Insurance fraud costs the USA $308.6 billion each year and manipulated claim documents are one of the most common tactics used by fraudsters. These can include altered invoices, forged medical reports, and digitally edited photographs that are designed to pass as legitimate evidence. As these methods become more sophisticated, detecting them with manual checks alone becomes increasingly difficult.

For your business, undetected fraudulent claims can lead to direct financial losses, higher premiums, and damage to your reputation. They also slow down processing times and divert resources away from genuine policyholders. Fast and reliable fraud detection is now essential to maintain trust and profitability.

Modern solutions use a combination of AI, Optical Character Recognition (OCR), and forensic data analysis to identify manipulation in seconds. In this guide, you will learn what document manipulation looks like, how to spot the warning signs, and how to protect your business from fraudulent claims.

Key Takeaways

- Insurance fraud costs businesses billions each year, with manipulated claim documents being a major contributor.

- Common manipulations include altered invoices, forged medical reports, fake police documents, doctored images, and AI‑generated evidence.

- Signs of manipulation include metadata mismatches, formatting inconsistencies, repeated documents, and unusual language patterns.

- Effective detection relies on tools like OCR, Intelligent Document Processing, metadata analysis, image forensics, duplicate detection, and AI content identification.

- Implementing an automated, AI‑powered fraud detection platform such as Klippa DocHorizon dramatically improves accuracy, speeds up verification, and integrates easily into existing workflows.

What is Document Manipulation in Insurance Claims?

Document manipulation in insurance claims refers to the alteration, forgery, or creation of false documents to support fraudulent requests for payment. This can involve changing key details such as amounts, dates, or signatures to make a claim appear legitimate. In many cases, these manipulations are done digitally, making them harder to detect without the right tools.

Common examples include edited invoices, tampered medical records, European Accident Statements, fake police reports, and doctored photographic evidence. Fraudsters may use simple editing software or advanced techniques to ensure changes blend seamlessly into original files. Even small alterations can have a major financial impact if they go unnoticed.

The risk is that manipulated documents directly undermine the integrity of the claims process. They not only lead to financial losses but also compromise compliance and damage trust between insurers and policyholders. Understanding what manipulation looks like is the first step toward effective detection and prevention.

Key Signs of a Manipulated Document

Spotting a manipulated insurance claim document often comes down to noticing subtle inconsistencies. Modern editing tools make changes look seamless, but certain red flags can reveal tampering when you know what to look for. Detecting these early can prevent fraudulent claims from slipping through.

Common warning signs include:

- Metadata mismatches: The creation or modification dates in the file do not align with the claim timeline.

- Font and formatting inconsistencies: Text size, style, or alignment differ within the same document.

- Pixel-level anomalies in images: Visual evidence shows signs of editing when examined closely.

- Duplicate documentation: The same file appears across multiple, unrelated claims.

- Inconsistent language or terminology: Wording differs from standard templates or past legitimate claims.

Identifying these signs is critical for fraud prevention teams. Once you know what to look for, advanced technology such as OCR and AI analysis can automate the detection process, saving time and increasing accuracy.

How to Detect Fraudulent Claim Documents

Detecting manipulated insurance claim documents requires a mix of structured analysis, automated tools, and targeted verification checks. The following steps can help your business identify and stop fraud before it results in financial loss.

Step 1: Digitize documents with OCR

Convert all claim documents into searchable text using Optical Character Recognition. This makes it easier to compare data, flag anomalies, and integrate with automated analysis systems.

Step 2: Perform metadata analysis

Review the document’s creation and modification timestamps, as well as its origin details. Inconsistencies between metadata and claim dates are strong indicators of tampering.

Step 3: Cross‑reference with trusted databases

Verify names, supplier details, invoice numbers, or medical report identifiers against reliable sources such as vendor registries, law enforcement, or healthcare systems.

Step 4: Conduct image forensics

Run photographic evidence through forensic tools that detect signs of editing, pixel manipulation, or mismatched lighting patterns.

Step 5: Apply AI‑powered anomaly detection

Train machine learning models using historical claim data to recognize unusual payment amounts, mismatched document types, or irregular claim patterns.

By combining these methods, insurers can dramatically reduce the risk of accepting fraudulent claims. Automating this process not only speeds up claim handling but also ensures greater accuracy.

Tools and Technologies for Insurance Fraud Detection

Fraudsters have more tools than ever to manipulate claim documents, which is why insurers need powerful technology to stay ahead. The right solutions can automate detection, improve accuracy, and free up experts to focus on high‑risk cases.

- Optical Character Recognition (OCR): Converts printed and scanned documents into searchable text, allowing systems to compare data, flag inconsistencies, and identify suspicious patterns across large volumes of claims.

- Intelligent Document Processing (IDP): Combines OCR with AI to not only read documents but also interpret their meaning, categorize content, and detect anomalies in context.

- Metadata extraction software: Analyzes hidden file attributes such as creation dates, modification history, and software used, which are all crucial for spotting discrepancies.

- Image forensic analysis tools: Detect subtle edits in photos, changes in file structure, and inconsistencies in lighting and resolution.

- AI‑based anomaly detection: Machine learning algorithms identify unusual claim activity, odd payment amounts, or document variations that fall outside normal patterns.

- Duplicate detection systems: Automated matching tools compare new submissions to historical claim records to flag reused, recycled, or suspiciously similar documents across different claims.

- AI-generated content identification: Recognize text, images, or supporting documents created with generative AI. This helps uncover fabricated invoices, synthetic medical reports, or staged photographic evidence.

Combining these tools creates a robust fraud prevention strategy and integrating them into a single platform maximises efficiency. This is where Klippa’s DocHorizon brings all these capabilities together in one solution.

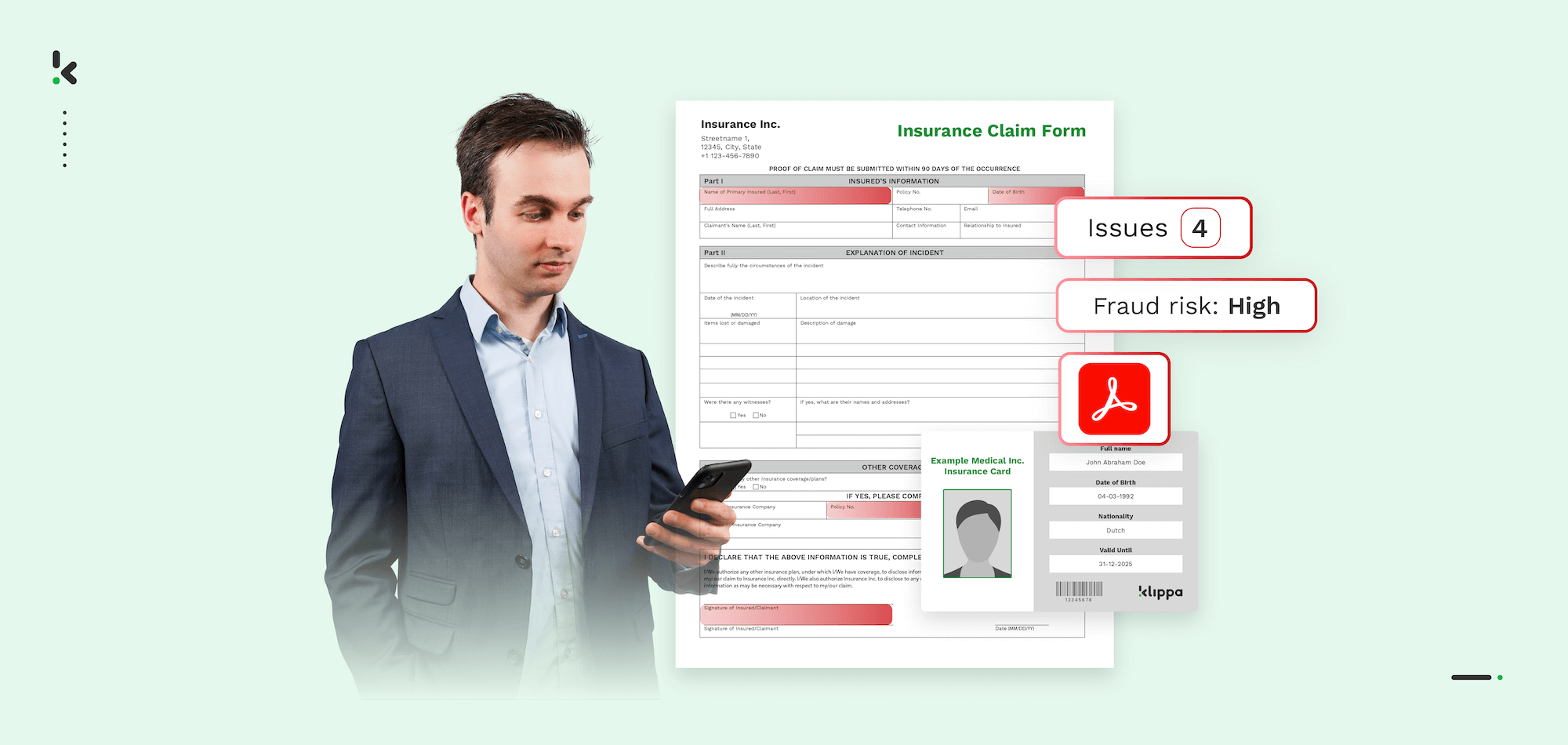

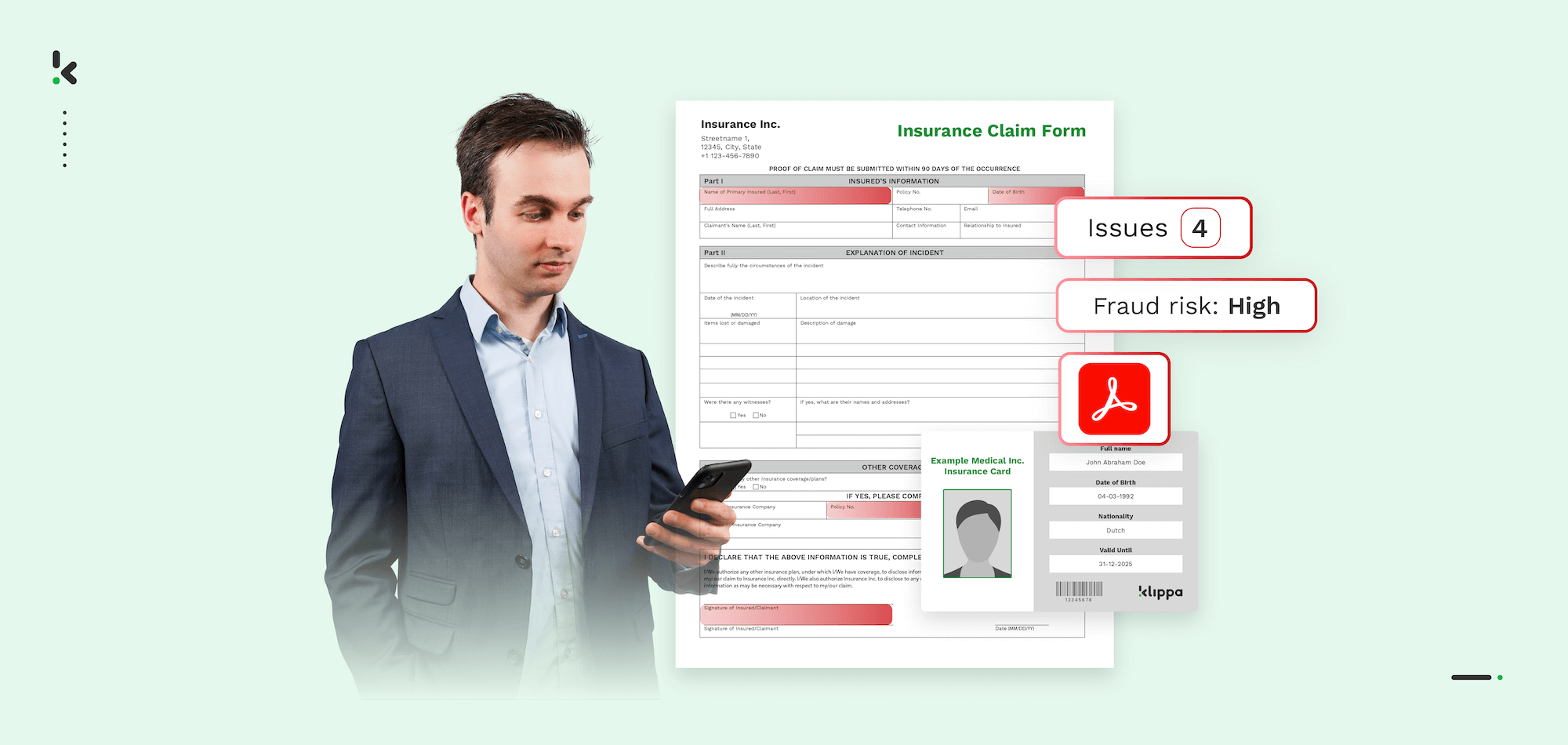

Why Klippa DocHorizon is the Best Solution for Insurance Fraud Detection

Klippa DocHorizon offers insurers an all‑in‑one fraud detection solution that combines speed, accuracy, and scalability. It digitizes claim documents with high‑precision OCR, making every piece of information searchable and ready for advanced analysis. This ensures that inconsistencies are spotted quickly, even across large volumes of claims.

Key benefits of Klippa DocHorizon for insurance fraud detection:

- Advanced OCR accuracy for invoices, forms, medical reports, and police documents.

- Intelligent Document Processing to automatically categorize, interpret, and validate content.

- Metadata extraction to expose hidden file details such as time stamps and editing history.

- Image forensic capabilities to detect subtle alterations in photographic evidence.

- AI‑powered anomaly detection to flag unusual patterns and high‑risk claims.

- Seamless integration with existing claims management systems via secure APIs.

- Customizable dashboards and alerts for fast, actionable fraud insights.

Protect your business from costly insurance fraud with a proven solution that works at scale. Contact Klippa today to see how DocHorizon can help you detect manipulated claim documents before they become a threat to your bottom line.

FAQ

Insurance document fraud is a significant issue worldwide, costing companies billions annually. Manipulated documents, such as forged invoices or altered medical reports, are among the most common methods used by fraudsters.

Yes. AI can analyze large volumes of claim documents, identify anomalies, check metadata, and detect inconsistencies that human reviewers may miss. When combined with OCR and Intelligent Document Processing, detection.

Metadata analysis involves reviewing hidden file information, such as creation dates, modification times, and source details. Discrepancies between this data and the claim details often point to document manipulation.

OCR alone makes documents searchable and easier to process, but it does not confirm authenticity. It is most effective when paired with AI, metadata analysis, and image forensics to create a complete fraud detection system.

Costs vary depending on the scope of features, integration requirements, and analysis volume. Klippa offers flexible pricing for DocHorizon, tailored to the size and needs of your insurance business.

Claims involving high payouts, such as medical expenses, vehicle repairs, and property damage, are often targeted. Fraudsters choose these because supporting evidence often comes from third parties and can be easier to fake.

Duplicate detection identifies documents, invoices, or photos that appear in multiple claims. This is a strong indicator of recycled evidence and can quickly uncover organized fraud schemes.

Yes. AI forensic systems can identify patterns and anomalies in text, images, and layouts that suggest a document was created or modified using generative AI. This helps detect fake invoices, synthetic reports, and staged photographic evidence.