The global e-invoicing market size reached USD 18.5 Billion in 2025. With Europe as one of the frontrunners, for example Belgium where e-invoicing is mandatory for B2B transactions starting in 2026. By 2030, the entire EU will require it for all cross-border trade. Even if you are based outside of the EU, these international shifts change how you do business globally.

Most teams are asking the same big question: when does this actually affect us, and what do we need to set up right now?

Whether you work in finance, IT, or operations, this change hits your daily workflow directly. If you wait too long to get started, you risk compliance issues, payment delays, and unnecessary costs. This guide explains exactly what e-invoicing is, when the deadlines hit, and how to get your organization ready in six simple steps.

Key Takeaways

- E-invoicing is becoming mandatory in Europe. In Belgium, it starts in 2026 for government (B2G) and business-to-business (B2B) deals. By 2030, the entire EU will require it for all cross-border B2B trade.

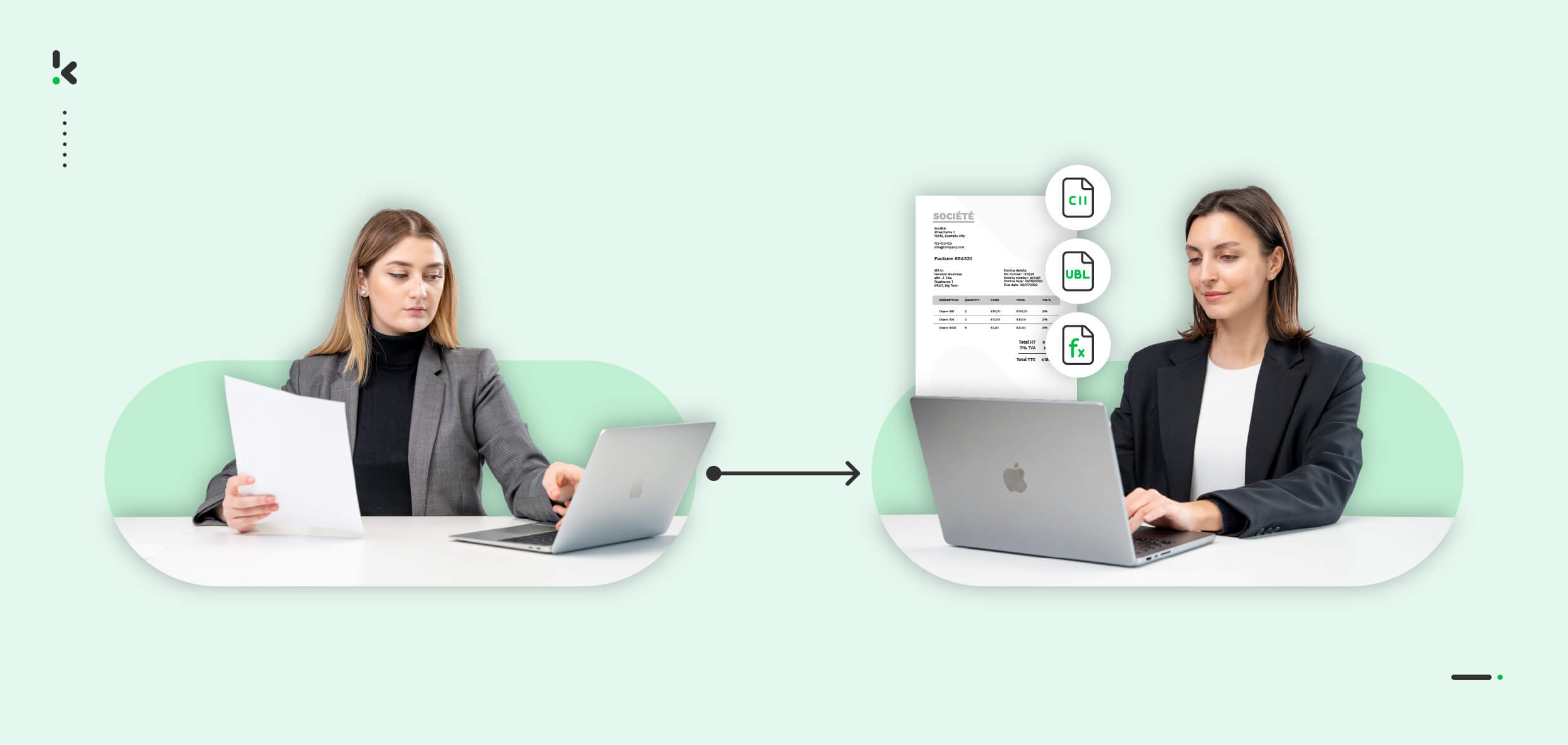

- PDF invoices are no longer enough. Soon, sending a PDF will not count as e-invoicing. You will need to use structured data formats like UBL or XML to meet the new legal standards.

- Peppol is the new gold standard. This network is the primary way businesses and governments securely exchange digital invoices. It is quickly becoming the universal bridge for global trade.

- It is about more than just compliance. Moving to e-invoicing cuts down on manual data entry, reduces human error, and speeds up your entire invoice processing cycle.

- Early preparation is key. Even if the rules do not hit your business today, starting now prevents a last-minute scramble. It also keeps your operations running smoothly while others are struggling to catch up.

What is Electronic Invoicing?

E-invoicing is the full digital process of sending, receiving, and processing invoices. Instead of typing in data from a scan or a PDF file, everything happens automatically using a structured digital format. This makes the entire billing process faster, more accurate, and more efficient. In many regions, it is already a requirement for government contracts.

What is an E-Invoice?

An e-invoice is the actual digital file used in this process. It is an invoice created and sent in a specific structured format like UBL or XML. This means your accounting software can read the data instantly. There is no need for anyone to manually enter the numbers into a system.

The Benefits of E-Invoicing

Changing your internal processes is rarely easy, but this shift is definitely worth the effort. E-invoicing offers some very clear wins for your business:

- Save time: Manual data entry becomes a thing of the past.

- Reduce errors: Less human touch means fewer mistakes on your bills.

- Lighter workload: Automation handles the heavy lifting so your team can focus on other tasks.

- Better security: Standardized formats prevent unauthorized changes to your data.

- Get paid faster: Shorter processing times mean your invoices get approved and paid much sooner.

- Total oversight: Digital archiving gives you a clear, real-time view of your cash flow.

Why E-Invoicing is Becoming Mandatory (And Why You Should Care Now)

E-invoicing is becoming the standard in more and more countries, forcing organizations to rethink how they handle billing. These new rules are not just about staying compliant. They also offer direct perks like less manual data entry, better control over your cash flow, and smoother collaboration with your clients and vendors.

The specific rules depend on where you do business:

- European Union: The Netherlands has required e-invoicing for government contracts (B2G) since 2017. Belgium is stepping it up in 2026 by making it mandatory for B2G and B2B deals. By 2030, the entire EU will require e-invoicing for all cross-border B2B trade under the new ViDA (VAT in the Digital Age) laws.

- United Kingdom: While there is no universal B2B mandate yet, the UK is pushing digital standards through Making Tax Digital (MTD). Additionally, many public sector organizations already require e-invoicing via the Peppol network.

- United States: There is currently no federal law mandating B2B e-invoicing, but the shift is happening fast. Many government agencies already require it, and the B2B Data Exchange framework is gaining ground as the preferred way for US companies to trade securely and cut costs.

If you are still relying on PDF invoices or typing in data by hand, change is coming your way. By switching to e-invoicing now, you stay ahead of the law and start seeing the benefits of faster processing and fewer errors today.

Interested in the regulations per country in the EU and the UK? See our full regulations guide.

Is E-Invoicing Mandatory for Your Organization?

There is a good chance e-invoicing is already required for you, or it will be in the very near future. Use the list below to quickly see where your business stands.

- You bill the government: In many cases, e-invoicing is already mandatory. The Netherlands, for example, has required B2G e-invoicing since 2017. In the US and UK, many government agencies now require digital billing through specific platforms.

- You do business in Belgium: Starting in 2026, e-invoicing becomes mandatory for B2G and most B2B transactions. This means you can no longer send invoices as PDFs. They must be submitted electronically in a structured format.

- You trade across EU borders: By 2030, e-invoicing will be mandatory for all cross-border B2B trade within the European Union. This is part of the new ViDA (VAT in the Digital Age) regulations.

- You still rely on PDFs or manual entry: Even if it is not legally required for you yet, preparation is a must. PDF invoices do not contain structured data, which means they will not meet future standards.

Not sure if the rules apply to your specific situation? Now is the perfect time to evaluate your billing process and get your business ready for a digital-first future. Reach out to us today to see how we can help you make the switch.

6 Steps to Switch to E-Invoicing

Now that you have a better idea of what e-invoicing is and why it matters, it is time to put it into practice. How do you actually prepare your organization? Follow these six steps to ensure a smooth transition.

1. Map out your current invoicing process

You cannot improve what you do not understand. Start by taking a look at your current workflow. Are you still using manual steps or sending PDFs via email? How long does it take to process a single bill? Where do the most mistakes happen?

By mapping the entire journey from receiving an invoice to archiving it, you will quickly see where the bottlenecks are and where you can save the most time.

2. Set clear goals and involve the right people

Good preparation starts with clear objectives. Are you switching to stay compliant with new laws? Do you want to speed up payments? Or is the goal to cut down on human error?

Set specific targets, such as: “process 80% of incoming invoices automatically within six months.” Make sure to involve the right departments early on, including finance, procurement, IT, and legal. Getting everyone on the same page is the secret to success.

3. Pick the right software for your business

E-invoicing is not one-size-fits-all. The right solution depends on your existing systems, your invoice volume, and your international growth plans.

Do you just need to send invoices via Peppol, or do you want full AP automation that handles data extraction, validation, and booking? Look for a platform that supports standard formats like UBL and XML, offers easy integrations, and is simple for your team to use. Always ask: is this solution ready to scale as we grow?

4. Use a phased rollout and test thoroughly

You do not have to change everything overnight. Start with a pilot program. Pick a few trusted vendors or customers and test the entire process from start to finish.

Use this pilot to catch any bugs and fine-tune your workflow. Make sure your team has clear instructions or a quick training session. The better they are prepared, the smoother the final launch will be.

5. Get your customers and vendors on board

E-invoicing works best when everyone is connected. Identify which partners you want to exchange digital invoices with and which channel you will use, such as the Peppol network.

Reach out to these parties early. Tell them what is changing, which format you expect, and who they can contact with questions. Clear communication prevents payment delays and makes the whole transition much more efficient.

6. Measure, learn, and improve

Moving to e-invoicing is not the finish line: it is just the beginning. Keep a close eye on your performance. How many invoices are being processed automatically? Where are errors still popping up?

Use these insights to keep optimizing your process. Stay updated on new tax laws and regulations in the US, UK, and EU to make sure your business stays compliant at all times.

Why Choose Klippa as Your E-Invoicing Partner

Making the switch to e-invoicing is easy with Klippa. As a Peppol-certified platform, we automatically convert your incoming and outgoing invoices into structured formats like UBL or XML. Everything is fully aligned with global and European standards. Our solution is ISO-certified and GDPR-compliant, so your data is always processed securely and correctly.

How Klippa helps your business:

- Convert PDFs to e-invoices: Automatically extract, classify, and convert invoice data into Peppol-ready formats with 99% accuracy.

- Fraud detection and document checks: Our smart verification system catches duplicate payments and fake invoices before they become a problem.

- Faster processing times: Save up to 70% on processing time thanks to efficient batch processing.

- Seamless integrations: Easily connect with over 50 systems, from popular ERPs to accounting software.

- Global support: Process invoices in more than 100 languages. This is perfect for businesses operating internationally.

- Secure Peppol Access Point: Use our certified access point for reliable and secure e-invoice exchange.

Dreading the transition? Don’t worry. Our experts will guide you through every step of the process. We keep it fast, clear, and simple.

Curious about what we can do for you? Get in touch for a chat or schedule a free demo. We would love to show you how Klippa helps your organization make a smooth, secure, and smart switch to e-invoicing.

FAQ

A PDF is basically a digital photo of a paper invoice. It looks nice, but it does not contain structured data that a computer can read. An e-invoice is built in a format like UBL or XML. This allows software to automatically read, process, and book the invoice: no manual typing or data entry required.

2. Is e-invoicing mandatory in the European Union?

Yes, the rules are tightening across Europe. For government contracts (B2G), it is already required in many countries. In Belgium, it becomes mandatory for most B2B transactions starting in 2026. By 2030, the entire EU will require e-invoicing for all cross-border B2B trade as part of the ViDA (VAT in the Digital Age) initiative.

3. Is e-invoicing mandatory in the USA?

In the USA, there is no federal law for B2B trade, but many government agencies do require it. More American companies are switching voluntarily to speed up payments and cut administrative costs.

4. Is e-invoicing mandatory in the UK?

In the UK, there is no universal B2B mandate yet, but the government is pushing digital records through “Making Tax Digital.” Many public sector organizations already require e-invoicing.

5. What is Peppol and why does it matter?

Peppol is a secure international network used to exchange e-invoices between businesses and governments. It provides a standardized, safe environment so invoices move faster and without errors. Klippa is a certified Peppol access point, which means we handle the secure connection for you so you can send and receive invoices globally.

6. Can Klippa convert PDF invoices into e-invoices?

Definitely. Klippa makes it simple to turn PDF invoices into structured formats like UBL or XML. Our smart OCR and AI automatically pull the data from the document and prepare it for the Peppol network or your accounting software.

7. Should I start with e-invoicing even if it is not mandatory for me yet?

It is smart to get ahead of the curve. By starting now, you are not just checking a compliance box. you also get faster processing, fewer mistakes, and a lighter workload for your team. Businesses that adopt early have a clear edge over the competition.

8. What happens if I do not follow e-invoicing regulations?

If you do not comply with mandatory rules, your invoices could be rejected by your clients or the government. This leads to late payments and potentially heavy fines. You also end up with a lot of extra manual work to fix errors that could have been avoided with automation.