If you’re still manually typing receipt data in 2026, your finance team is burning hours on slow, repetitive, and error‑prone data entry, from crumpled fuel slips to multi‑page hotel invoices and PDF order confirmations. With each document costing €2.50 to €5 in labour, according to Ardent Partners’ Accounts Payable Metrics report, these inefficiencies quietly drain tens of thousands of euros every year while increasing the risk of mistakes and compliance issues.

The Problem

Manual receipt processing is:

- Slow: Each document can take minutes to process.

- Error-prone: A wrong merchant name or total can mess up expense reports.

- Risky: Missing receipts weaken your audit trail and put compliance at risk.

When you’re chasing growth, every manual workflow is not just inefficient… It’s a competitive disadvantage.

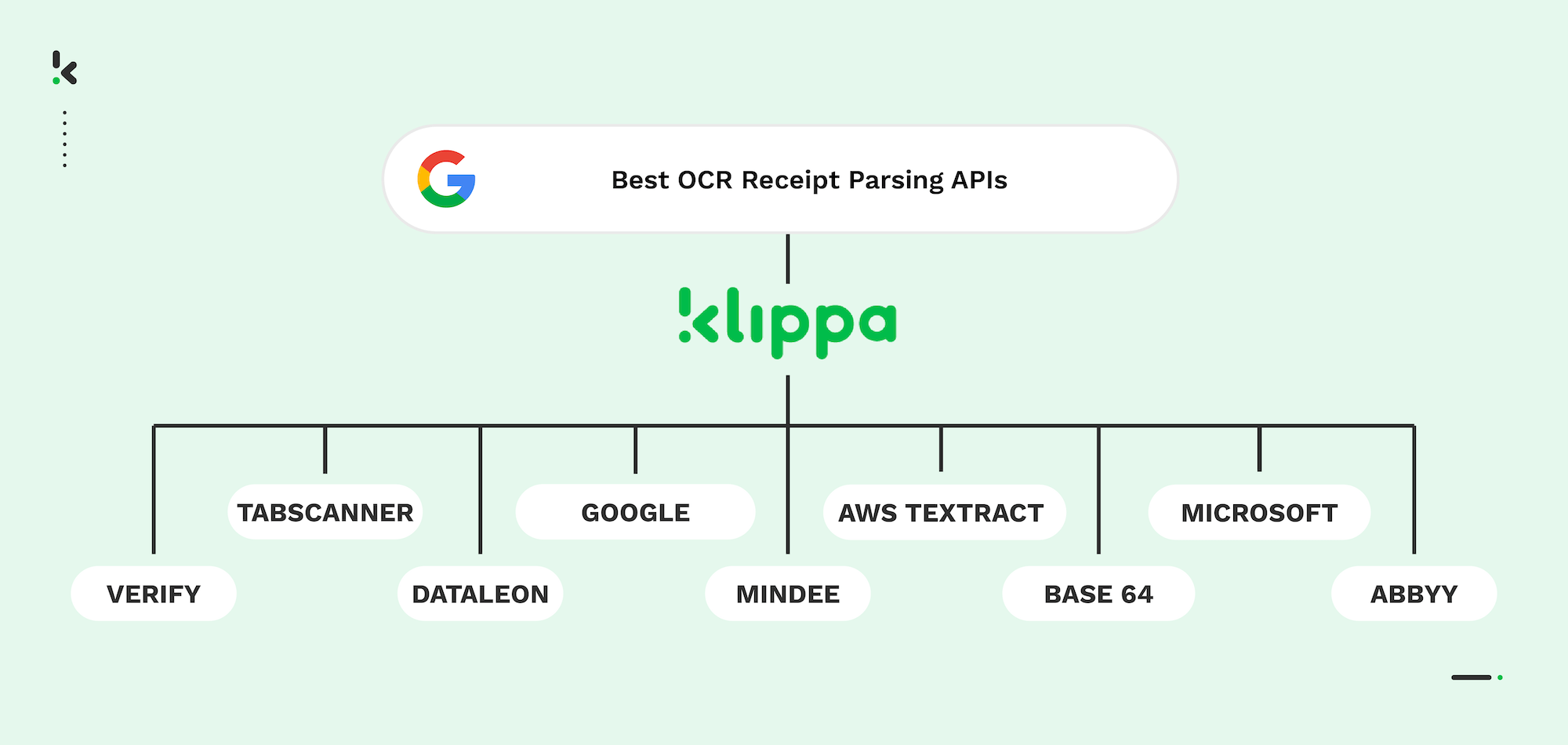

In this article, we’ll cover the best receipt parsing APIs in the market to help you make your choice.

Key Takeaways:

- Klippa DocHorizon: AI OCR, multilingual, fraud detection, ERP integration. For high‑volume enterprise use.

- Veryfi OCR API: Line‑item extraction, logo recognition, address normalization, fraud prevention. For expense and loyalty systems.

- Mindee Receipt Parsing API: Fast setup, SDKs, free tier, bounding box validation. For SaaS and app developers.

- TabScanner: Sub‑2s POS parsing, any language, line‑item detail. For retail and hospitality.

- AWS Textract: OCR with multi‑language, multi‑page support in AWS. For AWS‑driven workflows.

- Google Cloud Vision API: OCR and image recognition at scale. For Google Cloud users.

- Abbyy FlexiCapture: Structured/unstructured parsing, enterprise focus. For large organisations.

- Dataleon: Real‑time parsing, custom fields, niche formats. For specialised industries.

- Base64: Handles complex layouts, paper and digital. For non‑standard formats.

- Microsoft Azure Form Recognizer: Printed and handwritten parsing to JSON. For handwritten‑heavy workflows.

What is a Receipt Parsing API?

A receipt parsing API is software that extracts structured data from receipts using OCR, AI, and machine learning. It processes images, scans, or PDFs to read text and interpret context, then outputs cleaned data in formats like JSON, XML, or CSV.

The parsing API identifies key details such as merchant name, purchase date, total, taxes, and line items, allowing easy integration into accounting, expense management, or ERP systems. Modern receipt parsers support multiple languages and currencies, enabling seamless handling of varied formats for both local and international receipts.

By automating data capture, a receipt parsing API eliminates manual entry, increases accuracy, and speeds up workflows, helping businesses process receipts efficiently and focus on decision-making instead of data handling.

How Does a Receipt Parsing API Work?

Parsing APIs transform a static image of a receipt into structured and usable data in just a few seconds. Although the technology behind it is highly advanced, the process follows a sequence of clear steps.

Receipt Parsing Process:

- Integration: Structured data is exported in formats such as JSON, XML, or CSV for use in accounting software, ERP systems, or expense management tools.

- Capture: Receipt image or PDF is collected via mobile camera, scanner, or upload. APIs can handle various image qualities, including crumpled or faded prints.

- OCR Extraction: Optical Character Recognition converts printed or handwritten text on the receipt into machine‑readable characters.

- AI Interpretation: Artificial Intelligence and NLP identify and understand key details such as merchant name, total amount, tax rate, line items, currencies, and dates.

- Categorisation: Data is organised into structured fields like merchant, date, totals, taxes, and purchased items.

The 10 Best Receipt Parsing APIs in 2026

The receipt OCR market in 2026 offers advanced features like fraud detection, line‑item extraction, and multilingual support as standard. Choosing the right API means matching its capabilities to your accuracy, speed, integration, and compliance needs. In this chapter, we rank top‑performing APIs with overviews, standout features, and “Best for” tags to help you quickly find the best fit for your business or use case.

1. Klippa DocHorizon — OCR API

Klippa DocHorizon is built for high-volume document processing with a strong focus on accuracy, compliance, and flexibility. It supports multilingual and multicurrency extraction, advanced fraud detection using QR and barcode validation, and delivers outputs in structured formats such as JSON, XML, and CSV.

Key Features:

- Accuracy up to 99% across diverse receipt formats

- Multilingual support, including rare languages

- Fraud detection and verification of embedded codes

- GDPR and SOC 2 compliant

Pros:

- High precision suited for critical workflows

- Strong compliance meeting GDPR & SOC 2 standards

- Wide language and currency support

- Flexible structured output formats

- Optional: human in the loop possible for high-precision workflows

Cons:

- Requires technical integration knowledge.

- Best fit for enterprise-scale operations; may be overkill for small teams

2. Veryfi OCR API

Veryfi’s Receipts OCR API processes receipts in 38 languages and 91 currencies. It specializes in extracting Level 3 line-item data for deep purchase analysis while preventing fraud through duplicate receipt checks and altered total detection.

Key Features:

- Detailed line-item extraction including product names, quantities, and prices

- Duplicate and fraud detection for receipts

- Vendor logo recognition and address normalization

- SOC 2 Type II certified

Pros:

- Exceptional fraud prevention features

- Global language and currency compatibility

- Detailed purchase data for advanced analytics

- Highly scalable for large transaction volumes

Cons:

- Requires fine‑tuning and configuration for niche or uncommon receipt formats

- Pricing tiers can be high for extremely large‑scale usage

3. Mindee Receipt Parsing API

Mindee’s API is developer-friendly with quick setup, SDKs, free tiers, and thorough documentation. It accurately extracts merchant, date, totals, and tax information, along with bounding box coordinates for visual verification in UIs.

Key Features:

- REST API and interactive demo interface

- Confidence scoring for each extracted field

- Real-time processing speeds

- Pre-trained models with custom training options

Pros:

- Easy integration for developers

- Clear confidence scoring improves result accuracy checks

- Customizable through training

- Fast enough for on-the-fly use cases

Cons:

- The free tier has processing limits, which may constrain high‑volume usage

- May require custom training for uncommon or highly specialised receipt formats

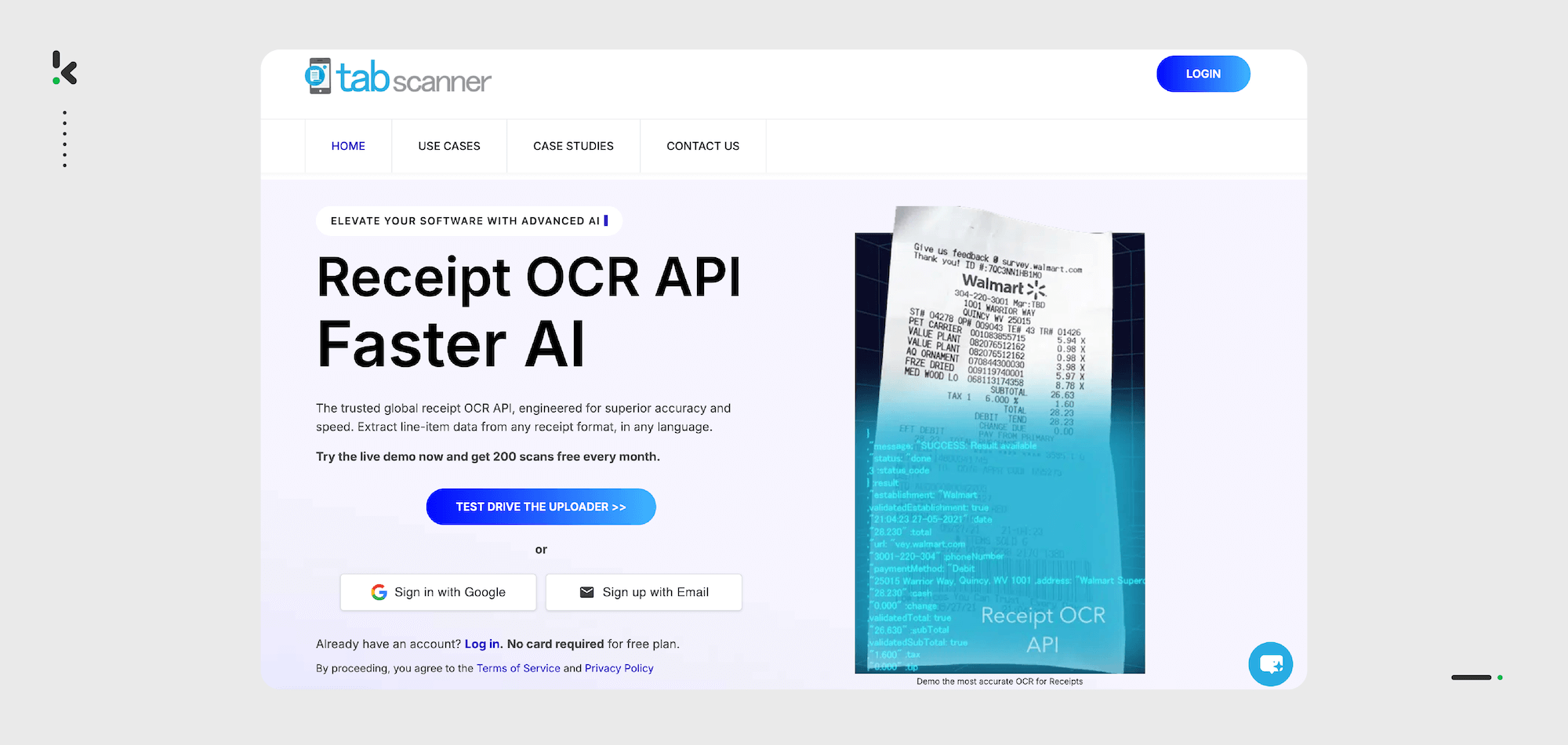

4. TabScanner

TabScanner processes receipts globally with speeds under two seconds and 98% accuracy on core receipt fields. It supports diverse POS formats and can handle line-item data from receipts in any language.

Key Features:

- 98% accuracy on core fields

- Global POS format support

- Machine learning refinement for better results over time

Pros:

- Lightning-fast parsing speed

- Strong support for international receipts

- Learns and improves accuracy with more data

Cons:

- Focused mainly on retail and hospitality environments, fast POS receipt parsing

- May require fine-tuning for complex, non-POS receipts

5. AWS Textract

AWS Textract extracts key information from structured and semi-structured documents. It supports multi-language parsing, handles multi-page documents, and integrates tightly with AWS services.

Key Features:

- Automatic recognition of key values from structured documents

- Multi-language support

- Multi-page document handling

Pros:

- Smooth integration with the AWS ecosystem

- Handles complex document structures

- Scales well for large workloads

Cons:

- Advanced setup can be technical for beginners seeking built-in document parsing within their cloud environment

- Geared towards AWS users, standalone use may require extra effort

6. Google Cloud Vision API

Google Cloud Vision API offers image recognition capabilities, including receipt parsing via tailored configuration. It processes quickly, integrates with Google Cloud AI services, and scales for varying workloads.

Key Features:

- Powerful OCR for clear image receipts

- Integration with Google Cloud AI services

- Flexible for image-based tasks beyond receipts

Pros:

- Highly versatile across use cases

- Speedy processing for well-scanned documents

- Seamless fit for Google Cloud-powered projects

Cons:

- Requires additional configuration and setup to optimize for receipt‑specific parsing.

- Accuracy decreases with poor‑quality scans or low‑resolution images.

7. Abbyy FlexiCapture

Abbyy FlexiCapture handles structured and unstructured documents, offering powerful receipt parsing. It integrates into enterprise workflows and processes data from a variety of formats with high accuracy.

Key Features:

- Accurate OCR across multiple formats

- Strong in unstructured data parsing

Pros:

- Works well in complex enterprise setups

- Effective with both structured and messy receipts

- High reliability in data extraction

Cons:

- Interface can feel complex for new users, leading to a steeper learning curve

- Enterprise-level pricing may not suit small-scale projects

8. Dataleon

Dataleon’s API offers real-time receipt parsing with customizable field selection. It caters to industries requiring precision, supporting rare formats, handwritten documents, and unique receipt layouts.

Key Features:

- Customizable parsing fields

- Support for rare and niche receipt formats

Pros:

- Highly adaptable for unique data needs

- Good performance on handwritten or unusual receipts

- Speeds suitable for real-time parsing

Cons:

- May be over‑engineered for simple receipt parsing needs, adding unnecessary complexity for basic use cases

- Requires setup and configuration effort to define custom fields before processing

9. Base64

Base64’s API parses paper, digital, and complex receipts from diverse sources. It integrates smoothly into workflows and handles varied receipt layouts from multiple regions.

Key Features:

- Supports multiple receipt formats and sources

- Easy workflow integration

Pros:

- Flexibility for mixed-format processing

- Simple to implement in existing systems

- Good global compatibility

Cons:

- Accuracy may vary for highly complex receipts.

- Limited advanced fraud detection features

10. Microsoft Azure Form Recognizer

Microsoft Azure’s Form Recognizer processes both printed and handwritten receipts using deep learning models. It extracts merchant details, totals, and taxes, returning results in structured JSON for easy downstream processing.

Key Features:

- Extracts merchant details, totals, and taxes

- Outputs structured data in JSON

Pros:

- Reliable for both printed and handwritten inputs

- Fits naturally within Azure cloud services

- Structured JSON output improves integration

Cons:

- May require additional setup for edge use cases

- Best suited for Azure cloud users

Criteria to Compare Receipt Parsing APIs in 2026

Choosing the right receipt parsing API in 2026 starts with understanding which features and capabilities will have the greatest impact on your workflows. Based on industry research and practical use cases, here are the most important criteria to consider:

1. OCR Accuracy

A high-quality API should consistently recognise text with precision, even from low-quality or complex receipts. Aim for APIs that can deliver accuracy above 95 percent, as this directly reduces manual verification work.

2. Processing Speed

Fast turnaround can make a big difference in expense management workflows, especially for businesses processing large volumes. Leading APIs now return structured data in seconds, streamlining approvals and reporting.

3. Language and Currency Support

Global operations need APIs that can parse receipts in multiple languages, including regional dialects, and handle currency conversion or recognition. This ensures consistent reporting across markets.

4. Line-Item Extraction

Item-level details allow for deeper analytics, fraud detection, and precise categorisation in accounting systems. Advanced APIs support Level 3 data that captures product descriptions, quantities, and prices.

5. Fraud Detection

Increasingly important for compliance and cost control, fraud detection can flag altered totals, duplicate receipts, or suspicious patterns before they reach approval.

6. Scalability and Integration Options

APIs should fit seamlessly into your existing systems, whether through SDKs, REST endpoints, or prebuilt connectors for ERP and accounting platforms. Enterprise-grade solutions also scale to handle peak loads without downtime.

7. Security and Compliance

Choose solutions that meet recognised standards such as GDPR, SOC 2 or ISO 27001 to protect sensitive financial data and maintain regulatory compliance.

8. Pricing Model

Consider whether the API pricing suits your usage pattern, be it per document, per page or subscription-based. The best fit balances cost efficiency with required performance and features.

Evaluating receipt parsing APIs using these criteria ensures you select a solution that meets your accuracy, speed, compliance, and integration needs. With this checklist in mind, let’s look at the best-performing APIs available in 2026 and see how they compare.

What are the Receipt Parsing APIs Benefits?

Implementing the right receipt parsing API is about more than advanced technology. The best solutions combine features that deliver measurable value in speed, accuracy, compliance, and cost savings.

Key Features and Advantages:

- Security & Compliance

Adheres to GDPR, SOC 2, and ISO 27001 standards with encryption and role‑based access. Protects sensitive financial data, ensures regulatory compliance, and builds trust with stakeholders.

Especially valuable for: Healthcare, government agencies, and financial services providers with strict data privacy requirements. - Advanced OCR & AI Data Extraction

Captures all relevant details from receipts, even with complex layouts or poor image quality. Improves accuracy, reduces manual corrections, and keeps records clean.

Especially valuable for: High‑volume processors, accounting firms, and auditors. - Fraud Detection & Duplicate Prevention

Flags fraud for e.g.: altered totals, edited images, reused receipts, or duplicates before they enter workflows. Reduces revenue loss and enforces policy compliance without slowing processing.

Especially valuable for: Finance departments, corporate expense teams, loyalty program managers. - Multi‑Language & Multi‑Currency Support

Processes receipts in various languages and currencies for standardised reporting across regions.

Especially valuable for: International companies and distributed teams. - Approval Workflows & Business Rules

Supports queues, multi‑level authorisations, and routing based on company policies. Automates decisions and removes bottlenecks.

Especially valuable for: Enterprises needing structured expense authorisation. - Real‑Time Processing Speed

Delivers parsed data in seconds, improving reimbursement cycles and audit readiness.

Especially valuable for: Travel and expense teams, retail operations, logistics companies. - ERP & Accounting Integrations

Seamlessly connects with tools like SAP, Oracle, Microsoft Dynamics, NetSuite, and expense platforms. Eliminates double data entry and keeps records current.

Especially valuable for: Businesses aiming to streamline financial operations and reporting. - Cost Reduction

Cuts processing costs by replacing manual entry with automation, and can lower per‑receipt costs by more than half.

Especially valuable for: SMEs scaling without adding headcount. - Freeing Staff for Higher‑Value Work

Moves teams away from routine data entry toward strategic analysis and decision‑making.

Especially valuable for: Growing businesses, maximizing productivity without expanding admin teams.

Why Klippa DocHorizon is the Best Pick in 2026

When evaluating the top receipt parsing APIs for 2026, Klippa DocHorizon rises above the competition with unmatched accuracy, lightning‑fast speeds, seamless integrations, and bulletproof compliance — all in one intelligent platform.

Purpose‑built for high‑volume and high‑stakes document processing, Klippa goes beyond basic OCR, combining AI‑driven extraction, real‑time validation, and fraud detection to safeguard and accelerate your expense workflows. It handles messy layouts, poor‑quality scans, and multi‑language inputs without relying on rigid templates, delivering structured data in formats like JSON, XML, and CSV in just seconds.

What makes Klippa stand out?

- Accuracy above 99%: Even for complex, low‑quality, or mixed‑language receipts

- Advanced fraud detection: Flags duplicates, altered totals, and verifies embedded QR/barcodes

- Pre‑processing enhancements: Blur detection, de‑skew, and noise reduction for cleaner data capture

- Multilingual and multi‑currency support: Processes over 100 languages and global currency formats

- Instant integrations: REST API, SDKs, and sample code for rapid deployment

- GDPR & SOC 2 compliant: Privacy‑first architecture with secure on‑premise/EU processing options

- Scalable architecture: From single real‑time receipts to massive batch operations

- Continuous model improvement: Trained on millions of receipts for evolving accuracy

If your business wants to slash manual processing time, eliminate fraud risks, and guarantee compliance, book a free demo today to see how Klippa DocHorizon can modernize, secure, and supercharge your receipt workflows in 2026.

FAQ

A receipt parsing API is a software service that extracts structured data from receipts and returns it in formats like JSON, XML, or CSV for use in other systems. It uses Optical Character Recognition (OCR) to read text, Natural Language Processing (NLP) to understand context, and Machine Learning to improve accuracy over time. Common fields captured include merchant name, date, total, taxes, and itemised purchases.

2. How does a receipt parsing API work?

The process starts with capturing the receipt as an image or PDF, followed by OCR extraction to convert text into machine‑readable form. AI and NLP then interpret the data, categorise it into structured fields, and finalise it for integration into accounting software, ERP systems, or expense tracking tools. The entire process can take just seconds, enabling real‑time expense reporting.

3. Why are receipt parsing APIs important in 2026?

They save time, reduce manual data entry errors, prevent fraud, and improve compliance with industry regulations. For global businesses, they also support multiple languages and currencies, enabling consistent reporting across markets. Choosing the right API can streamline workflows and improve operational efficiency.

4. What features should I look for in a receipt parsing API?

Key features include advanced OCR and AI data extraction, multi‑language and multi‑currency support, fraud detection, approval workflows, real‑time processing speed, seamless ERP/accounting integrations, and compliance with standards like GDPR, SOC 2, and ISO 27001.

5. Which are the top receipt parsing APIs in 2026?

The leading APIs include Klippa DocHorizon, Veryfi, Mindee, TabScanner, AWS Textract, Google Cloud Vision, Abbyy FlexiCapture, Dataleon, Base64, and Microsoft Azure Form Recognizer. Each has unique strengths, from developer‑friendly integration (Mindee) to advanced fraud prevention (Veryfi) and ultra‑fast POS parsing (TabScanner).

6. What industries benefit the most from receipt parsing APIs?

Industries such as finance and accounting, retail and hospitality, logistics and transportation, healthcare, and government agencies benefit significantly. They use these APIs to automate expense processing, improve accuracy, ensure compliance, and free up staff for higher‑value tasks.

7. How can receipt parsing APIs help prevent fraud?

By detecting duplicate receipts, altered totals, or suspicious image edits before approval. Advanced APIs can verify embedded QR codes and barcodes to confirm authenticity, reducing the risk of expense fraud or policy violations.

8. Is Klippa DocHorizon suitable for my business?

Klippa DocHorizon is ideal for enterprises, fintechs, and compliance‑driven organisations that need high‑volume, accurate, and secure document processing. It offers multilingual support, advanced fraud detection, and rapid ERP integration, meeting strict compliance standards like GDPR and SOC 2.

9. How much time and cost can automation save compared to manual receipt entry?

Automated receipt parsing can process documents in seconds versus minutes manually, reducing processing costs by more than half. This frees finance teams from repetitive tasks, enabling them to focus on analysis, compliance, and strategic decision‑making.