For many, business travel is an unavoidable part of their everyday professional life. 90.6% of corporate travel managers even believe that business travel is crucial to company growth.

Although a business trip is often perceived as something positive, it can bring many challenges. Besides all the organizational things, you need to document all travel expenses during the trip, and keep receipts to get reimbursed by your company. Are you familiar with this?

This stress of travel and expense management is history, as in this blog, we provide you with two travel expense report templates and explain an alternative solution, the digital travel expense report, in more detail.

Travel Expense Report Template: What It Is & How to Use It

When you take a business trip, costs quickly add up — for meals, accommodation, transport, and other work-related expenses. A travel expense report is the document used to record and organize these costs so they can be reimbursed by your employer, deducted from your taxes if you’re self-employed, or invoiced to a client if you’re freelancing.

A travel expense report, sometimes called an expense report, covers all costs incurred away from your usual workplace. To be valid, each expense must be supported by receipts or other proof, which are attached to the report.

By creating a clear, organized report, you make it easier for finance teams or tax authorities to process your claim. Next, let’s look at who can prepare a travel expense report and the rules around it.

Who Can Prepare a Travel Expense Report?

A travel expense report can be prepared by anyone who incurs legitimate business-related travel costs. The exact rules depend on whether you are an employee, freelancer, or self-employed, and on your organization’s policy or your local tax regulations.

For Employees

If you’re working for a company, you typically fill out your own travel expense report after completing a business trip.

Once submitted, the report is reviewed and approved by your company’s finance or HR department before reimbursement is processed.

Many organizations have a standard format and require digital submission to streamline approvals.

For Freelancers or Self-Employed Individuals

If you work independently, you can prepare a travel expense report to keep records for tax deductions or to itemize costs for invoicing clients.

In this case, the report acts as an official record for the tax office, showing your trip had a professional purpose. It also provides transparency when billing clients for travel-related charges.

Important Eligibility Rules

- The trip must be primarily business-related — personal vacations or mixed-purpose travel are generally not reimbursable.

- Expenses must comply with company policies or local tax laws.

- Supporting evidence (receipts, invoices) is mandatory in all cases.

✅ Pro Tip: Even if your company or client doesn’t require a formal report, keeping one for your own records helps track costs, claim deductions, and prevent disputes later.

Why Create a Travel Expense Report?

Creating a travel expense report is essential for both employees and self-employed professionals, but the reasons and benefits vary.

Employees

For employees, a properly completed travel expense report allows business travel costs to be reimbursed tax-free. Employers can also deduct these expenses when filing their corporate taxes. Most importantly, the report serves as formal proof that your trip was for work purposes, keeping your claims compliant and avoiding disputes with the finance department or tax office.

Freelancers & Self-Employed Individuals

If you work independently, your travel expense report becomes part of your tax documentation. It helps you deduct legitimate travel costs from your business income and can also be shared with clients when charging for travel-related expenses, ensuring transparency and trust.

Key Benefits for Everyone

- Clear Record-Keeping to reduce disputes

- Tax-Free Reimbursements for valid claims

- Employer or Business Tax Deductions for expense write-offs

- Compliance Proof in the event of audits

- Faster Approvals due to organized documentation

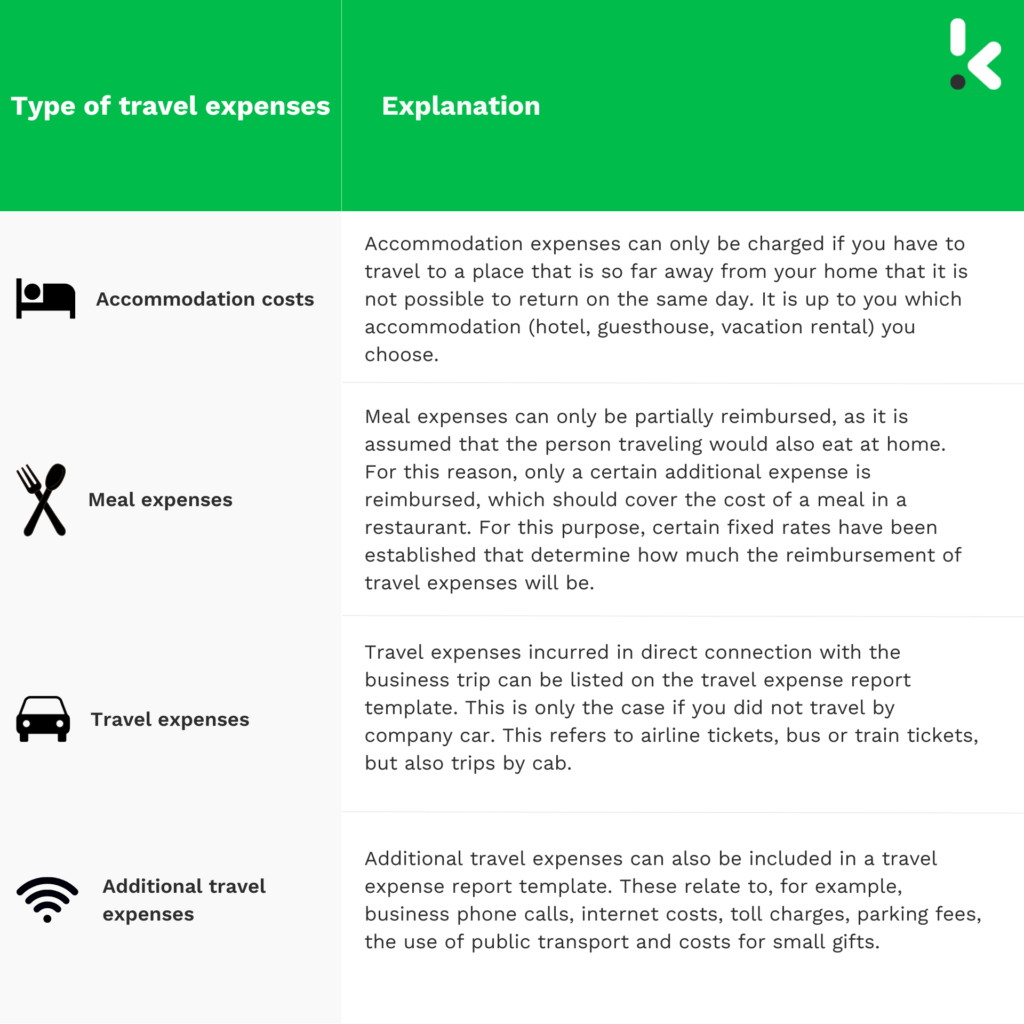

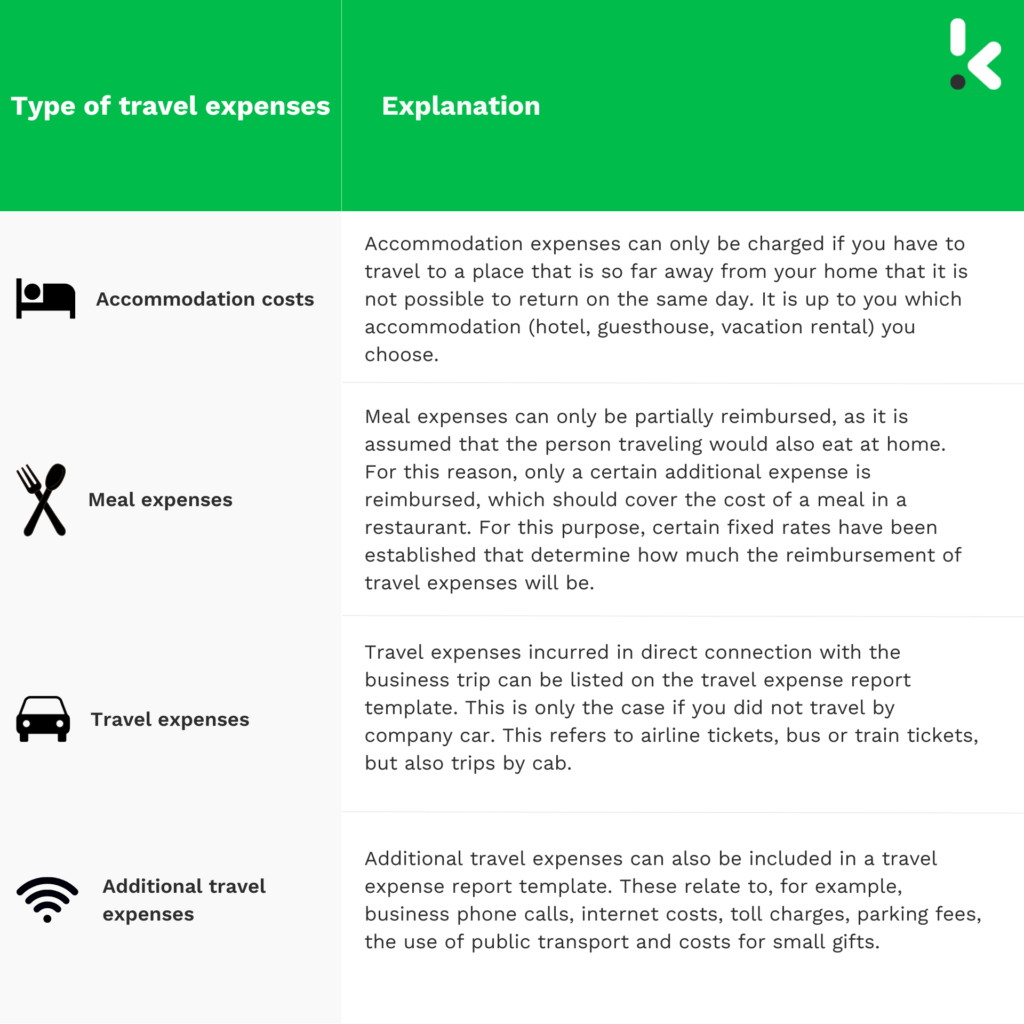

What Expenses Can You Claim?

When filling out a travel expense report, you need to know which costs are eligible under your company’s policy or local tax laws. This ensures that reimbursements are processed quickly and without rejection.

Main Claimable Categories

- Accommodation Costs – Hotel stays, guesthouses, or other necessary lodging while traveling for work.

- Meal Expenses – The cost of meals during your trip, whether billed directly to the company or reimbursed from personal payment.

- Travel Expenses – Public transport fares, taxi or rideshare costs, mileage for personal car use, parking fees, and tolls required for the business trip.

- Additional Business-Related Travel Costs – Expenses for internet use while working, conference fees, shipping work materials, or required visa applications.

The following table describes the individual travel expenses in more detail and explains what may be charged as travel expenses.

Fixed Meal Allowance

Some countries provide a fixed meal allowance instead of reimbursing actual costs.

This allowance depends on:

- Trip Length – Different rates apply for trips lasting over 8 hours compared to those exceeding 24 hours.

- Destination Country – Rates account for local pricing differences in food and beverages.

✅ Tip: Always check your company’s travel policy or your country’s official allowance chart before traveling. This helps you avoid overspending or claiming amounts that won’t be reimbursed.

What Expenses Can’t Be Claimed?

Knowing what not to include in your travel expense report is just as important as knowing what you can claim. Submitting non-eligible costs can slow approval, cause disputes, or even lead to compliance issues with the tax office.

Common Non-Claimable Expenses

- Fines or Penalties – Speeding tickets, illegal parking fines, and other legal violations are always excluded.

- Personal Extras – Massages, mini bar charges, in-room PayTV, or other leisure activities not directly related to business.

- Unnecessary Baggage – Extra luggage fees for non-work items.

- Non-Receipted Tips – Unless accompanied by a separate official receipt, tips are usually not reimbursable.

Why These Are Not Eligible

Reimbursement policies and tax laws typically allow only costs that are necessary, reasonable, and directly related to the business trip. Any personal or recreational spending falls outside these guidelines and must be covered at your own expense.

✅ Pro Tip: If you’re unsure about a specific cost, ask for approval from your employer or check the official travel policy before making the purchase.

Mandatory Information for a Travel Expense Report

A travel expense report isn’t valid unless it contains all required details. Missing information can delay reimbursement or cause rejection by your company’s finance team or the tax office.

Essential Details to Include

- Traveler’s Full Name – Identifies who incurred the expenses.

- Duration of the Business Trip – Start and end dates, including times if required.

- Destination – City and country visited.

- Purpose of Travel – Clear statement of the business reason.

- Itemized Expense List – Date of purchase, description, and individual amounts.

- Receipts and Proof Documents – Original receipts or approved electronic copies for each expense.

- Settlement Date – When the report is submitted for approval.

- Signatures – Traveler’s signature and, if applicable, the approving manager or finance officer.

Why Accuracy Matters

Every entry should be clear and supported by evidence. Receipts and invoices form the backbone of your claim — without them, reimbursements are at risk and tax authorities may reject deductions.

✅ Pro Tip: If you receive receipts electronically, save them in a secure folder during your trip. This makes attaching them to your expense report quick and error-free.

Sample Travel Expense Report

This is a sample travel expense report. Specific fields may vary depending on company policy. However, it should give you an overview of the information typically included in a travel expense report.

Employee Name: [Employee Name]

Department: [Department]

Business Trip: [City, Dates]

Purpose of Trip: [Purpose of Trip]

| Date | Description | Amount | VAT | Total |

| [Date 1] | [Description of expense 1] | [Amount 1] | [VAT 1] | [Total 1] |

| [Date 2] | [Description of expense 2] | [Amount 2] | [VAT 2] | [Total 2] |

| … | … | … | … | … |

| [Date n] | [Description of expense n] | [Amount n] | [VAT n] | [Total n] |

Total Expenses: [Total Expenses]

Employee Signature: [Employee Signature]

Date: [Date]

Approver: [Approver Signature]

Date: [Date]

Download Free Word & Excel Travel Expense Templates

A ready-made template makes preparing your travel expense report faster and ensures you include all necessary details for reimbursement or tax purposes.

We’ve created two free formats — one in Word and one in Excel — so you can choose the option that best fits your workflow.

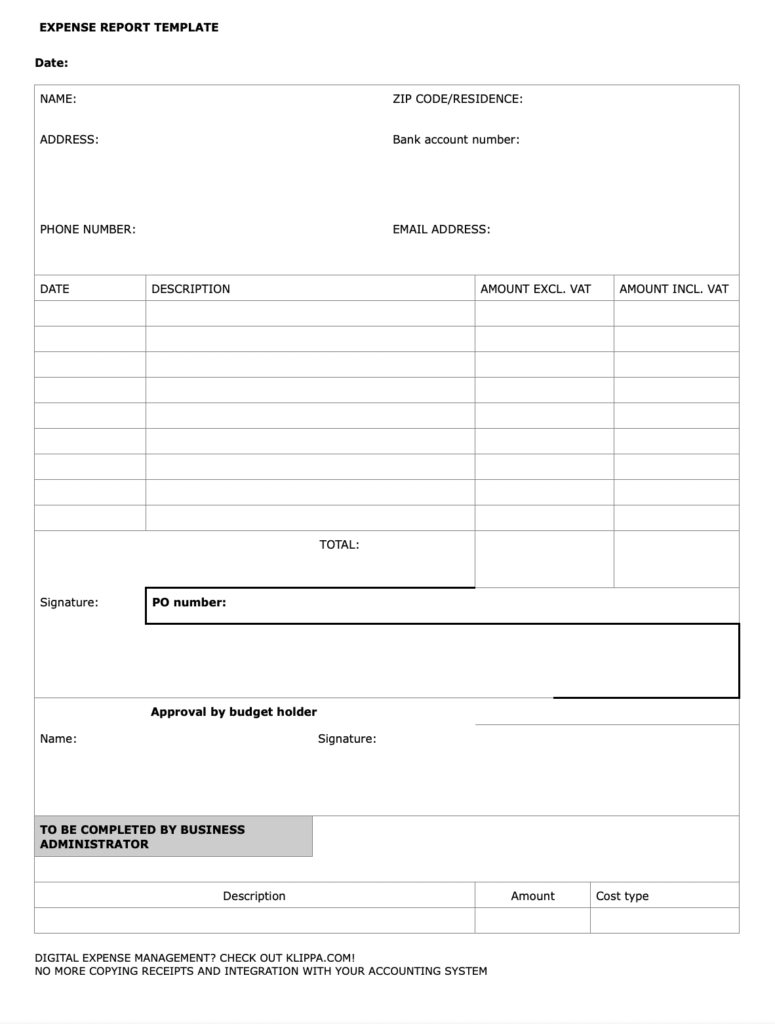

Word Template

The Word version is ideal if you want a simple, printable form you can fill in manually or digitally.

It includes:

- All mandatory fields (name, trip dates, destination, purpose, settlement date, signatures)

- Itemized expense table with columns for description, date, amount (excl. VAT), VAT, and total

- Space for total amounts and employer approval signature

Download your free travel expense report template here.

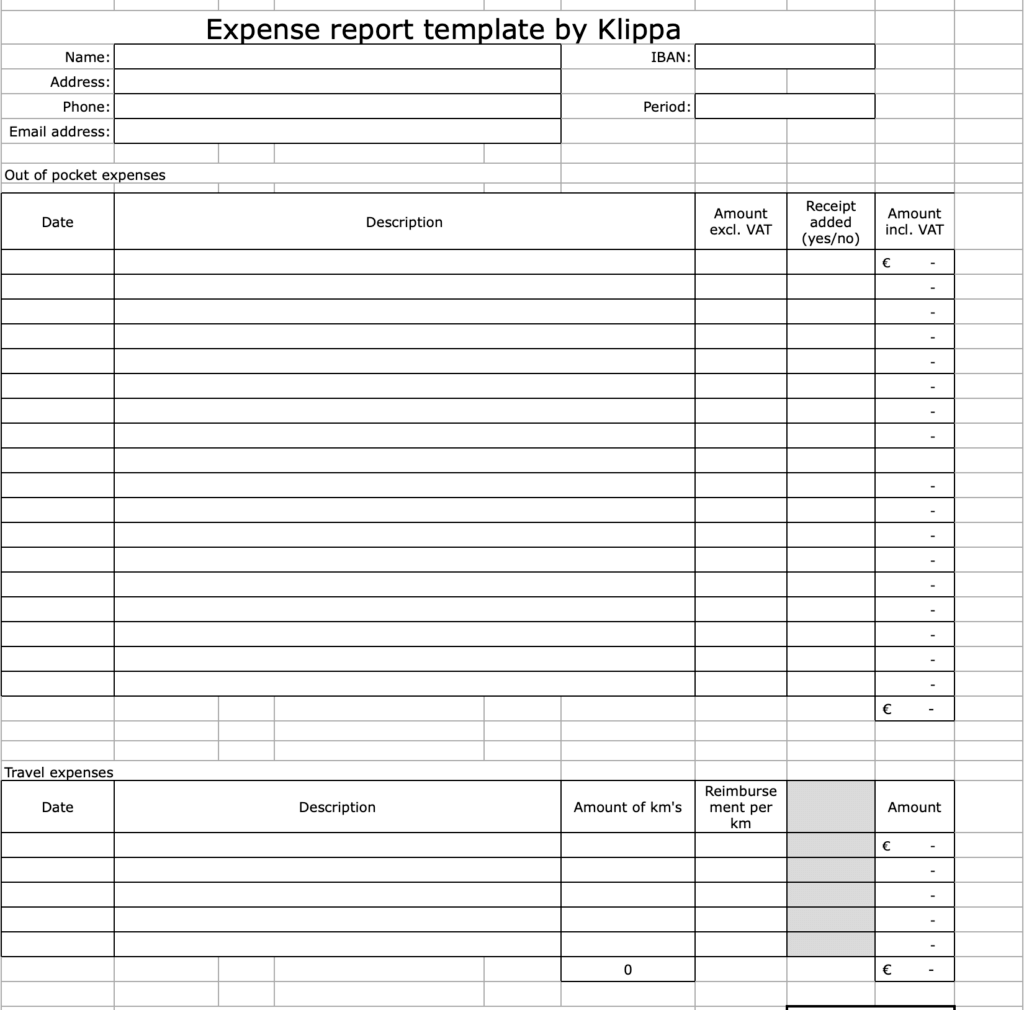

Excel Template

The Excel spreadsheet adds more flexibility for quick calculations and mileage claims.

It includes:

- Mandatory personal and trip details

- Columns for item descriptions, amounts without VAT, amounts with VAT, and VAT totals

- Checkbox or column to confirm receipt attachment

- Mileage allowance field for claiming business-related car travel

- Automatic total calculation

Download your travel expense report template here:

✅ Pro Tip: Save a blank copy of whichever template you use. This way, you can reuse it for future trips without reformatting. For even more efficiency, try Klippa’s digital reporting solution, which automatically fills in expense categories from scanned receipts.

Why Manual Travel Expense Reports Fall Short

While Word and Excel templates make expense reporting accessible, they come with significant drawbacks that can slow your workflow, increase errors, and frustrate both employees and managers.

Key Disadvantages:

- Formatting Issues – Different software versions can cause layout problems, breaking tables or formulas.

- No Real-Time Updates – Any changes only appear when someone downloads the latest version, creating version control headaches.

- Slow Reimbursement Process – Manual review takes longer, delaying payments.

- Attachment Problems – Receipts usually need to be sent separately, increasing the risk of lost documentation.

- High Error Rates – Manual data entry often results in incorrect amounts, missing expenses, or forgotten receipts.

- Compliance Risks – Missing information or incorrect formatting can trigger rejection by finance teams or tax offices.

The Bottom Line: Manual travel expense reporting might be familiar but it’s outdated. In high-volume or frequent travel environments, these inefficiencies quickly add up, costing your business time and money.

If travel expenses are a regular part of your business, moving to an automated digital solution can save hours every month and drastically reduce errors.

Advantages of Automating Travel Expense Reporting

Replacing manual Word or Excel templates with a digital travel expense solution delivers clear and measurable benefits for your business.

Top Benefits of Automation:

- Save Time – Upload a receipt and have the data processed instantly by OCR (Optical Character Recognition). No manual typing.

- Reduce Errors – Automatic data extraction improves accuracy and prevents missing receipts.

- Enforce Policy Rules – Flag duplicate or out-of-policy claims before they reach approval.

- Multi-Currency Handling – Automatically convert expenses for international travel.

- Instant Approvals – Integrated workflows notify managers, speeding up reimbursement.

- Simplify Integration – Connect directly to accounting or ERP software.

- Centralized Storage – Receipts, reports, and approvals in one secure, searchable location.

- Boost Employee Satisfaction – Faster reimbursement means happier, more productive staff.

Why It Matters: Automation transforms expense reporting from a slow, error-prone process into a quick, streamlined workflow — cutting processing time by up to 65% and providing better oversight for finance teams.

Best Practices for Travel Expense Reporting

Clear travel expense guidelines make reimbursement faster, reduce disputes, and keep your business compliant. Whether you report manually or use automation, these rules help employees file complete and accurate claims.

- Define Eligible Expenses – Specify which costs are reimbursable (e.g., lodging, meals, transport) and which aren’t.

- Set Spending Limits – Use daily allowances to control costs and avoid excessive claims.

- Require Proof for Every Expense – Ensure receipts or approved documents are submitted for each claim.

- Standardize Submission Formats – Use the same form or digital system so finance teams can process claims quickly.

- Clarify Deadlines – State when reports must be submitted after a trip to avoid delays.

- Train Employees – Provide short guides or workshops so staff understand policy and tools.

- Review and Update Policies Annually – Keep reimbursement rules in line with tax regulations and company changes.

✅ Pro Tip: Publish these guidelines in a central, easily accessible location, preferably within your expense management system, so staff can reference them while traveling.

Tax Compliance & Submitting Travel Expense Reports

When handled correctly, reimbursements for valid business travel expenses are tax-free income for employees and fully deductible for businesses.

Key Tax Points

- Employees – As long as original receipts or approved electronic copies are provided, reimbursements are not considered taxable income.

- Freelancers/Self-Employed – You can deduct valid trip costs from your business income to reduce your tax liability.

- No Receipts? – You may submit adequate proof (such as event tickets or meeting confirmations). However, without VAT-compliant receipts, you cannot claim VAT deductions.

Submitting Reports to the Tax Office

- In manual systems: Submit with original receipts attached or securely stored copies.

- In digital solutions: Apply for electronic archiving approval from the tax authority — this lets you store receipts digitally without losing compliance.

- Always follow your country’s rules for expense documentation to avoid claim rejection.

✅ Pro Tip: Automated solutions like Klippa ensure every expense entry has the required proof attached, making tax submissions faster and audit-friendly.

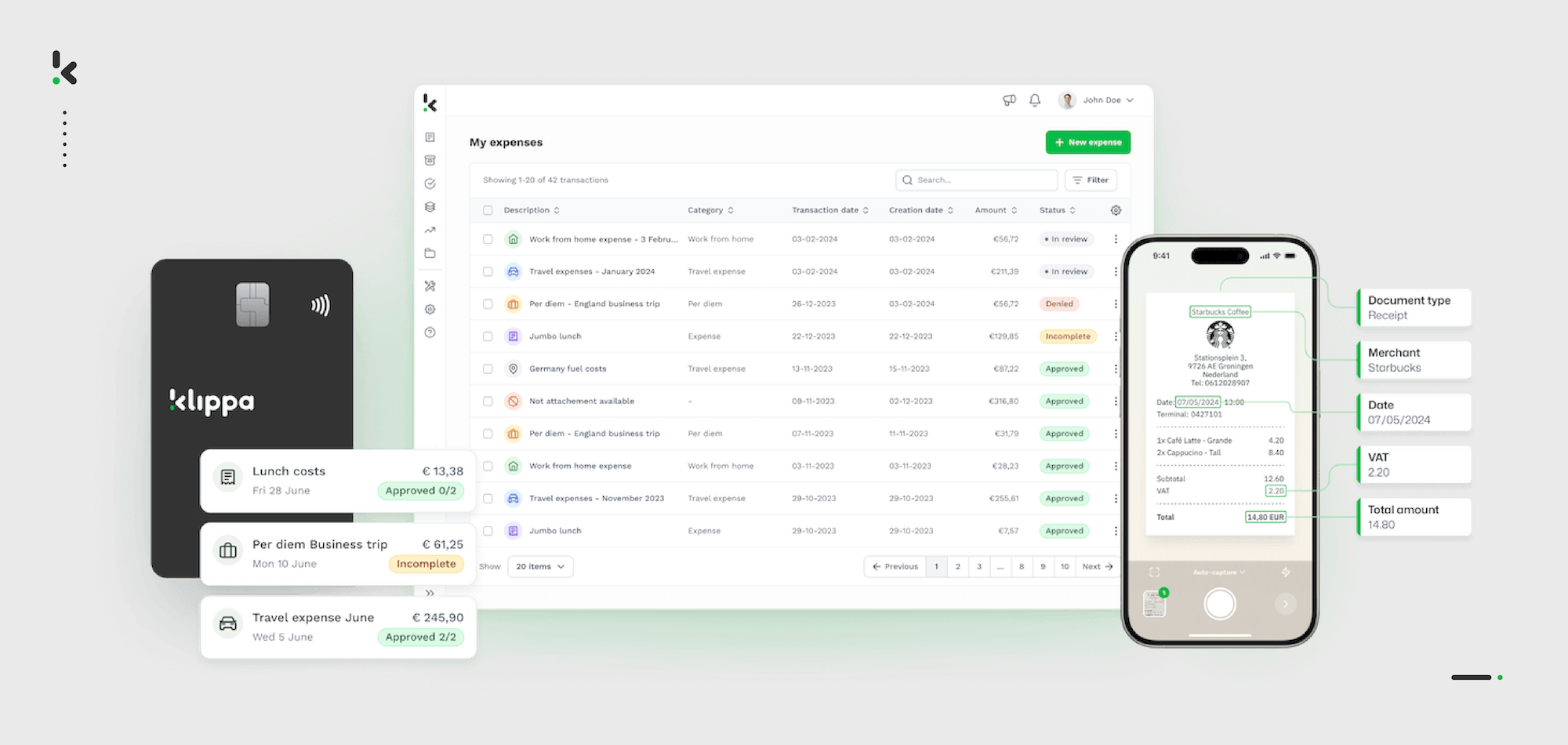

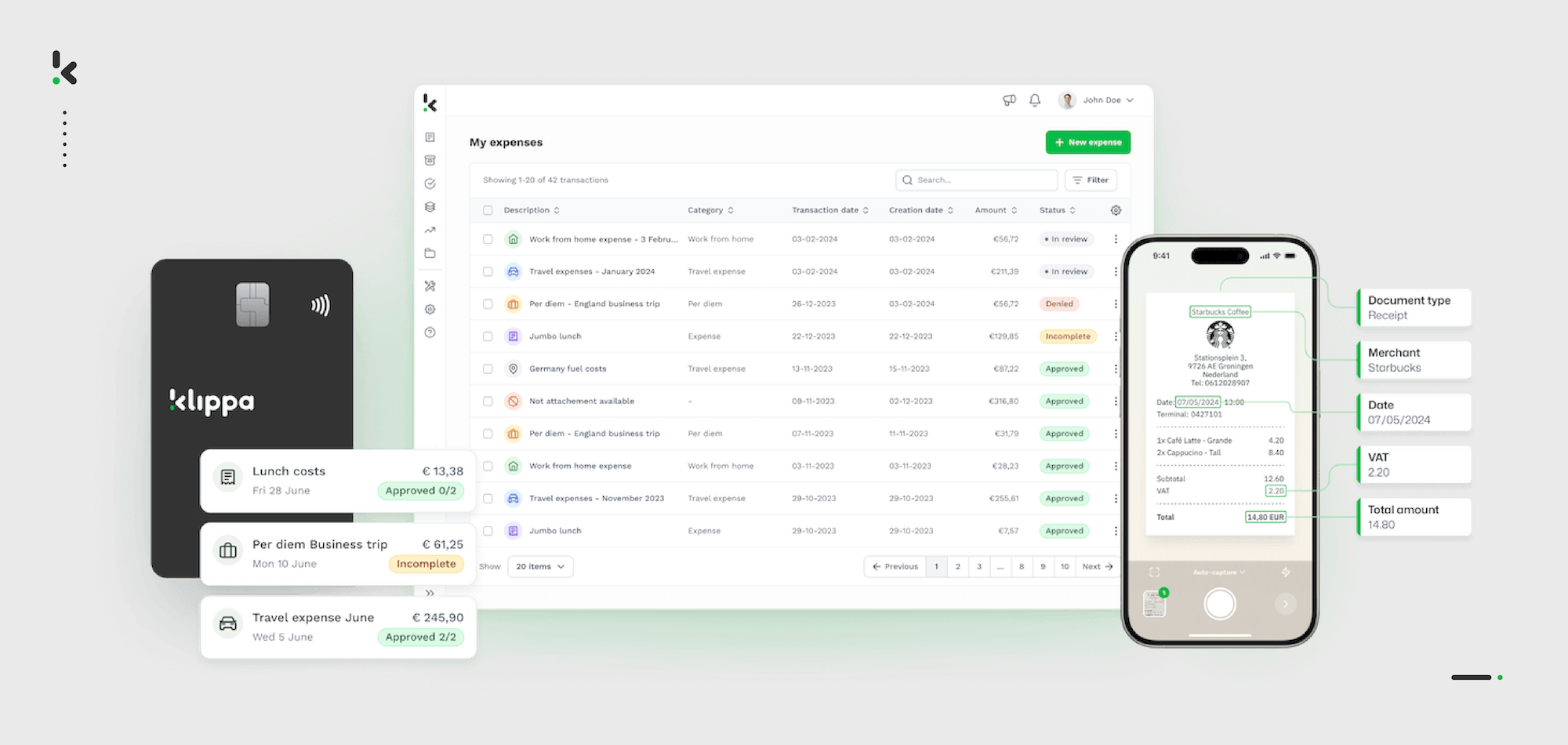

How Klippa Simplifies Travel Expense Reporting

Manual travel expense reporting is slow, error‑prone, and frustrating for employees and finance teams alike. Klippa makes it faster, easier, and more reliable by automating every step — from receipt collection to final approval.

With Klippa’s digital expense reporting solution, you can:

- Scan and process receipts instantly with OCR technology

- Automatically flag duplicates or out‑of‑policy claims

- Handle multiple currencies and languages effortlessly

- Route approvals to the right person without delays

- Store receipts securely in compliance with tax regulations

- Access real‑time reporting and insights from anywhere

The result? Faster reimbursements, fewer mistakes, and happier employees, while your business stays compliant and in control. Companies using Klippa cut processing time by up to 65% and drastically reduce rejected claims.

Curious to see how it works? Book a free 30‑minute demo or chat with our team today. We’ll show you exactly how Klippa can simplify your travel expense reporting.

FAQ

A travel expense report provides an overview of all costs incurred during a business trip. It is used to document expenses like accommodation, meals, and transportation, ensuring accurate reimbursement by the employer.

To write a travel expense report, list all expenses incurred during the trip, including dates, descriptions, and amounts. Attach relevant receipts for each expense and ensure all details align with your company’s travel expense policy.

Record travel expenses by keeping all receipts and logging each cost with relevant details, such as date, purpose, and category (e.g., meals, transportation). Use a template or digital tool to keep records organized and ensure compliance with company guidelines.

Travel expenses typically include accommodation, meals, transportation (e.g., flights, rental cars, public transport), and any additional business-related costs such as conference fees or parking. Personal expenses like minibar charges or fines are usually not included.

The amount you can write off for travel expenses varies by country and local tax regulations. Generally, you can deduct expenses that are essential for the business trip, provided you have receipts and the trip’s purpose is clearly documented. Always consult with a tax advisor for precise limits.