In 2026, insurance companies face growing pressure to deliver faster and more accurate services. Many are still weighed down by manual document handling, such as claims, policy applications, and compliance files that take hours or even days to process. This slows operations, increases costs, and risks frustrating customers who expect instant digital experiences.

Manual input is also highly error-prone, with a study by Decerto showing error rates between 1 and 12 percent, leading to incorrect policy details, financial losses from under- or overpayments, and potential compliance issues.

Manual workflows are not only slow but also error-prone and risky. A single misplaced or misread document can lead to compliance breaches or incorrect payouts, causing financial and reputational damage. Competitors who adopt automation are already processing claims in hours rather than days, setting higher expectations for customer service.

The good news is that AI-powered tools like Intelligent Document Processing (IDP), Optical Character Recognition (OCR), and Natural Language Processing (NLP) now make it possible to automatically capture, extract, and process insurance documents with speed and accuracy. In this guide, you will learn how to implement automation, the types of documents you can streamline, and the real-world benefits insurance companies are experiencing in 2026.

Key Takeaways

- Insurance document automation uses AI, OCR, NLP, and IDP to process documents quickly and accurately without manual work.

- Manual workflows are slow, error-prone, costly, and increase the risk of fraud and compliance breaches.

- Fraud prevention is a core benefit as AI can detect duplicates, flag inconsistencies, and identify suspicious claims instantly.

- Automation can handle claims forms, policy applications, compliance reports, and customer correspondence more efficiently.

- Klippa DocHorizon offers a complete automation solution with multi-format processing, easy integrations, compliance-ready workflows, and advanced fraud detection.

What is Document Processing Automation in Insurance?

Document processing automation in insurance is the use of technology to capture, extract, classify, and route information from documents without manual intervention. It combines tools such as OCR, NLP and IDP to manage large volumes of data quickly and accurately.

In practice, this means that claims forms, policy applications, medical records, and compliance reports can be read and understood by software that recognises key fields, validates data, and sends it to the right system or team. Instead of spending hours manually entering information, insurance staff can focus on decision-making and customer support.

By leveraging automation, insurers can reduce errors, lower operational costs, speed up service delivery, and maintain compliance with industry regulations. The technology works across multiple file formats and languages, making it ideal for the diverse and often complex documents handled in the insurance sector.

Why Automate in 2026? Latest Industry Trends

The insurance sector is undergoing rapid transformation in 2026, driven by both technological advancements and market pressures. AI and IDP platforms have matured, becoming more affordable and easier to integrate into existing workflows. Regulatory bodies are demanding faster and more accurate compliance, while customers expect quicker responses and transparent communication.

Automation technology is evolving at the right time. OCR and NLP software are now capable of handling complex, multilingual documents with high accuracy. Cloud-based solutions make deployment faster and more cost-effective, while API integrations allow automation tools to connect directly with policy management and claims administration systems.

Challenges in Manual Processing

Manual document workflows create bottlenecks that slow down insurance operations. Claims can take days or weeks to process due to the need for manual review and data entry. Human errors are common, leading to incorrect payouts, misclassified documents, or compliance breaches. The high labour costs associated with repetitive processing tasks make scaling difficult without adding more staff. Moreover, misplaced or incomplete documentation can cause delays in regulatory audits, increasing operational risk.

Fraud Prevention

Insurance fraud costs the USA $308.6 billion annually, and manual processing makes it harder to detect suspicious patterns. Automation tools use AI algorithms to flag inconsistencies, identify duplicate claims, and cross-check submitted documents against known risk databases in seconds. By integrating fraud detection into the document processing workflow, insurers can spot red flags early, reduce payout errors, and protect both profitability and brand reputation.

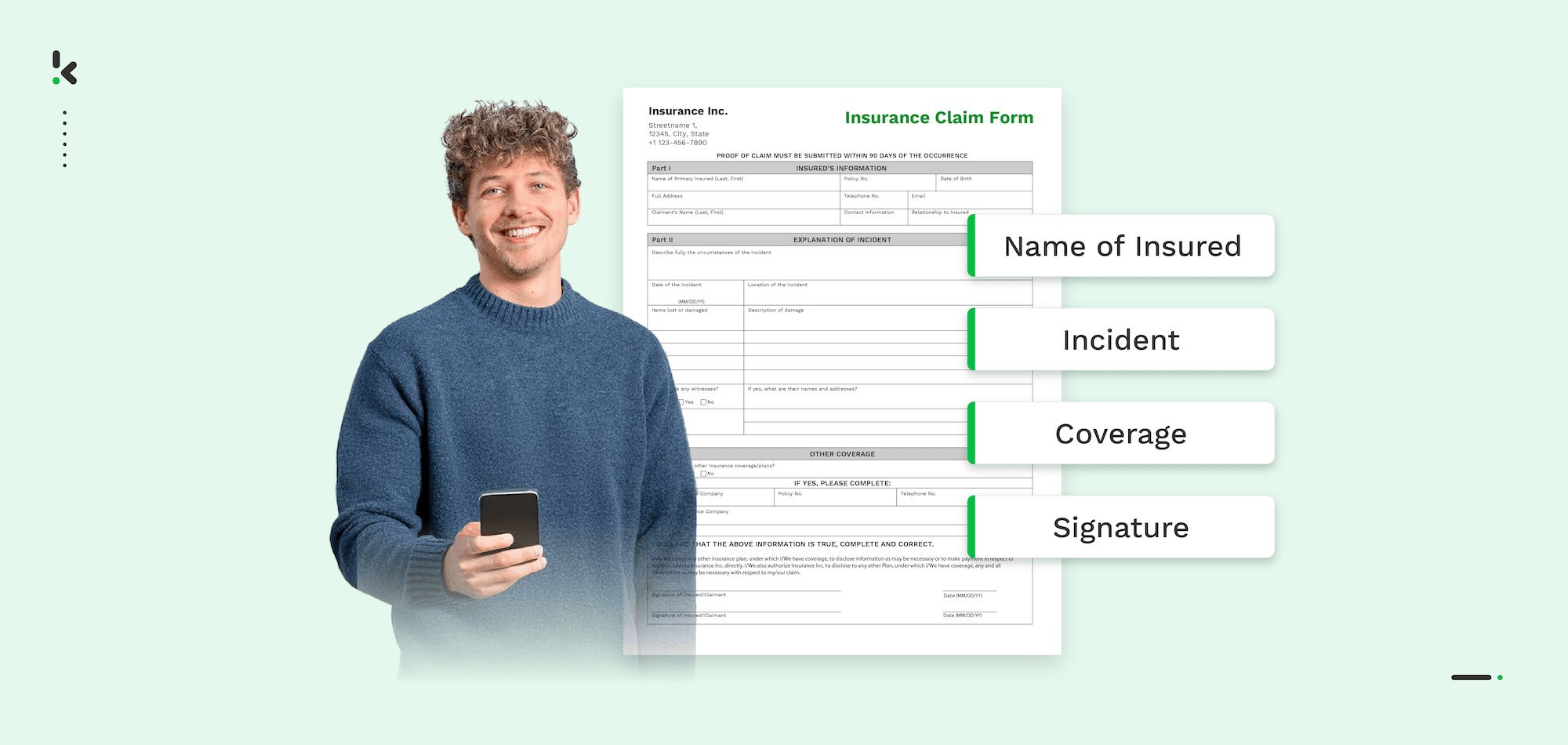

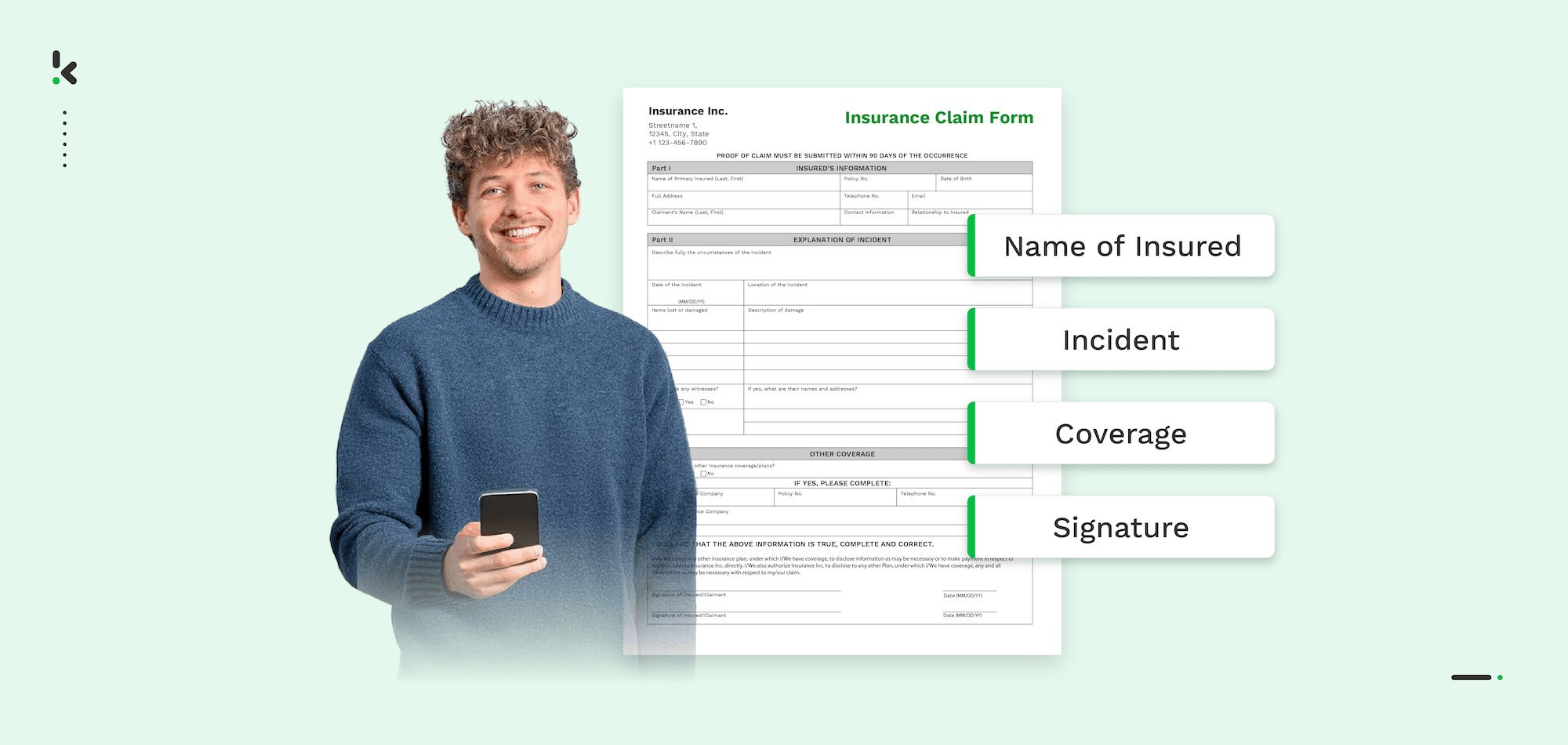

Document Types That Benefit Most from Automation

Insurance companies handle a wide range of documents every day, many of which are repetitive and data-heavy. Automating the processing of these documents allows for faster handling, higher accuracy, and reduced operational costs.

Common document types that benefit from automation include:

- Claims forms: Health, property, or life insurance claims containing customer details, incident descriptions, and supporting evidence. Or standardized documents like the European Accident Statement.

- Policy applications: New customer applications and renewals that require data capture, validation, and risk assessment.

- Supporting documents: Medical records, repair invoices, police reports, and other files attached to claims or policies.

- Compliance and audit records: Regulatory filings, disclosures, and internal compliance reports that must meet strict format and accuracy standards.

- Customer correspondence: Letters, emails, chat transcripts, and feedback forms that need categorizing and archiving.

By automating these document types, insurance companies can streamline their workflows from intake to final approval, keeping customer service consistent while ensuring that compliance and accuracy remain intact.

Step-by-Step: How to Automate Document Processing in Insurance

Implementing document processing automation requires a structured approach to ensure a smooth transition from manual workflows to technology-driven efficiency. Below is a proven six-step process tailored for the insurance industry.

1. Identify High-Impact Processes

Start by pinpointing areas where manual processing consumes the most time and resources. Common high-impact processes include claims handling, policy underwriting, and compliance audits. Focusing on these first will deliver the fastest return on investment.

2. Select the Right Automation Tools

Look for solutions that combine multiple capabilities such as Optical Character Recognition (OCR) for data extraction, Natural Language Processing (NLP) for understanding document context, Intelligent Document Processing (IDP) for end-to-end automation, and Robotic Process Automation (RPA) for workflow execution.

3. Digitize Existing Records

Convert physical files and non-searchable PDFs into machine-readable formats using OCR. This not only speeds up future processing but also creates valuable historical data that can be analyzed to improve decision-making.

4. Implement Automated Data Capture

Integrate automation tools to capture and process documents from multiple sources, including email attachments, customer portals, and mobile app submissions. This ensures that information enters your system in a structured format from the very beginning.

5. Integrate with Core Insurance Systems

Connect your automation software to policy management platforms, CRM systems, and claims administration tools using APIs. Seamless integration ensures that extracted data flows automatically to the right destination without manual intervention.

6. Monitor and Optimize Performance

Use analytics and reporting features to track processing times, accuracy rates, and compliance metrics. Regular monitoring helps identify bottlenecks and allows for continuous improvement of automated workflows.

Benefits Your Insurance Company Will See from Automation

Automating document processing delivers tangible advantages that go beyond speed. By reducing manual work, insurers can improve efficiency, accuracy, and customer satisfaction while lowering operational costs.

Key benefits include:

- Faster Turnaround Times: Claims and policy applications can be processed in hours instead of days, improving customer trust and competitiveness.

- Higher Accuracy: Automated extraction reduces human errors in data entry, minimizing incorrect payouts or policy handling mistakes.

- Cost Savings: Lower labour costs and reduced need for repetitive processing work can cut operational expenses by up to 60 percent.

- Enhanced Fraud Detection: Some software can rapidly flag duplicate claims, detect inconsistencies in submitted documents, and cross-check information against fraud databases.

- Improved Compliance: Automation software validates documents against regulatory requirements, reducing the risk of breaches and fines.

- Better Scalability: Workflows can handle increased volumes without the need to proportionally grow staff numbers.

- Enhanced Customer Experience: Faster responses and fewer errors lead to higher satisfaction and increased renewal rates.

How Klippa DocHorizon Can Help You Automate Insurance Document Processing

Klippa DocHorizon is an Intelligent Document Processing (IDP) solution that is built to handle high-volume, data-sensitive workflows like those in the insurance industry. By combining OCR, NLP, and automated validation, Klippa DocHorizon can transform the way your business processes documents from start to finish.

Why Klippa is a strong choice for insurers:

- Multi-format compatibility: Capture and process information from PDFs, scanned documents, images, emails, and more, without manual conversion.

- Multilingual capabilities: Read and understand documents in over 100 languages, making it ideal for international insurance providers and global customers.

- Advanced Fraud Detection: Automatically flag suspicious claims, identify duplicate submissions, and detect inconsistencies by cross-referencing data against fraud databases.

- Seamless integrations: Connect easily with policy administration software, CRM platforms, claims management systems, and regulatory reporting tools through API connections.

- Compliance-ready workflows: Meet industry regulations with automated data validation, secure storage, and ISO-certified security standards.

- Scalable performance: Handle thousands of documents per day without adding operational staff, keeping your workflow efficient and cost-effective.

With Klippa DocHorizon, insurers can reduce turnaround times from days to hours, eliminate costly errors, and build a consistent customer experience that stands out in a competitive market.

To experience these benefits firsthand, book a free demo or contact our team to discover how DocHorizon can streamline your document processing, enhance fraud prevention, and ensure full compliance while reducing costs.

FAQ

It is the use of technologies such as OCR, NLP, and Intelligent Document Processing (IDP) to capture, extract, and route information from insurance documents without manual input. This speeds up operations, improves accuracy, and reduces costs.

Common examples include claims forms, policy applications, medical records, invoices, compliance reports, and customer correspondence. Automation can handle both structured and unstructured data from multiple sources.

Modern automation systems can achieve accuracy rates above 95 percent, especially when combined with machine learning models trained on industry-specific data.

Yes. Automated validation can check documents against compliance requirements, ensure correct data formats, and generate audit-ready reports, reducing the risk of errors and fines.

Costs vary depending on the scale and complexity of your workflows. Cloud-based solutions like Klippa offer scalable pricing, allowing insurers to start small and expand as needed.

Some solutions can be deployed in weeks, especially when using cloud-based platforms with existing integrations for policy administration and claims management systems.

No. Automation handles repetitive and time-consuming tasks, freeing staff to focus on customer service, decision-making, and complex case evaluations.