What’s really going on in finance departments today? We wanted to know, so we asked the people who live it every day.

Klippa surveyed 246 finance professionals across the UK, Germany, and the Netherlands. From CFOs to finance managers and analysts, we asked them what’s working, what’s broken, and where automation fits in.

The results? Frustratingly clear:

Finance teams are still drowning in manual work, especially in reporting, accounts payable, and tax.

Despite growing access to AI-powered tools, most departments haven’t automated the workflows that burn the most time. Even worse, many feel held back by internal knowledge gaps, cost concerns, or fear of change.

In this article, we’ll unpack the top insights from our Automation in Finance report, highlight what’s slowing down automation, and offer practical ways forward.

Key Takeaways from Klippa’s Finance Automation Research

- 59% of finance professionals say reporting & analysis is their biggest time drain.

- >50% of finance teams still process accounts payable manually.

- Only 35.9% have automated tax-related workflows.

- 63% are not satisfied with their current automation tools.

- 73.1% want their companies to invest more in automation.

- 41.4% encounter duplicate invoices every month.

- 46.7% deal with fraudulent invoices regularly.

Bottom line: Finance teams are ready for automation, but lack the tools, knowledge, and investment to get there.

Top Time Wasters in Finance (And Why They’re Still Manual)

Ask any finance professional what eats up most of their week, and the answer is rarely a surprise. It’s the repetitive, manual work that refuses to go away despite the rise of automation.

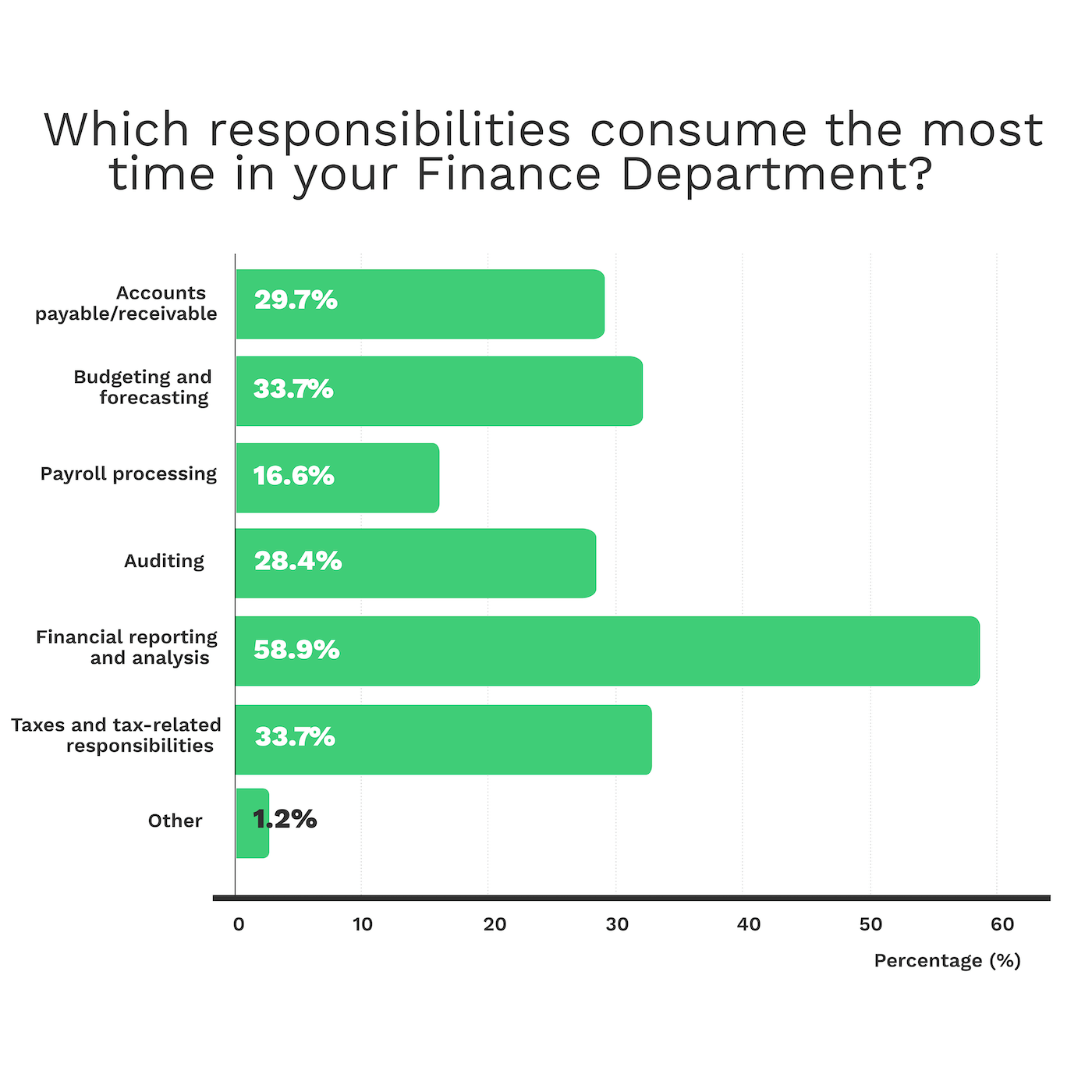

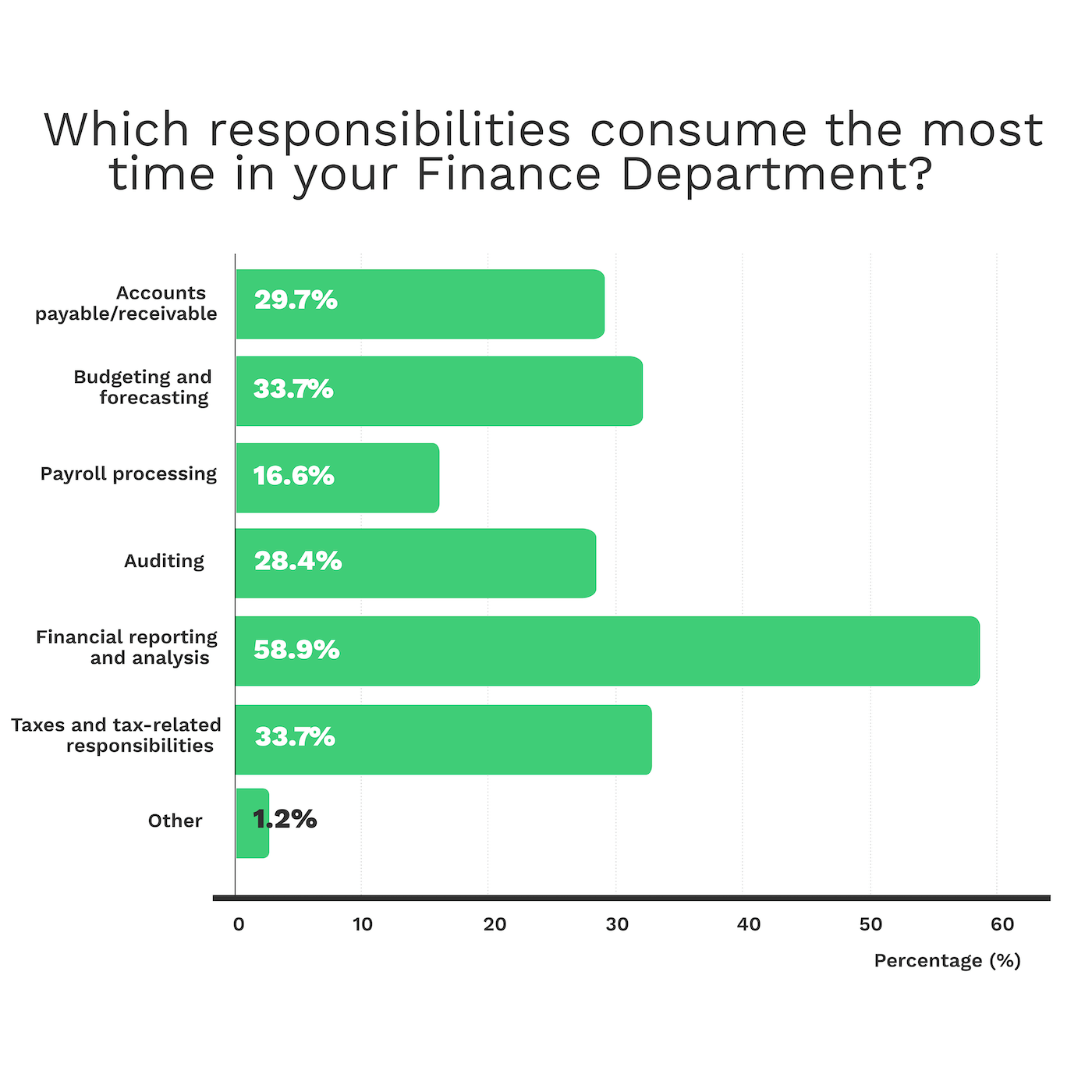

Here’s what our survey uncovered:

- Reporting & analysis → The biggest culprit by far, with 58.9% saying it’s their #1 time drain. Accurate reporting and financial statements are essential, but they’re also slow, manual, and error-prone when done without automation.

- Budgeting, forecasting, and tax → Roughly one in three finance professionals (33.7%) put these in their top frustrations. They’re complex, high-stakes, and still heavily Excel-driven in many companies.

- Accounts payable & receivable → Close behind, with 29.7% saying these processes take the most time. Think manual invoice entry, approvals, chasing payments — all areas ripe for automation.

- Payroll → Surprisingly low on the list at 16.6%. Why? Because payroll is already one of the most automated areas in finance.

The insight here is simple: the areas that waste the most time are often the ones that are the least automated. That’s the gap finance leaders need to close.

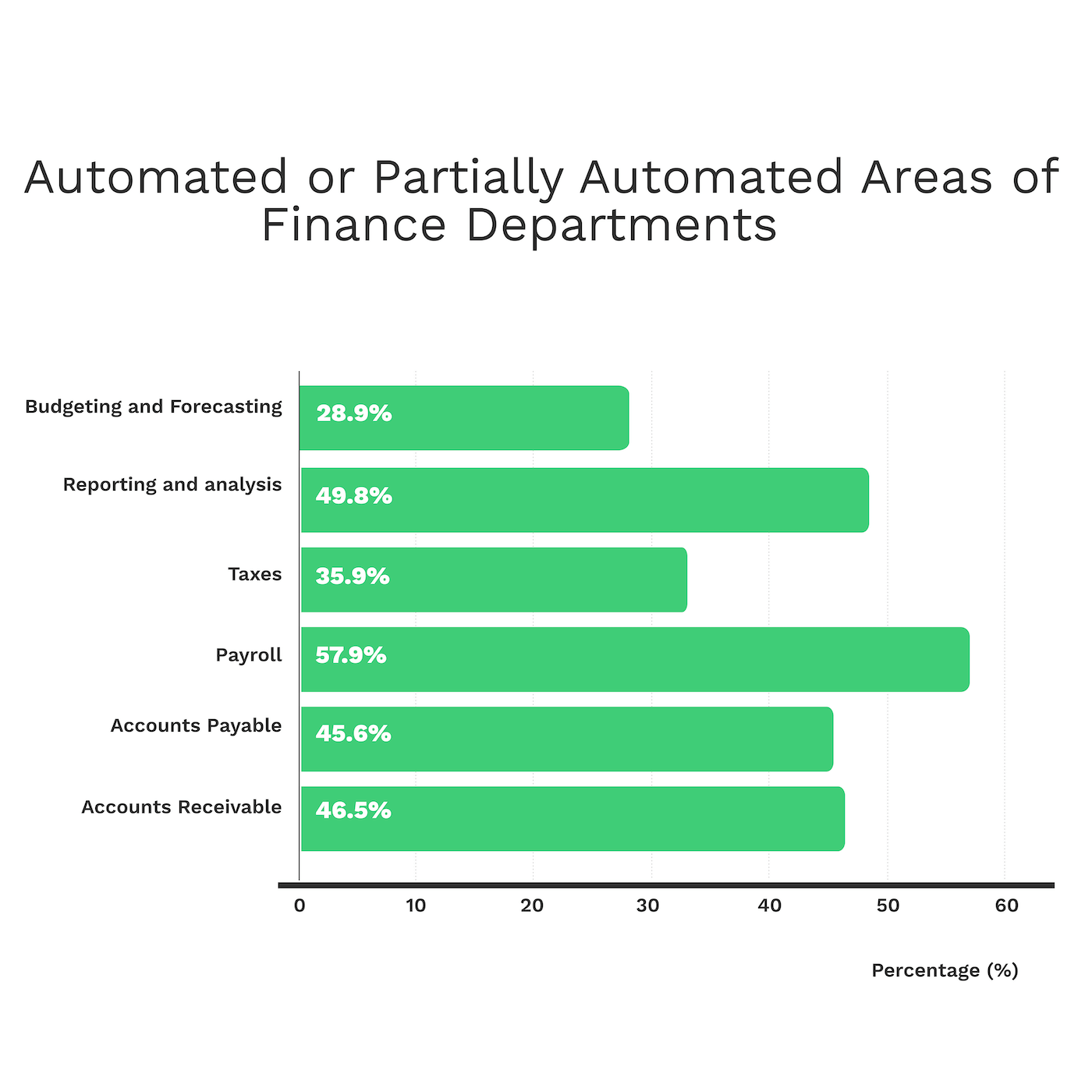

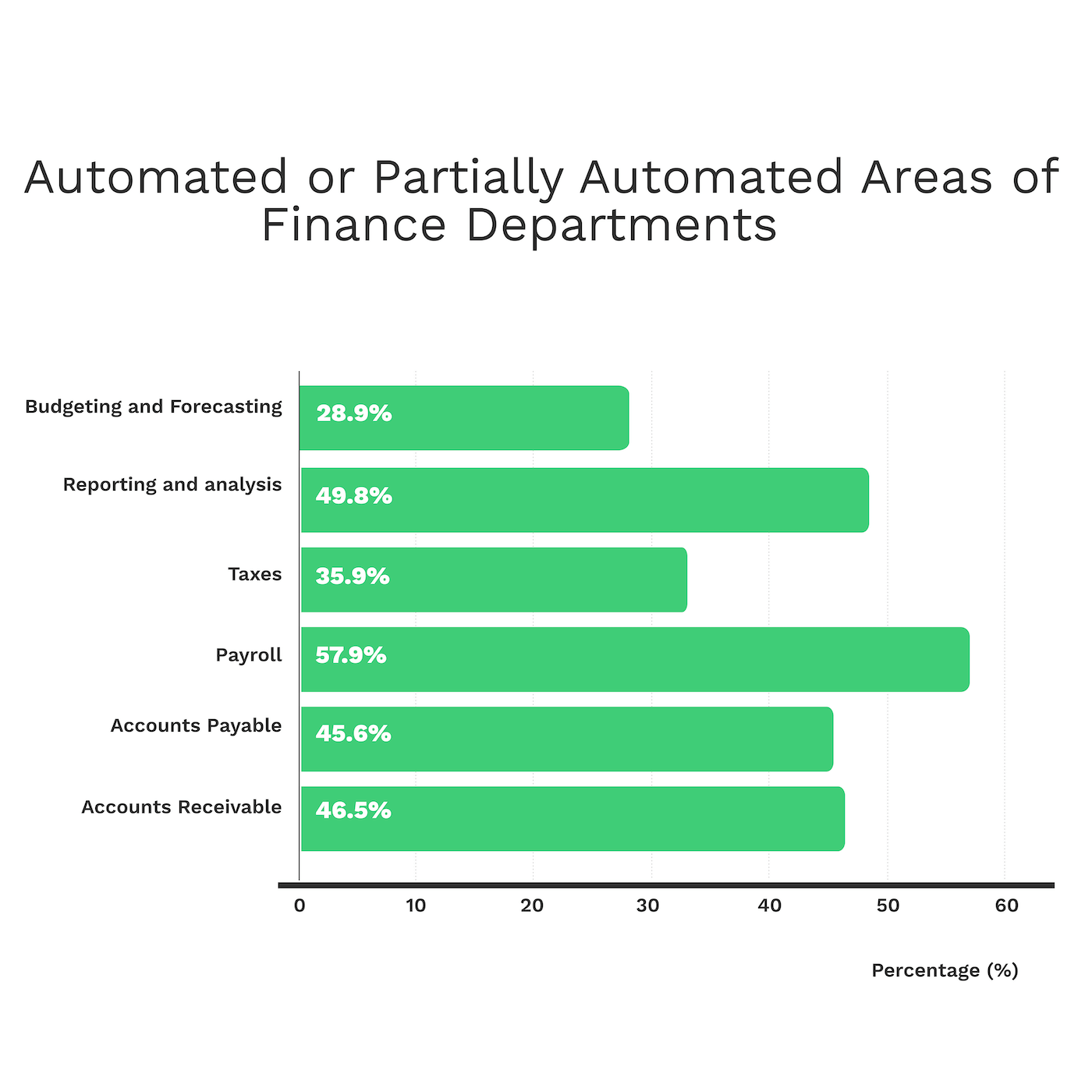

Where Automation Is Winning and Where It’s Failing

The good news? Automation isn’t a stranger to finance. Some processes are already streamlined, and teams are saving real hours.

The standout success story is payroll. Nearly 60% of finance departments have automated it, making it the most automated function by far. No wonder it also ranks as one of the least time-consuming tasks.

But beyond payroll, the picture is less rosy:

- Reporting & analysis → Still under 50% automated, even though it’s the biggest time sink.

- Taxes → Only 35.9% automated. That means two-thirds of teams are still slogging through manual tax workflows.

- Budgeting & forecasting → Even lower, with fewer than 30% of teams automating this critical area.

- Accounts payable (AP) → Over half of departments still process invoices manually – one of the most glaring gaps in the survey.

The pattern is clear: the more painful the process, the less likely it is to be automated. That’s not just ironic, it’s a missed opportunity.

Finance leaders who invest in automating these high-friction areas aren’t just saving time. They’re also cutting costs, reducing errors, and giving their teams the freedom to focus on strategy instead of firefighting.

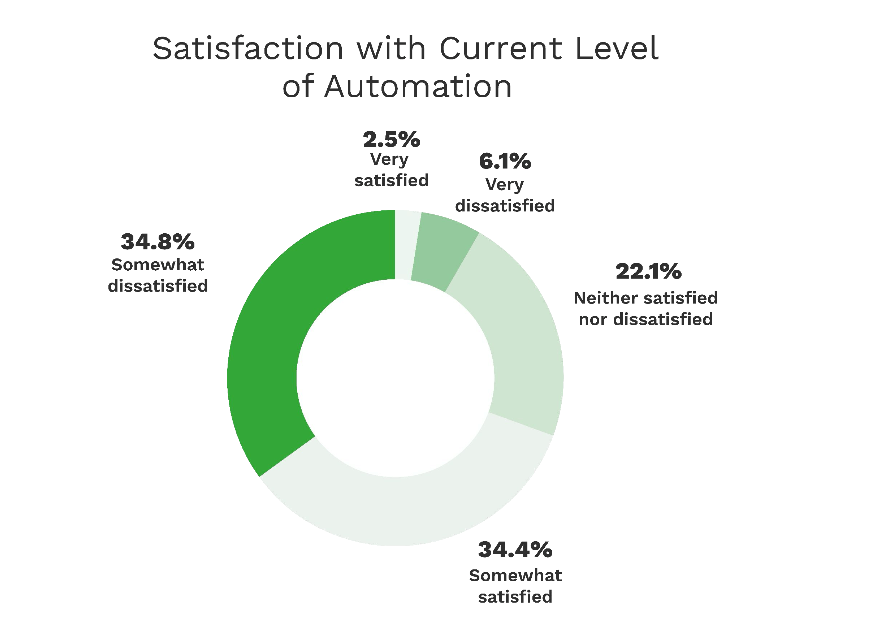

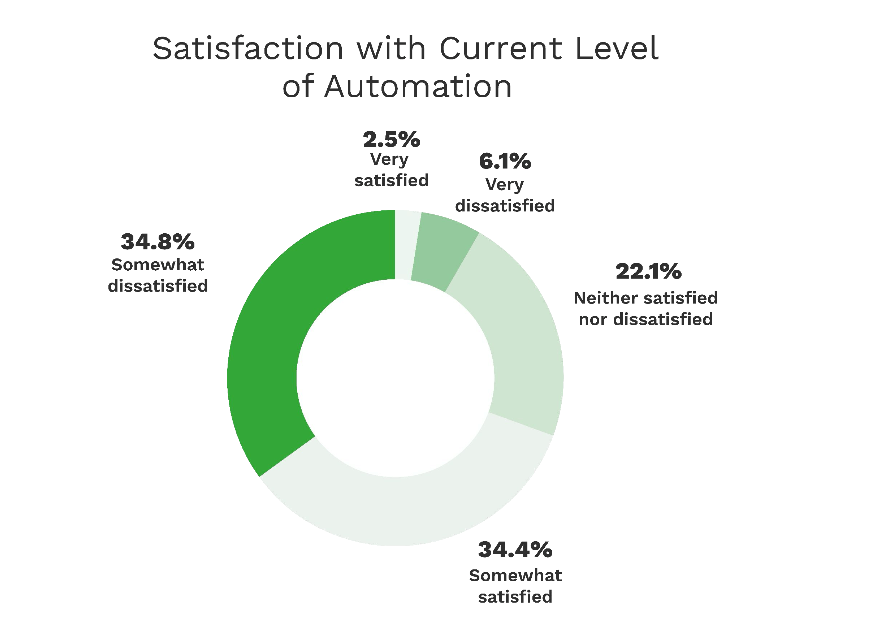

The Automation Gap Is Clear, and Frustrating

If finance teams know where their bottlenecks are, and automation technology is widely available… why are things still moving so slowly?

Our survey paints a frustrating picture:

- 63% of finance professionals are not satisfied with their current automation setup.

- Only 2.5% say they’re “very satisfied.”

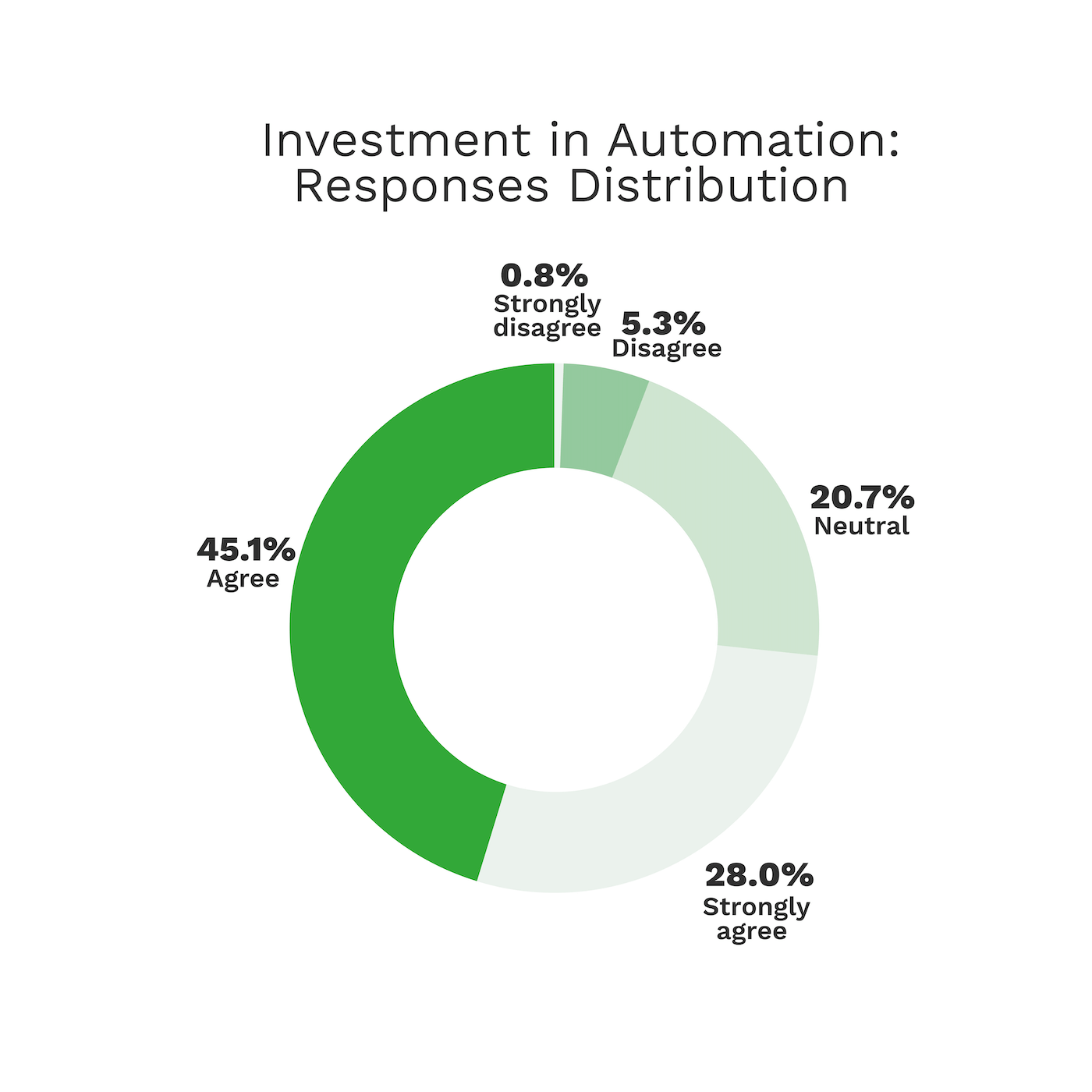

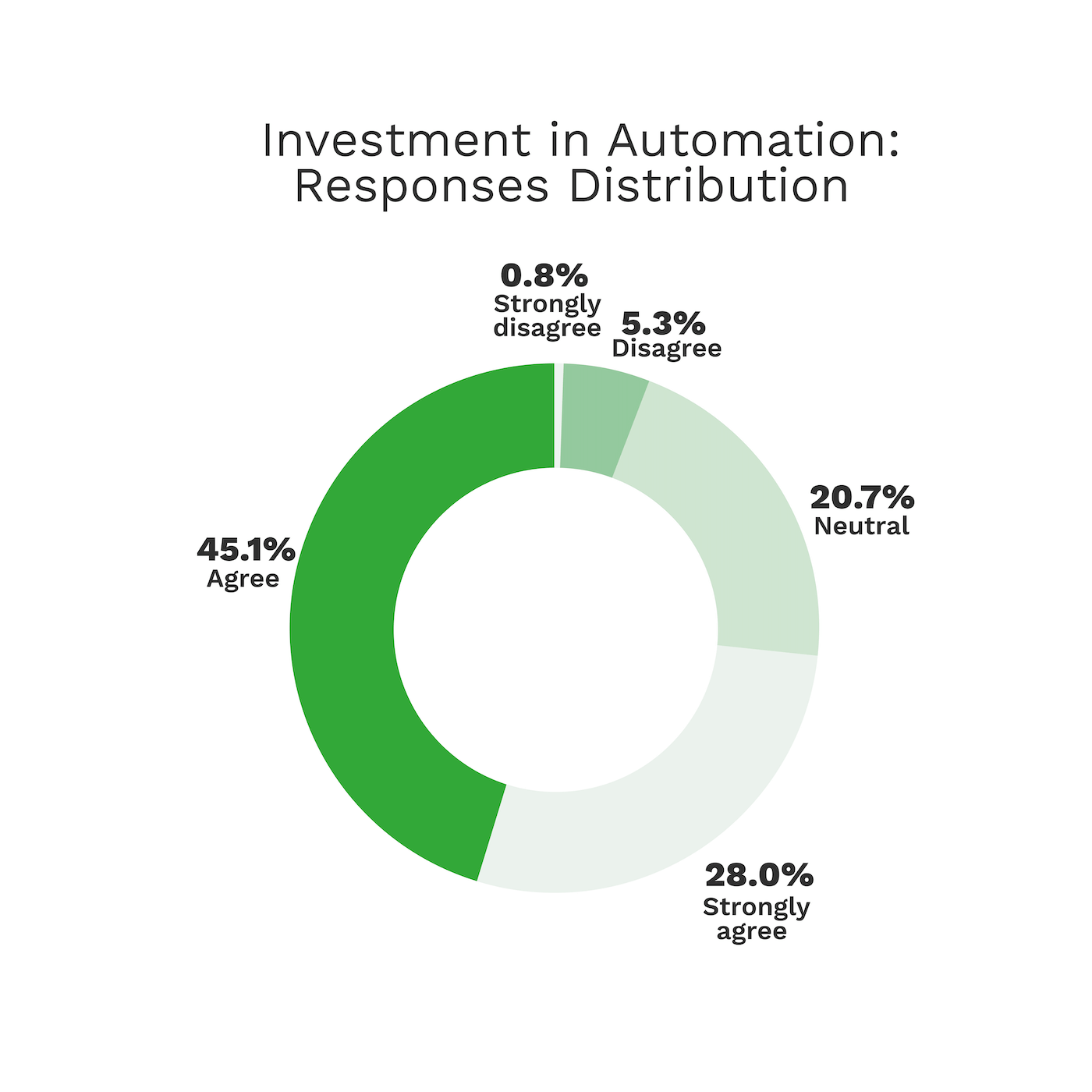

- A huge 73.1% believe their company should invest more in automation.

That’s not just a signal, it’s a cry for help. Finance professionals want to work smarter, but their tools aren’t keeping up.

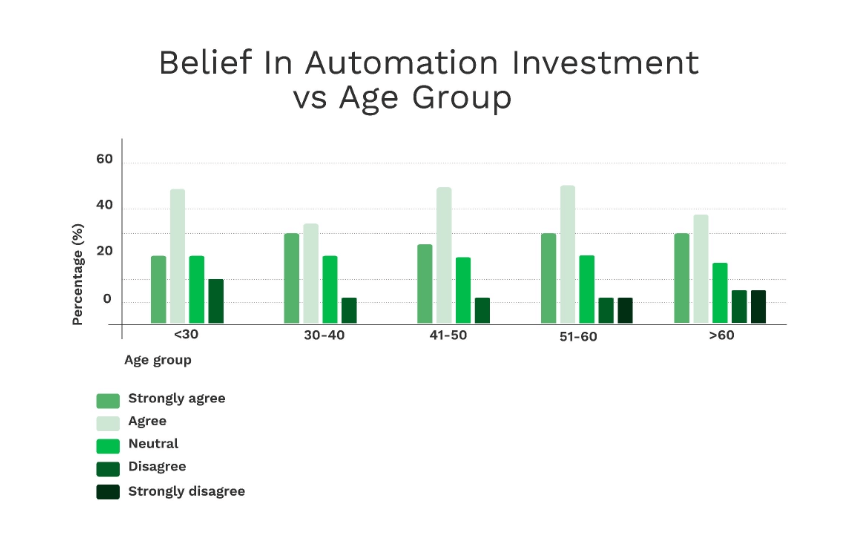

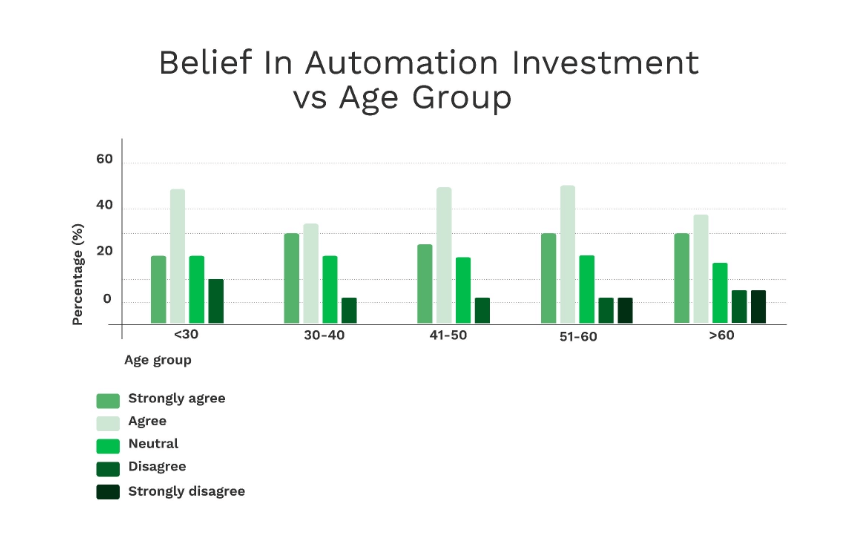

Interestingly, the strongest push for change comes from mid-career professionals aged 41–50, nearly 80% of whom demand more automation investment. These are people who know both the pain of manual processes and the potential of automation, and they’re tired of waiting.

The takeaway: Finance teams are ready for automation, but too many companies are still dragging their feet. Those that move faster will gain a serious edge.

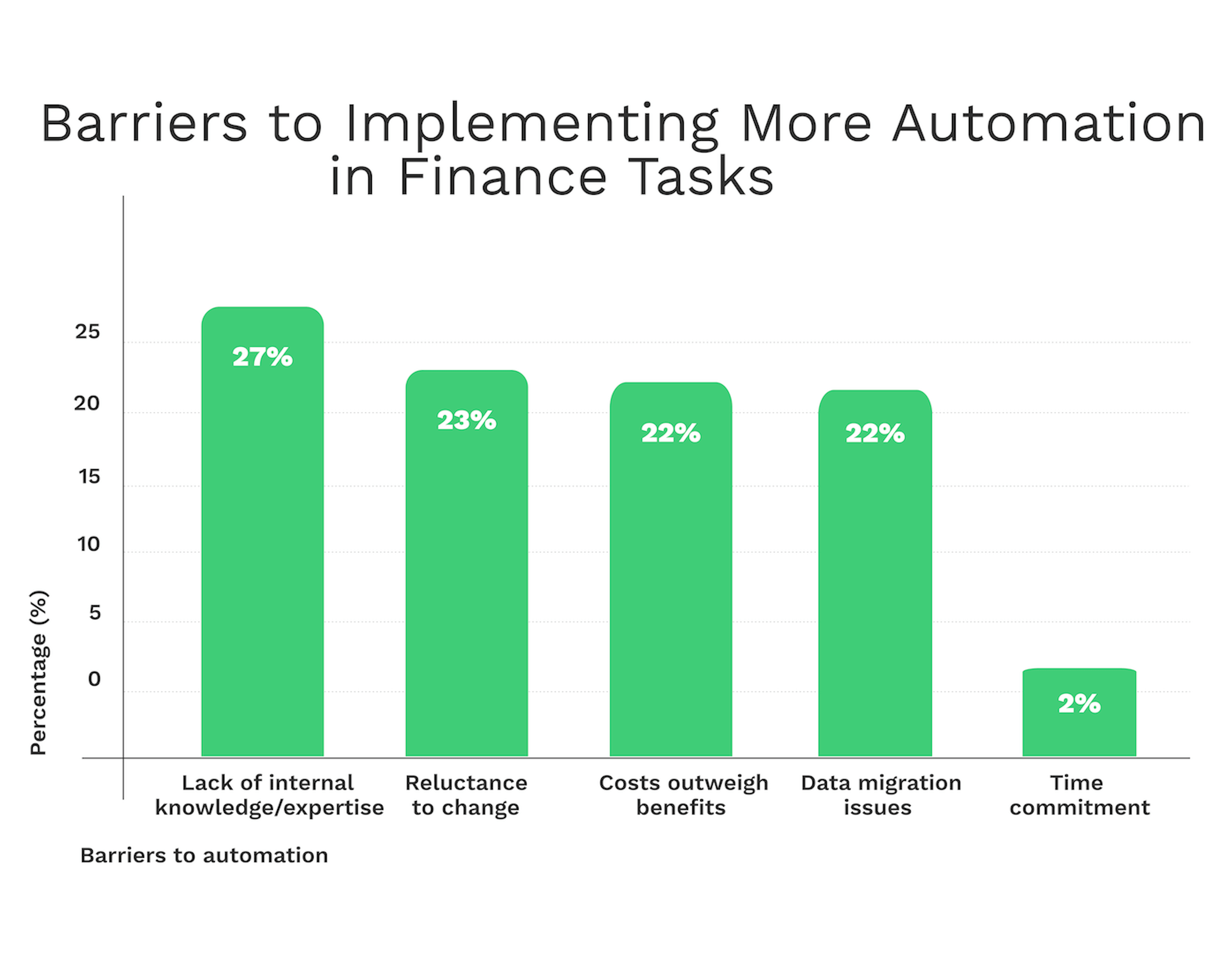

Barriers to Automation: Knowledge, Cost, and Migration

So, what’s really holding finance teams back from automating the workflows they hate most?

Our survey highlights four major roadblocks:

- Lack of internal knowledge (27.6%) → Many finance teams simply don’t know where to start. They lack in-house expertise to select, implement, and manage automation tools.

- Resistance to change (23.6%) → People get comfortable with existing processes, even if they’re inefficient. Fear of the unknown and doubts about benefits make it harder to push new systems through.

- Cost concerns (22.8%) → Some leaders still see automation as an expense, not an investment. Without a clear ROI story, budgets stay tight.

- Data migration challenges (22%) → Moving historical data into new systems feels risky and complicated. For many, that’s reason enough to postpone the shift.

These barriers are real, but none of them are insurmountable. In fact, they point directly to where vendors like Klippa add the most value: expert guidance, seamless onboarding, and clear ROI.

The message is clear: finance teams want automation, but they need more support to make it happen.

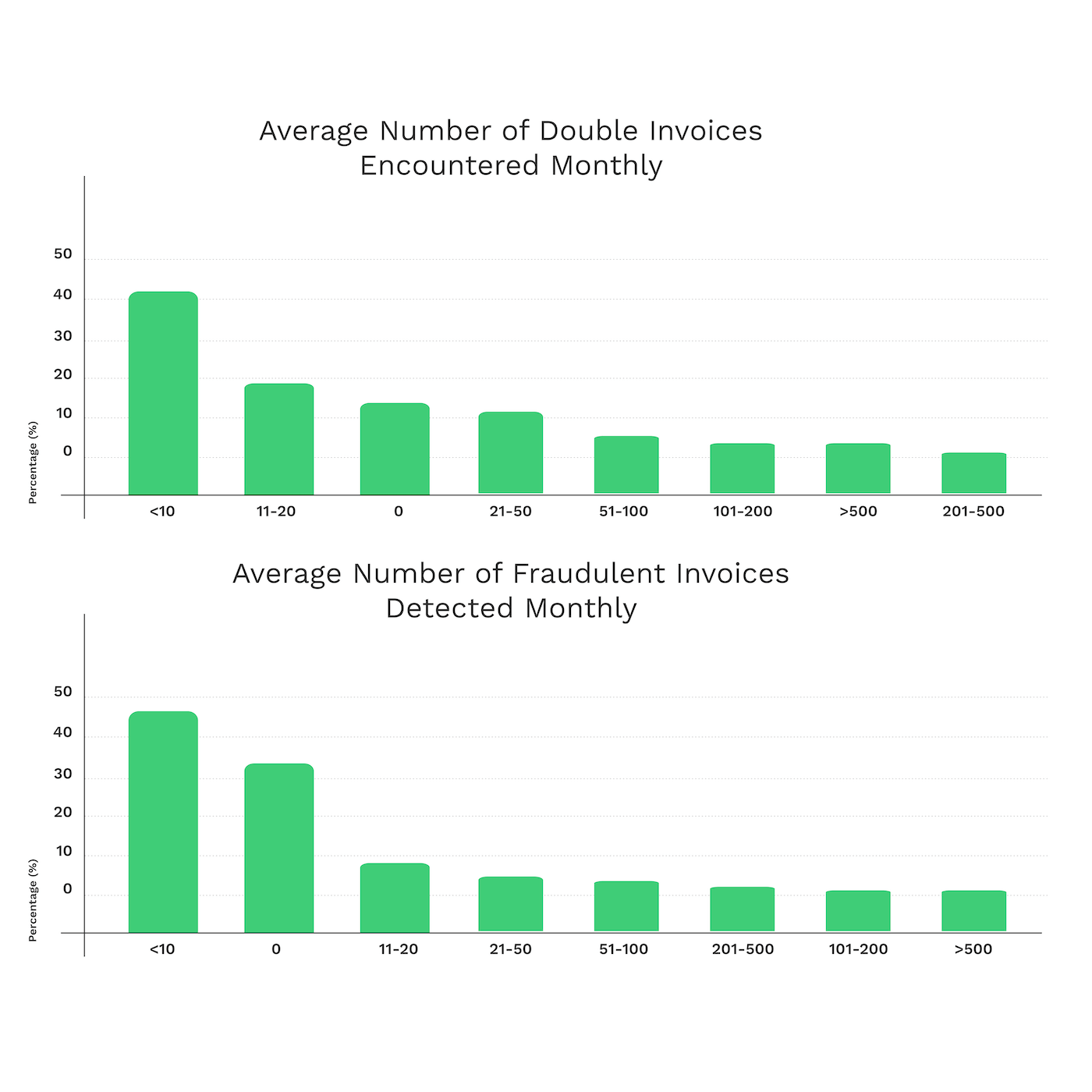

Duplicate & Fraudulent Invoices Are Still Common and Costly

Ask any finance team about invoice headaches, and two words come up fast: duplicates and fraud.

Our research shows just how widespread these problems still are:

- 41.4% of finance professionals deal with up to 10 duplicate invoices every month.

- Another 44% face even higher volumes.

- Nearly 47% detect up to 10 fraudulent invoices each month, while some large organizations face 100+ cases.

The silver lining? Most teams (63.4%) say they’re fairly confident in their fraud detection systems. But confidence isn’t the same as prevention. Every duplicate or fraudulent invoice that slips through is money lost and trust damaged.

This is where automation makes all the difference. With AI-powered invoice checks, finance teams can flag errors and fraud in real time, stopping issues before they become costly mistakes.

Regional Snapshot: Germany, UK, Netherlands

While the overall story of finance automation is consistent across Europe, some regional differences stand out.

🇩🇪 Germany

- Taxes are the biggest time sink, flagged by 22.9% of German finance pros.

- 71.3% are not satisfied with their current automation – the highest rate of frustration.

- Data migration is seen as the top barrier to adoption.

🇬🇧 United Kingdom

- The UK has the worst track record on invoice payments: 36.5% of businesses fail to pay on time.

- British teams are most concerned about automation costs – 29.4% say the price outweighs the benefits.

- On the plus side, UK respondents are less burdened by tax compared to Germany.

🇳🇱 Netherlands

- Dutch finance pros are the biggest champions of automation: 76.5% want more investment.

- Their biggest challenge? A knowledge gap – nearly 30% say they lack the expertise to implement new tools.

- They also show the highest satisfaction with fraud and duplicate detection systems.

Taken together, the message is clear: while the pain points are shared, the barriers and priorities vary. A one-size-fits-all approach won’t work. Solutions need to be tailored to regional realities.

Key Takeaways for Finance Leaders

Our survey shows a finance world caught between clear demand for automation and persistent barriers to adoption. Here are the main lessons for leaders:

- Reporting, AP, and taxes are the biggest drains, and still the least automated.

- Satisfaction is low: 63% of finance pros say current automation doesn’t meet their needs.

- The appetite is there: 73% want more automation investment, especially mid-career finance leaders.

- Barriers are solvable: knowledge gaps, resistance, cost, and data migration are the main blockers.

- Invoice fraud and duplicates are common. Automation is not a luxury here, it’s a safeguard.

- Regional nuances matter: German teams battle tax complexity, the UK worries about cost, and the Dutch lead the charge for more investment.

For finance leaders, the path forward is clear: double down on automating high-friction workflows and give teams the tools they need to work smarter, not longer.

How Can Klippa Help?

If there’s one thing our research makes clear, it’s this: finance teams don’t need more hours in the day. They need smarter workflows.

That’s exactly where Klippa comes in.

With Klippa DocHorizon, finance teams can:

- Automate reporting and analysis with AI-powered data extraction and enrichment.

- Streamline accounts payable, from invoice capture to approvals, cutting manual effort in half.

- Prevent duplicates and fraud with real-time detection mechanisms.

- Simplify tax-related workflows by digitizing and structuring complex documentation.

- Integrate seamlessly into existing finance systems with flexible APIs and expert onboarding.

The result? Less manual work, fewer errors, faster processes, and happier finance teams.

Want to see how automation could work in your department? Book a demo with Klippa and start turning your team’s biggest pain points into opportunities.

Frequently Asked Questions About Finance Automation

According to our research, reporting & analysis tops the list, with 59% of finance professionals calling it their biggest time drain. Budgeting, forecasting, tax, and accounts payable also consume large chunks of time.

The main barriers are lack of internal knowledge, resistance to change, cost concerns, and data migration challenges. Many teams want automation but feel underprepared to implement it.

Payroll is the clear winner. Nearly 60% of finance teams have automated it. Unfortunately, reporting, taxes, budgeting, and accounts payable lag far behind.

Very common. 41% of finance teams deal with up to 10 duplicate invoices every month, and nearly half encounter fraudulent invoices regularly. This highlights why automated fraud detection is becoming essential.

Yes, overwhelmingly. More than 73% of respondents said their companies should increase investment in automation. Only 6% disagreed.

– Germany: Taxes are the biggest time sink, and most teams are unhappy with automation.

– UK: Costs are the main barrier, and invoice payment delays are more common.

– Netherlands: Teams are most enthusiastic about more automation, but cite a knowledge gap.

Automation tools like Klippa DocHorizon can automatically scan invoices, detect duplicates, and flag suspicious activity before it becomes a costly mistake. This reduces risk and improves trust in financial reporting.

Start with the most painful, repetitive tasks, like accounts payable or reporting. These deliver fast ROI and free up time for strategic work. Partnering with a provider who offers expert onboarding and API flexibility makes the transition much smoother.