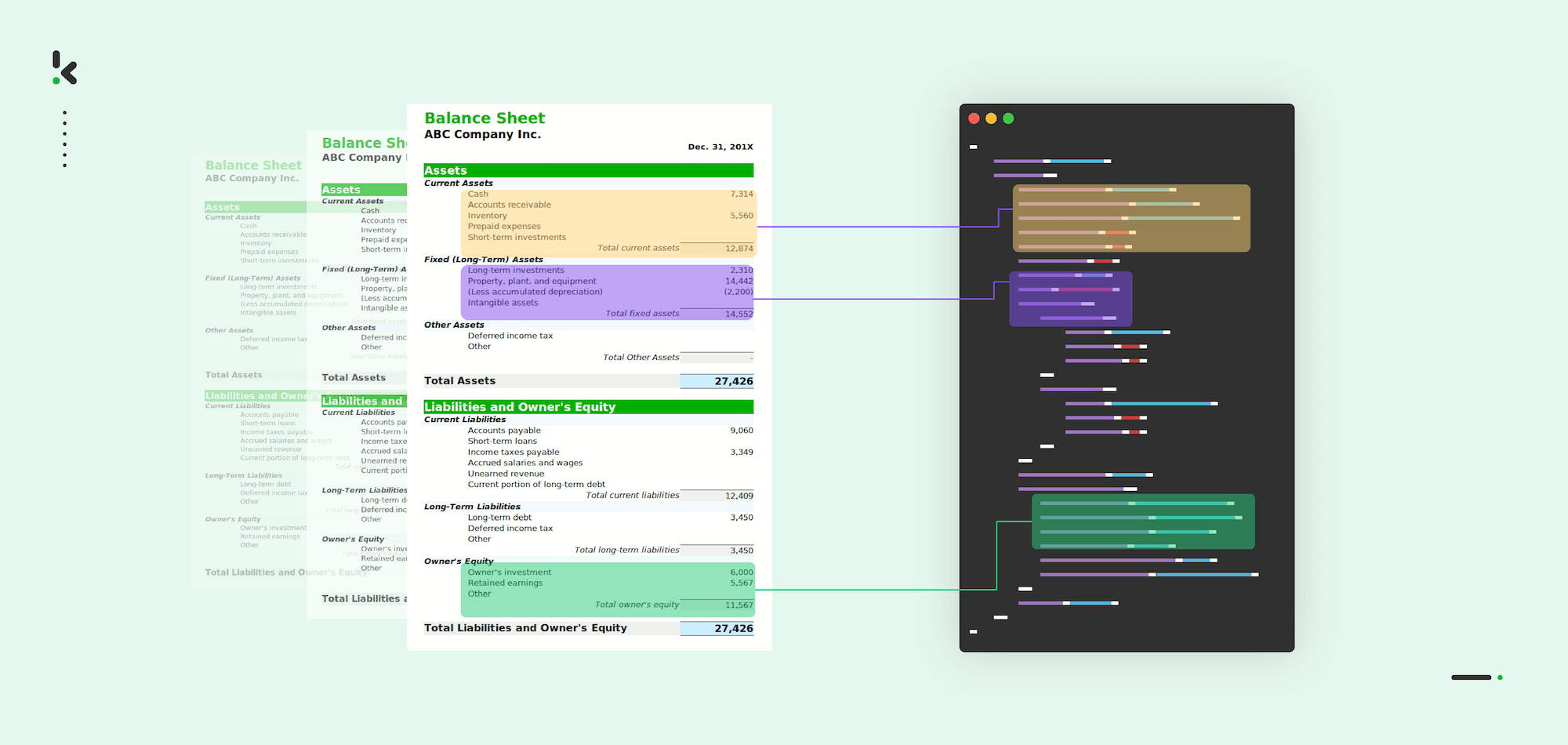

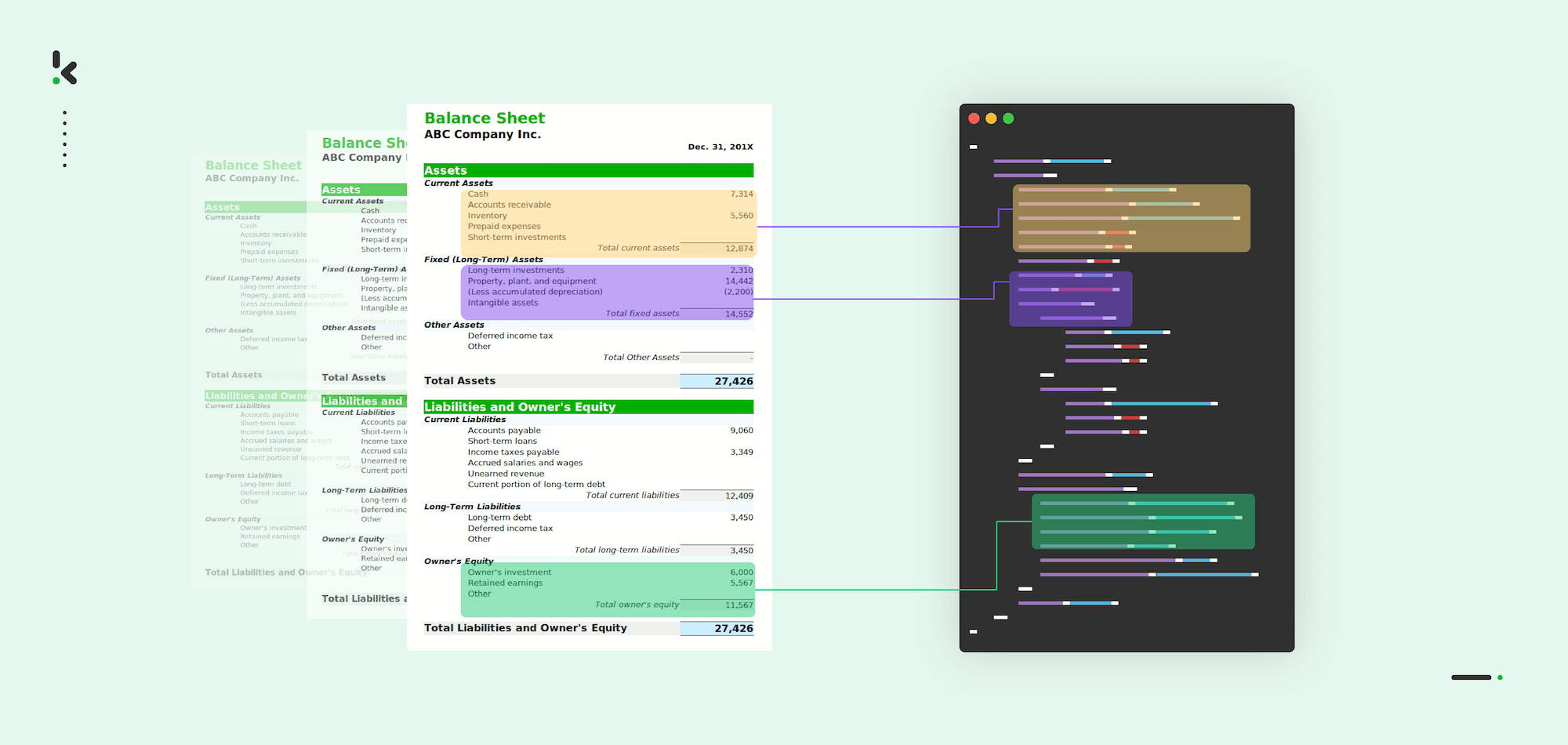

AI-powered solutions like Klippa DocHorizon can fully automate the process of extracting revenue data from financial statements, turning unstructured documents into structured information ready for analysis or integration into your preferred system.

Klippa DocHorizon is a powerful Intelligent Document Processing (IDP) platform that streamlines financial workflows and offers flexibility by supporting more than 100 different document types and formats.

To show you how it works, we’ll walk through a step-by-step process of extracting revenue data from financial statements using Klippa DocHorizon. And the best part? You can try it out for free!

Step 1: Upload Your Documents

Begin by uploading your documents through the channel that works best for you. You can use the web platform, mobile app, or email forwarding. Whether it’s a scanned financial statement, an email attachment, or an image file, the system will automatically pick it up for processing.

Supported formats include JPG, PNG, PDF, Word, Excel, HEIC, WebP, and more, so you don’t have to worry about converting files beforehand.

Step 2: Extract Key Information

Once uploaded, our AI-powered OCR technology analyzes your documents and extracts the information you need—without relying on static templates. This means it works on structured, semi-structured, and even messy, unstructured data.

For financial use cases, that could be revenue figures, reporting periods, currencies, and company details. But you can adapt the extraction fields depending on your document type and workflow.

Step 3: Validate Data

After extraction, the system automatically validates the results to ensure accuracy. Missing fields, inconsistencies, or fraud are detected instantly. This ensures that the data you’re working with is both reliable and compliant, which is especially valuable for financial reporting and auditing.

Step 4: Export to Your Destination

Finally, forward your structured data to wherever you need it. You can export it directly into your CRM, ERP, or database, or choose from a variety of common formats like JSON, CSV, XML, XLS, or UBL.

This flexibility makes it easy to fit into your existing workflows, whether you’re populating dashboards, preparing reports, or feeding data into accounting and compliance systems.

Conclusion: Transform Revenue Data Extraction with Klippa

Manually extracting revenue from financial statements is yesterday’s problem. With Klippa DocHorizon, you can automate the entire process – from document upload to structured data output – with speed, accuracy, and security. Whether you’re handling a handful of statements or thousands, the setup stays simple and scalable. Here’s what you gain:

- Saved Time – Automate revenue data extraction with OCR technology, eliminating tedious manual entry.

- Cut Costs – Reduce operational expenses by streamlining financial data processing.

- Tailored Outputs – Generate structured outputs like JSON, CSV, or Excel, ready for your dashboards or ERP systems.

- Minimized Fraud Risks – Detect altered or inconsistent statements instantly to protect your business.

- Compliance – Stay aligned with KYC, AML, and industry regulations while avoiding costly errors or fines.

- Seamless Integration – Connect Klippa DocHorizon to your existing finance stack via API or SDK for end-to-end automation.

At Klippa, simplicity is key. That’s why we continuously improve our platform to make implementation and integration as easy as possible. Plus, all of our workflows comply with HIPAA, GDPR, and ISO standards, ensuring secure and reliable financial data processing.

If you’re interested in automating your revenue data extraction workflow from financial statements with Klippa’s intelligent document processing solution, don’t hesitate to contact our experts for additional information or book a free demo!

FAQ

Revenue data extraction is the process of identifying and converting revenue-related information—such as total revenue, reporting period, and currency—from financial statements into structured, machine-readable data. This enables faster analysis, reporting, and automation without manual input.

2. Why is extracting revenue data from financial statements important?

Accurate revenue data is crucial for financial reporting, audits, compliance, and forecasting. Automating the extraction process saves time, reduces human error, and ensures consistency across large volumes of documents.

3. What types of documents can Klippa DocHorizon process?

Klippa DocHorizon supports over 100 document types, including income statements, balance sheets, annual reports, auditor reports, and bank statements. It works with both scanned and digital PDFs, Word, Excel, and image files.

4. How accurate is automated revenue extraction compared to manual processing?

AI-powered OCR and machine learning models deliver up to 99% accuracy, depending on document quality. Klippa also offers human-in-the-loop validation to review flagged data and ensure near-perfect results.

5. Can Klippa detect fraud or inconsistencies in financial statements?

Yes. Klippa’s intelligent validation and fraud detection features can flag altered, inconsistent, or duplicated data across financial documents, helping prevent errors or financial manipulation.