Inflation, labor shortages, and a lack of investment capital. If you’re a top executive in the Netherlands, chances are at least one of these keeps you awake at night.

To dig deeper into what’s really going on at the C-level, Klippa surveyed 100 Dutch executives, most of them CEOs and CTOs, leading organizations from startups to billion-dollar enterprises. We wanted to know: What challenges are hitting hardest right now? And do decision-makers believe AI can help?

The results reveal a clear picture: while executives face serious pressure from labor gaps and capital scarcity, they also see AI and automation as a powerful way forward. In fact, nearly 8 in 10 leaders believe AI can help solve their biggest problems, and the vast majority plan to invest more in it.

In this article, we’ll break down the top challenges Dutch executives face, how perspectives shift by region and company type, and why AI is emerging as the solution leaders trust most.

Report Highlights: Top Executive Challenges & the State of AI

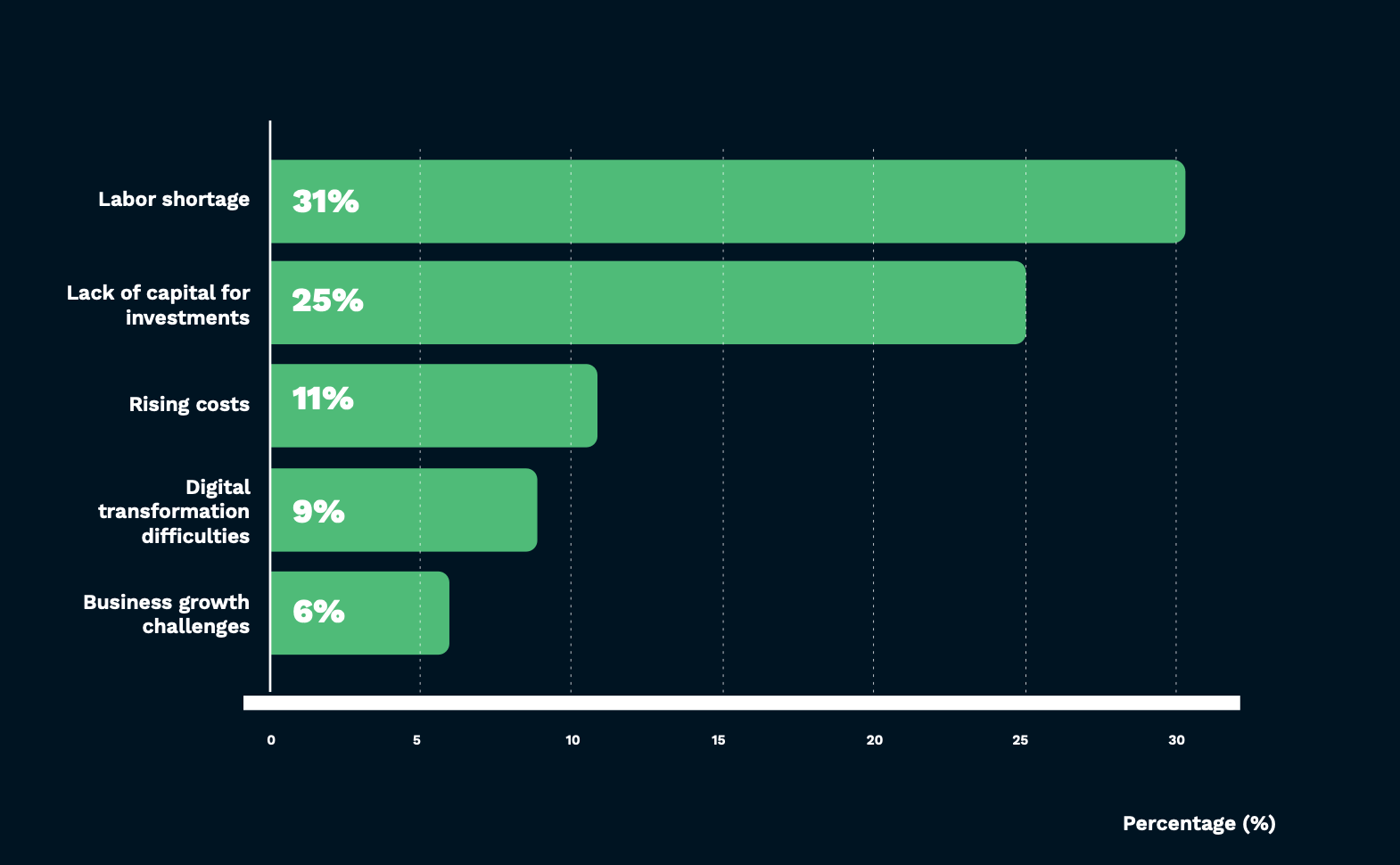

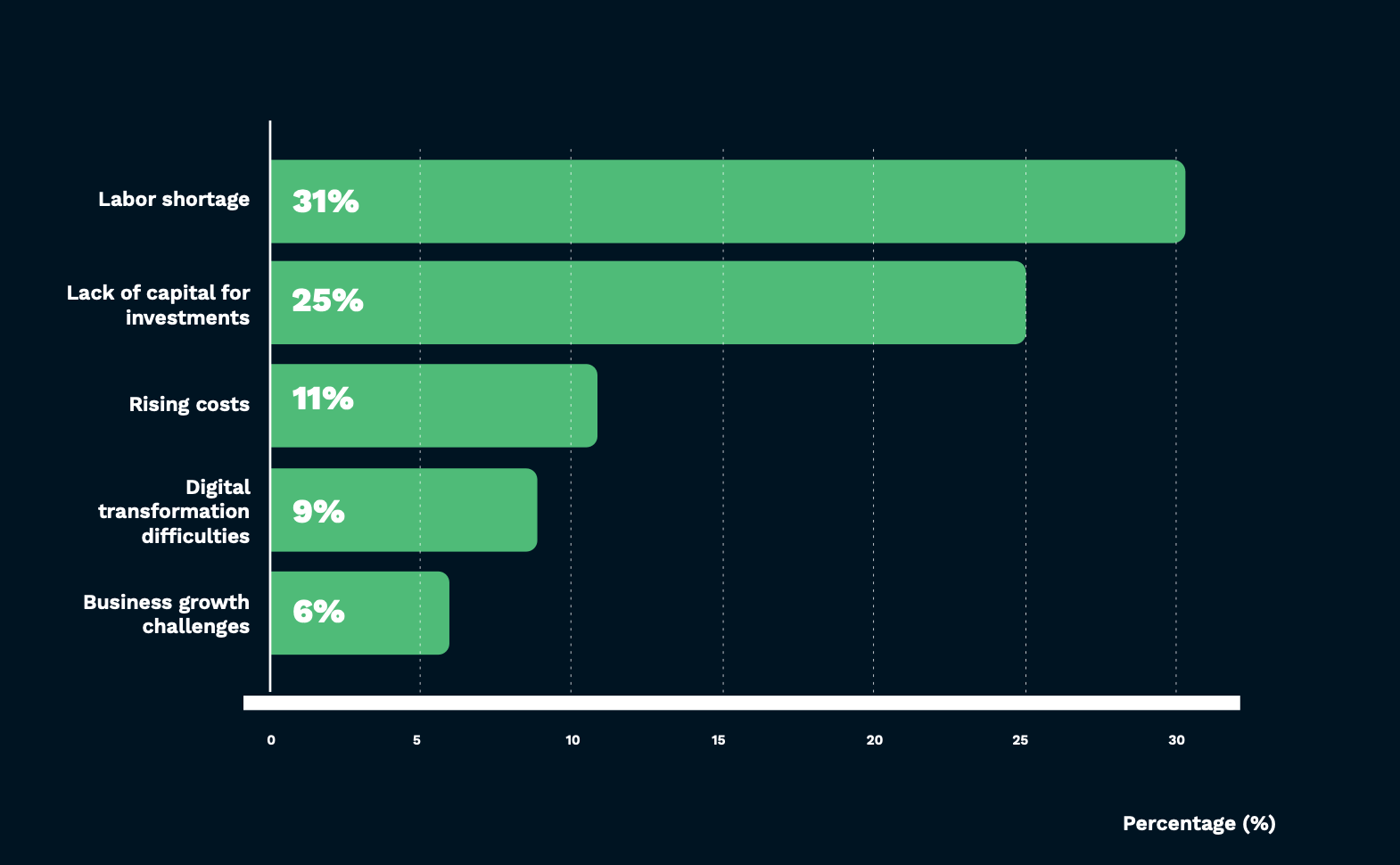

- 31% of Dutch executives cite labor shortages as their biggest challenge

- 25% struggle most with lack of capital for investments

- 13% highlight rising costs as a top concern

- 42% of executives outside the Randstad face labor shortages vs. 29% in the Randstad who struggle more with capital

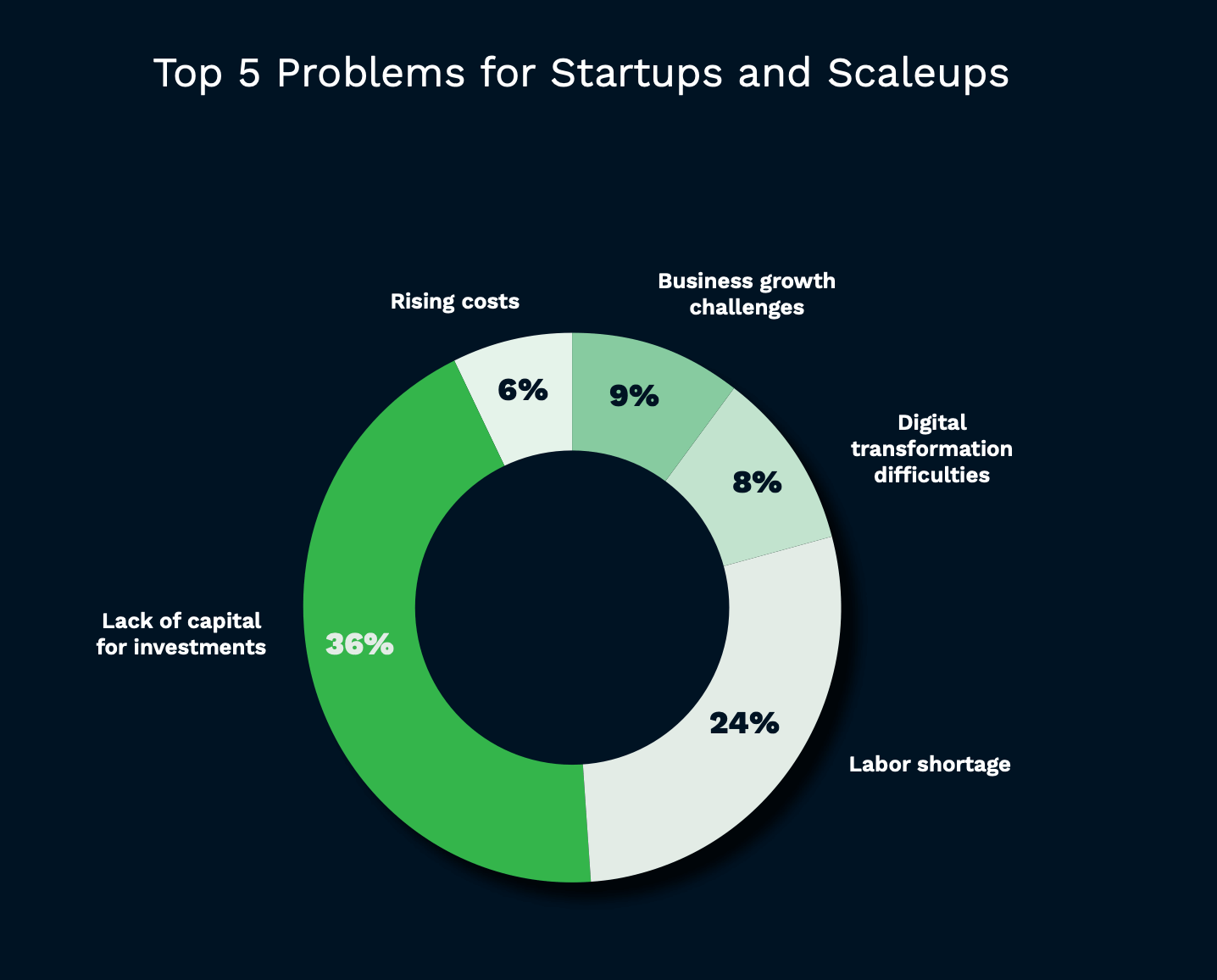

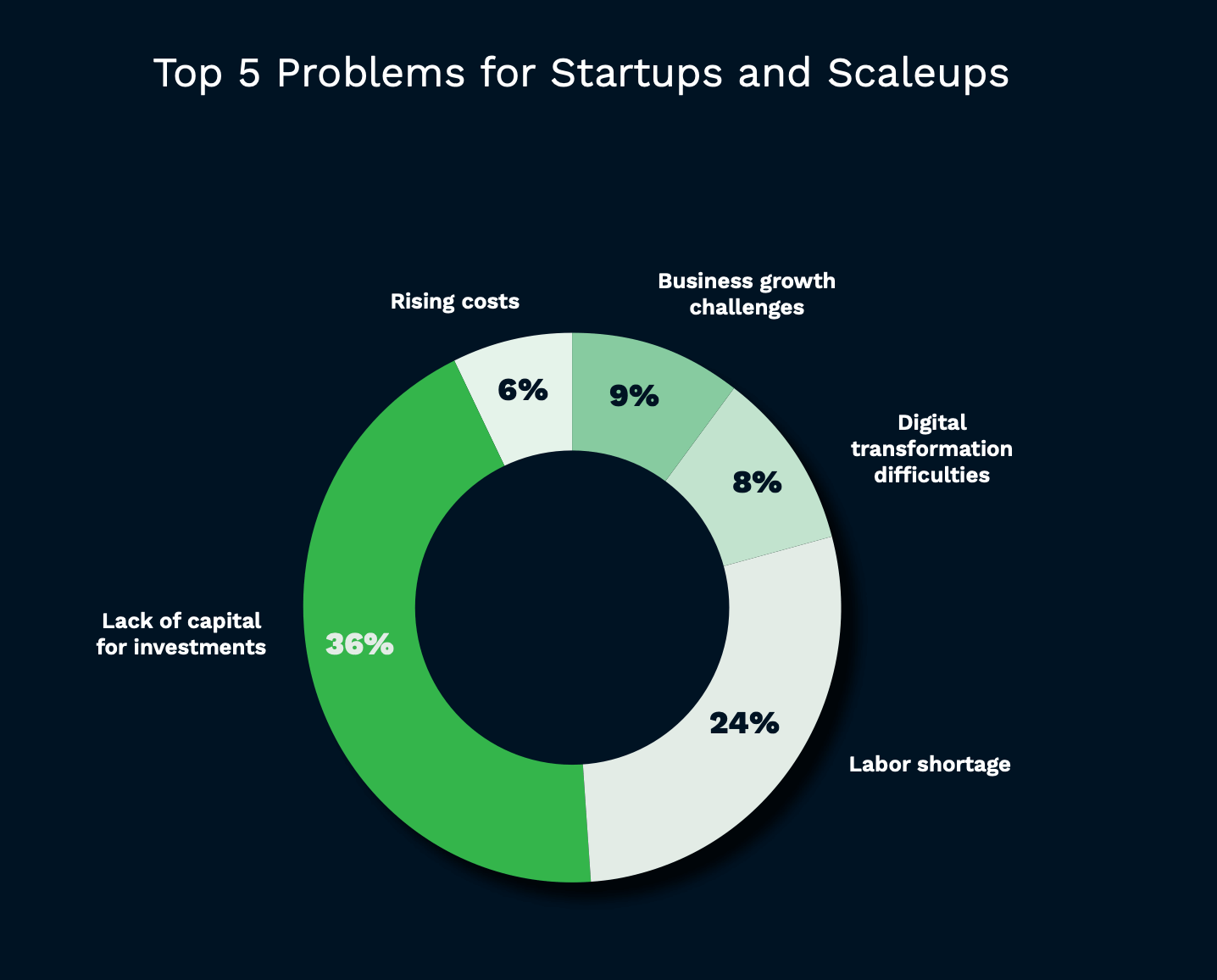

- 36% of startups & scaleups are burdened by lack of capital, while 47% of SMEs/enterprises wrestle with talent gaps

- 78% of executives trust AI will help solve their challenges

- 85% plan to increase AI investments; nearly 20% expect to double budgets

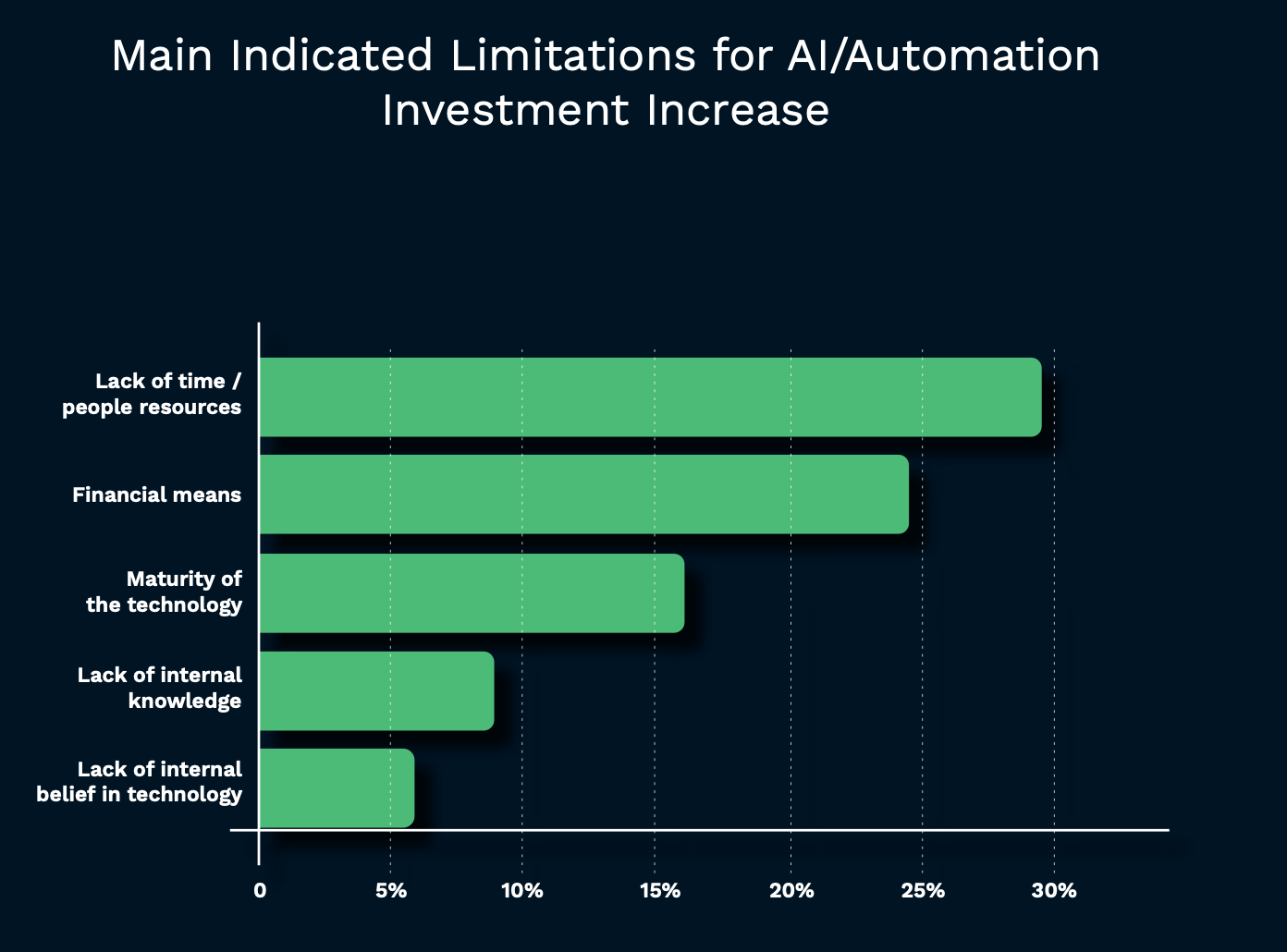

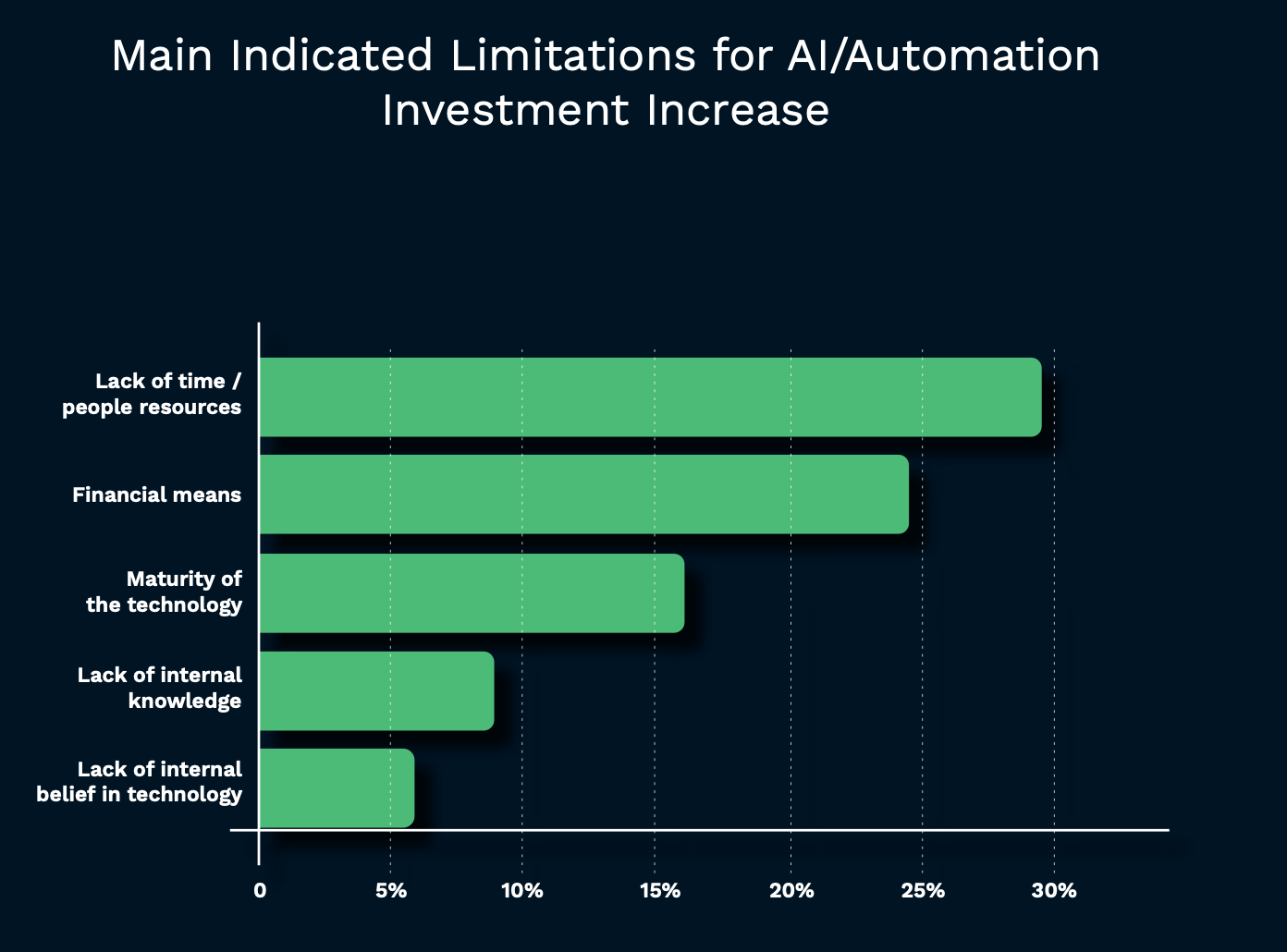

- Main barriers to adoption: lack of time & people (29%), high costs (24%), tech maturity (16%)

Bottom line: Dutch executives are squeezed between talent shortages and capital constraints, but most believe AI is the lever that can unlock growth.

The Top 3 Challenges Keeping Executives Awake at Night

Every leader has a different set of pressures, but in our survey, three themes rose above the rest: people, money, and costs.

- Labor shortages → The most pressing issue, named by 31% of executives. From finding skilled staff to keeping teams productive, the talent gap is the single biggest drag on growth.

- Lack of capital for investments → A close second at 25%. Executives told us that limited funding is delaying growth plans and innovation, especially in younger companies.

- Rising costs → Inflation may have slowed in the headlines, but it’s still a real headache in the boardroom. 11% flagged it as a top challenge, pointing to higher operational expenses and squeezed margins.

Taken together, these issues paint a picture of businesses caught in a squeeze: they can’t hire the people they need, they can’t always secure the money to invest, and they’re spending more to keep the lights on.

And yet, behind these challenges, leaders are already exploring solutions, from smarter recruitment and retention strategies to automation and AI.

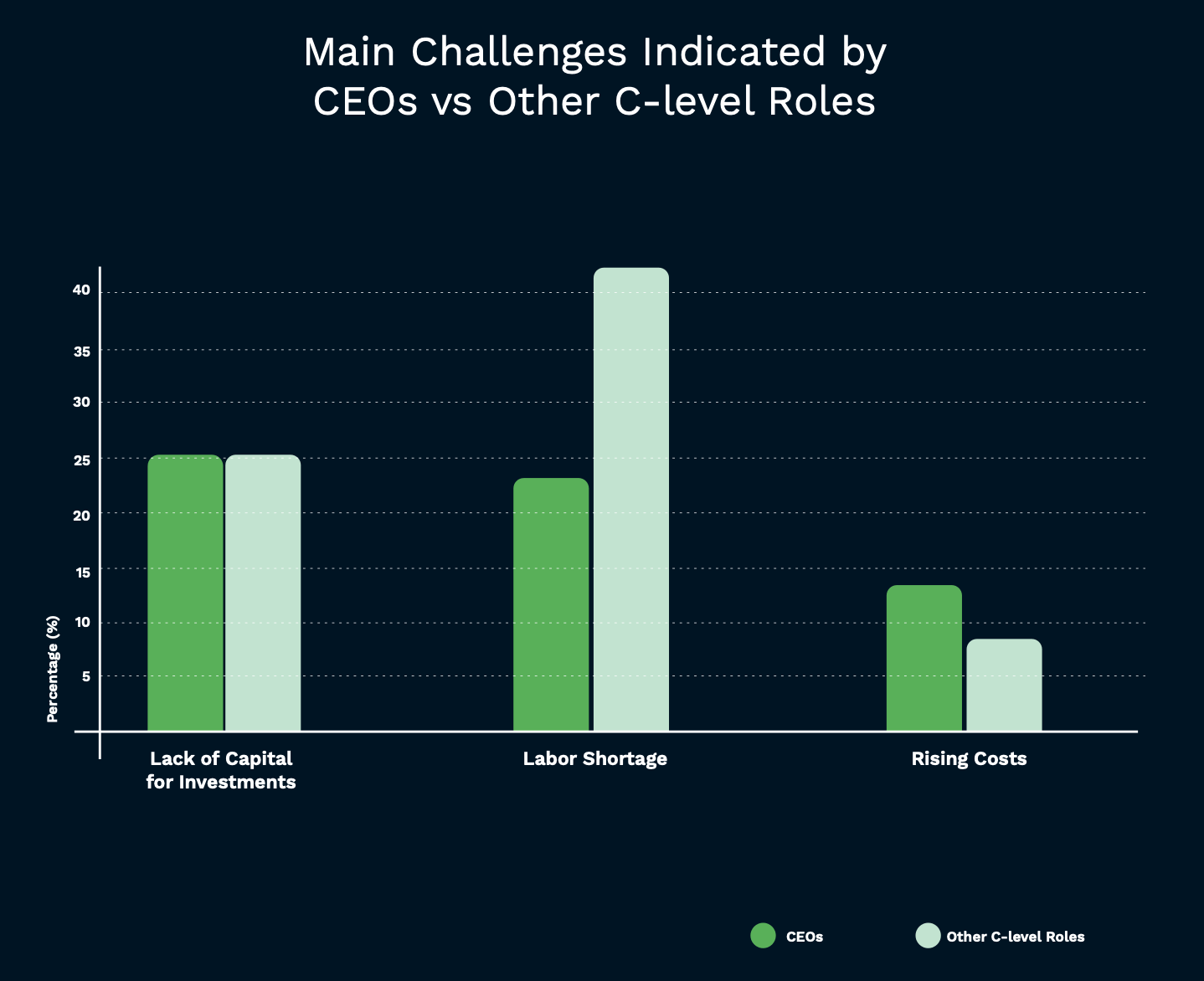

CEOs vs. Other C-Level Leaders: A Split View

Not all executives see the same problem when they look at their organizations. Our survey uncovered a clear divide between CEOs and their fellow C-level colleagues.

- CEOs (60% of respondents) ranked lack of capital for investments as their number one challenge, with 25% pointing to it as the biggest blocker. Labor shortages came in second at 23%. For many CEOs, securing funding is the difference between scaling and stalling.

- Other executives (like CTOs and CFOs) see things differently. 42% said labor shortages are the most urgent challenge, nearly twice as many as CEOs. For leaders closer to day-to-day operations, the talent gap feels sharper than the capital crunch.

The takeaway: while CEOs worry about how to fund future growth, their peers are more focused on the operational reality of too few skilled people to deliver it. Both perspectives matter, and both are fueling the search for solutions like AI and automation.

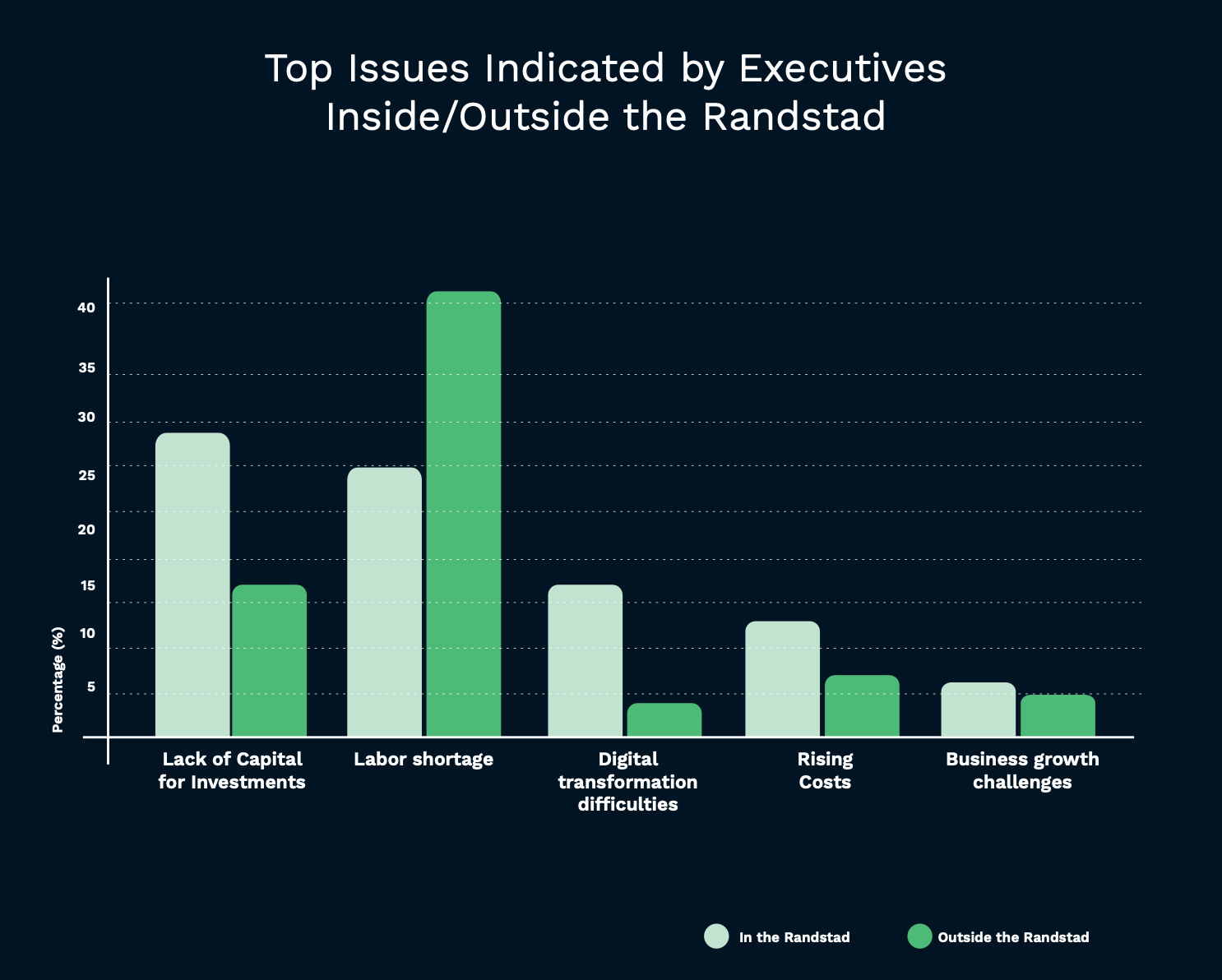

Randstad vs. the Rest: A Regional Divide

Location matters, and our research shows a sharp contrast between executives inside the Randstad and those outside it.

- In the Randstad → Executives are most concerned about capital shortages, with 29% naming lack of investment funds as their top challenge. Labor shortages still matter (25%), but they come second. In a region with easier access to talent, the bigger headache is finding the money to grow.

- Outside the Randstad → The picture flips. Here, 42% of leaders point to labor shortages as their number one issue, almost double the rate of their Randstad peers. For these companies, finding skilled people is far tougher than finding capital.

The divide is clear: where you’re based shapes how you see your biggest obstacle. In the Randstad, executives worry about fueling growth. Outside it, they worry about simply having the people to keep things running.

Company Size Matters: Startups vs. SMEs and Enterprises

Company maturity also shapes which problems feel most urgent.

- Startups and scaleups → More than a third (36%) say their biggest challenge is securing enough capital to invest. Whether it’s funding growth, scaling products, or attracting investors, money is the make-or-break factor for younger companies.

- SMEs and enterprises → Nearly half (47%) point to labor shortages as their top challenge. With more stable revenue streams, these firms aren’t struggling for capital — they’re struggling to find the people to execute on their ambitions.

In short: startups worry about raising money, while larger companies worry about filling seats. Both face bottlenecks, just in very different forms.

Shared Solutions Executives Are Already Using

Despite the pressure, Dutch executives aren’t standing still. In our survey, leaders shared the strategies they’re already putting in place to tackle today’s challenges:

- Recruitment and talent initiatives → From partnering with universities to boosting employee engagement, many executives are doubling down on finding and keeping skilled people. Automation in HR is also on the rise.

- Technology and innovation → Companies are investing in new tools, migrating to modern systems, and using digitalization to reduce inefficiencies.

- Funding and capital strategies → Some leaders are exploring debt or equity financing, while others look to organic growth, crowdfunding, or new partnerships to bridge capital gaps.

- Cost reduction measures → Executives also point to stricter budgeting, outsourcing, or faster revenue generation as ways to balance the books.

The message is clear: while external pressures remain, leaders are actively experimenting with solutions. And across nearly all categories, technology and automation keep emerging as common threads.

Executives Pin Their Hopes on AI

For all the challenges they face, Dutch executives share one big source of optimism: artificial intelligence.

- 78% of decision-makers believe AI and automation can help solve at least part of their main business challenges.

- 85% plan to increase their investment in AI in the near future.

- Nearly 1 in 5 expect to double their AI budgets, signaling strong confidence in the technology’s potential.

Executives told us they see AI as more than a buzzword. It’s a practical tool to streamline operations, reduce human error, and cut costs. From smarter document processing to data-driven decision-making, AI is moving rapidly from “experimental” to “essential.”

In boardrooms across the Netherlands, AI isn’t just seen as an opportunity. It’s becoming a strategy for survival and growth.

AI Perspectives by Age

Not every executive views AI through the same lens. Our survey shows clear differences by generation:

- Under 30 → 100% of respondents trust AI to help solve business challenges.

- Under 40 → 94% plan to increase AI investments, showing strong confidence among younger leaders.

- 50 and over → Trust starts to dip. Only 71% believe AI will help, and just 79% plan to increase investments.

The pattern is clear: younger executives see AI as a natural part of their strategy, while older leaders show more hesitation. For companies, this means internal buy-in may depend as much on who’s in the room as on the technology itself.

Barriers to AI Adoption Are Still Real

Belief in AI is high, but adoption isn’t without its hurdles. Executives cited several reasons why turning enthusiasm into action is harder than it looks:

- Time and staff shortages → 29% say they simply don’t have the people or bandwidth to roll out AI initiatives.

- Cost concerns → 24% find AI and automation solutions expensive, especially when ROI isn’t immediate.

- Technology maturity → 16% worry the tools aren’t advanced enough yet for their needs.

- Internal expertise gaps → 9% admit they don’t have the in-house skills to manage AI adoption.

- Resistance to change → 6% still see cultural pushback against new technology.

In other words, executives trust AI, but they need practical, accessible solutions and trusted partners to overcome these barriers. Without that, many projects risk stalling before they start.

Key Takeaways for Leaders

The survey makes one thing clear: Dutch executives are under pressure, but they’re not powerless.

- Acknowledge the split priorities: CEOs worry about funding, while other executives focus on talent gaps. Alignment at the top is essential before solutions can stick.

- Tailor strategies to context: Geography and company size change the picture. A startup in the Randstad won’t face the same hurdles as a mid-sized firm in the provinces.

- Move beyond firefighting: Inflation and rising costs are realities, but the bigger challenge is creating sustainable ways to grow despite them.

- Treat AI as strategy, not experiment: With nearly 8 in 10 executives already placing their trust in AI, the conversation should shift from if to how.

- Bridge the adoption gap: Barriers like cost, time, and internal expertise can be solved with the right partners, the right onboarding, and clear ROI targets.

For leaders, the real takeaway isn’t just that challenges are mounting. It’s that AI and automation are moving from optional tools to strategic necessities. The sooner organizations act, the stronger their position in navigating labor shortages, capital constraints, and cost pressures.

How Can Klippa Help?

The challenges Dutch executives face are big, from labor shortages to capital constraints. But the optimism around AI in our research shows a clear path forward: smarter, automated workflows that save time, reduce costs, and bridge talent gaps.

That’s exactly what Klippa DocHorizon delivers.

With Klippa, executives can:

- Automate manual processes and free up scarce talent for higher-value work.

- Cut operational costs by reducing errors, delays, and repetitive tasks.

- Detect risks early from fraudulent invoices to compliance gaps.

- Scale efficiently with flexible APIs and seamless integration into existing systems.

The result? Leaders don’t just believe in AI – they experience its impact, faster and with less risk.

Ready to see how AI can solve your team’s biggest challenges? Book a demo below and start turning your team’s biggest pain points into opportunities.

Frequently Asked Questions About Executive Challenges & AI

Because nearly a third (31%) of leaders say it’s their top challenge. Outside the Randstad, it’s even worse — 42% point to talent scarcity as the main barrier to growth.

In the Randstad, scaling is expensive. Twenty-nine percent of executives there cite lack of capital as their biggest problem, compared to just 17% outside the region.

Yes. For startups and scaleups, 36% say raising capital is the hardest part. SMEs and enterprises, meanwhile, struggle more with people — 47% cite labor shortages as their number one issue.

Seventy-eight percent believe AI will solve at least part of their challenges. They see it as a way to cut costs, reduce manual work, and boost efficiency.

Because practical barriers remain. Executives point to lack of time and staff (29%), high costs (24%), and doubts about technology maturity (16%).

It does. Every executive under 30 in our survey trusted AI to help, but among those over 50, trust dropped to just 71%.

Eighty-five percent plan to increase their budgets, and nearly 20% expect to double them — showing that AI is moving from pilot projects to strategy.

By removing the biggest barriers. With DocHorizon, executives can automate workflows, cut costs, and bridge labor gaps without long, complex rollouts.

Because the very issues leaders highlighted, labor shortages, rising costs, and efficiency bottlenecks, are exactly where Klippa’s AI-powered automation delivers value.

Klippa combines speed, accuracy, and easy integration. With flexible APIs and expert onboarding, executives don’t need extra staff or long projects to see results — a key advantage when time and talent are in short supply.