Manual invoice data entry is still slowing accounts payable teams and causing avoidable errors. In fact, Klippa’s The State of Finance Automation survey reported that over 50% of finance teams still process accounts payable manually.

This is, however, changing fast, with 73.1% wanting their companies to invest more in automation. Modern automated invoice scanning software uses AI OCR to capture invoice data in seconds, validate it, and feed it straight into AP workflows. These tools not only save time but also reduce costly mistakes and improve compliance.

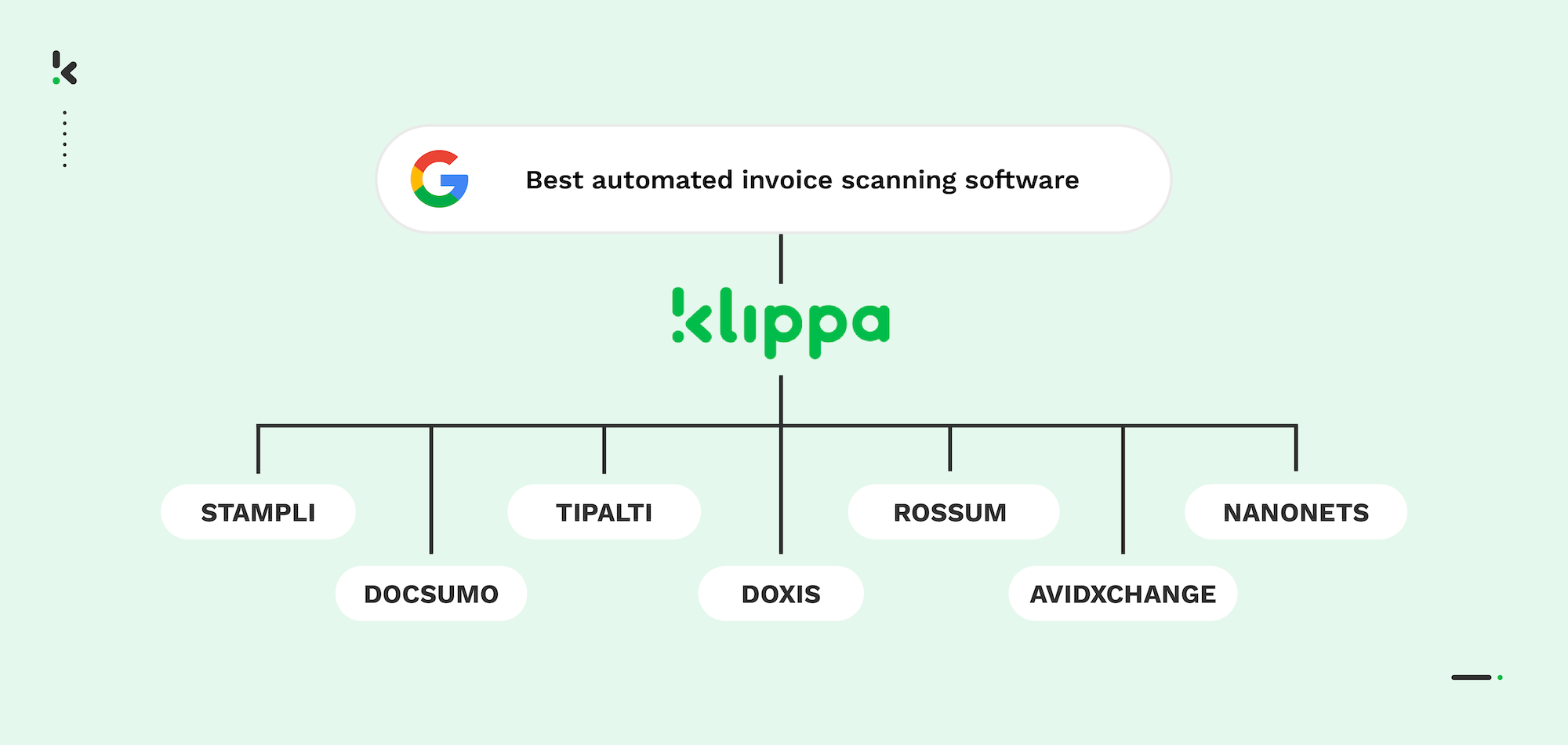

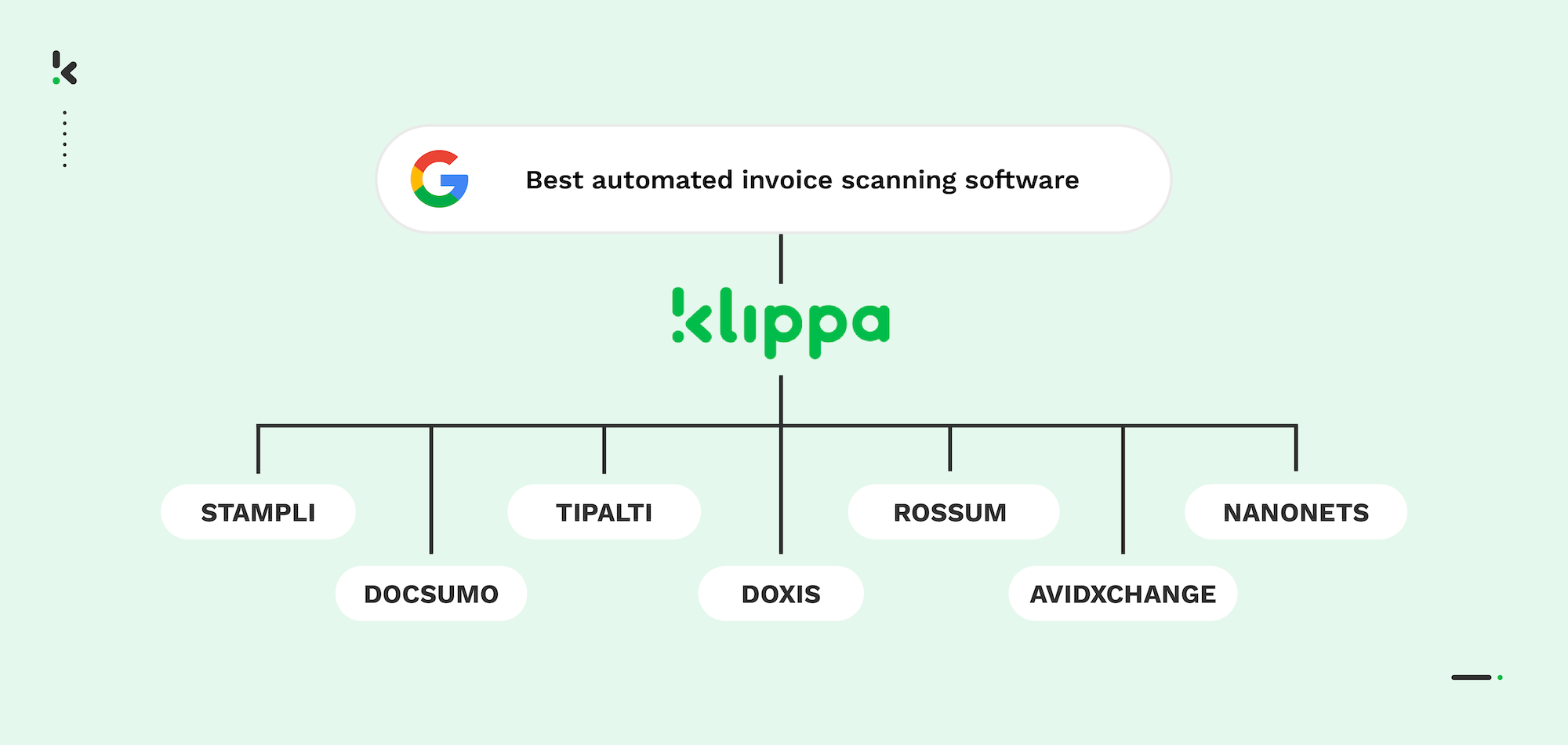

In this guide, we compare the best invoice scanning solutions in 2026, focusing on accuracy, automation features, integration capabilities, compliance, and ease of use, so you can choose the right fit for your accounts payable processes.

Key Takeaways – The Best Automated Invoice Scanning Tools

- Klippa DocHorizon – AI OCR with fraud detection, robust compliance, and flexible integrations.

- Doxis – Enterprise workflows with multilingual invoice capture and classification.

- Tipalti – End-to-end AP automation platform with advanced OCR and global payment capabilities.

- Rossum – Template-free AI-powered invoice capture for diverse layouts.

- Nanonets – Trainable AI OCR for structured and unstructured invoice formats.

- AvidXchange – Full AP suite with PO matching and fraud detection.

- Docsumo – Flexible AI document processing tailored for finance workflows.

- Stampli – AP automation that centralises invoice management for collaboration.

What is Automated Invoice Scanning Software?

Automated invoice scanning software uses OCR and AI to read invoice data from PDFs, scans, or images, converting it into structured, machine-readable formats for accounts payable workflows.

These solutions automate data capture for fields such as invoice numbers, dates, vendor details, line items, taxes, and totals, then integrate this data directly into ERP or accounting systems. This eliminates manual entry, reduces errors, speeds approvals, and improves compliance.

Top Tools for Automated Invoice Scanning in 2026

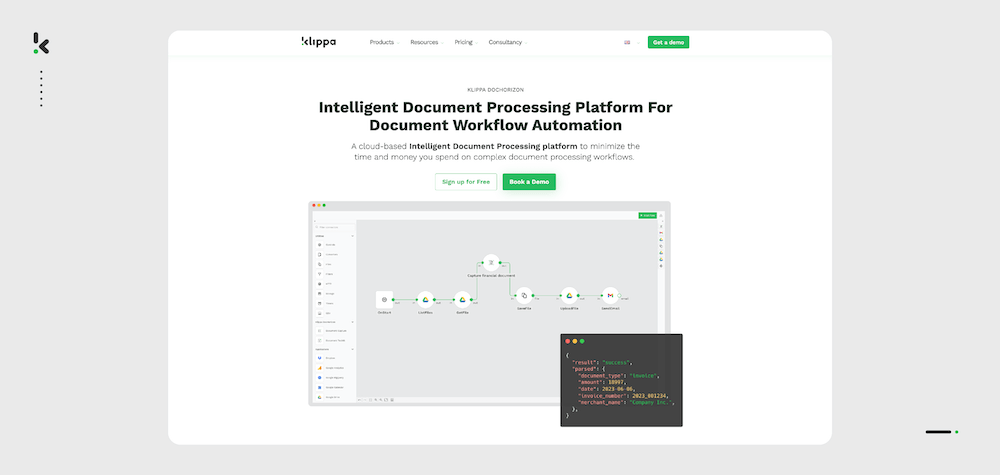

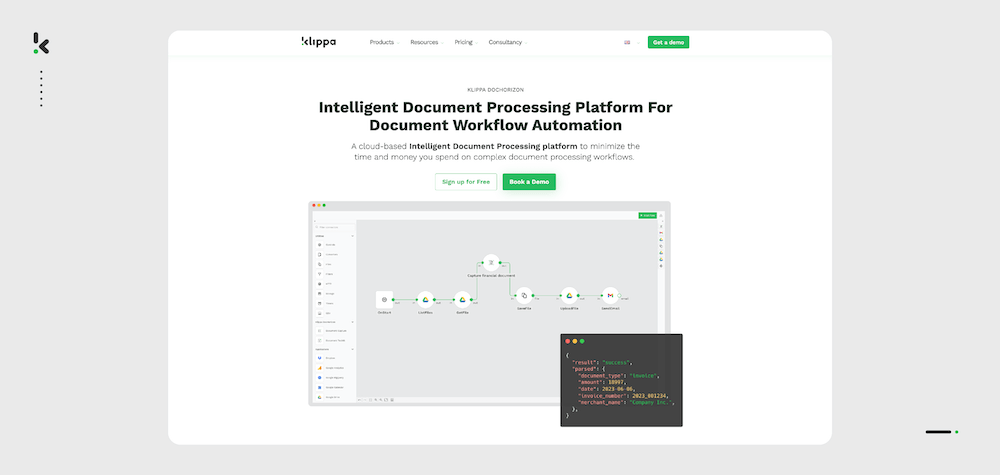

1. Klippa DocHorizon

Klippa DocHorizon is an intelligent document processing platform built to streamline invoice capture and AP automation. It uses advanced AI OCR to extract data from diverse invoice layouts without templates and includes built-in fraud detection to flag duplicates or suspicious entries.

Multi-language support, flexible integrations with ERP and accounting software, and robust compliance make it ideal for global operations.

Key Features

- 95%+ AI OCR accuracy

- Fraud detection and authenticity checks

- Support for multiple languages and currencies

- Bulk processing capabilities

- ERP and accounting software integrations

Pros

- Enterprise-grade compliance

- Fast onboarding and integration

Cons

- Advanced features may require setup time

- Best suited for medium-to-high invoice volumes

Best for: Organizations needing secure, scalable AP automation with fraud prevention.

2. Doxis

Doxis offers enterprise-grade document management with AI-powered invoice scanning workflows. It captures invoices in multiple languages, classifies them automatically, and routes them through approval chains.

Integrations with ERP platforms like SAP make it a natural fit for complex AP environments.

Key Features

- Multilingual OCR

- Automatic invoice classification

- Role-based access controls

- ERP integration

- Workflow management

Pros

- Strong compliance features

- Highly customizable workflows

Cons

- Higher learning curve for full deployment

- Primarily designed for large organizations

Best for: Enterprises with regulated environments and multi-entity AP workflows.

3. Tipalti

Tipalti is an end-to-end AP automation solution that includes invoice scanning, payment processing, supplier management, and global compliance.

Its AI learns from corrections to improve OCR accuracy over time.

Key Features

- AI-powered OCR invoice capture

- Global payment automation

- Supplier onboarding tools

- Compliance with payment regulations

- ERP integrations

Pros

- Comprehensive AP automation suite

- Continuous OCR improvement

Cons

- Higher cost for smaller businesses

- Broad focus beyond invoice scanning

Best for: Global businesses seeking a complete AP automation solution.

4. Rossum

Rossum’s AI OCR platform captures invoice data without predefined templates, making it ideal for varied supplier formats. Its workflow automation reduces manual intervention and integrates easily with AP systems.

Key Features

- Template-free data capture

- AI learning to improve accuracy

- Real-time validation

- API and integration options

- Approval workflow automation

Pros

- Flexible for diverse layouts

- Robust automation tools

Cons

- May require tuning for uncommon layouts

- Some advanced features are enterprise-tier

Best for: Businesses with multiple supplier formats and high-volume invoices.

5. Nanonets

Nanonets offers customizable AI OCR models to handle both structured and unstructured invoices. It supports multi-language capture and integrates with ERP or accounting platforms.

Key Features

- Trainable AI OCR models

- Multi-language support

- ERP and accounting integrations

- Bulk processing

- API-first platform

Pros

- Highly customizable extraction logic

- Good scalability

Cons

- Requires technical expertise for customization

- Smaller library of ready templates

Best for: Large organizations with unique invoice formats.

6. AvidXchange

AvidXchange provides AP automation with scanning, PO matching, fraud detection, and approval workflows. It integrates with over 200 accounting systems.

Key Features

- AI-powered invoice capture

- Purchase order matching

- Fraud detection tools

- ERP/accounting integrations

- Approval workflow automation

Pros

- Strong AP feature set

- Wide integration coverage

Cons

- Best ROI at medium-to-high volumes

- Advanced features may be overkill for small teams

Best for: Growing companies needing comprehensive AP features.

7. Docsumo

Docsumo’s AI OCR platform extracts key fields from invoices and other finance documents quickly and accurately. It offers flexible automation workflows for AP teams.

Key Features

- Pre-trained AI models

- Custom field mapping

- Bulk processing

- API integrations

- Workflow automation

Pros

- Fast deployment

- Strong accuracy for finance documents

Cons

- Smaller ecosystem compared to larger AP suites

- Limited mobile features

Best for: Teams needing quick, flexible invoice extraction.

8. Stampli

Stampli centralises invoice management, discussion, and approvals in one platform. Its OCR engine captures invoice data, and its collaboration features keep communication in context.

Key Features

- OCR invoice capture

- In-platform communication threads

- Role-based permissions

- ERP/accounting integrations

- Approval workflows

Pros

- Strong collaboration tools

- Easy for non-technical users

Cons

- Narrower focus compared to full AP suites

- Limited advanced automation

Best for: Teams needing collaborative invoice management.

Key Features to Consider in 2026

Choosing automated invoice scanning software for accounts payable isn’t just about replacing manual data entry. The right platform should match your workflow volume, integration requirements, and compliance needs, while providing the flexibility to adapt as your vendor base or internal processes evolve.

Here are the key factors AP leaders are evaluating most often in 2026:

- Accuracy & Field Coverage: Beyond basic fields like invoice number and total amount, modern AP scanning tools should reliably capture line items, tax details, payment terms, purchase order numbers, and vendor-specific identifiers. Look for OCR engines delivering ≥95% accuracy and AI-powered validation to reduce manual checks.

- Workflow Automation: Invoice scanning should fit seamlessly into automated approval and payment workflows. Platforms should route invoices to the right approvers, flag exceptions, and match scanned data to purchase orders or contracts automatically.

- Fraud Detection & Data Validation: Advanced systems can spot duplicate invoices, irregular payment amounts, and mismatched totals before they reach the payment queue. Fraud detection is particularly important for large, multi-entity AP operations.

- Integration with Finance Systems: The best solutions integrate directly with your ERP, AP automation tools, or accounting platforms like SAP, Oracle NetSuite, QuickBooks, or Sage Intacct, ideally through native connectors or robust APIs.

- Handling Diverse Formats: Invoices arrive in many forms: PDF, scanned image, email attachment, or even paper-based formats digitized via mobile apps. Multi-format support ensures data capture continuity across all sources.

- Multi-Language & Multi-Currency Support: Global AP teams need tools that handle documents in multiple languages and currencies, including proper recognition of regional tax structures and date formats.

- Scalability for High Volumes: Ensure the system maintains speed and performance at peak processing periods, such as month-end close or seasonal spikes. Batch scanning and queue management are critical here.

- Security & Compliance: Vendors should meet ISO 27001, SOC 2, and GDPR standards, with encryption in transit and at rest, role-based access control, and full audit trails for payment security.

- Ease of Use: An intuitive interface simplifies onboarding, minimizes training, and helps more team members use automation features effectively, even those without deep technical backgrounds.

Our Top AP Scanning Choice for 2026: Klippa DocHorizon

When we compare automated invoice scanning platforms, Klippa DocHorizon consistently stands out. It pairs high-accuracy AI OCR (95%+) with built-in fraud detection, multi-language and multi-currency support, and enterprise-grade compliance.

The no-template AI adapts to your suppliers’ invoice formats automatically, while integrations with ERP and AP systems ensure scanned data flows directly into payment workflows without disruption. Whether you process hundreds or tens of thousands of invoices monthly, Klippa DocHorizon is designed to scale alongside your needs.

Note: For teams seeking broader spend management functionality, Klippa also offers Klippa SpendControl, combining automated invoice processing, expense claims, approval flows, and corporate credit cards.

If you’re ready to see how it could transform your accounts payable process, you can request a demo or schedule a call with our team of experts.

FAQ

Most modern solutions can process PDFs, scanned images, email attachments, and invoices captured via mobile devices.

Yes. Advanced AI OCR engines extract detailed fields such as tax rates, descriptions, unit prices, and totals.

Top platforms achieve accuracy rates between 95–99%, with AI learning improving results over time.

Fraud detection algorithms flag duplicate invoices, altered amounts, or mismatched PO data before payment is approved.

Yes. Most leading solutions offer native connectors or open APIs for popular ERP and accounting platforms.

Absolutely. Batch scanning and queue management are standard in enterprise-focused AP automation tools.

Select vendors with encryption, role-based access controls, and compliance with ISO 27001, SOC 2, and GDPR standards.

Klippa offers €25 in free credits to get started with our invoice OCR solution. Once the free credits are used, we offer custom pricing tailored to your invoice volume and complexity. Request a quote here.